Why is Binance in a hurry to sell its Russian business to a newly launched exchange?

Why is Binance rushing to sell its Russian business to a new exchange?Author: Nianqing, ChainCatcher

On September 27th, Binance officially announced that it has sold all of its business in Russia to the cryptocurrency exchange CommEX. To ensure a smooth exit for existing Russian users, the withdrawal process will last for one year. A portion of new Russian users registered for KYC will be transferred to CommEX immediately and gradually expanded over time. In the following months, Binance will cease all exchange services and business lines in Russia. Binance will not receive any ongoing revenue sharing from this sale, nor will it retain any options to repurchase business shares.

According to the official statement, the sale of all business in Russia was made because “conducting business in Russia does not comply with Binance’s compliance strategy,” but the specific compliance strategy explanation was not provided.

What’s even more curious is that CommEX, the buyer of Binance’s Russian business, is a cryptocurrency exchange that officially launched on September 26th. Its social platform X account and Telegram community were registered around September 25th. According to the official website of CommEX, it is a centralized cryptocurrency exchange supported by “top-level crypto VC” and the team is committed to providing convenient, secure, and innovative services to “global users.” In addition to spot trading, CommEX also offers futures and P2P services. Its futures market provides up to 200x leverage perpetual contracts and up to 500x leverage simple futures trading. Currently, its spot trading market only offers USDT trading pairs for more than 20 cryptocurrencies, and P2P fiat trading only supports the Russian ruble (RUB). According to a response from the official staff of the CommEX Russian channel community, the team is gradually improving support for more cryptocurrencies, and other fiat currency businesses are not yet online.

- Variant Partner What are the benefits of bringing RWA onto the chain?

- SEC has been repeatedly ‘losing face’ in cryptocurrency cases. Is it because the US Department of Justice is intentionally balancing its power?

- What new opportunities has AI brought to the gaming industry in 2023?

Binance’s decision to sell its business in Russia to what appears to be a newly established exchange has raised doubts among the public, especially Binance users in Russia. Can a new exchange guarantee asset security? Can its trading depth accommodate Binance’s Russian users? However, more voices point to “CommEX being a front for Binance’s Russian business.”

Why is Binance eager to exit the Russian market?

Russia was once one of Binance’s largest trading markets, and its fiat business was also one of its important businesses. However, after the Russia-Ukraine war, Binance’s business in Russia became awkward.

Due to extensive US sanctions on the Russian financial industry, many Russians were unable to wire rubles to foreign bank accounts or convert money into other currencies. Cryptocurrency became one of the ways for Russians to escape these restrictions. In April of last year, Binance began limiting the cryptocurrency wallet balances of Russian users to no more than 10,000 euros, and blocked several accounts related to relatives of senior Kremlin officials due to international sanctions against Russia.

In March of this year, Binance closed the channel for Russian users to buy and sell USD and EUR through its P2P service. In addition, it also banned EU citizens from buying and selling rubles through P2P.

However, in April of this year, media reports revealed that Binance lifted the 10,000 euro deposit limit for Russian users. Binance responded by stating that all restrictions related to sanctioning Russian citizens still apply to the platform and its legal entities in the European Union.

In May, the US Department of Justice began investigating whether Binance was being illegally used to help Russia evade US sanctions and transfer funds.

In August, The Wall Street Journal reported that Binance was still processing a large number of ruble transactions, and Russian users could still transfer funds from sanctioned Russian banks to their Binance accounts through intermediaries. Binance also supported P2P trading of rubles for digital tokens, which often involved banks blacklisted by the West. A recent review of Binance’s peer-to-peer service website revealed that Binance recently offered at least five sanctioned Russian banks (including Rosselbank and Tinkoff Bank) as options for processing payments for Russian customers. Meanwhile, insiders revealed that the US Department of Justice is still investigating whether Binance may have violated US sanctions against Russia. However, shortly after this report, Binance immediately removed these five Russian lending institutions from its website. A Binance spokesperson stated that the system would be regularly updated to ensure compliance with local and global regulatory standards.

On August 28th, Binance announced through the media that due to disputes in the Russian market, it may “completely” withdraw from the Russian market. At the same time, Binance’s Russian Telegram channel was also updated, announcing several new rules for P2P exchange users: Russian users can only trade in rubles (RUB) on the P2P platform, and this option is only available to Russian residents who have passed KYC verification.

Earlier this month, Binance’s Eastern Europe and Russia Business Manager Gleb Kostarev and Binance’s Russia and CIS Regional Manager Vladimir Smerkis both announced their resignation on Facebook.

Therefore, Binance’s decision to withdraw from the Russian market is mainly due to the ongoing investigation by the US Department of Justice. In addition to this investigation, Binance has become a key focus of US regulatory agencies this year. In March, it was sued by the US Commodity Futures Trading Commission (CFTC), which accused its founder, Changpeng Zhao, and three Binance entities of repeatedly violating the Commodity Exchange Act (CEA) and CFTC regulations.

Subsequently, Binance Holdings Limited and its founder Changpeng Zhao were charged with multiple securities law violations by the US Securities and Exchange Commission (SEC) in June. This includes allegations that the overseas company operated an illegal trading platform in the United States and misused customer funds.

Therefore, in order to operate in compliance, Binance has to take corresponding measures.

In-depth analysis of CommEX: Its ambition may not be limited to Binance’s business in Russia

Currently, CommEX’s Telegram community has channels in Russian, English, and Korean. According to the response from the administrator in the Russian channel, CommEX is registered in Seychelles, not Russia. It is a global platform that focuses on multiple markets, including the Commonwealth of Independent States (CIS) countries. In addition, it will also focus on business in Asian countries, which is why a Korean community was established early on.

Although the official statement claims that this is an exchange supported by numerous “top VCs,” no relevant information has been disclosed. Users entering the community repeatedly ask questions such as “Where can I find information about the exchange?” and “Who are the founders and CEOs?” These questions are ignored by the administrators, who only respond with “The team will hold an AMA to address questions collectively.”

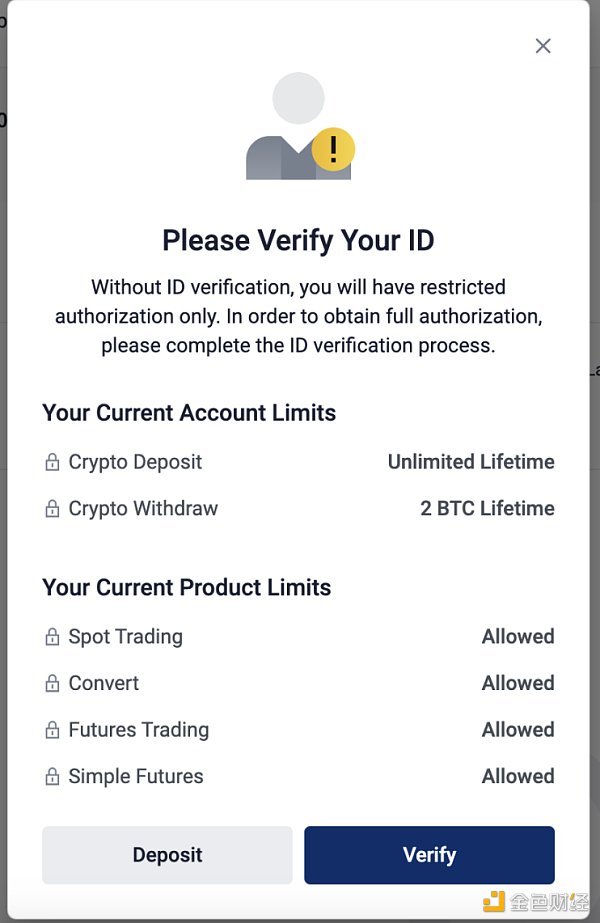

CommEX’s official website shows that it currently supports four languages: Russian, English, Japanese, and Simplified Chinese. Initially registered users can choose to register using their existing Binance accounts. The rights of newly registered users include currency exchange, spot trading, contract trading, and simple futures trading. Without KYC, there is a withdrawal limit of 2 BTC. In addition, ChainCatcher reporters discovered that the KYC of this exchange is targeting multiple regions and countries, including China. A reporter successfully passed the verification using a Chinese ID card within 12 hours.

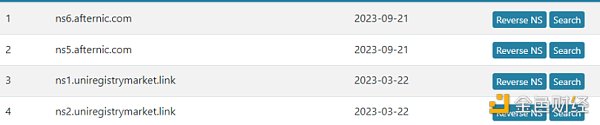

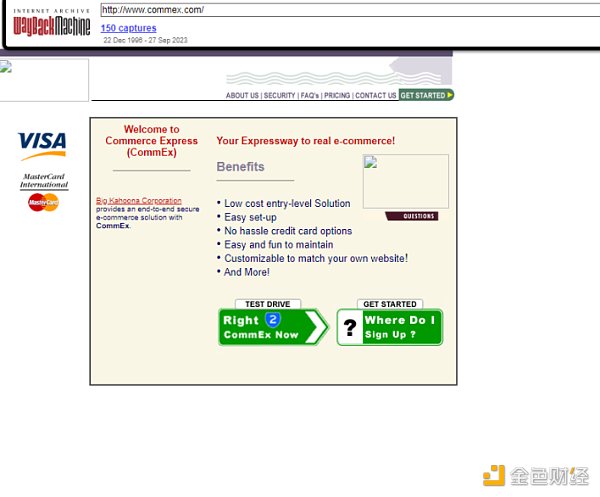

In addition, many users question the connection between CommEX and Binance. According to the disclosure by crypto KOL @Adam Cochran, based on the historical records of the name servers on the domain, https://www.commex.com/ was initially used for a commercial credit card company, and its servers were only updated on the 21st of this month.

CommEX can use Binance login to indicate that it operates on Binance Cloud. However, Binance Cloud, along with the Connect product, was shut down in 2022. Therefore, general partners do not have permission to operate on Binance Cloud, and even Binance’s partner WazirX has lost the privilege of “using Binance login.” Exchanges operating on Binance Cloud can share liquidity with Binance, which is why the BTC/UST trading volume on this newly launched website reached 1 million USD on the first day, and there is a good bid-ask spread in the market…

In my opinion, the above evidence is not very sufficient in proving that “CommEX is an empty shell company of Binance.” However, it is indeed suspicious that Binance sold Russia to such a newly launched exchange without disclosing relevant information. We will continue to follow up on more developments of CommEX in the future, so please stay tuned.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Co-founder of Three Arrows Capital, Su Zhu, has been arrested and may face 4 months of imprisonment, while co-founder Kyle Davies is still missing.

- LianGuai Morning News | Hong Kong Securities and Futures Commission Releases Multiple Lists of Virtual Asset Trading Platforms

- LianGuaintera Cryptocurrency Compensation Report 88% of practitioners work remotely, with executive salaries exceeding $5 million.

- Where is the total circulation of over 120 million Ethereum?

- GPT-4 is too costly, Microsoft can’t sustain it anymore, and it is reported to have quietly initiated Plan B.

- Cooperating with TON, Tencent wants to help Telegram create an ‘international WeChat’?

- Uniswap Foundation plans to raise 60 million to develop its ecosystem. What are the plans of the DEX Planner?