Global market crash with the spring of Bitcoin

Overnight the day before yesterday, U.S. stocks began to crash. The point is, this is not a crash of the US stocks, but a large one.

From the perspective of China, the epidemic situation has basically been better controlled and is gradually decreasing. This trend can be seen by everyone. But for foreign countries it is another matter.

According to the Xinhua News Agency, the number of cases of new crown virus infection in South Korea increased sharply by 169 in the 25th, and more than 1,160 have been confirmed so far. South Korean President Moon Jae-yin announced on the afternoon of the 23rd that the early warning level of the new crown pneumonia infectious disease crisis was raised to the highest "severe" level, and the epidemic prevention response system was significantly strengthened. And he himself may now need to be the subject of isolation. South Korea is becoming the next Wuhan.

- Gold hits a seven-year high, the stock market starts to fall madly, and the opportunity for bitcoin to rise is now

- New research: Lightning Network is becoming more and more centralized, the more nodes there are, the more centralized it becomes

- 71% of Bitcoin addresses remain profitable despite falling currency prices

You should know that the United Nations expects South Korea's GDP growth in 2020 to be 2%, but South Korea is a highly indebted country. After the financial crisis, the national debt rose to 150%. The most important thing is that although most of the manufacturing and processing industries are in China, South Korea has long existed as a shadow currency of the Chinese yuan, but its actual liabilities are all US dollars.

Because of the continuation of the epidemic, several South Korean companies have sought bank loans to gain time. However, due to the long-term decline of South Korea's internal market, the epidemic may accelerate the formation of South Korea's economic inflection point. The 2% growth under high leverage may slip towards 0% in the case of a stall. If this expectation emerges, South Korea will enter the Great Depression earlier.

In the conceivable future, if the epidemic situation improves, the market will accelerate the flow from capital to products to international head enterprise products after the shock of the global manufacturing shutdown in China. This means that the products of various industries in South Korea, which have always been compared with Japan, have formed a long and short double kill. Once the international market begins to lose confidence in Korean products that have been accelerated to be manufactured after the resumption of work, and the domestic market in South Korea is in a long-term recession, it will begin to hang on internally.

If the epidemic spreads severely, then the US dollar will form a strong blood-sucking, which will result in the double-killing of stock markets and foreign exchange markets in emerging markets, especially in countries with high dollar debt and high leverage, such as South Korea. If you pay attention to the Korean won foreign exchange market, you will find that capital is accelerating to flee from the Korean won. Unless South Korea once again accepts the "inequality treaty" of the United States during the financial crisis of 2008 to save itself, it also means that from the capital level, South Korea will inevitably lose the opportunity to stand up.

The dollar index formed a Damocles sword over the head for the South Korean won. South Korea may be the first Asian emerging market to crash in 2020.

Due to the existence of the Diamond Princess, the number of diagnoses in Japan has now exceeded 862. Because of Japan ’s attitude toward the Buddhist system, it has missed the best time for prevention and control. Considering the high population density in Japan and the congestion of public transportation facilities, the development of subsequent epidemics may overtake South Korea again. The International Olympic Committee also said that if the epidemic could not be controlled in May, the Olympic Games would be cancelled instead of postponed or changed to other countries and regions.

The epidemic poses an even higher challenge to aging countries like Japan than other countries, and the mortality rate of the elderly is significantly higher than that of young people. Japan's domestic survey shows that only about 10% of people want to host the Olympics, 18% propose to postpone, and 72% want to cancel directly. However, under the pressure of domestic and foreign public opinion, Japan still hopes to insist on hosting the Olympic Games on schedule, a large part of the reason comes from this is Japan's "national war."

After the 2011 earthquake in Japan, the Fukushima nuclear power plant leaked. Except for China and South Korea's contribution, Japan's tourism industry has almost never returned to its peak. On the other hand, Japan's domestic economic recession is also very serious. At present, the negative interest rates of banks make it impossible for large funds to find investment exports.

Just a few days ago, the Financial Times also reported that Japan ’s Central Agriculture and Forestry Treasury used a large amount of Japanese yen to make a capital whale in the US leveraged loan market, causing the yen to depreciate in the short term. Because the Japanese national economy is a deflationary economy, the yen is used as a safe-haven currency in the foreign exchange market to form a trading hedge with other currencies. When the Japanese financial industry started to lose direction and needed to do USD leverage trading, this hedging function may be short-term ineffective.

International GDP forecast for Japan in 2020 is a 0.8% growth rate. This is the expectation that was drawn only after the Olympic Games pulled. However, Japan ’s GDP in the fourth quarter of 19 fell 6.3% month-on-month. Affected by the epidemic, the Japanese economy is also likely to have negative growth in the first quarter of this year, and the Japanese economy may not be far away from the "fact recession".

The current situation in Japan is that as long as the public is not allowed to go to the hospital for examination, the diagnosis will not be confirmed. I hope that this will reduce the diagnosis rate. If the epidemic situation is not controlled in Japan and the Olympic Games will be cancelled in the end, it will on the one hand cause the international market to form a negative image of the Japanese government's inefficiency and on the other hand, it will severely hit the Japanese economy.

The political and economic double killings caused by the epidemic and the Olympics could make Japan the starting point for Japan's second "lost 30 years" by 2020. And this round will cause the Japanese National Transport to enter an ultra-long-term recession.

At present, Italy has announced that the total number of people diagnosed with the new type of coronavirus has increased to 323. The health ministers of neighboring countries gathered in Rome on the 26th to discuss the establishment of a joint prevention and control coordination mechanism. The European proliferation model started by Italy has caused widespread panic.

Since the 2008 financial crisis, the euro interest rate has not been able to embark on the normalization path, and population is a basic condition that determines the economy. After 2008, Europe is very similar to Japan in 1991, and has already embarked on the road of aging. However, the national conditions of European countries are still different. Taking the four major economies in the euro area, Germany, Italy, and France, for example, Italy's population situation is worse than Japan's. The proportion of the aging population is higher and the proportion of young people is lower. Similar to Japan, France's overall situation is slightly better.

Europe's current economic contraction is very close to Japan. Under the influence of the zero interest rate policy, there is no room for monetary policy to stimulate the economy, and there is no room for reconciliation between low economic growth and reduced domestic demand in Europe.

Today, due to Italy's European proliferation model, the domestic demand and exports of the economy have been hit more broadly, which is directly reflected in the stock market. European stock markets continued to decline, the German DAX index fell to 4.10% overnight, the European Stoxx 50 index fell 4.2%, the British FTSE 100 index fell 3.6%, the French CAC 40 index fell 4.14%, and the Italian FTSE MIB index fell nearly 6 %, Greek stocks fell more than 8%.

The message from the credit rating conference of rating company Moody's recently showed that in addition to the economic growth rate will slow down this year, the overall European default rate is rising. When the Great Depression opened, could Europeans accustomed to pampering themselves still maintain a decent life gracefully?

Europe is experiencing Japan's "lost 30 years", and the epidemic will make 2020 its turning point from slow to accelerated.

The three major U.S. stock indexes plunged by more than 3% on the 23rd, and plunged by more than 3% after the opening on the evening of the 24th. The Dow Jones Index once fell nearly 1,000 points after the opening. The Dow Jones Index fell below the 50-day moving average for the first time since February 3. The largest increase in the VIX panic index during the day was nearly 40%.

Although President Trump has been emphasizing that the impact of the epidemic on the United States is not great, as far as US bipartisan lawmakers are concerned, few believe it can control the development of the epidemic. White House chief economic adviser Kudlow insisted that the United States has so far contained the epidemic and that economic growth has not been significantly affected. But the market responded directly with a fall.

Monday's plunge is essentially different from Tuesday's plunge. Because when US stocks plummeted on Monday, you will find that hedging instruments such as gold are still rising, but by Tuesday, even the traditional hedging instruments that gold thinks are beginning to fall, it means that the market is already astonishing. Already.

The current market risk aversion is very strong, which can be seen from the performance of the bond market. US 10-year Treasury yields hit an all-time low on Tuesday, and US economic data was lower than expected, prompting traders to continue to hedge. An important signal here is that junk debt has accounted for more than 50% of US debt product investment, which is very similar to the situation before the 2008 subprime mortgage crisis.

The slump in U.S. stocks is just the beginning. 2020 is destined to be a year of long and short double kills, and the turning point of the American National Games will also come.

The major stock markets in the Asia-Pacific region have all shown a downward trend, except that China's A-shares have shown an upward trend. The turnover of the Shanghai and Shenzhen markets has exceeded 1 trillion yuan for 4 consecutive days, and yesterday exceeded 1.2 trillion yuan. At this time, "experts" came out to say: from the technical indicators, and from the perspective of funds and trading volume and other indicators, the major indexes are in line with the characteristics of the bull market.

The rise in China's stock market was mainly due to the 200 billion yuan medium-term lending facility (MLF) operation carried out by the People's Bank of China on February 17. The winning interest rate was also lowered by 10 basis points, as well as the 1.7 trillion yuan of liquidity investment in the previous two days. The central bank hopes to stabilize market expectations and boost market confidence, followed by the establishment and issuance of a special reloan of 300 billion yuan, which further shows that the central bank has ensured that funds are accurately invested in key enterprises for epidemic prevention and control.

But let's think carefully. At this time, most of the water released did not enter the entity, and all entered the secondary market. What is the reason for this round of rise? You taste, carefully. If we believe that because the liquidity has entered the secondary market, then the impact of the real economy on the epidemic has not been fully re-evaluated by the market. Although the transaction bottomed out immediately after the first day of the Spring Festival, and has been rising, it continues to attract everyone's attention. But would you believe that the impact of the epidemic is over?

In the long run, the impact of the epidemic may have limited overall impact on China's economy, far less than the impact on the economies of other countries. This is the greatness of the consensus of the global factory. In the short term, the market is "extraordinarily" optimistic about the recovery of the entity. This is inevitably unsustainable. Long-short double-killing is the main line of global liquid assets throughout 2020. I think no country can survive alone.

What's more, there was a signal in my last article, " Revisiting 2020, Bitcoin Wants to Say" . On the 24th, the Chinese Army Equipment Purchasing Information Network announced two bidding requirements to purchase 1.4 million sets of protective equipment. These 1.4 million sets of anti-personnel protective equipment include 930,000 sets of ordinary-grade body armor and 467,000 sets of high-grade body armor Board, gradually delivered in the next two years.

How Much Army Does China Have? Since the 15-year commitment to reduce military personnel, the Army currently has a total of 850,000 people in 13 groups. After this batch of purchases has ended, the average per capita is 1.65. It is no joke to say that this is not to prepare for regional conflict, it is to prepare for comprehensive conflict in the next two years.

Whatever happens in the coming year, 2020 could be a turning point in the fate of the East and the West. Among the three countries killed are Bitcoin and digital currencies.

This epidemic is actually an example of Bitcoin that has not yet become a safe-haven currency in global markets. When the epidemic came, for most ordinary people, do you think masks are hard currency or bitcoin is hard currency? But this does not prevent more and more people from paying attention to Bitcoin. In the past month, the number of potential investors in the non-currency circle who actively asked me about Bitcoin related matters has almost reached the number of the past year.

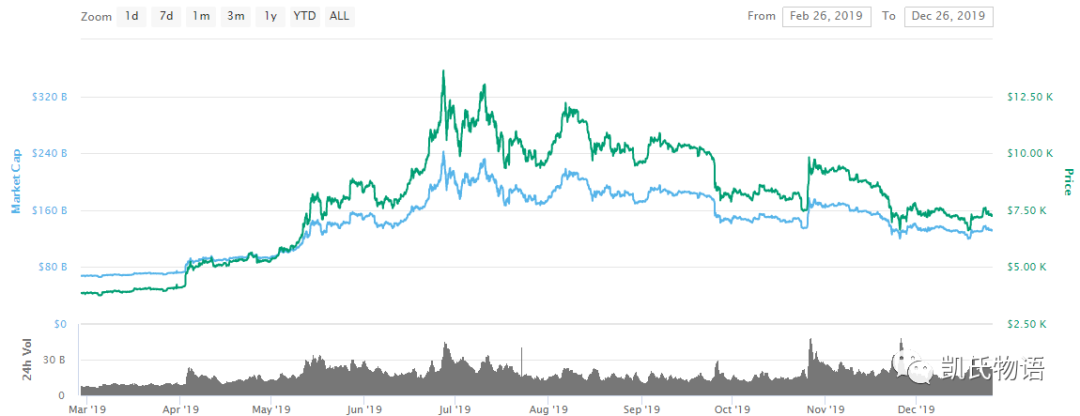

Since 19 years I have discovered that when the price of Bitcoin rises, there will be a significant increase in the number of people watching. This wait-and-see refers to the group who has not yet had a strong incentive to directly enter the digital currency investment and stop at the door. Until its peak in June 1919, Weibo's search volume exceeded 100 million. Since then, the continuous attention has continued to decrease as the price of Bitcoin has fallen.

Everyone is inert and used to the original investment market. It is difficult to switch investments without a direct motivation. Unless he can find a whole new motivation, whether it is because of the influence of market sentiment, because of the growing number of people around him, or because of his anxiety.

At this stage, many friends asked me to ask bitcoin related questions, mainly focusing on bitcoin itself, such as why bitcoin has value, how to show value, and how to prove that this is not a series of questions such as Ponzi scheme. This shows that traditional funds have not yet clearly stated their willingness to switch battlefields, and are still at the stage of crossing cognitive thresholds.

As the price of bitcoin has fallen, the voices of obvious followers have also dropped a lot. I believe that the vast majority of people did not invest in Bitcoin in the end of the year. After all, most people will ignore it subconsciously, especially in the process of falling.

But around the Spring Festival this year, due to the development of the epidemic situation, this situation has obviously changed. The questions of the friends I consulted are very focused. Basically, how to buy bitcoin, where to buy, what price is more suitable for investment, etc.

Is it because of the attention that Bitcoin has brought? Obviously, compared to the end of 2018, when the bottom of the $ 3,280 skyrocketed to a mid-2019 13764 stage high of more than four times the increase, the rise of bitcoin at the beginning of this year can be ignored. Obviously there are external forces pushing everyone to pay attention to Bitcoin.

The uncertainty of the global economic situation and the start of chaos in 2020 have made traditional funds more anxious.

This is why I don't think there will be a lot of traditional funds going into Bitcoin and digital currencies in the short term. When the market is anxious, the first response should first be to find leaders who are familiar with the market, such as the Chinese A-share market that has performed well in the past month, such as Tesla stocks in US stocks. It is unlikely to enter a completely new, cognitively impaired new investment market on a large scale immediately, especially in the early stages of chaos and development.

So now when bitcoin goes down, there are fewer people looking for me. The current bitcoin is still gaining momentum. A large amount of funds have no intention to leave the stock market directly. Even if everyone knows that this may be the final killing, but human nature is so fragile. You are neither willing to admit it nor to see new changes. arrival. Getting funds out of the comfort zone requires a strong stimulus.

Therefore, with the long and short double kills of the global investment market, Bitcoin will not directly show a strong willingness to rise so quickly. For those who do rounds, it is nothing more than three points: time, geography, and peace. The current chaos is not enough. The accumulation of emotions needs a flash point. Obviously, the current emotions are obviously not on Bitcoin. Masks are more important than Bitcoin.

The world is so cruel. In 2001, the house price in Shanghai was 4,000 square meters, and it was sent to the account. But everyone just wants to be alive, because you have no cash. U.S. stock prices were also very low in 2008, but everyone just wants to live because you have no cash. The upcoming days should be at the end of 2020. At that time, it is possible that Bitcoin will still be at a low point in the next ten years. Although it is higher than the price at the end of 19, everyone only wants to live because you have no cash. .

The vast majority of people in the world do not understand at this point in time:

Bitcoin is money, and before the global market crashed, holding bitcoin now was more valuable than owning fiat currency cash flow. Why wait until the end of 2020?

Human nature is as ancient as the mountains, unchanged from time to time. The fierce geopolitical conflict that may occur in the next year is likely to focus investors' attention on gold first, causing gold to rise. After all, the story of safe-haven currencies has been told for decades and is deeply rooted in the hearts of the people. What may appear next is that the safe-haven currencies such as gold and the Japanese yen, along with all other investment products, have plunged, which will cause investors around the world to fall into a nightmare fear. There are finished eggs under the nest. If you carefully compare the response of global capital markets this Monday and this Tuesday, you will know what this possibility brings, which is a devastating blow to traditional funds. The VIX panic index has soared 40% in just one day.

why? Because faith collapsed. When the old faith collapses, it is when the new faith is born.

On Monday, CNN interviewed Tim Drapper. In the interview, he did not disclose how many assets he had exchanged for Bitcoin, but in a post-event report, a reporter stated that he had exchanged most of the assets for Bitcoin. In fact, he just understood the point that most people in the world did not understand at this point in time.

The collapse of the global financial market caused by man-made disasters, natural disasters and wars will be the beginning of building the Bitcoin faith at the end of 2020.

As the shackles of the old world fade away, the door to the new world opens. After a year of baptism, Bitcoin will stand out from the chaos first. In the next round of global financial assets plummeting, and there is no hedging mechanism other than direct shorting, the skyrocketing bitcoin will attract everyone's attention around the world. The largest ethnic migration in human history will begin.

Long winter, can spring be far away?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin halving: price impact and historical correlation

- A shares should not be too optimistic, BTC medium-term or expected

- Jiangzhuoer mine was shut down forcibly. Is the epidemic good or bad for BTC?

- "The Secret History of Bitcoin" (1): Historical Background When Bitcoin Was Born

- Peter Schiff loses Bitcoin, says holding cryptocurrency is "bad idea"

- Bitcoin difficulty adjustment and soaring BSV prices

- Analysis: Bitcoin's Value Logic and Its Prospects