Cycle observation | market, economy and cycle (below)

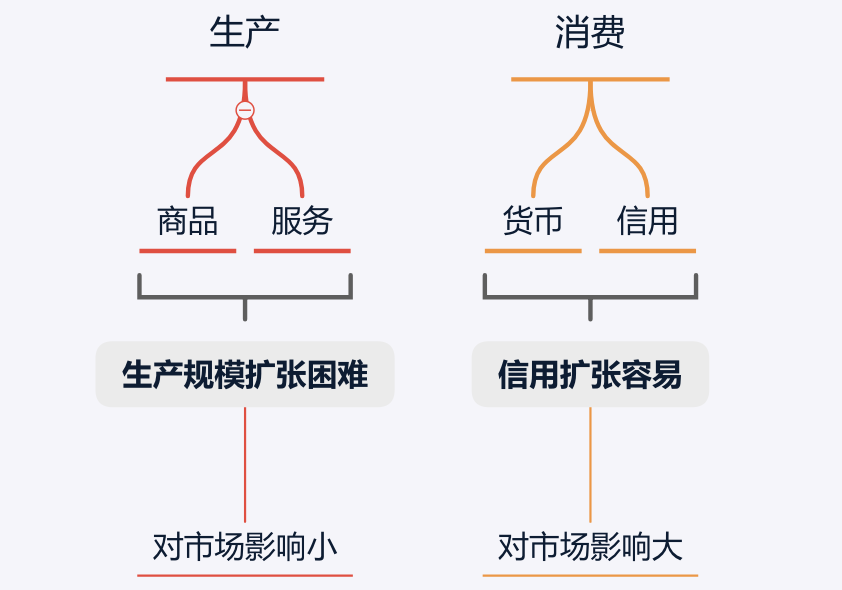

Ray Dalio's analysis of the economic system

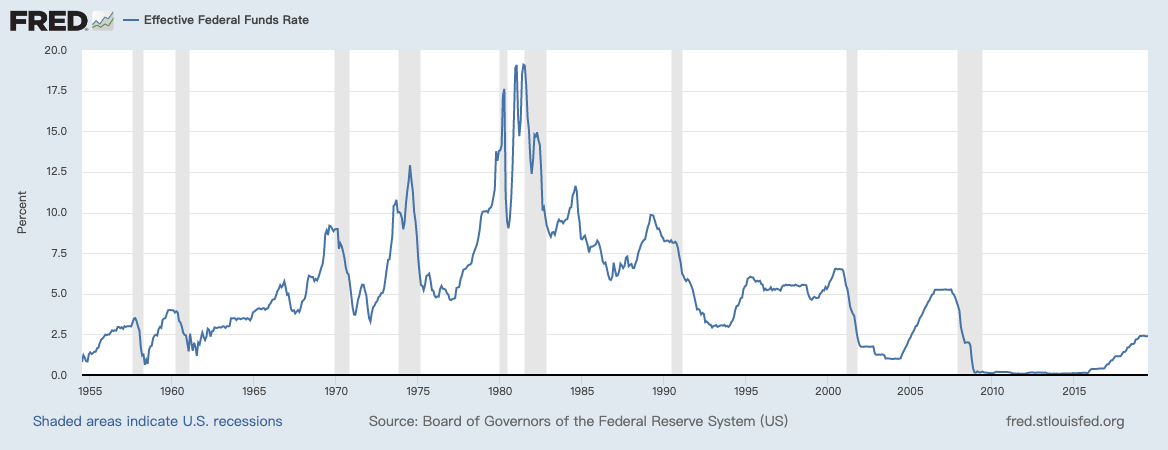

His analysis is actually an observation of the national conditions of the United States—that is, the Fed essentially regulates the liquidity of the entire economy by raising interest rates and cutting interest rates.

Ray Dalio's analysis of the economic system

- To save $1.7 billion, Telegram will release the TON blockchain code on September 1.

- Is the development of Ethereum opening a new direction? Hyperledger announces the acceptance of the first public Ethereum blockchain project Pantheon

- Recommend a "back door" wallet software, stealing nearly 200 bitcoin, he was sentenced to 5 years

Because people can make consumption exceed output through lending, but they have to make consumption lower than output when they repay. By accumulating each person's transactions and debts, the cycle of the entire economy can be derived.

The state can alleviate this problem by increasing the money supply (printing money), because the money in the economy is relatively depreciated. In order to reduce the asset write-down caused by depreciation, people tend to spend money to buy things. The consumption of the whole society has increased, and the economic crisis in the short term has been alleviated, but this is only to push the crisis back.

01 Cairns Economic Cycle

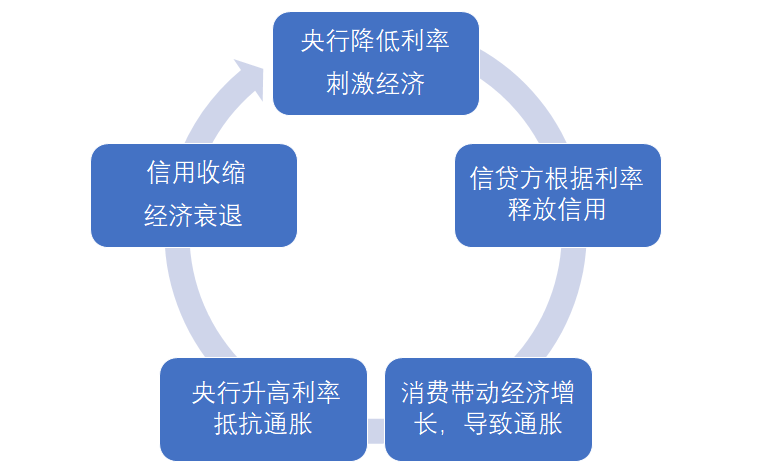

Banks lower interest rates on borrowing based on interest rates and stimulate people's credit. In this way, more people will borrow money to start a factory and start a company to start operations, thus driving economic growth.

The economic money supply exceeds social productivity and inflation occurs.

If inflation occurs during the course of economic growth, the central bank will raise interest rates and resist inflation.

Tight monetary policy (high interest rates) will cause the money in the market to return to the bank. At this point, the credit contracted and the economy entered a period of recession.

A complete Cairns economic cycle

This is actually the economic cycle of Keynesian economics.

In the same situation, Japan and Europe, in order to stimulate economic growth, they have implemented a negative interest rate monetary policy. But this did not make these countries' economic recovery, but instead fell into a stagflation.

02 How to spend the depression period?

A large number of unemployed people appeared during the Great Depression

03 Why does Ray Dalio look at US stocks?

Because of this incentive mechanism, the company's decision-making level will also be more inclined to carry out stock repurchase to raise the stock price, rather than really optimize the efficiency of the enterprise.

Macroeconomic policy and bitcoin

01. Bitcoin characteristics

We believe that it is actually a prologue that opens up the national VC, with these characteristics:

2. Network effect: The number of Bitcoin holders in the world is estimated to be tens of millions. The survival of Bitcoin is guaranteed.

3. Low barriers to entry: Traditional financial markets invest in high-tech companies with many restrictions, such as the amount of money and relationships. The bitcoin market is completely open.

02. Reasons for the skyrocketing of digital currency in 2016-2017

Studying the source of hot money is the key to our study of bitcoin skyrocketing.

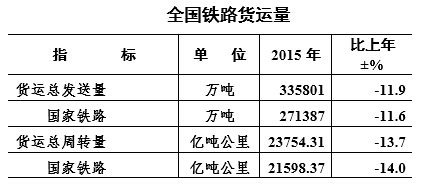

Source: Railway Statistics Bulletin 2015

Capital is unprofitable in the physical market and can only be turned into a highly speculative lending market.

This is also an opportunity for the rise of China's online lending industry. Industry data of the online loan home shows that by 2019, online loan companies have accumulated more than 6,000 in the country.

During this period, a large amount of speculative funds also turned their attention to Bitcoin. As a result, the price of Bitcoin has soared with the help of domestic hot money. This further stimulated the entry of funds from Japan and South Korea.

This time, the final admission is the funds of Europe and the United States.

Although the bitcoin market continued to rise to the end of the year, the foreshadowing of the crash has already been buried in mid-2017.

03. Our judgment on Bitcoin

Safe-haven assets are always a relative concept. Who is more stable and who is a safe-haven asset.

Bitcoin is the most stable in digital currencies, so it is a safe haven. For the real economy, further market feedback is needed to determine.

The coinage right is one of the most important powers of the state power, and no government will hand it over.

The social development of mankind has always been centralized, not decentralized. Even in the so-called democratic model of the United States, scholars lament that the current federal government is much more powerful than the federal government 100 years ago.

In fact, the recent round of Chinese government's crackdown on digital currency trading has begun. A large number of Alipay WeChat accounts, which are frequently involved in offline digital currency transactions, have been closed, and the capital's entry has been gradually closed.

Value is outside the law.

It is a website that uses Tor (onion router) to ensure anonymity and uses Bitcoin to trade. The main products are drugs, guns, ammunition, counterfeit banknotes, etc. Others include Netflix and Amazon Trojans, pirated content and False driver's license, passport, social security card, utility bill, credit card bill, car insurance record and other forms of identity documents.

In the less than two years of the Silk Road life cycle, its transaction volume reached 1.2 billion US dollars.

Bitcoin is a high-risk, high-reward stock market for investors. While the US stock market has been from 2016 to the present, although the S&P 500 index has risen by 1800-2800, the overall increase has been around 40%. This is in the bull market stage from the small cycle of the stock market. However, as the entire macro market enters the long-term debt cycle, the performance of this round of US stock market is actually the end of the bull market.

We think there are three possibilities.

2. Currency funds: After the small currency hype, the bubble burst and find a more stable digital currency to hedge.

3. Traditional funds: asset allocation. The inflow of a small portion of the traditional market into the bitcoin market can drive a large increase.

Conclusion

We hope that by sharing some of our recent observations of the market, we will have a more essential understanding of the market and hope to hear more about the market.

Written in the back

We create original content and translate the content into English for foreign communities. We sincerely recruit volunteers with the same interests, write articles and do translations with us, and interested friends must let the little assistant know! (Little Assistant WeChat: DaiGuanXorder)

WeChat public number: generation view

Official website: http://xorder.ai/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- $8.5 million! US Securities and Exchange Commission fines fraud

- PNC, the eighth largest banking company in the US, began using RippleNet for cross-border payments

- Opinion: Why is the price of Bitcoin not important?

- ConsenSys latest report: 2019 Stabilization currency status

- Bitcoin Mining In-depth Survey: Chinese mining machine dealers dominate, mining in the first half of the year is called profiteering

- Video | Babbitt "8 Questions" 2 minutes mixed, 40 industry big brothers together with the box, inciting people!

- Bitcoin breaks through 10,000, and the bull market really depends on halving support?