Crypto Derivatives: Blessing is not a curse, a curse cannot be avoided

Source: OKEx official blog

Compilation: First Class (First.VIP)

In the past, derivatives have been blamed as the root cause of the financial crisis. What about the cryptocurrency market?

- Hedge fund Fortress raises the price several times to buy MtGox claims. Will you sell 30% of Bitcoin?

- Ethereum's DETH: 2020 may be a particularly crazy year

- Asset on-chain practice: how the emerging public chain Algorand 2.0 promotes real-world transactions with ASA

The increasing uncertainty in global financial markets has prompted more and more investors to switch to safe-haven assets for the purpose of risk defense. In addition to precious metals and foreign exchange investment products, crypto assets provide investors with new options to prevent inflation and geopolitical risks. Crypto Derivatives add new options to crypto assets.

Regardless of whether it is recognized in the mainstream financial circle or not, Bitcoin, as the backbone of the cryptocurrency market, has played a role in promoting value exchange in the international financial market despite high volatility over the past 11 years. Cryptocurrency market players have great demand for freely accessible spot trading markets, and they also have the same expectations for futures markets that can be hedged. As a result, major crypto exchange operators are formulating plans for demand to attract global investors.

However, since some crypto exchanges began offering futures trading, some investors have begun to call it a casino, and futures have been accused of being the root cause of the past financial crisis. This raises the question: Is crypto derivatives trading a blessing or a curse to the cryptocurrency industry? Is it a godsend or a Pandora's Box that can't be covered?

History and data will not lie

Financial derivatives refer to contracts whose value depends on the value of the Underlying Asset. Traditional financial derivatives include forward contracts, futures, options, swaps, etc. The main characteristics are "zero-sum games" and high leverage . (Source: MBA Think Tank)

Some investors—let's call them “conservative camps” —have long misunderstood financial derivatives because their characteristics provide room for speculation. Indeed, we cannot underestimate the speculative factors mixed in, because investors can speculate on changes in prices in order to obtain huge returns. For example, George Soros, known as the "financial giant", is known for shorting the pound to defeat the Bank of England. In addition, during the 2007 subprime mortgage crisis, some speculative Wall Street investors shorted real estate mortgage securities and made a fortune.

Although these stories may drive many investors away from derivatives, this is not the case. It is said that in Uruk in ancient Mesopotamia, derivatives were invented in the form of tablets. At that time, people had to provide food or worship in temples on a specified date. In the Roman Empire, food futures could be used to exercise macroeconomic control. In the era of geographical discoveries, cross-border trade frequently occurred, but due to communication barriers, the problem of fluctuations in commodity prices has not been resolved, so that merchants may suffer full losses after shipping goods from one country or region to another . This is why commodity forward contracts are created by fleets to hedge the risk of price fluctuations. After the 18th century, more developed stock exchanges introduced strictly formulated trading rules to help institutional investors manage risk exposures. Since then, this has attracted wider participation by global investors in this market.

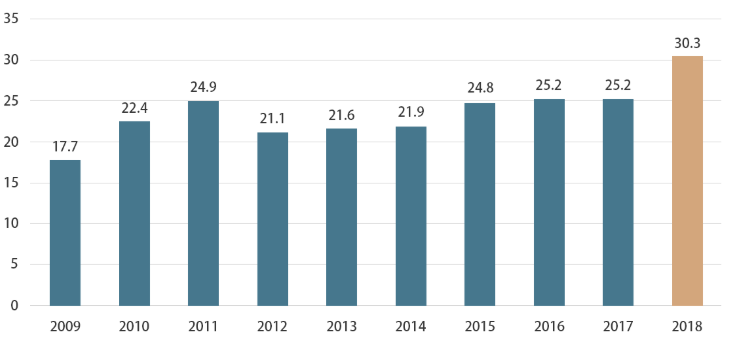

The original intention of the futures contract was to achieve spot delivery and maintain price stability. It not only guarantees the orderly production of goods, but also offsets fluctuations and other risks that are not conducive to flexible adjustment of production and marketing strategies. According to the latest data from the American Futures Association (FIA), the global futures and options trading volume in 2018 increased by 20.2% compared to 2017, reaching a record high of 30.28 billion contracts. Among them, futures trading volume increased by 15.6% to 17.15 billion contracts, and options trading volume increased by 26.8% to 13.13 billion contracts. It is worth noting that since 2010, the growth of global futures and options trading volume in 2018 is the fastest.

Figure 1: Global Futures Options Trading Volume from 2009 to 2018; Units: 1 billion contracts

Why are people's views on derivatives polarized?

Financial derivatives have their own value in controlling risks, reducing long-term price fluctuations, and rationally pricing assets. However, derivatives investors need to acquire enough knowledge and learn advanced strategies before trading to make better use of the tools.

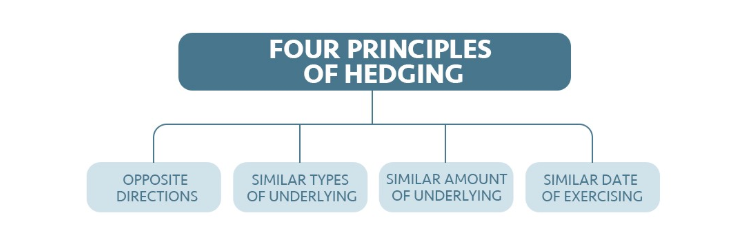

Many speculators fantasize about getting rich overnight with leveraged derivatives. However, they often forget that while exaggerating returns, overestimating investment capabilities and psychological strength, risks are also magnified. Therefore, the most important basis for derivatives trading is to first develop an independent strategy. The four major rules of risk hedging listed in the following figure are: reverse operation, equivalent underlying asset types, equivalent numbers, and close operation dates.

Figure 2: Four rules of risk hedging

In this information age, many investors deliberately misrepresent those "big shorts" and exaggerate their success while hiding the risks. In 1992, Soros used his fund to establish a huge short sterling British pound position, pushing himself to the brink of a cliff, and he would be in danger if British banks accepted foreign aid then. During the subprime mortgage crisis in 2007, after many years of wait-and-see, some big bears finally made profits in the bullish real estate market with years of accumulated judgment and willpower. Each step of using short-term trends is a bet, but little is known to outsiders.

From a larger perspective, the crux of financial instability lies in the bursting of asset bubbles. Financial derivatives have proven to be a corrective mechanism for investors and markets at critical moments. After countless trials and errors, the overall stability of the financial industry has been enhanced. Global operators in many key industries, including oil and aviation, purchase reverse options to hedge potential negative effects of energy prices and exchange rate fluctuations on inventory values. Therefore, the interpretation of derivatives trading as gambling is biased.

Derivatives or a godsend in the crypto market

Today, crypto assets have become the new favorite of investors, and this emerging market is expanding at an unprecedented rate. The problem, however, is that any investor can suffer losses in market fluctuations, even if lucky enough to be the final winner. The spot market is vulnerable to negative news (or even rumors) from market panic, uncertainty and doubt (FUD). If crypto investors do not realize the importance of risk management and the lack of risk hedging tools, it will be difficult to obtain long-term returns.

Both retail and institutional investors face the same problem. In 2012, Bitcoin's volatility soared to 94%, causing both margin and spot traders to suffer staggering losses. However, even if the media considers crypto assets as speculative commodities out of context, the long-term value of crypto assets has apparently surfaced with the rise and fall of their prices. The lesson for the industry is that investors need more tools to withstand short-term market fluctuations. After all, only a few people can "cross the bull and bear" to the end in the long run.

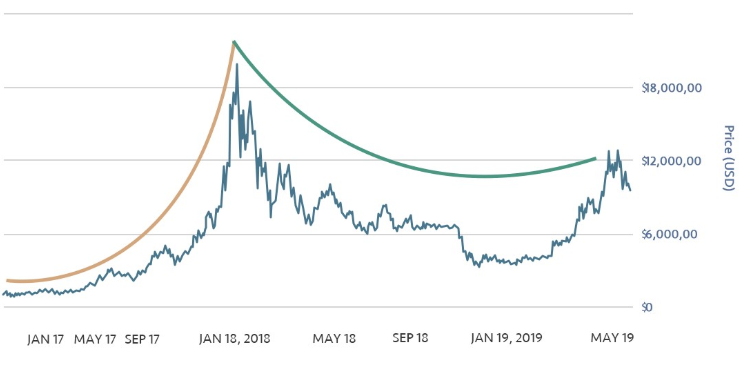

In this context, the launch of short-term hedge derivatives has attracted much attention. In June 2013, the first Bitcoin futures contract was launched. In 2017, the Chicago Mercantile Exchange (CME) launched bitcoin futures, when bitcoin's volatility plummeted within a year.

Figure 3: Bitcoin price trend after the launch of CME Bitcoin futures

In addition, in the autumn of 2019, Intercontinental Exchange ICE launched Bakkt, the first compliant Bitcoin futures trading platform. At the same time, digital asset investment bank Galaxy Digital and crypto investment agency XBTO completed the first major Bitcoin futures transaction on the platform.

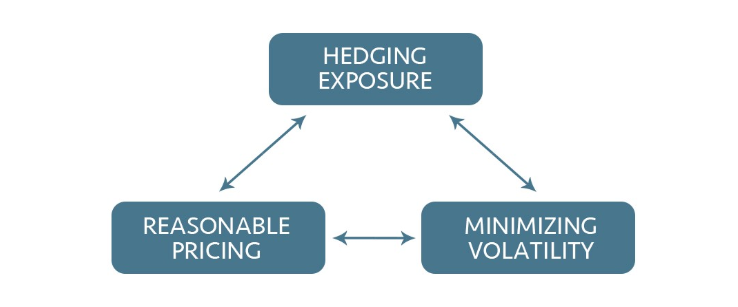

As a highly complex investment tool, crypto derivatives are usually invested by senior technical traders. Their main value is to hedge risks, reduce price fluctuations, and find reasonable prices for assets.

Figure 4: Key Values of Crypto Derivatives

As transaction volumes increase, the maturing crypto derivatives market has apparently reduced the volatility of major cryptocurrencies, including Bitcoin. The extensive participation of institutional investors in the market has also brought a more fair market environment and contributed to the healthy development of the crypto asset industry.

In the past, the lack of crypto derivatives has greatly restricted access to the crypto market by two other types of investors, miners and institutional investors.

We all know that miners need to bear a lot of the cost of mining equipment and electricity to operate a mining area. Therefore, they can only profit from the difference between the cost of mining and the price of the cryptocurrency. At the end of 2018, Bitcoin dropped sharply from around $ 17,000 to $ 3,000, directly affecting their livelihoods. There is even news that miners have started selling mining machines by weight. Like airlines and oil companies, mining machine makers need a risk hedging tool to maintain their business. The situation is similar for institutional investors and other crypto market intermediaries.

Because they strategically hold large amounts of client funds and secret assets, they need such a financial instrument to deploy a more stable investment strategy that takes fully into account the interests of customers and their own reputation. Therefore, considering the benefits that derivatives bring to miners and institutional investors, they will undoubtedly become a booster to attract new capital and promote the crypto market.

Crypto markets are much more volatile than traditional capital markets. Crypto exchanges urgently need to strengthen the risk management of derivative products, and the exploration of the derivative product market is still ongoing. The significance of fintech is to make financial services more transparent, accurate, and professional, and to allow investors to use fintech's high precision and automation to manage their assets. The idea of wanting to gain a foothold in the emerging trading market of cryptocurrency and promote its healthy development should not be forgotten by major intermediaries.

Disclaimer: This material should not be used as a basis for making investment decisions, nor should it be construed as a recommendation to engage in investment transactions. Trading digital assets involves significant risks that may result in loss of investment capital. You should fully understand the risks involved, taking into account your level of personal experience, investment objectives, and seeking independent financial advice when needed.

This article is sourced from the OKEx official blog, on behalf of the original author's personal opinion. First.VIP is always objective and neutral, presenting readers with diverse information for learning and communication, and does not constitute investment advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Big coffee perspective: 20 investment tips from the founders of Messari and the crypto market outlook

- How to judge whether the STO project is compliant? ——Based on public or private equity

- Introduction | Sablier: Uninterrupted Wage Flow with Ethereum

- Tencent Security Expert: How can blockchain technology be applied to digital construction of government affairs?

- One Piece Online Teaching | Digital Asset Security Management Answers

- First in the country! Judicial Application of Judicial Blockchain Smart Contract Technology in E-commerce Dispute

- New York Times article: Pursue innovation or avoid responsibility? Social media giant's decentralization movement questioned