SubDAO Divide and Conquer, a key step in the endgame of MakerDAO

SubDAO Divide and Conquer is a crucial step in the endgame of MakerDAO.Source: RuneChristensen, Founder of Maker

Translation: Karen, Foresight News

SubDAO is considered one of the major plans in Maker’s ultimate battle roadmap. RuneChristensen, the founder of Maker, recently outlined the vision and launch details of SubDAO. Foresight News has compiled this information.

Despite the current sluggishness in the cryptocurrency market, Maker continues to expand its dominant position in the DeFi field. Other projects are simply not worth mentioning. Maker has been performing exceptionally well, with a supply increase of 400 million Dai just last month.

- LianGuai Daily | JPEX involved amount has reached HKD 1.2 billion; Cryptocurrency startup Bastion completes $25 million financing.

- How did North Korean hackers use LinkedIn and social engineering to steal $3.4 billion in cryptocurrency?

- Exclusive Interview with Wintermute Co-founder Accumulated Trading Volume of 20 Trillion USD in 6 Years, the Secret to Success of a Well-known Market Maker

Now is the time for SubDAO to shine, as it will revolutionize the game rules in the crypto space.

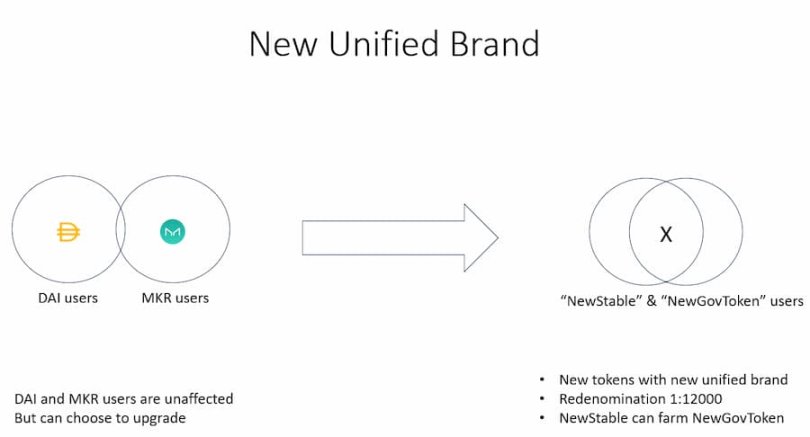

Before launching the four SubDAOs early next year, Maker will establish a foundation for the marketing and growth of SubDAO through a new simplified brand (name to be determined). Maker will focus on providing a simple, user-friendly, and enjoyable experience for new and existing users.

The biggest challenge facing Maker is that the system has grown so large, important, and complex that it cannot be effectively governed as a single entity.

The future belongs to SubDAOs. SubDAOs are smaller in scale but highly flexible and independent, allowing for parallel development and experimentation. Each SubDAO is unique, and its community can spontaneously organize and develop a brand and culture that suits its business.

After the launch of the new brand, Maker will also launch four SubDAOs simultaneously, each with its own token distributed through mining to holders who upgrade Dai to “NewStable”. The upgrade does not add additional risk, and users can easily unlock it back to Dai.

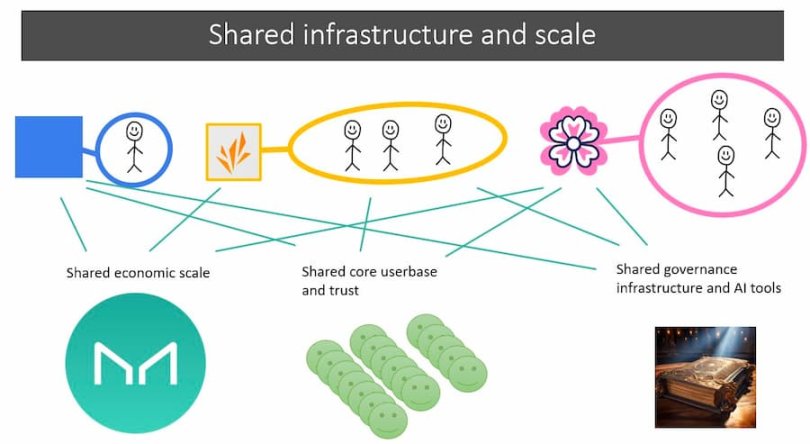

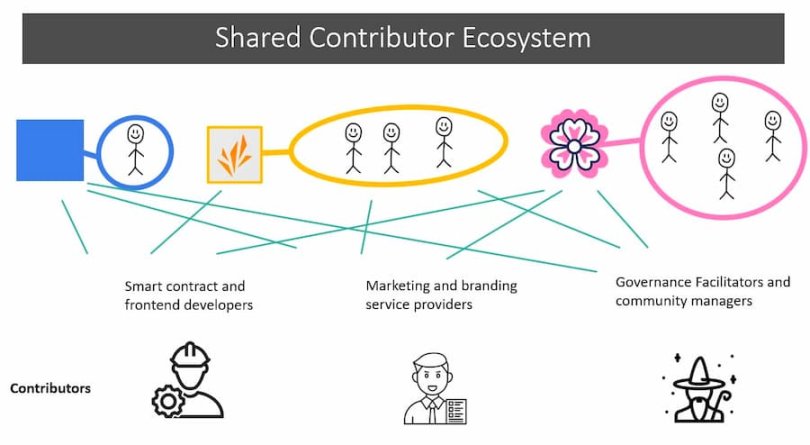

SubDAO is a win-win choice, allowing for autonomy, flexibility, and innovation, while also benefiting from Maker’s large economic scale, user base, reputation, governance tools, and other advantages.

In addition, SubDAO shares the resources of Maker’s incubated contributor ecosystem. Currently, over 30 companies contribute to and empower the Maker ecosystem, including five dev shops specializing in Maker-level EVM/Solidity. This shared talent pool means that each SubDAO will be operational immediately.

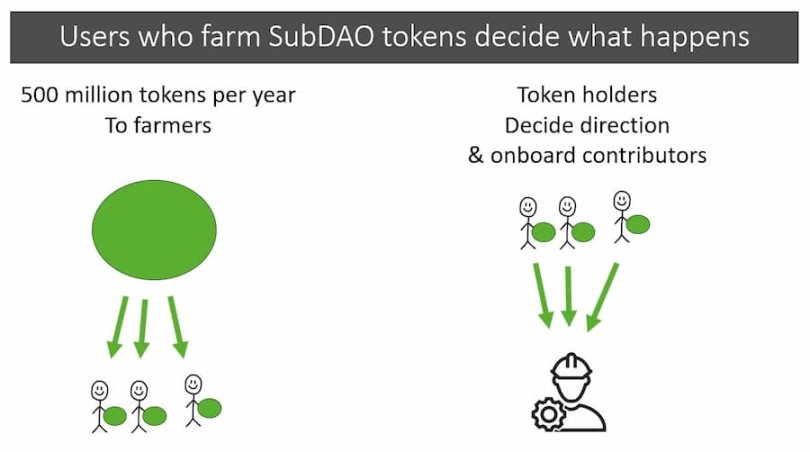

As for the much-anticipated SubDAO token distribution, the initial tokens will be allocated to users who upgrade their Dai to “NewStable”, with no insider allocation. This provides an opportunity for ordinary users to earn mining rewards fairly and without permission. Token holders will determine the direction and funding of SubDAO contributors.

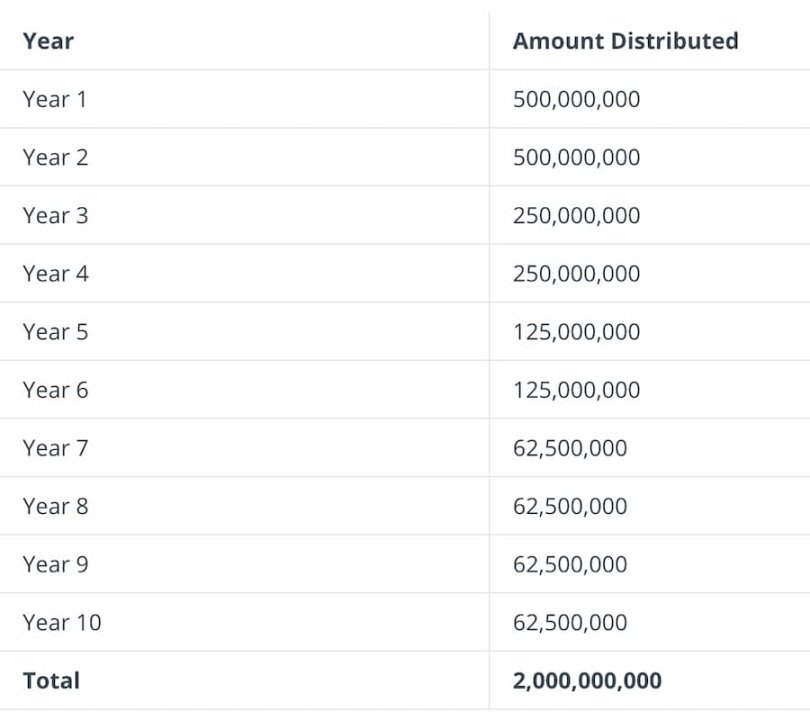

According to the MakerDAO official website SubDAO token economics, the initial supply of each SubDAO token is 2.6 billion, of which 400 million SubDAO tokens are reserved for incentivizing SubDAO employees or contributors, 200 million SubDAO tokens will be sold in the form of DAI over a period of 2 years and used to provide funds for the SubDAO treasury. In the first 10 years of the SubDAO lifecycle, there will be 2 billion tokens for liquidity mining. In the first two years, the rate of initial mining is 500 million SubDAO tokens per year, of which 350 million SubDAO tokens are used for NewStable mining users and 150 million SubDAO tokens are used for NewGovToken mining. In the next two years (the third to fourth year), the rate of initial mining pool is 250 million SubDAO tokens per year, of which 175 million SubDAO tokens are used for NewStable mining users and 75 million SubDAO tokens are used for NewGovToken mining users.

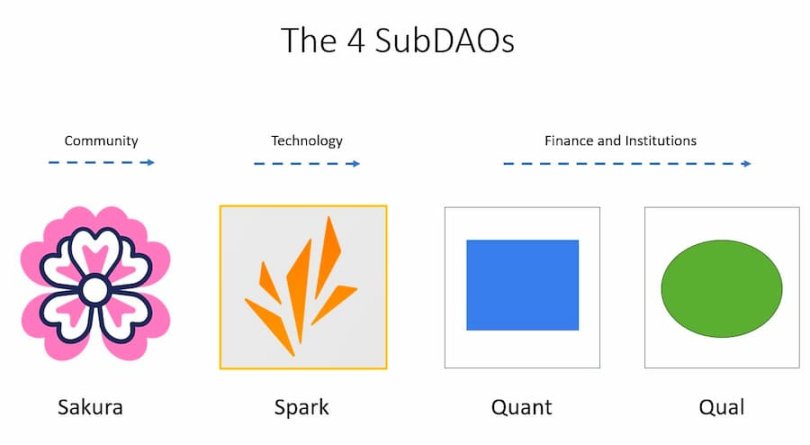

The four initial SubDAOs each have their own characteristics:

- SakuraDAO will build an interesting social community and achieve self-sustainability by promoting the growth of the Sakura revenue platform. SakuraDAO is open to all users and rooted in the Japanese cryptocurrency community, sponsoring games, activities, etc.

- SLianGuairkDAO focuses on leading the innovation in DeFi and applying Maker’s scale to DeFi products that users really want to use. SLianGuairk Protocol is a new lending engine that has attracted a total lock-up value (TVL) of $450 million.

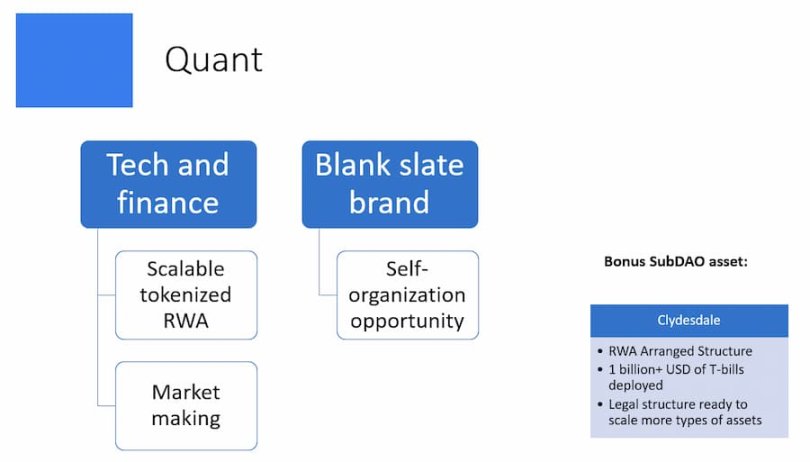

- Quant is a SubDAO focused on real-world assets (RWA), combining Maker’s billions of scale with tokenized assets using technology and scale to create value.

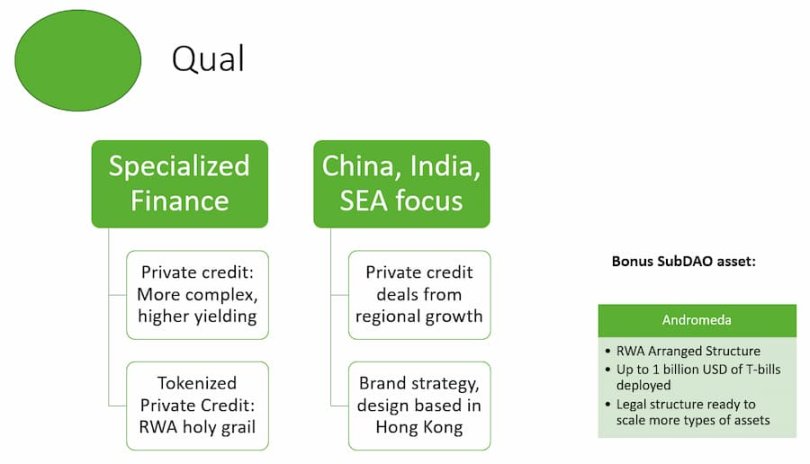

- Qual is also a SubDAO focused on RWA and finance, such as more complex and smaller scale private credit with higher returns. Qual is more oriented towards the Chinese crypto community and Southeast Asian community.

Of course, it will take some time before SubDAO is ready. But once launched, it will undoubtedly revolutionize the entire crypto industry and become a true growth engine.

As for the specific timeline, Maker plans to launch NewStable and NewGovToken in early next year, and launch SubDAO tokens in the second quarter of next year, supporting users to earn mining rewards with NewStable.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Daily | FTX Claims Portal Website Has Resumed Operations; JPEX Temporarily Shuts Down All Functions of the Gaming Hall

- Why are Telegram bot races so popular? How will they develop in the future?

- The Hong Kong virtual asset licensing system faces a dilemma the rise of JPEX while institutional enthusiasm for applying for licenses decreases.

- Bloomberg Thousands of Words Uncover How SBF’s Elite Parents Helped Him Build a Cryptocurrency Empire?

- LianGuai Observation | Chain gaming track has won large-scale financing, has GameFi passed the ice age?

- How can we prevent the Twitter attacks that even Vitalik Buterin fell for?

- LianGuai Daily | Binance.US lays off one-third of its employees; Hong Kong Securities and Futures Commission warns that JPEX is an unregulated virtual trading platform.