A Comprehensive Explanation of Chainlink Staking v0.2 Upgrade

Chainlink Staking v0.2 Upgrade ExplainedAuthor: ChainLinkGod, Chainlink Community Ambassador; Translation: LianGuaixiaozou

Chainlink Staking v0.2 will be released in the fourth quarter of this year. The key points are as follows:

-

The pool size is expanded to 45 million LINK

-

v0.1 stakers

Priority Migration

-

Unbonding mechanism for unstaking

-

Dynamically adjustable reward rate

-

For future modular architecture upgrades

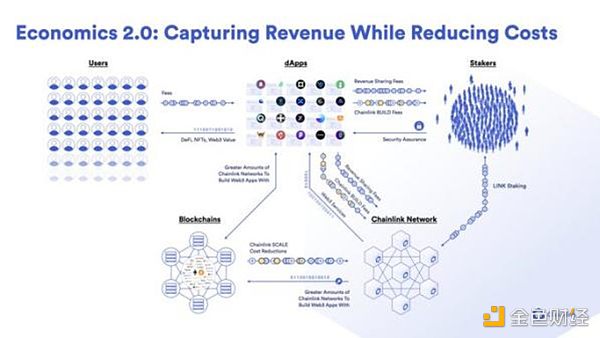

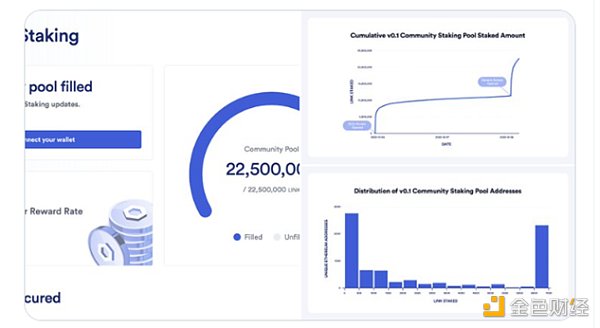

Staking is the core of Chainlink Economics 2.0, where node/token holders lock LINK to support oracle service performance and earn rewards. In December last year, Staking v0.1 was launched, with a LINK pool size of 25 million and a median of 1,161 LINK staked by 7,846 community stakers.

v0.2 is the latest version of Chainlink Staking, with several key objectives set on top of v0.1:

v0.2 is the latest version of Chainlink Staking, with several key objectives set on top of v0.1:

-

Providegreater flexibility for the community and node operators while maintaining a secure non-custodial design for staking LINK.

-

Providehigher security guarantees for oracle services within the scope of Chainlink Staking support.

-

Use amodular architecture to iteratively support future improvements and feature additions to Chainlink Staking, such as expanding to more services.

-

Dynamic reward mechanism that seamlessly supports future new sources of rewards, such as user fees.

1, Phased Rollout

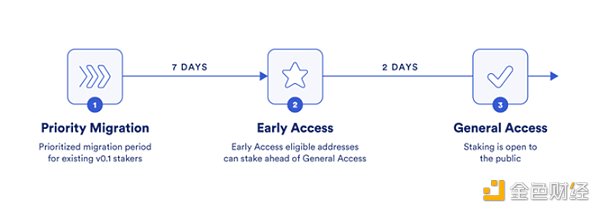

V0.2 will involve multiple entry phases to increase diversity among stakers.

-

v0.1 has a priority migration period of 7 days;

-

2 days of Early Access for eligible (historical activity) players;

-

Followed by General Access phase where anyone can participate in staking.

2, Modular Framework

The v0.2 codebase has been rebuilt as a fully modular, scalable, and upgradable staking platform.

Future upgrades – such as expanding to more oracle services, rewarding user fees, and BUILD claims – can be done without migrating to a new Staking contract.

3, Pool Expansion

A feature of v0.2 is the expansion of the pool to 45 million LINK, which is 80% larger than v0.1 and represents over 8% of the current circulating supply of LINK.

Over time, more Chainlink services will be ensured through staking, and the pool size is expected to increase.

4, Unstaking

Staked LINK does not have to remain locked until the next version is released; stakers can initiate a withdrawal request during a multi-week cooldown period at any time.

After the cooling-off period, stakers can withdraw their LINK during a claiming period that lasts for several days.

5、Claimable Rewards

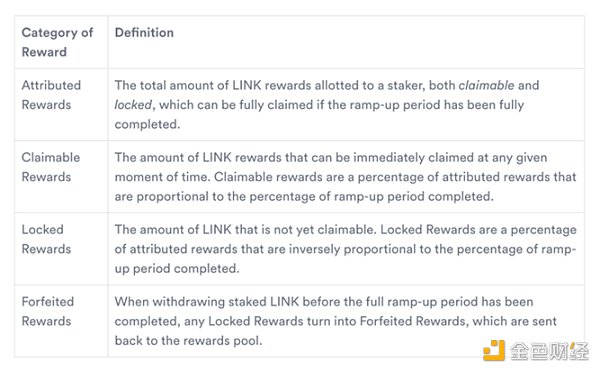

In v0.2, there are different types of rewards depending on the duration of the staking.

The rewards are initially locked and become claimable over time.

If a staker prematurely withdraws their staked LINK, they will lose the locked rewards.

6、Dynamic Reward Rate

The reward rate in v0.2 is variable, and regardless of the number of stakers, all stakers receive the same amount of rewards.

This design is necessary as staking rewards will increasingly come from user fees over time.

7、Staked LINK Forfeiture

In v0.2, when a staker triggers a valid alarm, the staked LINK of the affected service node will be forfeited.

Community stakers do not face forfeiture risk (to change this would require a migration).

8、Upgrade Time Lock

All critical configuration updates/upgrades to v0.2 must go through a time lock, with the most critical updates requiring a longer time than the unstaking time. V0.2 is not custodial, so your staked LINK cannot be withdrawn by others.

From a high-level perspective, the v0.2 upgrade for Staking introduces a new platform for iterating and adding/upgrading more modules. This modular iterative approach follows the feedback received from the previous v0.1 version.

Fundamentally, the economic approach of Chainlink can be summarized as follows:

-

Launch useful new oracle services (CCIP, low-latency oracles, Functions, etc.).

-

Monetize these oracle services to achieve sustainability.

If you are a v0.1 user, be prepared to migrate to v0.2 later this year, and you will have earlier access than others.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- NVIDIA’s market value surpassing cryptocurrencies, Tesla, and Facebook. Are we still in the early stages of the cryptocurrency industry?

- How can the POS network align with the long-term interests of all stakeholders?

- LianGuairadigm Open-source Wallet and Development Tools Rivet for Developers

- Why does the official BNB Chain Twitter focus on promoting MEKE?

- Opinion The collaboration between Base and optimism seems to be just a short-term verbal agreement.

- Changtui The Magic of OP Stack – Everyone Can Issue an L2

- Insights based on Friend.Tech Optimistic about the emergence of breakout applications in the Web3 fan economy