DeFi P / E: Valuation of DeFi Tokens

Foreword: In the current crypto field, there are not many projects that can generate cash flow. In addition to centralized exchanges and mainstream public chains, the main ones that can generate substantial cash flow are DeFi projects. So, if we follow the traditional price-earnings ratio approach, can we value DeFi tokens? There are definitely problems and imperfections in this method, but it may be a way for us to understand the value of the DeFi protocol. Lucas Campbell, author of this article, is translated by "LCs" in the "Blue Fox Notes" community.

In traditional finance, the PE ratio is a simple and straightforward formula that can be used to understand how investors evaluate a company's future growth expectations relative to its earnings. By definition, the PE rate means that the market is willing to pay $ x for every $ 1 the company generates. High-tech growth stocks like Netflix have a PE ratio of 84.2, which means the market is willing to pay $ 84 for every $ 1 earned by Netflix.

Generally speaking, the price-earnings ratio is an effective tool for assessing capital assets. Capital assets, such as stocks, bonds, and income-generating properties, all provide investors with cash flows based on future returns.

With the advent of DeFi in 2019, we can see the emergence of new currency protocols on Ethereum. Many of these currency agreements generate cash flow by charging a small fee for use. These cash flows are used to: 1) directly distribute them to participants in the ecosystem 2) drive scarcity by destroying native tokens. Although the destruction of native tokens may not intuitively seem to directly bring benefits to token holders, the destruction of tokens is actually a dividend because it leads to token holders holding tokens in the network or agreement Increase in proportion.

- CT detection of new coronary pneumonia with AI

- How to become a Bitcoin Core contributor? The most complete Bitcoin developer guide is here

- Is Bitcoin mining center moving from China to North America? Chinese "miners" have something to say

As many unlicensed currency agreements accumulate cash flow, P / E ratios can be a useful tool for evaluating native tokens because they have similar properties to traditional capital assets. Considering that crypto assets are still in their early stages, this is not a perfect measurement or evaluation method, but it does provide a simple framework for comparing the relative positions of tokens of the same type.

From the perspective of crypto assets, the P / E ratio equation can be expressed as follows: liquid market value / annualized income

DeFi Token Revenue

This is the background of the currency protocols we have chosen, and how they capture fees by using volume.

* Synthetix

It is a synthetic asset issuance agreement in which SNX holders can pledge tokens and earn fees incurred by trading synthetic assets.

* MakerDAO

In multi-collateral Dai, the spread between the DSR and the stabilization fee can be used to destroy the MKR.

* Kyber Network

KNC tokens are used to pay token transaction fees. Part of the KNC is destroyed and permanently removed from the circulating supply. The remaining part is allocated to the reserve manager who pledged KNC.

* 0x

The token transaction will incur a fee denominated in ETH and will be prorated to the liquidity provider that pledges ZRX.

* Nexus Mutual

ETH and DAI from expired insurance will be added to the capital pool, thereby increasing the value of NXM tokens.

* Augur

When REP token holders honestly report the outcome of any forecast market, they can earn ETH (soon Dai) fees.

* Aave

The costs of borrowing are allocated between the lender and the agreement. The cost of the agreement is used to destroy LEND tokens.

* Uniswap

All transactions on Uniswap incur fees, which are allocated to the liquidity providers of each respective liquidity pool.

Synthetix

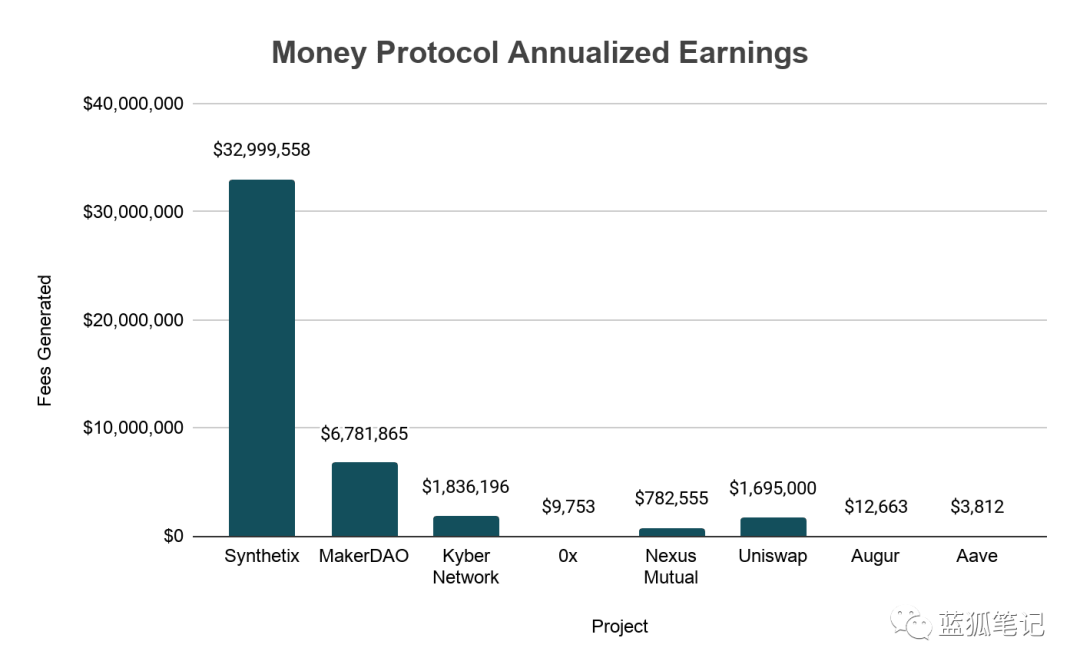

Judging from the annualized cash flow of major currency agreements, Synthetix is the clear leader, which generates annualized fees close to $ 32 million through the Synthetix exchange. Synthetix charges a 0.3% fee for all synthetic asset transactions, and the fees generated are prorated to SNX pledgers who provide pledges to the underlying synthetic assets.

Maker

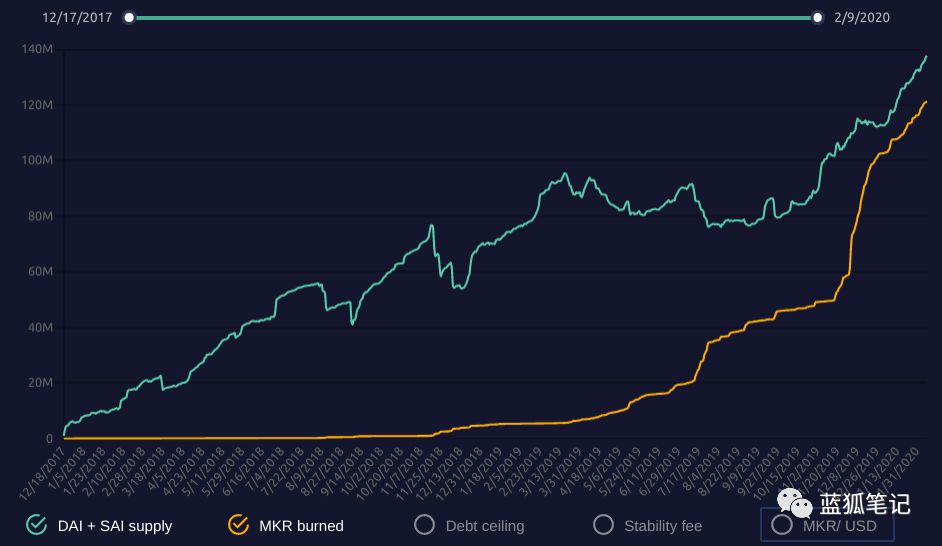

Although MakerDAO is the largest currency agreement by market value and the basis of other currency agreements, it only captures $ 6.7 million in annualized revenue through stabilization fees. Recently, it has transitioned from SCD (Blue Fox Note: Single Mortgage Dai) to MCD (Multi Mortgage Dai). At the same time, it has also changed the destruction drive of MKR because it introduced DSR (Blue Fox Note: Dai Savings Rate).

DSR allocates the stabilization fee obtained from the system's outstanding debt to Dai holders (locking their Dai to the holders of smart contracts). As a result, there is a difference between the DSR and the stabilization fee, which is currently 0.25%, of which the DSR is 7.5% and the stabilization fee is 8%. The cash flow generated from this difference is used to purchase and destroy MKR, thereby providing MKR holders with a wide range of dividends, while MKR holders are responsible for governing the overall system. (Blue Fox Note: This new value capture mechanism has led to a reduction in the amount of MKR destruction in the short term, because most of the stabilization fee is allocated to DSR. This part of the stabilization fee was originally used to destroy MKR. But if it can motivate more Large cakes will not necessarily be destroyed in the long run. The key is the size of the M1 money supply that Dai can capture)

Kyber & Uniswap

The two largest license-free liquidity agreements in DeFi are Kyber and Uniswap. They are the only two of them that can generate 7-digit annualized revenue. For Kyber, part of the fee is used to destroy Kyber's KNC tokens, and the other part is allocated to the reserve pool manager. Importantly, Kyber's forthcoming Catalyst upgrade will change how costs are accrued, allocated, and destroyed throughout the system. Another well-known license-free liquidity agreement, Uniswap, is an ecosystem of unissued tokens in which fees are allocated to liquidity providers who pledge token pairs of ETH and other tokens in the pool.

Nexus

Nexus Mutual is the last currency agreement to earn substantial cash flow. It is a decentralized insurance agreement. Nexus Mutual operates in a "bonding curve" mode, and users can purchase insurance on smart contracts where value is stored. (Blue Fox Note: The bonding curve was proposed by Simon de la Rouviere, and it describes the functional relationship between "token buying and selling prices" and "total amount of tokens issued.")

This kind of insurance is to cover the occurrence of hacking or vulnerabilities in smart contracts within a specific time (set by the user at the time of purchase). If the insurance expires without any claims, the ETH and DAI used to purchase the insurance will be added to the capital pool, thereby increasing the value of the NXM token.

0x, Augur, and Aave

The last few major currency protocols, including 0x, Augur, and Aave, all received a small fee, especially when looking at their market capitalization. Aave is fairly new and we can discount its accrued expenses. However, 0x and Augur have been on the Ethereum mainnet for quite some time.

Having said that, 0x has recently changed its token economic model, allowing liquidity providers to pledge ZRX and earn ETH-denominated fees. On the other hand, Augur is waiting for the upcoming v2 upgrade, which predicts that the market's capital pool will be denominated in Dai instead of the more volatile ETH. Among other improvements, this change will increase the accessibility of the decentralized prediction market platform.

P / E ratio

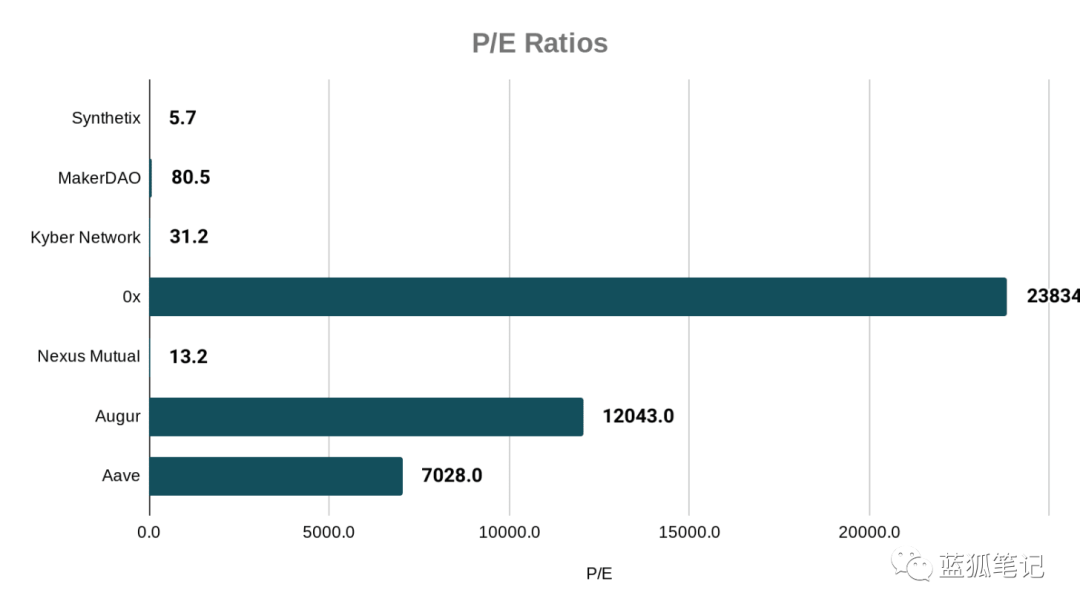

Taking into account the cash flow generated by all of the above agreements, here are the price-earnings ratios of these major DeFi tokens (higher likely means overvalued)

Defi's P / E ratio

Defi's P / E ratio

As we can see, in terms of crypto assets and traditional capital assets, both Synthetix and Nexus Mutual have very low price-earnings ratios of only 5.7 and 13.2. Given that these tokens drive open, license-free financial products (synthetic assets and insurance), the future growth of these currency protocols may be underestimated by the wider market.

Kyber Network is followed by a P / E ratio of 31.2, which is at the same level as Microsoft PE's 30.27. Kyber Network established itself as one of the leaders in license-free liquidity agreements in 2019, but the price action reflecting this growth has largely not materialized. In the coming months, it will be interesting to see how its price-earnings ratio changes as its upcoming Katalyst upgrades (token economic restructuring).

With a P / E ratio of about 80 times, MakerDAO corresponds to many high-growth stocks today. Over 12,000 MKRs were destroyed (Blue Fox Note: at the current price, it is equivalent to destroying about 7.5 million USD worth of tokens), and the circulation of Dai exceeded 100 million. MakerDAO has achieved tremendous growth in the past few years. Will continue to serve as one of the core projects for the development of DeFi.

Although the dollar-denominated price has been stagnant, it is largely due to the poor performance of Ethereum over the past few years. From the perspective of Ether, MKR's performance is actually quite good. Its assets are measured by ETH price, which has increased by 124% since January 2018.

The rest of the tokenized currency protocols, such as 0x, Aave, and Augur, all have extraordinary price-earnings ratios. According to the traditional capital market, it is almost unimaginable. In this way, we can assume that these protocols may either require larger-scale usage to generate cash flow, or restructure their token mechanisms to capture value from usage and protocol fees.

Comparison with CeFi

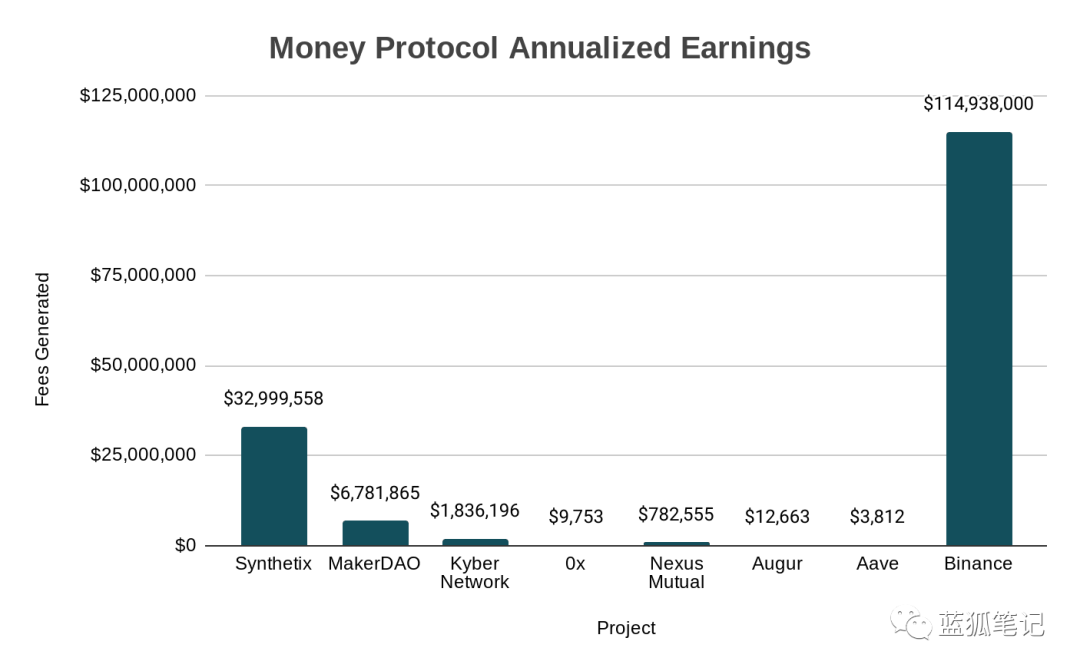

Although open, permissionless currency protocols seem exciting, we have also seen token strategies from major “crypto banks” such as Binance and BNB tokens.

Every quarter, Binance will use part of its profits from operations to destroy BNB tokens. Based on Binance's quarterly profits, it will effectively bring benefits to BNB token holders. Although the community has some different opinions on how to execute these token destruction (for example, BNB tokens are not purchased from the open market, but are destroyed from their crowdfunding reserves, these have never entered circulation, etc.) In terms of revenue, a centralized, licensed crypto bank is better than a decentralized, non-licensed currency agreement. And far better than them. (Blue Fox Notes: As far as current value capture is concerned, crypto banks represented by exchanges are still the largest value capturers. For details, please refer to the previous article of Blue Fox Notes, “Capturing Value in the Cryptoworld: Who Are the Super Capturers?” ? ")

In the past four quarters of token destruction, Binance destroyed a total of nearly 115 million USD worth of BNB tokens.

According to the annualized return of 115 million US dollars, the liquid market value of BNB tokens is 2.83 billion US dollars, then the price-to-earnings ratio of BNB is 17, which is relatively reasonable for the most valuable tokens in this field. Of course, although the income is impressive, it should be noted that BNB token holders do not have the same legal protection as equity holders.

Two thought experiments

1. What would happen if DAI reached 400 billion

The article "Ethereum's Economic Bandwidth Theory: The Billion Dollar Market for ETH" outlines Dai's potential under several hypothetical scenarios. The idea is that if Dai captures a small portion of the global money supply, then we need billions of dollars in circulation, if not trillions.

So, how will MKR tokens be affected in this case? With the price-earnings ratio of MKR, the cost of spreads, and the circulation of Dai, we can use the following algebra to predict the price of MKR.

Our formula for calculating MKR price is:

Liquid market value = earnings * price-earnings ratio

If Dai catches …

51% of M1 supply in Argentina = $ 13 billion

1% U.S. M1 supply = $ 40.3 billion

10% of U.S. M1 supply = $ 403.4 billion

Moreover, we assume …

Spread: 0.25%

Price-earnings ratio: 80

MKR supply: 1,000,000

So we come to …

If it reaches 10% of the US M1, the MKR price will exceed $ 80,000. (MKR currently costs $ 617)

Like the article "Ethereum's Economic Bandwidth Theory: ETH's Billion Dollar Market", the above figures are just to understand the future value of MKR, and you must have your own thinking (Blue Fox Note: The author here means that All the above figures are just experiments of thinking, not necessarily happening, so you cannot make investment decisions based on these, you need to have your own judgment and thinking)

This estimated MKR price does not take into account MKRs that have been destroyed in the past, but only calculates from the fully diluted MKR supply. In addition, DSR, stabilization fees, and potential spreads will change in the future. (Blue Fox Note: According to the past management history of Maker, DSR, stabilization fees, and spreads are almost certain to change in the future, so the above calculations are just thinking exercises)

In addition, if these numbers are realized, the P / E ratio will also change. If Dai continues to capture more money supply (and it will decrease in the future), investors may price MKR at a lower price-earnings ratio due to expected future growth decline. (Blue Fox Note: That is to say, the global money supply is relatively fixed. The more money the Dai captures, the less space there is in the future. However, it may be too early to worry about it. After all, even a drop in the ocean is not enough.) )

The opposite may also be true: If Dai's narrative as a global, license-free, stable value store is widely recognized, and the market believes that there are significant growth opportunities in the future, then investors may be able to give MKR even higher Pricing.

2. What will happen if Uniswap issues tokens?

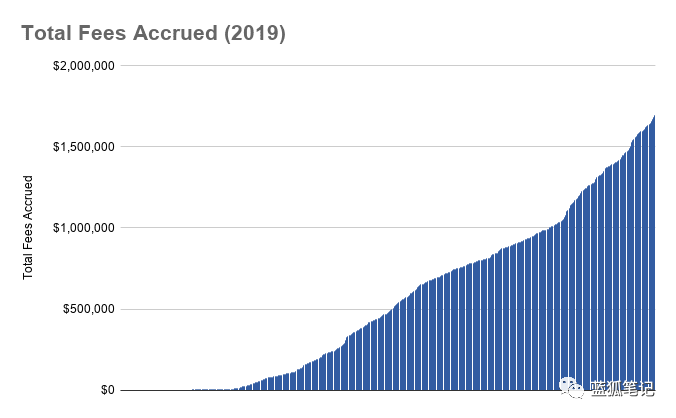

Uniswap quickly built itself into one of the leading license-free liquidity protocols on Ethereum. In 2019 alone, Uniswap has accumulated $ 1.69 million in fees. However, although it allocates millions of dollars in fees to liquidity providers, it lacks native tokens.

(From DeFiRate)

Let us assume that Uniswap decides to integrate native tokens in the future. So, what is the "fair value"? Where will it be in terms of market capitalization?

First, we quickly design a token economy for Uniswap that captures value from its transaction fees:

In order to become Uniswap's liquidity provider and be entitled to the cash flow of the agreement, then users need to hold X amount of UNI tokens.

Not elegant, but simple. UNI will represent the right to collect fees from Uniswap.

So, given the current $ 1.69 million gain, what should Uniswap's market capitalization be?

Observe that its closest competitor, Kyber Network, has a price-earnings ratio of 31, then Uniswap's tokenized liquidity can reach $ 52.39 million. If, given the explosive growth of Uniswap over the past year, investors may think that the price-to-earnings ratio of its tokens should be higher, then let us increase its price-earnings ratio to 50.

Calculated at a price-earnings ratio of 50, Uniswap's liquid market value will reach $ 84.5 million, exceeding Kyber's current $ 76 million. (Blue Fox Note: 50 * 1.69 million US $ = 84.5 million US dollars, in addition, the current market value of Kyber is 77 million US dollars)

Just for fun, if we increase the price-earnings ratio to 100 (still less than half of Tesla). Uniswap's mobile market value will reach US $ 169 million, making it among the other DeFi protocol levels, such as Augur (US $ 158 million), Synthetix (US $ 185 million) (Blue Fox Note: Synthetix ’s market value has fallen sharply recently and has dropped to 1.53 One hundred million U.S. dollars)

Conclusion

Considering that these currency agreements generate cash flow and have similar properties to traditional capital assets, it makes sense to calculate the price-earnings ratio for DeFi tokens.

Importantly, DeFi tokens are unlikely to accumulate currency premiums (as SNX may have), as they primarily promote the underlying protocols and are not used as reserve assets or value storage. (That is to say, the tokens of these protocols mainly capture the value of fees, not the value of the currency itself, which is significantly different from the underlying assets of public chains such as btc and eth. This is why synthetix has recently considered increasing its collateral cause of eth)

Therefore, from the perspective of traditional capital assets, it seems fair to look at DeFi tokens this way. Tokens like Synthetix and Nexus Mutual have very low price-earnings ratios, indicating that their use is high relative to their market value. This may mean that they are undervalued by the market as a whole, or that their future growth is not expected. (Given that DeFi is still very early and their future potential, this seems unlikely.)

On the other hand, tokens like Augur and 0x have extremely high price-earnings ratios, which means that these token protocols are in a difficult period to accumulate large amounts of cash flow relative to their market value. It seems that crypto investors either: (1) overestimate these assets, or (2) have extremely high expectations for their future growth.

In any case, looking at DeFi tokens from a price-earnings ratio perspective gives investors a clearer understanding of the use of these protocols and potential investment opportunities in the future.

It is also obvious that this industry is an emerging industry. In terms of cash flow, there is still a long way to go to compete with licensed crypto banks, and the gap is even wider when competing with traditional companies.

Risk Warning: All articles of Blue Fox Notes can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Perspective | Adjusting Bitcoin Units Could Be the Key to a Bull Market

- Under the epidemic, how can blockchain technology empower medical data sharing scenarios?

- Bitcoin's secret history: 21 million is not the ultimate total of Bitcoin

- "China Maritime Arbitration Commission Online Arbitration Rules" formally released: clear electronic evidence identification, connecting core technologies such as blockchain

- BIS: 2019 Central Bank Digital Currency Survey, CBDC Coming

- Digital currency is becoming a consensus. Why is there still many obstacles to Libra landing?

- How many people own at least 1 Bitcoin? In-depth analysis suggests that about 400,000 to 800,000 people