Less than a week and it has absorbed $700 million, is MakerDAO’s 8% interest rate really that attractive?

In less than a week, MakerDAO has attracted $700 million. Is the 8% interest rate really that appealing?Author: LianGuaiBitpushNews Mary Liu

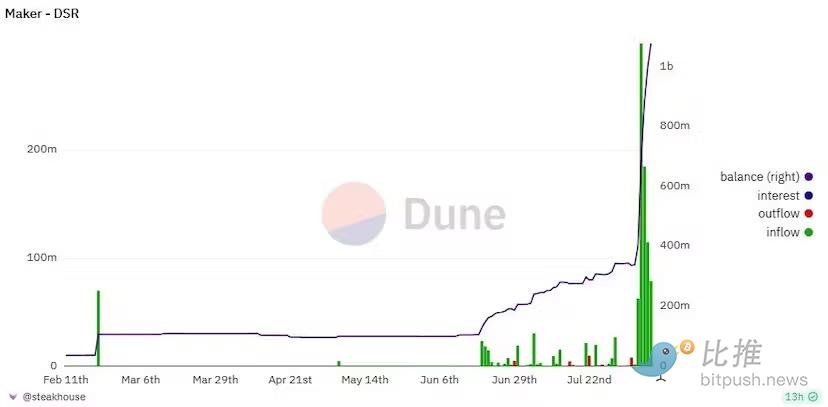

According to Dune data, after MakerDAO increased the DAI Savings Rate (DSR) from 3.3% to 8%, MakerDAO has attracted nearly $700 million in funds. The purpose of this measure is to promote the adoption of DAI stablecoin, SLianGuairk Protocol, and DSR.

Since the interest rate increase, the amount of DAI deposited in DSR has doubled to over $1 billion.

- IMF Working Paper (Part II) How to Tax Cryptocurrencies?

- Is the highly touted concept of a fully integrated blockchain gaming system really feasible?

- Interview with Animoca’s Director of Investment Where is the next wave of application scenarios for NFT?

DAI now offers the highest yield among stablecoins, surpassing various money market rates and DEX LP returns. Many crypto celebrities are also participating. On-chain data shows that Tron founder Justin Sun exchanged over 90,000 stETH for 77.8 million DAI and deposited it in Maker. With an annual yield of 8%, he can easily earn over $10,000 a day.

This is the second time Maker has increased the savings rate, the first being in May, when it was raised from 1% to 3.3%. With the introduction of new stablecoins from Curve and Aave, this move is aimed at stabilizing DAI’s market share.

Both Curve’s crvUSD and Aave’s GHO allow users to mint stablecoins based on the protocol’s generated returns. This means that users can continue to earn passive income while gaining stablecoin liquidity based on their assets.

Therefore, increasing DSR allows DAI to compete with its new competitors for market share. SLianGuairk Protocol is a branch of the Aave v3 lending protocol launched with the support of MakerDAO in May. The DAI-centric money market has also created new use cases and revenue opportunities for DAI holders, allowing depositors to access DSR and obtain loans using DAI as collateral.

Volatility in the Aave DAI Market

The interest rate on DAI on the top money market protocol Aave v3 has been highly volatile in recent months.

From February to mid-June, the borrowing cost of DAI remained stable between 2% and 4%, with a maximum increase of up to 10%. On July 13, the rate soared to 31% and reached 26% twice before the end of the month.

In the first week of August, the rate is still fluctuating and appears to be rising again.

The rise of SLianGuairk may provide alternative sources of income for stablecoin holders, further exacerbating the volatility in Aave’s DAI market.

Is the Strategy Sustainable?

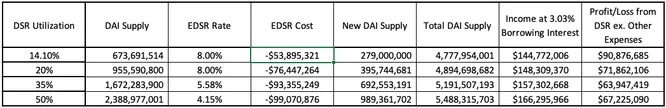

A report released by Delphi Digital shows that this strategy has had a significant financial impact. With the current DSR set at 8%, Maker’s annual cost is estimated to be $54 million. As a result, this will reduce Maker’s projected annual profit from $84 million/year to $41 million/year. Nevertheless, it can be seen as a customer acquisition cost that reignites demand for DAI.

Analysts say that, to put it simply, EDSR is based on a multiplier of 3.19% of the base interest rate DSR. As the utilization rate of DSR increases, this ratio will shrink, with a maximum of 8%:

0-20% = 3x DSR = 8%

20-35% = 1.75x DSR = 5.58%

35-50% = 1.3x DSR = 4.15%

As more and more DAI is minted, the interest generated by Maker for newly minted DAI will exceed the interest paid by DSR. However, as DSR deposits increase, this dynamic will put pressure on Maker’s profitability, leading to a decrease in profitability unless it reaches the level of 4.15% EDSR.

Delphi Digital believes that, compared to US Treasury bonds, the enhanced version of DAI DSR provides an attractive on-chain alternative. Given its higher yield, the utilization rate of DSR is likely to stabilize below 35%, consistent with the current Treasury bond benchmark interest rate of 5.5%. This strategic move aims to promote the development of Maker and lay the foundation for the introduction of the Maker SubDAO, aiming to increase the demand and utility of DAI and MKR tokens.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Performance art or hidden motives? Bold speculation on the reasons and identity behind the consecutive burning of significant assets by nd4.eth.

- LianGuai Daily|The Federal Reserve launches a new plan to regulate banks’ cryptocurrency activities; Founder of MakerDAO proposes to change the maximum value of EDSR to 5%.

- In-depth Research Can Algorand, a public chain focusing on developer and marketing, stage a comeback?

- Leading Ethereum-based project ETHS launches virtual machine, innovation seems to return to its origins.

- EigenLayer in-depth research report Ethereum’s middleware protocol leading the narrative of re-staking

- LianGuai Observation | All In Imports Elements of the Coin Circle, Coin with the Same Name Rides on the Heat

- The Success Story Behind the Explosion of TG Bots A Successful Tale of On-Chain Marketing and Grassroots Counterattack