Comment: IRS doesn't consider Bitcoin as a virtual currency at all

The Internal Revenue Service (IRS) has removed claims on its website that it uses game currencies as examples of convertible virtual currencies. This clarification is important because the new tax declaration requires taxpayers to report whether they are involved in virtual currencies.

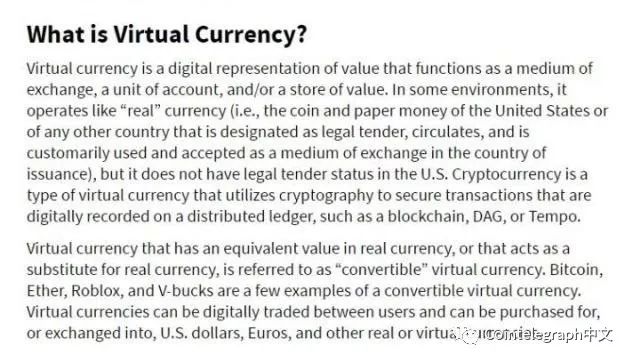

On February 13, Bloomberg Tax reported the move for the first time. The official guide on the IRS website states that V-bucks in Fortnite and Robux in Robot Bricks are both virtual currencies. A screenshot of the official website provided by Bloomberg Tax shows a fairly detailed concept of virtual currency, which even mentions blockchain alternatives, such as directed acyclic graph (DAG).

Source: Bloomberg Tax

- Bobby Lee: Bitcoin will eventually reach $ 1 million

- Hardcore | 2040: A World Without Bitcoin

- Crypto company BlockFi secures $ 30 million in funding, Silicon Valley legend Peter Thiel's venture capital agency leads again

Bad example of virtual currency

The IRS's definition of virtual currency depends on its ability to "operate like a 'real' currency," meaning it needs to be freely transferable between users and easily convertible into fiat currency.

A spokesman for Imperium, publisher of Fort Night, told Bloomberg that none of the above explanations apply to game currency:

V-bucks cannot be 'used by users for digital transactions', nor can they be 'converted into U.S. dollars, euros, or other real or virtual currencies'.

A representative of Roblox expressed a similar position, but also pointed out that Robucks can be converted into fiat currency under certain circumstances. The company added that related transactions were automatically submitted to the IRS.

The revised official guide only mentions BTC, removing previous references to Ethereum (ETH), and the reference should have the same definition.

Radical position on cryptocurrencies

U.S. tax enforcement agencies have recently taken a powerful step to curb tax evasion using cryptocurrencies. Now, there is a simple problem in the 1040 table:

Considering that fraud on the form could result in a fine of up to $ 250,000, this measure could be used to force cryptocurrency users to report their earnings.

Such a move can be quite complicated. For example, every cryptocurrency to cryptocurrency exchange is considered a taxable event that must be reported. Although some people hope that these transactions fall into the category of "similar transactions," an IRS official denied it , saying that the definition meant that cryptocurrency income would only be taxed when converted to fiat currency.

Cryptocurrency taxation is a topic that is not yet clear, as regulators around the world take a very different approach. For example, France does not levy taxes on cryptocurrency transactions.

But the US Congress recently introduced a new bill that could simplify the use of cryptographic payments by eliminating tax returns for low-value transactions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Observation | Blockchain concept stocks have now achieved speculative bubble-related business revenue of only 10%

- Blockchain analysis company Elliptic receives $ 5 million investment from Wells Fargo

- $ 100,000 for the next stop? The bitterness of the world makes Bitcoin more brilliant

- Hedge fund managers: "deflation crisis" triggered by the Federal Reserve will cause Bitcoin to soar

- Data privacy dilemma: slow humanity in technology iterations

- Featured | Here are our top ten data discoveries for the crypto market in 2019

- Perspective | ENS: Why We Choose Ethereum Over Another Stove