Mixin’s aftermath of being stolen about 200 million US dollars Compensation plan includes bonds, Li Xiaolai’s Weibo questioned Where is the users’ money?

Mixin's aftermath of being stolen about $200 million. Compensation plan includes bonds. Li Xiaolai questions the whereabouts of users' money on Weibo.Author: Nancy, LianGuaiNews

In 2017, the old project Mixin unexpectedly attracted attention in the industry again, but this time it was in the form of theft.

On September 25th, security firm SlowMist issued a security alert stating that the database of Mixin Network cloud service provider had been attacked, involving approximately $200 million. Subsequently, Mixin admitted in a tweet that some assets on the mainnet were lost due to a hacker attack and that they had contacted Google and SlowMist to assist with the investigation.

Regarding compensation for user losses and attack details, Mixin founder Feng Xiaodong responded in a live broadcast that the official maximum compensation would be 50%, and the remaining amount would be compensated in the form of bond tokens. Specific attack details would need to wait for the official announcement. In fact, as of now, the official has not given an accurate statement on which assets were stolen and how much funds were involved.

- Market value doubled within a year, will Azuki be knocked down How much longer can Pudgy Pengunis remain popular?

- Hot discussions among peers, uncovering the little-known stories of market maker DWF Labs and Lianchuang.

- Weekly Financing Report | 18 public financing events; Cryptocurrency gaming company Proof of Play completes $33 million seed round financing, led by Greenoaks and a16z.

With the escalation of the Mixin theft incident, “old-timer” in the industry Li Xiaolai, who had been out of the spotlight for a long time, returned to the public eye. Li Xiaolai is not only an investor in Mixin, but also played a crucial role in promoting the project.

Maximum compensation for stolen assets is 50%, mainly from Li Xiaolai’s platform B.watch

After preliminary verification by the Mixin official, the funds involved in this attack are approximately $200 million. Currently, Mixin’s deposit and withdrawal services have been suspended and will be reopened as soon as the vulnerabilities are confirmed and repaired through discussions with various nodes. According to data released by PeckShield, the mainstream assets involved in this attack, including $94.48 million worth of ETH, DAI, and BTC, are all over $23 million, with a total value of approximately $140 million.

It seems that the hackers only chose assets with good liquidity. However, according to Feng Xiaodong, there were no serious thefts of assets such as BOX and XIN. Among the remaining assets of over $900 million, BOX and XIN account for about $400 million. The reason why BOX and Xin did not suffer widespread theft is that these assets have no value outside the Mixin ecosystem. Some community members also expressed that the reason why EOS (one of the assets that make up BOX) was not stolen may be related to the power of EOS super nodes to freeze accounts.

The stolen funds mainly came from B.watch. According to DefiLlama data, as of September 25th, Mixin ranked eighth among public chains with a TVL of approximately $350 million, with B.watch contributing over $260 million, accounting for 75.2% of the total amount. B.watch is a one-stop investment research community launched by Li Xiaolai, which once set a threshold of holding more than $500,000 worth of encrypted assets and supports regular investment in BOX.

Regarding the compensation issue that users are concerned about, Feng Xiaodong revealed that the maximum compensation for all affected users’ assets is only 50%, and the remaining amount will be compensated in the form of bond tokens. In the future, the official will use profits for repurchases, and Mixin’s annual profit is approximately between $10 million and $20 million. At the same time, the official has also launched a new system for user asset migration, but currently, only half of the user’s balance can be transferred, and the rest will be displayed in the form of bond tokens.

It is worth mentioning that the trading platform ExinOne on Mixin once invested over $5 million worth of customer assets into FCoin for wealth management. After the FCoin incident, the platform also proposed solutions such as issuing bonds and postponing redemption.

Li Xiaolai personally promoted it, but the token price fell by over 88%

Mixin is a public chain project launched at the end of 2017, focusing on universal cryptocurrency payments. In 2017, the Mixin token $Xin raised 8 million EOS, with a calculated value of approximately 88 million RMB at the time.

Mixin remained relatively unknown for two years until Li Xiaolai personally stepped in to support it. According to Tianyancha, both Li Xiaolai and Feng Xiaodong are shareholders of Fageman (Beijing) Technology Co., Ltd. Feng Xiaodong holds 94% of the shares, while Li Xiaolai holds 5%. Luo Yonghao was also a shareholder of Fageman and held 4% of the shares before February 2016, but later withdrew from the shareholder list. In addition, Mixin has other industry veterans such as Lao Mao as team members. After the news of the hack came out today, some users left comments on Li Xiaolai’s Weibo asking, “What happened to the users’ money?”

On July 3, 2019, Li Xiaolai, who had been in hiatus for a long time, livestreamed on Mixin’s chat application, Mixin Messenger. In addition to sharing his investment knowledge, he also recommended a new project called BOX. Public information shows that BOX is a completely open, transparent, and zero management fee blockchain ETF product designed by Li Xiaolai. The total issuance of BOX is 200 million, consisting of BTC, ETH, EOS, DOT, MOB, XIN, and UNI. Each BOX contains 0.0001 BTC, 0.0001 ETH, 0.03 EOS, 0.005 DOT, 0.01 MOB, 0.0008 XIN, and 0.01 UNI.

To express his long-term optimism about BOX, Li Xiaolai once shared in the group chat that he exchanged 100 bitcoins, 150,000 EOS, and 800 XIN for 1 million BOX. At the same time, Li Xiaolai’s other project, B.watch, also launched the new token BOX and used his own shares as an incentive.

Furthermore, Li Xiaolai claimed on his personal WeChat account “Learn, Learn Again, and Learn More” that “dollar-cost averaging strategy is the only reliable investment strategy for ordinary people” and called on everyone to participate in BOX dollar-cost averaging, revealing that over 2.8 million BOX were dollar-cost averaged in the past month. In addition, Li Xiaolai also set up a BOX dollar-cost averaging practice group to teach members how to dollar-cost average. Despite the annual fee threshold of around 2,000 RMB for joining the group, it still attracted thousands of members.

Although Li Xiaolai’s dollar-cost averaging strategy with personal interests has strong appeal, it has not been able to change the downward trend of Xin. According to CoinMarketCap data, as of September 25, Xin has fallen by nearly 88.6% from its peak and can only be traded on BigOne and the DEX on Mixin, earning it the nickname “standalone coin”. Nowadays, Li Xiaolai has openly stated that he is staying away from the chaos in the cryptocurrency industry and is focusing on writing his own books.

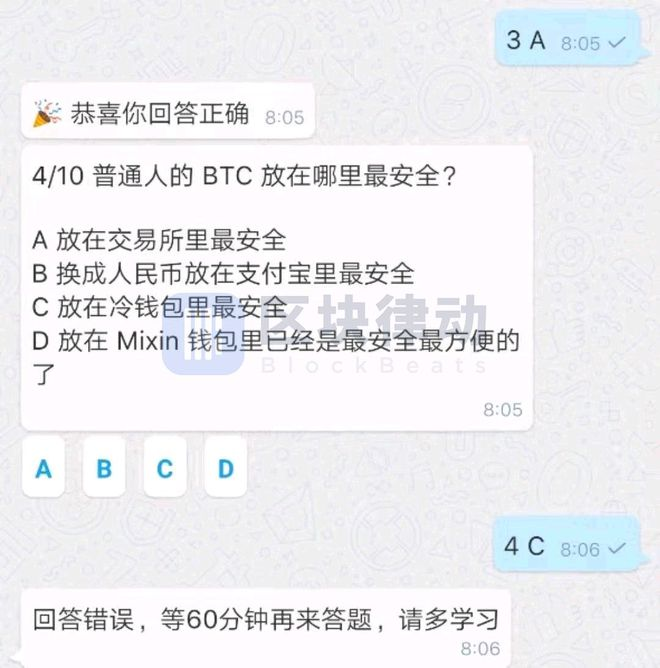

Li Xiaolai’s joining brings attention to Mixin, but Mixin itself is also controversial. For example, in December 2019, Mixin launched the “Sign in and get Bitcoin” activity. According to the rules of the activity, signing in for a year can get 0.0679 Bitcoin. At that time, if users persist for ten years, they can get more than 300,000 yuan worth of Bitcoin, which also attracted a large number of active users. Li Xiaolai once claimed on Weibo that Mixin has 60,000 daily active users. However, shortly after the sign-in activity, the official began to continuously modify the rules, including inviting new users, answering questions, and even depositing money to participate, which also caused community backlash. Interestingly, in the question-and-answer session, Mixin intentionally increased users’ awareness of its security, such as the answer to the question “Where is the safest place for an ordinary person to store BTC?” being Mixin Wallet.

It is worth mentioning that regarding Li Xiaolai’s regular investment plan, Jiang Zhuo’er, the founder of the LBP pool, once predicted, “What is stored on Mixin is only (tokens that can be exchanged for BTC by the operator). BTC is in the hands of the operator. If the operator refuses to exchange, runs away, gets seized, gets stolen, or goes bankrupt, your BTC will be gone.”

The Mixin attack incident once again confirms the saying, “Not your keys, not your crypto.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Weekly Notice | The deadline for FTX customers to submit claims will be September 30th; Bitget old users need to complete KYC verification before October 1st.

- Unveiling SBF’s Defense Draft of up to 250 pages I did what I believed was right.

- Data Analysis 37 listed companies in South Korea hold approximately $160 million in cryptocurrency assets, which tokens are preferred?

- Friend.tech is gaining momentum alongside Telegram, how will the veteran social protocol Lens Protocol counterattack?

- Overview of International Cryptocurrency Regulatory Agencies

- What do legal experts think of the SBF trial?

- FTX Reappearance? JPEX Embezzles User Assets and Is Involved in a High-Value Fraud Case