Current Status of Data Analysis in NFT Lending: Blend Takes 80% Market Share in First Month, Three Major NFT Loans Exceed Half the Total Amount

Data Analysis on NFT Lending: Blend Dominates 80% Market Share in First Month, 3 Major NFT Loans Exceed Half the Total AmountAuthor: Nancy, BlockingNews

Due to low liquidity, NFT lending protocols used to improve capital efficiency have thrived, and the overall scale has continued to expand with the richness of NFT assets and the growth of categories. The rapid evolution of the NFT ecosystem is also driving product innovation, and the market is beginning to accelerate its competition and elimination mechanisms.

What is the current scale of NFT lending? What are the mainstream lending protocols and new players in the market? And which NFTs are more popular with lending funds? Let’s use data to explore the truth.

Blend accounts for 80% of the market share, and new and old players are accelerating their competition

Overall, with the recovery of the NFT market, lending demand has begun to grow. According to Dune Analytics data, as of May 29, the cumulative loan amount of mainstream lending protocols has exceeded 1.55 billion U.S. dollars, of which NFTFi’s total loan amount has reached 430 million U.S. dollars, ranking first, followed by BendDAO with more than 280 million U.S. dollars, and BlockingrasBlockingce with about 250 million U.S. dollars in third place.

- Opportunity and risk, BRC-20 brings Bitcoin into the “smart era”

- Reflections on the .sats domain: Current development status and value analysis

- News Weekly | Hong Kong’s “Guideline on Virtual Asset Trading Platform Operators” will take effect on June 1, 2023.

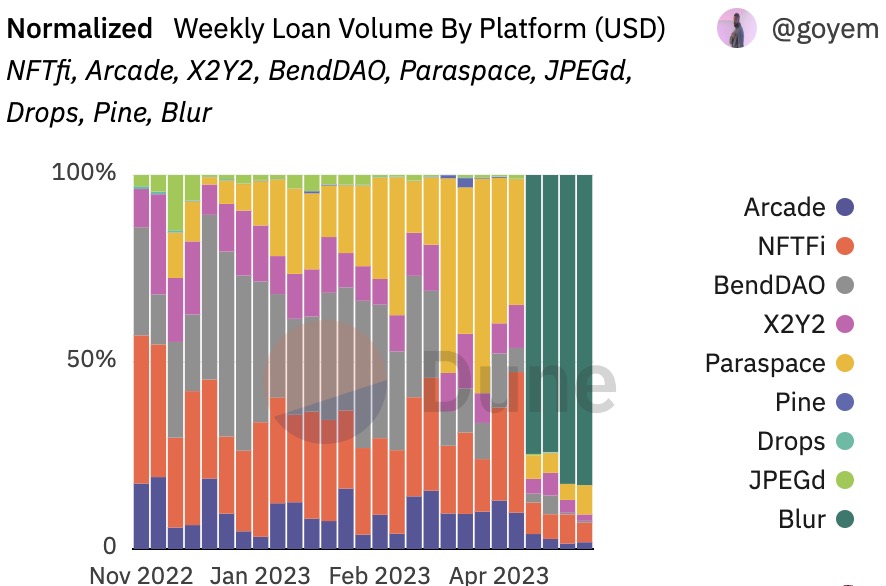

However, from the market share of the latest weekly loan volume, as of May 29, Blend ranked first with a market share of 82.9%, followed by BlockingrasBlockingce with 7.8%, and NFTFi with 5.2% in third place. At the same time, from the market share of the latest daily independent addresses, Blend accounted for 67.1%, followed by BlockingrasBlockingce with 15.5%, and NFTFi with 10.9%.

From the data, it can be seen that the players in the NFT lending market have undergone a reshuffle, and the main reasons behind this change are: first, Blend is backed by the head NFT trading market Blur, and has created a competitive advantage by not charging borrowers and lenders any fees, continuously adding support for popular NFT series such as Punk, Azuki, BAYC, Milady, and DeGods, and launching ETH loan repayment in batches, which has resulted in more than 157,000 ETH and 20,000 loans in less than a month; second, for months before Blend was launched, BlockingrasBlockingce’s market share was always ranked first, but not long ago, a large number of users panicked and fled due to an internal “quarrel” incident, although the internal conflict was eventually resolved, the impact on the business is evident.

However, the NFT lending market is still full of variables. On the one hand, leading NFT lending projects are launching related products to improve the user experience and incentivize users. For example, the founder of Blockingrace is offering a $100,000 gas subsidy to the community and is hinting at rewarding loyal users. The platform is also upgrading wallet transaction monitoring and proof to rebuild user trust. Recently, NFTFi launched the “Earn Season 1” incentive plan, where users can earn exclusive loyalty points “Earn Points” after repaying loans. These points are non-transferable but can be used to offset loans. X2Y2 also launched X2Y2 Fi and V3 versions, where X2Y2 Fi provides financial services specifically for NFTs. All NFT loan activities (including borrowing and refinancing) will take place on X2Y2 Fi. The core of the V3 version is to provide a better user experience for both lenders and borrowers. It introduces a series of features such as canceling gas-free loan discounts, optimizing gas consumption, automatic refinancing, and configurable long-term loan quotes.

On the other hand, the NFT lending market has recently welcomed many newcomers, including:

Binance NFT Market has launched blue-chip NFT collateralized lending, currently supporting BAYC, MAYC, Azuki, and Doodles.

Astaria, an NFT lending platform co-founded by former Sushi CTO Joseph Delong, has officially launched. The platform has instant liquidity, fixed terms, and no forced liquidation, and is launching a pre-funded treasury. Astaria has completed an $8 million seed round of financing with participation from True Ventures, Arrington Capital, Ethereal Ventures, and Wintermute.

A former Coinbase engineer has launched the NFT lending platform BlockingprMeme built on Uniswap, which allows borrowers to use NFTs as collateral and issue loans in the form of BlockingprMEME. Token holders are the lenders. It currently covers 20 popular NFT series and has received a $3 million investment from Coinbase Ventures.

In addition, NFT lending protocol Fungify will also be launched in Q2 this year. The product has raised $6 million in investment from Distributed Global, Flow Ventures, and former Polychain Capital president Joe Eagan. Fungify mainly provides real-time NFT sales, NFT collateralized loans, and revenue blue-chip NFT indexes by using Chainlink’s NFT floor price feed.

Under the acceleration of new and old players, more liquidity will be brought to the NFT market.

Three major NFTs account for half of the lending volume, Friendship Bracelets had the highest liquidation rate

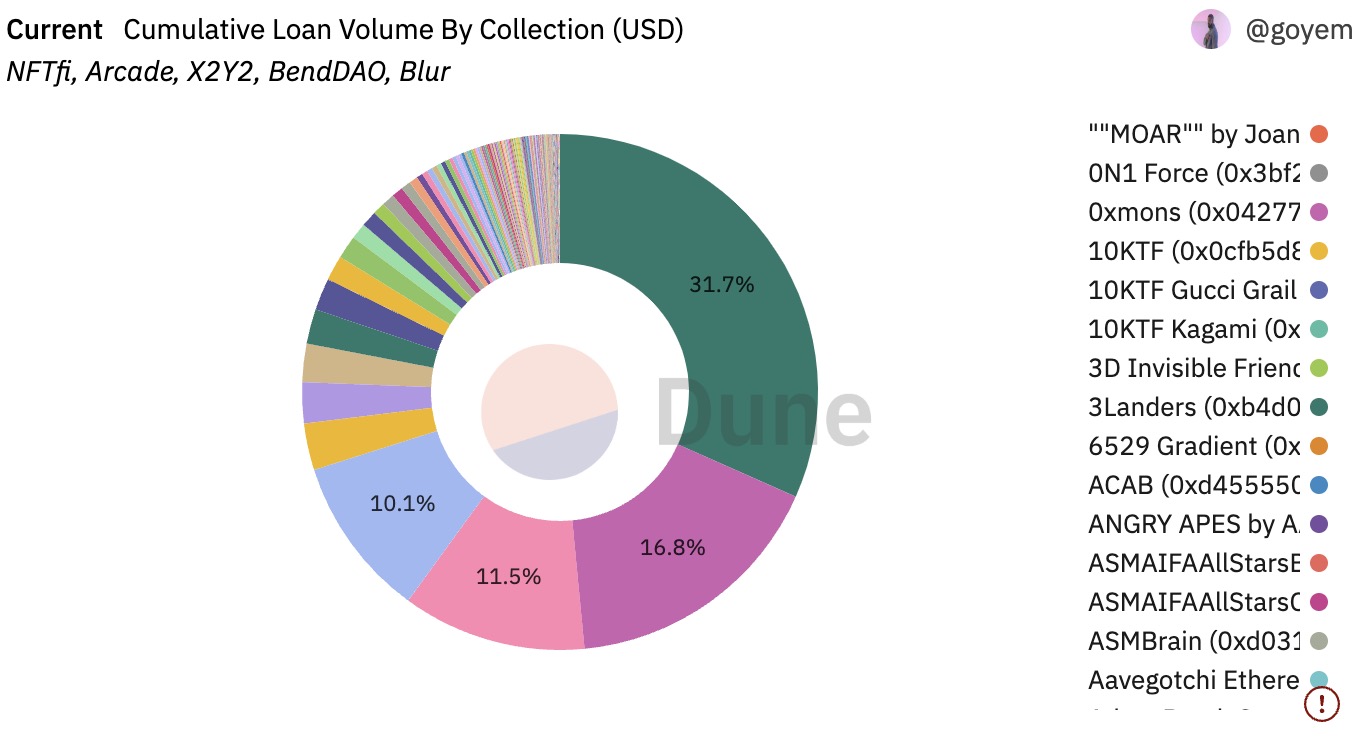

When faced with a variety of NFT assets, which types of projects receive the most loan funds? According to Dune Analytics data as of May 29th, the top three NFTs account for about 60% of the total loan amount, with BAYC’s cumulative loan amount exceeding $350 million, accounting for 31.7% of the market share; followed by Wrapped Cryptopunks, which received over $180 million, accounting for 16.8%; and Azuki, which accounted for 11.5% of the market share with over $120 million. In addition to these projects, MAYC, Milady, DeGods, Pudgy Penguins, The Captainz, and Otherside are also popular collateral projects based on the latest loan projects and loan amounts.

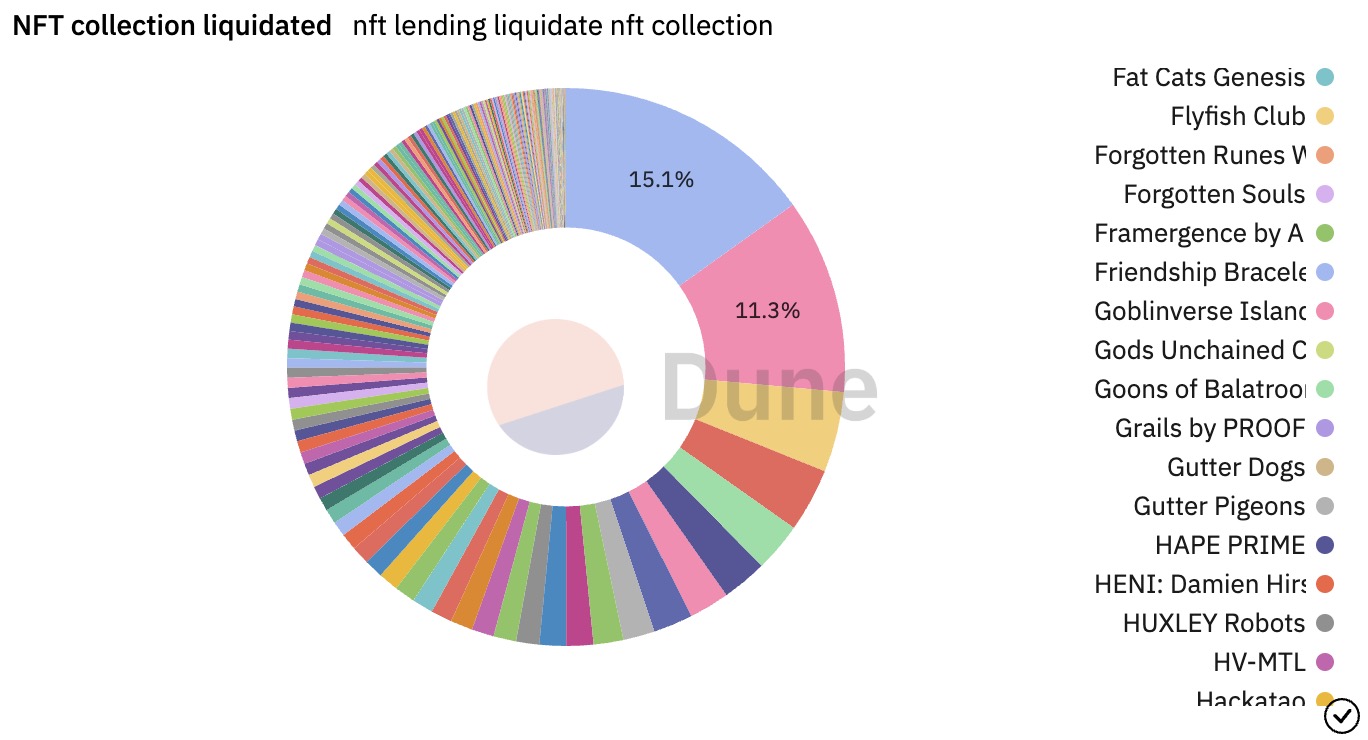

From the number of NFTs liquidated, Dune Analytics data shows that as of May 29th, the market has accumulated more than 16,000 liquidated NFTs, of which NFTFi has the most types of NFTs and users, accounting for 94.4% of the total; followed by X2Y2, which has 429 liquidated NFTs. In terms of liquidated NFT projects, Friendship Bracelets accounted for 15.1% of the total, Art Blocks accounted for 11.4%, followed by Otherside, Wrapped Cryptopunks, rektguy, and MAYC.

In addition, Dune Analytics data shows that as of May 29th, the average annual interest rate of mainstream NFT lending platforms is about 58%, and the annual interest rates of Otherside, World Of Women, The Captainz, Sandbox’s LANDs, Sewer Blockingss, Meebits, and Cool Cats all exceed the average. The average loan amount is $13,103, with BAYC, Wrapped Cryptopunks, Azuki, MAYC, Moonbirds, and others exceeding the average, while Milady, CloneX, DeGods, Pudgy Penguins, and The Captainz have relatively low average loan prices.

Overall, although the current number of NFT assets is not small, the total amount of NFT loans is far less than other segments of the cryptocurrency market, and blue-chip NFTs account for a large share of the total loan amount. This further illustrates the low penetration rate of NFTs, and compared to Bitcoin, Ethereum, and other FT assets, NFTs are still long-tail assets. Even blue-chip projects cannot drive the growth of the loan market. However, from the recent surge in loan volume and user data, as well as more NFT lending projects entering the market, NFT market liquidity may be further activated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Glassnode Data Research: A Review of the “Crazy Week” of Bitcoin Scripting Outbreak

- Why is DigiFinex Coin considered as the “backbone” and pillar between fiat currency and virtual assets, even though it is not a stablecoin pegged to the Hong Kong dollar?

- Ark Introduction: A Layer 2 Protocol for Anonymous Bitcoin Payments Off-Chain

- BXB Capital: Made fortune from kimchi premium, once co-founded Korean market with Binance

- Multiple macroeconomic negative factors have hit the market, causing Bitcoin to drop below 26,000 US dollars in the short term.

- Macro negative factors continue to ferment, and Bitcoin may weaken in the short term and test $26,000.

- New Order: Money Meme – When Game Theory Meets Memes