DeFi Series Report | Decentralized Encrypted Asset Lending Platform

DeFi: Decentralized finance, as a branch of Dapp, seems to be one of the best use cases for blockchain technology. This article translated the first part of the DeFi report series released by the Institute of Credit Research, which focuses on the cornerstone application type of DeFi: decentralized encryption asset lending platform. An in-depth analysis of representative DeFi projects, market participants and motivations, and the advantages and risks of these platforms compared to a centralized financial system.

This article was translated from the report issued by the Institute of Credit Research on June 6th, and some of the contents were slightly deleted.

Original report:

Https://info.binance.com/en/research/marketresearch/defi-1.html

- Opinion: How far is the blockchain deposit really “landing”?

- Bittorrent Speed beta users question BTT blockchain technology: perhaps the revenue component is not online at all

- Facebook will release a cryptocurrency white paper on June 18; the US SEC sues Kik for billions of illegal ICO

Core Abstracts Decentralized finance, also known as open finance, or DeFi, has evolved into one of the core drivers of Ethereum's web applications. The core principle of DeFi is to provide a new, unlicensed financial services ecosystem that can be used by anyone in the world without any central authority. In this ecosystem, users are the custodians of their own assets, have complete control and ownership of their assets, and they are free to enter all decentralized markets on the market. Lending agreements and platforms provide market participants with different motivations for use, such as: For borrowers: you can short an asset or borrow a right (such as governance). For a lender: you can use your own assets to earn interest on the above. Both: There are cross-platform arbitrage opportunities. Compared to traditional financial products, decentralized, non-custodian agreements offer several promising advantages, such as transparency and price effectiveness , because prices are subject to market demand. Facilitating convenience and speed when lending occurs Anti- regulation and immutability However , given the experimental nature of these financial prototypes, they do show some specific shortcomings compared to centralized competing products, such as: technical risk ( transactions) The risk of the opponent is replaced by the risk of the smart contract.) Low liquidity (ie, it is difficult to borrow on a large scale without affecting the current interest rate level) Overall, the cryptocurrency-driven lending sector is still in its early stages, but A compelling value proposition that individuals and institutions can use the past credit model to provide a broader The funding channel does not require a trusted intermediary or a third party. While it is difficult to determine which platforms or protocols will attract the most users in the long run, the tools together provide more and more decentralized solutions to capitalize and form a more comprehensive DeFI toolbox.

This report is the first article in our DeFi series , covering a number of different platforms and protocols that are designed to disrupt the existing financial industry and infrastructure. Overall, this report will discuss the cornerstone application of DeFi: Decentralized Encrypted Asset Lending Platform.

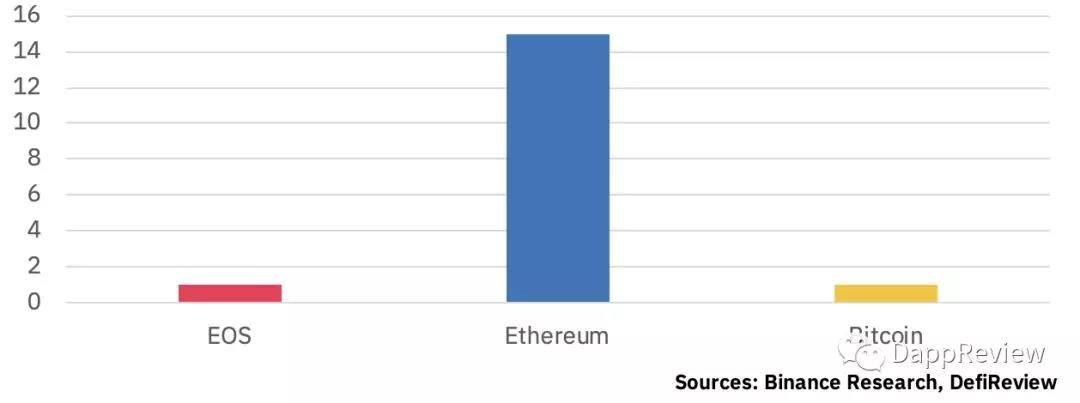

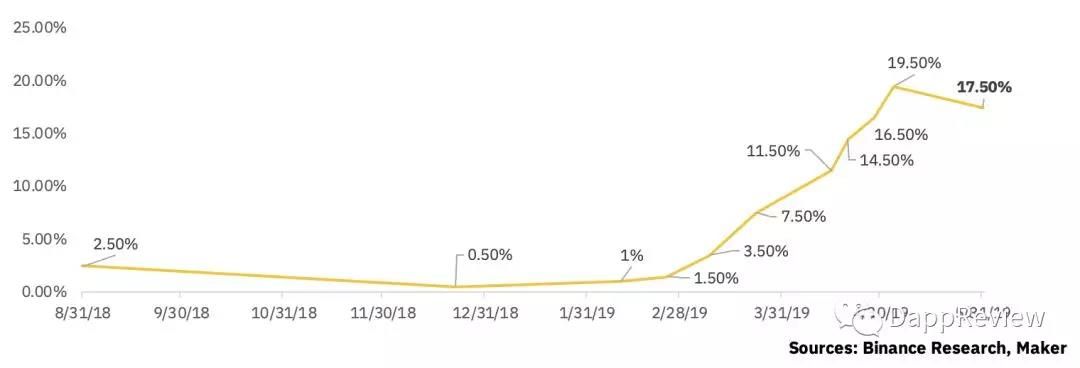

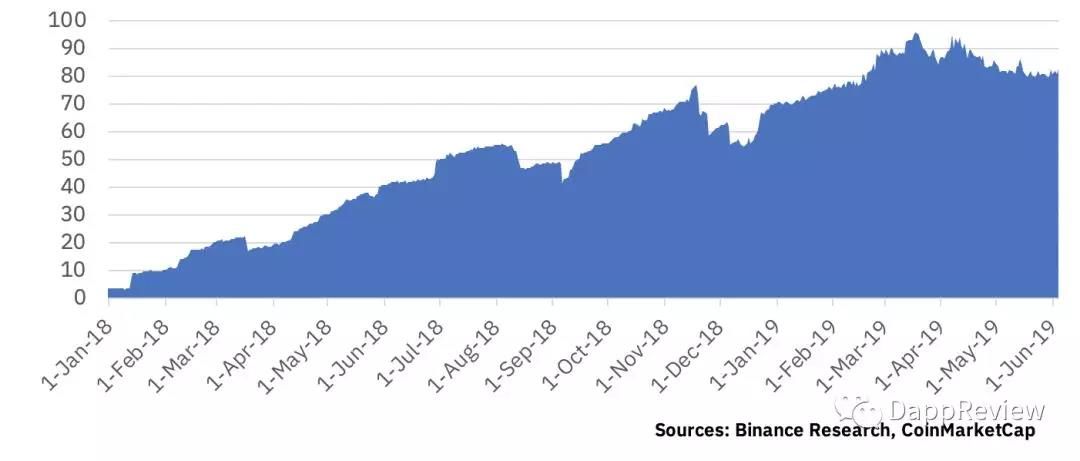

Although open finance is inherently platform-independent, most DeFi-like applications are currently being developed and used in Ethereum. The stable currency Dai is one of the cornerstones of DeFi, and Dai is a decentralized stable currency collateralized by encrypted assets, produced in the Maker ecosystem.

As of May 31, 2019, Ethereum dominated the existing applications, the number of transactions, and the amount of money locked in platforms such as Maker and Compound. Therefore, the DeFi class Dapp based on Ethereum will be the focus of this report.

For a long time, loans have been built on trust between the two parties. So, compared to the centralized platform, how does the decentralized platform for decentralized encrypted assets match loans between anonymous strangers without trust?

1. Decentralized lending overview

DeFi can be defined as:

“An ecosystem of unlicensed blockchains, peer-to-peer protocols, and applications built on decentralized networks to promote lending practices or trade with financial instruments.”

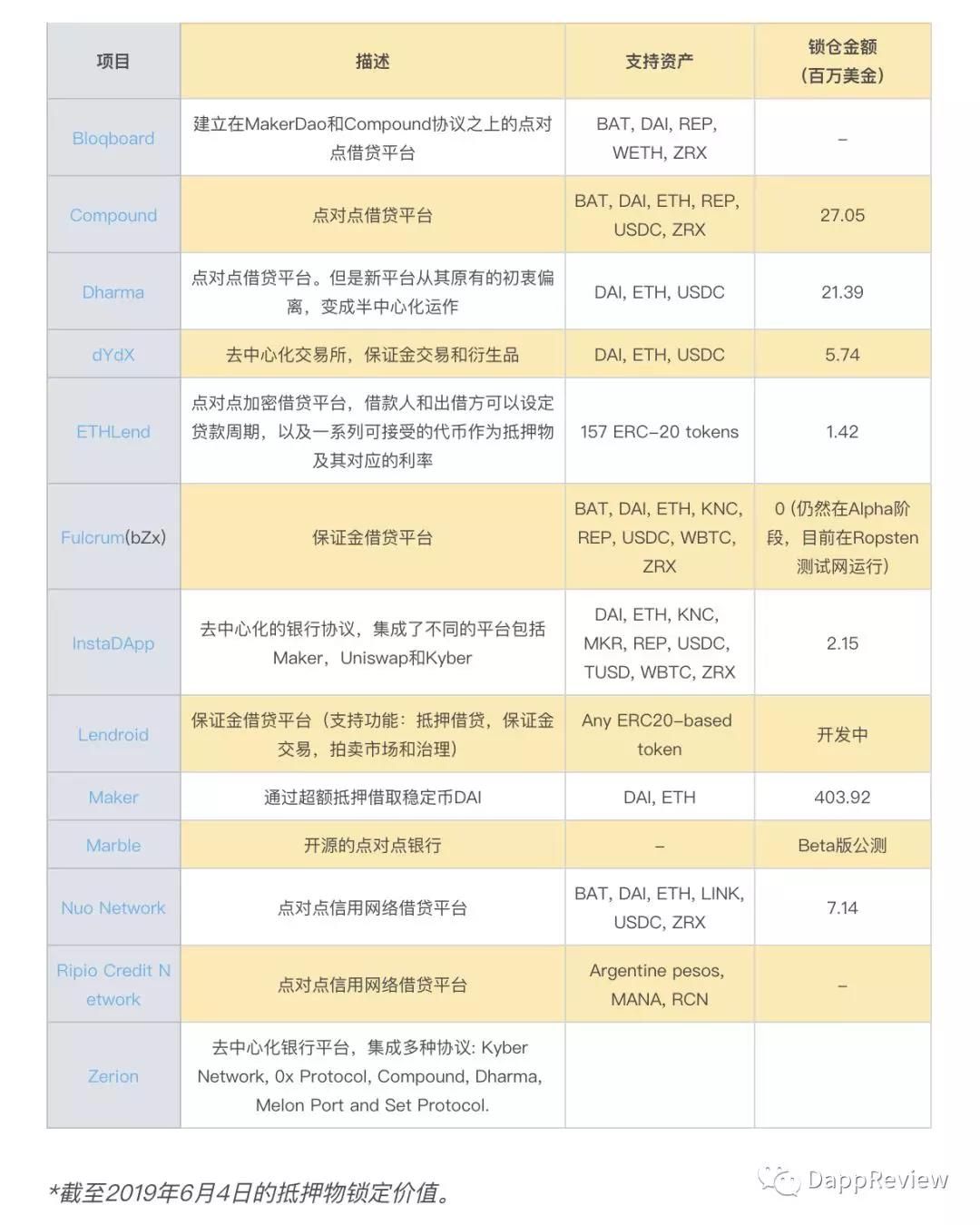

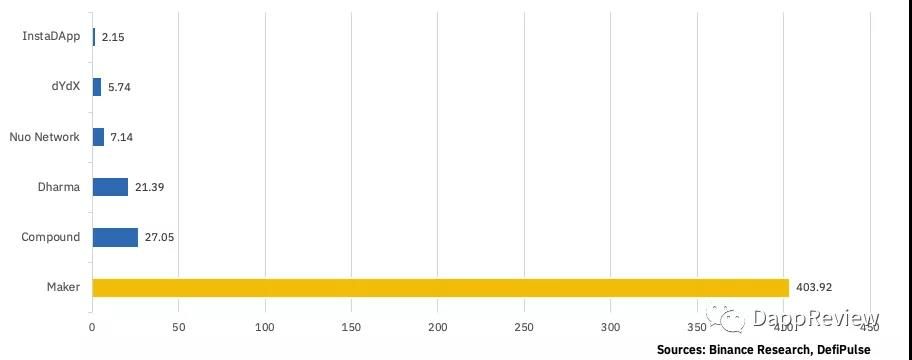

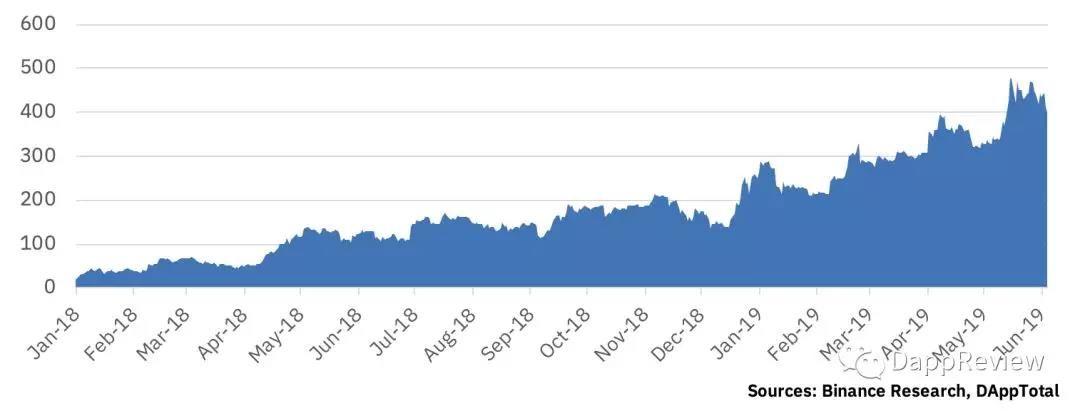

Figure 2 – Total amount of locked positions in the DeFi application (in millions of US dollars) (as of June 5)

- Loan collateral

- Loanable assets

- Borrowable assets

- Governance assets (eg MKR)

Point-to-point lending pools can be divided into two types:

- Direct pairing (eg Dharma, Ethlend, etc.)

- Liquidity pool (eg Compound, dydx)

In most of these platforms, the platform directly matches lenders and debits, and there is a spread between interest rates, and the platform or protocol developer maintains operations through spreads as revenue.

Each market is linked to a cToken (such as cBAT), which acts as an intermediary for lending assets on the agreement. With cToken, the lender can get interest accrued over time. Specifically, the amount of interest is accumulated in the block dimension. During the loan period, a new block comes out every 15 seconds, and cTokens will continue to increase.

In Compound, there is also an undo feature that allows users to convert cTokens to their original assets (for example, from cBAT to BAT).

The interest rates for each asset are based on real-time market supply and demand relationships. When the borrower's demand is excessive, the interest rate will increase, and the excess amount of the borrowing will result in a drop in interest rates. In addition, the lending rate is always lower than the borrowing rate to generate liquidity on the platform.

2. Market participants

- "Reward" for long-term investment. Long-term position holders (ie, value investors) can receive rewards through these interest rates (usually denominated in the same currency), giving them new sources of income (in addition to capital appreciation or “HODL strategies”). For example, investors who invest in Ethereum for a long time can benefit from these lending platforms and receive additional yields.

-

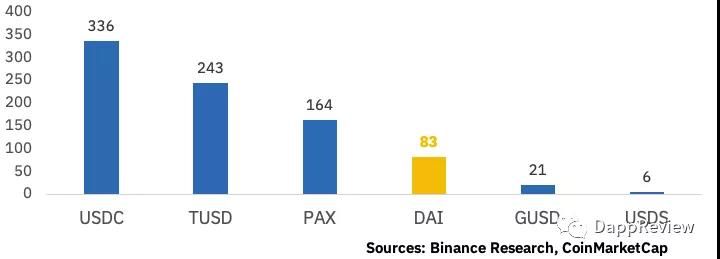

The dollar's yield on stable currencies. Unlike most regular bank accounts in banks, stable currencies do not generate any yield. Storing dollar-denominated stable coins on digital wallets is similar to keeping dollar notes in leather wallets: no one can bring in revenue. Considering the risk of inflation, this translates into a depreciation of the effective value of the stable currency. For stable currency issuers, in order to compete for market share, some of the revenue from the bank deposits is motivated to be distributed to users who support the circulation supply through these decentralized platforms.

- Ability to short assets. The borrower can short the asset by borrowing the asset and immediately sell it on any exchange to obtain another cryptocurrency (usually a stable currency). This has a similar function to the central exchange's margin trading. Similarly, it provides the ability to trade margin on platforms that do not support this feature. For example, a trader can short assets on Coinbase (because it does not allow margin trading). As the list of borrowable assets expands over time, this application scenario will become more and more valuable.

-

Borrow the use value of the token (for example, borrowing governance rights) . The borrower can decide to (temporarily) borrow assets to gain more power or governance power in the blockchain. For example, someone can borrow REP (Augur) to participate in the resolution mechanism on the chain.

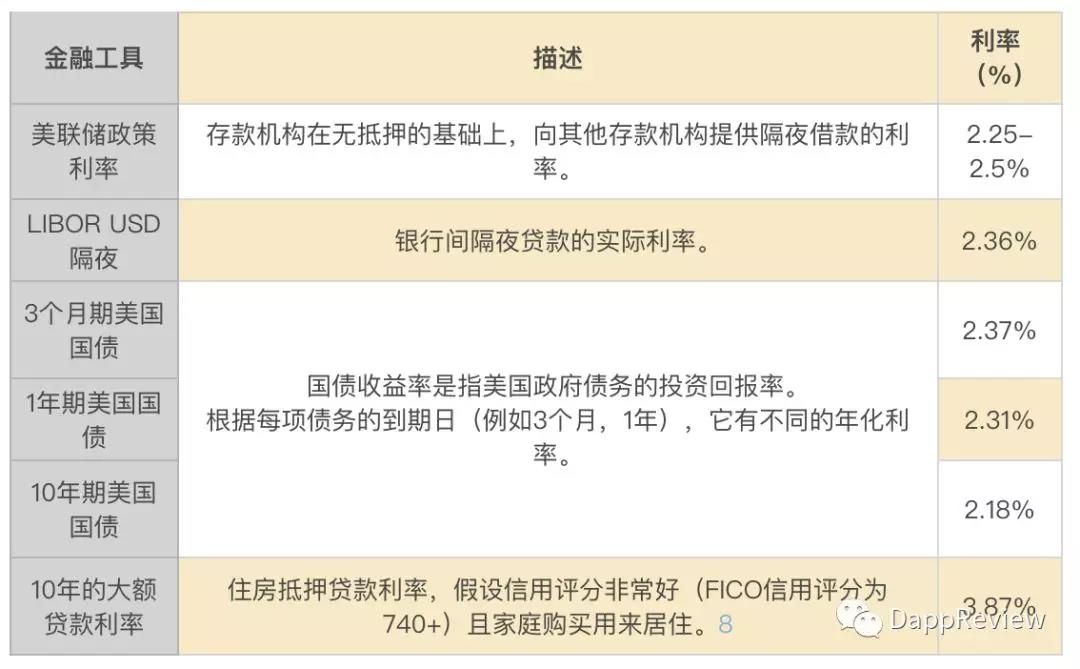

- Arbitrage between the decentralized platform and the centralized platform. As of this writing, Dharma offers a 90-day loan at USDC's 8% annual interest rate. There are arbitrage opportunities for consumers who are able to obtain credit in US dollars (based on regulatory arbitrage of existing visits to KYC accounts, etc.). Arbitrage can borrow dollars at an interest rate below 8%, transfer those dollars to Coinbase to purchase USDC, and then lend USDC to Dharma. However, such arbitrage is affected by specific risks. For example, if the demand for a specific interest rate defined by the platform is insufficient, the loan may never match the one on Dharma. In addition, these opportunities also have potential risks (traders, platform-specific risks), which are discussed in detail in the next section. Ultimately, arbitrage may exist on platforms with limited access (or more rigorous KYC) and these opportunities may last longer.

-

Arbitrage between decentralized platforms: This is expected to be even more rare as decentralized platforms currently have large spreads between lending rates. One of the main reasons is that the participation rate of this industry is low, after all, it is still in the early stage. Not only that, but because of the nature of these open decentralized platforms, the number of participants who eliminate arbitrage opportunities is greater. On top of that, these arbitrage opportunities are usually fleeting, as many platforms integrate lending information on other platforms (such as Zerion). In addition, for pure arbitrage, the two loans must have similar parameters. In particular, the term (term length) and maturity date of the loan must be the same or similar in order to best perform such arbitrage, otherwise the potential risks may include network environmental factors, (invoiced) native inflation rate, price changes Risk and early repayment/liquidity (regardless of whether the interest rate and duration are fixed or variable). If different platforms have different policies on how the borrower closes the position before the loan expires, there may be a risk of early repayment.

3. Risks and advantages of decentralized agreements

- Increased price efficiency: Since loan and loan agreements allow anyone to short on assets, higher price discovery and efficiency can be achieved in the marketplace.

-

Immutability and anti-censorship: A single transaction cannot be reversed and no third party can stop the borrowing process. This creates an effective market without review and does not discriminate against users.

- Broader capital access: Participants living in capital-controlled countries can obtain stable coins based on other legal currencies, such as the US dollar or any stable currency denominated in French currency (eg, pounds, euros).

- Transparency and efficiency: On a pure P2P lending platform, interest rates are determined only by market participants, and loans are secured through over-collateralization . Moreover, information about the loan can be publicly and easily obtained without cost.

- Flexibility and loan isolation: Use a wallet to borrow multiple cryptocurrencies at the same time. Different risks can also be completely independent. For example, you can borrow USDC with ETH through one wallet, and another wallet borrows BAT with ETH. If a loan defaults (ie, the value of the collateral is below its clearing threshold), it will only affect the collateral because the risk is isolated. However, for platforms that allow multilateral mortgages, risk can be reduced by bringing together different assets into a single set of collateral.

-

Reduce process cost/turnaround time: Unlike traditional financial industries, decentralized finance removes all intermediate credit reviews, and any user can borrow funds very quickly at market prices.

- Ability to transfer borrowed funds across platforms and trading venues : Unlike centralized loan trading venues, individuals can borrow funds and transfer them freely to other locations, with only collateral locked into smart contracts.

- Fully escrow funds: People who want to trade margins can effectively short assets on decentralized exchanges without abandoning tokens

-

Ability to conduct margin trading in restricted jurisdictions . On a fully decentralized loan agreement, the entire process takes place on the chain and does not require KYC. Therefore, any market participant – regardless of national policy – can access assets (whether long or short) and then enter margin trading.

- Lack of insurance mechanism: Unlike the traditional financial industry, there is no insurance mechanism for chain loans. Therefore, there is a risk of default, although some platforms may provide insurance for users in the event of a default by the counterparty, which is still a general defect of these decentralized platforms.

- Difficulties in redeeming legal tender: Since loans are denominated in cryptocurrency, it is often difficult to convert these loans into legal tender. It seems that it is difficult to use these borrowed funds in the real economy, but this is actually a broader issue, which involves how to use blockchain assets more widely in the real economy. In addition, the support of mortgage-stable coins (especially USDC) may further motivate users to lend funds and redeem French currency using native blockchain assets such as Ethereum.

- Over-collateralization does not help "unopened" users (ie users who do not have encrypted assets): Since there is currently no credit score available, the loan must be over-collateralized. For users who do not have encrypted assets, there is no opportunity to borrow. So these loans and lending platforms do not serve economic growth because one of the prerequisites for loans is overcollateralization (sometimes as high as 150%). Another system based on credit scoring is also under development, but it is not clear how to design such a blockchain lending system without a clear KYC policy, but it is possible to further “discriminate” some market participants.

-

Over-collateralization has little effect on leveraged trading: although funds can be borrowed and transferred to other platforms, but because of the need for over-collateralization, speculative traders are less interested in borrowing on decentralized platforms and agreements. Centralized exchanges make margin trading easier to operate, relying on automated margin systems, sophisticated clearing algorithms and insurance funds to allow traders to create highly leveraged positions.

- Network congestion: Ethereum may be blocked by applications like crypto cats; FCoin's chain voting policy also caused Sybil Attack. In the event of network congestion, transactions may remain in a wait state, eventually leading to market inefficiencies and information delays.

-

Transaction costs, such as Gas fee: Since the transaction is based on Gas fee competition, transactions with low Gas Fees may await confirmation at a lower priority. Conversely, some products sometimes do not have a clear or fixed Gas fee, which can result in higher costs for users.

- Lack of complete transparency. For example, Dharma is the third-largest DeFi app, but there is still a lack of transparency in certain areas. It is unclear how the fixed interest rate for each asset is defined because it is not affected by the market environment (supply and quotation dynamics). In addition, the loan matching process is opaque. There is no real-time information on how many loans are pending, and there is no way to audit whether the matching of loans is based on fair rules such as “FIFO (first come, first served)”.

- Interest rate governance : The centralized platform can change interest rates at any time, bringing uncertainty to lenders and borrowers.

-

Counterparty risk : If the platform is semi-centralized (the funds are sent directly to the smart contract through the transfer of the intermediary), the platform itself can control the assets and potentially use the funds maliciously.

- Failure of the price mechanism : Some oracles, that is, data providers that value mortgage assets, have operational risks, such as data manipulation or the inability to retrieve the correct market data due to price sources. This can lead to problems with incorrect valuation of mortgage assets.

- Volatility risk: If prices fluctuate too quickly, some users may be forced to liquidate their mortgage assets.

- Smart Contract Defects: Because transactions cannot be reversed on the blockchain, hacking attacks caused by any problem in smart contracts can cause significant losses to users of decentralized protocols. With the development and ongoing rapid iteration of Ethereum, the platform needs to continuously maintain the development and version migration of smart contracts to prevent financial losses.

-

Time Defect: When the platform's block time is stable, the interest rate is calculated at the block level. Otherwise, if the blockchain is stagnant or decelerated (or reversed), the interest rate may vary, and the logic of the smart contract to calculate interest is tied to the interest rate of each block.

- Securities classification: There is more and more uncertainty about whether a stable currency can be classified as a security. Although CFCT can treat it as a “swap (swap transaction)”, the SEC (US Securities and Exchange Commission) may treat these as “demand notes”.

- Hosting: The uncertainty with an unmanaged platform is: Who is the actual custodian of the loaned asset? Many professional investors are required to rely on third-party custodians, and the use of these platforms may create potential regulatory loopholes as some regulatory requirements may not be met.

- Licence/License: Decentralized platforms operate in most jurisdictions without a license, regardless of where the end user is located. In the medium term, many of the platforms recently supported by USDC may have potential “license risk” that will ultimately affect the cost of the operator, resulting in higher interest rates or higher transaction costs.

-

Tax uncertainty: For these platforms, the location of the office and the judicial policies to be followed in the local are all grey areas.

4 Conclusion

As it is still in its early stages, there are still some risks in the lending industry, and these risks are expected to ease as the industry matures (especially as inflows increase and transaction volumes increase) . In more mature industries, more products should provide more choices for participants, enabling users to have more complete access to financial services.

In addition, these decentralized financial platforms may be the basis or data point for centralization agencies to make entry decisions, and hope to gain more financial services by strengthening competition with traditional financial institutions (the gatekeepers of today's financial sector). .

Although JPMorgan's forked version of Ethereum, Quorum, is being developed with plans such as JPM Coin, from the perspective of decentralized applications, Ethereum remains the model for all blockchains.

As shown by these lending platforms, DeFi seems to be one of the best use cases for blockchain technology, potentially reaching billions of users around the world and enabling users to access basic financial services more efficiently.

Original reference material

1.Circle Research (Ria Bhutoria). A closer look – Dharma-larm (2019).

Https://medium.com/circle-research/a-closer-look-dharma-larm-8088e51c0886

2.Delphi Digital. Decentralized Finance (DeFi) – Thematic Insights (2019).

Https://www.delphidigital.io/defi

3.Kyle J Kistner. How Decentralized is DeFi? A Framework for classification Lending Protocols (2019).

Https://hackernoon.com/how-decentralized-is-defi-a-framework-for-classifying-lending-protocols-90981f2c007f

4.Macro Narratives in Blockchain (Andrew Wong). The next FinTech: Global “Open Finance” Infrastructure (2019).

Https://medium.com/macro-narratives-in-blockchain/the-next-fintech-global-open-finance-infrastructure-90ac093a411b

5.Maker Team. The Dai Stablecoin System (2017).

https://makerdao.com/whitepaper/DaiDec17WP.pdf 6.Multicoin Capital. Investment Thesis (2019).

Https://multicoin.capital/2019/04/24/multicoin-investment-thesis/

7.The Block (Ryan Todd). Block by Block: Crypto Lending (2019).

Https://www.theblockcrypto.com/2019/01/18/block-by-block-crypto-lending/

8.The Block (Contributor Network). The benefits of trustless lending (2019).

Https://www.theblockcrypto.com/2019/01/31/the-benefits-of-trustless-lending/

9.Wave Financial (Roy Learner). Crypto lending: too good to be true? (2019)

Https://medium.com/wave-financial/crypto-lending-too-good-to-be-true-fc010e7fc86c

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- US Congressman: Encrypted currency is related to national security, the government should avoid double taxation

- Weekly Insight | SEC sues Kik for illegal ICO, G20 will discuss cryptocurrency regulation

- Data report: Which exchanges are the most used in currency, fire, and OKEx?

- From EOS, Sun Yuchen and Ownen Cong, ADA founder Charles Hoskinson took turns to diss it again.

- Market Analysis on June 10: Bitcoin Tests 7500 Support Again

- "Algorithm Stabilizing Coin" is a pseudo-proposition

- Market analysis on June 10: The market is weak and the risks are far from being fully released