Data Monthly Report: Cryptocurrency price trend correlation A shares> US stocks Guangdong has the most blockchain companies in the country

China is an important part of the blockchain world, but many people do not understand its role. To this end, we have carefully studied the indicators of global blockchain data, especially in China.

This study found:

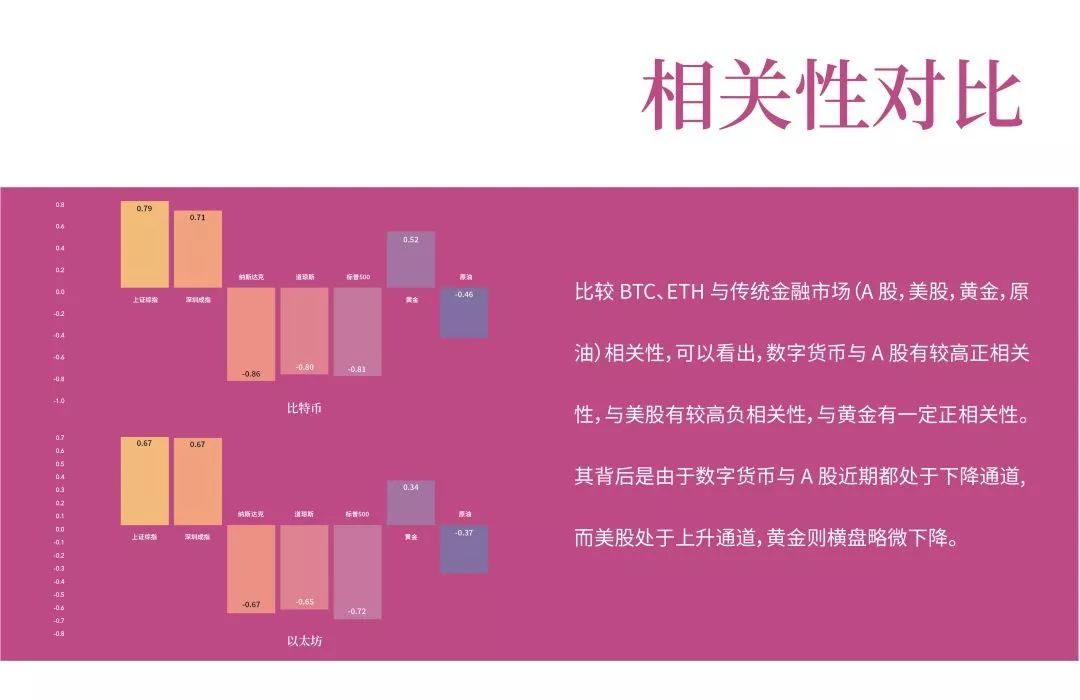

- The price movements of cryptocurrencies are not as consistent as those in the United States, but they are closely related to the trend of Chinese A-shares.

- Although other cryptocurrencies other than Bitcoin rank higher on some specific indicators, Bitcoin still dominates and the network is more active.

- In the past month, the prices of most cryptocurrencies have fallen. Among them, the currencies with higher return on investment have the possibility of artificial manipulation due to the excessive concentration of chips.

- In terms of block production, the United States is still far ahead of other countries, including China, but China and even Asia have performed better than Europe.

- Interest rates in decentralized financial (DeFi) cryptocurrencies are more attractive than dollar assets such as stablecoins.

- As of November 30, Guangdong Province of China (the province where the high-tech center Shenzhen is located) has the largest number of blockchain-related companies in the country.

Comparison of financial indicators

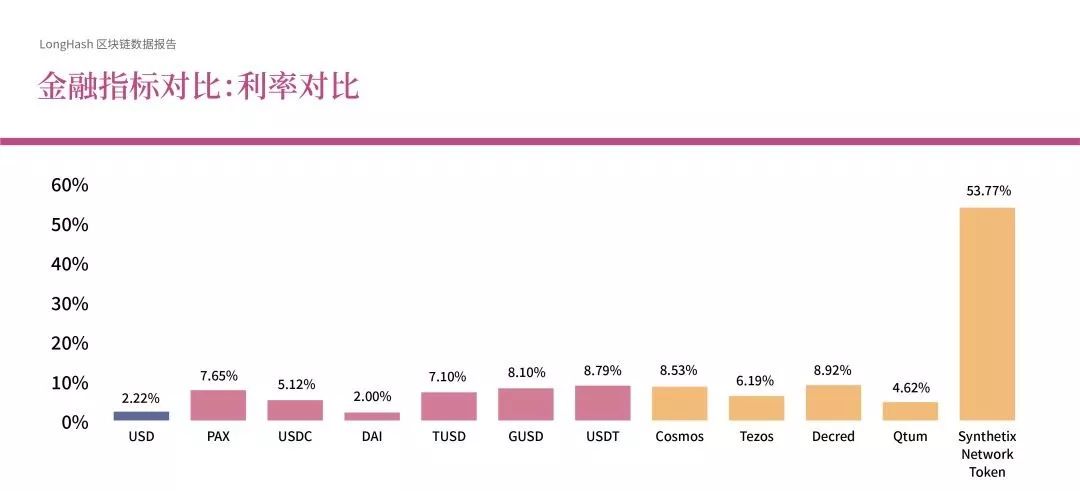

1. Interest rate comparison

DeFi is one of the future development directions of the blockchain. Compared to the low interest rates of the US dollar wealth management caused by the Fed's continuous interest rate cuts, the interest rates of blockchain open finance will look much better. Not to mention that the interest rates of major stablecoins can reach an annualized rate of 10%. At present, the synthetic asset mortgage project SNX in the Kyber ecosystem can reach an annualized interest rate of nearly 60%. This may seem beautiful, but please note that this data does not reflect the size of the capacity. Decentralized finance is very good, but the first problem to be solved is the widespread issue.

- Taobao sells hardware wallets, "currency ban" is still on

- Qingdao Daily Special Edition | Grab the scene of the "window period", Qingdao blockchain industry in progress

- Bank of Korea: No plans to launch central bank digital currency yet

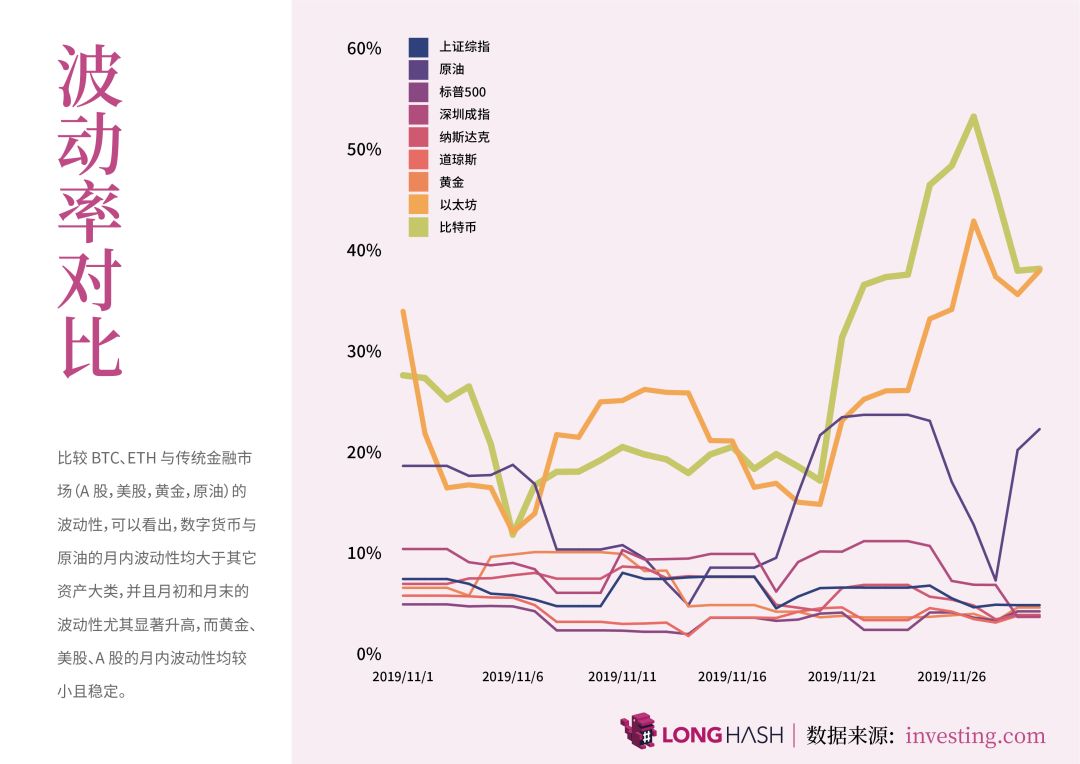

3. Volatility comparison

Comparing the volatility of BTC, ETH and traditional financial markets (A-shares, U.S. stocks, gold, crude oil), it can be seen that the intra-month volatility of digital currencies and crude oil is greater than other asset classes, and the volatility at the beginning and end of the month is particularly Significantly increased, while gold, U.S. stocks and A-shares had less and stable monthly volatility.

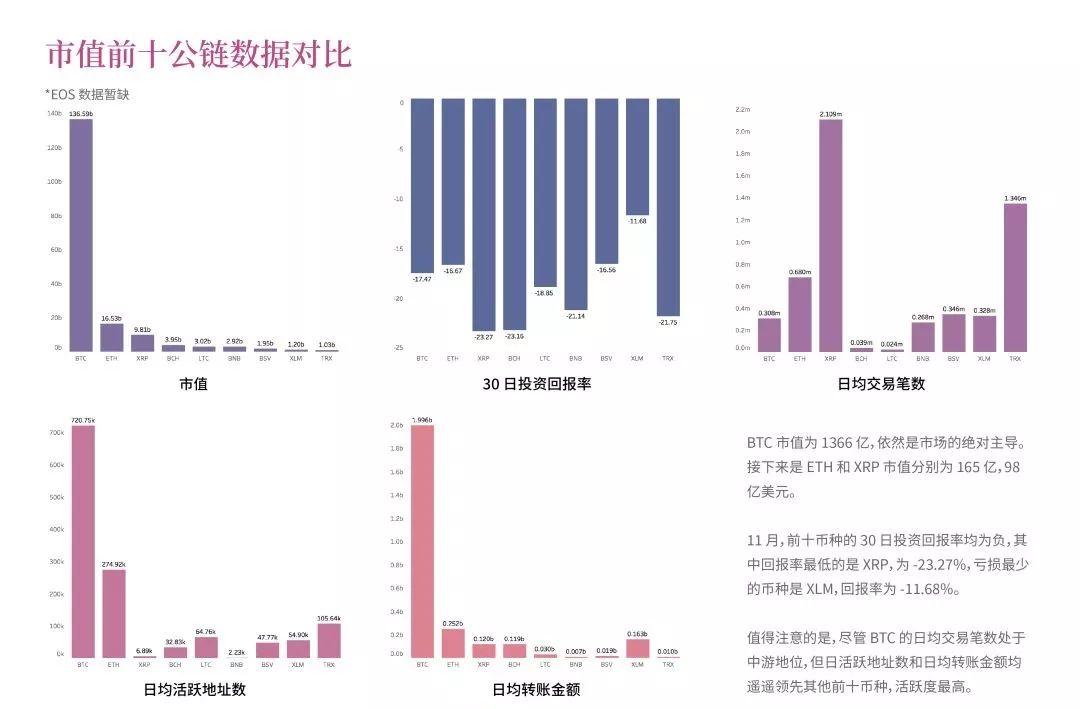

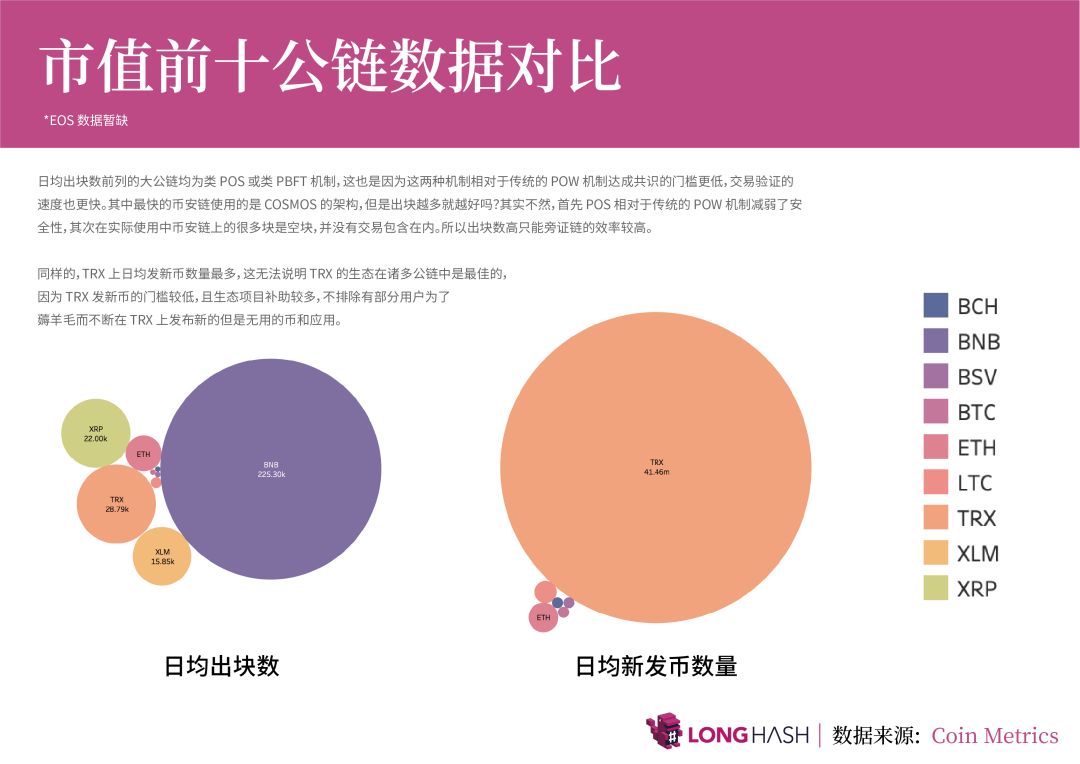

Comparison of the top ten public chain data by market value

At present, the market value of BTC is 136.6 billion, which is still the absolute market leader. The market value of ETH and XRP is $ 16.5 billion and $ 9.8 billion, respectively.

We compare the data of BTC, ETH, XRP, BCH, LTC, BNB, BSV, XLM, TRX, 30-day return on investment, daily average transactions, daily average active addresses, average daily transfer amount, etc. See what conclusions will be drawn.

Similarly, the average number of new coins issued by TRX on a daily basis does not indicate that the ecology of TRX is the best among many public chains, because TRX has a low threshold for issuing new coins and there are more ecological project subsidies. Users continue to release new but indispensable coins and applications on TRX in order to fleece the wool.

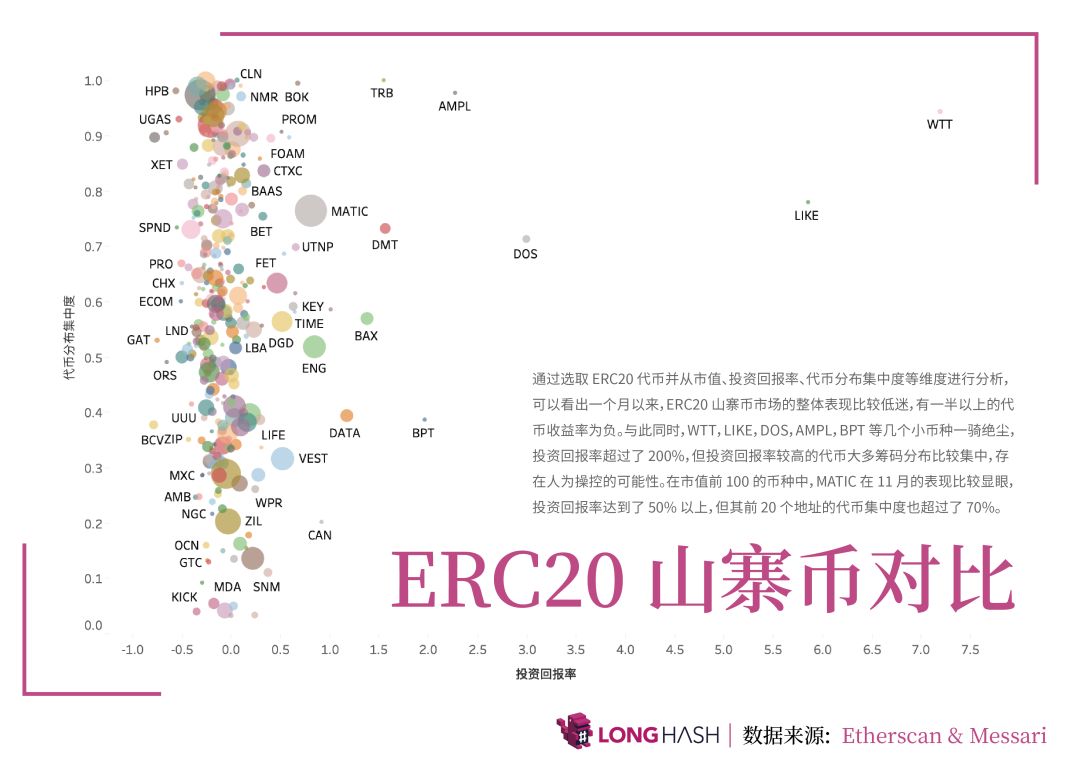

ERC20 altcoin comparison

By selecting ERC20 tokens and analyzing them from dimensions such as market value, return on investment, and concentration of token distribution, it can be seen that the overall performance of the ERC20 altcoin market has been sluggish over the past month. . At the same time, several small currencies such as WTT, LIKE, DOS, AMPL, and BPT have been riding in the dust, and the return on investment has exceeded 200%. Possibility.

Among the top 100 currencies by market capitalization, the performance of MATIC in November was relatively prominent, and the return on investment reached more than 50%, but the concentration of tokens in its top 20 addresses also exceeded 70%.

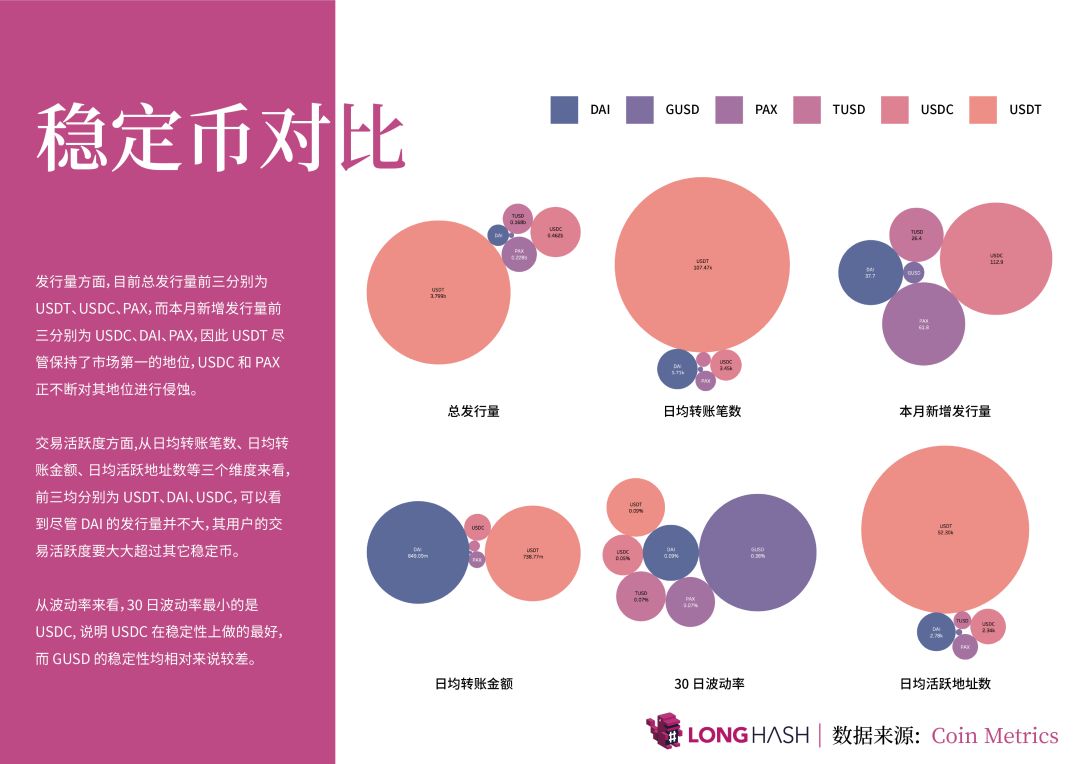

Comparison of stablecoins

In terms of issuance of stablecoins, the top three total issuances are currently USDT, USDC, and PAX, while the top three new issuances this month are USDC, DAI, and PAX. Therefore, USDT has maintained the number one position in the market. PAX is continuously eroding its position.

In terms of transaction activity, from the three dimensions of daily average transfers, average daily transfer amount, and average daily active addresses, the first three are USDT, DAI, and USDC. It can be seen that although the amount of DAI issued is not The transaction activity of its users is much larger than that of other stablecoins.

From the perspective of volatility, the lowest volatility on the 30th is USDC, indicating that USDC has done the best in stability, while GUSD has relatively poor stability.

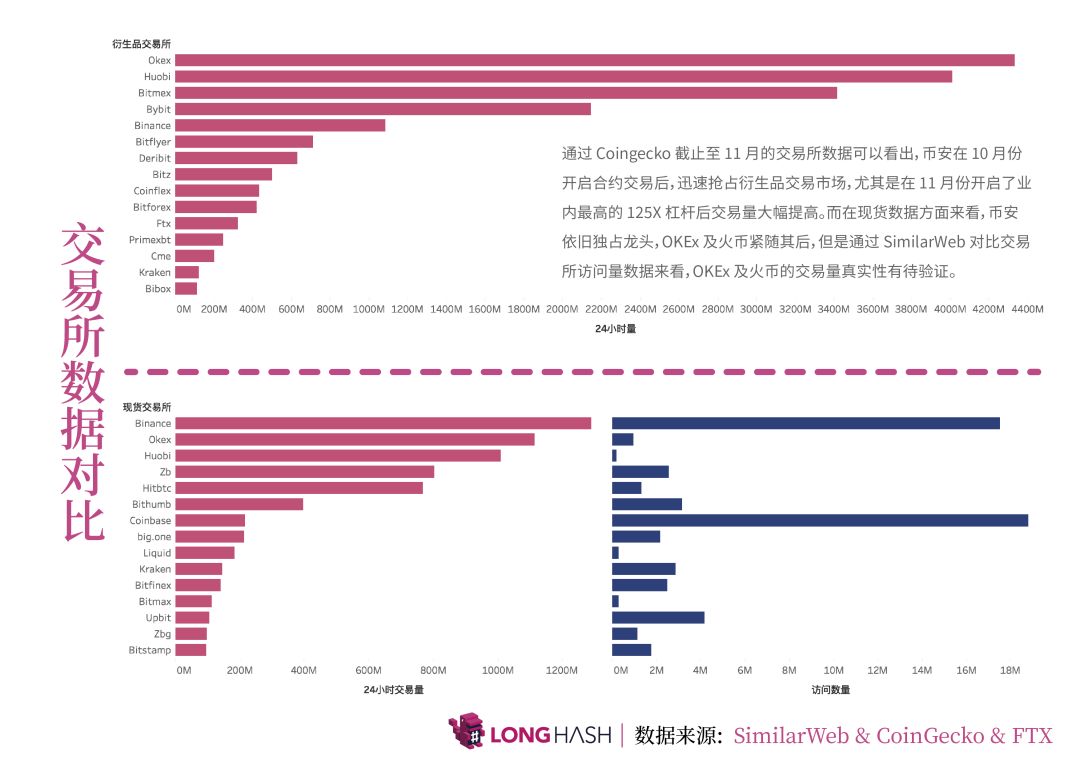

Exchange data comparison

According to the data of Coingecko's exchanges up to November, Binance quickly seized the derivatives trading market after opening trading contracts in October, especially after the industry's highest 125X leverage was opened in November. In terms of spot data, Binance is still the dominant player, QKEx and currency are close behind. However, by comparing the access data of the exchange with SimilarWeb, the authenticity of the transaction volume of OKEx and currency needs to be verified.

Industry development

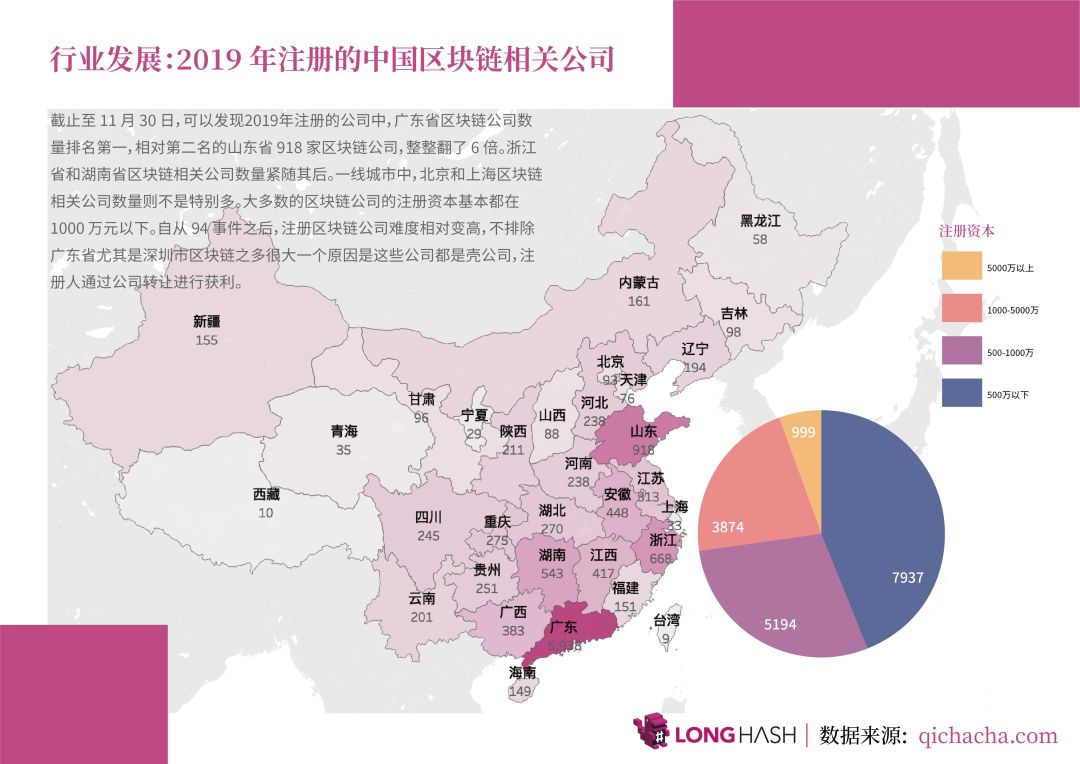

1.Chinese blockchain-related companies registered in 2019

As of November 30, it can be found that among the companies registered in 2019, Guangdong Province ranked first in the number of blockchain companies, which is a 6-fold increase compared to the second largest number of 918 blockchain companies in Shandong Province. The number of blockchain-related companies in Zhejiang and Hunan is close behind.

In the first-tier cities, the number of blockchain-related companies in Beijing and Shanghai is not particularly large. The registered capital of most blockchain companies is basically below 10 million yuan. Since the 94 event, the difficulty of registering blockchain companies has become relatively high. It is not ruled out that Guangdong Province, especially Shenzhen, has a large number of blockchains. One reason is that these companies are shell companies, and the registrant makes profits through company transfers.

2.Blockchain related patents

From the data of SooPat and Google Patents, it can be seen that the number of blockchain patents in China in July and August 2019 is large. Globally, the number of US blockchain patents is the largest, nearly double that of China, which is the second largest. Overall, the number of patents in Asian countries is much higher than in other continents, and the number of patents in Germany and the United Kingdom in Europe is much higher than in other countries.

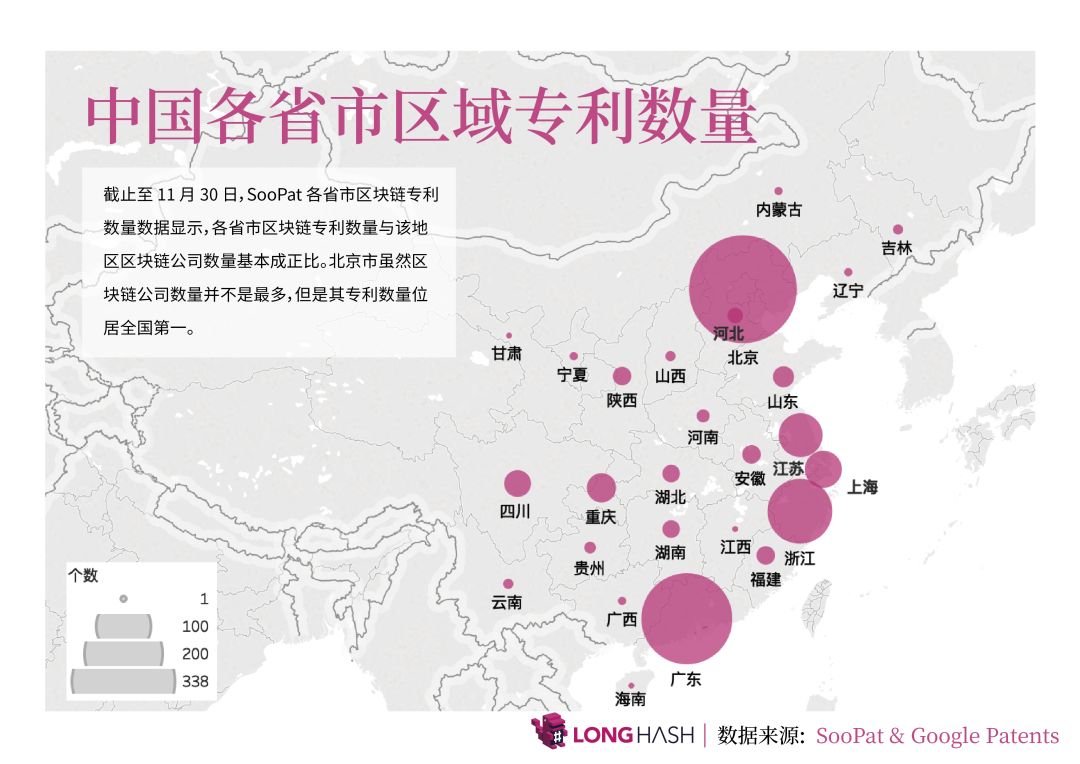

3. Number of regional patents in provinces and cities in China

As of November 30, SooPat's provincial and municipal blockchain patent data shows that the number of provincial and municipal blockchain patents is basically proportional to the number of blockchain companies in the region.

Although the number of blockchain companies in Beijing is not large, their patents rank first in the country.

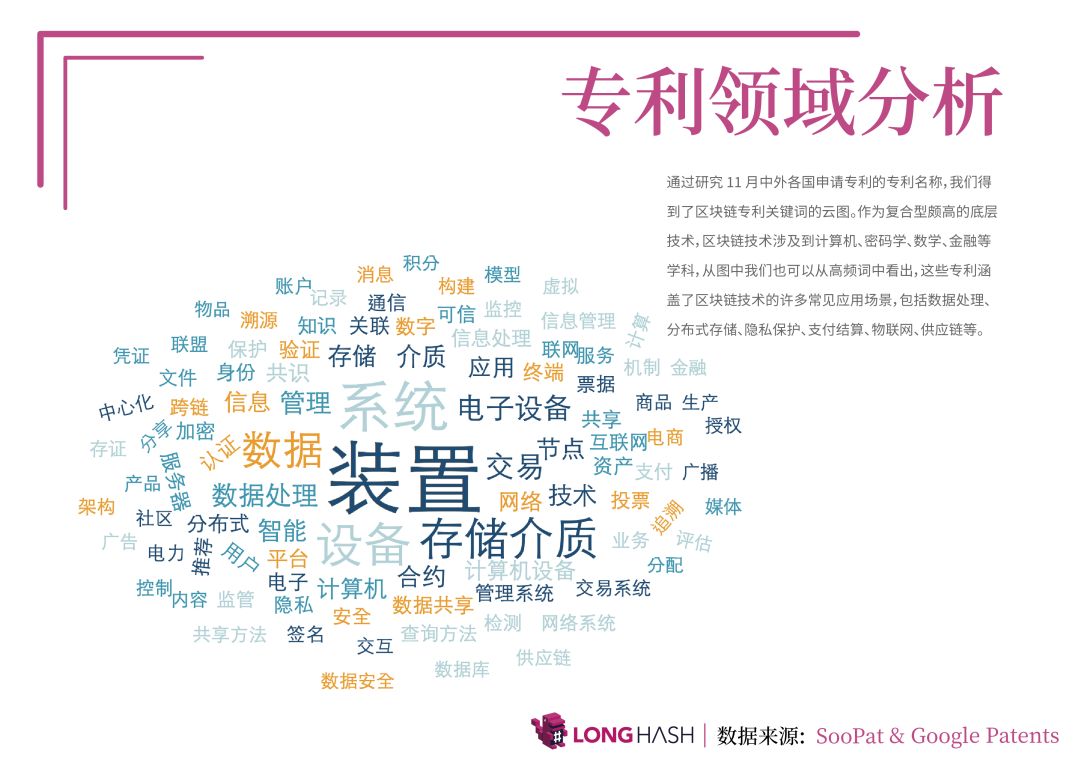

By studying the patent names of Chinese and foreign countries applying for patents in November, we have obtained a cloud map of blockchain patent keywords. As a highly complex underlying technology, blockchain technology involves computer, cryptography, mathematics, finance and other disciplines. From the figure we can also see from high-frequency words that these patents cover many of the blockchain technology Common application scenarios, including data processing, distributed storage, privacy protection, payment settlement, Internet of Things, supply chain, etc.

5.Blockchain / cryptocurrency supervision

November 13 : Heath Tarbert, Chairman of the US Commodity Futures Trading Commission (CFTC), shared his views on the current state of the US crypto / blockchain industry while attending the conference on Tuesday. Tarbert believes that the United States should play a more active role in this field and, if possible, even take the lead.

November 22: The Shanghai headquarters of the People's Bank of China stated that in recent years, hype related to virtual currencies (such as ICO, IFO, IEO, IMO, STO, etc.) has been renovated, speculation has prevailed, prices have skyrocketed, and risks have quickly gathered. Relevant financing entities through illegal sale, circulation of tokens, raising funds from investors or virtual currencies such as Bitcoin and Ethereum are essentially illegal public financing activities without approval, and are suspected of illegally selling token tickets, illegally issuing securities and Illegal fundraising, financial fraud, pyramid schemes and other illegal crimes have seriously disrupted the economic and financial order.

November 30: Anatoly Aksakov, chairman of Russia ’s State Duma Financial Markets Commission, recently stated that Russia may ban crypto payments for goods and services, but achieving that ban may be quite difficult. He said that these instruments (cryptocurrencies) were banned in the draft Digital Financial Assets Act. As a result, other meals are being drafted at the same time; they aim to introduce responsibility for cryptocurrency transactions on the territory of the Russian Federation.

November 19: Bank of Japan Governor Tokuhiko Kuroda stated that Japan does not need a central bank to issue digital currency, but will continue to study digital currency. It also stated that if the stablecoins supported by large platform companies are issued globally, it may affect the stability of monetary policy and the financial system. Stablecoins should not be issued without adequate regulations and risk management systems.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin has become the darling of academia, with more than 13,700 related papers in 2019

- 2020 Outlook: A crucial year in the crypto space, what factors will drive the widespread adoption of blockchain?

- Crypto year review: what we went through in 2019

- Annual Inventory: Hacker Raves Behind the Crypto Market Boom

- "Premature" blockchain 50 index: 40% of companies are still in the research stage

- The path to breaking open finance in 2020

- Perspective | Can Energy Investment Determine Bitcoin Value?