Encrypting World Investors: Drawing on Buffett's Ideas How to Cross the Bulls and Bears

This article is the author's Buffett Shareholders' Meeting. The next article discusses the "match" between the encrypted world and traditional investment from the perspective of investment. The first article " Involving the Buffett Shareholders' Meeting, Encrypting World Investors Have Something to Say "

At the Berkshire Shareholders' Meeting in 2019, Buffett and Munger answered nearly 50 questions from shareholders in six hours. The investment philosophy discussed was similar to that of previous years: value investment, moat, not doing things outside of their own capabilities, safety. Margin and so on. It sounds like a cliché, but these ideas are his principles and persistence for many years, and the secret of successful investment.

Although crypto assets are emerging assets, they are currently more volatile than traditional assets, lacking effective valuation models and low profitability. However, with the development of industry and professional investment institutions in the past 10 years, platform coins have begun to appear. Defi and other credit assets with cash flow business; some organizations have begun to try to use NVT, CAPM and P/E valuation models to analyze encrypted assets; the emergence of financial derivatives such as futures options has reduced the volatility of assets to a certain extent, and the encrypted assets have Beginning to apply Buffett's investment philosophy.

Below I will talk about some inspiration and thinking about the investment of encrypted assets from the two dimensions of value investment and capability circle.

- A battle worth 100,000+ dollars: Peter Rizun yells at Adam Back for expansion debate

- Dollar hegemony is threatened, and members of Congress have opened their minds to prohibit all Americans from buying cryptocurrencies.

- Twitter Featured: US Conference Members Call for Banning the Bitcoin Giants' Layout on Ethereum

value investment

Buffett’s most famous saying is snowballing. He said, “Life is like snowballing. The key is to find wet snow and long hillsides.” Small snowball is your starting capital, wet snow is low-cost long-term capital, long Long hillsides are excellent companies with long-term competitive advantages. With these conditions, the investment can get a compound interest in snowballing.

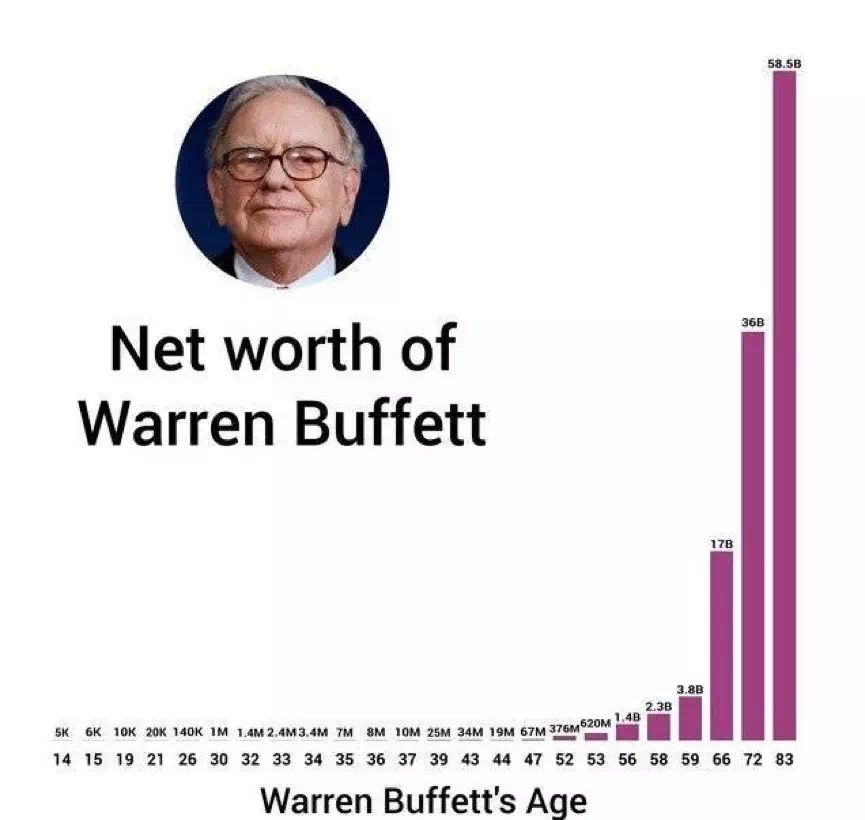

Source: dataviz.com

(The Buffett asset start-up capital is $5,000, and the fastest value-added appears after the age of 52. So everyone should exercise well and live as long as Buffett before they can enjoy the subsequent time compounding)

- Low-cost long-term funding

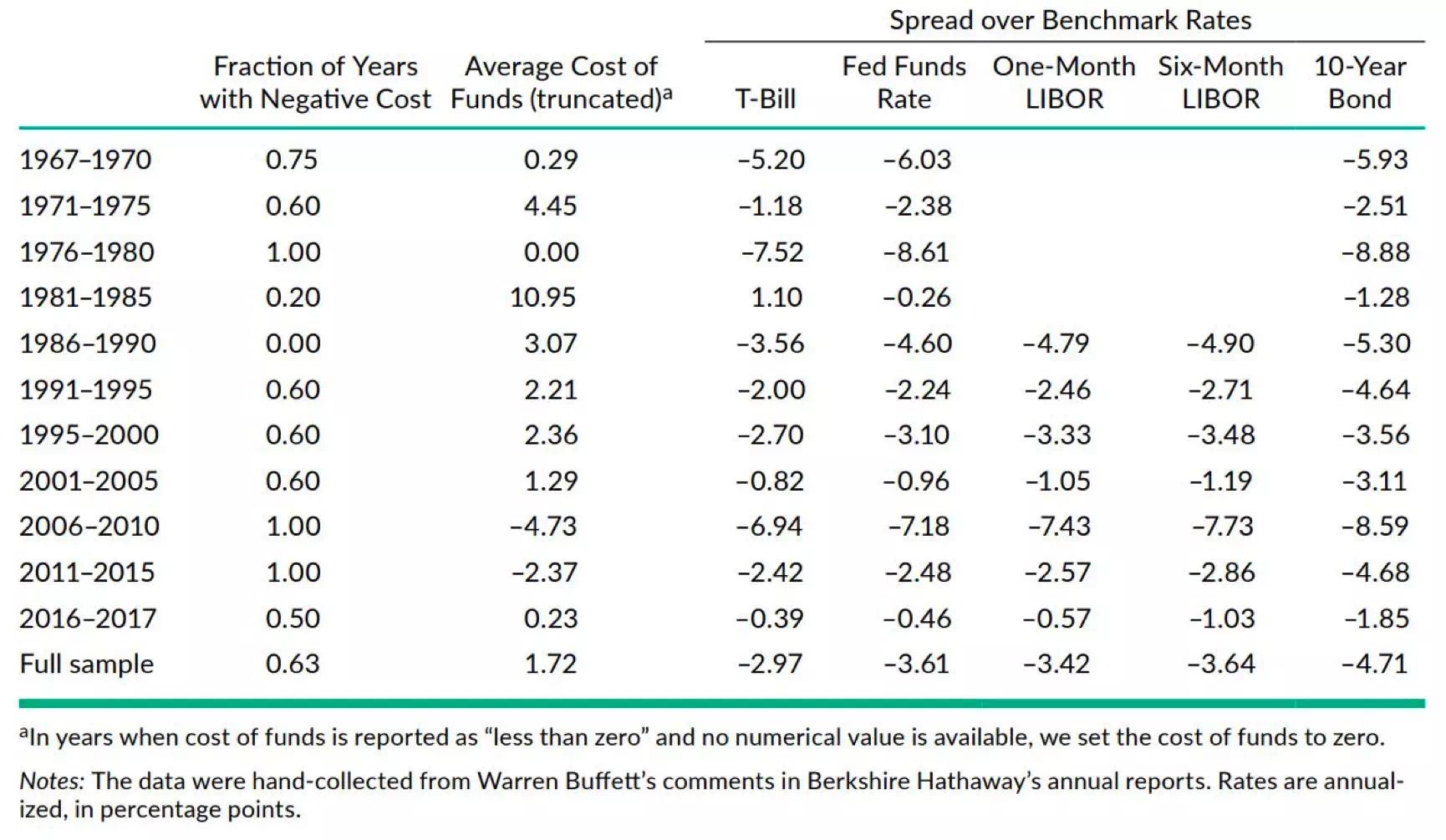

Buffett’s repeated shareholders’ meeting mentioned that zero-cost or even negative-cost insurance deposits are the key to Berkshire’s success because the cost is low enough. According to statistics, Buffett’s average capital cost is as low as 1.72%. US Treasury yields are all three points lower, which means that Buffett’s credit costs are lower than the US government. On the other hand, this is also an investment lever. Buffett often advises people not to use leverage to create a misunderstanding that he never uses leverage. In fact, Buffett does not need high leverage. Berkshire's leverage has been controlled between 1.5 and 2, the leverage is manageable and the risk is low.

Source: Buffett's Alpha

For crypto asset investments, low-cost long-term funding is equally important. Generally speaking, VCs in the primary market have a 5-7 year fund duration, while Token is an emerging asset. Most LPs are not currently used as their main asset allocation, resulting in quick results and high returns. As a selling point, Tokenfund often has a duration of 1-2 years. In the golden age of ICO in 2016-2017, the average time of a project from launch to completion (list exchange) is 3-6 months, and the rate of return reaches several hundred times, and the short-term investment in LP is undoubtedly in the early stage of industry development. Brought convenience.

During the bubble period, this short-term investment has accelerated the turnover rate of funds, improved the performance of the fund, and brought more investment funds. However, this kind of short-sightedness has also accelerated the bursting of the industry bubble. In order to survive the bear market, the project's listing period has been extended and the lock-up period has been lengthened. The early projects cannot be quickly withdrawn, resulting in a shortage of market liquidity. New projects cannot be financed, and The market deteriorated further, forming a negative cycle of Davis double kill.

For retail investors, Li Xiaolai mentioned in the "self-cultivation of leeks" that the only way to get rid of leeks is to obtain long-term stable low-cost cash flow. Some people make money through the field, and some people get this ability through continuous fundraising. . For Tokenfund, because the Matthew effect is obvious, the best way to obtain low-cost long-term funds is to build a brand and influence, and quickly become a head fund in order to obtain long-term low-cost financial support, resist industry cycle risks, and cross the cattle. Bear.

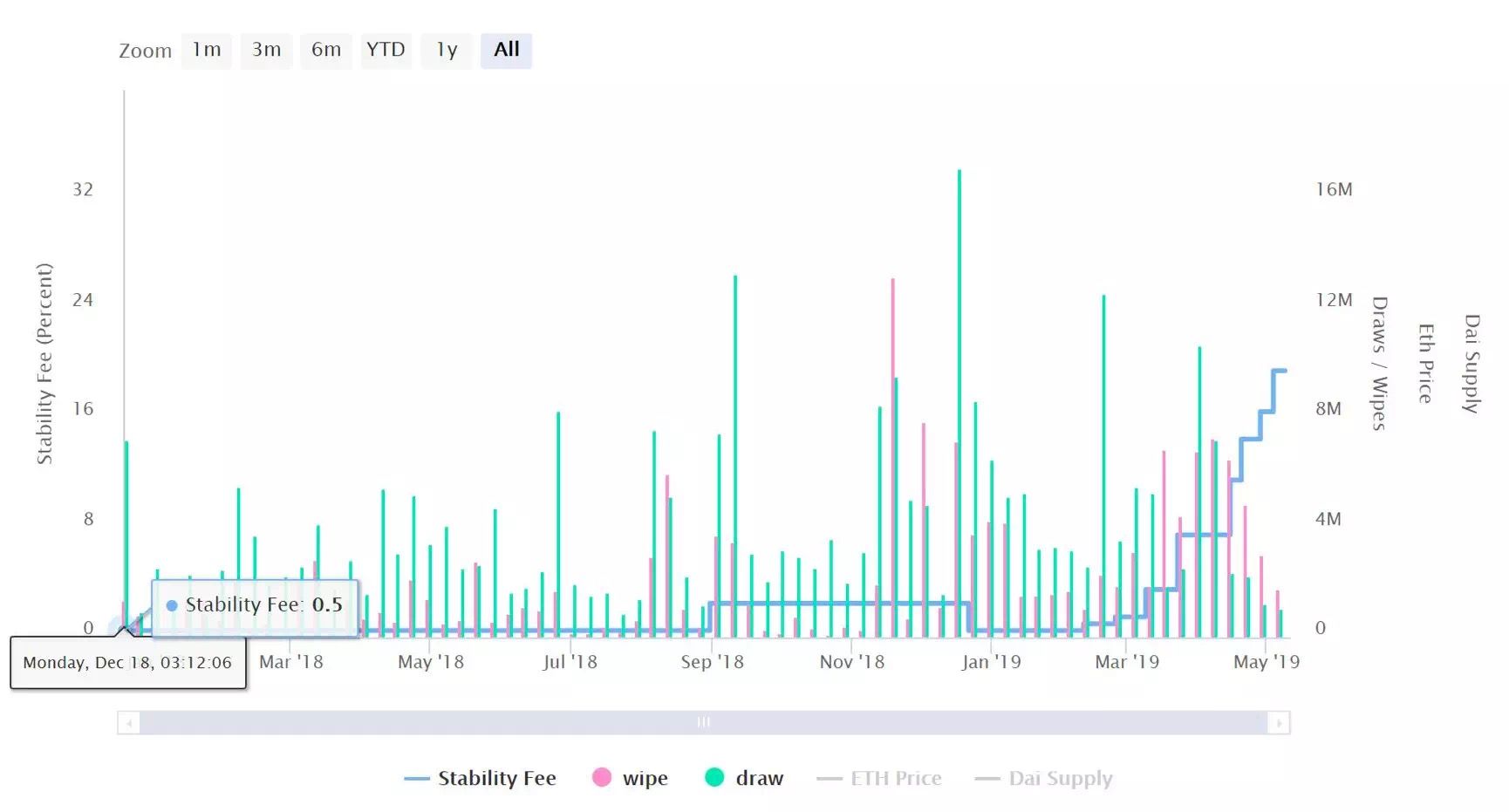

Source: MakerDao

As for leverage, amaranths like to trade through exchange contracts, and the leverage ratio is 10 or even 50 times. This is tantamount to gambling. The high volatility of the encryption assets themselves magnifies the related benefits and risks.

Learning Buffett's correct leverage is to use the Defi platform such as MakerDao and other low-leverage collaterals to obtain stable coins for the purchase of new crypto assets during the rapid rise and fall of crypto assets. The initial annualized MakerDao rate is only 0.5%, and the capital cost is extremely low. Of course, due to the expansion of the number of users, the stable rate has been relatively high at 16.5% per year after multiple adjustments, and can wait for the future rate to be lowered.

- Grasp long-term trends and hold for a long time

At the shareholders meeting, Buffett bluntly said: "We are very lucky to be born in the United States, of course, not bad in Canada." In my opinion, the first half of the sentence is really important, and the latter part of the sentence may not have the current stock.

Buffett was born in 1930, and the United States happened to be in the Great Depression of 1929-1933. Since then, although the short-term experience of the 1973 oil crisis, the 2000 Internet bubble, the 2008 subprime mortgage crisis and other financial crises, but in the long-term trend, this nearly a hundred years is the United States' continued prosperity. If you start with Buffett’s first investment in 1942 and buy a $1 non-commissioned S&P 500 index, all dividends will be reinvested and will become $5,288 by 2019. You don't need to read the annual report, you don't need to understand finances, you just have to trust the United States. You don't need to choose which stock to invest in, just choose to invest in the US.

Of course, grasping the national movement and the trend is not enough, and it still needs to be held for a long time. We tend to underestimate long-term value and overestimate short-term changes. When the shareholders meeting asked Mengge to answer the interesting personal investment, he said, “The stock I bought has risen 30 times soon, but I sold it when it rose 5 times. This is the most stupid thing in my life. decision."

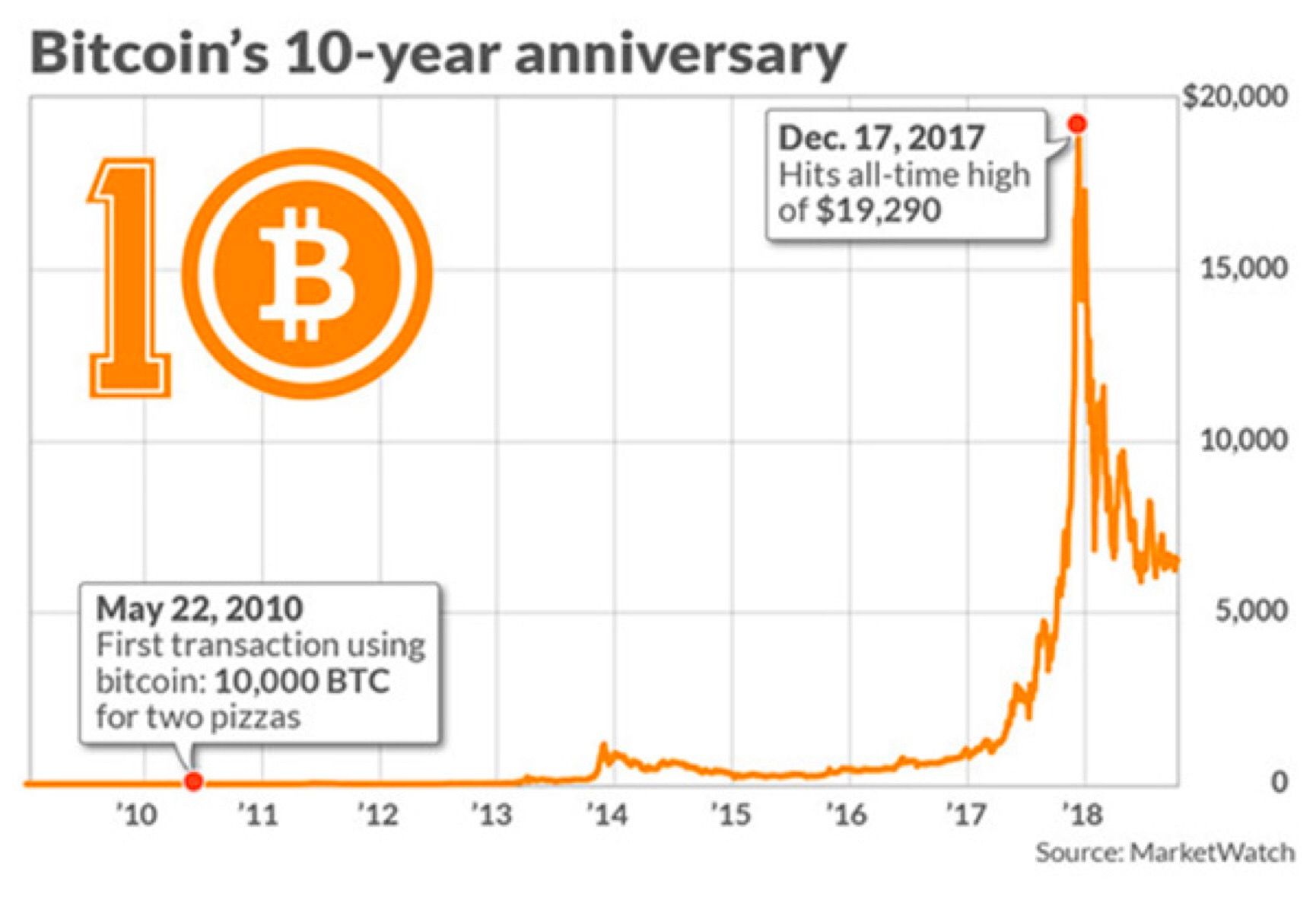

Encrypted assets, whether in the past 10 years or in the next 10-20 years, are undoubtedly a big snow slope. Bitcoin is like the US National Games. After several ups and downs, every time it is predicted to die, but it will survive and then create new highs.

(12 years – 13 years, 15 years – 16 years of bear market from a long period of 10 years, but a small wave in the big wave)

The reason why many amaranths are self-deprecating is amaranth, mainly because they can make a good profit in the short-term, but they often miss the biggest value in the short-term, and even lose money in the middle of the operation.

Organizations sometimes miss out on quality crypto assets because of cognitive biases. My partner was the first institutional investor to invest in small ant (later renamed NEO) and held a large amount of small ant. If the price will be 9000 times that of the investment in 2018, but when the small ant coin has risen 15 times, he thinks that the small ant coin has a big bubble and it is sold. It is a pity. Therefore, in the follow-up investment process, under the premise of guaranteeing the LP principal, we will hold the optimistic crypto assets for a long time, avoiding similar tragedies and regrets.

- Looking for excellent companies with long-term competitive advantages and cheap

At the shareholders meeting, Buffett explained the reason for buying Amazon stocks: "The 'value' in value investing is not an absolute low price-earnings ratio, but a comprehensive consideration of the indicators of buying stocks, such as whether it is a business understood by investors, Future development potential, existing revenue/market share/tangible assets/cash holdings/market competition, etc.”.

Combined with Berkshire's past investment cases, we can find that Buffett's stock selection has these characteristics: 1. low elasticity and low volatility; 2. cheap valuation (low price-to-book ratio); 3. high quality (good profitability) , strong scale effect, good growth and high dividend rate). Among them, Buffett's favorite is the consumer industry. From 1963 to 2013, consumer stocks had the highest yields and almost the lowest volatility.

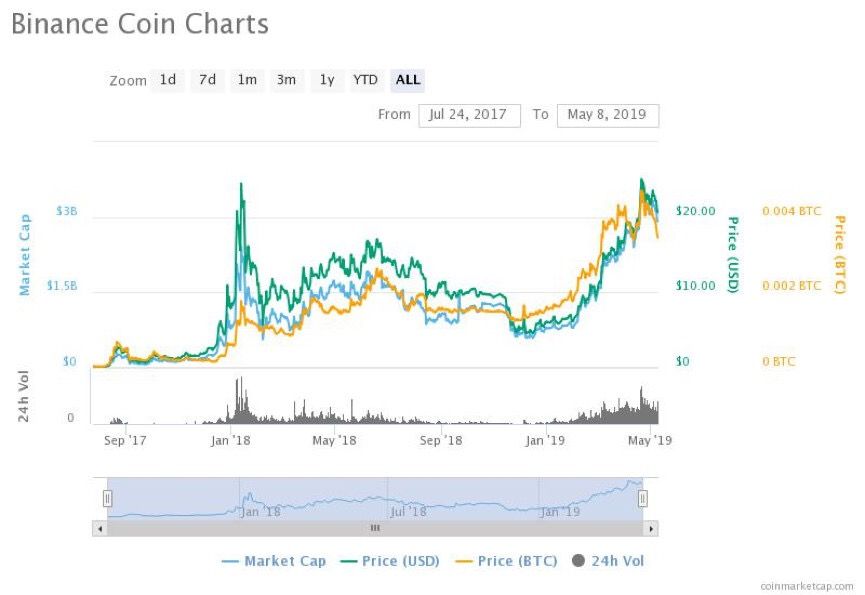

Among the crypto assets, the platform currency of the current exchange is a section that can cross the bulls and bears the characteristics of Buffett's stock selection. Take BNB issued by the currency security as an example, it has good profitability (net profit of about 446 million dollars in 2018), strong scale effect (users break through 10 million), good growth (still growing rapidly since its establishment in 2017), dividends The rate is high (repurchase 20% of net profit every year), and the bear market is cheaper in 2018 (down to the historical lowest price of 4.12 US dollars on December 7, 2018). And the currency security is still breaking through its own boundaries. In 2019, the currency security chain was opened, and the new business such as the central exchange, the legal currency transaction, and the IEO was opened. It belongs to a project with limited down space and unlimited upside space. The specific analysis is not detailed here. You can refer to the platform currency valuation analysis series report released by Chain Capital.

(BNB is the first in the bear market to break through the highest price in the bull market, and hit a record high, becoming a bear market light)

To sum up: Value investing is to choose a good company in a long-term stable industry, buy at a reasonable price when you have low capital costs, then hold it patiently and add value with quality assets.

Ability circle

When the shareholders' meeting returned to how to replicate his success, he said: "I think the best way to do it now is to specialize. You don't want to go to a dentist to see orthopedic diseases. So the most common way is to slowly narrow down. Professional scope, to achieve refined specialization."

Buffett said: "I and Munger will not rush into a new field, just because others told us to do so, we may hire 10 people who are completely focused on new areas to invest." Every company and individual has their own The ability circle and the boundary, the ability circle is to do something different, stick to their ability circle.

Reflecting on ourselves, since 2016, Chain Capital has invested in more than 50 projects in the public chain, storage, AI, Internet of Things, finance, games and other fields, and the investment is too much. Although the fund's overall return is good, there are some projects because FOMO, for some areas outside of its own ability circle, blindly bet in the absence of awareness, resulting in investment failure.

The favorite statement of the entire shareholders meeting is that Buffett said that time and love can't be bought with money, and it is also the most important. By giving this sentence to all investors and entrepreneurs in the field of encryption assets, let us not only seize the blockchain era, but also exercise more, invest in ourselves, care for the people around us, and gain wealth while harvesting. Healthy and happy life.

PANews Contributing Author | Chain Capital Founding Partner Li Xiangmin

This article has been edited by Babbitt Information, and has been deleted. Original address: https://mp.weixin.qq.com/s/CLtmawVsbzy6tZzTo4c3LA

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- After sending 1000 lightning network transactions, we have something to say.

- Market analysis on May 10: The big cake sucks blood and replicates the trend of 2017?

- Global Encryption Quantification Fund Industry Research Report

- Japanese game apocalypse: art, gameplay, theme… What is missing in the current chain tour?

- Staking is so hot, but inflation accelerates centralization

- 50 banks participate together! Distributed ledger startup R3 Voltron trade financing application accepted inspection

- The US House of Representatives new working group will review blockchain and cryptocurrency