Why are Telegram bot races so popular? How will they develop in the future?

Why are Telegram bot races popular? How will they develop in the future?Author: LianGuaiAsher Zhang

According to Coingerk data, the Unibot token UNIBOT has surged from $3 in May to a peak of $148 on July 24, an increase of about 50 times. From recent data, both Banana Gun and MaestroBot currently have more users than Unibot, especially Banana Gun, which has gained popularity due to the token presale announcement. Despite the overall downturn in the cryptocurrency market, the Telegram bot sector remains hot. So why are Telegram bots so popular? What are the reasons behind the popularity of the Telegram bot sector? How will the Telegram bot sector develop in the future?

Market Downturn, Unibot’s Rise Ignites the Bot Sector

Telegram Bot is a robot on Telegram that provides various DeFi trading tools. After entering the wallet mnemonic, it can execute certain commands for users, such as token exchange, copy trading, analysis, automatic airdrop trading, asset cross-chain, and other automated operations. The leading player in the trading bot sector was originally MaestroBot, whose performance was relatively average for a considerable period of time. Data statistics show that from November to December 2022, MaestroBot’s average daily income was about 4-5 ETH, and from January to February 2023, it fluctuated between 6-10 ETH.

- The Hong Kong virtual asset licensing system faces a dilemma the rise of JPEX while institutional enthusiasm for applying for licenses decreases.

- Bloomberg Thousands of Words Uncover How SBF’s Elite Parents Helped Him Build a Cryptocurrency Empire?

- LianGuai Observation | Chain gaming track has won large-scale financing, has GameFi passed the ice age?

However, with the entry of Unibot, Unibot changed the economic model of MaestroBot, which in turn ignited the bot sector. The initial economic mechanism of MaestroBot, the leader of the bot sector, was to charge a usage fee. However, Unibot introduced a new token economic model, making the Telegram bot sector hot. Unibot earns income mainly through two methods: robot trading fees (Bot Fee) and a 5% transaction tax on the native token UNIBOT. For the former, Unibot charges a 1% fee for each transaction, of which 40% is allocated to token holders. As for the latter, all UNIBOT token transactions are subject to a 5% tax, of which 1% of the trading volume is allocated to token holders, and token holders with a balance of more than 50 UNIBOT are eligible to receive income sharing rewards.

Unibot’s economic mechanism transformation has been a huge success and has been recognized by industry influencers. The wealth effect of the Telegram bot sector continues to expand. According to Coingerk data, the Unibot token UNIBOT has surged from $3 in May to a peak of $148 on July 24, an increase of about 50 times. Subsequently, a hype wave of trading projects in the cryptocurrency industry, such as Telegram bots and Discord bots, emerged in a short period of time. Bot projects demonstrated significant short-term wealth creation effects, such as the Loot Bot token LOOT, which experienced a daily increase of up to 4 times.

Regarding the popularity of Unibot and others, Bobby ONG, co-founder of Coingecko, once commented: “One of the biggest pain points in bringing retail into cryptocurrency is that using wallets and interacting with DeFi protocols is too difficult. After experiencing Unibot a few weeks ago, I think I now know how the next billions of new users will interact with cryptocurrencies. The idea of Unibot is simple – building a fast and easy wallet on Telegram and integrating it closely with DEX to reduce the risks of buying junk coins and copy trading. For me, it’s really much easier now to do DeFi trading on my phone.”

Why are Telegram Bots so popular

The main factor driving the rise this year is actually the hype behind technological innovation. The most significant hype in the first half of this year was undoubtedly Bitcoin Inscriptions. According to Dune data, the BRC-20 protocol has been growing steadily since April 21 (accounting for 4.1% on that day), with the non-Ordinals protocol accounting for 84.2%; subsequently, the BRC-20 protocol has grown significantly, reaching a maximum of 65.3%. Subsequently, competitors to the BRC-20 protocol began to emerge, such as BRC-21, as well as ORC-20, and so on.

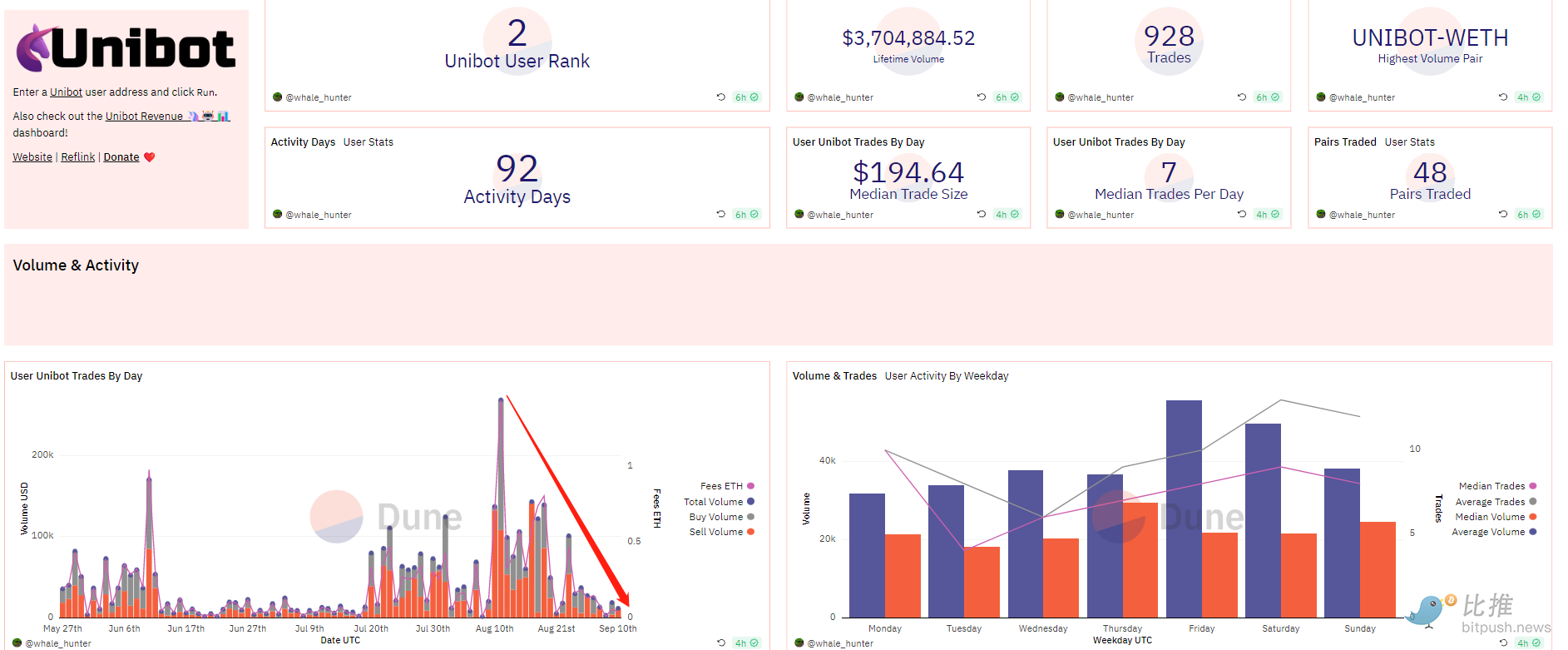

Unlike the purely meme attributes of BRC-20 tokens, Telegram Bots have certain practical value and more promising speculative expectations. Telegram, as one of the most widely used social software in the crypto community, has a huge market demand for trading bots and other auxiliary trading tools for many new users. However, from the data perspective, the popularity of Unibot is largely the result of speculation rather than a significant outbreak of actual use cases, because the market as a whole is in a bearish state and trading remains relatively weak. According to data from Dune@whale_hunter, Unibot has captured a total of 3,280 ETH in income since its launch in May, worth $6.08 million, and has completed a total trading volume of $85.76 million. The data shows that more than 80% of the fees captured by Unibot actually come from the transaction tax of the native token UNIBOT (users need to pay a 5% transaction tax for each UNIBOT token transaction), and less than 20% of the income comes from the claimed transaction fees. The currencies traded by the Unibot trading bot are mostly memecoins.

From the recent popularity of Banana Gun and MaestroBot, it is still the result of speculation. Banana Gun, as one of the trading bots, has similar general functions to other trading bots and does not have very significant innovations. Compared with Unibot, its main changes are in the token mechanism, so overall it is still a new coin speculation. UNIBOT token holders are eligible to receive income sharing rewards only if they hold more than 50 UNIBOT tokens. Under the token mechanism of Banana Gun, token holders can receive income sharing on the official DApp, namely robot income (40% recommended) and 50% of tax revenue; in addition, users can receive a certain number of token rewards by using Banana Gun to buy or resist new listings. MaestroBot, as a leading Telegram Bot, has not yet issued tokens, and the market expects it to eventually issue tokens, with strong expectations of airdrop in the market.

A Survey of Mainstream Projects in the Telegram Bot Field

The development of the Telegram Bot field is relatively fast, and specifically, it can be divided into DeFi category, data analysis category, airdrop ambush trading category, and others.

DeFi Category

Unibot (trading), Banana Gun, WagieBot (trading and tracking), Boltbot (trading), 0x Sniper (trading), NitroBot (trading), Xbot (custom trading), ASAP (Discord exclusive), SwipeBot ($ETH, $ARB, $BSC AI trading), Bridge Bot (cross-chain), AI DEV (AI trading, token issuance), All In (AI trading)

Data Analysis

Cipher Protocol (analysis), NeoBot (analysis and tracking), Meowl (analysis and tool suite), TokenBot (social trading), Trace AI (AI analysis), Scarab Tools (analysis), BlackSmith (AI analysis), TrackerPepeBot (AI analysis and contract security detection), DAGMI (tracking), First Sirius (analysis), The DIG (token and NFT analysis), WallyBot (wallet analysis),

Airdrop Ambush Trading

Farmer Friends, LootBot, alfa.society (with airdrop tips)

Others

EnigmaAI (customizable AI for trading on CEX), NexAI (a bunch of AI tools), 0x1 (multifunctional), MagiBot (privacy)

There are many projects in the Telegram Bot field, and below are brief introductions to some distinctive projects. UniBot provides limit orders, mirror sniping, and other functions. SwipeBot focuses on ease of use. OxSniper has anti-MEV protection. LootBot automatically participates in airdrops and harvests, solving the inefficiency of manual airdrop harvesting and demonstrating some innovation. GenieBot uses AI technology to answer various cryptocurrency knowledge questions posed by users.

Predicted Development Trends of Telegram Bot Field

For the future development trends of Telegram Bots, the overall market is very optimistic. Below are some viewpoints from well-known figures for readers’ reference.

Cryptocurrency analyst Asher stated that there are several potential profit directions in the Bot field: 1) MaestroBots, with a weekly income of $1.1 million, has a high possibility of launching tokens, and there is a good chance of a new wave of Bot airdrops creating wealth effects; 2) Unibot’s new trading terminal Unibot X, integrated with GeckoTerminal, is building an all-in-one trading bot. Based on its revealed roadmap, it will also add more horizontal functionality extensions; 3) As Bot tokens become popular in the market, the trend of listing on CEX is on the rise. In addition, Twitter Bots are becoming mainstream, and the influx of new users is expected to further drive the development of the Bot field.

Crypto Veda (@thcryptoskanda) tweeted that Telegram Bot is the first feasible large-scale deployment solution for the Crypto decentralized front-end. It may be the great evolution of the second Ponzi scheme after DeFi.

BTCdayu (@BTCdayu) tweeted that the Bot field has been very hot recently, with Master Bot leading the way and intense competition between Unibot and Bananas. There is no need to worry about who is the leader yet, as the cake has not even been made. Even during the coldest times in the market, the income of front-row Bots is still high. What if the market is hot? Similarly, the user base can increase by another 10 times, and that’s when the flywheel starts. More trading volume – higher income – higher token price – more trading – more users.

The future market demand for Telegram Bots is expected to be very high, but the sustainability of trading Bots is currently questioned. Taking Unibot as an example, its current income mainly relies on tax revenue generated from token speculation, with memecoin tokens being the most traded on Unibot. Secondly, the decentralization level of trading Bots is not high, and their security is questionable. Using trading Bots requires importing mnemonic phrases into these “centralized applications,” which exposes users to high risks in the event of a hack. Additionally, trading Bots face legal risks, such as Telegram Bots directly participating in fund trading activities, which carries the risk of being treated as securities trading, as well as potential involvement in money laundering, etc.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How can we prevent the Twitter attacks that even Vitalik Buterin fell for?

- LianGuai Daily | Binance.US lays off one-third of its employees; Hong Kong Securities and Futures Commission warns that JPEX is an unregulated virtual trading platform.

- Full Name Exploring the Path of Future On-chain Identity Layer Construction

- LianGuai Daily | LianGuai Launches Cryptocurrency to USD Exchange Service; MakerDAO Protocol RWA Total Assets Reach $2.613 Billion

- Cryptocurrency Track Weekly Report [2023/09/11] ETH Staking Rate Rises, Layer2 TVL Declines

- In-Depth Analysis of Coinbase’s Proposal for Flatcoin How to Design an Inflation-Adjusted Stablecoin?

- Why should MakerDAO choose Cosmos instead of Solana?