Detailed DCEP future use scenarios-highly concurrent retail payments

This issue of: Joyce Lin, senior technology media, community representatives Conflux, former executive editor CoinDesk China, in-depth observation of the block chain industry.

The Central Bank's statutory digital currency (DCEP) is near, and traditional fiat currencies will gradually disappear, although at a very slow pace. But so far, most of the related discussions of DCEP still revolve around the abstract theoretical level. Here, through a series of articles, I will try to discuss more specifically what DCEP is and its possible use scenarios in the future.

The future of money

- Blockchain traceability industry research report

- A solution to realize small and micro payments of digital currency

- 2019: "Year of the Blockchain" in Washington, Silicon Valley and Beijing

In 1995, the U.S. Congress held a hearing entitled "The Future of Money" to discuss the early embryonic form of virtual currencies and other related innovations that were beginning to emerge.

Alan Blinder, then the vice chairman of the Federal Reserve, testified at the testimony that for the consideration of coinage tax and the prevention of monopolies, the Federal Reserve's self-issue of electronic money has its advantages.

This may be the earliest positive statement of the world's largest central bank on the issue of digital currencies.

"The Fed doesn't have any clue to pass regulations to curb the evolution of this emerging industry. Instead, the Fed encourages innovations in payment technology that can benefit consumers and businesses," Alan Blinder said. He also emphasized that "Although these innovations may pose a threat to related law enforcement and regulatory matters, they may also bring long-term commitments in some places, especially if they can promote a faster, safer, and more effective Payment system. "

(Photo: Alan Blinder | Source: Vimeo)

Unfortunately, in a time when even smartphones and blockchains have not yet appeared, Alan Blinder's ideas may be too advanced and have not caused much response. At the time, he absolutely could not imagine that after a full 25 years, the concept of a central bank digital currency is likely to be implemented first in China.

On Monday (9th), according to a report in Caijing, the People's Bank of China took the lead, plus the four major banks in China (industrial, industrial, agricultural, China, and construction) and the three major telecommunications operators (China Mobile, China Telecom, and China Unicom). ), Will jointly participate in the central bank's legal digital currency pilot project called DCEP. It is expected to settle in Shenzhen and Suzhou at the beginning of the plan. The pilot will be closed in small-scale scenes by the end of this year, and it is expected to be widely promoted in Shenzhen next year. If successful, the People's Bank of China is likely to be the first major central bank in the world to launch a digital currency.

The central bank's legal digital currency is close at hand, and the traditional legal currency will gradually disappear, although at a very slow pace.

The current technical discussions on central bank digital currencies are mostly focused on what kind of technical route will DCEP itself take? Is it using blockchain technology or a traditional account system? How much TPS (Transaction Per Second) can reach and so on.

But for practitioners and developers in the blockchain industry, more opportunities exist in the future use scenarios of central bank digital currencies? Because the various applications and scenarios that can be combined with the central bank's digital currency are the potential markets provided to the entire blockchain industry.

High-concurrency retail payment scenario

According to the official information released by the central bank, retail payment is the first target application scenario that needs attention.

Former People ’s Bank of China Governor Zhou Xiaochuan said in a public speech recently that one of the first goals of the forthcoming central bank ’s digital currency is to provide more convenient retail payments.

The full name of DCEP is Digital Currency and Electronic Payment, which literally translates to "digital currency and electronic payment" in Chinese, and the official definition is "digital payment tools with value characteristics".

It can be seen that DCEP is designed to have the function of electronic payment tools from the starting point, which is an important feature that distinguishes it from paper money. But different from general electronic payment, DCEP is positioned to directly replace cash bills and coins (M0), not only merchants cannot refuse to accept, but also “dual offline payments” (that is, both the payer and the payer can complete the payment offline) . According to Mu Changchun, director of the Digital Currency Research Institute of the Central Bank, "As long as you have a DCEP digital wallet on your phone, you do n’t even need the Internet. As long as the phone has power, two phones can touch one person. The digital currency in the digital wallet is transferred to another person. "

In addition, DCEP adopts a “two-tier operation system”. The central bank does not provide DCEP directly to the public, but exchanges DCEP to the general public through banks or other operating agencies. Due to the high concurrency of retail payments, it is through a two-tier operating system, rather than the central bank, to directly face the public that the use needs can be guaranteed to the greatest extent.

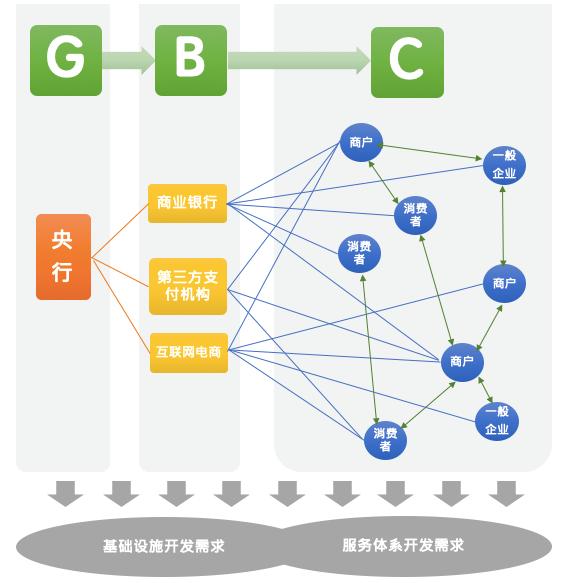

G2B2C operation model

This is a G2B2C operating model. The B-side in the middle can be a commercial bank, a third-party payment institution, or an Internet e-commerce, etc., while the C-side can be divided into different roles such as general enterprises, merchants, and consumers. (As shown below)

(Figure: DCEP "G2B2C" operating system)

Such an operating system and usage scenarios can generate a variety of infrastructure and service system development requirements between G & B, B & C, or B & B. In addition to commercial banks, the Internet and third-party payment institutions with more innovative technology development capabilities, such as Alipay and WeChat Pay, can and will inevitably become an important supplementary role in the central bank's digital currency operating system. From the perspective of users, opening up multiple competitions between different B-side participants will be more conducive to accelerating system optimization and improving user experience.

From this perspective, we can better understand why the central bank's legal digital currency and the four major banks and the three major telecommunications operators in the pilot program will plan to focus on the choice of transportation, education, medical care and consumption scenarios. The consideration behind it is to enter the real service scenario, and test it in a scenario that can reach C-end users and generate frequent transaction applications.

But this is only the first use case of DCEP. In fact, DCEP has more and more innovative use cases such as cross-border payments and cross-border remittances, which will continue to be explained one by one in the next few articles.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- SIBC Lands in Qiantang New District, Hangzhou, Builds Asian Blockchain Project Bridgehead

- Filecoin test network is about to go live, these changes need attention

- Global Blockchain Investment Statistics in November: U.S. investment agencies are the most active, occupying "half of the country"

- Nine reasons why the Lightning Network will break out in 2020

- US SEC Chairman: Blockchain technology development helps promote capital formation and provides investment opportunities for investors

- Analysis | 3 key indicators to measure the performance of the blockchain network

- Interpreting DSR: Is DAI one step closer to real money?