Nearly 200,000 bitcoins, only "selling" 180 million, how can the US and Australia miss the big bull market of cryptocurrencies?

In the history of Bitcoin ’s 10-million-fold skyrocketing history, many early investors have become wealthy, such as Wu Jihan, Jiang Zhuoer, Roger Ver, etc., they have achieved stratum crossing, becoming the earliest fans and firm of Bitcoin Supporters .

However, there are also many investors who cannot bear the plunge after the bitcoin surge, and choose to "get off the bus" midway, which leads to permanent missed opportunities and regrets. For example, Chen Sijin, 480,000 brothers, etc. Some of them left the circle and some changed Become "bit black".

This is true of individual investors, as well as at the national level.

After “seizing” a large number of so-called illegal bitcoins, many countries chose to quickly divest, and suffered “losses” in the subsequent surge of bitcoin. For example, the United States—the country that sold the most bitcoin at the national level—and some countries have been curious about cryptocurrencies. Showing unprecedented "passion", such as North Korea.

- Monthly Data Report | The plan for the year lies in the spring, and the plan for reducing production lies in the stockpile

- Ronaldo is followed by Messi, FC Barcelona will issue fan tokens

- Beware of the "sequelae" of anti-epidemic, can blockchain protect personal privacy data?

1 the country that sells the most bitcoin-the United States

The countries that have sold the most bitcoin in history are Uncle Sam.

According to a recent survey by Jameson Lopp, CEO of key security company Casa, the U.S. government has so far seized a total of 185,230 BTC, and its auction proceeds total approximately $ 15144 million, and with the current Bitcoin price breaking through $ 10,000 again, these bitcoins The value has reached $ 1.874 billion.

Based on this calculation, the US government lost about $ 1.72 billion (12 billion yuan) in gains. [1]

U.S. government auctions of bitcoin quantity and time Jameson Lopp collates data

The largest bitcoin "income" in the history of the US government comes from the US Marshals Service. In 2013, the US Marshals Department confiscated 175,000 bitcoins from the dark web " Silk Road " .

After confiscating the bitcoin, the bailiff returned to normal procedures and disposed of it in the same way as cocaine smugglers' speedboats: auctions. This was a challenging task, due to the huge market value of 175,000 bitcoins, which accounted for 2% of all circulating bitcoins at the time. According to prosecutors familiar with the case, the bailiff adopted a staggered auction to prevent the value of Bitcoin from plummeting. [2]

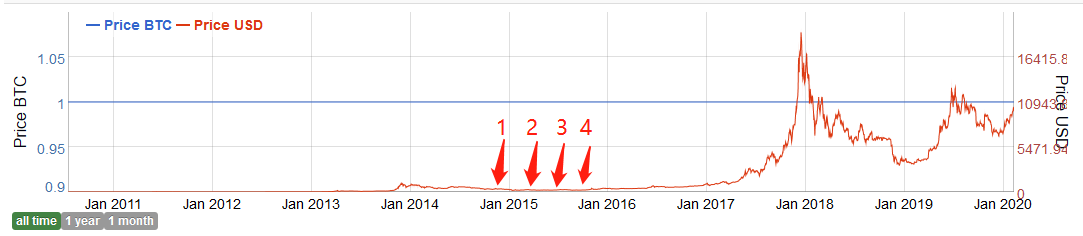

The specific method is to divide these bitcoins into four rounds of auctions. Let us review these four auctions.

The first " Silk Road " Bitcoin auction was held at the end of June 2014. Tim Draper sold 29,656 Bitcoins at a price of around $ 500. A total of 45 registered bidders participated in the auction and a total of 63 bids were generated. At that time, the price of Bitcoin was around $ 500.

The second round of the " Silk Road " Bitcoin auction was held in December 2014, and 48,000 of the 50,000 were purchased by the Bitcoin Investment Trust. At that time, the price of Bitcoin was around $ 350.

The third round of the " Silk Road " Bitcoin auction was held in March 2015. 14 bidders participated in the 50,000 BTC auction. The auction was worth 13.4 million U.S. dollars and there were 34 times in the 6-hour auction process. tender. Details were not disclosed. At that time, the price of Bitcoin was around $ 270.

The fourth round was held in October 2015. At that time, the New York Bitcoin Exchange itBit announced that it successfully won 10,000 BTC at the fourth Silk Road Bitcoin auction, but did not disclose the transaction price at that time. In addition, the remaining 34,341 Bitcoins confiscated from the Dark Web Silk Road were also transferred, but the identity of the buyer was not disclosed. At that time, the price of Bitcoin was around $ 240 (this was the lowest price in previous auctions).

With the auction of the last 44,341 BTC, the 173,997 BTC that the US Marshals seized from Ross Ulbricht, the director of the Silk Road, has been auctioned.

U.S. Marshals' location for four large-scale auctions of Bitcoin

According to the information that has been released so far, the individual who has captured the most bitcoin from the US Marshals Agency should be Tim Draper, co-founder of Defengjie Investment Co., which he Communist Party in two auctions Earned 31,656 BTC, and at the same time estimated based on the bitcoin market price at the auction, Draper also had the highest bid cost.

Looking back on the entire process, the US Marshals Agency's eagerness to sell these Bitcoins can be described as a "loss" . Jameson Lopp, chief executive of key security company Casa, said that the US Marshals Service has lost more than $ 1.7 billion (about $ 11.9 billion) in gains to date due to its early auction of bitcoin.

However, the pace of U.S. Marshals auctions of Bitcoin does not appear to be slowing down.

On January 22, 2020, the U.S. government announced that it would auction off 40.04.54 BTC (worth about $ 40 million). According to the bailiff official, this auction will be held on February 18th. Only participants who have passed the pre-registration ($ 200,000 deposit) can participate in the online auction, while unsuccessful auction participants will be in the auction. Get a refund at the end.

I believe that the United States will sell more cryptocurrencies in the future.

Following Uncle Sam , Australia also auctioned bitcoin confiscated from drug dealers.

According to a Global Network report on June 1, 2016, Ernst & Young (Ernst & Young), a multinational financial management services company that is one of the four largest auditing companies, was responsible for Australia's 24,518 bitcoins, which were worth $ 16 million at the time . Ernst & Young will sell the confiscated cryptocurrency at auction, allowing bidders to bid for 24,000 Bitcoins. These Bitcoins are divided into 12 shares, of which 11 are 2,000 Bitcoins each. [3]

Roughly calculated, the Australian government indirectly caused losses of US $ 229 million (1.6 billion yuan) due to the early sale of these bitcoins. Of course, as Bitcoin continues to appreciate, this number will inevitably become larger.

Contrary to the US, Australia and other government departments choosing to auction Bitcoin, other countries regard these cryptocurrencies as treasures in their pockets, such as North Korea.

2 North Korea, the country with the most "credit" cryptocurrencies

Among many countries, North Korea is the country that loves cryptocurrencies the most, but their means of obtaining cryptocurrencies are not bright. Many news reports and international events can also explain this from the side.

In mid-September 2019, the U.S. Treasury Department announced sanctions on three North Korean hacker groups. Specifically, the sanctions include Lazarus, a well-known hacker group, and Bluenoroff and Andariel, two other relatively low-profile organizations.

These North Korean hackers were sanctioned because they were involved in numerous thefts of cryptocurrencies around the world.

In a report released by the United Nations in early 2019, the North Korean hacker group Lazarus was accused of creating five cryptocurrency thefts. The attack targeted four South Korean cryptocurrency exchanges, each of which was Yapizon (with a loss of 3816 BTC, or 5.3 million). USD), Coinis (loss unknown), YouBit (loss of 17% of assets), Bithumb (loss of $ 32 million), and a Japanese exchange Coincheck (loss of 523 million NEM ($ 534 million)), five attacks were reported The total profit was as high as $ 571 million.

Just as the U.S. Treasury announced sanctions against North Korean hackers, the UN Security Council's "Korean Sanctions Committee Expert Panel" re-issued a report stating that North Korea was alleged to have targeted financial institutions and virtual Currency exchanges carried out 35 cyber attacks, stealing a total of nearly $ 2 billion in fiat and cryptocurrencies. However, North Korea denied the allegations earlier this month and accused the United States of spreading rumors.

Of course, the United Nations is not the only one who publicly accuses North Korean hackers of stealing cryptocurrencies.

On February 4, 2020, KoreaHerald, Korea ’s largest English-language information platform, announced that the originator of the $ 7 million cryptocurrency that had stolen DragonEx from the cryptocurrency exchange was the North Korean hacker group Lazarus. [4]

The research results were announced by blockchain analysis company Chainalysis. The latest findings of the research firm show that the North Korean hacker group Lazarus hacked into the Singapore-based crypto exchange DragonEx in March 2019 and stole about $ 7 million worth of cryptocurrency. , Including BTC, XRP and LTC.

Chainalysis even restored the theft process of the hacker organization: Lazarus hackers created a fake company, claiming to provide an automatic cryptocurrency trading robot, and forged websites and company employees, thus reaching the core figures of DragonEx. DragonEx employees downloaded a free-trial trading robot software that allowed hackers to hack their computers and steal millions of dollars. Chainalysis also points out that Lazarus is different from other hacker groups in that its motivation is mainly to make money, not to create chaos.

In addition, there is more detailed research on North Korea's "intimate relationship" with cryptocurrencies.

Cointelegraph reported earlier this year that North Korea ’s Internet usage has surged 300% in the past three years as North Korean government agencies continue to carry out various activities through cryptocurrencies.

Monero is an anonymous cryptocurrency created in April 2014

In addition, North Korea has shown a strong curiosity about Monero. A recent report from US cybersecurity company Recorded Future states that since May 2019, Monero (XMR) mining network traffic originating from North Korea ’s IP range has grown “at least ten times”, making it more than Bitcoin in the mining industry And become the most popular crypto asset. [5]

As for why hacking organizations from North Korea have such a strong "acquisition desire" for Bitcoin, a report from the US cybersecurity company Recorded Future intelligence agency Insikt Group gives the answer: The use of cryptocurrency and blockchain technology is North Korea is one of the main strategies for generating income, transferring and using illegally obtained funds.

As a global emerging asset, the cryptocurrency represented by Bitcoin is bound to attract the attention of more and more countries as its market value continues to increase.

Some deals are purely for making money, such as North Korea; others are purely for asset disposal, such as the United States. But anyway, all these activities will make the entire cryptocurrency ecosystem develop in a healthier direction.

Reference link:

[1] Bitcoin's strong five-figure return, but the US government lost $ 1.7 billion;

[2] Demystified: How much bitcoin has been hoarded by the US Marshals Service;

[3] Australia will confiscate Bitcoin for the first time outside the United States;

[4] The originator who previously stolen DragonEx's $ 7 million cryptocurrency was the North Korean hacker group Lazarus;

[5] New report from US cybersecurity company: North Korean hackers steal funds from South Korean cryptocurrency exchanges

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Comment: IRS doesn't consider Bitcoin as a virtual currency at all

- Bobby Lee: Bitcoin will eventually reach $ 1 million

- Hardcore | 2040: A World Without Bitcoin

- Crypto company BlockFi secures $ 30 million in funding, Silicon Valley legend Peter Thiel's venture capital agency leads again

- Observation | Blockchain concept stocks have now achieved speculative bubble-related business revenue of only 10%

- Blockchain analysis company Elliptic receives $ 5 million investment from Wells Fargo

- $ 100,000 for the next stop? The bitterness of the world makes Bitcoin more brilliant