Why was my OpenSea account banned due to ‘US sanctions’?

Why was my OpenSea account banned for 'US sanctions'?Author: Cat Brother; Editor: Colin Wu

Process of Being Banned

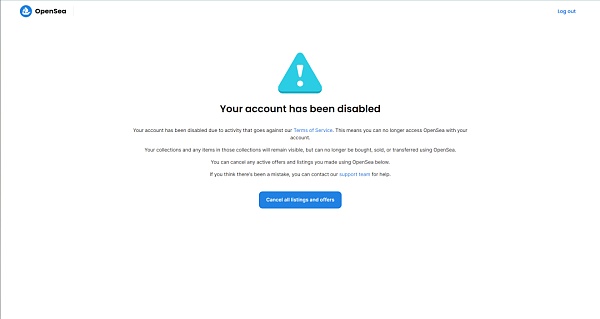

On August 20th, when I logged into Opensea to check the NFT market, I found that my account couldn’t be logged in. It showed that my account was banned due to activities that violated its terms of service, and I could no longer use OpenSea for buying, selling, or transferring.

- Arbitrum and DeFi Perfect Match?

- A Comprehensive Explanation of Chainlink Staking v0.2 Upgrade

- LD Macro Weekly Report China’s Expectations Hit Bottom, Who are the Long-Term Beneficiaries of AI

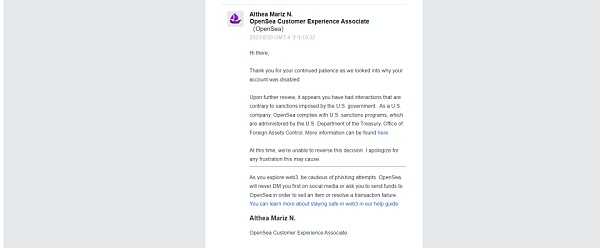

Since I hadn’t used Opensea for NFT purchases or other activities for several months, I sent an email to Opensea to inquire about the specific reason for the ban. Opensea explained that it was due to violating the sanctions imposed by the US government. As a US company, Opensea needs to comply with the US sanctions program managed by the Office of Foreign Assets Control (OFAC) of the US Department of the Treasury.

Possible Reasons

First, based on Opensea’s statement, I checked the SDN sanctions list published by OFAC and found that my name was not on the list.

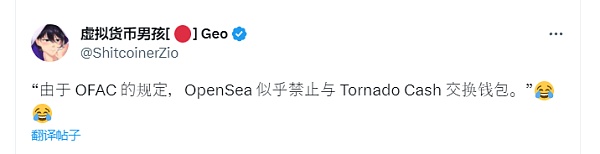

Then, by reviewing Twitter and my own transaction records, I speculated that I might have been banned in July due to using Tornado.Cash, as other users on Twitter had similar experiences.

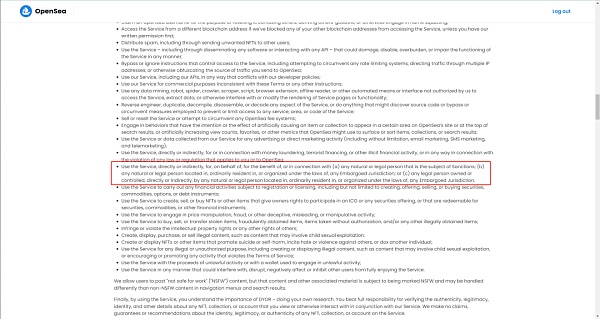

By reviewing Opensea’s terms of service, I found the possible reason for the ban, which is: directly or indirectly using the service for, on behalf of, in support of, or in connection with (a) any sanctioned natural person or legal entity; (b) any natural person or legal entity located, ordinarily resident in, or organized under the laws of any sanctioned jurisdiction; or (c) any legal entity directly or indirectly owned or controlled by natural persons or legal entities located, ordinarily resident in, or organized under the laws of any sanctioned jurisdiction.

Background Introduction

On August 8, 2022, the US Department of the Treasury added Tornado Cash to the sanctions list, prohibiting all US individuals and entities from interacting with Tornado Cash or any Ethereum wallet addresses associated with the protocol.

Subsequently, major crypto entities in the US joined the sanctions against Tornado Cash. Circle blacklisted the wallet addresses controlled by Tornado Cash, and wallets that participated in Tornado Cash mining were also blocked by Aave. After that, the official website and Discord of Tornado Cash were closed one after another, and the Github page disappeared. On August 10th, the Dutch Financial Intelligence and Investigation Service arrested Tornado Cash developer Alexey Pertse in Amsterdam.

The latest development in the Tornado Cash incident is that on the SDN sanctions list issued by the US Department of the Treasury on August 23, Tornado Cash co-founder Roman Semenov was included. The other co-founder, Roman Storm, was also arrested by the Federal Bureau of Investigation (FBI) and the Internal Revenue Service (IRS), charged with conspiracy to launder money, conspiracy to operate an unlicensed money transmission business, and conspiracy to violate sanctions regulations. Deputy Secretary of the Treasury Wally Adeyemo also stated that they will continue to investigate those who operate and support similar mixing services that pose a threat to US national security.

However, at present, there has not been a final judgment on the Tornado Cash case, and there is also significant opposition to the sanctions against Tornado Cash within the United States. Jake Chervinsky, Chief Policy Officer of the Blockchain Association, tweeted, “Privacy is universal, code is speech, and the right to anonymity is crucial for a free society. These principles are deeply embodied in the U.S. Constitution, and I firmly believe that over time, even if these principles are ignored by the executive branch today, they will eventually be recognized by the judicial branch.” Hayden Adams, the founder of Uniswap, also expressed his views on the U.S. Treasury Department’s sanctions against Tornado Cash in a tweet: “Privacy is crucial for a normal and secure society. Sanctioning an immutable smart contract, rather than an individual or organization, involves a significant issue of freedom of speech and sets a bad precedent. Sanctioning a company to comply with the law is usually less effective than coming up with reasonable legal or policy measures.”

Actual Impact

Similar to what was mentioned earlier about Aave banning wallets that participated in Tornado Cash mining, Opensea’s ban on users who have used Tornado Cash is also targeted at the front-end, and the ban measures also include other Opensea products such as Opensea Pro.

On the other hand, other NFT markets such as Blur, X2Y2, and LooksRare have not banned the address and allow normal NFT trading. Other DeFi projects such as AAVE have also not banned the address and allow normal transactions.

In summary, the ban this time is due to Opensea’s proactive, strict control policy, which bans addresses that have used Tornado Cash at the front-end. However, it does not affect the trading of assets themselves or the use of other crypto applications. Although its actual impact is limited, if users are accustomed to using Opensea for NFT trading or want to retain Opensea usage records for a certain address, they should avoid using that address to interact with Tornado Cash or use other mixing services.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Tornado Cash founder arrested Does privacy transaction tool have original sin?

- Dragonfly Managing Partner DeFi TVL at its Lowest Point in Two and a Half Years, But DeFi is Not Dying

- NVIDIA’s market value surpassing cryptocurrencies, Tesla, and Facebook. Are we still in the early stages of the cryptocurrency industry?

- How can the POS network align with the long-term interests of all stakeholders?

- LianGuairadigm Open-source Wallet and Development Tools Rivet for Developers

- Why does the official BNB Chain Twitter focus on promoting MEKE?

- Opinion The collaboration between Base and optimism seems to be just a short-term verbal agreement.