Exclusive Interview with Wintermute Co-founder Accumulated Trading Volume of 20 Trillion USD in 6 Years, the Secret to Success of a Well-known Market Maker

Exclusive Interview with Wintermute Co-founder $20 Trillion Trading Volume in 6 Years, the Secret to a Market Maker's Success.Interview and editing: Jack, BlockBeats, Vision, Metastone

Organized by: Sharon, kaori, BlockBeats

A market maker, also known as a liquidity provider (LP), focuses on providing liquidity to the market to ensure the healthy development and stable operation of projects. In the traditional financial sector, market makers are subject to strict regulation; however, in the cryptocurrency industry, the development of market makers appears to be quite “wild,” which has led to criticism that this industry has “contributed to the collapse of many projects,” “intermediaries profiting from spreads,” and “creating a false prosperity” in the industry.

- LianGuai Daily | FTX Claims Portal Website Has Resumed Operations; JPEX Temporarily Shuts Down All Functions of the Gaming Hall

- Why are Telegram bot races so popular? How will they develop in the future?

- The Hong Kong virtual asset licensing system faces a dilemma the rise of JPEX while institutional enthusiasm for applying for licenses decreases.

The explosion of FTX, the impact on a series of leading platforms, has made market makers and lending the hardest hit areas. For retail investors, talking about market makers is always like playing a game of blindfolded elephant. Behind all the controversies, what are the considerations of market makers regarding regulation, liquidity, and competition? At the TOKEN 2049 conference, BlockBeats conducted an exclusive interview with Yoann Turpin, co-founder of Wintermute, a well-known market maker in the cryptocurrency industry.

Wintermute is one of the most well-known market makers in the current cryptocurrency field and has participated in market-making for projects such as dYdX, OP, BLUR, ARB, APE, etc. Its co-founder, Yoann Turpin, graduated from EDHEC Business School and has held positions such as co-founder and CFO of Innovify and founder of Kaifuku Capital.

Maintaining “Market Neutrality”

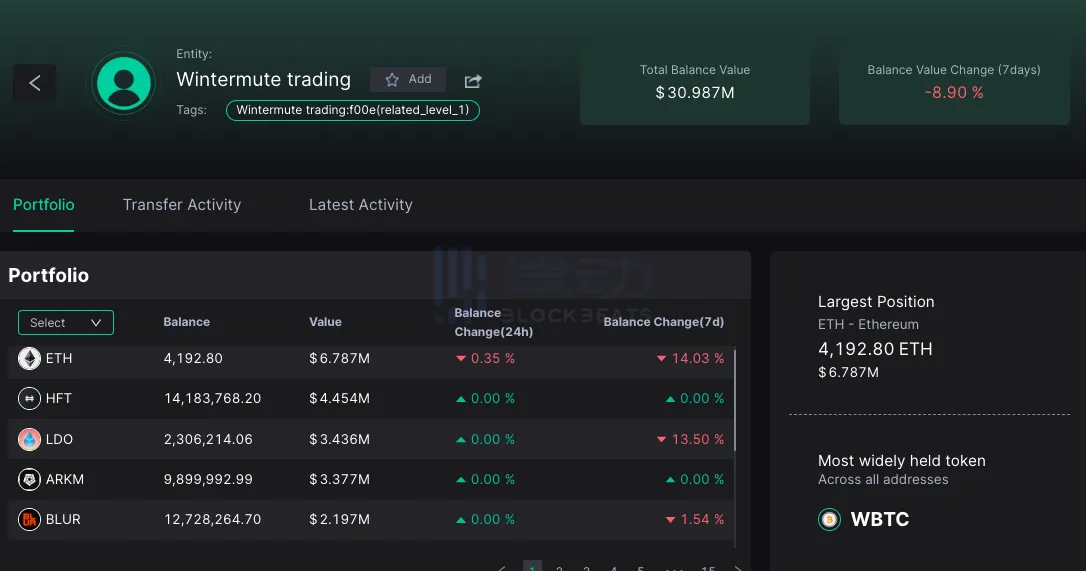

How big is Wintermute now? According to information on the Wintermute official website, as of the time of writing, its cumulative trading volume has exceeded 20 trillion US dollars. According to data from watchers, the largest trading asset for Wintermute currently comes from Ethereum, but it only accounts for less than 1% of its token portfolio.

Image source: watchers

BlockBeats: Please introduce yourself and Wintermute.

Yoann: We co-founded Wintermute in 2017, and we now have a team of about 100 people. Compared to 20 people in 2021, we have experienced significant growth, which also reflects the changing shape of Wintermute. We are striving to become a more diverse platform, focusing more on trading markets, and in 2021, we entered the derivatives market in Singapore.

We are increasingly engaged in over-the-counter trading, so we have more clients, but we actually face counterparties and conduct trading on our proprietary accounts. Wintermute has now become the world’s largest spot market maker, with our trading volume accounting for 16% to 20% of the total trading volume. In the derivatives market, we rank in the top 5 in terms of options. We are very active in investments, with about 100 investment projects, which means we have about $100 million on various venture capital balance sheets.

We have also incubated some projects, such as Bebop. In addition, we are increasingly involved in public investments. Wintermute hopes to maintain the company’s scale at a smaller level so that we can focus enough on one goal. Once you have two or three business units within the same company, things can get a bit chaotic, so we believe the best approach is to spin off things or let others support the execution of these ideas. You will see some results in the coming weeks and more frameworks related to incubation and mining.

As a founder, I am mainly focused on venture capital transactions and business development transactions, especially in Asia, which means I will be doing a lot of exploration in Korea. I have been to Japan and Peru earlier this year, and I will go to New York next year. We will travel back and forth to Hong Kong and explore Southeast Asian markets, including Indonesia, in the next few years.

Avoiding Overexpansion

BlockBeats: How did you survive the bear market? What strategies will Wintermute adopt during the DeFi liquidation process? What impact will DeFi on-chain derivatives have on the subsequent market?

Yoann: Basically, when the market drops, we start buying because people also push us into a position, we are basically forced to go long, and then we buy and sell. Our idea is that even if we may lose money on the long position, we can make enough money to offset this loss through the spread between buying and selling. That’s how we survived the bear market.

Regarding DeFi, it’s an interesting question because sometimes people misunderstand that we sell on DeFi protocols. What they see online is actually more about buying on CeFi and then putting it into DeFi because DeFi has more abundant liquidity. Maybe we just bought a lot of tokens on Binance or other exchanges, and then we have to sell somewhere, and DeFi also comes into play in this regard through P2P and other methods. But overall, we remain very “market-neutral”. Market neutrality means that we don’t make money by going long or short, but by making millions of trades every day to earn the spread.

BlockBeats: Actually, regarding this follow-up question, I remember a few months ago there was a huge market crash, and there were rumors that it might be caused by the withdrawal of liquidation providers or market makers, one of which could be Wintermute. What do you think about this?

Yoann: As the largest spot liquidity provider, people think of us in this way when a huge crash happens, but in reality, we are doing fine. The market trends have their ups and downs, and the whole market has the wealth effect. Imagine that we operate very well in a team of less than 100 people. Our competitors have 200-500 employees. I think their market opportunities may be the same or even lower. This is because we manage cash well and do not want to overexpand. Although in the summer of the cryptocurrency industry, our performance may not be as good as other companies, in 2021, we did not overexpand, and our business model survived well in the winter (compared to other competitors).

Choose Tokens Based on Scale and Longevity

BlockBeats: What criteria do you consider when choosing trading tokens? Do you need to borrow from foundations to start trading? What tokens do you like? Any preferences? What assets do you decide to become market makers and provide liquidity for?

Yoann: Obviously, this is more like a partnership. We borrow assets from foundations, and we hope that the interests of all parties can align. We don’t want to occupy too high of a comprehensive dilution percentage in terms of value. So we need to borrow a certain type of token that amounts to at least 2 to 3 million US dollars to have an impact on the business level. However, we also don’t want to borrow more than 2 to 3% of the fully diluted valuation (FDV), so when we make a choice, the project must have a large enough scale. Basically, the FDV of the projects we choose needs to exceed 100 million US dollars. If they are already listed, they need to have enough presence on exchanges. Usually, people come to us because they need a reputable market maker to help them list on other exchanges.

Our trading volume on certain exchanges can account for 10%, 20%, 30%, or even 60%. This is a close partnership with exchanges. The standard is that most T1 teams provide liquidity. We just need to ensure that the teams meet good standards and whether they are committed to long-term development. At the same time, there are also business considerations, requiring sufficient trading potential or sufficient existing trading.

BlockBeats: Can you still make money in extreme situations such as a sharp price drop?

Yoann: In the case of a sharp price drop, we usually have enough structure to profit from it, but a sharp price drop is generally bad for everyone. Because a sharp price drop means that some people are liquidated, and these funds have essentially been lost. But even in the traditional financial sector, you will see this situation. (During a downturn) we see the government’s balance sheet increasing just like at that time. So basically, the better we do, the smaller the impact of liquidation on the market. I mean, it’s a balance, but there will also be better prices entering the market.

Ethical Self-discipline Achieves Self-regulation

The Grudges and Rivalry with DWF Labs

In the market-making field, besides Wintermute, we have to mention one of its competitors, DWF Labs. The two companies had a public dispute in March this year, with DWF Labs accusing Wintermute of instigating blockchain media outlet The Block to smear them, and Wintermute questioning DWF Labs’ malicious intentions and security risks. In response, Yoann also stated that DWF Labs treats “over-the-counter trading as an investment,” which fundamentally has issues.

BlockBeats: What are your thoughts on DWF Labs? Because I know you have strong opinions about their methods. Do you think this is market manipulation? Do you think they are market makers?

Yoann: According to our terminology, they are not market makers, but what confuses many people is that they declare over-the-counter trading as investment. People usually think that investments are long-term in nature, while trades are more short-term. But if you announce an investment and then sell it immediately after the announcement, it is difficult to consider it as an investment. In many ways, this is the nature of the open and almost permissionless system we are in. There are also more obvious cases involving various bans and fundraising, for example, you will see people randomly sending cryptocurrencies to influence certain (bad) things, and the reasons are not sufficient.

I think it is best to maintain the openness of the system, and then people should become more and more aware of where they are sending their funds. I think (this industry) needs some mild regulation because you certainly don’t want bad actors. In fact, this is just repeating some of the mistakes of traditional finance, such as excluding many people from the banking industry. So the cryptocurrency industry needs to find a balance in it, and this balance will eventually be achieved over time. This is also why we started. Achieve self-regulation through ethical self-discipline?

The biggest criticism of market makers in the market is that there are a large number of people who “manipulate the market” rather than “provide liquidity to guide the development of the market conscience”. Wintermute prefers to position itself as a “liquidity provider” rather than a “market maker”, and Wintermute currently achieves self-regulation through ethical self-discipline throughout the company.

Avoid the US market and regulatory issues

BlockBeats: The next question is about regulation. If the SEC strengthens regulation and starts paying attention to tokens or NFTs, will this fundamentally change Web3? I’m curious about your thoughts on this.

Yoann: In 2021, we don’t deal with the SEC at all, so we intentionally decided to register in the UK for spot trading; and in the UK, they explicitly stated that they do not want to provide derivatives to retail traders, so we completely avoid this risk by putting the derivatives business in Singapore. But in the US, we have almost no business because all commercial activities basically happen outside the US. So we deliberately avoid (SEC regulation) in many ways, and actually now we are more focused on Asia, so we moved to Singapore.

Positioning as a “liquidity provider” rather than a “market maker”

BlockBeats: Another point about regulation is that in traditional finance, the role of market makers is strictly regulated; but in the cryptocurrency field, many market makers are to some extent unregulated and they also cooperate with exchanges. So can you talk about the issue of market maker regulation in the cryptocurrency industry?

Yoann: Generally speaking, those who are unethical will be exposed and have a bad outcome, whether it is in terms of brand development or business expansion. Typically, we choose to run a highly conscious ethical company and do our best to do what is ethical, which goes beyond the categories of “legal” and “illegal”. Everything we do is legal, but just because something is not illegal does not mean it is right, so we consider aspects such as consistency with long-term interests.

In fact, a lot of education is needed in the field of encryption, which is very time-consuming and difficult. One of the things I do now is to ensure that we are not misunderstood. We have largely stopped using the term “market maker” to describe ourselves and only use “liquidity provider,” which is also applicable in traditional finance.

There may be a point of confusion in the crypto field because liquidity providers are sometimes seen as “more passive LPs in DeFi AMM pools”, but in reality, a lot of what we do is provide liquidity and help discover prices, which means striving to find the true price of a token at any given time. Some people who claim to be market makers do not actually make an effort to find the true price of a token, which is completely contrary to the ecosystem. But I think these issues will be gradually resolved over time, depending on one’s own hardcore competitiveness and the ability to operate the business honestly and correctly.

Of course, you cannot expect everyone to maintain noble ethical values or make everyone follow the rules. We have this requirement for our own team. Internally, we obviously live up to this and require people to maintain fairly high standards. But what about other participants? For competitors, we only have one rule, which is basically to categorize competitors as good or bad, and we do not rush to judge people too quickly because reality is often more complex and has more gray attributes than what people say.

So we believe that for good competitors, we invest together with them. For example, if we borrow funds from a foundation, they need another liquidity provider to provide liquidity for their tokens, and sometimes we recommend other competitors to each other. So there is competition in this sense. But only those that we think have been around long enough and can truly get the job done and have synergies in most cases are included in what we consider to be “good competitors”. However, even within the realm of good competitors, if you dig deeper, we actually provide quite different services. We place a strong emphasis on engineering, primarily in building, which is why we have only about 8 people in terms of business expansion, or 9 if you include me.

Solana Takes Over from Polkadot

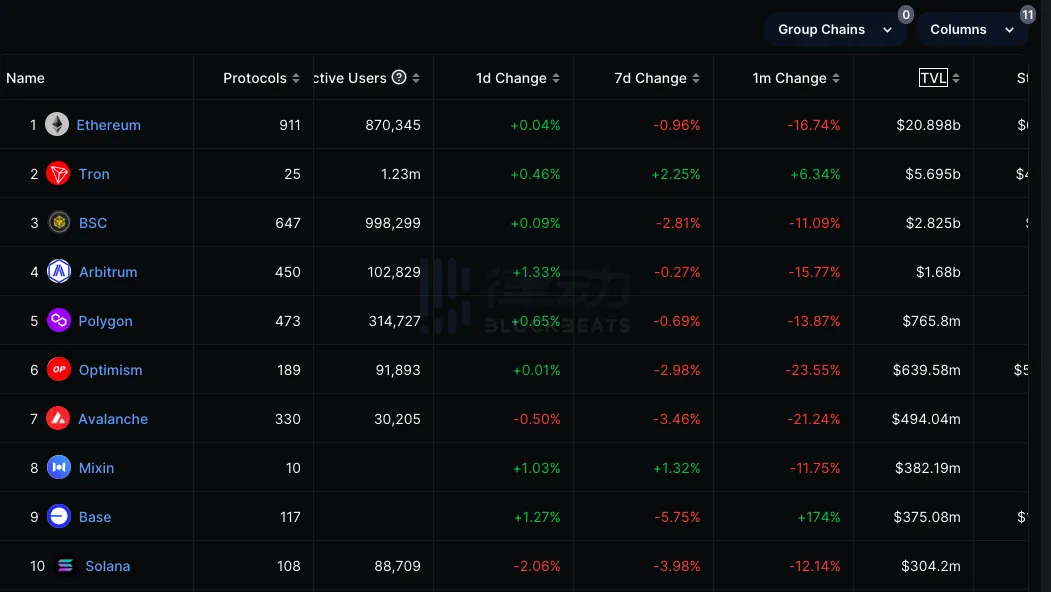

In this interview, Yoann also talked about the future of public chains. According to defiLlama, Ethereum is still ranked first in terms of lock-up volume, but Yoann believes that Solana has the potential to replace Polygon and become the second most influential public chain after Ethereum.

Image Source: defiLlama

BlockBeats: The last question is, we know that Concensys has launched Linea, Coinbase has launched Base, and Layer 2 is emerging in the market. Modular blockchains have become an important way to scale Ethereum. What do you think of this trend? Do you have any other strategies for Layer 2 or blockchain?

Yoann: Regarding Layer 2, the disclaimer is very clear. We have invested in almost all projects except StarkWare. It doesn’t mean StarkWare is a bad solution, but when we learned about StarkWare, it was already valued at $20 billion, and we prefer earlier investments. In addition, due to our choices in the DeFi field, we are often invited to integrate with various Layer 1 and Layer 2 projects, as a significant portion of value now comes from transactions.

As for the Coinbase issue, I think Coinbase has actually been supporting DeFi and strengthening its development for many years, so I am not surprised by their actions. For us, we always face a dilemma of choosing which chain to integrate and transact with. We are both successful in business and facing the same problem as the entire industry, which is finding reliable smart contract developers is difficult.

BlockBeats: We have seen a trend of returning to Ethereum, and it seems that EVM compatibility is actually crucial, mainly because Ethereum has the largest developer community. I remember Polkadot used to have the second-largest developer community, but things have changed now. Which chain do you think might be the next influential one?

Yoann: I think after Polkadot, it might be Solana. But even with Solana, the numbers are hard to verify because if you consider Solana developers, many teams participate in hackathons, build their first application on Solana, and then switch to building other applications because they find the first one not specific enough.

Last year, we invested in three teams that participated in hackathons on Solana and ended up developing there. So you will see many cases where the authenticity of the data is difficult to determine. But Ethereum can be considered the leading platform in terms of building applications, although there are other teams as well, such as many teams working to achieve Bitcoin’s functionality. So that’s another aspect. We see progress in the engineering side, but not necessarily in the transaction side.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bloomberg Thousands of Words Uncover How SBF’s Elite Parents Helped Him Build a Cryptocurrency Empire?

- LianGuai Observation | Chain gaming track has won large-scale financing, has GameFi passed the ice age?

- How can we prevent the Twitter attacks that even Vitalik Buterin fell for?

- LianGuai Daily | Binance.US lays off one-third of its employees; Hong Kong Securities and Futures Commission warns that JPEX is an unregulated virtual trading platform.

- Full Name Exploring the Path of Future On-chain Identity Layer Construction

- LianGuai Daily | LianGuai Launches Cryptocurrency to USD Exchange Service; MakerDAO Protocol RWA Total Assets Reach $2.613 Billion

- Cryptocurrency Track Weekly Report [2023/09/11] ETH Staking Rate Rises, Layer2 TVL Declines