Decoding RWA: The Most Valuable Encryption Narrative in Compliance Context

Decoding RWA: Valuable Encryption Narrative in ComplianceListing: ThePrimediaDAO

Author: Jerry, BeeGee

“Today, I am pleased to announce the establishment of a new company, Superstate, whose mission is to create regulated financial products that connect traditional markets and the blockchain ecosystem.” Robert Leshner, founder of DeFi lending protocol Compound, announced the birth of his new company, Superstate, on Twitter on June 29.

He is targeting the current hot narrative and entering the tokenization of real-world assets (RWA).

- Concerns arise over the association between TUSD and Prime Trust as issues with the minting and redemption system emerge.

- Guide to landing Web3.0 in Hong Kong Cyberport: How to receive a subsidy of 1.3 million and a free office?

- Guide to landing Web3.0 in Hong Kong Cyberport: How to obtain 1.3 million subsidies and a free office?

This is consistent with our judgment: we believe that as the era of Web3 native application markets is coming, it is necessary to mobilize more real-world assets/capital (RWA) to integrate into the cryptocurrency market to provide capital assistance; especially in compliance In the context, we believe that RWA is the most valuable wealth password in this round of cycles.

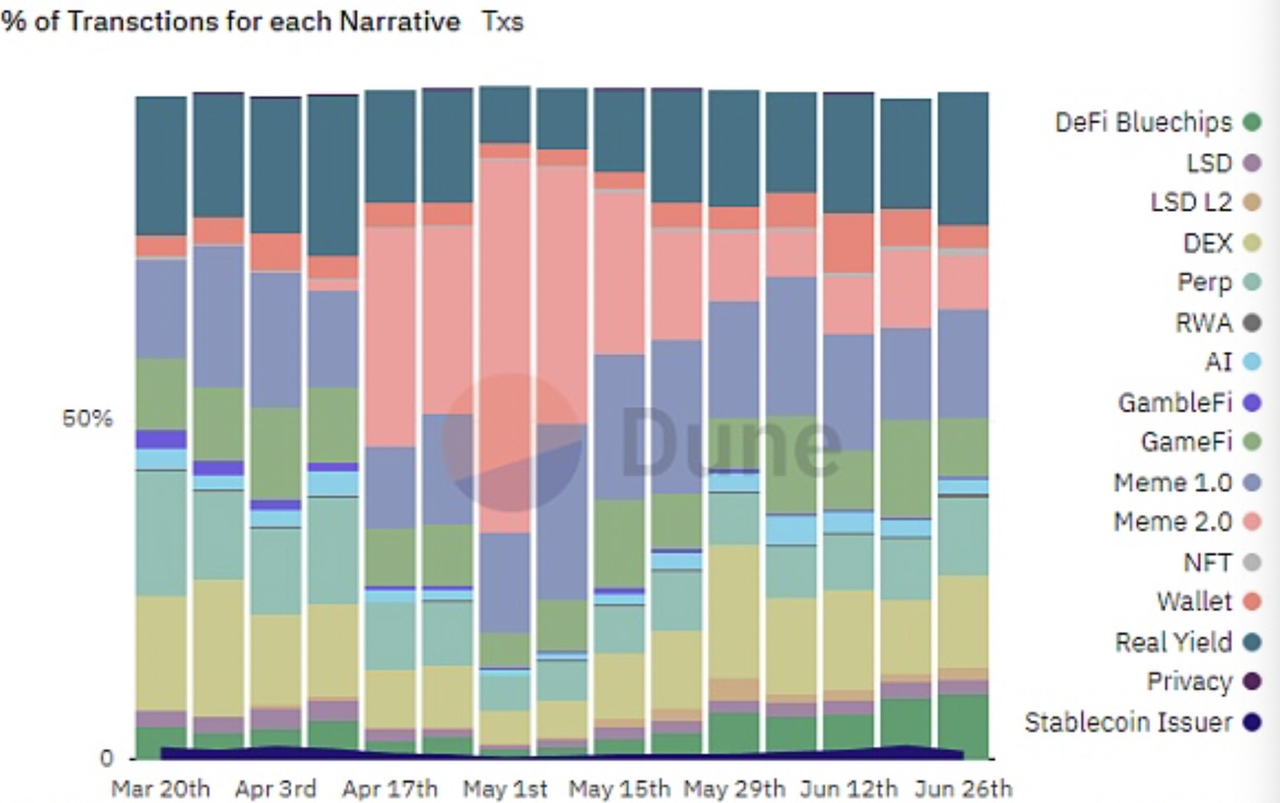

However, in terms of specific data, LSD L2 narrative is the winner in the second quarter of 2023, led by new projects such as Pendle, Lybra, and Tenet; Meme 2.0 has experienced a typical ups and downs; RAW has not yet released energy. Therefore, our analysis is based on the prediction of crypto narratives and objective environment.

Caption

CaptionFormer Dust: Why Synthetic Assets Did Not Blossom

Before explaining the prediction logic, we need to trace the history of RWA and explore its conditions for existence and development process to predict the future.

RWA existed in the earliest days as a concept of synthetic assets, and it is not a fresh thing for the DeFi world. Including the US dollar stablecoin can be regarded as synthetic assets (RWA), it plays more of a role in linking two worlds and does not show strong investment value. Until January 28, 2021, when the main battlefield of ordinary investors, the Robinhood platform, and several local US brokers successively announced restrictions on the opening of stocks such as GME and AMC, ordinary investors were only allowed to sell and could not buy. Synthetic asset protocols became a lifesaving straw and were highly expected, so their value was not only in the pure encrypted world but also out of circle to traditional capital markets, including US stocks, foreign exchange, and so on.

At that time, people were full of expectations for synthetic assets (RWA). Synthetic assets are tokens that represent financial derivatives in digital form. If derivatives are financial contracts tailored to the underlying assets or financial holding situations to customize risk exposure, then synthetic assets are tokenized representations similar to holding positions. A more intuitive example of synthetic assets is the simulation of some assets with prices. For example, the simulation of Apple stock. You can simulate Apple’s stock to build synthetic assets, you can synthesize all assets of NASDAQ and NYSE, and you can synthesize assets such as fiat currency (foreign exchange), gold, BTC, etc.

In November 2021, the synthetic asset project Synthetix underwent an Avior version upgrade on Optimism, with a new WrapperFactory contract added to deploy new wrapping contracts to support any ERC20 token. The lending and synthetic asset protocol dForce has partnered with the physical asset financing platform EntroFi to jointly promote physical asset financing (including real estate, bonds, collateral loans, acquisition financing, accounts receivable, etc.) through liquidity integration between protocols.

This can be seen as part of the DeFi iteration 2.0 process, as these are adjustments and optimizations made by synthetic asset developers. Since 2019, we have witnessed a surge in DeFi, but project developers and industry observers have begun to examine, reflect on, and attempt to iterate into a new era. In May 2021, Vitalik Buterin questioned the market value of the cryptocurrency market, saying that the actual achievements of projects such as DeFi do not support the popularity and valuation they have received. The efforts of synthetic asset (RWA) projects Synthetix, dForce, and EntroFi in 2021 did not achieve the expected success. Subsequently, the market entered 2022, which caused several collapses in the cryptocurrency market, especially under the emotion of regulatory crackdowns by the US government and the US cryptocurrency community. The synthetic asset (RWA) projects in the US market were not accepted by the market.

However, as of 2023, the RWA narrative has gradually been established. Taking several chain-based national debt projects as examples:

Ondo Finance announced the launch of a tokenized fund in January this year, bringing risk-free interest rates to the chain, allowing stablecoin holders to invest in bonds and US Treasuries; Matrixport, an asset management company, launched a chain-based bond platform, Matrixdock, which went live in late January with national debt-related businesses; OpenEden, created by a former Gemini employee, launched tokenized US Treasuries in April this year, and stablecoin holders can mint TBILL through the OpenEden TBILL Vault to obtain risk-free returns on US Treasuries…

Timing: RWA in the context of application ecology and compliance

In “Talking about Ethereum’s Three Transformations: V God’s Attack and Defense,” we analyzed that in some difficult life-and-death moments, V God painted a big picture, saying that he wanted to make 1,024 shards and directly increase performance by 1,000 times; in some difficult life-and-death moments, V God talked about dreams, envisioned DeSoc, and searched for the soul of Web3… But now, V God can talk about life and death, this is V God’s most confident moment. V God has the confidence to promote critical and specific transformation plans and build his Ethereum into a decentralized non-monetary application ecology.

This will be the strongest fundamental support in this cycle, which means that Ethereum is entering the era of application ecology. This also inevitably requires more real-world assets/capital (RWA) to be mobilized into the encrypted market to provide capital. Ethereum’s entry into the application ecology will give us confidence in the encrypted narrative, but we believe that the biggest support in the market is RWA.

In early June, MakerDAO conducted a nominal survey vote to establish a real-world asset (RWA) Vault called BlockTower Andromeda, which is managed by BlockTower Capital and invests up to $1.28 billion in short-term US Treasury bonds. The US Treasury bond yield is usually considered a risk-free rate by the capital market. At that time, the context was that as US short-term interest rates continued to rise, DeFi interest rates fell, and the demand for on-chain stablecoins to obtain returns through off-chain markets increased. Recently, the founder of Compound joined the RWA track. This is consistent with our consistent attitude and judgment:

1. In “Why ‘Integration’ Becomes the Value Research Theme of the Next Bull Market”: The theme of the next bull market “integration” includes three dimensions: the integration of web3 technology with many industries; the integration of encrypted economy with sovereign finance; DeFi and The integration of web3 industry. In this way, with the encrypted economy as the core, the economic system of the entire world will be reshaped, and the world’s financial structure and order will be rebuilt.

2. In “On the Value Logic of “Bear Market Bottom” with “Civilization as the End””: In the encrypted economic system, when the energy of DeFi blossoms in the web3 industry, it will push the narrative of the encrypted world to a higher level. If the growth logic of traditional financial capital markets can only come from the mainstream of economic growth, then DeFi can match the excess number of users and user funds in depth and breadth, demonstrating unprecedented economic development at the index level.

3. In “Don’t Panic! Look at the Opportunities and Challenges of” US Regulation and Hong Kong New Policy “”: Hong Kong needs to integrate the role of “financial center” into the narrative of Web3/encrypted economy, and needs to convert the power of speculation and hype in the currency circle into support for the development of native Web3 markets. The key point in this is how the Hong Kong government makes good use of the capital allocation function of DeFi, which is native to the encrypted economic system. Of course, the current choice of the Hong Kong government to put the trillion-dollar off-chain assets on the chain (RWA) is a smart and wise choice-in the future one or two bull and bear cycles, Hong Kong will promote the integration of virtual assets in the encrypted economy with the real-world financial system as the main battlefield, advance and retreat.

Therefore, compared with MakerDAO’s BlockTower Andromeda and Compound founder’s Superstate, we are more concerned about Bank of China International’s issuance of HKD 200 million digital notes via UBS in mid-June, which we believe is a successful practice of RWA – UBS Group said the transaction marked the first such product in the Asia-Pacific region that complied with Hong Kong and Swiss laws and was tokenized on the Ethereum blockchain. However, some people have raised some opinions and suggestions – the “main Ethereum blockchain” mentioned in the UBS original text is not actually the Ethereum mainnet, but a centralized consortium chain deployed by Ethereum as open source code. Under uncontrollable risks such as policy compliance, regulation, and transaction efficiency, traditional institutions still have a long way to go to deploy business on the public chain in the true sense.

In “Decoding RWA: Can “Dubai’s WEB3 New Trends” Serve as a Reference for “Hong Kong Crypto Narrative”?”, we introduced BG Trade as a case with more native encryption genes, which truly deploys business on the public chain. But how it works, how its mechanism is set up, whether the functions and services covered by the BG Trade ecosystem can be used as a reference for the Hong Kong crypto narrative at the practical level: BG Trade aims to integrate multi-dimensional asset investment on the same platform, providing efficient connection opportunities for both the traditional stock market and the cryptocurrency world, and plans to build an ecosystem that backs tokens and traditional stocks 1:1, breaking down the barriers between the currency circle and the stock market.

1. Issuance platform: BG Trade provides a convenient way for RWA projects to issue tokens and initial decentralized transactions (IDO) on the issuance platform. By providing this platform, BG Trade promotes the fundraising of RWA projects and attracts potential investors’ attention.

2. OTC trading: BG Trade has realized OTC trading functions, providing privacy protection for OTC trading and minimizing market impact, providing solutions for participants with large trading volumes.

3. Asset exchange: The BG Trade platform integrates assets from Web2 to Web3 to ensure that users can convert between different asset categories and provide users with a trading experience across different asset categories.

4. ve-Governance: BG Trade empowers users to participate in decentralized governance and decision-making processes, and strives to ensure a fair and transparent ecosystem by incorporating the community into important decisions and making the community voice heard.

5. Pledge mining: Participants can pledge their BGT tokens on the BG Trade platform as liquidity providers to contribute to the stability and growth of the platform and receive rewards.

6. zkDID: BG Trade uses zkDID technology, which allows users to manage their own identities without disclosing personal information to third parties. This feature ensures privacy and data security while achieving true data mining.

During the writing of this article, we hesitated because the RWA (synthetic asset) track existed in the previous cycle but did not shine, why do we judge that it can become the most valuable wealth password in this round? Therefore, we pay attention to industry dynamics at all times. We contacted BG Trade as a case study through the “Exploring Release: Web3 and RWAs” theme forum; we gained confidence in this theme judgment because Compound’s founder entered the RWA track.

As mentioned earlier, we judge that the application ecology of Ethereum and other public chains will be the strongest fundamental support in this round of cycles, but it brings us more confidence. The biggest support at the market level is RWA-RWA includes “any real-world assets with clear monetary value”, including tangible assets such as gold and real estate; or intangible assets, such as government bonds or carbon credits. However, the certainty and cost pressure of the trillions of dollars of off-chain asset rights is uncertain and cannot be fully realized in the short term; but the Hong Kong SAR government can make the chain on the trillions of dollars of off-chain assets in the next ten years. It can become the basis for Hong Kong’s encrypted narrative. The RWA market estimated by traditional institutions such as Citibank and BCG (Boston Consulting Group) in 2030 of tens of trillions of dollars or 16 trillion US dollars has been launched. This is mainly in the digitalized and structured assets, including the main business chain of BlockTower Andromeda, Superstate in the chain National debt market and BG Trade’s currency stock market.

As the era of the application ecology of the encrypted world is coming, RWA is becoming a bridge between traditional finance (TradFi) and decentralized finance (DeFi). We look forward to all of us gaining something in the new cycle, whether it is ecological construction or market investment.

Note: This article was completed through the collaborative research and creation of TheprimediaDAO, and the main collaborators are TheprimediaDAO initiator Jerry (@ThePrimedia) and TheprimediaDAO Builder and TigerVCDAO Investment Head BeeGee (@BeeGeeETH).

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Understanding Ethscriptions in one article: principles and advantages and disadvantages

- Delphi Digital: Polygon releases new vision, intertwining OP/ARB stack and cross-chain security

- Speculation about the development of NFTs in the next two years: 99.999% of old NFTs will tend towards zero value, and Grail NFTs have the opportunity to outperform ETH.

- Conversation with Qi Zhou, founder of EthStorage: Data Availability and Decentralized Storage

- Decoding RWA: The most valuable wealth password in a compliance context

- AzukiDAO proposes to initiate a proposal to bring a lawsuit against founder Zagabond.

- Arrington Capital submits application for XRP-based hedge fund to the U.S. Securities and Exchange Commission