Chainalysis Asia Pacific cryptocurrency trend development report (October 2019)

Author: Chainalysis

Compilation: Dcoin Coin Research Institute

Source: Dacoin

Editor's Note: The original title is "Asia Pacific cryptocurrency trend development report"

- Privacy Backtracking and Investment: Oligarchs are significant and future value can be expected

- Libra responds to G7 full text: Improving opportunities for cross-border payments

- The cryptocurrency developer 108 will (1): the craftsmen who hide behind the code

In order to study the regional development trend of cryptocurrencies, we need to know the distribution of exchanges in each region. The services of digital currency exchanges are usually cross-border. Just knowing where the exchange's headquarters is is not the best way to understand its service market.

There are no single indicators in this report to determine the market segment of the exchange. We analyze the trades into different markets by analyzing several indicators, including head currency trading pairs, sources of network traffic, company registrations, public resource information, or direct dialogue with the exchange. We define global exchanges as not just serving a particular region, but serving multiple regions, such as Binance and Bitfinex.

Here are our findings in the Asia Pacific region:

1. Among the top 50 bitcoin trading platforms, 40% of the trading platform's bitcoin chain transactions took place in the Asia Pacific region.

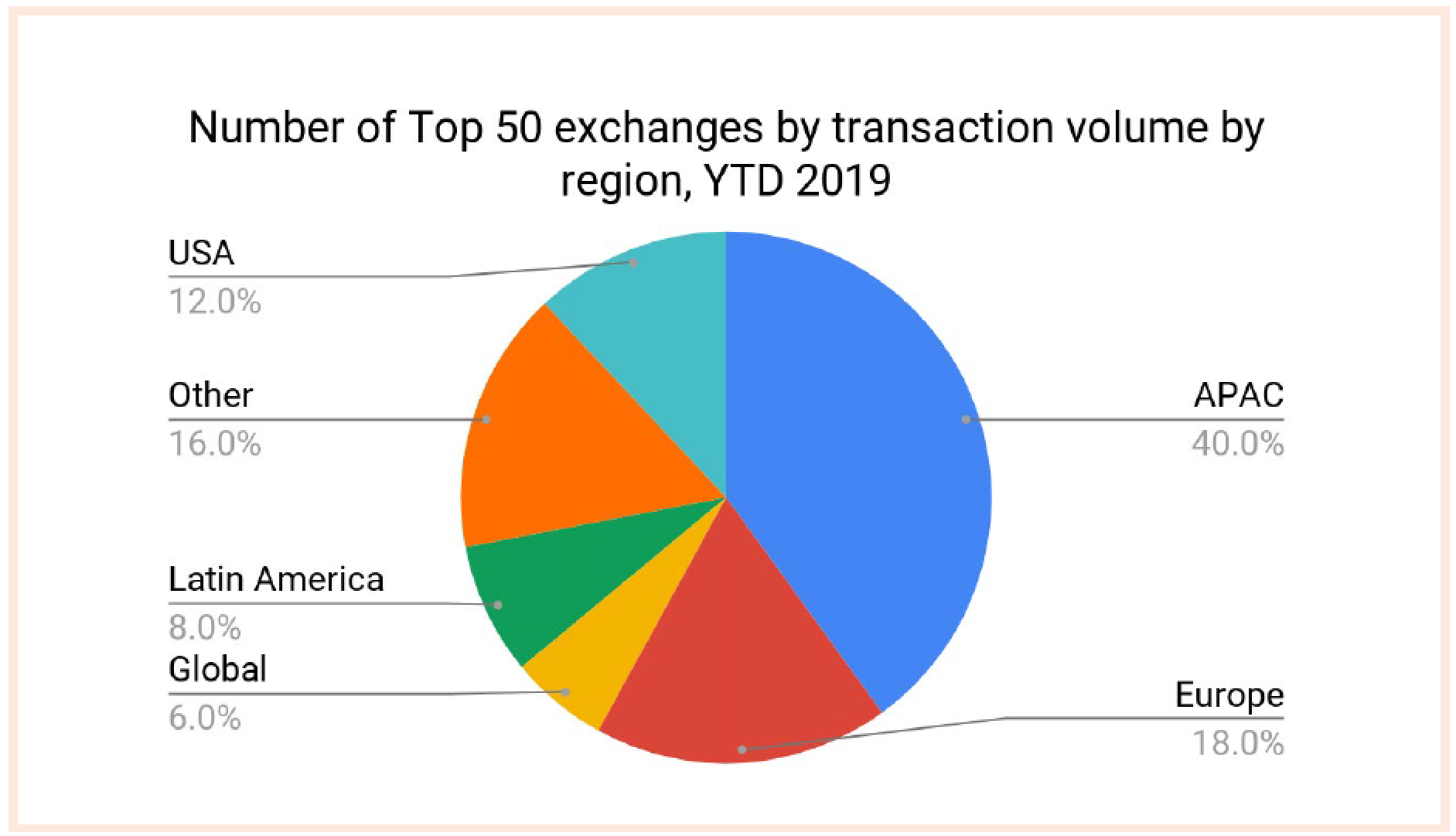

Figure 1 Distribution of trading volume in different regions of the top 50 exchanges (Source: Chainalysis)

According to the chain transaction data analyzed by Chaininalysis in the first half of 2019, 20 of the top 50 exchanges are in the Asia Pacific region, 9 in Europe, 8 in other regions, 6 in the US, 4 in Latin, and globally. There are 3 sexes. In the Asia Pacific region, most of the exchanges are in China, followed by South Korea and Japan.

2. Asia Pacific exchanges receive and trade the most bitcoins

The demand for Bitcoin in the Asia Pacific region exceeds that of any other region, which in turn has driven the development of Bitcoin, which has a large cryptocurrency business.

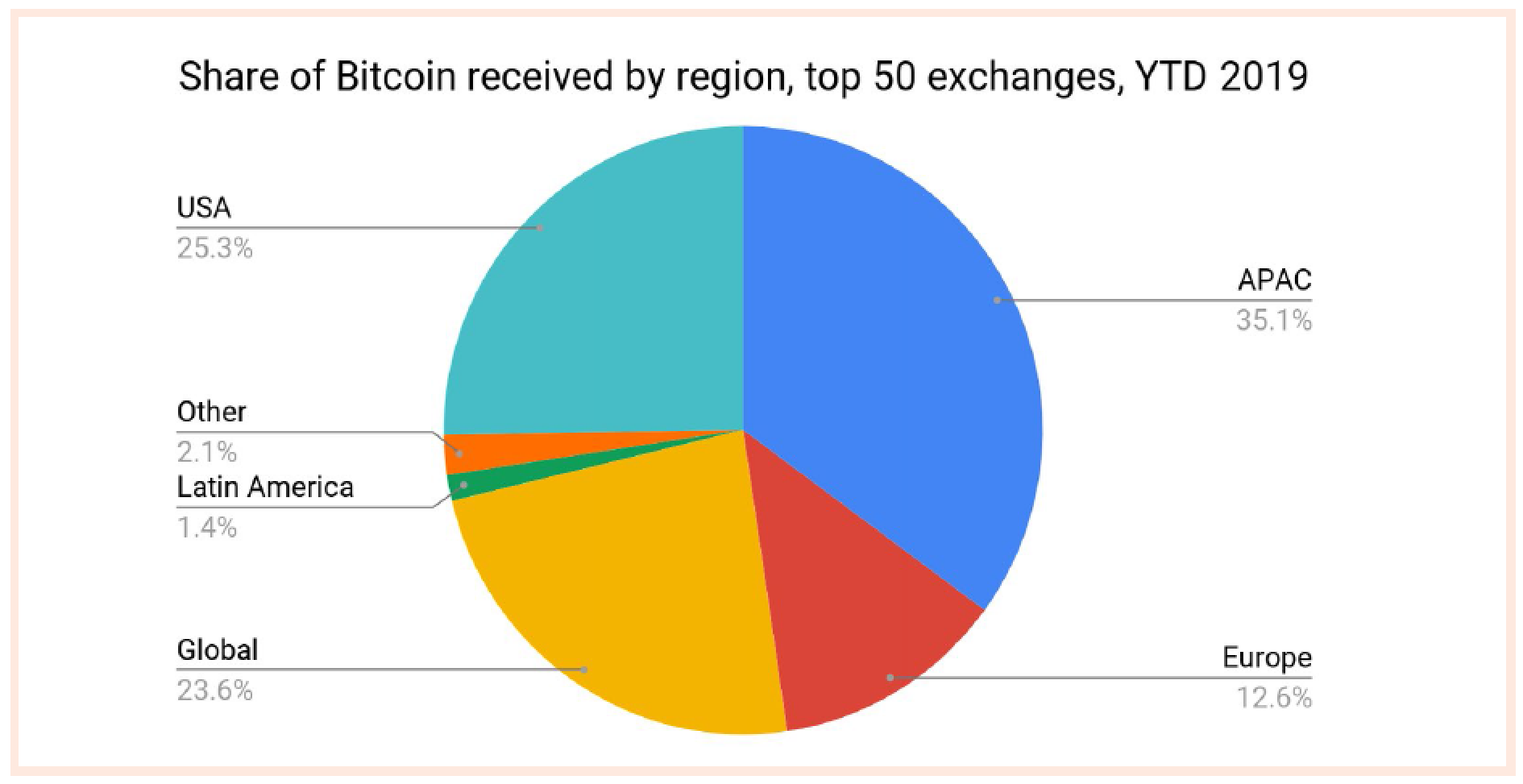

Figure 2 Bitcoin share distribution in the top 50 exchanges (Source: Chainalysis)

Among the top 50 exchanges, the Asia Pacific exchange received the most bitcoin in the first half of 2019, accounting for 35%. The North American exchange is close behind, with global exchanges ranking third. The exchange that receives the most bitcoin in the Asia Pacific region is Huobi.

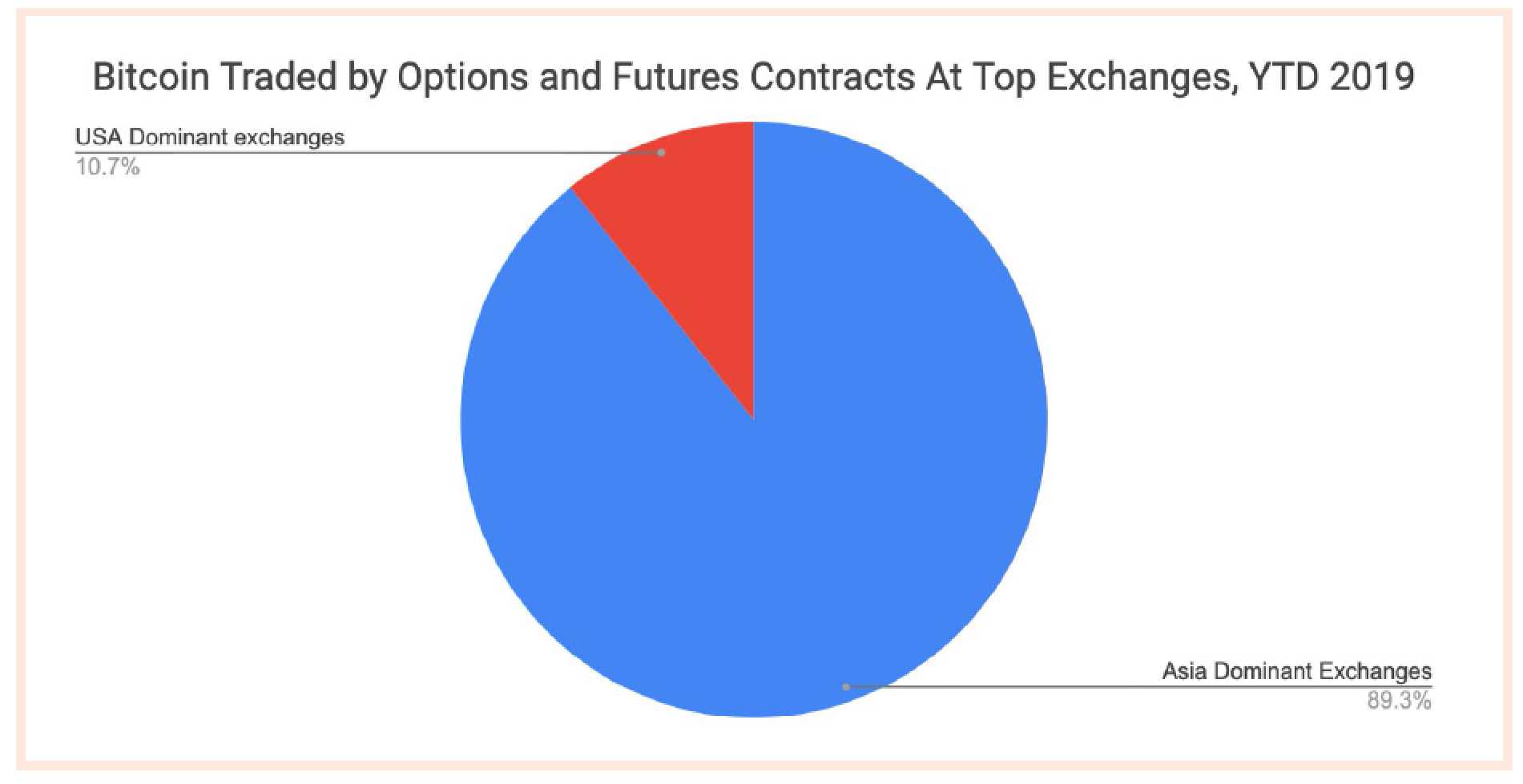

The share of Asia Pacific Exchange's spot trading (immediate purchase of cryptocurrency) is consistent with other markets. But Asia Pacific exchanges account for nearly 90% of the $2.36 billion options and futures contract market.

Figure 3 Distribution of Bitcoin options and futures trading on the head exchange (Source: Kaiko and Chainalysis)

3. Asia Pacific exchanges primarily trade with other Asia Pacific exchanges

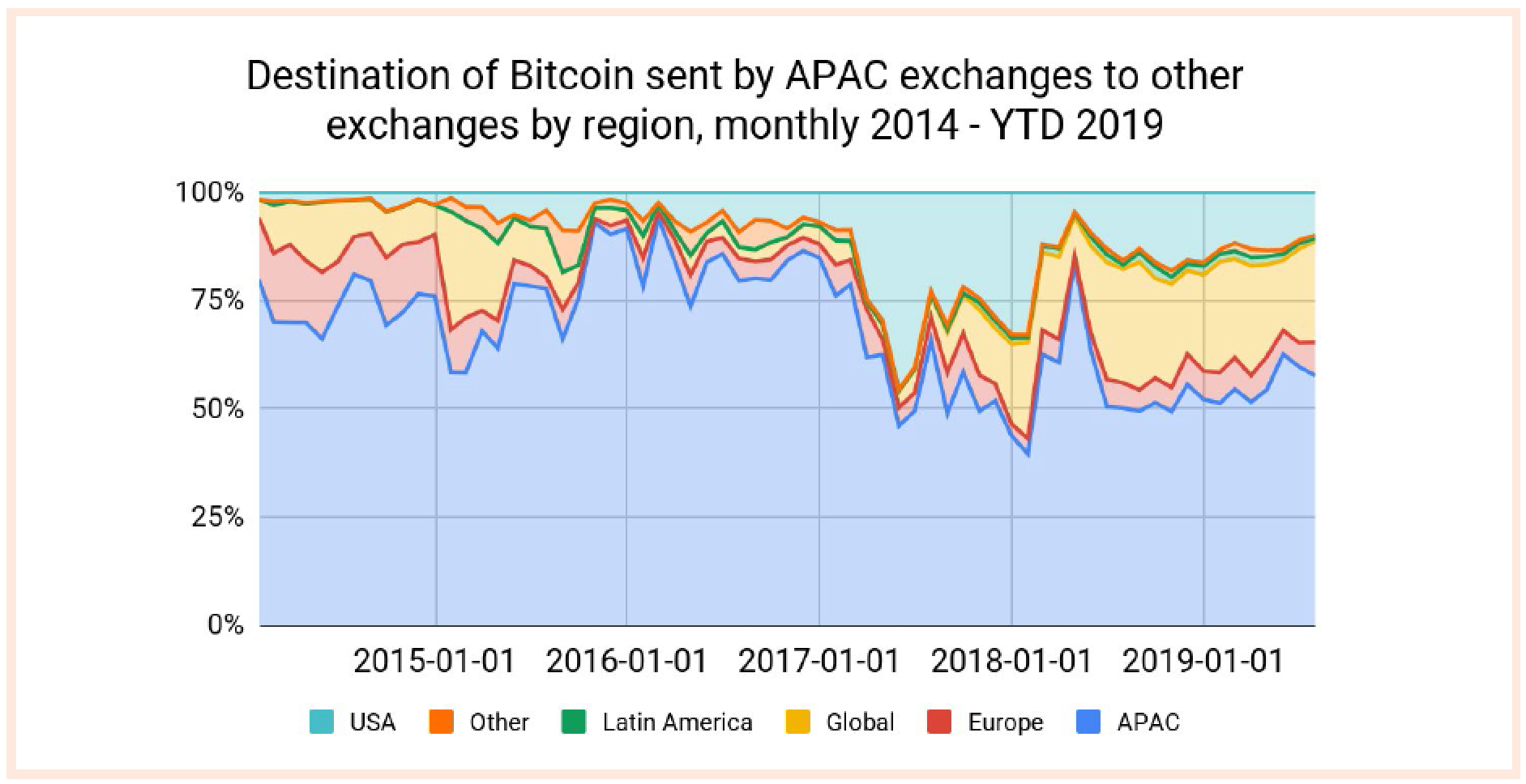

Figure 4 Destination distribution of Bitcoin sent by Asia Pacific exchanges to other exchanges (Source: Chainalysis)

After the rise of Bitcoin in 2017 and China's tightening of cryptocurrency regulation, nearly 50% of the funds left the Asia-Pacific region and flowed to US exchanges. The funds then flowed from the US and European exchanges to global exchanges, probably because the two markets have stricter KYC requirements. In the second half of 2017, global exchanges began to offer more cryptocurrencies for people to trade, and therefore more attractive to professional traders.

Despite this, from 2014 to the first half of 2019, the Asia Pacific exchanges still spend most of their money on other exchanges in other Asia Pacific regions. China's OKCoin is the largest sender and receiver in intra-Asian trading. In addition to the Asia Pacific region, Bittrex received the most funds from the region, followed by Binance and Bifinex.

4. In the first half of 2019, the Asia-Pacific exchange increased by 1 million bitcoin deposit addresses.

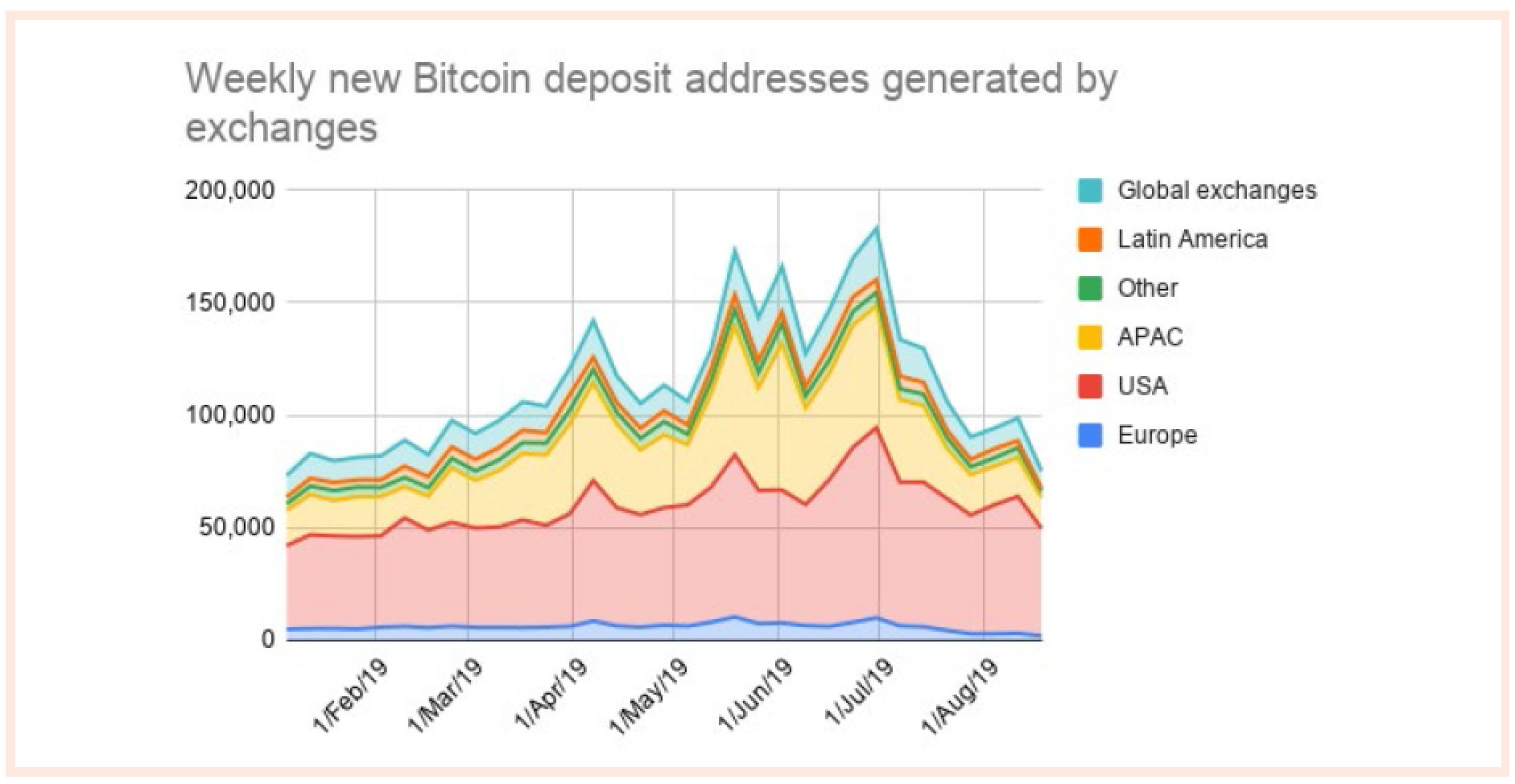

Figure 5 Number of new Bitcoin deposit addresses added by the exchange each week (Source: Chainalysis)

The US exchange has the largest number of bitcoin deposit addresses, with 1.8 million. The number of deposit addresses added by exchanges in the Asia-Pacific region ranked second, and by August this year, it had increased by 1 million. Bitcoin prices rose sharply in May and June, during which time the Asia Pacific exchange's bitcoin deposit addresses increased significantly compared to other regions. However, after the peak period, the number of new bitcoin deposit addresses in the Asia-Pacific region dropped sharply to the lowest level this year, while the new bitcoin deposit addresses on the US exchange have been relatively high.

The number of newly created Bitcoin deposit addresses on the exchange provides a means of estimating the number of Bitcoin participants. Detecting this activity can estimate the upper limit of the number of people interacting with the exchange on the Bitcoin blockchain, but cannot estimate the maximum number of people on the exchange for new transactions, because one can trade multiple deposit addresses in one transaction and can be more Home exchange deposits. People can also interact with multiple exchanges through legal currency deposits, and this does not result in a new number of bitcoin deposit addresses. They can also interact with the exchange by storing other cryptocurrencies. However, most of the bitcoin transactions are mainly related to exchanges. The addition of bitcoin deposit addresses is a relative measure of users' participation in Bitcoin.

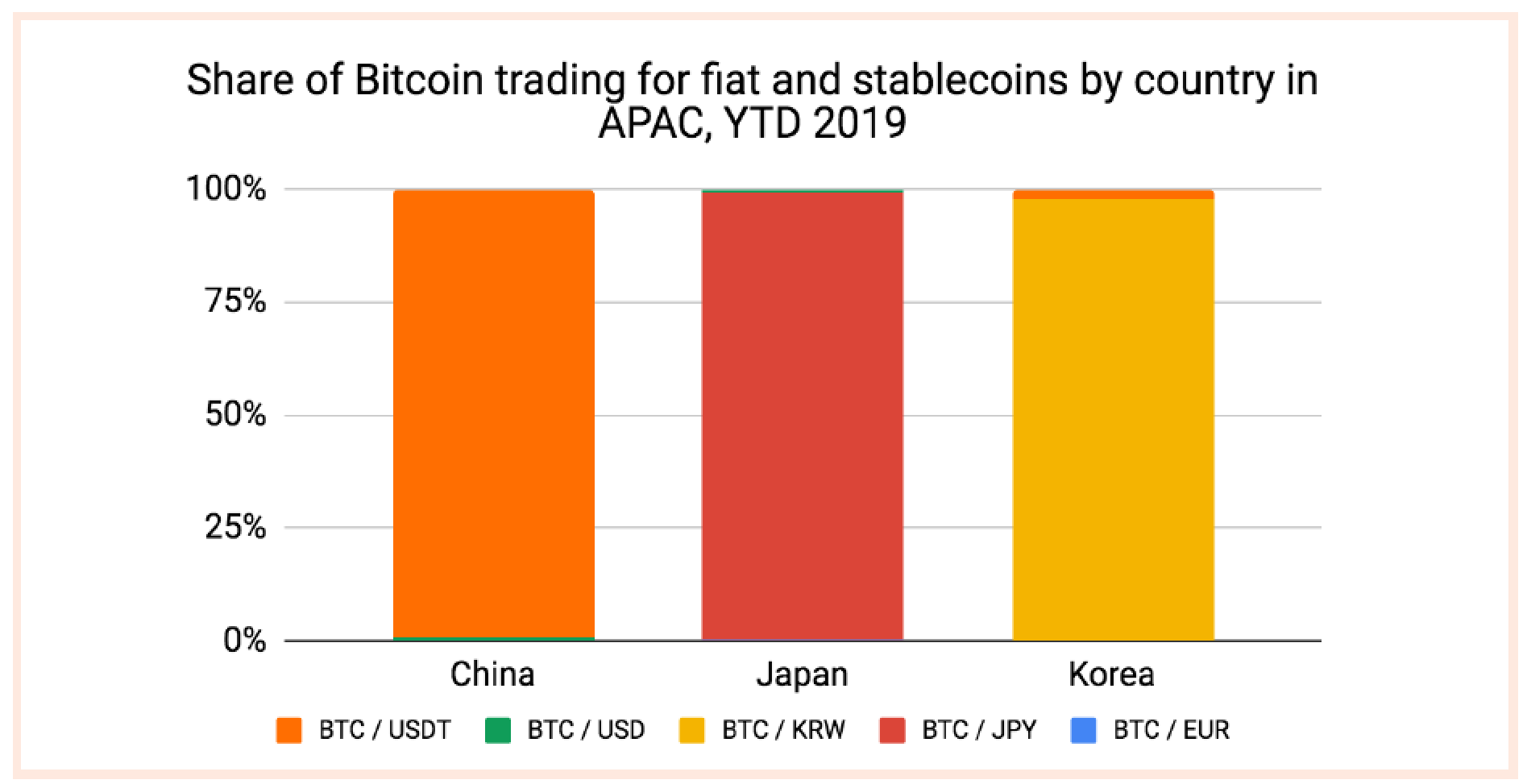

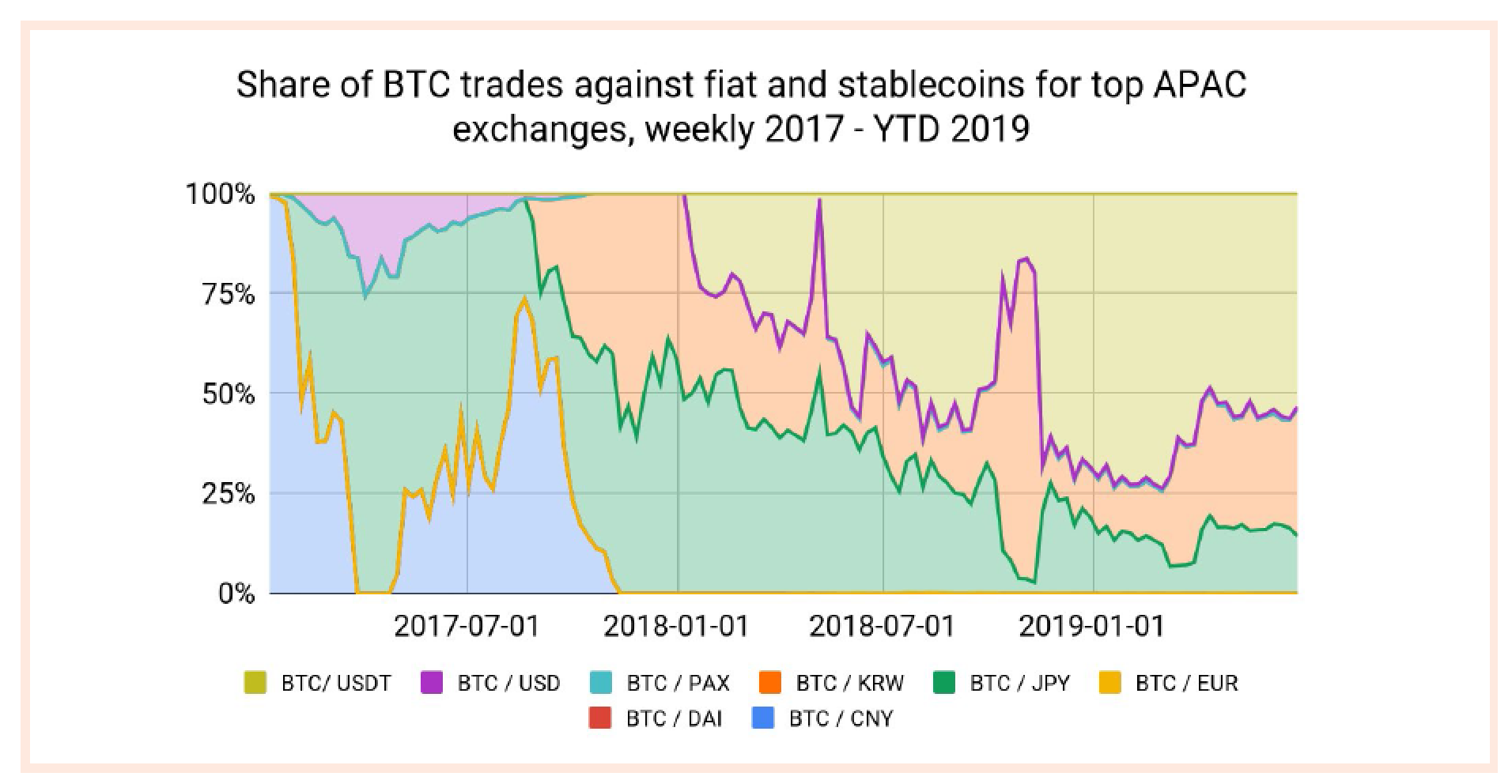

In Japan and South Korea, Bitcoin transactions are mostly traded with traditional French currency, while in China, 99% of Bitcoin spot transactions are conducted through USDT.

Figure 6 Distribution of Bitcoin and French and Stable Currency transactions in the Asia Pacific region (Source: Kaiko and Chainalysis)

Japanese exchanges only use yen to trade, while Korean exchanges mainly use Korean won to trade, which indicates that there is a strong banking relationship between Korean banks and established exchanges that accept French currency. In China, USDT has become the most popular currency.

Figure 7 Distribution of Bitcoin and French and Stable Currency Trading Shares in the Asia Pacific Head Exchange (Source: Kaiko and Chainalysis)

As shown in the above chart, this shift occurred after China banned Bitcoin and RMB trading, and USDT replaced the RMB as the choice of trading pair. It is worthy of Chainalysis's attention that the bitcoin against the Korean won in the middle of 2018 may be due to false transactions.

5. Illegal and hazardous activities in the Asia-Pacific region are in line with global trends

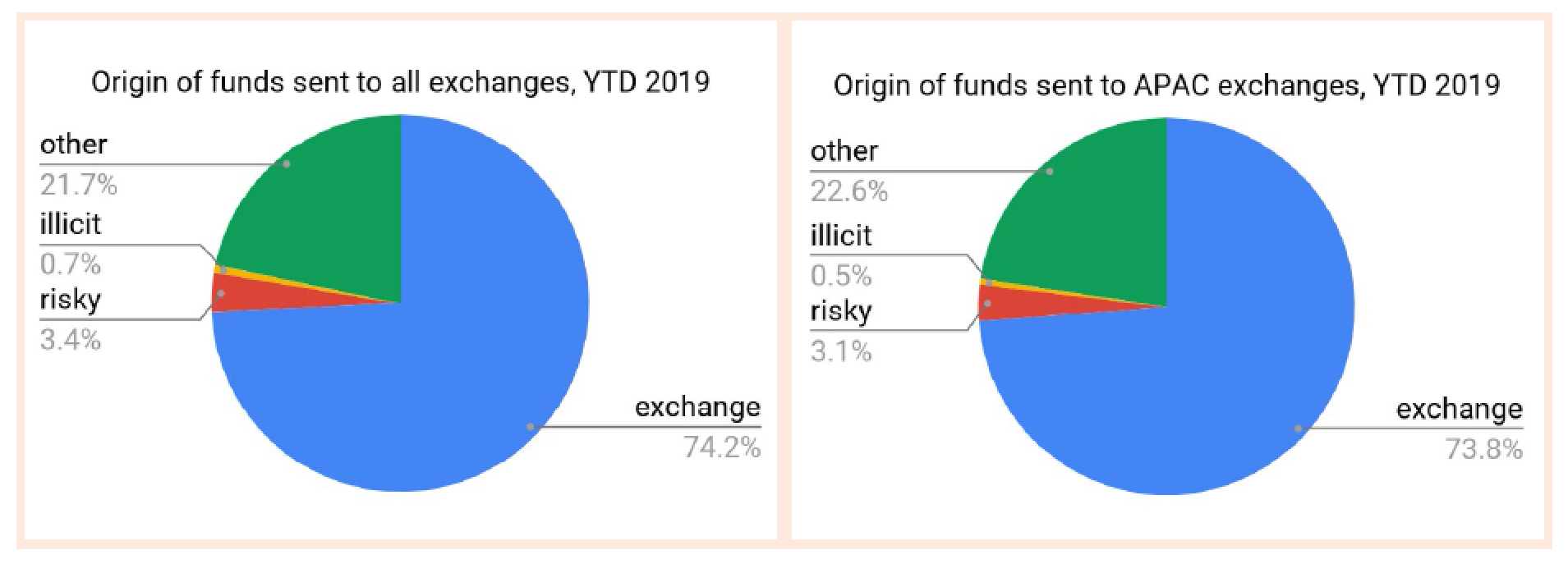

Figure 8 Distribution of sources of funds remitted to the exchange (Source: Chainalysis)

Most of the funds received by exchanges in the Asia Pacific region come from other exchanges, and 3.6% of the funds come from illegal or dangerous addresses. 22.6% of the funds come from other sources, including merchant services, managed wallets, mining, unknown activities and other categories.

Japan and South Korea also have similar risk activities, and 3% of the funds received by the exchange come from high-risk categories. However, in Japan, risk activities from high-risk transactions are more concentrated, and Korea has a higher exposure to personal-to-person transactions. The proportion of such risk activities in South Korea is much higher than in Japan, at 1.1% and 0.09% respectively, but most of the Korean exchanges receive illegal funds from fraud.

In general, the importance of the Asia-Pacific region to the global cryptocurrency market cannot be overstated. The Asia Pacific region has the largest number of top exchanges, receiving the most bitcoin, with the largest volume of transactions, and is the driving force behind stable currency.

Original Source: https://uploads-ssl.webflow.com/5a9360f88433cb00018022c2/5da5c0711dba53c2d828e9ad_APAC%20report-%20English_digital_10.11.pdf

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The four operations of the correct investment in the encryption market: how to minimize losses to make a profit?

- New Balance's latest sneakers are coming soon, plus the blockchain hidden gameplay do you know?

- Deputy Governor of the Bank of France: Encrypted assets have the potential to replace the traditional banking system, stabilizing the currency or will have a systemic impact

- If Solana succeeds, does it mean that all the shards are scams?

- Telegram insists that Gram is not a security, former SEC legal counsel: this is just a struggle

- The first full text! Libra Association calls out the G7: Libra can coexist harmoniously with the central bank's digital currency

- Explore the cemetery of cryptocurrencies: Who killed the altcoin?