Popular Token Simple Rating CRV Achieves the Best Performance, OP Only Has Speculative Value

CRV, a popular token, has achieved the best performance in terms of simple rating. On the other hand, OP only holds speculative value.Author: Nate | eatsleepcrypto.eth

Compilation: Deep Tide TechFlow

Recently, I have been thinking about token design and have created a token economy grading list. This article will rate and analyze the token designs of several well-known DeFi protocols, exploring the elements that a good token economy model should have, including capturing value, governance rights, economic security, etc., which are crucial for understanding the intrinsic value of tokens. Let’s take a look at which token designs are well-executed and which ones need improvement, and draw inspiration from them.

Of course, these are not investment advice – a good token economy model is necessary but not sufficient for long-term returns, and a high ranking does not guarantee the economic security of these protocols.

- Mixin’s aftermath of being stolen about 200 million US dollars Compensation plan includes bonds, Li Xiaolai’s Weibo questioned Where is the users’ money?

- Market value doubled within a year, will Azuki be knocked down How much longer can Pudgy Pengunis remain popular?

- Hot discussions among peers, uncovering the little-known stories of market maker DWF Labs and Lianchuang.

In the S grade, I excluded all tokens because…

1) I will never give a perfect score;

2) I even hesitate to give an A;

3) I am not familiar with the “S” grade.

The criteria for rating in this article are: protocol utility, value capture, and economic security each accounting for 30% – these are demand-side factors; the remaining 10% is based on supply-side factors.

I would give Curve Finance an A-.

$CRV has supply issues, and some of them are quite bad, but they are cleverly solved by veTokenomics. However, I am more concerned about demand than supply because demand is important in the long run. The demand for $CRV is directly proportional to the flow value of bribes paid to $veCRV holders.

The fundamental innovation of Curve Finance is not ve tokenomics but the bribery system.

Liquity Protocol is also rated A.

Liquity uses the amount of excess collateralized $ETH to mint $LUSD. LiquityProtocol’s $LUSD is a secure decentralized stablecoin, and this approach protects its peg.

$LUSD is not without risks, but it has come as close as possible to solving the trilemma of stablecoins. In addition, Liquity rewards $LQTY holders with real returns.

The Maya Protocol is also rated A.

Maya has a dual-token system, with $CACAO used for liquidity pairs and $MAYA capturing fees from the system.

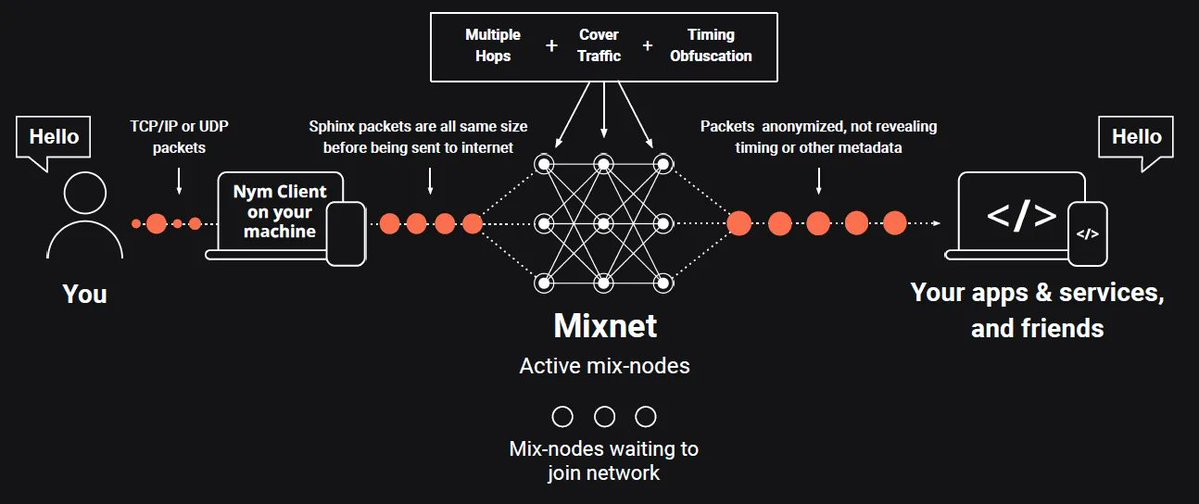

The Nym Project has an A-grade demand token economics. The supply side is another story, as once they stop distributing $NYM tokens to miners, the price will rebound. It is suggested that Nym allocate these rewards to community managers who recruit real users in online seminars.

Synthetix I ranked it at C+.

$SNX has gained a lot of value, but its use is limited because it is not private and has a public founder. If its DAO stops manipulating monetary policy, everything will fall apart.

Synthetix operates similarly to Mirror on Terra, but with less asset diversification. Because the founder of $SNX is not anonymous, Synthetix cannot issue synthetic forms of commodities or traditional assets like $TSLA, $GOOG, etc.

This lack of diversification also makes $SNX more vulnerable and susceptible to economic security vulnerabilities, similar to Terra’s Anchor protocol.

I hesitated between B-level options and ultimately decided to put SushiSwap at C-level.

Sushi was lucky in the vampire attack on Uni, and since then it hasn’t really innovated. Real earnings are good, $SUSHI outperforms $UNI, but the standard is set very low. In addition, real earnings are not only the easiest way to gain value, but also one of the worst ways because it doesn’t leave much economic moat.

Aave is ranked at C-level.

Frequent bad debt and a governance committee full of Degen really don’t do it any good. Especially after the recent release of GHO, the current price of $GHO is still $0.97.

GHO’s central bank strategy reminds me of the USD/JPY arbitrage trades of several funds before the Bank of Japan announced its intention to raise interest rates. I’m interested to see how this will develop when Aave raises rates.

Uniswap is ranked at D-level.

I often write articles about Uniswap’s failures. As expected, v4 did not solve the problem of UNI’s obvious lack of value capture, and then there’s impermanent loss…

Rocket Pool is ranked at F.I was originally going to give it a D, but it has a very bad flywheel design, especially in front of competitors. $RPL is inserted as an arbitrary staking requirement, and even its reward is not $ETH, but its native token.

Optimism is also ranked at F.

The price of $OP is completely driven by speculation, and Optimism hasn’t taken any action either. Optimism hopes to capture value through sequencers—I bet it won’t. In the end, $OP still relies on continued speculation to maintain its price, just like meme coins. But unlike $DOGE, OP is not even used in the circular economy.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Weekly Financing Report | 18 public financing events; Cryptocurrency gaming company Proof of Play completes $33 million seed round financing, led by Greenoaks and a16z.

- Weekly Notice | The deadline for FTX customers to submit claims will be September 30th; Bitget old users need to complete KYC verification before October 1st.

- Unveiling SBF’s Defense Draft of up to 250 pages I did what I believed was right.

- Data Analysis 37 listed companies in South Korea hold approximately $160 million in cryptocurrency assets, which tokens are preferred?

- Friend.tech is gaining momentum alongside Telegram, how will the veteran social protocol Lens Protocol counterattack?

- Overview of International Cryptocurrency Regulatory Agencies

- What do legal experts think of the SBF trial?