Overview of House Hearing: SEC Enforcement Actions Criticized, Cryptocurrency Regulations May Take Years

House hearing overview: SEC criticized for enforcement actions; cryptocurrency regulations may take years.Author: BlockingBitpushNews Mary Liu

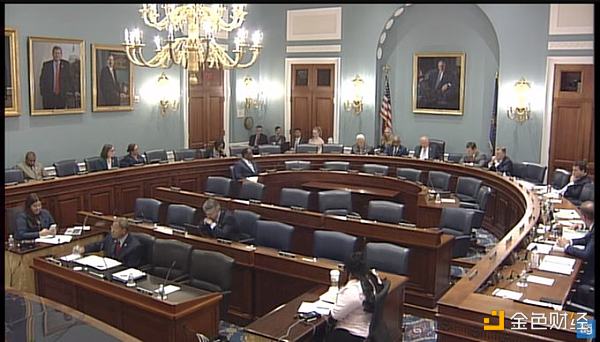

As the SEC intensifies its comprehensive crackdown on the cryptocurrency industry and files lawsuits against Binance and Coinbase, the House Agriculture Committee held a dual-panel hearing on digital asset regulation on June 6.

This hearing can be described as an “all-star lineup”, with CFTC Chairman Rostin Behnam presiding over the hearing, Coinbase Chief Legal Officer Blockingul Grewal, and Robinhood Chief Legal and Compliance Officer Dan Gallagher participating in the second panel discussion of the hearing. Witnesses in the second panel also included former CFTC Chairman Christopher Giancarlo, former CFTC Commissioner and former SEC general counsel Dan Berkovitz, and former CFTC Acting Chairman Walt Lukken.

- Quickly review the SEC’s “only” seven allegations against Coinbase, is hitting your own child light?

- U.S. SEC sues Coinbase, alleging violation of U.S. securities rules

- From Static to Dynamic: How NFTs are Changing Digital Ownership?

Law enforcement regulation is unsustainable, and regulatory responsibilities are not a “zero-sum game”

Several lawmakers expressed concerns about the law enforcement regulatory model currently used in the United States. Republicans, especially those on the House Agriculture Committee, criticized Gensler’s cryptocurrency regulatory approach, arguing that his agency had “overstepped its bounds.”

Pennsylvania Republican Congressman and committee chairman Glenn Thompson said during the hearing, “While I can’t and won’t speak to any specific allegations against [Coinbase], I do want to point out that this behavior is exactly why we’re here today, to say that law enforcement regulation is not the appropriate way to manage markets, fully protect customers, or foster innovation.”

CFTC Chairman Rostin Behnam said that the SEC should have regulatory authority over assets classified as securities, but law enforcement regulation is unsustainable. He added: “The fact is that the biggest token, Bitcoin, is a commodity, as determined by a U.S. court, and is not subject to SEC regulation under U.S. law.”

South Dakota Republican representative Dusty Johnson explored whether the SEC should specifically manage digital assets. Behnam believes that the division of U.S. crypto regulation responsibilities is not a “zero-sum game,” saying, “I won’t take away anything that CFTC may get from any legislative or legal authority, but there is indeed a regulatory vacuum and a gap in regulation of digital commodity assets.”

During the meeting, Behnam focused his comments on the need for clear categorization of cryptocurrency tokens, existing regulatory enforcement practices, and the call for clear regulatory guidance, arguing that the CFTC needs to expand its powers in the cryptocurrency commodity field and noting that few exchanges have formally listed assets as commodities.

Behnam further asserted that the problem is not with the CFTC or SEC taking legal action against illegal entities, but with the need for increased congressional power to manage cryptocurrency-related risks and establish clear regulations.

Behnam also warned of potential financial instability risks: “The volatility of the cryptocurrency market has stabilized over the past six months, and if it fluctuates and grows again, we may face serious financial stability issues.”

SEC refuses industry communication and dialogue

Coinbase Chief Legal Officer Blockingul Grewal criticized SEC regulation in the absence of clear rules for the digital asset industry, arguing that this approach is damaging US economic competitiveness and companies like Coinbase that are committed to compliance, and he called for “fair rules” to be established for cryptocurrencies.

Legislators did not ask specific allegations against Coinbase, but discussed issues raised in the lawsuit, such as token classification and exchange registration. Grewal responded by saying that Coinbase had gone through a long review process in accordance with SEC requirements before being allowed to go public directly in 2021.

He said, “In the current situation of the US Securities and Exchange Commission… they repeatedly emphasize ‘come in and register,’ but as Coinbase tried to discuss how to register… after months and months of discussion, we are still being ignored.”

Grewal said, “I am still digesting the charges received today, but what I can say in more detail is that we have had a lot of interaction with the SEC, not only for a few months, but for several years.”

Robinhood’s Chief Legal and Compliance Officer Gallagher expressed similar frustration to Grewal’s, stating that Robinhood has spent over a year complying with the SEC’s current regulatory requirements, saying, “When Gensler says ‘come in and register,’ we did… we went through a 16-month process with SEC staff trying to register as a special purpose broker-dealer, and then in March we were told that process was over and we have not seen any results from that effort.”

Solana (SOL), cardano (ADA), and polygon (MATIC), which have been classified as securities in lawsuits against Coinbase and Binance, are currently available for trading on Robinhood’s cryptocurrency platform. Dan Gallagher, Robinhood’s Chief Legal and Compliance Officer and former SEC commissioner, stated at the hearing that the company is weighing how to handle the tokens listed on its platform.

All members of the panel and most lawmakers agreed on the way forward for cryptocurrency, that Congress should take immediate action to address current regulatory loopholes to protect consumers and promote innovation.

CFTC Fights for Budget, No Consensus on New Digital Asset Bill Among Both Parties

The hearing discussed the Digital Asset Bill drafted by Committee Chairman Glenn Thompson and House Financial Services Committee Chairman Blockingtrick McHenry. The Thompson-McHenry bill will change the way securities and commodities are defined based on how the assets are traded (whether acquired from the issuer or purchased on an exchange) and the degree of decentralization. The bill will also redefine digital commodity brokers and traders without changing the core components of the market structure.

Thompson said, “We hope there will be a bipartisan committee proposal.” Republican Representative Dusty Johnson (SD – R) said there is “uncertainty” whether digital assets are securities or commodities, and the bill helps fill those gaps.

Democratic committee members pointed out that the 162-page bill is “extremely complex,” was only released last week, and needs time to study. CFTC Chairman Rostin Behnam described it as “handcuffing regulators.”

Behnam showed little interest in the new bill but specifically called on Congress to authorize the CFTC to fill regulatory gaps in digital asset regulation. Behnam said not to expect new U.S. crypto rules to be implemented immediately, even if new legislation creates a clearer path for digital assets to transition from securities to commodities. Currently, the CFTC has a budget of $360 million and has applied to increase next year’s budget to $410 million, while the Appropriations Committee is recommending $345 million. Behnam said that if the budget is cut, the agency will have to furlough employees.

Behnam said, “It will take at least one to two years to implement new regulatory rules, and additional funding will need to be provided by Congress, and I estimate this may take three to four years.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What are the differences between the three stablecoin protocols based on Ethereum LST on the market?

- a16z Investments: dydx, Alongside, LayerZero…

- Blockchain game Illuvium to launch NFTs in collaboration with game retailer GameStop, on sale from June 12th.

- Why does the US SEC, which has clearly classified more than a dozen tokens as securities, continue to avoid addressing the status of ETH?

- Hourglass Finance: Providing Comprehensive Infrastructure for Time-Locked Tokens

- Understanding the Pros and Cons of FPGA and GPU Acceleration for Zero-Knowledge Proof Calculation

- Web3 IP: What’s Next?