If Bitcoin does not take off as expected, what should miners do after halving?

The original article is a research report on the trends and impacts of the Bitcoin inflation mechanism in the study of the Bitcoin halving event, titled: "Trends & Implications of Bitcoin's Inflation Mechanism"

Translator: Odaily Sunday newspaper Xin Nan, if you need to reprint please indicate the original and compiled source.

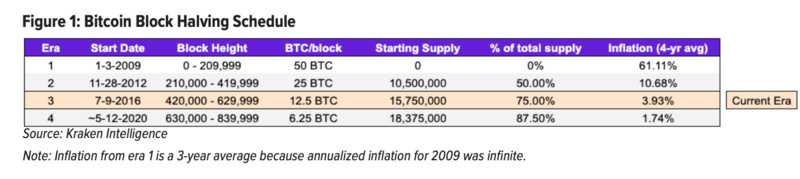

Bitcoin is hailed as the most robust non-sovereign currency due to its tightly controlled inflation rate-Bitcoin has kept its total supply constant at 21 million blocks per 210,000 blocks (approximately every four years) One block reward halved.

- Decentraland first experience: virtual world based on Ethereum

- Viewpoint | Historical data inventory, see the evolution of Ethereum

- Weekly development of industrial blockchain 丨 Blockchain policies are frequently promulgated, and many points of government application blossom

The most recent halving of Bitcoin is also the third halving of the network since its birth. This time, Bitcoin will be halved on the 630000th block, which is expected to occur on May 12, 2020.

After this halving, the Bitcoin block reward will be reduced from 12.5 bits to 6.25 bitcoins per block, and the inflation rate will also be reduced from 3.72% to 1.79%.

This means that Bitcoin's inflation rate will be the first to achieve the 2% inflation target designed by most central banks for their fiat currencies. As of January 31, 2020, there were 18.19 million Bitcoins in circulation, accounting for about 87% of the total supply. According to Shi Jianjin, halving is often regarded as the trigger point of skyrocketing prices. But will history really repeat itself?

This report, produced by cryptocurrency exchange Kraken , discusses the time trend of the previous halving, Bitcoin in the context of other commodities, and the impact of halving on mining.

Bitcoin halving introduction

The Bitcoin network adds an average block every 10 minutes, and each block will issue a new Bitcoin reward to miners who successfully verify the block.

At present, the reward per block is 12.5 bitcoins, and the Bitcoin network is adding 1800 bitcoins per day at an average speed of 144 blocks per day (about 3.9% annual inflation rate).

According to the code behind the Bitcoin network, Bitcoin's inflation rate will show a downward trend before the total supply in 21140 approaches 21 million Bitcoins. However, it is worth noting that by 2032, 99% of Bitcoin will be minted.

Every 210,000 bitcoin blocks, that is, about every four years, the number of bitcoin rewarded by the block is reduced by 50%.

(Table 1: Bitcoin halving schedule Note: Era1's inflation is a 3-year average, as the annualized inflation in 2009 is unlimited)

Based on the block height of 615,350 as of January 31, 2020, the last bitcoin is expected to be mined in March 2140.

Analysis of historical halving

By analyzing the past two histories of the network, we can find a bull market law that appears around halving.

Bull markets usually start 12-18 months before the halving and end 12-18 months after the halving. We find that it is useful to analyze the "relative bottom" and "relative peak" changes in prices during this period of.

Halved for the first time

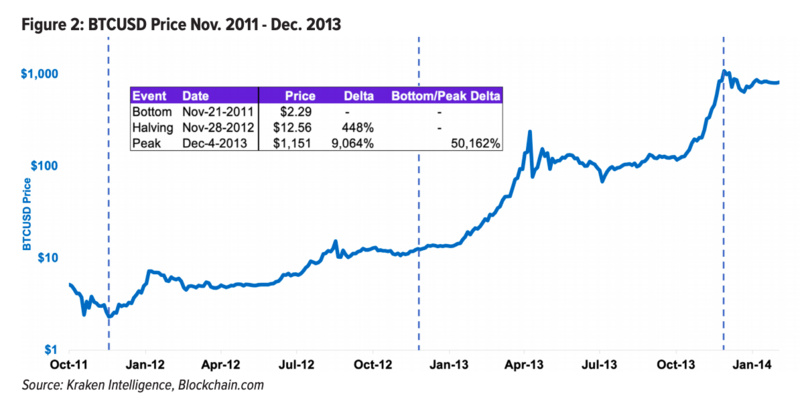

On November 28, 2012, Bitcoin halved for the first time on 210,000 blocks, reducing the block reward from 50 Bitcoins to 25 Bitcoins.

Before the halving, the entire network could mine 144 blocks per day. After the halving, the block reward will be reduced from 7,200 bitcoins to 3600 bitcoins.

As you can see from Chart 2 below, this year's bull market started in November 2011, exactly the year before the halving. Similarly, the bull market ended in December 2013, exactly one year after halving.

During this period, the price of Bitcoin rose by 50162% from trough to crest. Later, the upward trend of Bitcoin reversed at the end of December 2013, entering a bear market that lasted for many years, and fell by 80%.

(Table 2: Price trend of BTC against the US dollar from November 2011 to December 2013)

Second halving

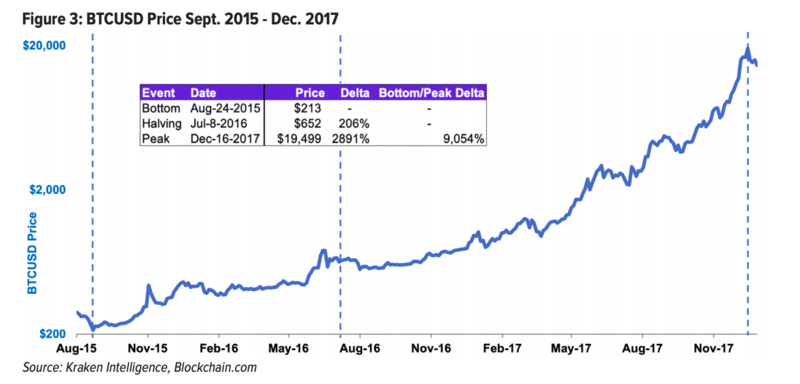

The second halving took place on July 9, 2016. On the 420,000th block, the block reward was reduced from 25 Bitcoins to 12.5 Bitcoins.

On a daily basis, the daily output of Bitcoin has dropped from 3600 to the current 1800.

It is worth noting that the interval between the first and second halvings is only 1316 days, which is nearly 150 days shorter than the generally expected 1460 days. Of course, this is due to the increase in computing power beyond the adjustment of the network's mining difficulty since the introduction of ASIC mining machines and replacement of GPU mining.

Although the mining difficulty is also automatically adjusted, it is adjusted about every 2016 blocks or about every two weeks to adapt to the increase of the computing power of the entire network and maintain an average discovery time of about 10 minutes per block, but the algorithm does not take into account unusually rapid technological progress ——From mining methods such as GPU and FPGA to the era of ASIC mining.

After ASIC mining, every dollar of investment can generate 20-50 times bitcoin than GPU mining. Of course, this in turn promotes the huge mining needs of miners.

Unlike the first bull market, which opened half a year ago, the second bull market that Bitcoin experienced began 9 months before the halving. On the surface, it crossed the 2017 bull market, when the price of Bitcoin was close to $ 20,000. In this round of bull market, Bitcoin has risen from the relative bottom price of US $ 213 on September 21, 2015 to a peak price of US $ 19,499 on December 16, 2017.

That is to say, after 18 months of Bitcoin's second decline, the price increased by 9054%. This parabolic bull market caused Bitcoin to fall by 80% until it bottomed out in December 2018.

(Table 3: Bitcoin price to US dollar price trend from October 2015 to December 2017)

Macro perspective

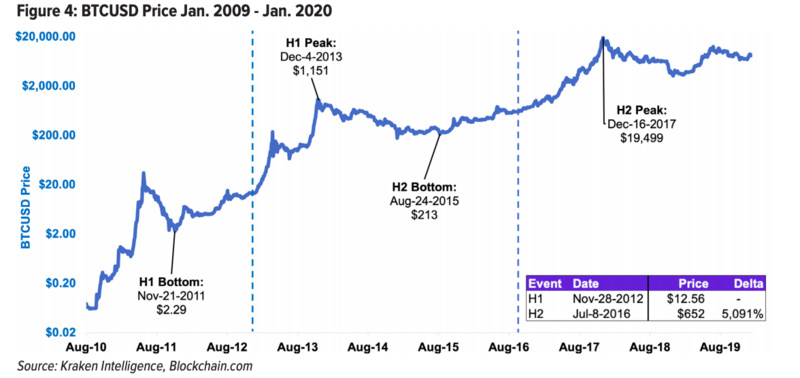

The commonality between these two halvings shows that the price of Bitcoin will rise for two years after halving, but it will be followed by a downward trend of 12-18 months, with a decline from peak to trough. 80%.

Around the first halving in November 2012, the peak price of bitcoin's relative price reached $ 1,151 in December 2013, almost exactly a year after the halving event.

Two years later, the price of Bitcoin dropped 81.5% to $ 213 in August 2015, and then the second halving started, and the bull market cycle started.

The second halving pushed the bull market to end after two and a half years, with Bitcoin price reaching a peak of $ 19,499.

Similar to the first halving, one year later, the price of bitcoin dropped by 83% and reached the lowest point of US $ 3,225 each at the end of December 2018. As of January 31, 2020, the bitcoin price has partially recovered to $ 9,300, an increase of 188% year-on-year.

(Table 4: Bitcoin price trend against the US dollar from January 2009 to January 2020)

Impact and significance of halving

"It's more like a typical precious metal, not to stabilize the value by changing the supply, but to determine the supply in advance and change its own value. As the user grows, the value of each coin is also increasing. It may form a positive cycle: as the number of users increases, so does the value, which will attract more users to profit from this growing value system. "-Satoshi Nakamoto

Halving is the key to Bitcoin becoming a sound currency.

Halving the supply of Bitcoin follows an anti-inflation curve. The upcoming halving will reduce the annual supply inflation rate from 3.7% to 1.8%. This marks the first time that Bitcoin's inflation rate has fallen below the 2% inflation target designed by most central banks for fiat currencies.

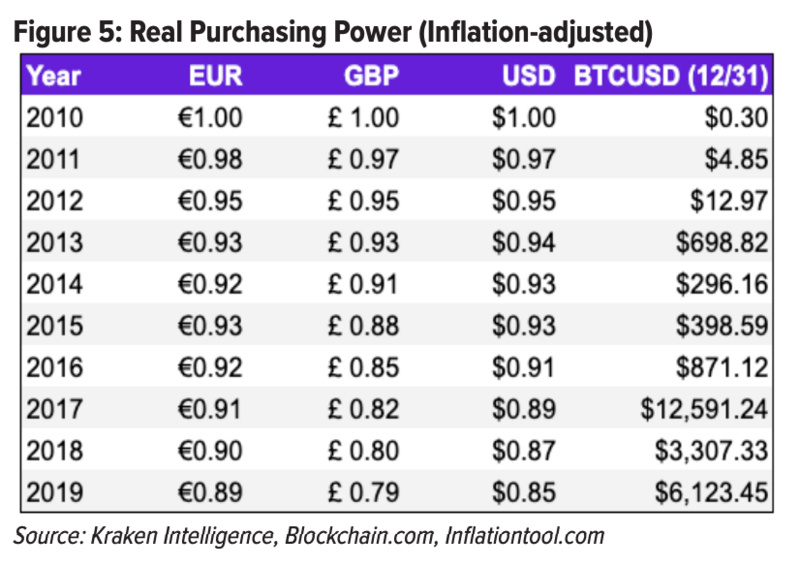

Facts have proved that, compared with inflation assets (such as fiat currency), anti-inflation assets such as gold are a better means of preserving value.

For example, the pound sterling is the oldest fiat currency with a history of 317 years and has depreciated more than 99.5% since its birth. (This price decline has not taken into account the depreciation of silver, because the value of each pound was originally 12 ounces of silver.) That is to say, the most successful currency in history may not be worth its value under the influence of inflation 0.5%.

On the other hand, since the United States officially ended the gold standard in 1973, gold has appreciated by 1760%, while the cumulative inflation rate of the US dollar during the same period was 472.53%. In other words, the purchasing power of $ 1 in 1973 is equivalent to $ 5.73 today.

(Table 5: Real purchasing power of different fiat currencies in different years)

Scarcity and Stock-to-flow

"As a thought experiment, imagine that there used to be a base metal that is as rare as gold, but it has the following characteristics: it is boring gray, not a good conductor, not particularly strong, not easy to extend, and cannot be used for Practical or decorative use, but can be transmitted through a communication channel. "-Satoshi Nakamoto

A white paper published by Satoshi in 2008 proposed an idea: how to prove that scarce data can exist as a form of electronic cash.

Generally speaking, Bitcoin is often compared with commodities such as gold or silver. Bitcoin is often referred to as "digital gold", but due to factors such as price fluctuations, scale limitations, and complex user experience, it is difficult for Bitcoin to compete with widely used payment systems.

In other words, many adopters of bitcoin have a firm faith in "bitcoin as a means of storing value." Existing value storage methods, gold, have similar limitations to modern payment mechanisms:

- Few merchants accept gold payments, and the price of gold is prone to fluctuations, albeit to a lesser extent. Moreover, wanting to transport or modify the size of a transaction can only be done by melting and cutting bullion.

- Although gold is not an ideal modern medium of exchange, it has become one of the oldest and most trusted means of value storage for human beings.

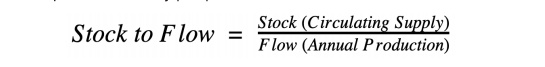

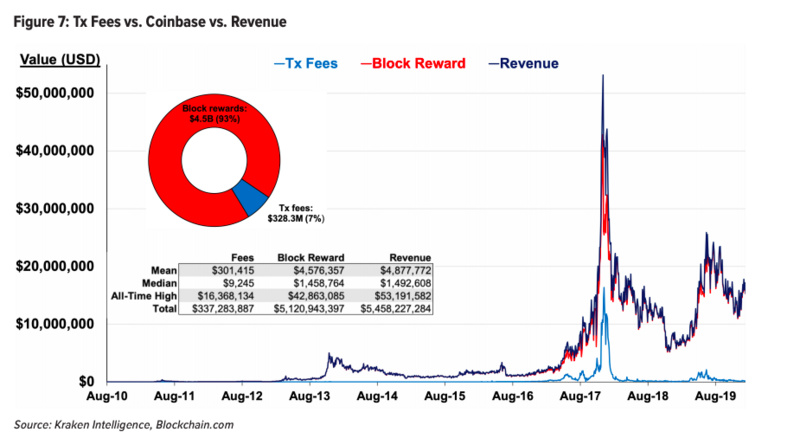

In fact, the value of gold is enduring because of its scarcity. This attribute is usually measured using the SF ratio (Stock-to-Flow ratio, hereinafter referred to as SF). The SF ratio quantifies the scarcity of assets by dividing "stock" of "assets" by "flow of annual production."

The Stock-to-flow theory states that the economic utility of consumer goods can only be realized when used. However, investment assets with high SF ratios often depend on their stock and eventual resale.

For reference, an asset with an S2F ratio of 50 will require 50 years of current production speed to reach the existing stock.

(SF value of metal products before and after halving and SF value of BTC)

High S2F assets tend to have lower annual inflation rates. Among the currently popular metal commodities, gold currently has the highest S2F value. However, after the fourth halving of Bitcoin in May 2024, Bitcoin's S2F value is likely to rise immediately and is expected to immediately become a leader.

Although Bitcoin is not a metal, this is indeed a meaningful comparison, because Bitcoin is often regarded as "digital gold" and has attributes such as value storage, scarcity, currency functions, and production through "mining".

If there are significant resource discoveries, or if resources can become cheaper to mine, the S2F value of certain commodities (including gold) may be unpredictable.

For example, the discovery of a large gold mine, the emergence of new technologies for extracting gold, etc. may all result in higher than expected capital flows.

Bitcoin is uniquely benefiting from its mathematical certainty and its inferable supply based on parameters on the current network.

Moreover, the scarcity of Bitcoin is likely to be underestimated. A large amount of bitcoin supply may not be available (such as lost BTC, BTC locked in a wallet that cannot be consumed), and it is estimated that this proportion is likely to be 7%-29% (1.5-6 million Bitcoins) between.

Impact on mining

"In the next few decades, when the return is too low, the transaction fee will become the main compensation for the block producer node. I believe that after 20 years, either the transaction volume will be very large or there will be no transaction volume." ——Satoshi Nakamoto

Halving is not just affecting Bitcoin's mining output. Market participants should also note that mining is likely to be affected as well. Because their income and costs will change as they change.

Immediately after the halving, miners' income will be reduced by about 50%, which may complicate matters. Due to the regular adjustment of the mining difficulty of the Bitcoin network, miners want to produce valid blocks and need to adjust their programming methods every two weeks in a programmatic manner.

It is worth noting that the Bitcoin network will encounter an adjustment in the difficulty of mining at block 631,008, just over 1,000 blocks after the third halving.

This means that miners will have to pay the same hash power before halving to get only half of the previous income until the network mining difficulty is adjusted. (Less competition, less difficulty, and vice versa)

Therefore, the block's verifier must take appropriate actions before adjusting the difficulty to avoid related financial risks.

As halving approaches, Bitcoin participants should consider the following effects:

- Miner's block reward is expected to decrease by 45% -50%;

- The profitability of the mining industry may be under tremendous pressure. Since the operating expenses of facilities and electricity are basically fixed, this pressure also mainly depends on the price performance of Bitcoin during the halving cycle;

- Assuming that the price of Bitcoin is $ 9,300, after halving in May 2020, the total annual mining revenue will fall from $ 6.1 billion to $ 3.1 billion;

- When network participants start to digest the sluggish network subsidy environment, it is expected that transaction costs will become a topic worth discussing.

- Although the current security of the Bitcoin network is very high, the price is far higher than the marginal production cost of similar products. But if miners choose to withdraw from the market, the computing power and security of the Bitcoin network may be reduced.

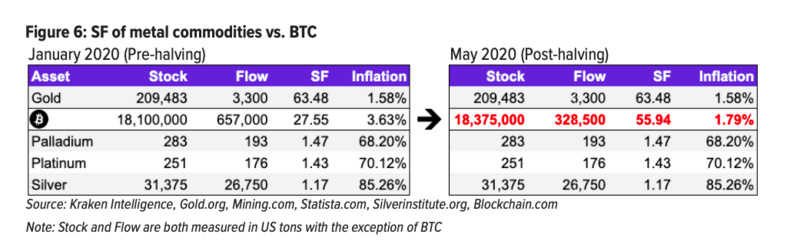

Since transaction fees account for only 4-8% of the total block reward, we must consider whether a wider range of adoption rates and transaction volumes are likely to make transaction fees sufficient to cover the entire block reward.

Furthermore, whether the halving interval of 4 years is enough for this exaggerated move to be adopted.

Transaction fees are determined by Bitcoin users themselves.High fees will incentivize miners to actively process transactions. Compared with halving the value of Bitcoin itself, transaction costs are more closely related to the increase in demand.

It seems that transaction costs have not increased because revenue has been halved, but on average, transaction costs have indeed increased over time.

(Form 7: Transaction Fees and Revenue)

Although this phenomenon may change in the future, in the current state of the network, Bitcoin does not have enough transaction volume or fees to make up for the decrease in block reward subsidies.

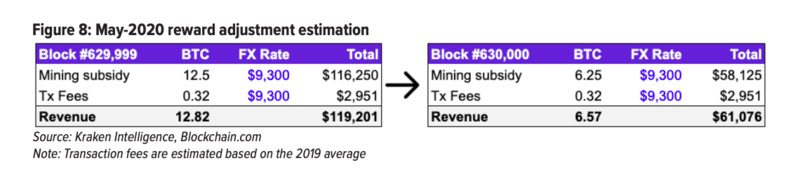

(Table 8: Estimated reward situation after May 2020 block reward adjustment Note: The column of transaction costs is based on the 2019 average)

As shown in Figure 8 above, on block 630,000, the total income of miners will decrease by $ 58,125 (assuming the price of BTC / USD is $ 9,300). In order to fully compensate the miners' income loss, transaction costs need to increase by 19.7 times.

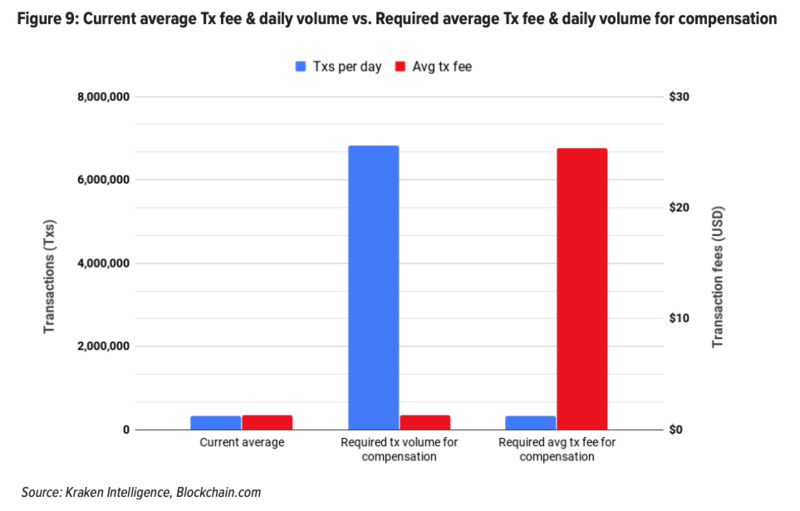

This means that assuming an average of 330,000 transactions per day and a total cost of $ 425,000 (based on the 2019 average), either the daily transaction volume must be increased by 1970% to bring the average transaction volume to $ 6.83 million; or The cost of the transaction increased by 1,869% to $ 25.40 to cover lost revenue (see Figure 9).

(Table 9: Current average transaction fee and daily transaction volume Vs after halving the average transaction fee and daily transaction volume required for subsidy)

We expect that this topic will receive more attention by half in 2020. Moreover, for now, the only indicator capable of fully compensating for the decline in miner income is the proportional increase in the value of Bitcoin.

Summary and conclusion

The previous two halving history shows that the price of bitcoin experienced a two-year upward trend from 12 to 18 months before the halving, followed by a downward trend of about 80% from the peak to the bottom.

The latest bull market lasted for nearly two and a half years, ending in December 2017, after the price reached a maximum of $ 19,499, and then gradually dropped by 83%.

In late December 2018, Bitcoin dropped to a low of $ 3,225. By January 31, 2020, Bitcoin has partially recovered to $ 9,300, a year-on-year increase of 188%.

Halving is essential to help Bitcoin meet the definition of a sound currency. As Bitcoin's production process experiences a 50% price reduction, the supply of Bitcoin follows an anti-inflation curve. Other assets that follow the anti-inflation curve, such as gold, have proven to be a better means of preserving than inflation assets (such as fiat currencies).

The third halving is expected to start on May 12, 2020, which will reduce the annual supply inflation rate of bitcoin from 3.7% to 1.8%. This is the first time that the bitcoin inflation rate has fallen below the 2% set by most central banks. Inflation target.

The Bitcoin code provides for a downward inflation rate until the total supply in 2140 approaches 21 million Bitcoins; however, by 2032, 99% of Bitcoins will be produced.

Assets with higher S2F values, such as gold, have lower annual inflation rates. Although gold still has the highest SF value among mainstream metal popular commodities, Bitcoin's SF value is expected to lead after halving in May 2024.

Although Bitcoin is not a metal commodity, we consider this a meaningful comparison because this digital asset is often considered "digital gold" because it has similar properties.

When halving, the profitability of miners may be under great pressure. It depends on Bitcoin's price performance, as estimated Bitcoin returns will fall by 45% to 50%, and operating costs such as facilities and electricity will remain essentially unchanged.

To compensate for the crisis caused by the decrease in overall block rewards, Bitcoin currently does not have the required transaction volume or fees, although these may change in the distant future.

Transaction fees may become a hot topic as network participants begin to enter a subsidized environment where block rewards are low. Currently, the only indicator capable of fully compensating for the decline in miner income is the same proportional increase in Bitcoin value.

In summary, due to price volatility, scale limitations, and complex user experience, Bitcoin is currently unable to compete with widely adopted payment systems. Of course, the halving of bitcoin has also allowed many bitcoin users to strengthen bitcoin's confidence as a “means of value storage”.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Viewpoint | Blockchain-based fintech is a weapon for epidemic prevention

- DeFi week selection 丨 bZx should be stolen? How should DeFi be taxed

- Is Ethereum resistant to Asic mining? No, this is a rumor!

- Analysis of the main organizations in the Cosmos ecosystem: Agoric, Regen, Lunie, and Chorus One

- When the real crisis comes, the safe haven Bitcoin is forgotten

- Babbitt weekly election 丨 FCoin came to an abrupt end after a thunderstorm; "Mentougou" bitcoin whale lost thousands of bitcoins

- Data decreased slightly, rumors triggered a single-day net outflow of Binance