Decoding RWA: The most valuable wealth password in a compliance context

Decoding RWA: The key password for compliance context wealth.On June 29th, Robert Leshner, the founder of DeFi lending protocol Compound, announced the creation of a new company, Superstate, whose mission is to create regulated financial products that connect traditional markets and the blockchain ecosystem.

He is targeting the current hot narrative and entering the world of real-world asset tokenization (RWA).

This aligns with our judgment: We believe that as we enter the era of Web3 native applications, it is necessary to mobilize more real-world assets/capital (RWA) to enter the crypto market to provide capital assistance; especially in the context of compliance, we believe that RWA is the most valuable wealth code of this cycle.

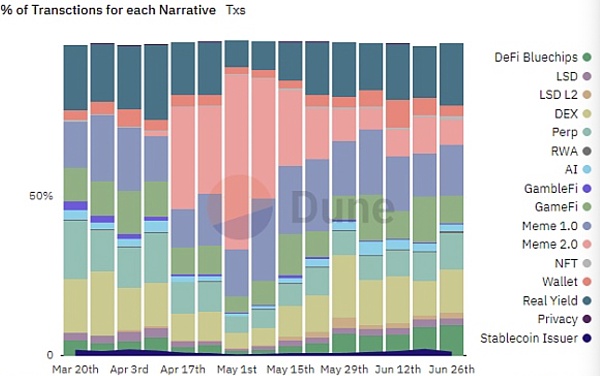

However, in terms of specific data, the LSD L2 narrative will be the winner in Q2 2023, led by new projects such as Pendle, Lybra, and Tenet; Meme 2.0 has experienced a typical rise and fall; and RAW has not yet released its energy. Therefore, our analysis is based on the prediction of crypto narratives and objective environments.

- AzukiDAO proposes to initiate a proposal to bring a lawsuit against founder Zagabond.

- Arrington Capital submits application for XRP-based hedge fund to the U.S. Securities and Exchange Commission

- Digging into on-chain data: What’s behind DODO’s 2.6 billion monthly trading volume?

Former Dust: Why Synthetic Assets Haven’t Blossomed

Before explaining the logic of prediction, it is necessary to trace the history of RWA and predict the future in exploring its conditions of existence and development process.

RWA existed in the early stages as the concept of synthetic assets, which is not a new thing for the DeFi world. Stablecoins, including the US dollar, can be considered synthetic assets (RWA), and they are more of a role linking two worlds, rather than showing strong investment value. It wasn’t until January 28, 2021, when the main battlefield for ordinary investors, Robinhood, and several US local securities brokers successively announced restrictions on opening positions in stocks such as GME and AMC, that synthetic asset protocols became a lifesaver and were highly anticipated. Therefore, its value is not only in the pure crypto world but also in traditional capital markets, including US stocks and foreign exchange.

At the time, people had high expectations for synthetic assets (RWA). Synthetic assets are tokens that represent financial derivatives in digital form. If derivatives are financial contracts tailored to risk exposure for underlying assets or financial positions, synthetic assets are tokenized representations similar to positions. A more intuitive example of synthetic assets is the simulation of some priced assets. For example, the simulation of Apple stock. You can simulate Apple’s stock to construct synthetic assets, synthesize all the assets on Nasdaq and NYSE, and synthesize fiat currencies (foreign exchange), gold, BTC, and other assets.

In November 2021, the synthetic asset project Synthetix upgraded to the Avior version on Optimism, adding a new WrapperFactory contract that can deploy new wrapping contracts to support any ERC20 token. The lending and synthetic asset protocol dForce has partnered with the physical asset financing platform EntroFi to jointly promote physical asset financing (including real estate, bonds, collateralized loans, acquisition financing, accounts receivable, etc.) through liquidity integration across protocols.

This can be seen in the context of the DeFi iteration 2.0 process, as an adjustment and optimization made by synthetic asset developers. Since 2019, we have witnessed a booming DeFi, but project developers and industry observers have begun to examine, reflect and attempt to iterate into a new era. In May 2021, Vitalik Buterin questioned the bubble in the cryptocurrency market capitalization, saying that the actual achievements of projects such as DeFi cannot support their popularity and valuation. The efforts of the synthetic asset (RWA) projects Synthetix, dForce, and EntroFi in 2021 did not achieve the expected success. Subsequently, the market entered 2022, which saw several cryptocurrency market crashes, especially under the emotional impact of U.S. government crackdown-style regulation and the failure of the U.S. market’s synthetic asset (RWA) projects to be accepted by the market.

However, as we enter 2023, the RWA narrative is gradually taking shape. Taking several on-chain national debt projects as an example:

Ondo Finance announced the launch of a tokenized fund in January of this year, bringing risk-free interest rates to the chain, allowing stablecoin holders to invest in bonds and U.S. Treasuries; Matrixport’s asset management company launched a debt platform on the chain, Matrixdock, which went online with national debt-related businesses in late January of this year; and OpenEden, created by former Gemini employees, launched tokenized U.S. Treasuries in April of this year, allowing stablecoin holders to mint TBILLs through the OpenEden TBILL Vault to obtain risk-free returns on U.S. Treasuries…

Timing: RWA in the context of application ecology and compliance

In “Starting with the “Three Transformations of Ethereum”: V God’s Attack and Defense,” we analyzed that at some difficult life-or-death moments, V God drew big pies, saying that he wanted to have 1024 shards and directly increase performance by 1000 times; at some difficult life-or-death moments, V God talked about dreams, envisioned DeSoc, and sought the soul of Web3… But now, V God can talk about life and death, this is V God’s most confident moment. V God has the confidence to promote key and specific transformation plans and build his Ethereum into a decentralized non-monetary application ecology.

This would be the most powerful fundamental support in this cycle, which means that Ethereum has entered the era of application ecology, and this will inevitably require more real-world assets/capital (RWA) to be mobilized to enter the cryptocurrency market to provide capital. Ethereum’s entry into the application ecology will give us confidence in the cryptocurrency narrative, but the biggest support at the market level we think is RWA.

In early June, MakerDAO conducted a nominal survey vote to establish a real-world asset (RWA) Vault called BlockTower Andromeda, which is managed by BlockTower Capital and will invest up to $1.28 billion in short-term US Treasury bonds. The US Treasury bond yield is usually viewed by the capital market as a risk-free interest rate. At that time, the context was that as US short-term interest rates continued to rise and DeFi interest rates fell, the demand for on-chain stablecoins to obtain returns through off-chain markets increased. The latest news is that the founder of Compound has entered the RWA track. This is consistent with our consistent attitude and judgment:

1. In “Why ‘Integration’ Becomes the Value Investment Research Topic of the Next Bull Market”: The “integration” theme of the next bull market includes three dimensions: the integration of web3 technology and many industries; the integration of encrypted economy and sovereign finance; the integration of DeFi and the web3 industry. In this way, with the encrypted economy as the core, the entire world’s economic system will be reshaped, and the world’s financial pattern and order will be rebuilt.

2. In “On the Value Logic of ‘Civilization Stops’ and ‘Bear Market Bottom'”: In the encrypted economic system, when the energy of DeFi’s integration with the web3 industry is bloomed, it will push the narrative of the encrypted world to a higher-order process. If the growth logic of traditional financial capital markets can only come from the main line of economic growth, DeFi can match the excess number of users and user funds in depth and breadth, and show unprecedented development of the economy at the index level.

3. In “Don’t Panic! Look at the Opportunities and Challenges of ‘US Regulatory and Hong Kong New Policies'”: Hong Kong needs to integrate the role of “financial center” into the narrative of Web3/encrypted economy, and needs to transform the restless power of speculative hype in the currency circle into capital that supports the development of Web3 native markets. Among them, the key point is how the Hong Kong government can make good use of the capital allocation role of DeFi, which is native to the encrypted economic system. Of course, the current choice of the Hong Kong government to go online with the trillion-dollar off-chain assets (RWA) is a wise and intelligent choice-the main battlefield for Hong Kong to promote the integration of virtual assets in the encrypted economy with the real-world financial system in the next one or two bull and bear cycles, and can attack and defend.

5. Staking mining: Participants can stake their BGT tokens on the BG Trade platform, contribute to the stability and growth of the platform as liquidity providers, and earn profits.

6. zkDID: BG Trade uses zkDID technology, which allows users to manage self-owned identities without revealing personal information to third parties. This function ensures privacy and data security while achieving real data mining.

During the writing of this article, we hesitated because the RWA (synthetic asset) track existed in the previous cycle but did not shine. Why do we judge that it can become the most valuable wealth password in this round? Therefore, we are always paying attention to industry dynamics. We came into contact with BG Trade as a case study due to the “Exploring Release: Web3 and RWAs” themed forum. We gained confidence in this theme judgment because the founder of Compound entered the RWA track.

As mentioned above, we judge that the application ecology of Ethereum and other public chains will be the strongest fundamental support in this round of cycles, but it is more about giving us confidence. In terms of market level, we believe that RWA is the biggest support-RWA includes “real-world assets with clear monetary value”, including tangible assets such as gold and real estate; or intangible assets such as government bonds or carbon credits. However, the uncertainly and cost pressure of the hundreds of trillions of dollars of off-chain asset ownership cannot be fully realized in the short term. However, the Hong Kong government’s on-chain of trillions of dollars of off-chain assets can become the basis of Hong Kong’s encryption narrative in the next decade or so. Citibank, BCG (Boston Consulting Group) and other traditional institutions estimate that the tens of trillions or $16 trillion RWA market in 2030 has been launched, mainly in digital and structured assets, including BlockTower Andromeda, the main business chain of the sovereign bond market of Superstate, and BG Trade’s coin-stock market.

As the era of the application ecology of the encrypted world approaches, RWA is becoming a bridge between traditional finance (TradFi) and decentralized finance (DeFi). We look forward to reaping rewards in the new cycle, whether it is ecological construction or market investment.

Note: This article was collaboratively created by TheprimediaDAO. The main collaborators are TheprimediaDAO founder Jerry (@ThePrimedia) and TheprimediaDAO Builder, TigerVCDAO Investment Head BeeGee (@BeeGeeETH).

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Top 10 Web3 Events in the First Half of 2023 Inventory

- Page 181: A Complete Review of Coinbase’s Legal Documents – Strong Response to SEC Lawsuit, Seeking Dismissal of Case.

- Conversation with EthStorage founder: Data Availability and Decentralized Storage

- How infrastructure supports billions of users through account abstraction

- Page 181: A Comprehensive Review of Coinbase Legal Documents: Strong Response to SEC Lawsuit and Seeking to Dismiss the Case

- The growth engine of the DeFi field: a detailed explanation of the four innovative mechanisms of Uniswap V4

- MPC+AA is the path that Crypto wallets with a billion users must go through for Mass Adoption.