Why does the US SEC, which has clearly classified more than a dozen tokens as securities, continue to avoid addressing the status of ETH?

Why hasn't the US SEC addressed the status of ETH, despite having classified over a dozen tokens as securities?Original source from CryptoSlate, written by Jacob Oliver, translated by Baize Research Institute.

The recent lawsuit against Binance by the U.S. Securities and Exchange Commission (SEC) has shocked the crypto industry.

Binance is facing 13 different charges, including some that may have long-term negative effects on the company, such as mixing customer assets with their own assets, allowing U.S. customers to use Binance Globe, and deliberately inflating the trading volume of the Binance.US platform using virtual trades.

Lawsuit document: https://www.sec.gov/files/litigation/complaints/2023/comp-pr2023-101.pdf

- Hourglass Finance: Providing Comprehensive Infrastructure for Time-Locked Tokens

- Understanding the Pros and Cons of FPGA and GPU Acceleration for Zero-Knowledge Proof Calculation

- Web3 IP: What’s Next?

Binance has responded to the lawsuit: https://www.binance.com/en/blog/ecosystem/sec-complaint-aims-to-unilaterally-define-crypto-market-structure-8707489117122437402

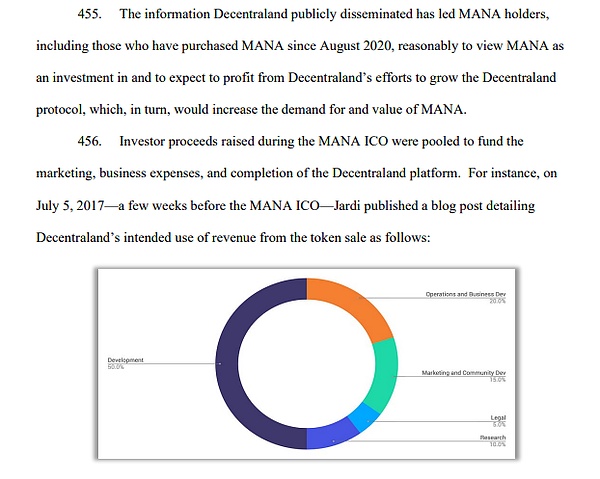

It is worth noting that the SEC explicitly stated in the lawsuit that many of the tokens listed on Binance are “unregistered securities,” including but not limited to Solana (SOL), Cardano (ADA), Polygon (MATIC), Coti (COTI), Algorand (ALGO), Filecoin (FIL), Cosmos (ATOM), Sandbox (SAND), Axie Infinity (AXS), and Decentraland (MANA).

While this is the most explicit statement the SEC has used so far in clarifying its judgment on “unregistered securities,” it once again avoids responding to an important question: Is Ethereum (ETH) a security? If so, why is the SEC remaining silent on this issue? If not, then what exactly is Ethereum?

From cryptocurrency to “cryptocurrency securities”

The SEC’s argument that the above tokens are “cryptocurrency securities” is analyzed in detail in Section 8 of the lawsuit (pages 85 to 123), which breaks down each project in turn and it is clear that they have similar patterns: the process of initial token issuance (1C0), token ownership, core team distribution, and the use of these tokens to facilitate profit generation.

However, Ethereum, which has the same pattern as the above, is not included. SEC Chairman Gensler has been vague on the issue of whether Ethereum and its anchor tokens (such as WETH) are securities. ETH is typically held as an investment, suggesting it could be classified as a security, but it is also widely used as a daily cross-protocol exchange medium, making its function more like cash.

Previously, Gensler had stated that “every crypto token except for Bitcoin” could be considered a security, but he refused to explicitly state Ethereum. When asked if Ethereum was a security, Gensler usually did not answer. It is curious that the SEC is so eager to make the same demands for other tokens but is unwilling to classify ETH explicitly. Why is this?

Is ETH a security in the eyes of the SEC?

This may be a question of internal debate within the U.S. government.

Ethereum may fall under the jurisdiction of the U.S. Commodity Futures Trading Commission (CFTC), which has classified BTC, ETH, and USDT as commodities, not securities. These two categories are not only distinct from each other, but this overlap could spark a regulatory tug-of-war, so Gensler is trying to avoid infighting within the government and take a more public stance on Ethereum.

Crypto media Protos once published an over-analysis that Gensler’s avoidance of Ethereum may be the result of the SEC’s inaction after the infamous “The DAO hack” incident, which resulted in the Ethereum network forking and putting the entire ecosystem at risk, causing many investors to be in hot water. However, SEC did nothing at the time, choosing silence and inaction. Now Gensler finds himself in an embarrassing position of trying to make up for his predecessor’s neglect. Since the Ethereum ecosystem has spent years recovering its reputation, retroactively declaring it an unregistered security now would have catastrophic consequences for investors.

In other words, protecting investors in this situation means protecting them from the protector’s infringement.

Another reason why Gensler may not want to categorize Ethereum explicitly is that he may not know.

Cryptocurrencies and their underlying blockchain technology are innovative and novel. They represent a fundamental change in the way we understand finance and asset ownership, and in the development of ecosystems like Ethereum, they introduce many new use cases. Any new thing is inconvenient to categorize, and Ethereum is doing just that-it is both “decentralized” enough and fits the “concept” of a security (investor, profit promise), which is the core of the difficulty of regulation.

The regulatory ambiguity has presented Ethereum with complex challenges, as the progress of the crypto industry depends on Layer-1 tokens (such as Ethereum) receiving clear legal definitions, which serve as both a medium of daily transactions and an investment tool within their respective ecosystems. Regulatory ambiguity constitutes a significant barrier, stifling potential, impeding mainstream adoption, and fostering uncertainty in the crypto industry, which is full of growth and innovation.

The binary classification of cryptocurrencies (whether they are securities or not) blurs the boundaries between different types of tokens, forcing us to face the inadequacies of the existing legal structure. To push the crypto industry forward, regulatory agencies must address this subtle issue. The unique crypto industry requires equally unique rules.

The Crypto Industry Requires Meaningful Regulatory Progress

Currently, the path to comprehensive cryptocurrency regulation is blocked by two major obstacles, both of which must be urgently addressed to promote responsible development of the industry.

First, the SEC must establish a formal stance on Ethereum. Given the SEC’s inaction when it had the opportunity to limit Ethereum, it unwittingly created a situation where investors are caught in regulatory limbo. As the protector of investors, the SEC has a responsibility to provide some form of regulatory guidance – even if temporary – as a starting point. Lack of clear regulation not only creates inconvenience, but also lacks necessary protection for the increasing number of participants in the crypto market.

Second, open discussion about the nature of cryptocurrencies is crucial – a dialogue that takes place without “preconceived” ideas, biases, or hollow rhetoric. We often say that we need to “make room for dialogue,” but we have to admit that the need for dialogue and actual dialogue are two completely different things. Perhaps everyone in this industry – and those who are interested in it – would benefit from practicing the latter.

Risk Warning:

According to the Notice on Further Preventing and Dealing with the Risk of Virtual Currency Trading Speculation issued by the People’s Bank of China and other departments, the content of this article is for information sharing only, and does not promote or endorse any business or investment behavior. Please strictly abide by local laws and regulations and do not participate in any illegal financial activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Deep analysis of the intent behind SEC’s lawsuit against Binance: a jurisdictional dispute or a show of power?

- Apple Vision Pro priced at 25,000 yuan released, ushering in the next generation of human-computer interaction?

- Is Binance in trouble this time with “Li Chu” or “Taking on a Hot Potato”?

- 13 Key Points to Understand the SEC’s Lawsuit Against Binance and Changpeng Zhao

- Is “Li Chu” still a “hot potato”? Is Binance in trouble this time?

- dYdX Founder: Hoping Cosmos’ influence doesn’t overshadow dYdX

- Exclusive Interview with Vechain Founder Sunny: From LV to Crypto World, Web3 is the Perfect Answer for Sustainable Development