Did you know the "bull rule" in the Bitcoin halving market?

(Source: QKL123)

Bitcoin halving is imminent. As of the date of publication, there are 65 days before Bitcoin halving. The total amount of unmined Bitcoin is: 2,745,900. "Half the market" has become the hottest topic today, with analysis and prediction abound.

What is halving?

- Standing on the inflection point of the global economy, how should US stocks, gold, US Treasury bonds, and BTC be chosen?

- Bitcoin halved: revolution, scam, revolution, scam …

- Quantitative fund companies: Bitcoin is also more susceptible to "market panic" than other assets

The total supply of bitcoin is limited to 21 million. Whenever 210,000 bitcoins are newly mined, miners receive half of the block reward for mining. Bitcoin halving is an event that occurs every four years. It will continue until 21 million bitcoins are in circulation.

"Half" means that the amount of bitcoin produced per block is halved, and the supply of bitcoin has slowed. The most obvious market law: the market price is directly proportional to the demand and inversely proportional to the supply. Bitcoin halving will directly cause the price of Bitcoin to rise, but this law must assume that the market demand for Bitcoin is unchanged. According to the actual situation, there are many factors that affect the price of Bitcoin.

At the beginning of the epidemic, the price of bitcoin rose rapidly, and some markets said that because bitcoin has the property of avoidance; after the epidemic spread globally, the price of bitcoin fell again, and the market analyzed and predicted accordingly. Obviously, social events have a greater impact on the price trend of Bitcoin, and Bitcoin price fluctuations prove that Bitcoin is more sensitive to market news.

Halving the market: opposite market sentiment

In the two months of the beginning of 2020, the price of Bitcoin fluctuated greatly, exceeding $ 10,000 twice and falling to around $ 8,000. The "half quotation" public opinion has changed with the fluctuation of the price of Bitcoin. When Bitcoin rises to $ 10,000, the market is full of analytic statements that halving will bring dozens of times bullish; when Bitcoin falls to $ 8,500 The market's main theme is "the wolf is here" again.

Market picks up after halving

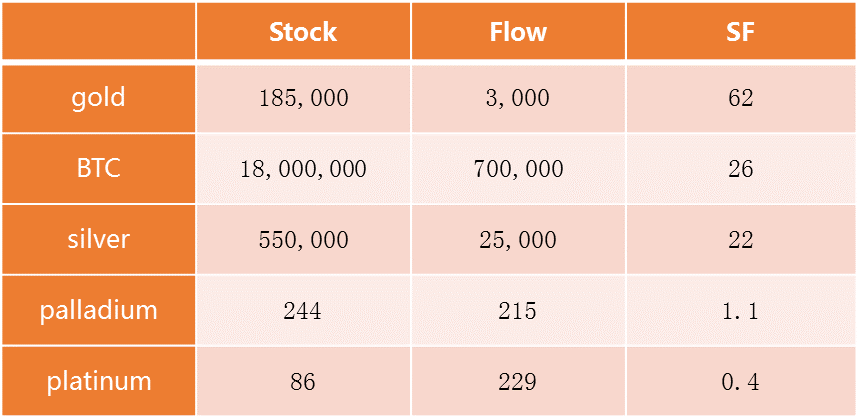

Quantitative calculation of the scarcity of Bitcoin according to the stock-flow (S2F) model. At present, Bitcoin's total mining volume is about 18 million, with an annual output of 700,000. Its S2F is 25, which is slightly higher than silver's S2F. Under the premise that bitcoin's scarcity is recognized, miners can only sell half of bitcoin, which will naturally increase the value of bitcoin, and the price is the currency performance of value, and it is logical that the price of bitcoin will rise. What's more, the halving date is well known, and it is difficult to guess whether the market will deliberately drive up the currency price.

(Stock-flow model, cartography: running finance)

Recently, the OKEo Intelligence Bureau shared live on the logic of bitcoin halving and the overall situation of the market. According to the previous historical experience of bitcoin, it will rise before halving, and it will fall when halving. After the halving, the probability is rising. Because supply is reduced. The market in 2020 is relatively optimistic, and may not immediately start a bull market, but it must be a warming situation.

Venture capitalist Mike Novogratz said: Bitcoin may retest its all-time high of $ 20,000 before rewards are halved in May.

Bitcoin price unaffected by halving

The market ’s expectation of "halving the market" will greatly reduce the "halving effect." For example, the business opportunities that 80% of people know will indicate that this round of business opportunities has basically no investment value. Bust. "

In addition, it is the consensus of the market that cryptocurrencies fluctuate greatly, and Bitcoin also has a wave of sharp rises and falls. However, since the past ten years, Bitcoin has been volatile. With the halving time as the benchmark and the period from half a year to one year, the price of Bitcoin must rise. Therefore, it is a subjective assumption of the market to associate the sharp increase in the price of Bitcoin with halving.

Data analysis halving market trends

On August 5, 2019, Litecoin (LTC) halved for the second time. The overall trend of the Litecoin price before the halving was first rising and then falling. After the halving, the price of the Litecoin has been falling. According to Wang Xinxi, co-founder of the Litecoin Foundation, most of those who bought Litecoin in half were old fans.

As if, Litecoin's halving market failed.

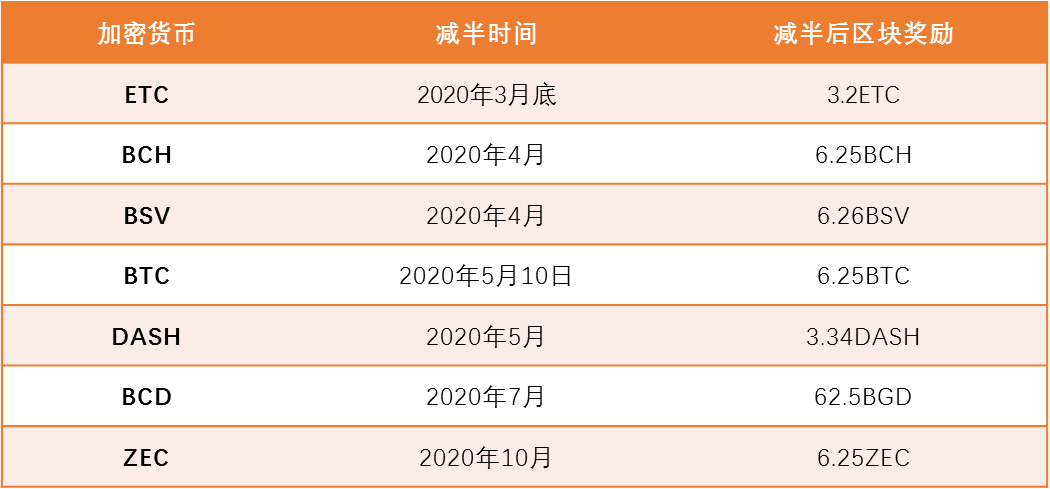

A reporter from Finacerun has summarized cryptocurrencies that will be halved in 2020. In the case of ETC, which is about to be halved, the price of ETC has increased from $ 3.23 at the end of December last year to more than $ 10. But with the advent of halving, ETC prices have not risen strongly.

(Cryptocurrency halving in 2020, charting: Run Finance)

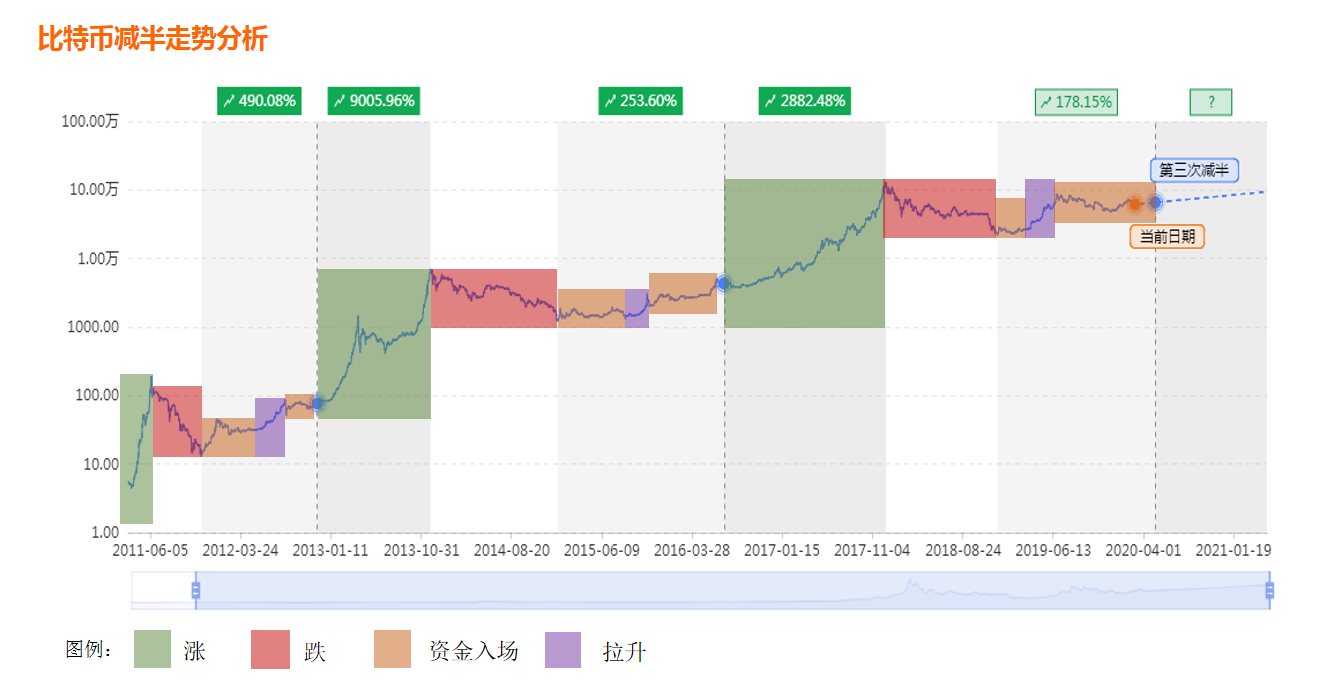

Since the birth of Bitcoin, it has experienced two halvings.

On November 28, 2012, the supply of Bitcoin blocks was halved for the first time. In the first round of halving, on November 16, 2011, the lowest bitcoin price for this round, the price was $ 2. After halving, Bitcoin ushered in a bull market, and reached this on November 30, 2013. The highest point of the round was $ 1,175.

(Data source: QKL123; Legend: Run Finance)

On July 9, 2016, the supply of Bitcoin blocks was halved for the second time. In the second round of halving, on January 14, 2015, the lowest price of bitcoin for this round, the price was $ 152. After halving, the price of bitcoin reached a high of $ 19,891 on December 16, 2017. It fell to $ 19,500 on December 17.

It is expected that on May 10, 2020, there will be a third halving of Bitcoin. In the expected third round of halving, December 15, 2018, the lowest price of bitcoin for this round, the price is 3,122 US dollars.

According to this, the long cycle and rising volatility of Bitcoin price before and after halving have certain regularity. All financial products are cyclical and can be summed up and searched for certain rules. However, the price fluctuation of bitcoin is still affected by the external environment, and the macro background, participants, social consensus and other factors continue to affect the price trend of bitcoin. Therefore, this leads to a topic worthy of discussion: the short-term view of trends, the long-term view of value.

OKEo Investment Research Director K Ye publicly stated that halving the output of Bitcoin is a major change in its fundamentals and a long-term influence on the future price of Bitcoin.

Halving mechanism: the value of Bitcoin

From the data point of view, after the halving this time, the daily supply of bitcoin has decreased by 900 pieces. This data is not obvious in the overall transaction volume. At present, there are many Bitcoin coin hoarding users and a large amount of coin hoarding. According to Coinmetrics' cryptocurrency valuation report: As of March 1, 42% of Bitcoin UTXOs have not changed for two years or more. Therefore, the impact of halving on supply should not be used to measure the price trend of Bitcoin. After all, the effect of halving on supply is far less than the current demand for bitcoin.

At 23:00 pm on March 3rd, Beijing time, the Federal Reserve announced that it would lower its benchmark interest rate by 50 basis points and reduce its excess reserve ratio (IOER) by 50 basis points to 1.1%. The US Federal Open Market Committee (FOMC) unanimously agreed to a rate cut. This is the ninth unconventional meeting of the Federal Reserve since 1998 to cut interest rates.

After the news was announced, spot gold rose sharply by $ 20 to a new high of $ 1628.80 in the week. The impact of major events on scarce resources is short-term, basically because a large amount of speculative funds have been gathered in the short-term, but long-term investment will still be in line with the laws of the market economy.

The correlation between Bitcoin and the price trend of assets such as gold and the US dollar is not high. This time, the price of Bitcoin was not bullish for the Fed to cut interest rates. However, according to the interest rate transmission mechanism, falling interest rates will increase global asset liquidity, and value-invested assets will increase. At the same time, global investment in crypto assets is gradually optimizing, and the proportion of derivatives transactions has increased. Crypto assets have gradually penetrated into the asset allocation pool of global investment institutions. Of course, Bitcoin will become the first choice.

Bitcoin's output has been halved in about four years. The block reward for this halving of production will be reduced from 12.5 BTC to 6.25 BTC. Bitcoin's halving mechanism makes Bitcoin supply anti-inflation properties. After this halving, the actual inflation rate of Bitcoin dropped from 3.7% to 1.8%. This means that Bitcoin's inflation rate will be less than the 2% inflation designed by most central banks for fiat currencies. And in theory, the decline in Bitcoin's inflation rate will help the price of Bitcoin to fiat currency rise.

What is the role of controlling inflation? Ethereum founder Vitalik Buterin has stated the need for Bitcoin halving: the main reason for this is to control inflation. One of the main drawbacks of traditional "legal" currencies controlled by the central bank is that banks can print money at will, and if too much is printed, the law of supply and demand will cause the value of currencies to start falling rapidly.

According to reports, according to stock-flow (S2F) model research, after halving, as the stock of Bitcoin increases, the output remains constant. Around 2022, Bitcoin's S2F will exceed gold (currently, S2F is 62), which will become the most scarce value product in history.

In terms of mechanism setting, Bitcoin has the property of scarce resources and has the value of long-term preservation or appreciation. But as a virtual value created by humans or machines, Bitcoin's greatest source of value may be social consensus. Just like the earliest form of currency in the form of shells and salt, society generally recognizes its circulation value. In other words, compared with the value given to Bitcoin by the scope of consensus, participation scale, transaction frequency, social perception, etc., halving is more like a trigger for Bitcoin's rise.

The third halving that Bitcoin is preparing to carry out has completely different circulation values, social consensus, participation scale, and transaction methods than the previous two. According to data from Skew Markets, the number of open positions in bitcoin futures contracts will increase by 60% in early 2020, and the positions of both OKEo and BitMEX exchanges will exceed $ 1 billion. The strength of the cryptocurrency derivatives market will have a huge impact on the overall market.

In short, it is expected that the long-term value of Bitcoin will be reflected in its price within the next 1-2 years. The overall ecology of cryptocurrencies will be different in 2020. As the "leading figure" of cryptocurrency, the value reflected by the halving mechanism will greatly affect and stimulate the entire market transactions in 2020.

The "halving market" is not a repetition of history, but a new ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Global market crash with the spring of Bitcoin

- Gold hits a seven-year high, the stock market starts to fall madly, and the opportunity for bitcoin to rise is now

- New research: Lightning Network is becoming more and more centralized, the more nodes there are, the more centralized it becomes

- 71% of Bitcoin addresses remain profitable despite falling currency prices

- Bitcoin halving: price impact and historical correlation

- A shares should not be too optimistic, BTC medium-term or expected

- Jiangzhuoer mine was shut down forcibly. Is the epidemic good or bad for BTC?