What hidden information is there in the research on the development trajectory of Bored Ape Yacht Club (BAYC) and Milady?

What hidden information is in the research on Bored Ape Yacht Club (BAYC) and Milady's development trajectory?Author: @the_metadata Translation: Huohuo/Baihua Blockchain

Boring Apes (and most NFTs) have been in a continuous decline. Many people have suffered significant losses.

But there is a $10,000 PFP collection that has defied this trend and has been rising steadily – that is Milady.

So, how do we identify potential winners in a bleak market?

- Where is the future of money with AI-reconstructed DingTalk?

- Why is it difficult to generate true random numbers on the blockchain?

- What hidden information is there in the research on the development trajectory of BAYC and Milady?

Here are some insights:

Clearly, Boring Apes and Milady are on different paths. Boring Apes has been in a continuous decline, dropping to 23 ETH, a decrease of over 50%.

People attribute this to the miners of Blur: as mining for BLUR airdrops became less attractive, they have been selling off their inventory.

On the other hand, Milady has been a shining star. After a period of stagnation, it has achieved a 50% price increase this month.

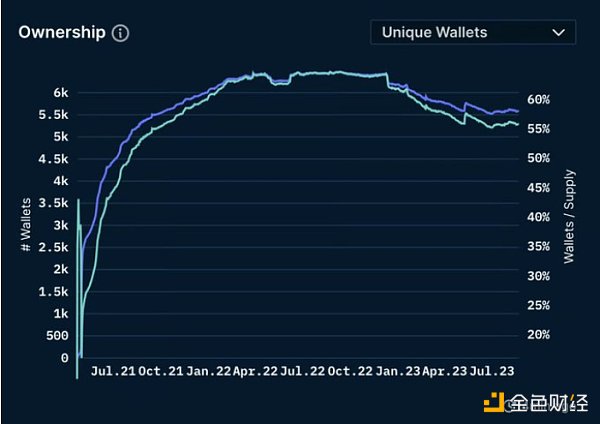

Ownership tells the story of two different trends.

The common belief is that higher-priced special NFT ownership signifies scarcity and is held by whales, who are often speculators rather than long-term holders.

Boring Apes has enjoyed a higher percentage of unique ownership for most of 2022, staying above 60%.

Superficially, this may seem positive, but since early 2023, the number of unique wallets has been declining, which is a concerning development.

@miladymaker started with a lower base of unique ownership, around 30%, but has been steadily increasing since February 2023 and now stands at 36%.

At first glance, a lower percentage of unique ownership may seem unfavorable for the price, but in the long run, this is not the case.

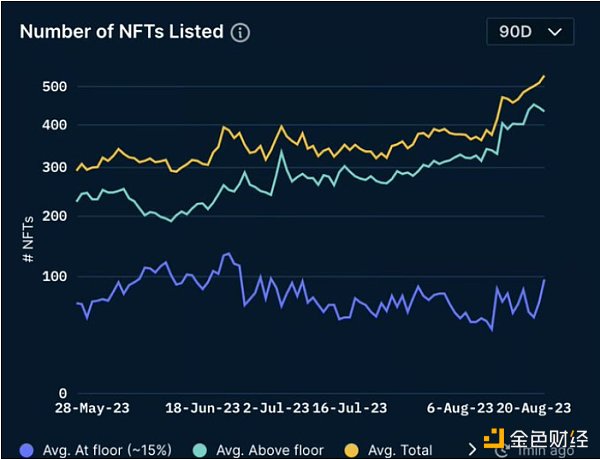

Listings provide another interesting perspective.

In the past 90 days, Boring Apes’ listings on OpenSea have grown by 70% (from around 300 to over 500+).

Typically, listings indicate a stronger intent to sell the NFT by its owner.

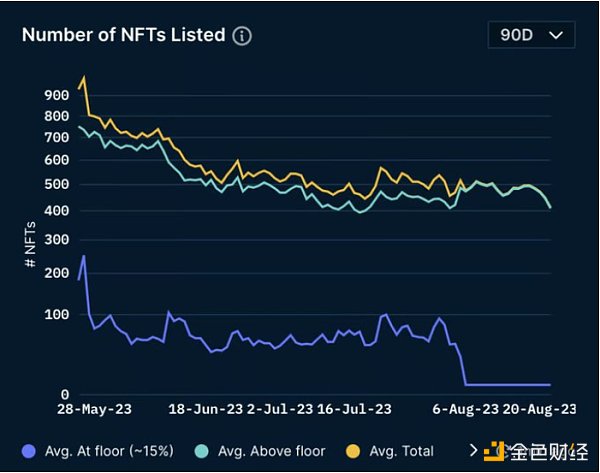

In contrast, Milady’s NFT listings were quite high in May (over 900), but have been declining since then.

The number of NFTs listed for sale has dropped by 45% to around 500 today.

Boring Apes and Milady have similar numbers of NFT listings, but the trends are completely different.

So what’s the overall situation? Ownership and listings provide us with clues about the price trends of NFT collectibles, just like tea leaves:

The percentage of unique owners and the number of NFTs listed are not so important, as each project has its own dynamics.

Comparing at a single point in time is not very effective, it’s most important to focus on trends.

An increase in the percentage of unique ownership + a decrease in the percentage of listings = a positive signal for prices. Conversely, the opposite is true.

Of course, it’s not 100% accurate, but it’s worth keeping in mind as a necessary reference!

(Thanks to @nansen_ai for providing the chart)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyzing the RUNE protocol from both bullish and bearish perspectives.

- County Youth Engaged in Cryptocurrency Trading Lost 130,000 Yuan and Returned to the Construction Site to Repay Debts Again

- LianGuai Encyclopedia | What is a known plaintext attack

- An Exploration of Everything Behind Friend.Tech

- Base and Optimism launch shared governance and revenue sharing framework

- An In-depth Analysis of Aave Governance V2 A More Inclusive and Efficient Decision-making System

- Coinbase is in talks with Canadian banking giant to promote cryptocurrencies