Perspective | Can Energy Investment Determine Bitcoin Value?

Editor's Note: The original title was "Can Energy Input Determine Bitcoin Value"

This article is an article published by Charles Edwards, a value investment / crypto asset investor. PayPal Finance has been authorised by the author to compile the content and title of the article accordingly.

In the bitcoin market, the factors that affect the price of bitcoin have not been conclusive. Where is Bitcoin's Value Support? What factors affect the price of coins? How to estimate the trend of Bitcoin? From the perspective of energy input, the author of this article made a hypothesis and explored the relationship between Bitcoin price and energy input, hoping to provide some reference for Bitcoin investors.

//View//

- Grab the index "Dongfeng", the value of the layout of blockchain theme funds?

- Blockchain 50 index released, regular army does not speculate

- Opinions | How does the blockchain trust mechanism promote the development of inclusive finance and help solve the financing difficulties of small, medium and micro enterprises?

- Unit of energy input: Joule, which can be used to evaluate the fair value of Bitcoin

- Increased energy input increases the fair value of Bitcoin (and vice versa)

- Bitcoin's price reflects the average of its energy consumption costs to some extent

- The energy value model shows that the fair value of Bitcoin on December 12, 2019 was approximately $ 11,500, which is 50% higher than the current currency price.

1. Discovery: The close connection between currency prices and energy consumption

In the author's previous article, it was said that Bitcoin's power consumption can be used to estimate production costs, which can then be used to estimate the profitability of miners. By observing the relationship between the price of bitcoin and production expenditure, we find that the change in the cost of bitcoin production is closely related to energy consumption and the efficiency of mining equipment.

Assuming other factors remain the same, let's consider a question:

Can Bitcoin's basic value be measured solely by energy consumption?

2. Model: Calculate the fair value of Bitcoin

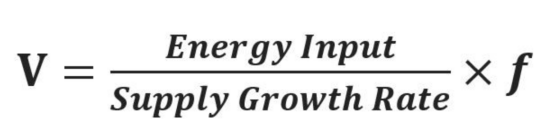

Assumption: The fair value of bitcoin is a constant function of energy input (Energy Input), supply growth rate (Supply Growth Rate), and the fiat currency coefficient f representing energy.

These variables can be combined into the following equation, called the energy value (V) of Bitcoin:

among them:

- Energy consumption (unit: watts) = hash rate (GH / s) * mining efficiency (J / GH)

- Supply growth rate (unit: s-1) = The annual growth rate of Bitcoin circulation, equal to the inverse of the Reserve Production Model (S2F). Calculated as the annual change rate of Bitcoin (unit: year-1), and then converted to seconds

- Fiat currency factor (USD / Joule) = a constant conversion factor to take into account the fiat value of energy

Since the hash rate and supply rate of all units can be offset, the equation shows that the fair value (V) of Bitcoin can be expressed as the energy consumption to produce a Bitcoin:

Energy value formula: Bitcoin's value is a function of energy consumption

3. Calculation: Bitcoin's energy value

In order to verify this theory, all input data comes from: blockchain.info, except for the energy efficiency of mining.

The most challenging part is the accurate assessment of the energy efficiency of Bitcoin mining at different points in time.

3.1 Evaluating the Energy Efficiency of Bitcoin Mining (J / GH)

The energy consumption of Bitcoin mining is related to two factors: the hash rate of the SHA-256 algorithm and the energy efficiency of the miner itself.

In the early days, Bitcoin was mined using high-power CPU and GPU.

And now the mining efficiency of ASIC miners is more than 100,000 times higher than that of the miners used in 2009. This means that a relatively high portion of the average electricity bill for miners today has been transformed into effective hashing power.

To evaluate the historical overview of the energy efficiency of Bitcoin mining machines, I calculated the energy efficiency of 150 Bitcoin mining machines from Cambridge (ASICs only), BitcoinWiki (FPGAs), and Bitcoin.it (ASICs, CPUs, and GPUs). All energy-efficient (J / GH) ASICs, FPGAs, and Intel, AMD, and Nvidia hardware were considered, and an approximate mining machine launch time was found. The common models are grouped and the average energy efficiency of the models is calculated on the basis of equal weight.

The daily energy efficiency of the Bitcoin network is then calculated as a weighted average of all hardware, which averages within two years after the CPU / GPU / FPGA release and within 1.5 years of the ASIC release.

The reason for choosing a depreciation period is because:

- CPU and GPU miners usually use years

- Bitcoin mining is usually not competitive in the early days

- Other studies have also shown that in recent years, the depreciation period for ASICs has typically been 1.5 years

Finally, a one-month moving average of energy efficiency was calculated to phase out the model types in stages.

In fact, some mining machines have a wider range of uses and a longer service life. However, due to the risk of increasing historical errors in the energy value model and trying our best to obtain an unbiased result, we did not exclude, minify or other data operations these miners.

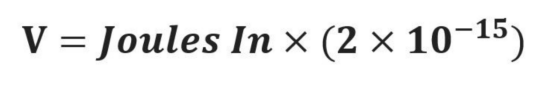

In the above process, over time, Bitcoin energy efficiency (J / GH) has formed the following trends.

S-curve that improves with Bitcoin mining efficiency (indicating that J / GH gradually decreases over time). Please note that since the introduction of ASIC-type miners from 2013 to 2014, mining efficiency has increased dramatically.

3.2 Calculating the Fiat Currency Coefficient (USD / Joule)

The fiat currency factor is a constant that converts energy consumption units (joules) into fiat currencies (USD). It simply means how much we value energy.

According to the above energy efficiency curve, the fiat currency coefficient obtained is: 2.0E-15

The value of the fiat currency factor depends on the accuracy of the energy efficiency curve, so the value provided here should be considered as an approximate estimate. In the long run, the depreciation of the US dollar, hyperinflation or the collapse of the fiat currency will cause the fiat currency coefficient to increase in a 1: 1 relative manner.

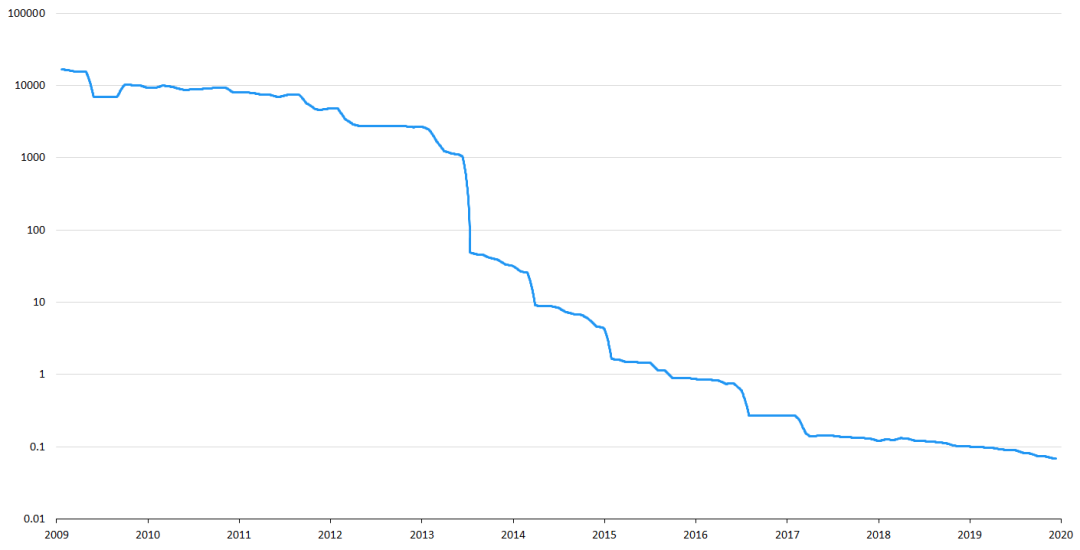

4. Conclusion: Energy value matches historical currency price

The mapping results show that the energy value of Bitcoin is very close to historical prices.

Bitcoin Energy Value in 10 Years

From 2013 to 2014, the energy value of Bitcoin dropped sharply, which was mainly driven by the transformation of GPU / FPGA to ASIC miners. Although there may be a significant decline during this period, this result is likely to be exaggerated due to the hardware usage and depreciation model assumptions outlined above.

5. Market power-building a bridge between supply and demand

The first question is:

Is Bitcoin's energy value model logical?

In the article "Bitcoin Value Model Built with Scarcity", Plan B found that market prices have a strong relationship with the scarcity of assets such as Bitcoin. We can assume that this represents the basic relationship between mankind's "demand" for long-term "hard currency" and value-preserving assets.

But there is a problem here.

Not all scarce assets have or maintain broad market value. For example, about 3,000 cryptocurrencies have a market value of less than $ 500. Many of these tokens have a "limited" supply model, but the market still believes they have no fundamental value. Scarce, but worthless. Scarce assets that are easily available or copied have a lower market value.

Continuous, high-level human input is often related to demand.

When energy (energy) is invested in an event, the energy provider (worker) expects others to have a need for what they are giving. When suppliers see the fruits of their labor and the demand for workers grows, workers will work harder to get greater returns. However, if supplier demand for labor declines, or workers get better returns elsewhere, they may stop investing in the event.

This can both explain the dispute over Bitcoin's computing power and serve as an argument for the energy value model of Bitcoin.

Continuous mining investment represents a balance between supply and demand. Rising bitcoin price through the increase of computing power and technological improvements to encourage miners to increase mining input, thereby improving energy efficiency. Therefore, a sharp increase in market prices will usually promote an increase in mining investment, and therefore increase the energy value of Bitcoin. However, when speculative actions lead to skyrocketing prices, if there is no corresponding increase in energy consumption, according to historical experience, prices will plummet back to energy values.

It represents the phenomenon of mean regression, as expected by fundamental value-driven intrinsic value estimates.

Bitcoin's price and energy value are interconnected, just like magnets. Although there may be discrepancies between the two, they are ultimately compatible. Although mathematically the value of Bitcoin's energy has nothing to do with transaction price and volume, the market's "invisible hand" linked them together.

Bitcoin value is based on the reserve production model and mining expenditures to obtain long-term demand for scarce assets, which represents the symbiotic relationship between Bitcoin supply and demand.

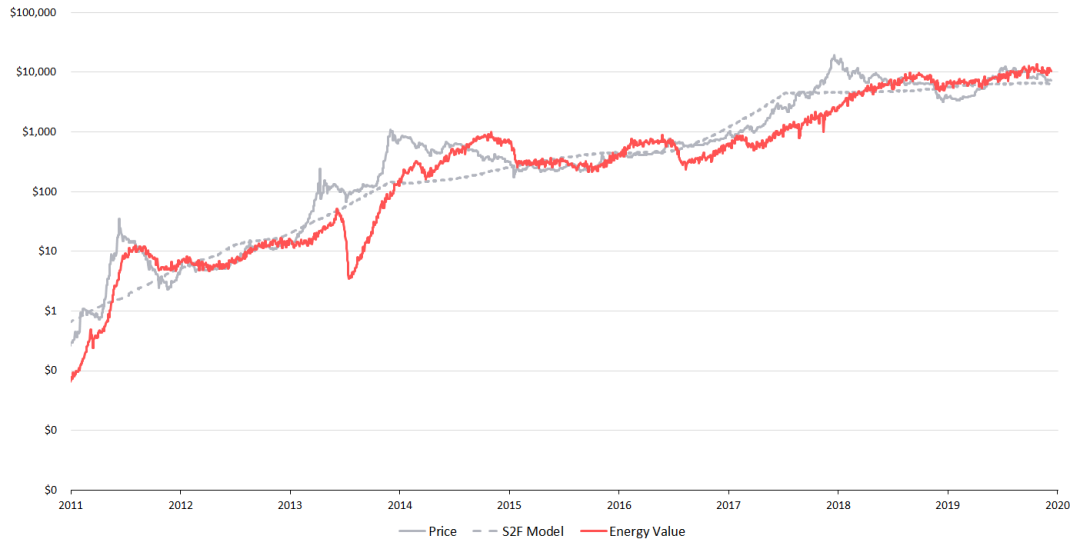

6. Measurement: how effective the energy value model is

According to daily data from January 2010, R2 of the "Energy Value" formula is 80% of the actual Bitcoin price (the higher R2, the more realistic the model is). In contrast, under the same data, the reserve production model has an R2 of 88% under the same data.

Although it is 8% lower than the reserve production model, there are several points to consider:

- The energy value of Bitcoin is highly dependent on our estimated mining efficiency. In this analysis, a total of 150 bitcoin miners were manually sorted out. There is a possibility of data omission or data error. The depreciation period is an approximation of the actual situation. Efficiency may also vary based on changes in operating conditions and overclocking. It is impossible to perfectly represent the mining machine used by every Bitcoin miner at every point in history. Therefore, some errors may occur here.

- If all miners suddenly stop mining bitcoin, then according to the prediction of the reserve production model, the bitcoin price will reach infinity. The energy value forecast is zero. If all miners give up Bitcoin (such as a catastrophic event: the collapse of the SHA-256 algorithm, a better way of storing wealth), no new blocks will be generated, no transactions will be sent, and the blockchain network When paralyzed. In such cases, using only the reserve production model (0.4 * SF³) would consider bitcoin to have unlimited value. The energy value model says that if all miners stop mining bitcoin tomorrow, the power input will be zero and bitcoin will be worthless.

- The reserve production model is a fitted power law. Bitcoin's price has already performed exponentially, and a reserve-production model has been specifically chosen to match it. By optimizing the parameters, better bitcoin price fitting accuracy is obtained. The value of energy has no curve fitting parameters, only a fixed constant that allows conversion of pure energy into dollars. In fact, the exponential increase in mining efficiency and the increase in hash rate may explain the exponential relationship between reserves and production.

In summary, 80% R2 is considered a strong result of energy value.

7.Find investment opportunities based on energy value models

Bitcoin's energy value model and reserve production model

From the above figure, we can see that the inflection point and huge gap between the price of bitcoin and fair value herald a good time for buying and selling bitcoin.

A sharp drop in energy consumption often means a good time to exit the market, while a strong increase in energy consumption represents a good time to buy.

The energy value formula states that Bitcoin's current (December 12, 2019) fair value is approximately $ 11,500, which is 50% higher than the current transaction price.

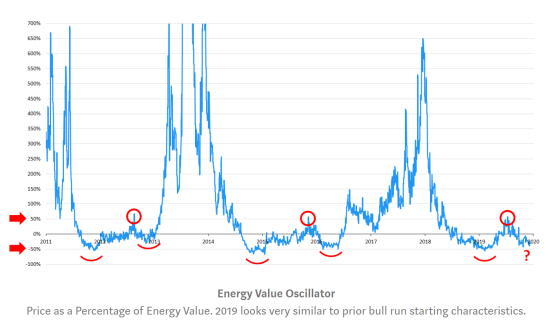

This shows that Bitcoin will have a huge risk reward in early December 2019. The following energy value oscillation chart also gives a positive signal.

However, energy consumption can drop at any time.

Historically, it has been unwise to buy when the hash rate has fallen, and to buy when the hash rate has risen has a much higher risk return.

Energy value oscillation chart

Bitcoin price as a percentage of energy value. The 2019 trend looks very similar to the characteristics before the start of the previous bull market.

8. Enlightenment from energy value models

By considering the growth of energy and supply, we discovered the intrinsic link between the price and value of Bitcoin.

Bitcoin's value is a function of its energy input in joules.

Here are some implications of the energy value model:

- The health of the mining network is intrinsically linked to the value of Bitcoin

- An increase in electricity bills will increase the basic value of Bitcoin (and vice versa)

- Higher hashrate (with constant energy efficiency) means higher value for each bitcoin

- Significant improvements in mining technology (such as the use of ASICs) have led to considerable fluctuations in the short-term value of Bitcoin due to a significant increase in energy efficiency rather than an increase in computing power

- If advances in quantum computer technology (or other major technologies) make it cheaper to attack the SHA-256 algorithm, according to the energy value formula, the intrinsic value of Bitcoin will decrease

- Changing the code of bitcoin to increase the supply growth rate of bitcoin will reduce the basic value of each bitcoin in circulation

- In 2140, if Bitcoin is not dead, its supply growth rate will be zero. The energy value model, like the reserve production model, can predict the super high value of Bitcoin (in US dollars) at that time. However, unlike the reserve production model, this depends on the development of mining activities.

If Bitcoin is heavily used as a value storage tool or a global currency, we may have more financial data indicating that its value is intrinsically linked to the energy consumed in mining activities.

Our time is limited-it is our most valuable resource. We choose to invest our energy and time in this matter, this is our most valuable choice.

Bitcoin's value can be measured in terms of energy value. Just as quality can be expressed in terms of energy, so can the price of Bitcoin.

Tip: Investment is risky and you must be cautious when entering the market. This information is not intended as investment and financial advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Viewpoint | The commercialization of blockchain is mainly based on centralized blockchain, not decentralization

- Viewpoint 丨 Can blockchain restore Japan's lost two decades?

- Crypto funds die in batches, but these ten are still making high-frequency shots

- Views | What impact will the central bank's digital currency have on Alipay and WeChat?

- 2020 spotlight: PlusToken, a $ 2 billion Ponzi scheme, may become a cloud over bitcoin prices

- Dry Goods | Revalidation Proof vs. Error Proof

- Talk to Microsoft China's chief innovation technology consultant: Can the development of blockchain applications be simplified?