How can the POS network align with the long-term interests of all stakeholders?

How can POS network align with stakeholders' long-term interests?Authors: Vishal KanKani, Tushar Jain; Translation: Luffy, Foresight News

Currently, almost all Proof of Stake (PoS) networks provide incentives through protocol staking and inflation. However, no PoS network has been able to provide the killer feature: long-term staking.

Term structures allow investors to strategically lock up capital for different periods of time in exchange for higher investment returns. In traditional finance, term rates make up the yield curve, which is an important component of a well-functioning financial market. However, these primitives do not exist at the protocol level in the cryptocurrency space.

Note: It is important to note that although we use the terms “term structures” or “yield curves,” they operate differently from the traditional fixed-income market. For example, in the United States, the Federal Reserve is responsible for managing monetary policy and controlling the flow of money. On the other hand, the U.S. Treasury issues fixed-income products to raise money that is already in circulation. In this proposal, we suggest reallocating inflation of cryptocurrencies implemented programmatically in PoS blockchains.

In this article, we will explore how PoS networks can better align stakeholders with the long-term success of their networks, and we propose specific financial structures to elegantly achieve this goal.

The Role of Staking

Staking is not just a way to earn rewards. It plays a crucial role in the security of PoS networks, which is why token holders can earn token rewards by participating in staking.

However, in the current staking model, regardless of intention, rewards are distributed equally among all participants in the ecosystem, disregarding their specific contributions to the network. Whether it is a short-term, long-term, or diamond hand that will never sell, they receive the same rewards. The result is that stakeholders who take risks and bear volatility to improve the network are not adequately compensated.

Furthermore, the ability to unstake within a relatively short waiting period may pose potential risks to the stability of the network. Especially in extreme cases where a large amount of staking is withdrawn in a short period, it is likely to destabilize the network, disrupt the entire system, and even worse, trigger a comprehensive economic attack.

Ethereum uses a queuing system to mitigate this risk. In this article, we explore potential alternatives.

Staking is effective, but it can be improved.

Long-Term Staking

Long-term staking will reward long-term stakers with a higher proportion of tokens in exchange for longer staking lock-ups, thereby promoting network stability and longevity.

Long-term staking introduces a time-locking variable during the staking process (e.g., stakers can choose to lock up their staked tokens for 1 year, 2 years, etc.). The protocol can treat it as time-weighted stakes, where the distribution of stake rewards favors stakers who bear more risk over a longer period of time.

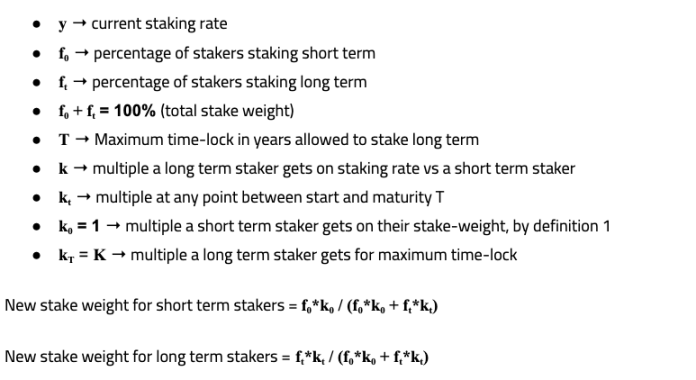

Let’s define some variables:

We intentionally define k as a separate multiplier instead of purely time-weighting the staking, which allows for flexibility. By avoiding strict time multiplication, especially in the case of long-term lockups, this design can prevent excessive adverse effects on short-term staking rates. This, in turn, eliminates any potential barriers for stakers who may not have long-term interests, ultimately preventing a decline in staking participation (important for short-term consensus security). Additionally, long-term staking rates can be increased by increasing k if necessary.

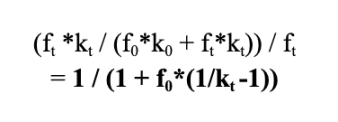

Assuming the validators perform consistently, long-term stakeholders can increase their rewards in the following way:

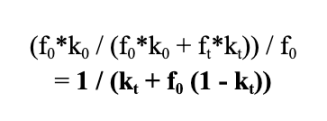

However, rewards for short-term stakeholders will decrease.

Exploring Financial Architecture to Facilitate Risk Transfer

PoS networks can implement long-term staking in two direct ways: permanent time-locked contracts and fixed-term contracts.

Permanent Time-Locked Contracts

First, the network can offer a permanent staking contract for one year to stakers interested in long-term staking. You can think of it as a redeemable bond.

Every epoch/block, stakers can submit redemption requests. After submitting a redemption (i.e., unstaking) request, they must wait for the one-year time lock to expire before they can withdraw the underlying assets.

If stakers want to continue staking, the time lock will automatically reset to one year (i.e., automatically roll over) every epoch/block. From the stakers’ perspective, they avoid taking on any uncertainty of principal repayment beyond the one-year time lock.

If the one-year permanent staking contract does not meet the stakers’ needs, the network can also introduce contracts with other durations: 3 months, 6 months, 2 years, 3 years, 5 years, 10 years, etc.

Fixed-Term Time-Locked Contracts

Fixed-term contracts are another way to implement term staking. This looks more like traditional bonds where the principal will be returned on a fixed date in the future, and the expiration time shortens over time.

In general, we believe that permanent time-locked contracts are a better financial structure than fixed-term contracts because:

The one-year time lock structure of permanent time-locked contracts allows the network to operate under the maximum possible time lock for each epoch/block, effectively incentivizing long-term staking;

Because each epoch/block is locked for 1 year, multiple k can remain unchanged throughout the entire staking lifecycle. This is particularly important because as the expiration date approaches for fixed-term contracts, the staking multiplier for participants interested in long-term staking decreases, narrowing the interest differential between long-term and short-term stakers and reducing the attractiveness to long-term stakers.

DeFi: Facilitating Risk Transfer

Even the most basic implementation should be able to cater to the preferences of long-term stakers who need the ability to exit native assets through liquidity staking before the staking period ends. We expect to see token pools based on term-based liquidity staking emerge to facilitate this risk transfer.

In addition, due to the mean-reverting nature of yield rates and the power of composability, automated market makers can facilitate seamless risk transfer across time horizons between market participants through liquidity staking pools. In fact, yield curve trading is already an important market in traditional finance. For example, we anticipate independent trading of stToken-12month and stToken-6month, with these tokens driving on-chain trading and liquidity development.

Thought Experiment: Long-Term Staking in a Hypothetical PoS Network

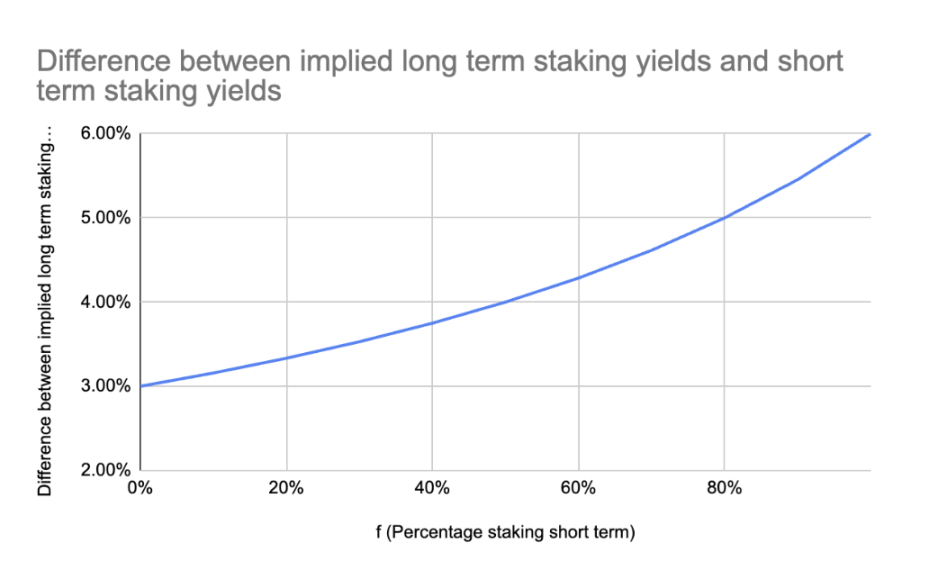

Let’s consider a hypothetical PoS network with a staking reward rate of y = 6%. Let’s use K = 2 to balance short-term and long-term staking rates. In this calculation, we assume T = 1 year.

We find that in an extreme case, when everyone engages in short-term staking, everyone receives the same staking reward rate of y = 6%. However, the first person to engage in long-term staking can receive double the rate, i.e., K * y = 12%. On the other extreme, when everyone engages in long-term staking, the staking reward rate remains at y = 6%, but anyone choosing short-term staking only receives y / K = 3%. In fact, the ultimate equilibrium state may lie between these two extremes. Therefore, at the same inflation rate, the network may achieve higher security over a longer period of time.

Note: The above graph shows that as more people engage in short-term staking, the staking rate curve becomes steeper and incentivizes more people to engage in long-term staking.

It must be acknowledged that the thought experiment here focuses on a specific duration: one year. This simplifies implementation while maintaining flexibility for easy expansion to other lock-in periods in the future. The process of expanding to multiple lock-in periods should be a collaborative one, with the community conducting in-depth research into the specific characteristics of each subsequent lock-in period and respective PoS networks.

This design has the following features: 1) simple and intuitive, 2) easy to reconfigure based on market feedback, 3) integrates with the demands of the free market, 4) ensures that the long-term staking rate is greater than the short-term staking rate.

Managing Design Risks

Long-term staking is not a panacea, and there are some limitations to consider.

One of the most important risks in this design is that whales with a large number of tokens can lock them up for the longest term and achieve the following objectives:

-

Control K (the multiple of the long-term staking rate), which may penalize short-term stakers and increase the risk of them leaving the network, leading to centralization of the network.

-

It may have a detrimental impact on short-term stakeholders who are validators. It may reduce the competitiveness of these validators and increase the likelihood of them leaving the network.

The solution is to design a community-driven approach to determine the value of K. This multiple should be large enough and important enough, but also small enough not to harm the interests of short-term stakeholders. The determination of the final value of K requires consultation with multiple stakeholders – short-term stakeholders, long-term stakeholders, validators with different stakeholder combinations, etc.

A More Powerful Blockchain

We believe that in order to ensure the network’s resilience and develop into a financial infrastructure that supports billions of users and trillions of dollars, a PoS network needs to seriously consider how to incentivize long-term, value-aligned stakeholders. The yield curve is a pillar of well-functioning financial markets. Long-term staking is a cryptographic native approach to turning this vision into reality, and we can also leverage the power of composability to create seamless risk transfer mechanisms between different market participants.

By implementing long-term staking, a PoS network can create a strong ecosystem that rewards those who participate in the long term and align with the network’s values. In addition, long-term stakers can significantly enhance the implicit security of the network by voluntarily locking their tokens for the long term. As long-term “stakeholders,” they instill confidence in blockchain security, attract more stakeholders, and promote a virtuous cycle of network growth. By implementing these measures, we can significantly improve the state of PoS blockchains and enhance their stability, security, and long-term viability.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Changtui The Magic of OP Stack – Everyone Can Issue an L2

- Insights based on Friend.Tech Optimistic about the emergence of breakout applications in the Web3 fan economy

- What hidden information is there in the research on the development trajectory of Bored Ape Yacht Club (BAYC) and Milady?

- Where is the future of money with AI-reconstructed DingTalk?

- Why is it difficult to generate true random numbers on the blockchain?

- What hidden information is there in the research on the development trajectory of BAYC and Milady?

- Analyzing the RUNE protocol from both bullish and bearish perspectives.