Overview of the current situation of cryptocurrencies in the Middle East and North Africa

Cryptocurrency situation in the Middle East and North AfricaAuthor: Chainalysis

Translation: Luffy, Foresight News

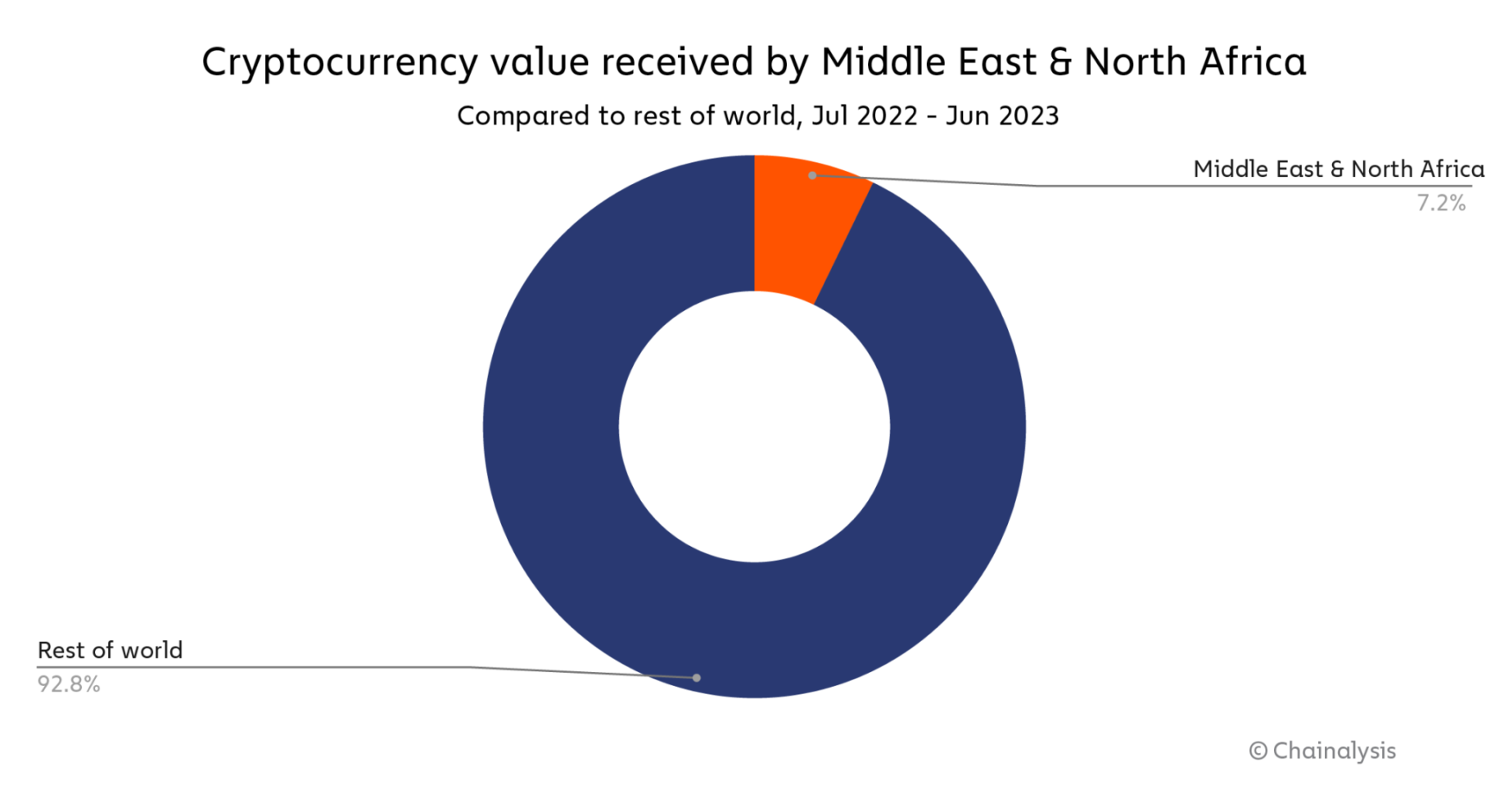

The Middle East and North Africa is the sixth largest cryptocurrency economy in our research (2023 Cryptocurrency Geography Report) this year. From July 2022 to June 2023, the total value of on-chain transactions in the region was approximately $389.8 billion, accounting for nearly 7.2% of global transaction volume.

- Multicoin leading investment, gathering of experts, what is the magic of the first fully homomorphic encrypted blockchain developed by Fhenix?

- Overview of Ethereum distribution with a total circulation of over 120 million.

- Celestia’s large-scale airdrop, Eclipse’s release of Layer2 new solution, what other latest developments are there in modular blockchain?

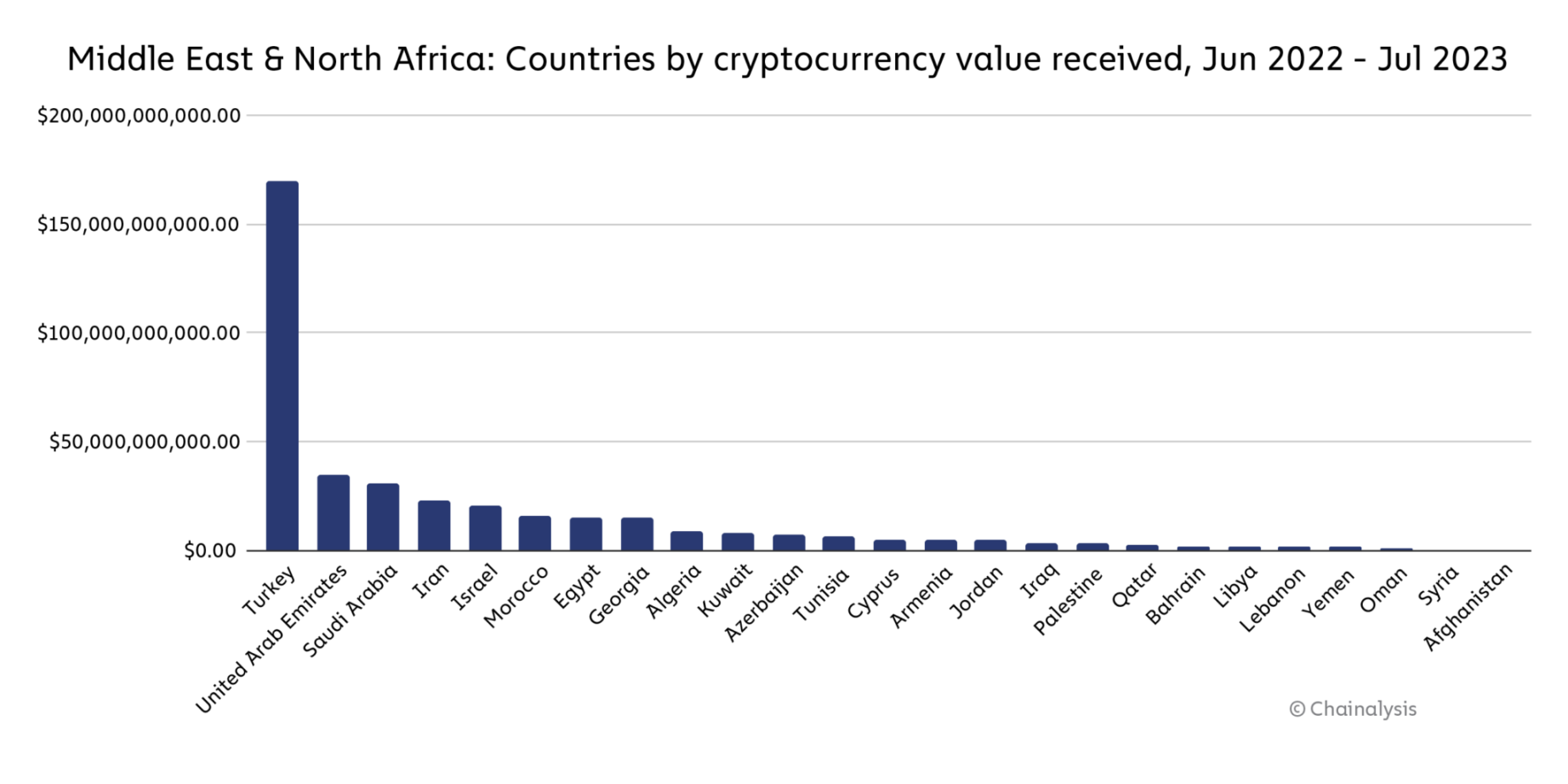

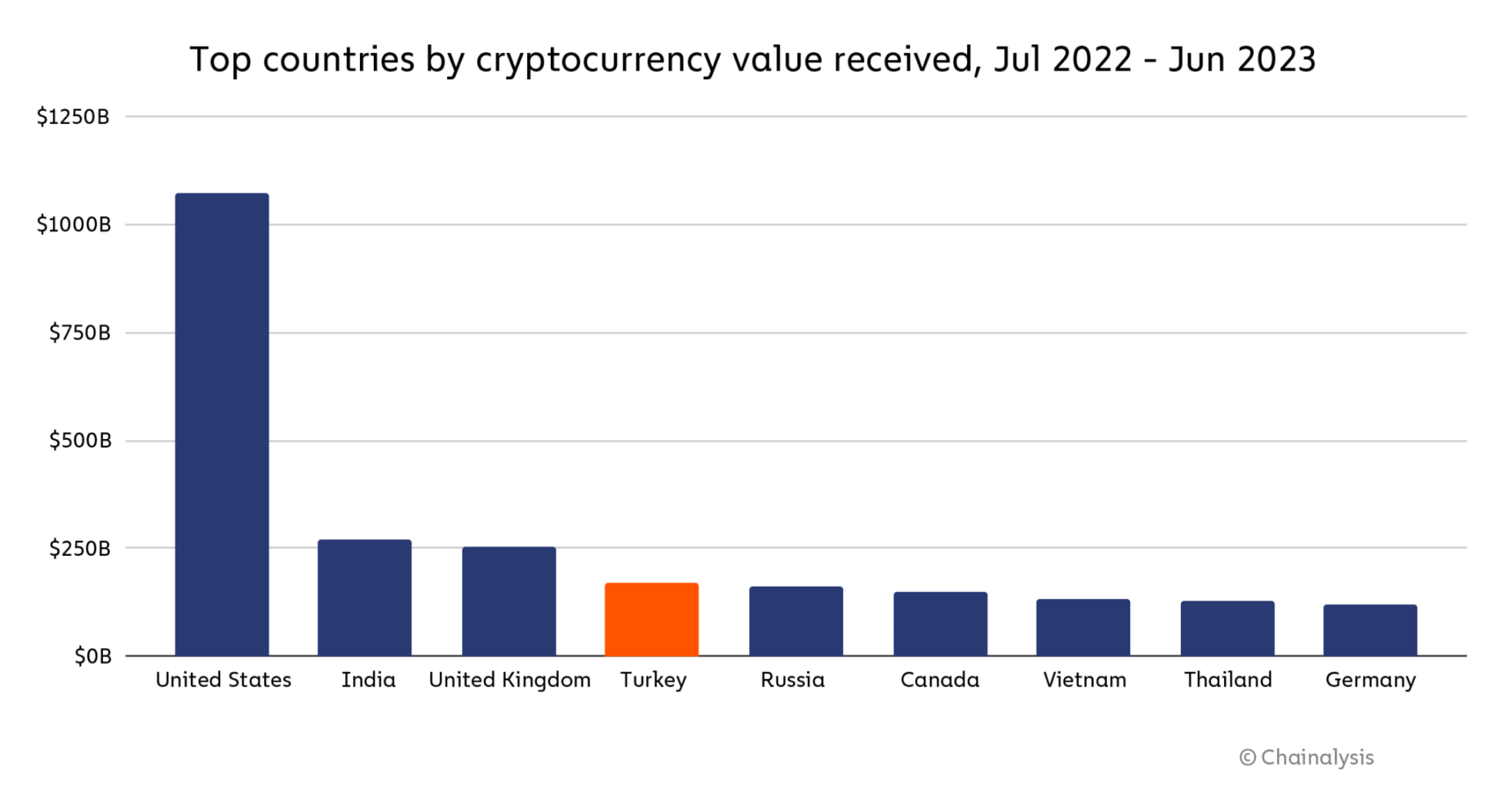

The Middle East and North Africa region occupies 3 seats among the top 30 countries in the index ranking this year: Turkey (12th), Morocco (20th), and Iran (28th). Among them, Turkey dominates in terms of transaction volume, as shown below.

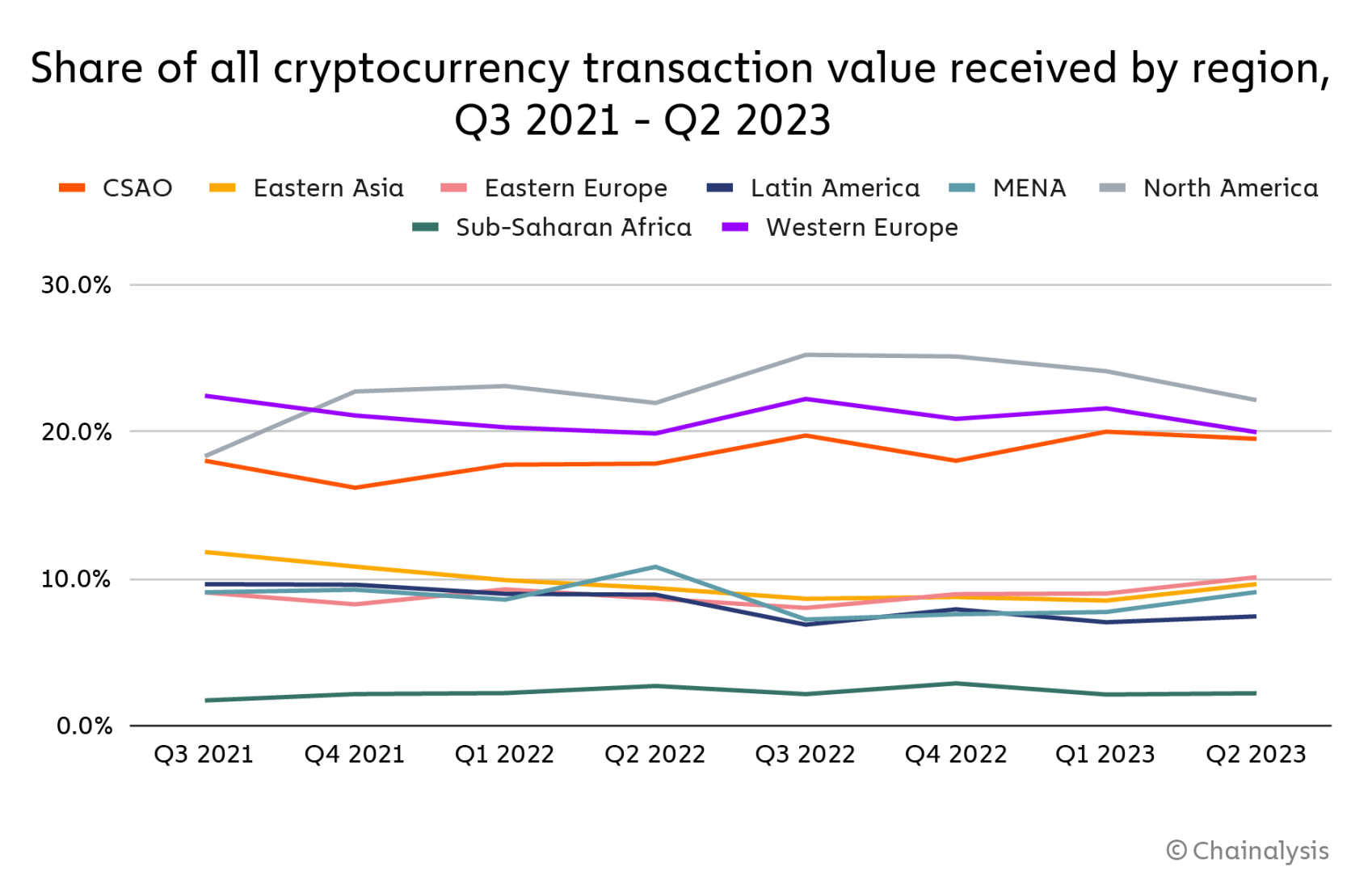

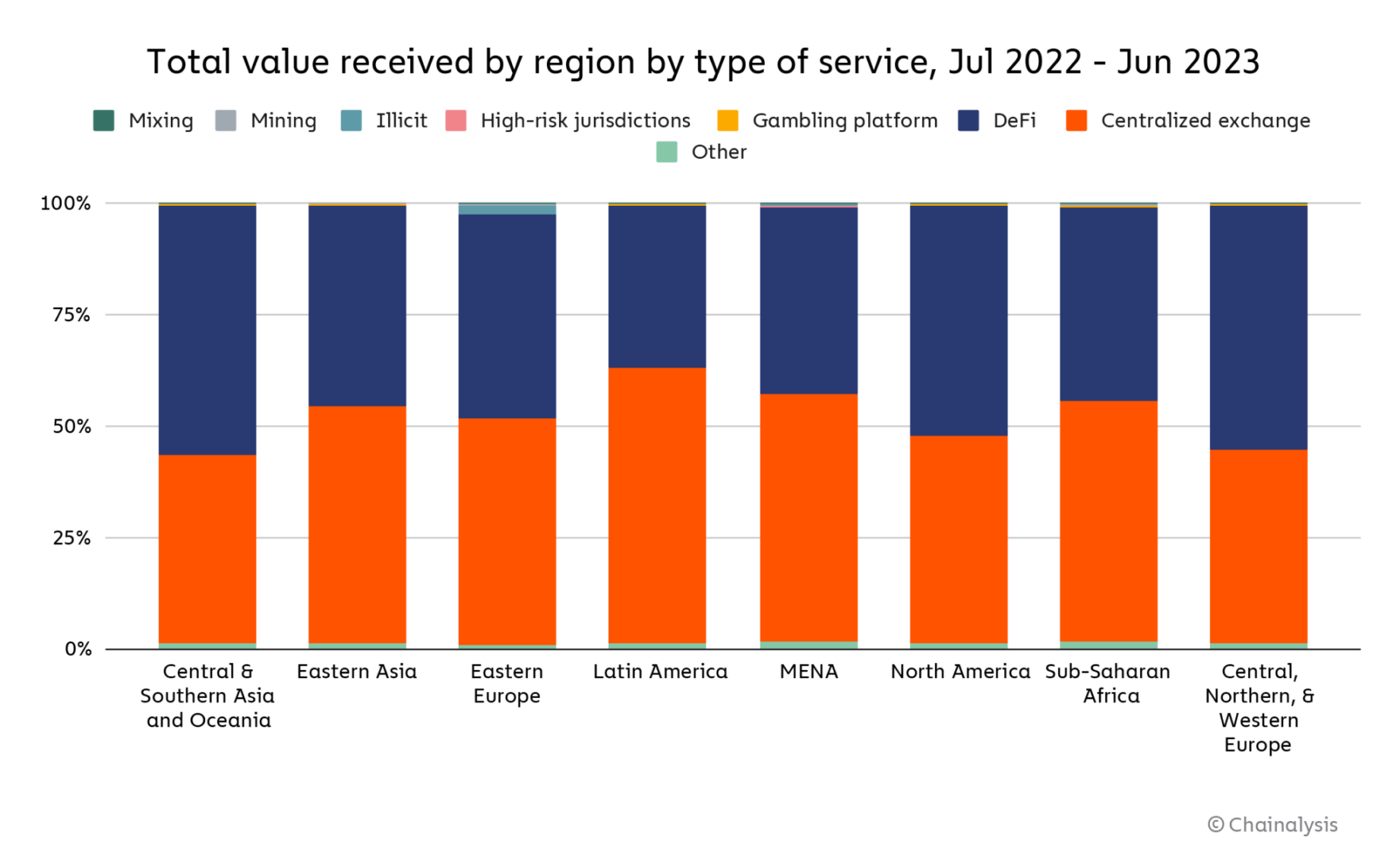

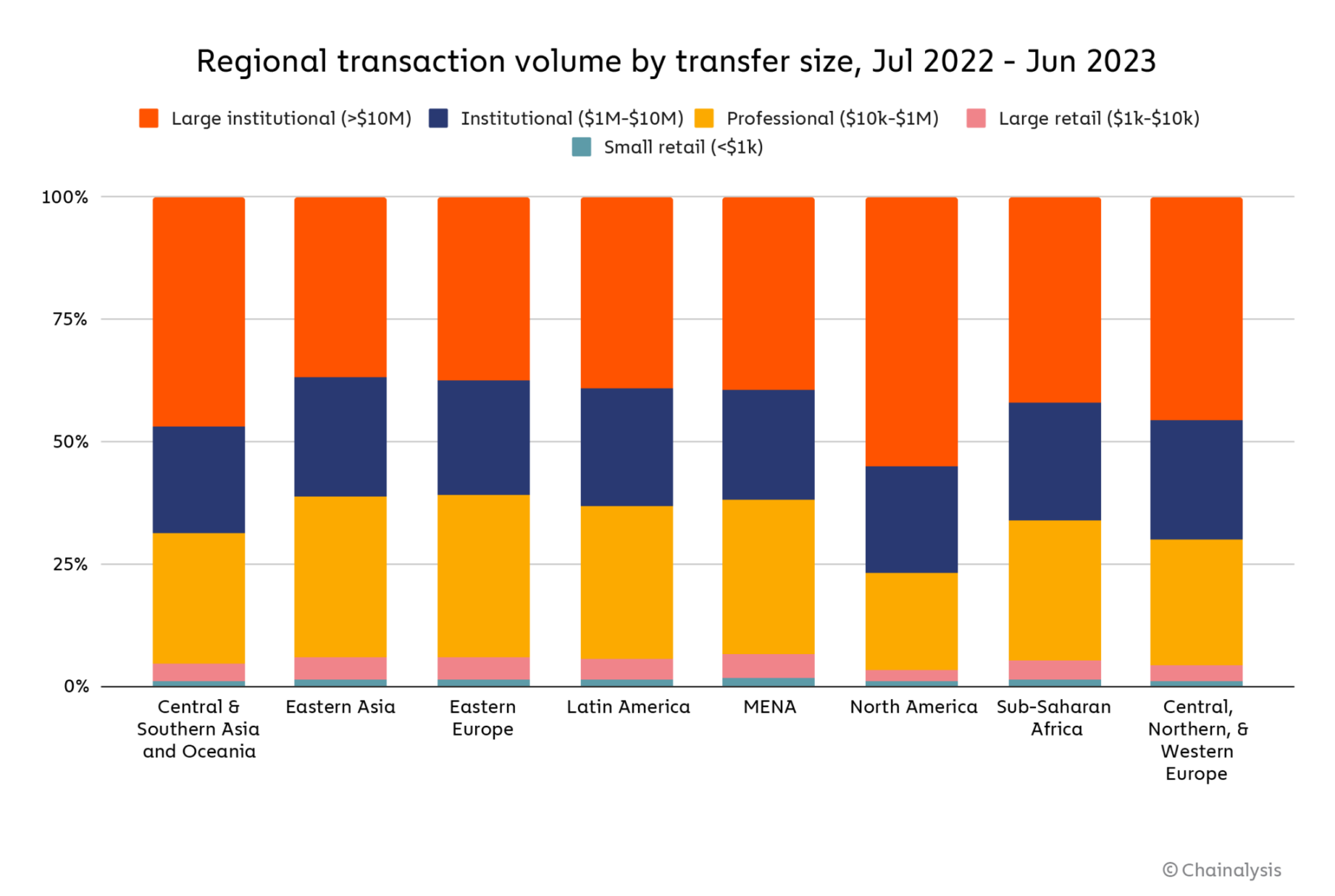

Overall, the transaction volume in the Middle East and North Africa region is similar to other regions when segmented by transaction size and platform type.

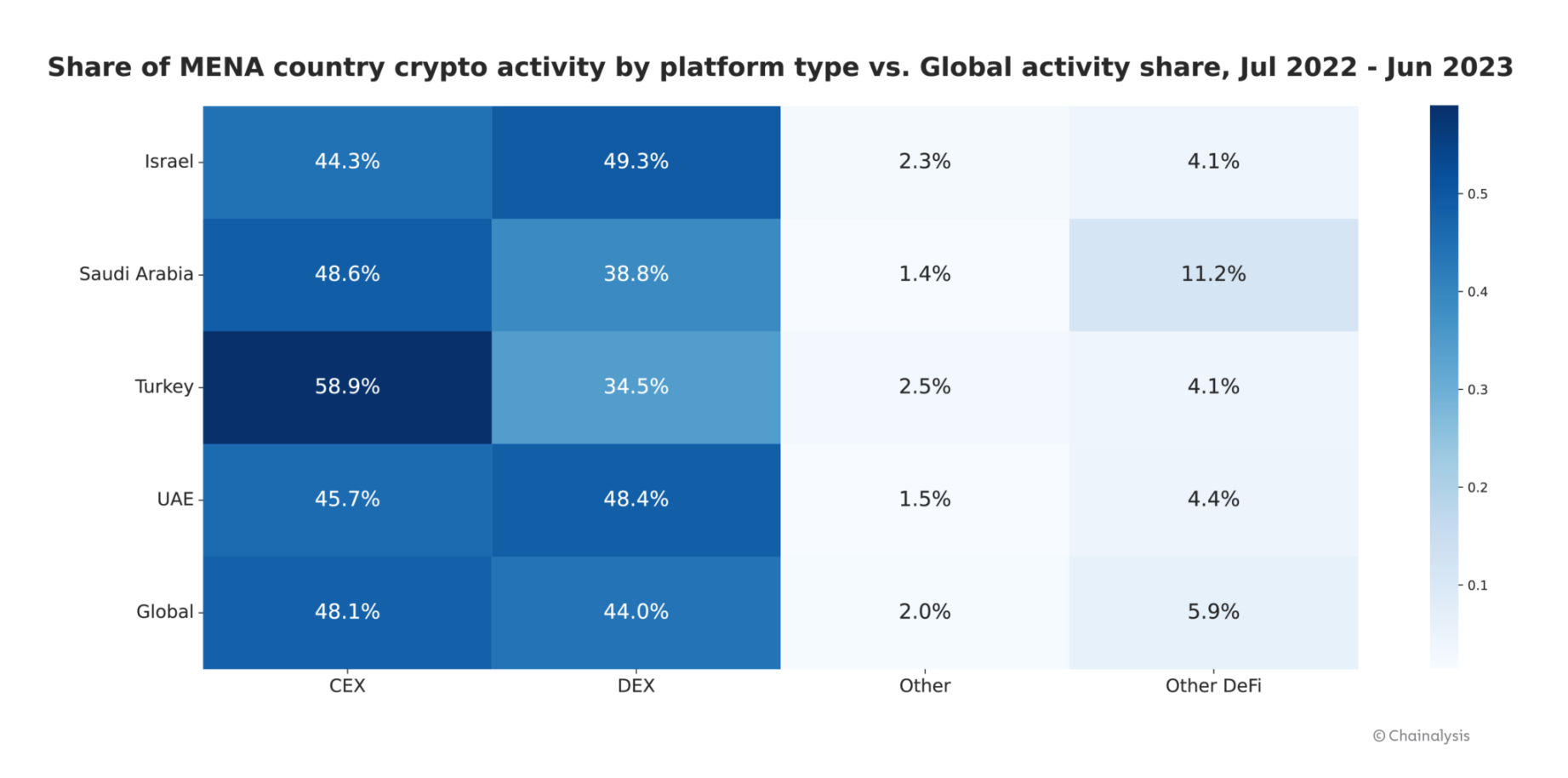

However, we see significant differences between different countries in the region. Refer to the heat map below, which compares the activities of some top cryptocurrency economies in the Middle East and North Africa region last year by platform type.

The most prominent is the United Arab Emirates. Compared to neighboring countries in the region except Israel, the proportion of cryptocurrency activity conducted by the United Arab Emirates in DeFi is much higher. One reason may be that the United Arab Emirates has adopted a regulatory framework favorable to innovation, enabling breakthrough cryptocurrency platforms to develop better and turn itself into a global cryptocurrency center. These regulatory frameworks have attracted many cryptocurrency entrepreneurs and enthusiasts to the region, which may be why DeFi is more widely adopted there.

On the other hand, cryptocurrency activity in Turkey is more concentrated on centralized exchanges, as its users seem to be more focused on acquiring cryptocurrencies to hedge against currency depreciation. We will explore these trends and more below.

United Arab Emirates (UAE): How Forward-Looking Regulatory Agencies Shape the Global Cryptocurrency Hub

Due to its unique innovation-friendly regulatory policies, the United Arab Emirates attracts top financiers, young tech entrepreneurs, and innovative companies from around the world. The UAE is also at the forefront of adopting advanced technologies to improve business efficiency and enhance the quality of citizen’s lives, and blockchain technology is no exception.

The regulatory authorities in the United Arab Emirates (UAE) have been paying close attention to cryptocurrencies for a long time. The city of Dubai, which has the largest population in the country, launched its blockchain strategy in 2016. Since then, the regulatory authorities in the UAE have been at the forefront of the industry. In 2018, Abu Dhabi established the world’s first cryptocurrency regulatory framework with the goal of establishing a forward-looking regulatory framework for cryptocurrencies, promoting innovation, protecting consumers, and ensuring that the UAE stays at the forefront of the cryptocurrency field. Dubai established its own Virtual Asset Regulatory Authority (VARA) in 2022, dedicated to achieving similar goals. Earlier this year, the UAE passed further cryptocurrency regulations at the federal government level, allowing VARA and other local regulatory authorities to flexibly regulate and maintain economic free zones to attract cryptocurrency innovation.

We interviewed Akos Erzse to learn more about how VARA and other regulatory authorities are creating a vibrant environment for cryptocurrency companies to operate in the UAE. Erzse is the Senior Manager of Public Policy at BitOasis, a cryptocurrency exchange platform headquartered in Dubai. He praised the comprehensive regulatory framework released by VARA in February 2023, stating that “VARA has brought new impetus to forward-looking regulatory clarity in the region, attracting a large number of cryptocurrency players to the UAE.” He mentioned that the difference between the VARA framework and frameworks in other parts of the world lies in its handling of the specificity of different types of virtual asset services and activities. “There are different rules for staking, brokers, advisory services, and custodians, which makes it easier for companies to understand the specific regulatory requirements for providing certain services.” VARA is committed to ensuring that the rules meet industry needs, and Erzse cited a recent amendment made by VARA as an example, which now allows custodians to stake custodial assets. “This responsiveness allows us and companies like us to innovate quickly.”

Erzse emphasized the importance of the unique and dynamic regulatory framework in the UAE, particularly as regulatory momentum increases in other parts of the world. “There is ongoing regulatory competition between markets that are seeking to establish themselves as centers for cryptocurrencies, and smaller markets are also rapidly developing.” The UAE’s regulatory approach enables it to attract global enterprises, cryptocurrency entrepreneurs, and high-net-worth individuals who wish to invest in cryptocurrencies through regulated platforms.

When asked about the future of cryptocurrencies in the UAE, Erzse expressed excitement about innovative business models such as asset tokenization. TOKO, a platform focused on tokenization, recently obtained a license from VARA to provide such services in the UAE.

He also pointed out that remittances are an important use case for cryptocurrencies in the UAE and the wider region. “We are a hub for remittances, and people are certainly already using cryptocurrencies to send money back home, but it will be exciting to see specialized products emerge within the existing regulatory framework.” In fact, India, the Philippines, and Pakistan are all in the top ten of our adoption index, which is also a good sign for the UAE. These countries account for a significant portion of the UAE’s expatriate population, and the increasing popularity of cryptocurrencies in these countries may be related to the increasing adoption of cryptocurrencies in the UAE.

Rising Inflation in Turkey Drives Adoption of Cryptocurrencies

In addition to ranking 12th in our Global Cryptocurrency Adoption Index, Turkey also ranks fourth in the world in terms of cryptocurrency trading volume (having received around $170 billion in transfers last year), only behind the United States, India, and the United Kingdom.

Yasin Oral, CEO and founder of the Turkish cryptocurrency exchange LianGuairibu, pointed out that Turkey’s relatively high cryptocurrency adoption rate is not surprising, and there are several reasons for this, such as the country’s recent macroeconomic environment and the interest of young people in innovation and technology. He explained, “Influenced by tight monetary policies, the world has had a difficult year, and Turkey has also been affected. In this situation, individuals tend to seek alternatives like cryptocurrencies to store value and achieve portfolio diversification. Associated with this behavior is the attraction of new investors and adopters with each market cycle, as more individuals and entities understand the benefits of blockchain, ultimately leading to an increase in cryptocurrency adoption.”

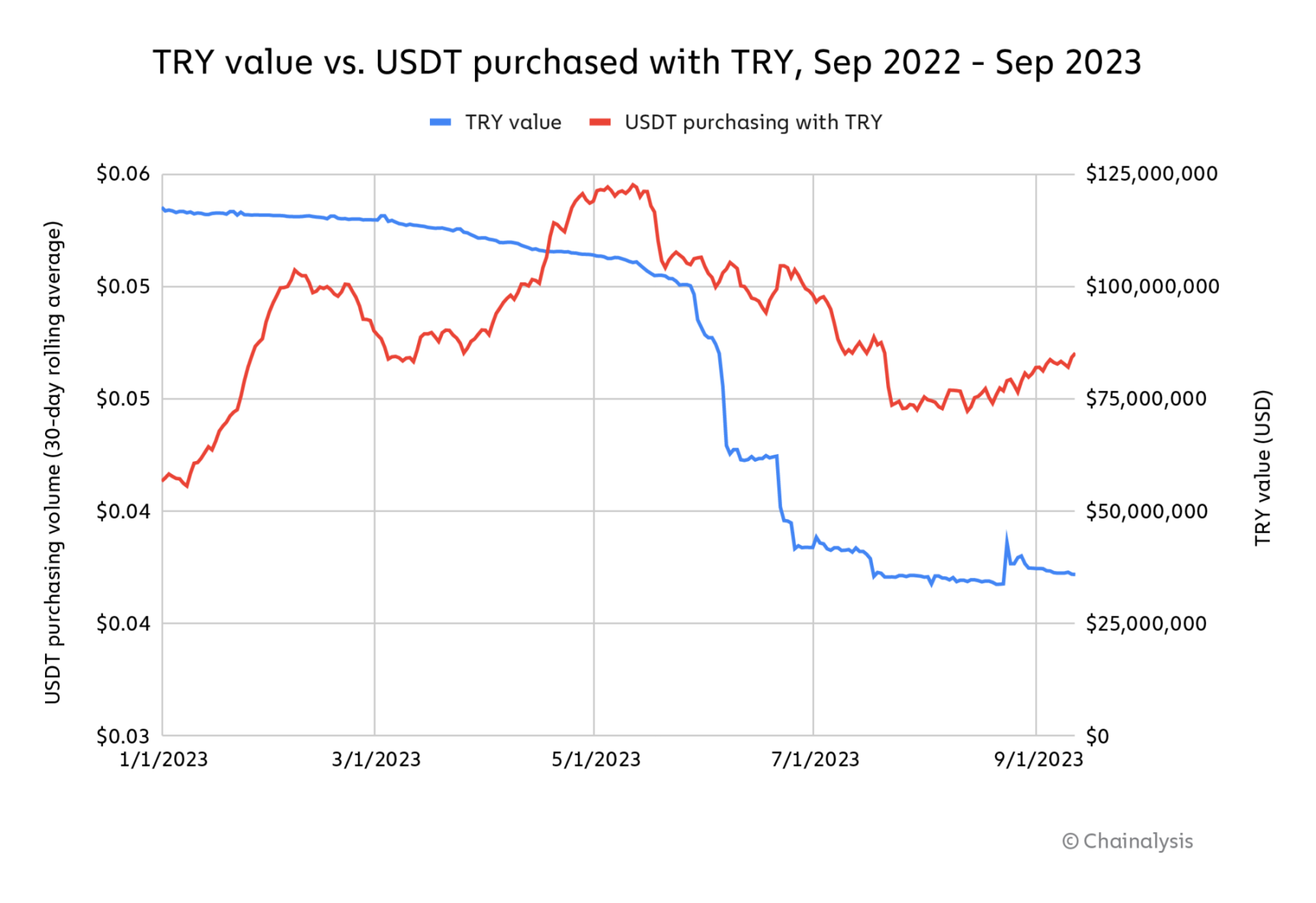

In fact, Turkey has been facing the issue of rising inflation, with an inflation rate close to 60% in August 2023. Furthermore, after the Central Bank of Turkey cut interest rates by 100 basis points, the Turkish lira plummeted in 2021. Since then, the lira has not recovered – in fact, it reached a historic low in the mid-2023. We can see evidence of the interest in cryptocurrencies driven by the devaluation of the Turkish currency in the following chart. There was a significant peak in purchases starting from around March 30. Analysts say that regardless of who wins the May election in the country, the value of the lira will plummet significantly, as the lira is already weak. After a continued decline, the lira reached a new low of $0.04, and shortly after the announcement of the central bank’s interest rate, the USDT purchase volume rose again in late July. It is important to note that we use the 30-day average of lira purchases of USDT data as the displayed data, which may slightly lag behind the trend.

Source: CryptoComLianGuaire and ExchangeRate-API

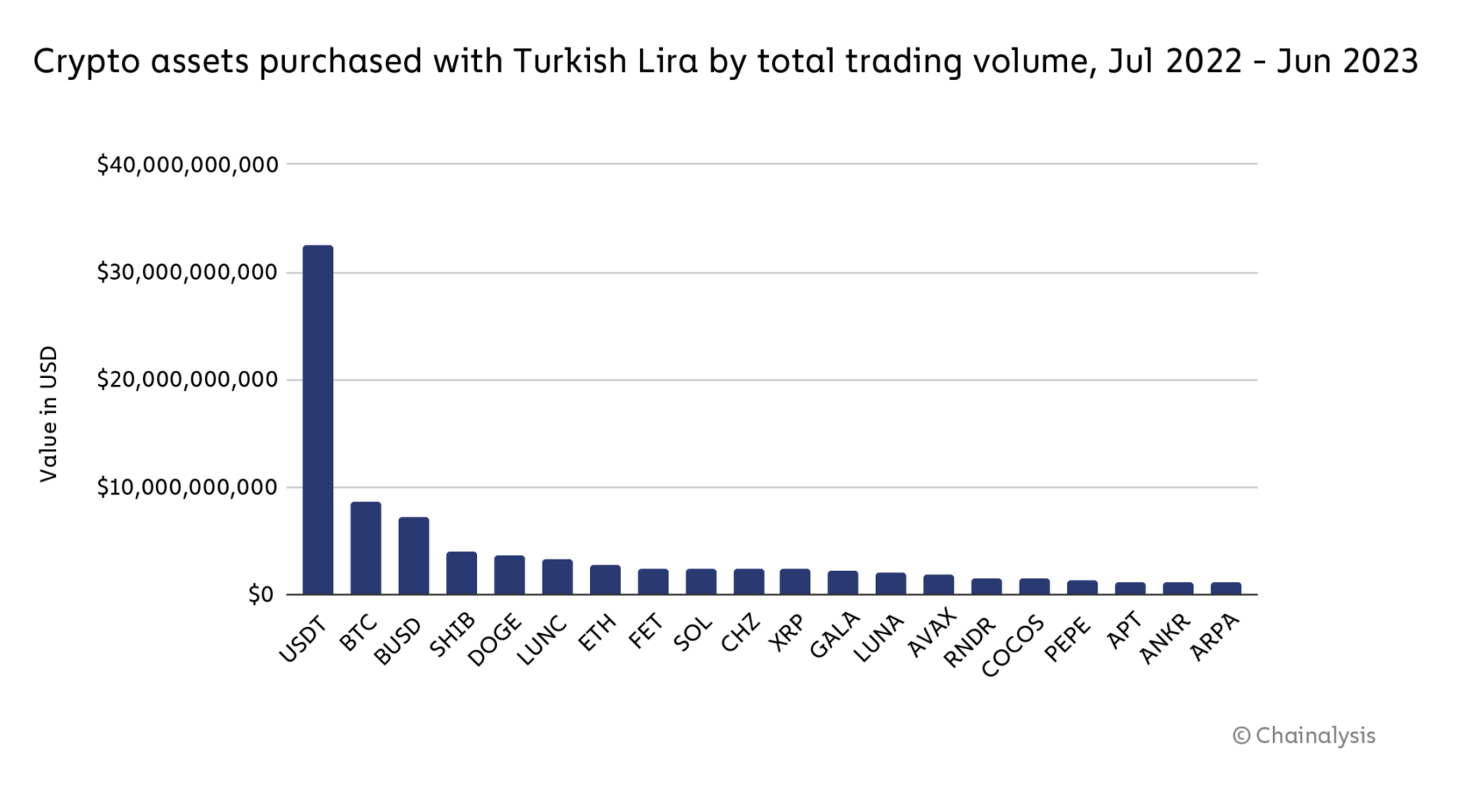

Overall, we also found that USDT is the most purchased cryptocurrency asset with lira among global exchanges.

Source: CryptoComLianGuaire

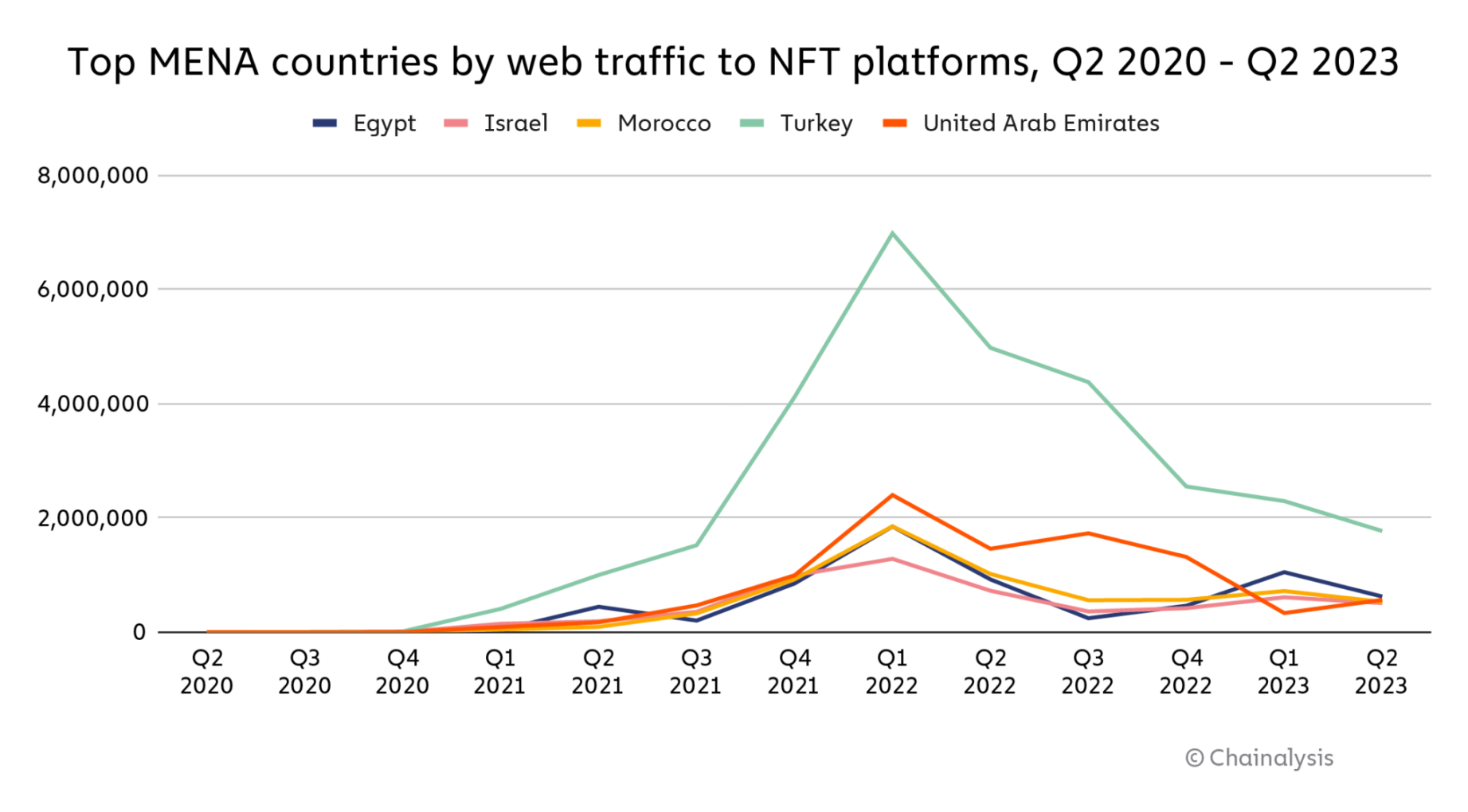

However, cryptocurrency activity in Turkey is not solely focused on stablecoins. A broader analysis shows that although NFT activity has declined overall since mid-2022, Turkey is the country with the highest network traffic on NFT platforms in the Middle East and North Africa region.

Refik Anadol, a Turkish-American entrepreneur, is one of the earliest artists to use artificial intelligence to create immersive artworks, and he helped pioneer the Turkish NFT craze. During this time, local crypto platforms such as LianGuairibu attracted and supported NFT activities. The recent market turmoil may lead to a decline in the popularity of NFTs, but Oral believes that NFTs will play an important role in the future. “We believe that NFTs and utility tokens are crucial for innovative solutions in many industries, including retail, entertainment, and art. Turkey will indeed become an important center for the next wave of blockchain solutions, and NFT technology will be a key component.”

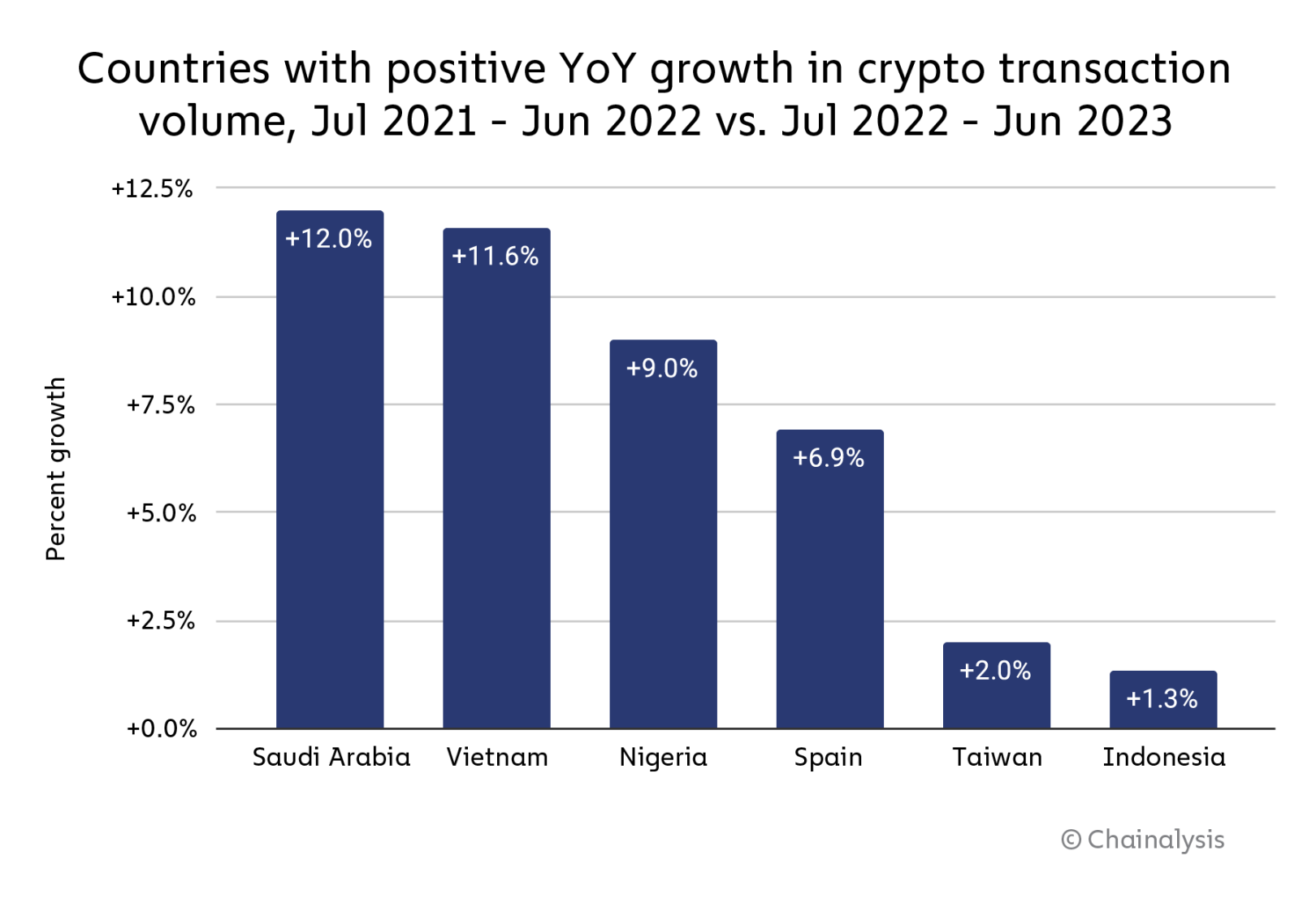

Saudi Arabia leads the world in year-on-year growth in cryptocurrency trading

Last year, no country saw greater growth in its crypto economy than Saudi Arabia, with its trading volume increasing by 12.0% year-on-year. In fact, Saudi Arabia was one of only six countries we studied that experienced year-on-year growth in trading volume.

Abdulmajed Alhamzah, General Manager of Rain, a cryptocurrency exchange in Saudi Arabia, described why cryptocurrencies are attractive to Saudi users. “Retail investors are often the largest group turning to cryptocurrencies to seek portfolio diversification. Many have invested in real estate, stocks, and other assets, and they are eager to invest in cryptocurrencies. They remember the transformative impact of the internet and are eager to get involved in cryptocurrencies early on, expecting significant growth in the coming years.” He also pointed out that cryptocurrency adoption and institutional interest in the region have increased, which constitutes a significant portion of Rain’s institutional clients in the region. “Many of the businesses we work with see the long-term value of cryptocurrencies. Cryptocurrencies are seen as an asset class in customers’ diversified portfolios.”

These positive use cases and the overall growth of the cryptocurrency market may prompt the Saudi Arabian government’s interest in cryptocurrencies. In 2018, the Saudi government stated that the use of Bitcoin is illegal and warned of the potential risks of other cryptocurrency transactions. However, the country’s crypto market continues to grow, and in September 2022, the Saudi Central Bank hired tech entrepreneur Mohsen Al Zahrani as the so-called “Crypto Sheikh” to lead the digital transformation of the central banking system. In addition, Saudi Arabia has expressed interest in diversifying its economy through nurturing Web3 and blockchain gaming projects. One of the projects is a collaboration with The Sandbox to explore the metaverse. Abdulmajed is optimistic about the prospects, saying, “Regulatory authorities in the region are working to provide a robust regulatory framework to drive innovation in this field and, more importantly, to protect user funds and shield users from potential fraud.”

The Future Growth Potential of the Middle East and North Africa Region

Overall, our data and interviews with cryptocurrency companies in the Middle East and North Africa indicate that the region is embracing cryptocurrencies for various reasons. In countries with unstable currency inflation, cryptocurrencies help protect wealth, while users in economically more stable countries like the United Arab Emirates may be more inclined to explore investment-focused use cases. The UAE also provides a valuable example of how innovative regulations and rules enable countries to build cryptocurrency hubs, thereby boosting the local economy.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Chainalysis Research Mass Adoption of Cryptocurrencies in India, the Philippines, and Pakistan

- What makes Fhenix’s first fully homomorphic encrypted blockchain so magical, with Multicoin leading the investment and a gathering of experts?

- Protecting the Future of the Banking Industry Exploring the Synergy between Blockchain and Network Security

- Overview of TON Blockchain Ecological Applications, 551 DApps Covering 16 Tracks

- What are the legal risks of blockchain games in the new trend of NFT digital collections?

- Is NASA interested in crypto too? Their own researchers are testing blockchain storage on the moon base.

- Celestia, a modular blockchain, launches its own cryptocurrency. Take a quick look at the airdrop details and token economy.