Weekly Financing Report | 18 public financing events; Cryptocurrency gaming company Proof of Play completes $33 million seed round financing, led by Greenoaks and a16z.

Weekly Financing Report | 18 public financing events; Proof of Play, a cryptocurrency gaming company, raises $33 million in seed round financing led by Greenoaks and a16z.Highlights of this issue:

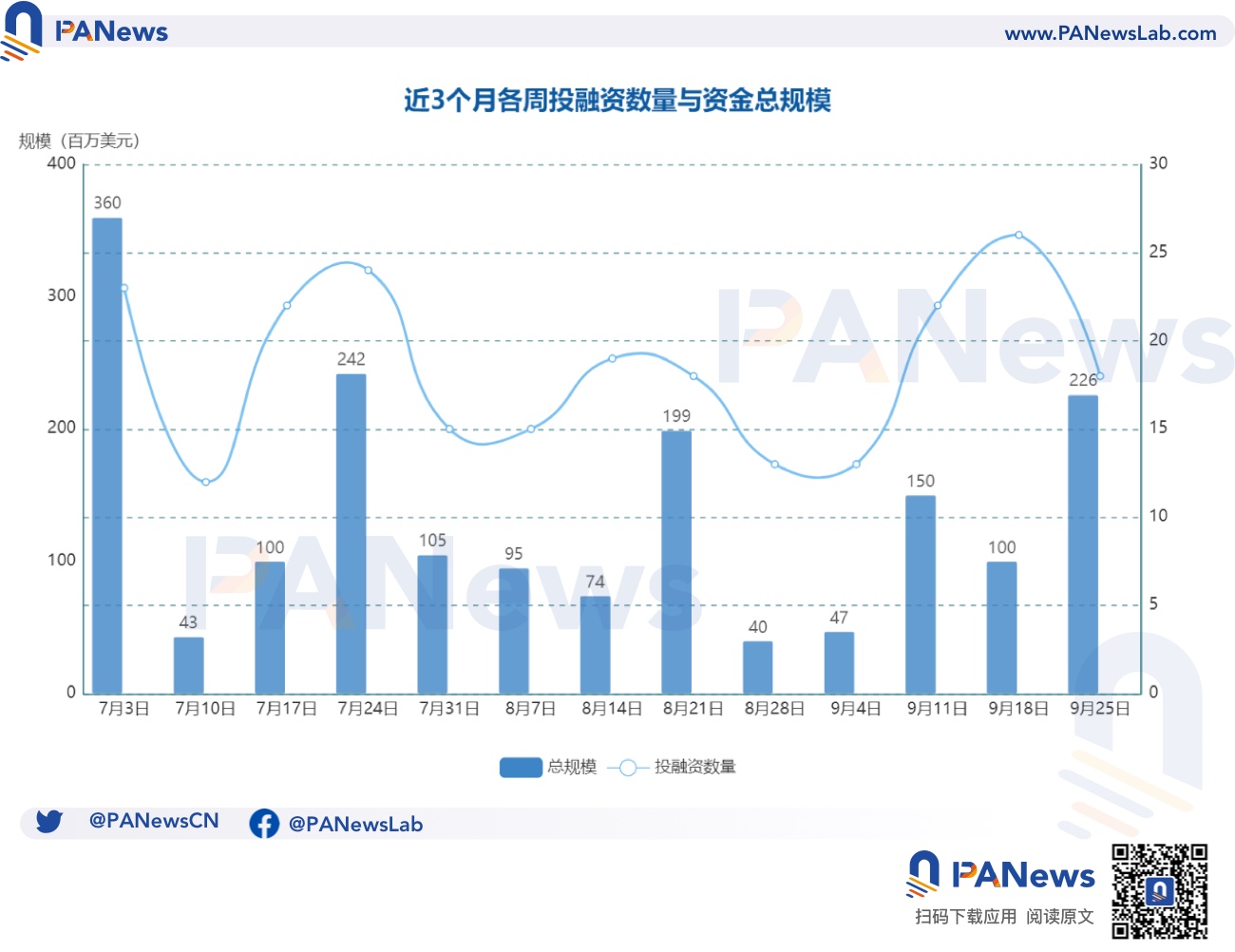

According to incomplete statistics from LianGuaiNews, there were 18 blockchain investment and financing events worldwide last week (9.18-9.24), with a total funding of over $220 million. The overview is as follows:

- DeFi announced one investment and financing event: Hybrid cryptocurrency exchange GRVT completed two rounds of financing totaling $7.1 million, with the seed round led by Matrix Partners and Delphi Digital;

- NFT and Metaverse announced one investment and financing event: Metaverse data analysis service provider Geeiq announced the completion of a $6.6 million Series A financing, led by YFM Equity Partners;

- Blockchain gaming announced one investment and financing event: Cryptocurrency gaming company Proof of Play raised $33 million in seed financing, co-led by Greenoaks and a16z;

- Infrastructure and Tools announced five financing events, including cryptocurrency transfer and payment service startup Mesh (formerly Front Finance) completing a $22 million Series A financing, led by Money Forward;

- Other Web3/crypto-related projects announced eight financing events, including Bitmain’s $53.9 million investment in Bitcoin mining company Core Scientific to expand the long-term cooperation between the two companies;

- Centralized finance announced two financing events, including cryptocurrency startup Bastion completing a $25 million seed round financing, led by a16z crypto.

DeFi

Hybrid cryptocurrency exchange GRVT completes two rounds of financing totaling $7.1 million

- Weekly Notice | The deadline for FTX customers to submit claims will be September 30th; Bitget old users need to complete KYC verification before October 1st.

- Unveiling SBF’s Defense Draft of up to 250 pages I did what I believed was right.

- Data Analysis 37 listed companies in South Korea hold approximately $160 million in cryptocurrency assets, which tokens are preferred?

Hybrid cryptocurrency exchange GRVT raised $7.1 million in seed and pre-seed funding, with a valuation of $39 million. GRVT aims to provide the efficiency of centralized exchanges and the self-custody functionality of decentralized exchanges. The seed round of financing for GRVT was $5 million, co-led by Matrix Partners and Delphi Digital. Other investors in this round of financing include ABCDE Capital, Susquehanna Investment Group, CMS Holdings, Hack VC, and Matter Labs (developer of Ethereum scaling network zkSync). The pre-seed financing valued at $2.1 million received support from investors such as 500 Startups and Folius Ventures.

NFT & Metaverse

Fashion metaverse data analysis provider Geeiq completes $8.2 million Series A financing

Geeiq, a metaverse data analysis service provider focusing on the fashion industry, announced the completion of a £6.6 million (approximately $8.2 million) Series A financing, led by YFM Equity Partners, with participation from GFR Fund and FOV Ventures.

Geeiq primarily provides metaverse market data analysis services for brands and helps businesses obtain customized data analysis capabilities on metaverse platforms such as Roblox, Zepeto, Decentraland, and Fortnite. Its current clients include fashion brands such as Gucci and Tommy Hilfiger.

Chain Games

Crypto gaming company Proof of Play raises $33 million in seed funding, led by Greenoaks and a16z

Crypto gaming company Proof of Play, led by Amitt Mahajan, co-founder of FarmVille and former Zynga executive, has raised $33 million in seed funding. The round was led by Greenoaks and a16z. Other participants in this round of funding include Ravikant, who was an early investor in Uber and Twitter, as well as Balaji Srinivasan, Justin Kan, and Emmett Shear, the founders of Twitch. Proof of Play aims to create fun and user-friendly blockchain games. Its first game is a social role-playing game called “Pirate Nation”. According to the statement, FarmVille has over 300 million players and is the number one game in Facebook’s history. In addition to creating FarmVille, Mahajan has also worked as an executive at Zynga and later founded Toro, which was later acquired by Google.

Infrastructure & Tools

Crypto transfer and payment company Mesh raises $22 million in Series A funding

Crypto transfer and payment service startup Mesh (formerly Front Finance) has raised $22 million in Series A funding. The round was led by Money Forward, with participation from Galaxy, Samsung Next, Streamlined Ventures, SNR.VC, Hike VC, Heitner Group, Valon Capital, Florida Funders, Altair Capital, Network VC, and several angel investors. Mesh, founded by Bam Azizi and Adam Israel in 2020, enables businesses to move assets, including cryptocurrencies, between different platforms. Users can connect different types of assets and accounts with read-write and transfer capabilities to Mesh, allowing the platform to aggregate all their accounts. Mesh supports in-app asset transfers across exchanges and wallets, as well as cryptocurrency payments and expenditures.

Digital asset startup Fuze raises $14 million in seed funding

Middle East-based digital asset startup Fuze has announced $14 million in seed funding. The round was led by Further Ventures, a venture capital firm in Abu Dhabi, with participation from Liberty City Ventures, an early-stage venture capital firm based in New York. Fuze, founded in December 2022, joined Abu Dhabi’s global tech ecosystem Hub71 earlier this year. Fuze enables banks, fintech companies, or enterprises to offer regulated digital asset products to their customers through native applications. Its white-label solution handles the complexity of blockchain and regulatory costs for enterprises, allowing them to easily offer stablecoins, cryptocurrencies, CBDCs, and tokenized assets, among other digital assets.

Blockchain technology company Jiritsu raises $10.2 million in funding

Jiritsu, a blockchain technology company specializing in verifiable computation, has raised a total of $10.2 million in two funding rounds. The funding was led by gumi Cryptos Capital, with participation from Susquehanna Private Equity Investments, LLLP, Republic Capital, and other investors. Jiritsu also launched its asset tokenization platform, Tomei RWA, today. The company plans to use the new funds to “accelerate the development and adoption” of the UVC platform and Tomei RWA. Founded in 2020, Jiritsu has developed technologies such as Unbounded Verifiable Computation (UVC), which aims to provide a programmable approach that can be applied to any workflow and generate workflow proofs.

Cryptocurrency Startup Essential Completes $5.15 Million Seed Funding Round

Cryptocurrency infrastructure startup Essential has completed a $5.15 million seed funding round, led by Maven11. Other participants include Robot Ventures, Karatage, Batuhan Dasgin, Skip, James Prestwich, Brandon Curtis, Eclipse founder Neel Somani, and more, with the valuation undisclosed. Essential, founded earlier this year, aims to reconnect the cryptocurrency trading supply chain and focuses on building intent-based infrastructure, a relatively new technology that supporters hope will bring a better user experience and higher efficiency to blockchain. According to the announcement, the core components of the infrastructure being built by Essential currently include Ethereum’s intent standards, a domain-specific language (DSL) for intent expression, and a “fully intent-centric blockchain protocol.”

Layer 1 Solution Provider Swisstronik Completes $5 Million Seed Funding Round

Layer 1 solution provider Swisstronik has announced the completion of a $5 million seed funding round on the X platform and has launched a private token sale. Two investors, Constantin Guggi and Anton Polianski, have joined the team as co-founders and executives. Swisstronik has not disclosed the investors yet but stated that more information will be shared later. It is reported that Swisstronik’s main goal is to create a user-friendly and secure network, addressing key issues such as legal compliance, data privacy, and interoperability. It aims to become the developers’ preferred choice while emphasizing privacy and decentralization. Swisstronik’s future roadmap includes the launch of its mainnet in 2024, followed by a decentralized messaging system, decentralized authorization system, enterprise decentralized oracle, and asset tokenization suite in 2025.

Others

Bitmain to Invest $53.9 Million in Core Scientific and Reach New Hosting Agreement

Bitmain is investing $53.9 million in Bitcoin mining company Core Scientific to expand the long-term partnership between the two companies. Bitmain and Core Scientific have reached an agreement involving a combination of equity and cash to fund the purchase of new, more efficient Bitcoin mining equipment. Additionally, Bitmain has entered into a new hosting agreement with Core Scientific to support Bitmain’s mining operations. According to the terms of the purchase agreement, Bitmain will provide Core Scientific with 27,000 Bitmain S19J XP 151 TH Bitcoin mining servers in exchange for $23.1 million in cash and $53.9 million worth of Core Scientific common stock, with the per-share value to be determined based on the restructuring plan approved by the bankruptcy court, which is expected to be completed in the fourth quarter of this year.

Blockchain Medical Data Exchange Platform Briya Raises $11.5 Million in Series A Funding, Led by Team8

Blockchain-based medical data exchange platform Briya has announced the completion of an $11.5 million Series A funding round, led by Team8. Other participants include Insight LianGuairtners, Amiti Ventures, Innocare Health Investments, George Kaiser Family Foundation, and more. After the Series A funding, Briya’s total funding will reach $17 million. The funds will support Briya in changing the way data is exchanged between healthcare organizations and life science organizations.

CoinScan, an encrypted data analysis platform, completes a $6.3 million financing

CoinScan, an encrypted data analysis platform, has completed a $6.3 million financing. The largest individual shareholder of sports betting company DraftKings, Shalom Meckenzie, the CEO of gambling software development company Playtech, Mor Weizer, and digital asset trading company Tectona participated in the investment. It is reported that CoinScan has been developed for two years and aims to provide data for cryptocurrency users to help reduce losses caused by vulnerabilities, hacker attacks, and scams.

Web3 creator community AfterLianGuairty completes $5 million financing, led by Blockchange Ventures

The Web3 creator community AfterLianGuairty has completed a $5 million strategic growth financing round, led by Blockchange Ventures. Acrew Capital, Act One Ventures, Tamarack Global, Wilson Sonsini, and Vinny Lingham also participated in the investment, bringing the total funds raised to $12 million. AfterLianGuairty announced the launch of a new platform, AfterLianGuairty AI, which allows creators to expand personalized fan interactions and generate unique images and videos for fans as NFT collectibles on the blockchain. AfterLianGuairty is a platform that provides tools and technology for creators to scale one-on-one fan interactions, established in 2021. Its creator tools simplify content monetization and ownership, leveraging cutting-edge technologies such as blockchain and artificial intelligence to help creators strengthen fan relationships. AfterLianGuairty previously completed a $3 million pre-seed financing in 2021 and completed a $4 million active financing round in 2022.

Decentralized information market protocol Freatic completes $3.6 million seed financing led by a16z crypto

The decentralized information market protocol Freatic has raised $3.6 million in a round of financing led by a16z crypto. Participating investment institutions in this round of financing include Anagram, Archetype, Not3Lau Capital, Robot Ventures, and Arweave. Angel contributors include Stefano Bernardi, Meltem Demirors, Stephane Gosselin, Jutta Steiner, and MacLane Wilkison. The project aims to connect people with untapped information using cryptography and game theory. By combining the power of blockchain cryptography and game theory, it accelerates the flow of real-world information in different markets. The team has developed two technical demonstrations, including Alpha Factory, dedicated to encrypted insight management on Polygon, and Capture The Alpha, introducing an on-chain reputation mechanism on Arbitrum.

Blockchain data visualization company Bubblemaps completes $3.2 million seed financing, led by INCE Capital

Paris-based blockchain data visualization startup Bubblemaps has raised $3.2 million in seed financing led by INCE Capital. Other participants include Stake Capital, Momentum 6, Lbank, V3ntures, Nicolas Bacca of Ledger, Dyma Budorin of Hacken, and French influencers and entrepreneurs Owen ‘Hasheur’ Simonin. Bubblemaps plans to use this funding to expand its team and accelerate growth, particularly by hiring more developers and strengthening its marketing efforts on social media platforms. Bubblemaps currently supports Ethereum, Binance Smart Chain, Fantom, Avalanche, Cronos, Arbitrum, and Polygon.

Web3 social application Orb completes $2.3 million pre-seed funding

Orb, a web3 social application based on the Lens Protocol, has completed a pre-seed funding round of $2.3 million. Investors in this round include Superscrypt, Founders, Inc., Foresight Ventures, Aave ComLianGuainies, Aave ComLianGuainies, Lens Protocol founder Stani Kulechov, and Polygon co-founder Sandeep Nailwal. This round of equity financing began in March and ended in May. Orb, based on the Lens protocol, allows users to chat and join communities.

Decentralized hackathon platform BeWater announces million-dollar funding, led by ABCDE and OKX Ventures

BeWater, a decentralized hackathon platform and global open-source developer organization, has announced the completion of a $1 million angel funding round. This round of funding was led by ABCDE and OKX Ventures, with participation from ScalingX, Galaxy Mercury Asia, Contentos, Blake Gao, and other individual investors. Currently, BeWater.xyz has attracted over 22,000 Github-certified developers and over 3,000 Figma-certified designers from more than 50 countries. BeWater.xyz provides standardized event services, including hackathons, and prides itself on being able to launch a hackathon in 10 minutes without permission. In the past three months, it has collaborated with large ecosystems such as zkSync, Celestia, Polyhedra, Taiko, Aleo, Solana, NEO, and Sei to host more than 20 hackathons with a prize pool exceeding $2 million.

Centralized Finance

Cryptocurrency startup Bastion raises $25 million in funding, led by a16z crypto

Cryptocurrency startup Bastion has completed a $25 million seed funding round, led by a16z crypto, with participation from investors such as Laser Digital Ventures (a subsidiary of Nomura Group), Robot Ventures, and Not Boring Capital. Bastion provides services such as cryptocurrency custody. The company’s initial employees include regulatory and compliance executives from cryptocurrency exchanges such as Kraken. Bastion co-founders Riyaz Faizullabhoy and Nassim Eddequiouaq (former CTO and Chief Security Officer of a16z crypto, respectively) had previously worked in Meta’s blockchain security infrastructure department for two years before joining a16z Crypto.

Singapore fintech company DCS Fintech Holdings raises $10 million in strategic funding

Singapore fintech company DCS Fintech Holdings has secured $10 million in strategic investment from Foresight Ventures, which will be used to create a payment solution that bridges cryptocurrency and fiat currency. DCS Fintech Holdings’ subsidiary, DCS Card Centre (formerly Diners Club Singapore), is a credit card issuer regulated by the Monetary Authority of Singapore. The company will utilize this funding to develop new payment solutions that provide seamless connectivity between Web2 and Web3. DCS Card Centre deployed and issued the USD-anchored payment token DUS on the PlatON network in early September.

Venture Capital Institutions

Blockchain Capital raises $580 million for two new crypto funds

San Francisco-based venture capital firm Blockchain Capital has raised $580 million for two new cryptocurrency investment funds. The company, founded in 2013, announced today the launch of its sixth early-stage venture fund and its first opportunity fund, raising a total of $580 million. Payment giant Visa is one of the companies providing funding. Visa and LianGuaiyLianGuail also invested in Blockchain Capital’s fifth $300 million fund, which concluded in 2021. According to the announcement, the company focuses specifically on investing in cryptocurrency startups in the infrastructure, gaming, DeFi, consumer, and social sectors. The company also stated that the volatility of the industry in the past year or two has “exposed the danger of short-term thinking, leading many to misjudge this emerging technology.”

EJF Capital’s fund has raised $104 million and will invest in blockchain and other fields

Hedge fund company EJF Capital LLC has raised $104 million for its EJF Ventures Fund, which will seek to invest in early-stage fintech startups, with a particular focus on blockchain infrastructure, banking technology, wealth management, and capital market software. The fund will also provide strategic guidance and funding for startups focusing on innovative solutions in real-time payments, data analytics and coordination, risk management, and customer acquisition. EJF Capital previously led a $20 million Series A funding round for crypto tax and accounting platform Ledgible and participated in a $7 million Series A funding round for iLianGuaiaS company Onramp Invest.

Oak Grove Ventures launches $60 million new fund to invest in Web3, AI, and other fields

Oak Grove Ventures has launched a $60 million new fund that will focus on early-stage projects in cutting-edge technology fields such as Web3, artificial intelligence, and biotechnology. The Oak Grove Ventures team includes former Sino Global Vice President Sally Wang, former Libra CTO Ethan Wang, Alchemy co-founder Shawn Shi, and former Coinbase Vice President Michael Li. Oak Grove Ventures was previously a family office with a strong track record in early-stage investments, having supported over 30 projects in the past, including 8 funds and 14 high-quality projects, including SLianGuaiceX and Neuralink.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Friend.tech is gaining momentum alongside Telegram, how will the veteran social protocol Lens Protocol counterattack?

- Overview of International Cryptocurrency Regulatory Agencies

- What do legal experts think of the SBF trial?

- FTX Reappearance? JPEX Embezzles User Assets and Is Involved in a High-Value Fraud Case

- Behind the Balancer attack incident In addition to the downsizing of the security team, we should pay more attention to the hidden concerns of centralized front-ends.

- Where are the criminal risks of crypto market makers?

- Telegram against MetaMask It is not only a battle for Web3 traffic entrance, but also a battle between Web2 and native encryption.