The growth engine of the DeFi field: a detailed explanation of the four innovative mechanisms of Uniswap V4

Uniswap V4's four innovative mechanisms that drive DeFi growth, explained in detail.Author: Daniel Li

On June 13th, Uniswap released the Uniswap V4 version code draft, which caused a strong shock in the industry and also became a hot topic in the past few weeks. As the largest decentralized trading platform, Uniswap has long held more than 50% of the on-chain trading share, and its trading volume is more than three times that of its second largest competitor. The launch of Uniswap V4 will further consolidate its position as the largest DEX in DeFi.

In Uniswap’s “Our Vision for Uniswap v4” and “Uniswap v4 Core WhiteBlockingper” (white paper), Uniswap Labs introduced in detail Hooks that can achieve AMM customization, Singleton that changes the account framework and order logic, and Flash accounting and Native ETH that can greatly reduce Gas fees. These innovative features will bring greater freedom, better liquidity, lower transaction fees, and more choices to DEX. At the same time, it injects a catalyst for DEX, which has been in a weak position in the competition between DEX and CEX in the long term, accelerating the pace of DEX catching up with CEX, which will have a profound impact on the future development of DeFi.

Uniswap leads the development of the entire DeFi industry with innovation

The reason why the upgrade of Uniswap V4 has attracted the attention of many institutions is that on the one hand, the US Securities and Exchange Commission (SEC) sued the world’s largest CEX Binance, which made institutions in the industry begin to worry about the future development of CEX, and DEX with decentralization and anti-auditability undoubtedly gained more favor. In addition, the most important point is that as the industry leader, every version of Uniswap’s release has led the development direction of DEX, been imitated by successors, and driven the prosperity and development of the entire DeFi. Let’s review each historical version of Uniswap below.

- MPC+AA is the path that Crypto wallets with a billion users must go through for Mass Adoption.

- Weekly Preview | FTX Debt Claim Website to Launch; Sui to Unlock Tokens Valued at Over $20 Million

- An Interpretation of ERC6551

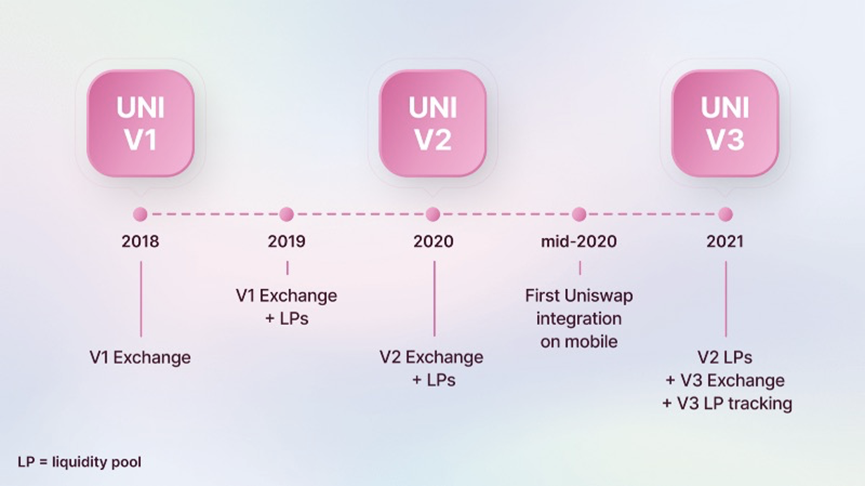

Uniswap V1 was the first official version, launched in November 2018. It provided transactions between ERC-20 tokens and ETH, and introduced the automated market maker model for the first time, automatically adjusting token prices and liquidity, making token transactions faster, simpler, and lower-cost. This approach also inspired many later decentralized exchanges and laid the foundation for the development of the entire DeFi ecosystem. During the same period, SushiSwap, Curve Finance, and Bancor all learned from Uniswap V1’s approach.

Uniswap V2 was launched in May 2020, further providing support for trading between ERC-20 tokens and introducing liquidity mining mechanisms that reward liquidity providers to increase the liquidity of trading pairs. With V2’s liquidity empowerment, projects that emerged during the same period include Yearn.finance, AAVE, Compound, and Chainlink.

Uniswap V3 was launched in May 2021, introducing concentrated liquidity and price limit order (PLC) functions. Concentrated liquidity allows market makers to more effectively manage funds, thereby increasing their profits and efficiency. PLC allows users to set upper and lower limits on transaction prices according to their needs, enabling more precise control over trading. During the same period, Concentrated Liquidity and BarnBridge both achieved higher efficiency and returns by using Uniswap V3’s centralized liquidity and PLC functions.

Uniswap V4 is the upcoming new version, although the specific launch time has not yet been announced. According to information released by the project team, the Uniswap V4 version will be different from V1-V3, no longer a technical innovation from scratch, but a comprehensive subversion from the infrastructure of DeFi. For example, V4 will provide token pools that can be created and managed independently, AMMs that can add new functions through “hooks”, and a large contract framework to replace the previous factory/pool mode, etc. These innovations will further strengthen Uniswap’s characteristics as a decentralized trading platform and bring new changes and opportunities to the entire DeFi ecosystem.

Uniswap V4: Four Innovative Mechanisms to Create DeFi’s True Infrastructure

As an important participant and leader in the DeFi industry, Uniswap has played a crucial role in promoting industry progress and improvement. Uniswap V4 will create an efficient, flexible, and low-cost infrastructure that is truly suitable for DeFi by introducing innovative mechanisms such as Hooks, Singleton, and Flash accounting, providing users with a better trading experience and more opportunities. Let’s take a closer look at these new features of Uniswap V4.

Hooks

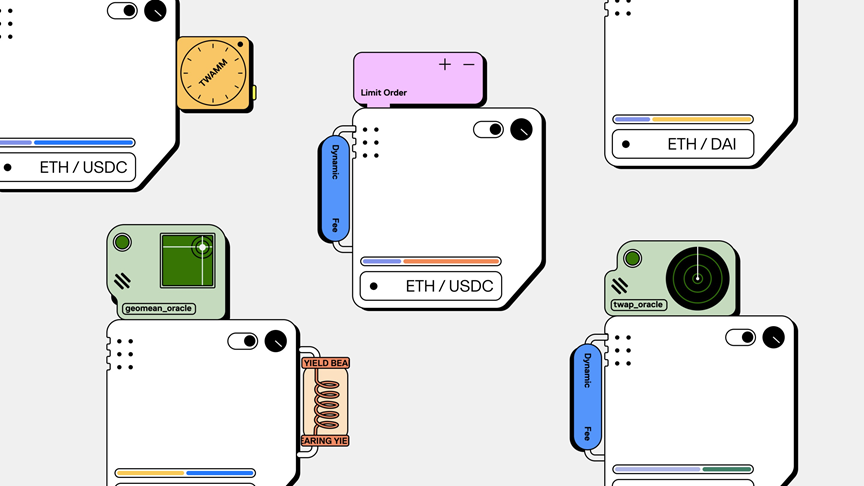

One of the key innovations of Uniswap V4 is the introduction of “hooks,” which are essentially external contracts created and defined by developers to define transaction logic. With hooks, developers can call external contracts to perform specified operations at specific points in the lifecycle of the liquidity pool (such as adding, adjusting, deleting, and exchanging), such as creating limit orders before trading or adjusting transaction fee levels after changes to the liquidity pool positions.

By adding plugin functionality through Hooks, Uniswap V4 has become a customizable liquidity pool platform. This customizable feature is unattainable for centralized exchanges. Developers can freely experiment and develop new features based on this foundation to meet various trading scenarios and make liquidity more deeply bound to the project’s own development. In addition, this customizable feature can inspire the imagination and creativity of developers and the community, further increasing the network effects of Uniswap V4, making it a fundamental infrastructure for the entire DeFi ecosystem.

Currently, Uniswap V4 displays the following Hook samples:

- Time-Weighted Average Market Maker (TWAMM)

Traditional AMM market makers create significant slippage when executing large trades because the price in the pool changes during the transaction process. TWAMM reduces price fluctuations, slippage, and improves trade smoothness by splitting large trades into several smaller trades that complete over a period of time, providing a better trading experience for users.

- Dynamic Fees

Dynamic fees are calculated based on factors such as the amount of assets in the liquidity pool, trading volume, and volatility. When market volatility is low, trading fees decrease, providing a more competitive trading environment. When market volatility is high, trading fees increase correspondingly, protecting the stability and security of the liquidity pool.

- On-chain Limit Orders

On-chain limit orders are implemented by introducing a new contract type called the limit order contract, which allows users to automatically execute preset trading orders at specific price conditions. With on-chain limit orders, users can trade more flexibly to meet specific trading needs.

- Idle Liquidity Lending

In traditional AMM exchanges, liquidity providers can only deposit assets into the liquidity pool to earn transaction fees and mining rewards. However, if the liquidity exceeds a specific range, this liquidity may not be maximally utilized and becomes idle assets. In Uniswap V4, idle liquidity can be transferred to lending protocols through the idle liquidity transfer contract, improving capital utilization efficiency and increasing revenue sources.

- Customized on-chain oracle

The customized on-chain oracle is implemented through the introduction of a new contract type, called the Aggregator Contract. The Aggregator Contract can select different oracle service providers, data sources, and calculation formulas based on user configuration, thus achieving customized oracle services.

- Internalized MEV profit distribution to LP

In traditional AMM exchanges, MEV profits are usually obtained by miners or other participants, and liquidity providers can only earn revenue from transaction fees and mining rewards. However, by internalizing the MEV profit distribution back to LP, liquidity providers can directly benefit from the MEV profit, thus increasing their revenue sources and levels.

Singleton

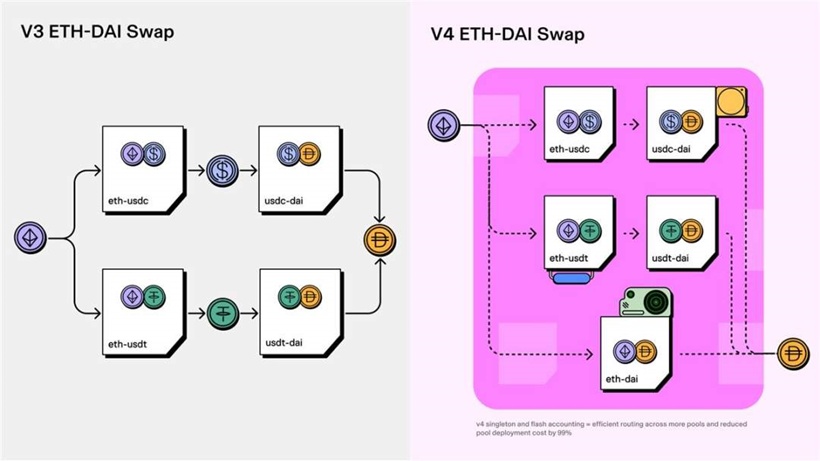

Singleton is a new contract architecture for Uniswap V4. In previous versions, each liquidity pool corresponded to a contract, and when a new liquidity pool was added, a new contract needed to be deployed. This not only increased the deployment cost for developers, but also caused transactions to cross multiple contracts, resulting in increased gas fees and transaction times. In the Singleton architecture, all liquidity pools are stored in one contract, greatly reducing the cost of creating liquidity pools and gas fees, and improving transaction efficiency.

The advantages of the Singleton architecture are mainly as follows:

- Cost reduction: Since all liquidity pools are stored in the same contract, developers do not need to deploy separate contracts for each liquidity pool, thus reducing development and maintenance costs.

- Improved efficiency: The Singleton architecture implements multi-hop transactions, and users only need to call the contract once to complete all exchanges, which greatly improves transaction efficiency and reduces gas fees.

- Scalability: The Singleton architecture can easily add new features and capabilities, leaving more possibilities for future innovations and making Uniswap V4 more scalable and flexible.

- Simplified liquidity position management: In the Singleton architecture, liquidity positions are no longer encapsulated using tokenization, but are managed using addresses, which makes it easier and more efficient to manage liquidity position data.

Flash Accounting

Flash Accounting is a new accounting method introduced on top of the Singleton contract architecture. In previous versions, the balance of all relevant positions needed to be calculated for each transaction, which consumed a lot of gas and led to high transaction costs. The Flash Accounting system can calculate transaction fees based solely on the net balance (i.e., the change in balance), thereby reducing gas consumption.

Specifically, the FlashAccounting system takes advantage of the fact that all liquidity pools in Uniswap V4 are managed by a single contract. When a user makes a trade, the Flash Accounting system queries the current pool’s net balance (i.e. the difference between the buy and sell volumes) and calculates the transaction fee based on the user’s net balance in the trade. By only calculating the net balance, the Flash Accounting system can avoid computing the balances of all relevant positions, reducing the amount of gas required for the calculation.

In addition to reducing gas consumption, the FlashAccounting system can improve cross-pool routing efficiency and further reduce the cost of trading across multiple pools. This feature, combined with the hooked contract, becomes very useful, supporting more complex integrations and innovations, which can greatly increase the number of pools.

Native ETH

Native ETH in Uniswap V4 refers to direct trading between Ethereum’s native token (ETH) and other tokens during the trading process. In previous versions, in order to trade between ETH and other tokens, one had to convert ETH to the WETH token first, which required multiple trades and gas fees, resulting in high transaction costs and low efficiency.

In Uniswap V4, the concept of Native ETH has been introduced, allowing for direct trading between ETH and other tokens without first converting to WETH. This can greatly reduce transaction costs and time. At the same time, Native ETH can also increase liquidity, attracting more liquidity providers to enter the Uniswap V4 ecosystem and provide better liquidity and prices for traders.

Specifically, Uniswap V4 adds an ETH pool to the core contract, which is used only for direct trading between ETH and other tokens. When a user makes a trade between ETH and other tokens, the system automatically compares the transaction volume with the amount of ETH in the pool, and then calculates the corresponding amount of other tokens based on the ratio. As a result, users can directly trade between ETH and other tokens in Uniswap V4 without going through the cumbersome conversion process. Therefore, the introduction of Native ETH makes Uniswap V4 more convenient and efficient, providing users with a better trading experience, and further strengthening the liquidity and competitiveness of Uniswap.

Uniswap V4 may become an opportunity to solve the DEX dilemma

In the digital asset trading market, CEX and DEX are the two main exchange models. Due to long-term liquidity issues, poor user experience, high trading fees and costs, DEX has long been overshadowed by CEX in the digital asset trading market. With the rapid development of DeFi, the development dilemma of DEX has also attracted more and more attention. In this context, the release of Uniswap V4 may become an opportunity to solve the DEX dilemma. Through innovative solutions, Uniswap V4 plans to improve DEX from four aspects. Once successful, it will lead more institutions to join in and jointly promote the complete solution of the DEX dilemma.

Improving Liquidity: Liquidity is one of the core issues of DEX. Uniswap V4 enhances the customizability and liquidity of DEX by introducing Hook function and internalized MEV profit distribution back to LP, among other hooks. Hook function allows anyone to use custom contracts to deploy liquidity pools, making Uniswap’s liquidity more composable and scalable, while internalized MEV profit distribution back to LP can encourage more LPs to participate in Uniswap liquidity provision, thus improving liquidity.

Improving User Experience: Uniswap V4 introduces TWAMM algorithm and limit order function, which improve the efficiency of price discovery and the user’s trading experience. The TWAMM algorithm can calculate prices based on time-weighted average, reflecting more accurate market prices, while the limit order function allows users to set upper and lower price limits, better controlling trading risks. These features can improve the user experience and attract more users to participate in DEX trading. In addition, the Hook custom contract for deploying liquidity pools can meet users’ different needs and greatly enhance their experience.

Lowering Trading Fees: Trading fees are one of the most important reference indicators for users to choose exchanges. Uniswap V4 lowers trading fees through hooks such as internalized MEV profit distribution back to LP and flash accounting. Internalized MEV profit distribution back to LP can increase LPs’ income, thus lowering users’ trading fees, while flash accounting can reduce the cost of frequent trading, providing users with lower trading costs and higher efficiency.

Improving Cost Efficiency: Uniswap V4’s Singleton architecture sets all LP contracts to a single contract, which not only reduces the gas cost of creating LP and multi-hop trade, but also greatly improves the efficiency of deploying contracts. Coupled with flash accounting to reduce the cost of frequent trading, Uniswap V4 helps users achieve maximum benefits or value at minimal cost, while also providing a better foundation for the sustainable development of DEX.

Conclusion

Uniswap is one of the important pioneers in the DeFi industry, and has been constantly introducing new innovative mechanisms to drive the development of the entire industry. Uniswap V4, as the culmination of these innovations, is undoubtedly a major innovation in the DeFi industry and even the entire cryptocurrency industry. Uniswap V4 gives users greater freedom, higher liquidity, lower fees, and more complete and convenient services, making it a more competitive trading platform, and also promoting the progress and improvement of the entire DEX industry.

Although there is still a big gap between DEX and CEX in terms of user experience, cost, and security, this gap is gradually narrowing with the continuous updates and improvements of the Uniswap version. It is believed that in the near future, Uniswap V4 will occupy a more important position in the competition between DEX and CEX, become the liquidity growth engine of the DeFi industry, and lead the development direction of the entire industry.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Time and patience are the scarcest resources for any brand.

- Did BCH triple in two weeks? Is the resurrection of PoW narrative just a dream?

- Exploring Whether LUSD Will Become the Best Choice in the Stablecoin Competition Landscape?

- Understanding ZeroLiquid: A Non-Liquidating Zero-Interest Lending Agreement Secured by LST

- Development of Polkadot parallel threads has already begun. Learn how it works.

- Will the combination of the ZK and OP methods become the future of Ethereum Rollup?

- Has the PoW Narrative Renaissance become a dream as BCH tripled in two weeks?