Concerns arise over the association between TUSD and Prime Trust as issues with the minting and redemption system emerge.

Issues with the minting and redemption system have caused concerns about the association between TUSD and Prime Trust.Authors: MICHAEL BODLEY & BESSIE LIU, compiled by Blockworks, translated by Shannouba

With increasing interest in short selling, traders say they are analyzing the liquidity and pricing of stablecoin True USD.

The issuer of True USD (TUSD) previously claimed that it had no “affiliation” with digital asset import and export company Prime Trust, which has recently been shut down by Nevada regulators.

However, the latest audit report shows that there is a $26,000 associated risk between True USD and Prime Trust, and regulators have put Prime Trust under receivership. However, compared to the circulating supply of $3 billion of True USD, this associated risk is negligible.

- Guide to landing Web3.0 in Hong Kong Cyberport: How to receive a subsidy of 1.3 million and a free office?

- Guide to landing Web3.0 in Hong Kong Cyberport: How to obtain 1.3 million subsidies and a free office?

- Understanding Ethscriptions in one article: principles and advantages and disadvantages

The minting and redemption mechanism of TUSD tokens has become confusing, and some users have reported difficulties in both areas.

Carlos Gonzalez, a research analyst at 21.co, told Blockworks on Thursday that attributing liquidity issues with TUSD to the $26,000 associated risk with Prime Trust “doesn’t make much sense.”

“It’s a negligible amount compared to its circulating supply of $3 billion. If it was just $26,000, there wouldn’t be much reason to stop the stablecoin from being minted and redeemed, but obviously Prime Trust is the clearing bank for TUSD, and that’s why this happened,” Gonzalez said.

Users who have recently tried to mint TUSD have found that the stablecoin has been reminted back into their wallets. TUSD had previously relied on Prime Trust to provide its users with crypto-to-fiat import and export services.

An independent audit of TUSD’s internal data files conducted on Thursday revealed that the $26,000 asset “is held at a U.S. depository institution that has received orders from state regulatory authorities to suspend deposit and withdrawal services for digital asset accounts.” Industry participants say these findings related to Prime Trust “impede our ability to obtain sufficient and appropriate evidence” to prove TUSD’s issuer’s claim that “cash balances held by the depository institution in the collateral account can be easily exchanged for the equivalent amount of cash.”

It is unclear whether Prime Trust still holds other cash or TUSD assets. Representatives for Prime Trust and TUSD have not responded to or declined to comment on the matter.

Decoupling of TUSD

Due to the above reasons, the price of TUSD has fallen and is decoupled from the US dollar. According to Blockworks’ data, the current trading price is $0.99. Previously, it was more decoupled before Thursday, but the loss has reduced this weekend.

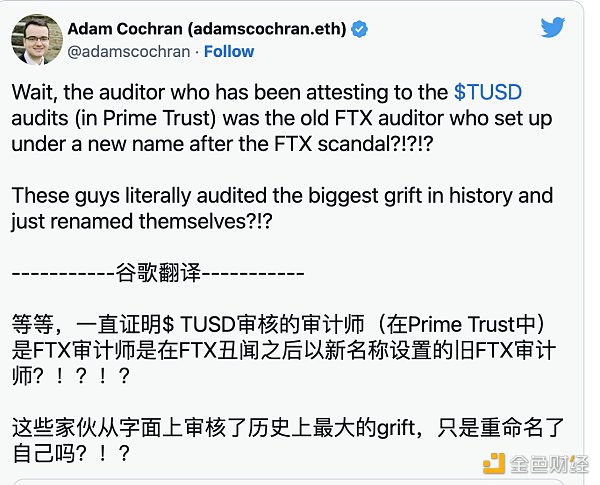

Additionally, there have been concerns expressed about The Network Firm’s attestation report on TUSD.

However, Nic Carter, General Partner at Castle Island Ventures, said that the two companies are not the same.

He wrote on Twitter: “The Network Firm is not a reboot of Armanino, it’s a completely new company specializing in crypto auditing, stablecoin attestations, etc. Armanino closed their crypto practice because they got a lot of negative attention after FTX.”

Meanwhile, centralized exchange Kraken has announced support for TUSD deposits and withdrawals on Justin Sun’s Tron network, potentially allowing users to redeem the token.

Interest in stablecoin lending and borrowing remains relatively strong, Gonzalez said. This is evidenced at least by metrics such as liquidity for DeFi-based lending solutions supporting TUSD and other stablecoins.

According to Blockworks Research, TUSD is the fifth largest stablecoin by market cap, slightly behind DAI, and traded $138 million in volume over the last 24 hours.

Gonzalez said there is a lot of short interest in TUSD, which has had an impact on price. However, lending activity for the stablecoin has increased significantly, with TUSD’s allocation on Curve’s 3pool rising from 27% on June 20 to around 70% on Wednesday.

“Right now, people can’t really redeem the stablecoin. It’s just being recast on-chain, which is clearly a bad sign. We should wait and see if it’s just because of Prime Trust, and whether they can stop this process,” he said.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Delphi Digital: Polygon releases new vision, intertwining OP/ARB stack and cross-chain security

- Speculation about the development of NFTs in the next two years: 99.999% of old NFTs will tend towards zero value, and Grail NFTs have the opportunity to outperform ETH.

- Conversation with Qi Zhou, founder of EthStorage: Data Availability and Decentralized Storage

- Decoding RWA: The most valuable wealth password in a compliance context

- AzukiDAO proposes to initiate a proposal to bring a lawsuit against founder Zagabond.

- Arrington Capital submits application for XRP-based hedge fund to the U.S. Securities and Exchange Commission

- Digging into on-chain data: What’s behind DODO’s 2.6 billion monthly trading volume?