In-depth analysis of Pendle LSDfi integrates RWA DeFi Lego to stack new puzzle blocks

Pendle LSDfi combines RWA DeFi Lego to create new puzzle blocksAuthor: Climber, LianGuai

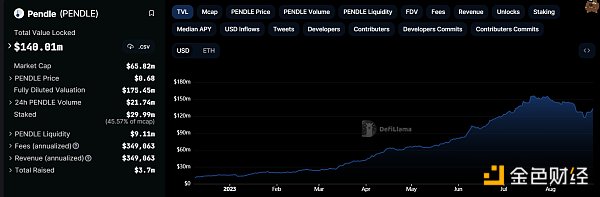

Since the Ethereum Shanghai upgrade in April this year, the LSD WAR has intensified. Liquidity staking allows users to maximize the utilization of their funds, and various DeFi projects continue to launch products to compete for market share. Pendle has benefited greatly from this trend, with its TVL increasing nearly tenfold since the beginning of the year.

Pendle is a decentralized yield trading protocol where users can execute various yield management strategies. Shortly after its launch on Binance in early July, it received investments from the Mantle ecosystem fund and Binance Labs. Recently, Pendle announced that it will use MakerDao’s sDAI and Flux Finance’s fUSDC in its first RWA product.

RWA is currently one of the hottest tracks in the crypto world. While everyone was still waiting for Pendle to join the camp, these two types of portfolios were already launched simultaneously. And within just five days, its TVL has exceeded $15.3 million, with the sDAI interest rate trading LP pool surpassing the GLP pool to become the second largest TVL pool on Pendle.

- Exclusive Interview with Connext Adopting a Points Mechanism to Determine the Number of User Airdrops, with Plans to Expand to 20 Chains by the End of the Year

- LianGuai Daily | Grayscale Wins Lawsuit Against the US SEC; Ethereum Foundation Launches Ethereum Execution Layer Specification

- In-depth conversation with Sui, Chief Scientist of Mysten Labs How does Sui solve the problem of network scalability from theory to practice?

1. Fundamental Analysis

LSDfi is a series of protocols based on LSD, including DEX and lending protocols, as well as more complex protocols built using LST attributes, such as Baskets protocol, stablecoins, and yield strategies.

Pendle belongs to the category of protocols for crypto asset yield strategies. Users can increase their yield exposure in a bull market and hedge against downward yield in a bear market by using the DeFi products provided by Pendle, thus maximizing their returns.

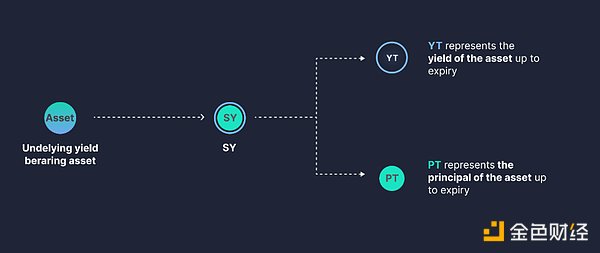

The Pendle project system consists of three main parts: yield tokenization, AMM, and vePENDLE. Through this system, Pendle can package users’ crypto assets into standardized yield tokens SY, which can be further divided into principal and yield components, namely PT (principal token) and YT (yield token). Both PT and YT can be traded through Pendle’s AMM.

vePENDLE is a functional token used for Pendle governance, which users can obtain by staking PENDLE.

With the help of the LSD track, Pendle’s further product design, the yield maximization mechanism, has attracted a large number of users. According to DeFiLlama data, Pendle’s TVL is $140 million, with the highest increase of 1000% since the beginning of the year.

However, the yield staking track has a long history, and many projects have transitioned into it after the popularity of LSD, such as Lido, MakerDAO, RocketPool, Stkr (Ankr), Stakewise, and many others. Compared to them, Pendle is relatively new. Despite offering slightly better returns, it still faces development bottlenecks in the fiercely competitive market share landscape.

Against the backdrop of global economic recession, deep bear market in the crypto market, and rising US bond yields, the RWA track has been favored by investors seeking stable returns with low risk.

Currently, the RWA track is developing rapidly. In addition to the participation of well-established cryptocurrency projects, traditional financial institutions are also entering the field at an accelerated pace.

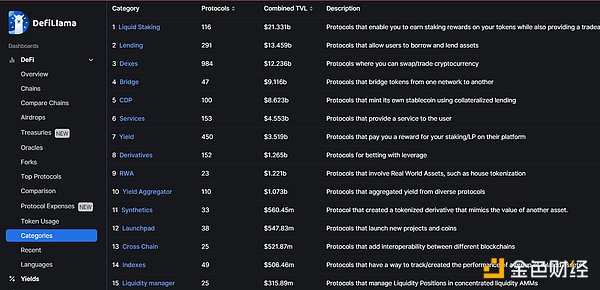

In the DeFiLlama’s classification of DeFi track categories, the LSD sector ranks first in terms of Total Value Locked (TVL) with $21 billion, leading the lending sector by almost double. The RWA sector is also growing rapidly, especially since April 8th of this year. Its TVL has rapidly climbed from $150 million and has reached $1.2 billion at the time of writing, an increase of nearly 900% in four months.

While already having a significant share of the value in the DeFi track’s largest sector, Pendle’s appetite seems to be even greater as it extends its reach to the rapidly growing and highly potential RWA sector.

II. Protocol Mechanism

In DeFi, users deposit funds into yield farming pools and earn Annual Percentage Yield (APY) that fluctuates over time. For example, the DAI pledged in Compound is represented as cDAI, and the ETH pledged in Lido is represented as stETH.

However, the generation of these passive incomes depends on the length of the collateralization period, and the expected returns are indirectly bound, unable to be maximized. Even through recursive lending, not only is the risk increased, but the gas fees are also higher.

Pendle not only untethers users’ principal and earnings but also provides them with more options for trading and using their earnings while ensuring a fixed income for users.

Specifically, Pendle packages LSD/LST into platform-native SY tokens, which are then split into PT (Principal Tokens) and YT (Yield Tokens), essentially tokenizing the yield.

Users can buy and sell PT on the Pendle Automated Market Maker (AMM), and its price is generally determined by market supply and demand. Since PT does not include the yield portion, it is relatively cheaper to purchase the corresponding asset, i.e., at a discounted price. Therefore, it can only be equivalent to the original asset when the product reaches maturity.

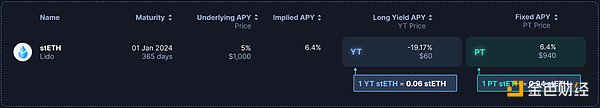

For example, suppose there is an stETH pool in Pendle with a maturity period of 1 year. In that case, PT stETH holders can redeem stETH at a 1:1 ratio after 1 year.

It is worth noting that although PT can only be redeemed for the underlying asset at maturity, users can also choose to sell it in advance based on their own circumstances and market conditions.

On the other hand, YT (Yield Tokens) can be traded on the Pendle AMM in the same pool as PT (Principal Tokens). As the yield portion of the collateralized principal, YT can be traded at any time.

If investors believe that the future average APY will be higher than the current implied market APY, they can choose to go long on the yield. The future average APY can be based on the current underlying APY, i.e., the APY generated in the underlying protocol. If all conditions remain exactly the same from now until maturity, the future APY should be the same as the underlying APY.

Specifically, when the implied yield is greater than the base APY, the long-term yield APY will be negative. This means that assuming the base APY remains unchanged, the cost of purchasing YT will be higher than the average future yield collected, so it is best to choose to sell YT.

However, even when the implied APY is less than the base APY, if the user purchases YT with a positive long-term yield APY, the average future APY may also be lower than the implied APY of the transaction, resulting in losses.

Therefore, the user’s long position profit depends on holding or increasing yield.

The trading foundation of PT and YT comes from Pendle’s unique AMM mechanism design, which belongs to a one-sided trading pool, where anyone can trade PT and YT on Pendle with any major asset through the built-in automatic routing.

The AMM curve will change to consider the yield generated over time, and the price range of PT will narrow as it approaches expiration. By concentrating liquidity into a narrow and meaningful range, the capital efficiency of trading yield will improve as PT approaches the expiration date.

In Pendle V2, the liquidity pool is set as PT/SY, for example PT-aUSDC/SY-aUSDC. Exchanging PT is a simple process of swapping between two assets in the pool, while exchanging YT is enabled through flash swaps in the same pool.

In addition, Pendle V2’s design also ensures that impermanent loss is negligible. Pendle’s AMM moves the AMM curve over time to push the PT price towards its intrinsic value, thereby mitigating time-related impermanent loss and naturally appreciating the price of PT.

III. Access to RWA: Open Source Efficiency

According to data from the Pendle official website, the TVL of the new RWA pool is growing rapidly. Within just one week of its launch, the TVL of the PT sDAI Pool is $13.7 million, and the TVL of the PT fUSDC Pool is $2.69 million.

Looking at the overall trend of Pendle’s TVL, it reached a peak of $155 million on July 20th and has since stabilized, even showing a downward trend. However, after the announcement of adding RWA products, it began to enter an upward range. It is worth noting that the cryptocurrency market was still in a sideways phase at this time.

Such significant liquidity growth is due to the high yield set by Pendle for the PT sDAI Pool. As can be seen from the graph, the fixed APY of the sDAI pool is 3.74%, and the long-term yield APY is 32.4%.

In addition, by providing liquidity to the sDAI pool, users can not only obtain a portion of the fixed income exposure but also simultaneously gain a blended yield of sDAI native yield, additional rewards, sDAI fixed income (from PT-sDAI), and Pendle incentives.

Previously, the DSR of the SLianGuairk Protocol was reduced from 8% to 5%, but this high interest rate is still subsidized by MakerDAO’s revenue. Moreover, as the actual EDSR mechanism, if USDT fluctuates strongly or MakerDAO’s revenue decreases, the actual returns for users may be lower than the yield provided by sDAI products in Pendle.

The new RWA pool has also attracted the participation of some whales. The wallet address 0xa8321f92e4589f7754831cac607180372197b7f6 has deposited $2 million in the sDAI pool on Pendle. Another wallet address, with a total value of $2.5 million, 0x18f7a7ad23163c5ea7d5c059c1a98c3ce57cb5c0, has deposited $1 million. In addition, there are also many other accounts with large deposits.

Conclusion

Liquidity shortage has become a challenge for all market participants in the bear market of cryptocurrency. Maximizing the use of funds and reducing risks are the current needs of most investors. After releasing the funds pledged by users, LSD needs to generate greater efficiency, and Pendle provides a new choice for this purpose.

The continuous expansion of the RWA track has also allowed institutions and investors to see a broader market. Tokenization of US bonds is just a pilot, and we believe that more real-world assets will become tokenized financial products in the future. Therefore, Pendle’s timely action has given it a ticket to occupy a larger market share in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Friend.Tech frenzy subsides daily trading volume drops by 90%, Base network returns to rationality

- Explaining Zeth, the Ethereum Block Validator The First Type 0 zkEVM

- No matter how much emphasis is placed on it (1) 10 steps to ensure the security of encrypted assets

- From now on, will OP and Base become ‘family’? Maybe not, discussing the variables and prospects of superchain cooperation.

- Binance Research In-depth Study of Decentralized Sorters

- Dida Chain The ‘AMM Moment’ of Full-chain Gaming

- Exploring THORChain’s lending module Revealing the hidden impact of Terra LUNA.