Global Encryption Quantification Fund Industry Research Report

Encrypted certificates have the characteristics of high profitability and low correlation with traditional assets, and have become an indispensable part of the global asset allocation. At the same time, because the encrypted exchange trading market has the characteristics of long trading time, large fluctuation range, global pricing, and multi-transaction linkage , it is suitable for quantitative trading.

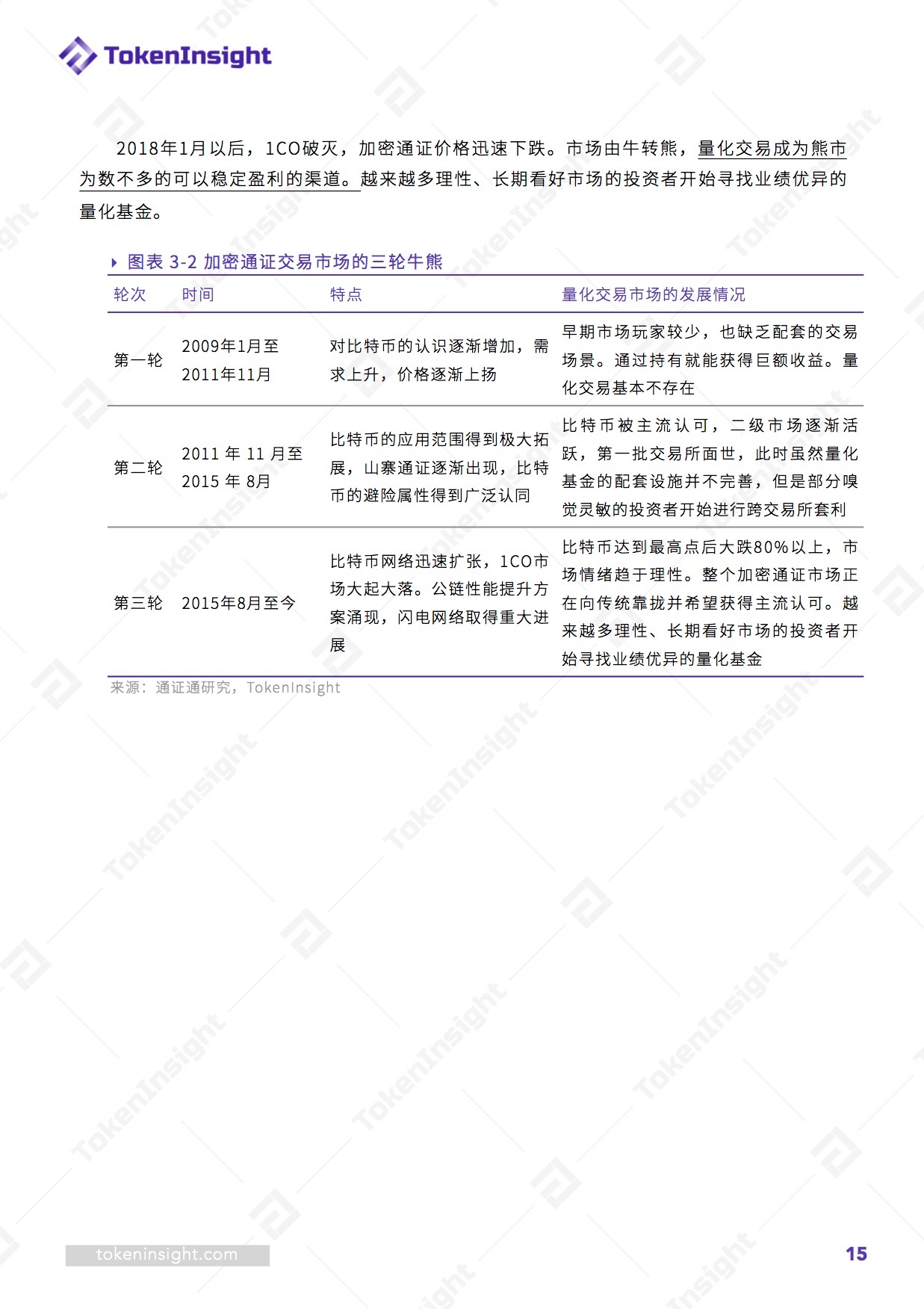

The encrypted pass trading market has experienced three rounds of bulls and bears in the past decade, and the market trading style has also been differentiated with the baptism of the altcoin and 1CO. The market is rational, and quantitative trading is gradually accepted by the market.

TokenInsight has researched more than 100 quantitative funds at home and abroad, and has written a research report on the quantitative fund industry. It will quantify the development of the fund and products, quantify the background of the team, and show the future trend of the industry development in the industry.

The following is a summary of the points:

- Japanese game apocalypse: art, gameplay, theme… What is missing in the current chain tour?

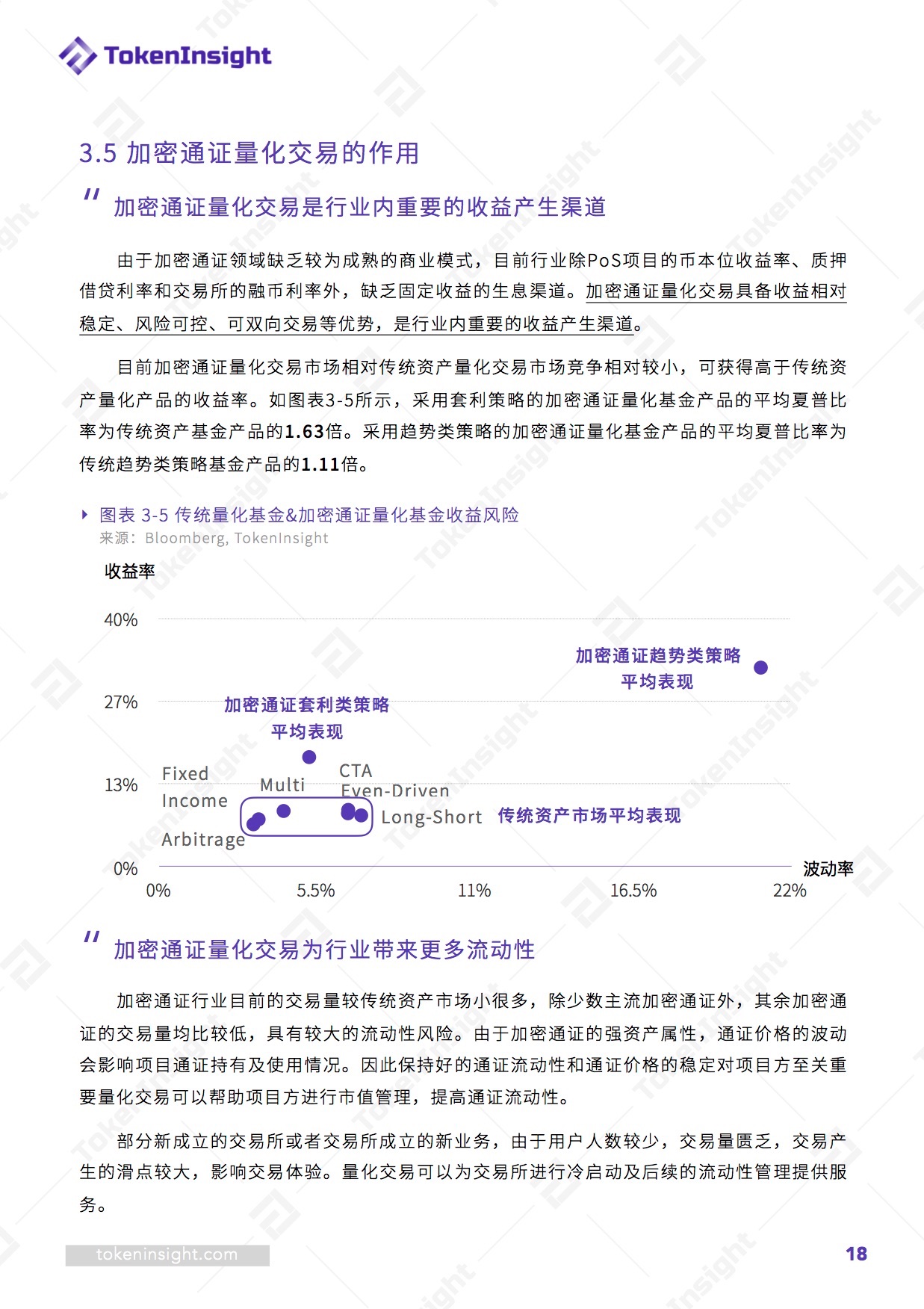

- Staking is so hot, but inflation accelerates centralization

- 50 banks participate together! Distributed ledger startup R3 Voltron trade financing application accepted inspection

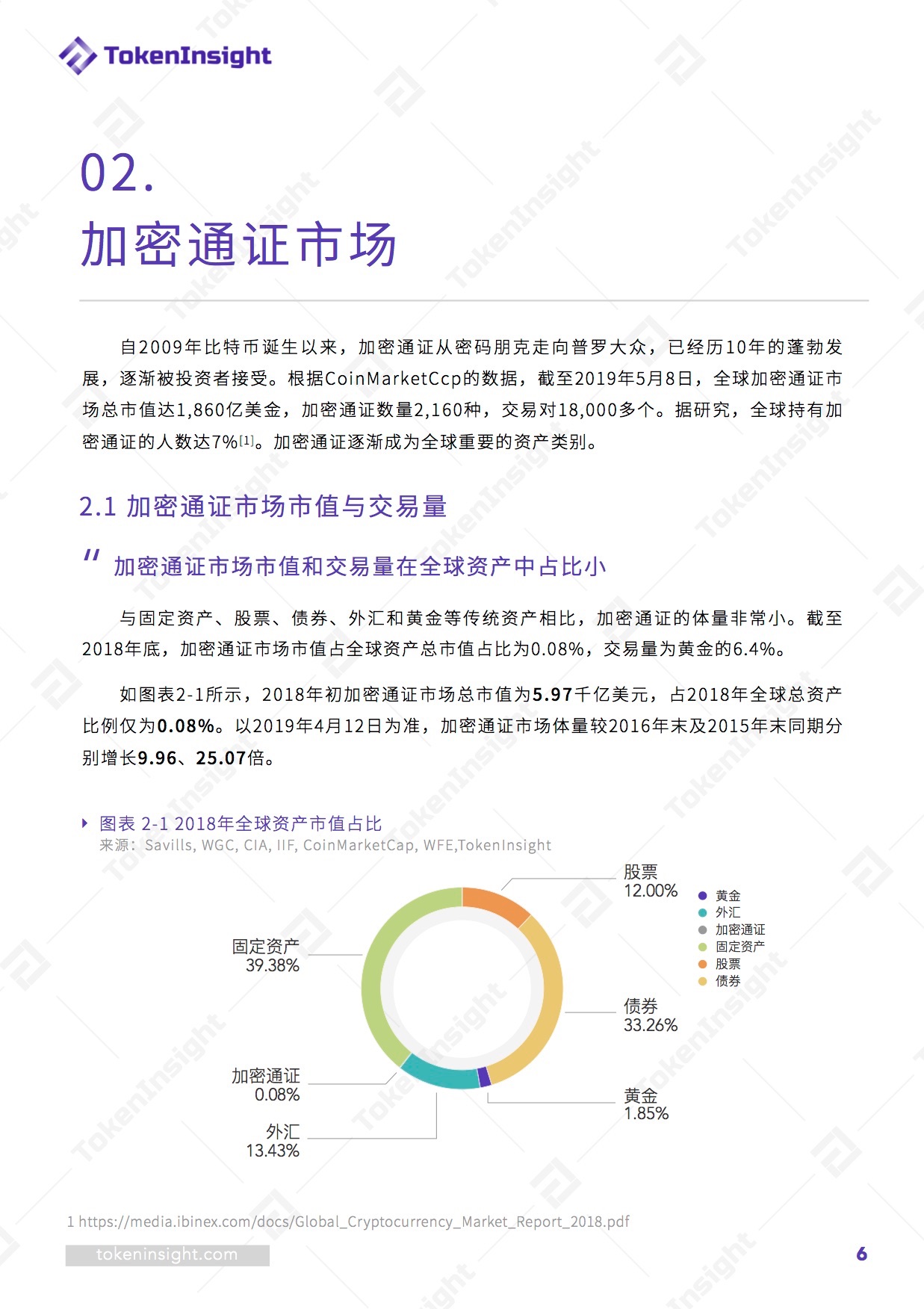

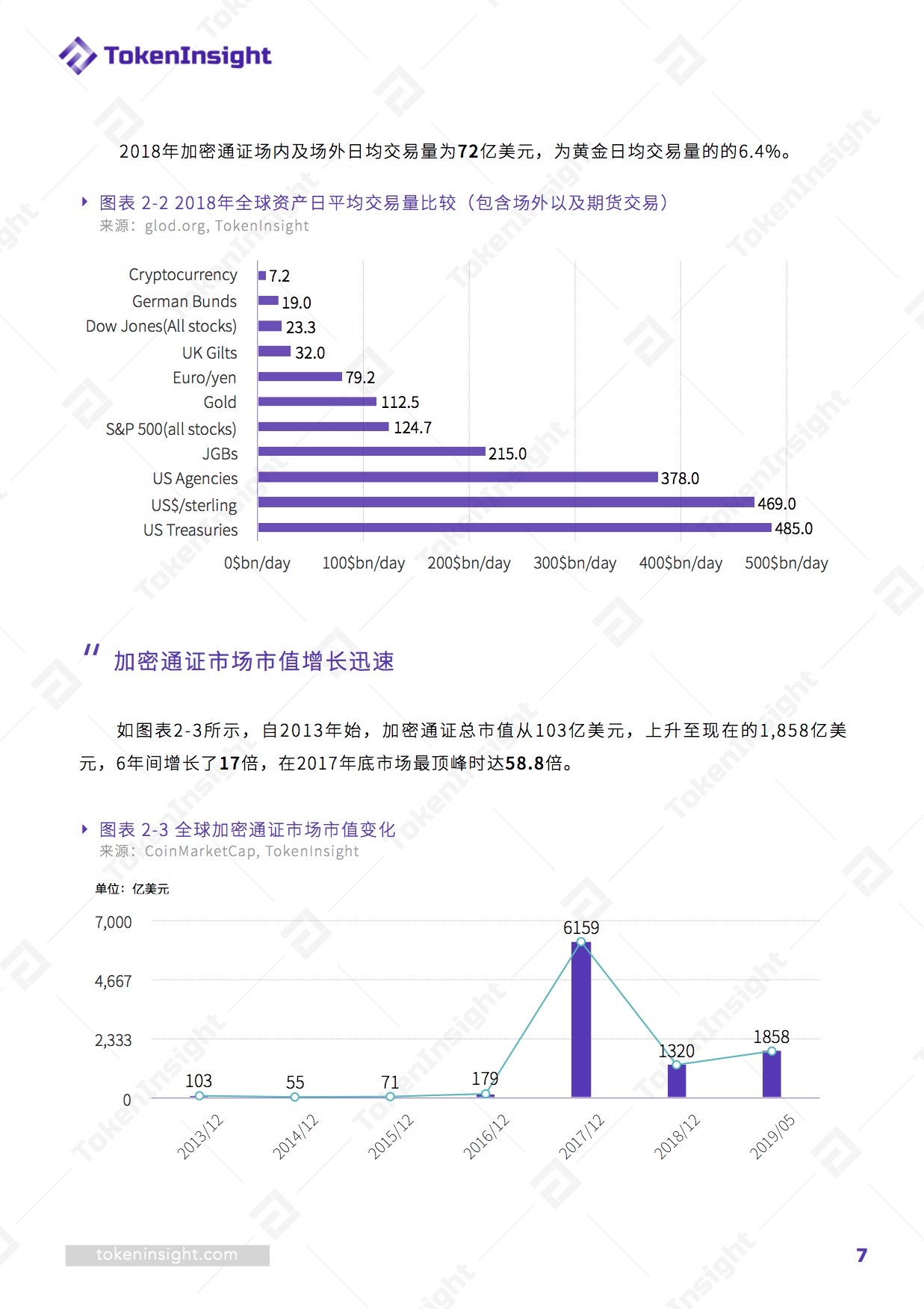

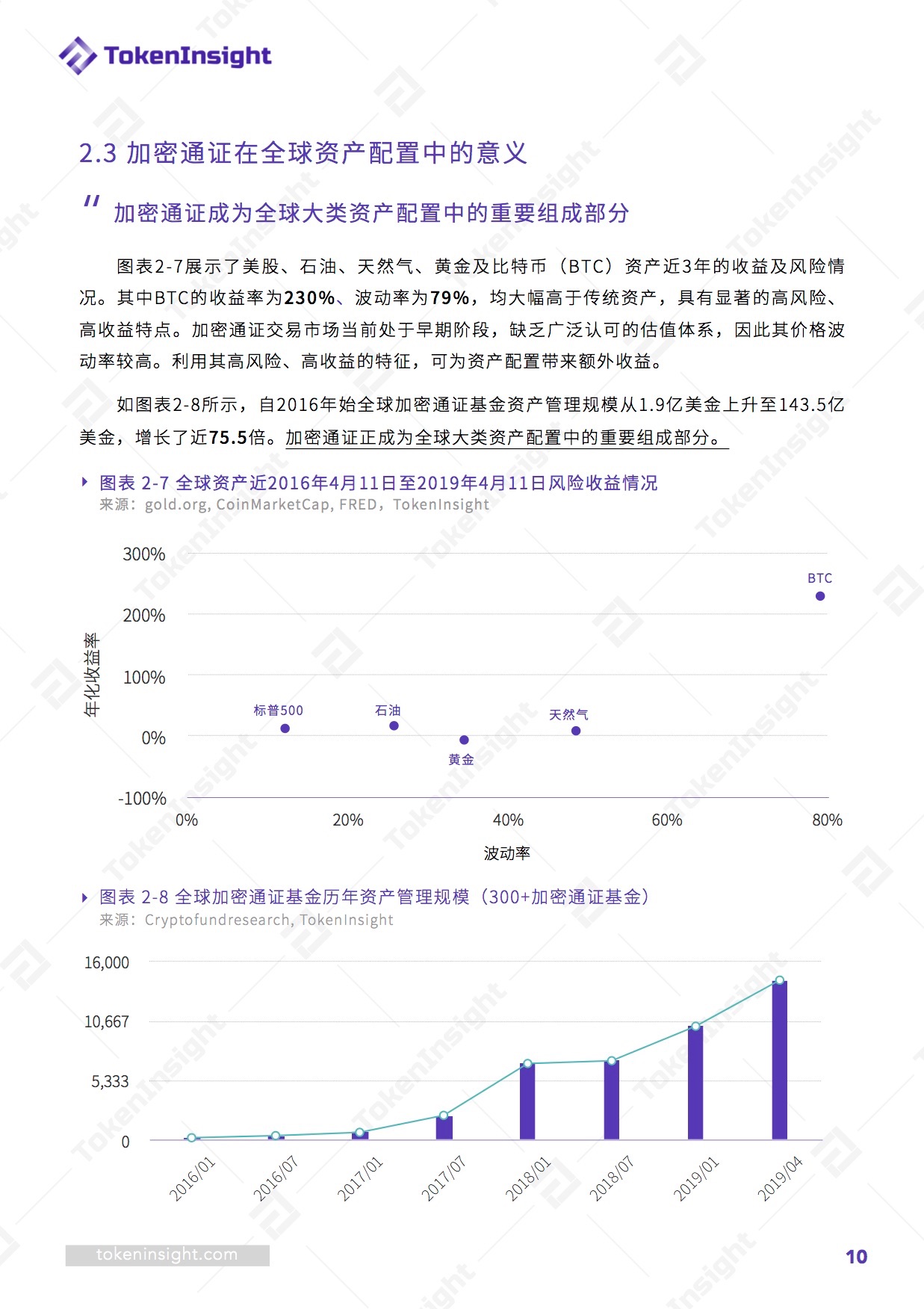

1. The market value and transaction volume of the encryption pass market are smaller in the global proportion, but they are growing rapidly. The crypto-pass market has the characteristics of multi-exchange global linkage, long trading time and high volatility.

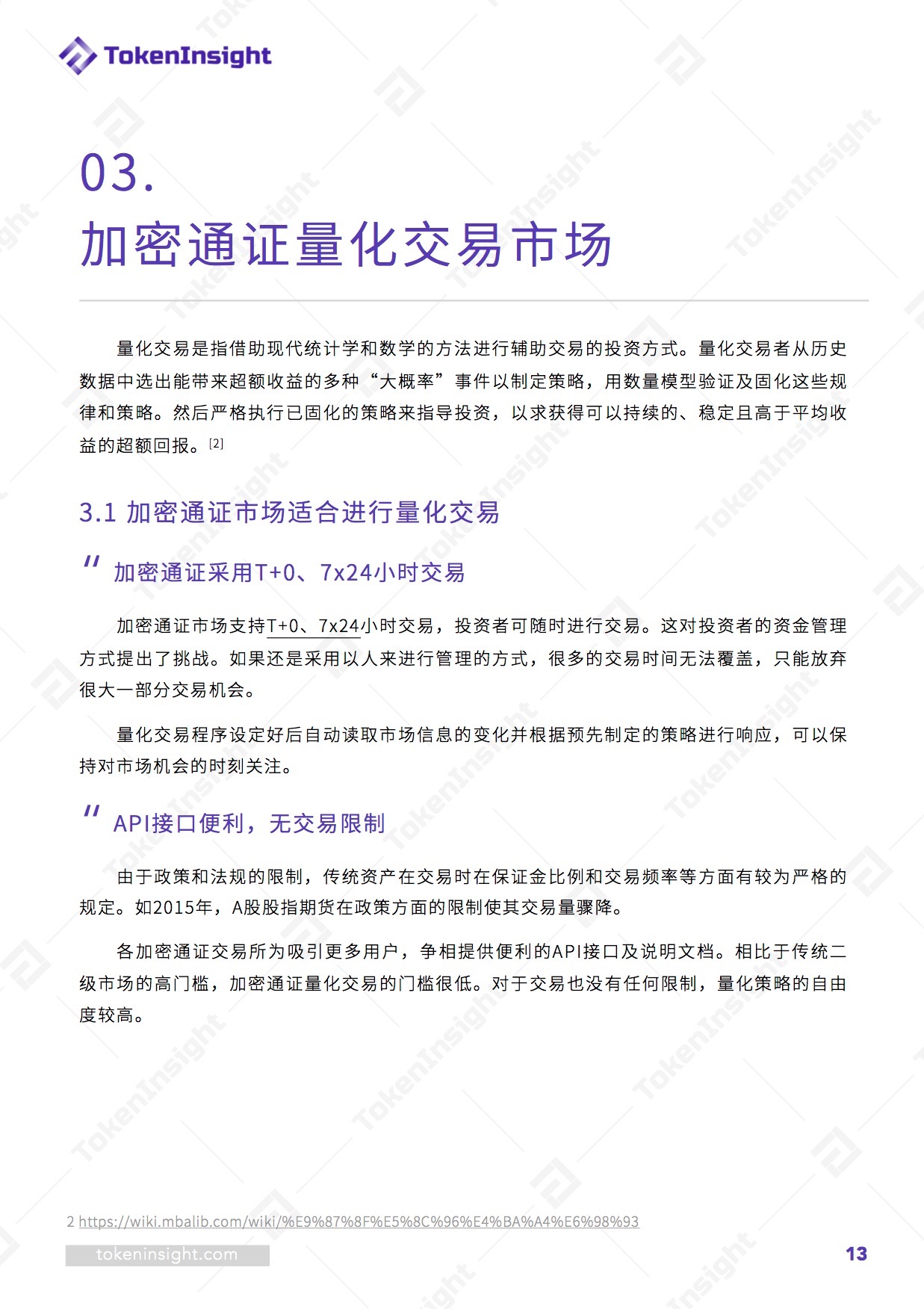

2. Encryption certificate has the characteristics of high profitability and low correlation with traditional assets, and is becoming an important part of the global asset allocation.

3. Encrypted pass is T+0, 7×24-hour trading, with convenient API interface, no trading restrictions and numerous exchanges, which is suitable for quantitative trading.

4. The crypto-transformation market has experienced three rounds of bulls and bears in the past decade. Quantitative transactions have become a few channels in the bear market that can stabilize profits and are gradually accepted by the market.

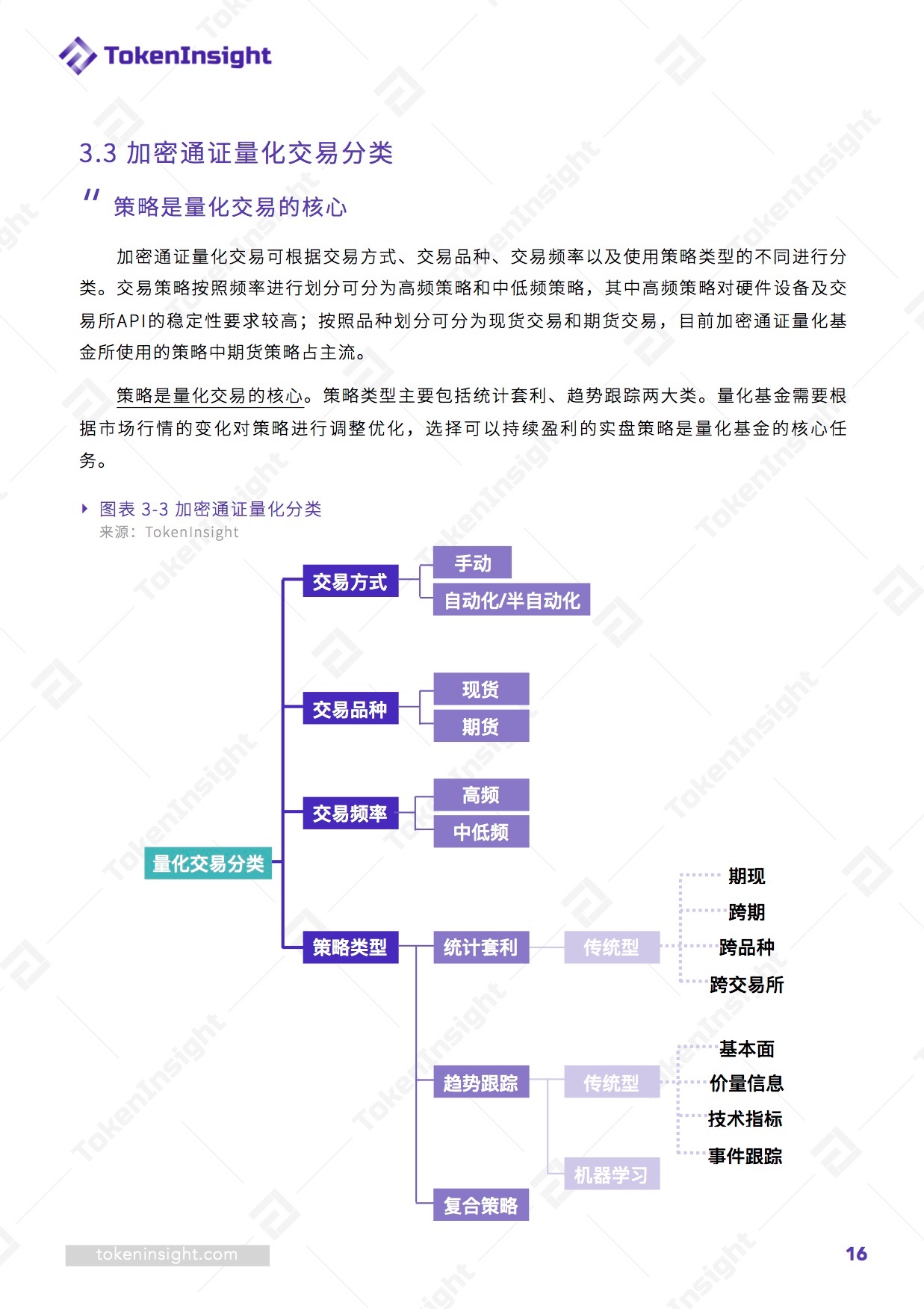

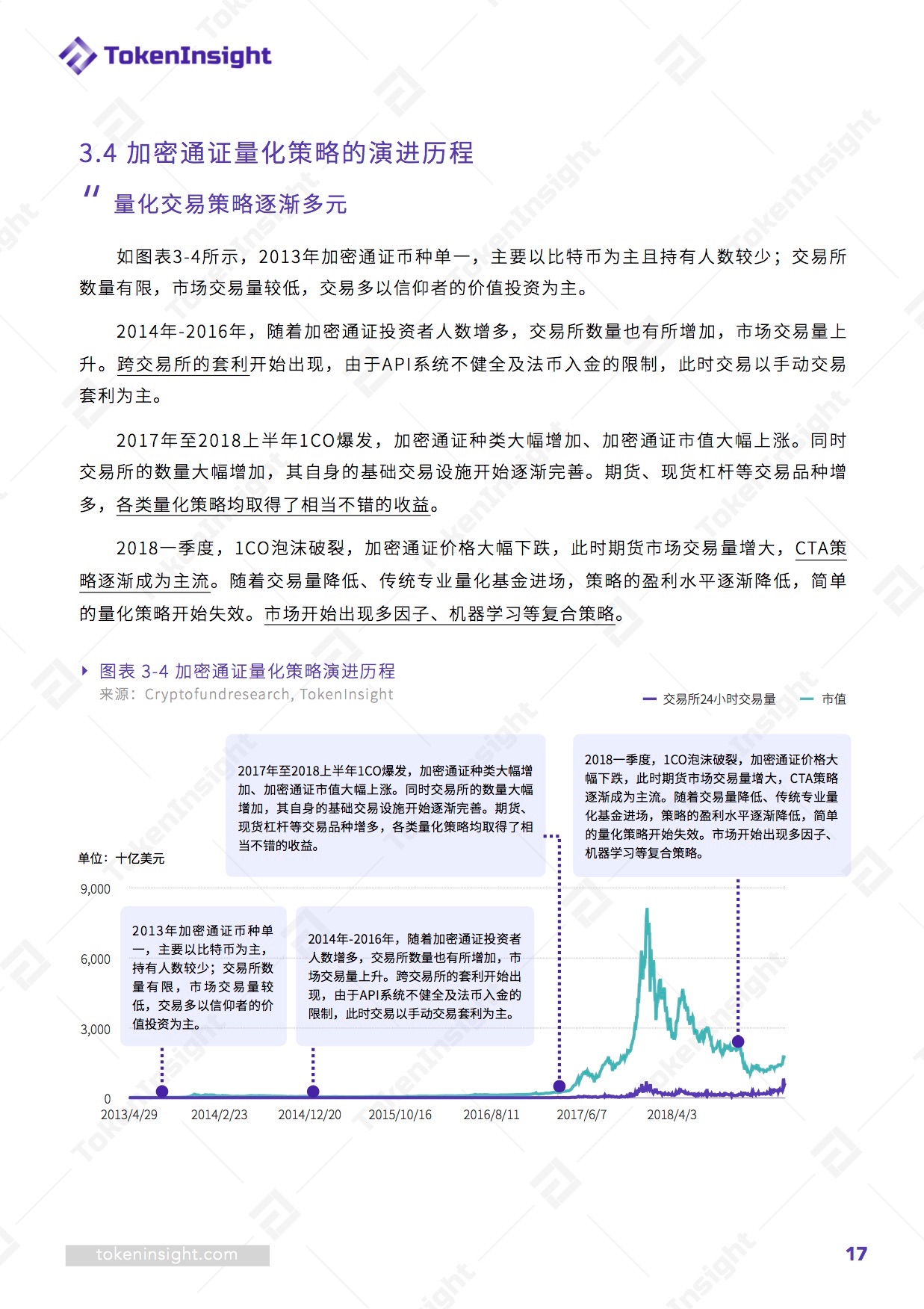

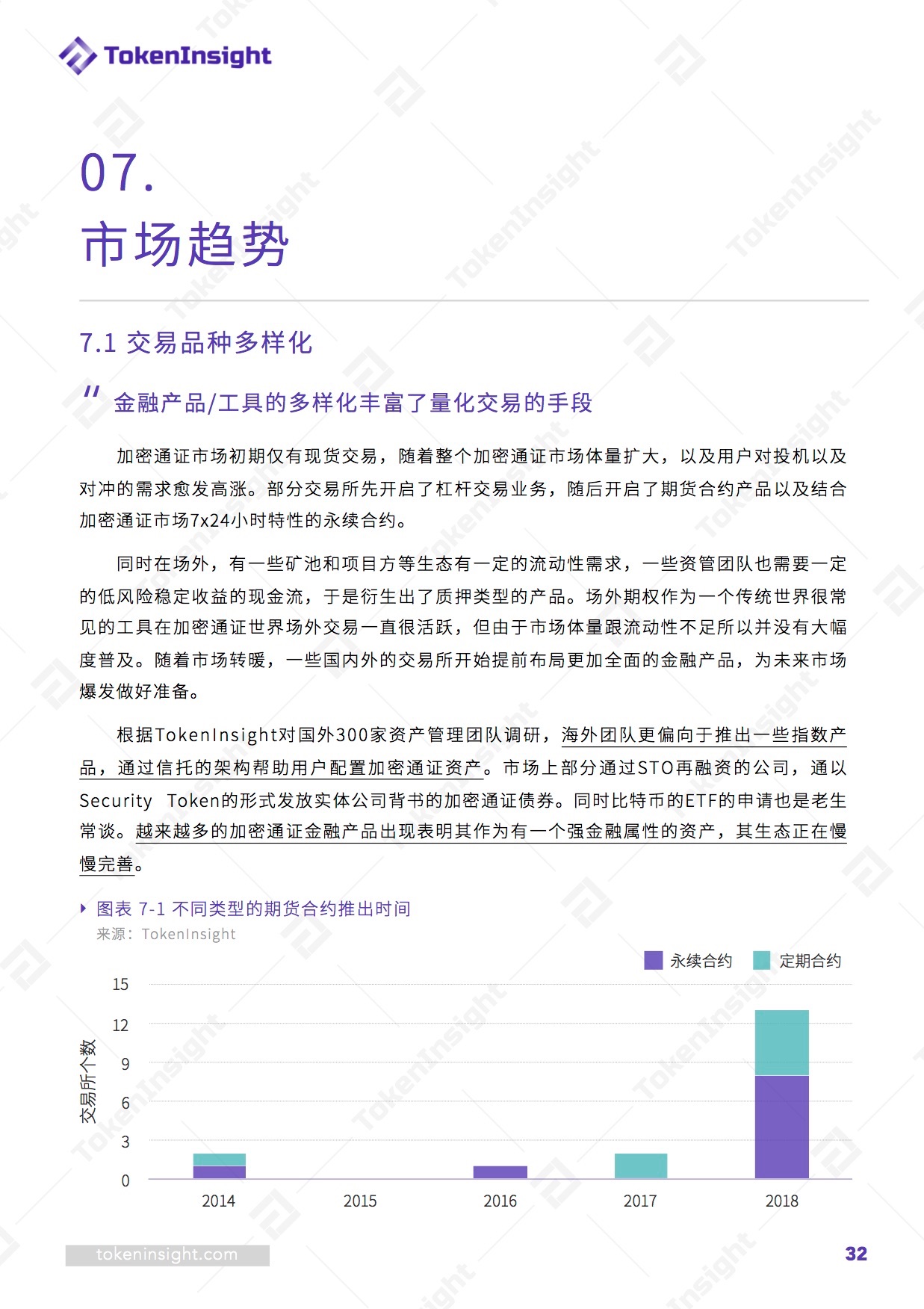

5. Encrypted Quantitative Trading Strategies A simple strategy of cross-market arbitrage has evolved into a richer portfolio of strategies, including various arbitrage strategies, trend strategies, and composite strategies .

6. Encrypted and Quantified Trading has the advantages of relatively stable returns, controllable risks, and two-way transactions . It is an important revenue generating channel in the industry. Encrypted cryptographically quantified transactions bring more liquidity to projects and exchanges, improve the price discovery function of the trading market, and promote the fairness of trades in the industry.

7. At present, the global quantitative funds are mainly distributed in the United States, China, Canada, the United Kingdom and Russia. The quantitative funds in China are mainly distributed in big cities such as Beishangshen.

8. A large number of cryptographic vouchers have entered the market from 2017 to 2018, and the scale is generally small. At present, most of the quantitative funds are below 1,000 BTC, and most of the products they issue are between 100-300 BTC.

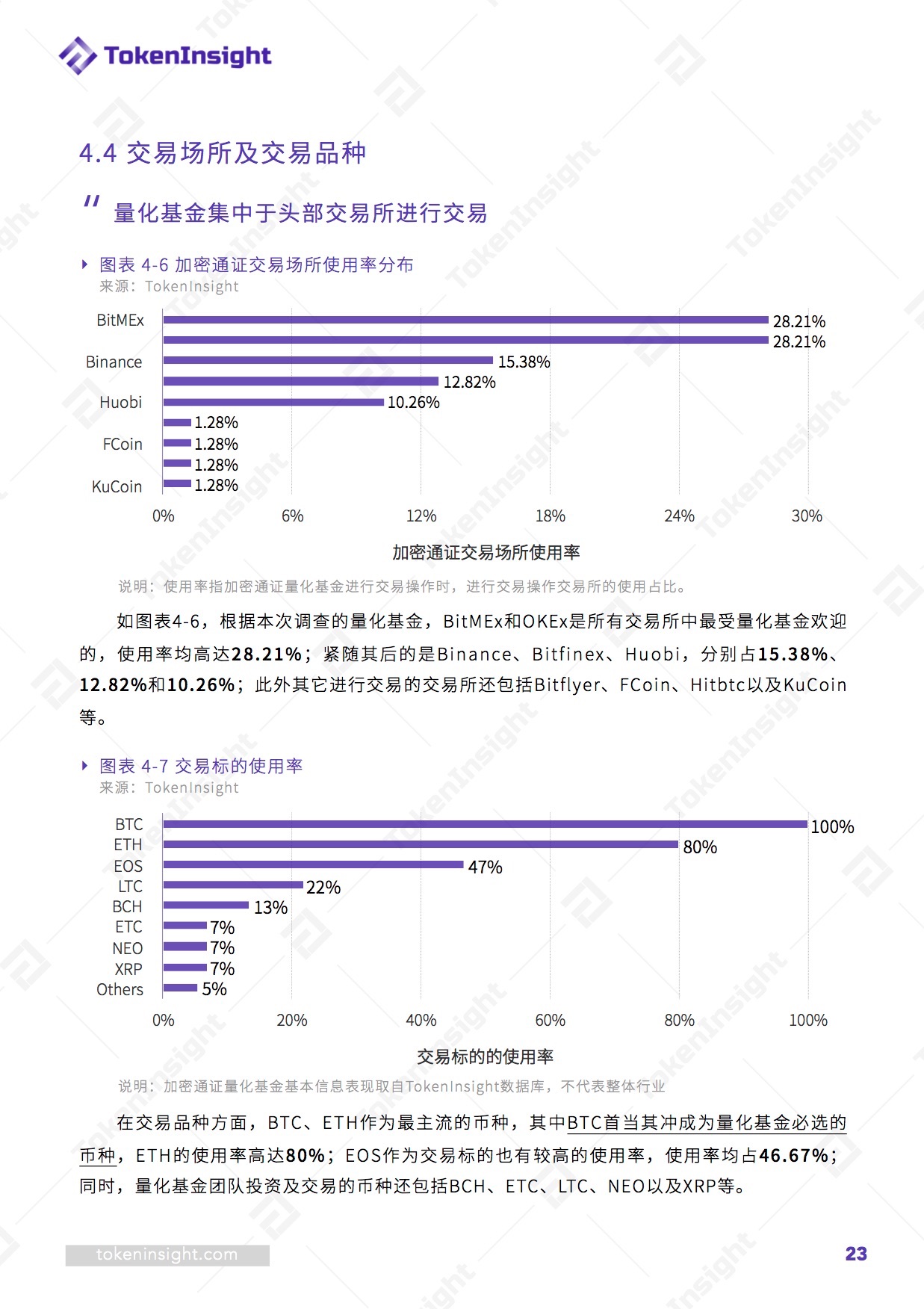

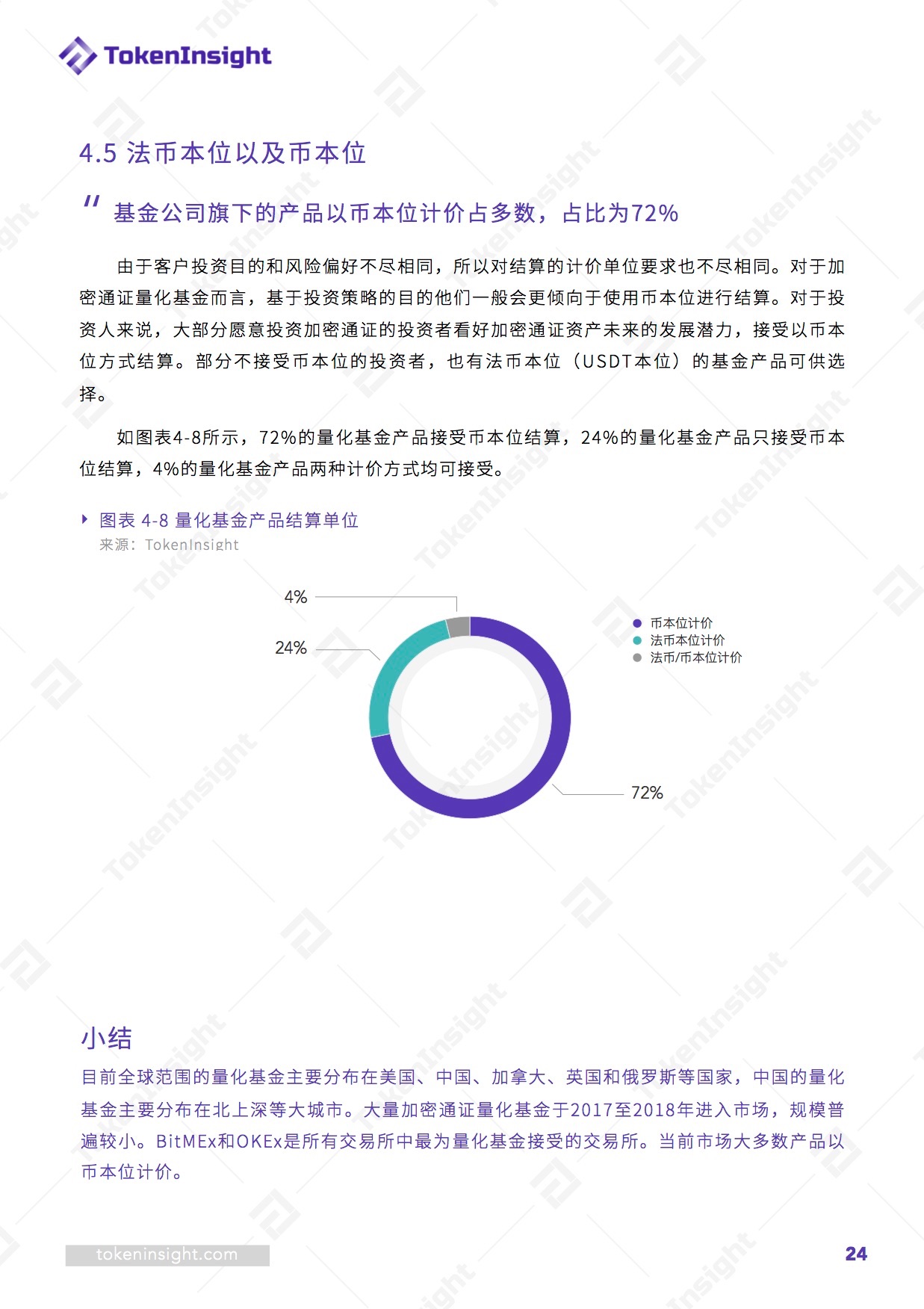

9. BitMEx and OKEx are the most accepted exchanges on all exchanges, followed by Binance, Bitfinex and Huobi, which are directly related to the size of exchanges and futures exchanges. In terms of trading asset types, BTC is a mandatory currency for quantitative funds, and ETH and EOS are also selected by most quantitative funds. Most products in the current market are denominated in the currency standard.

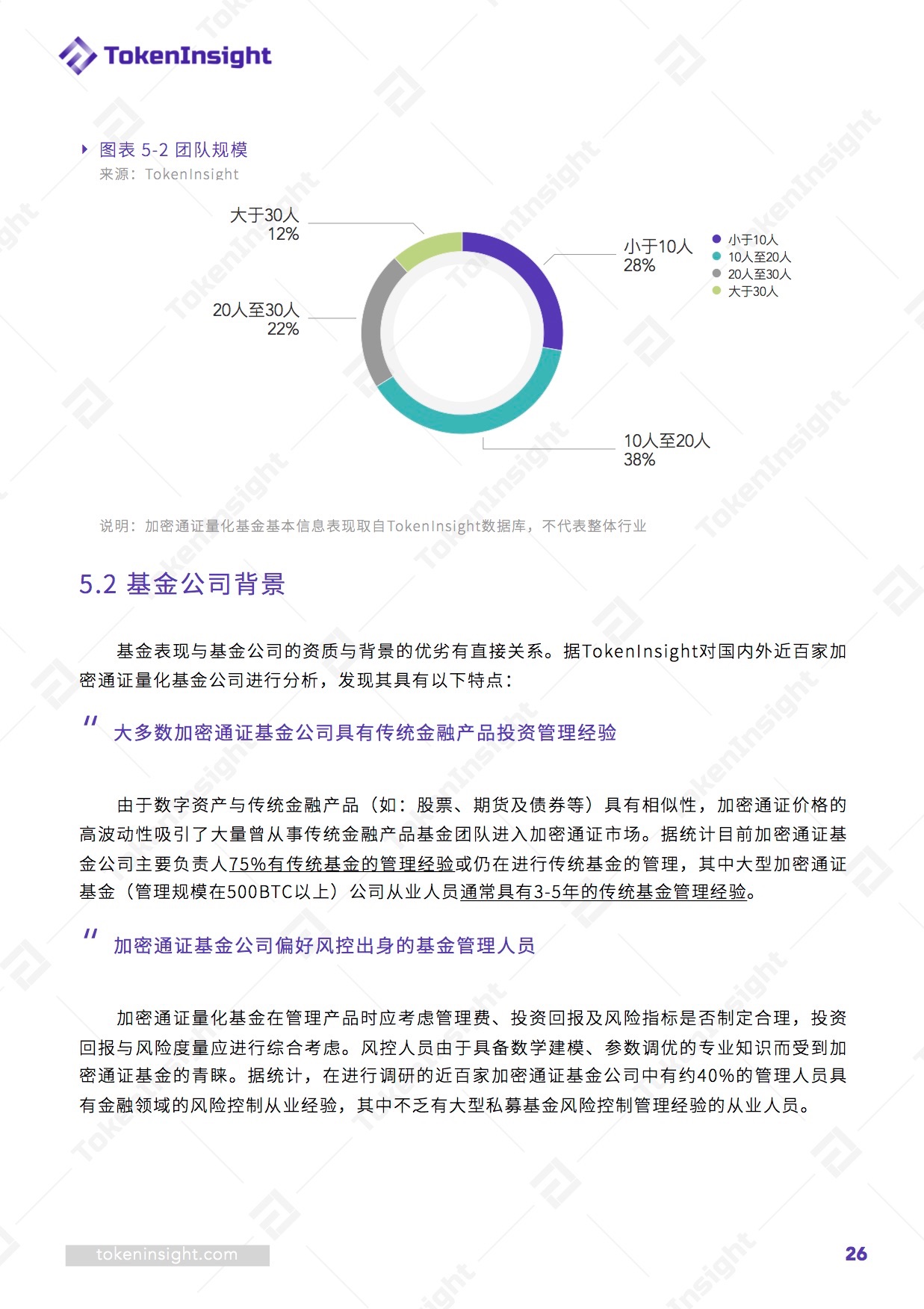

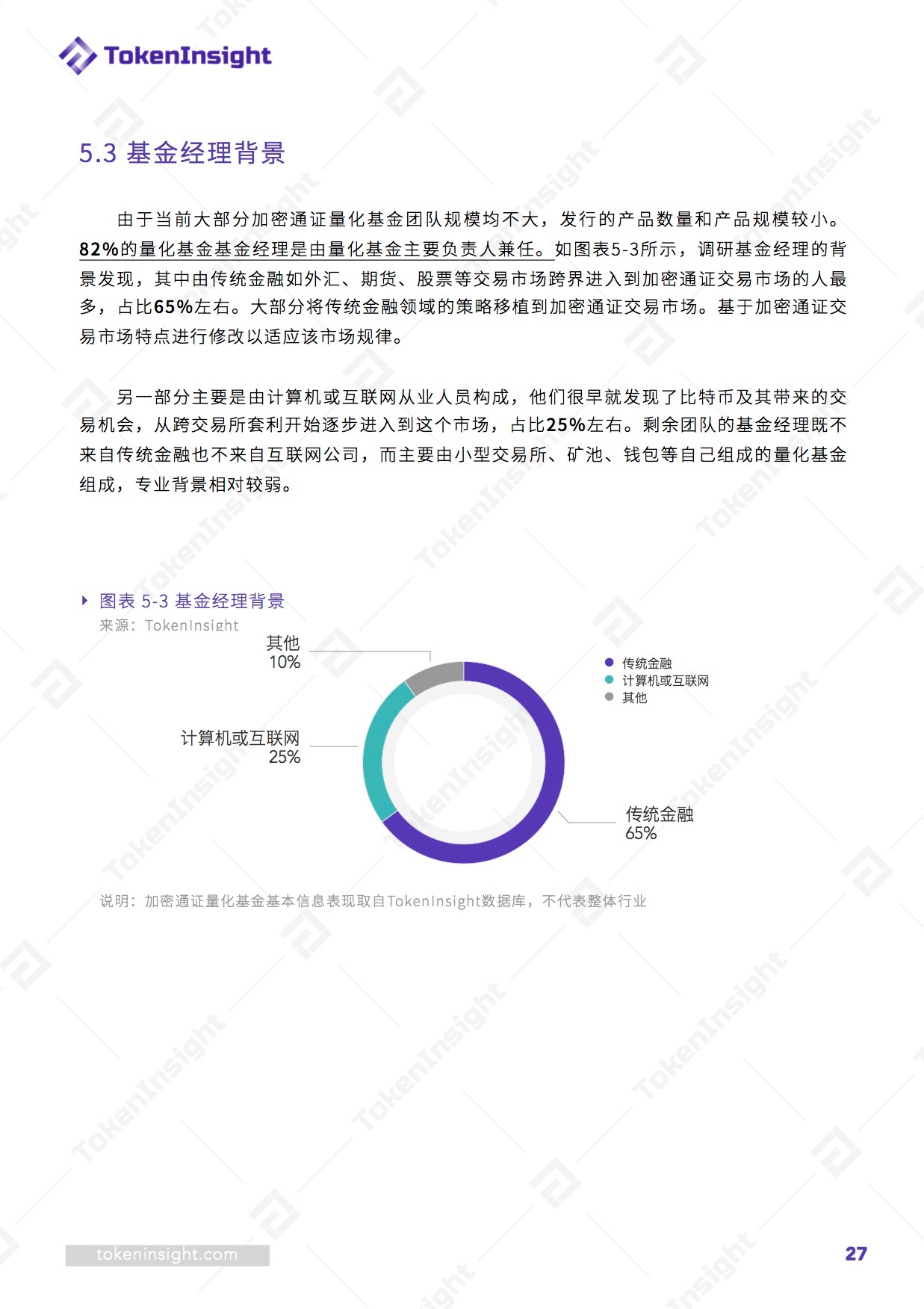

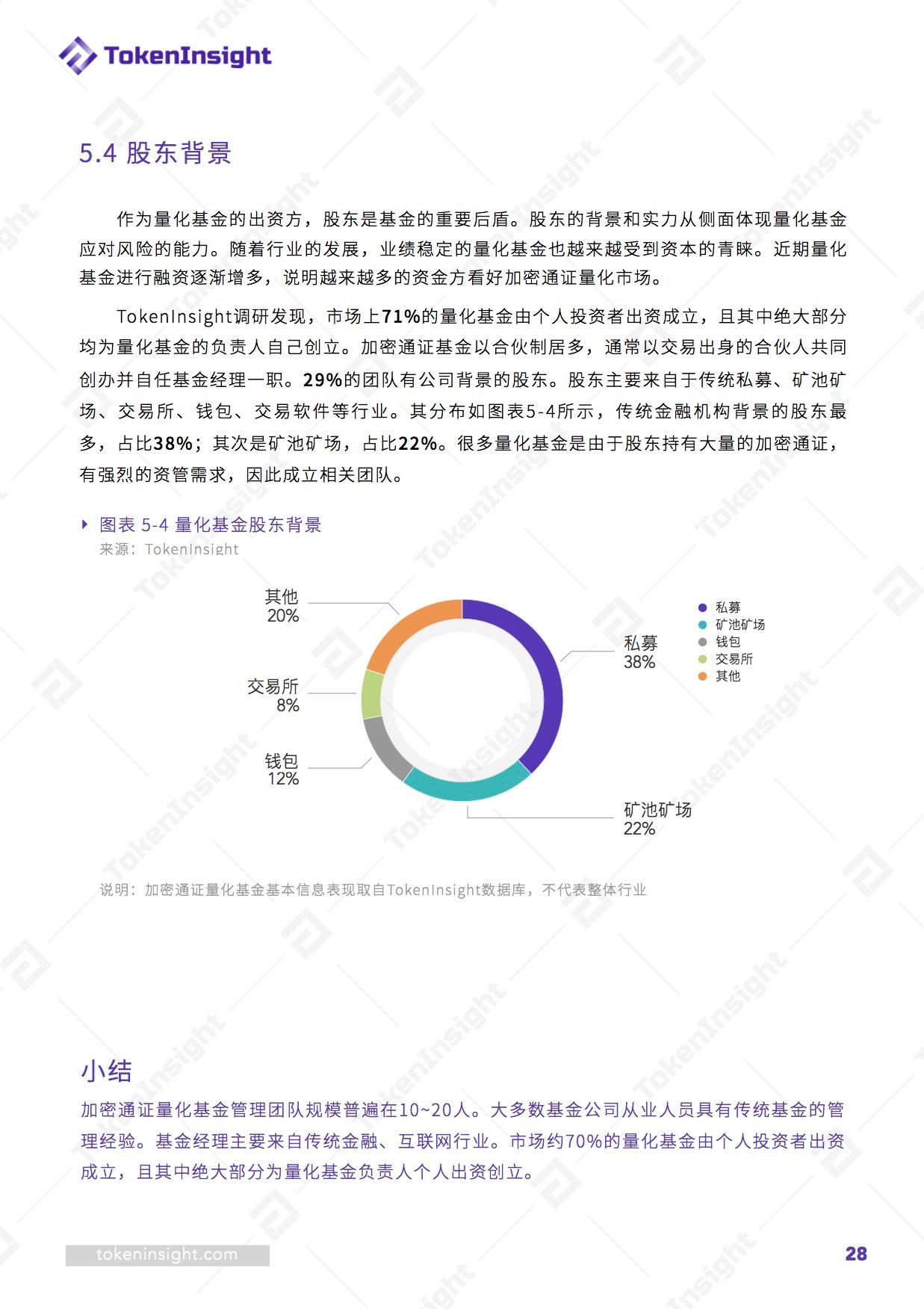

10. The size of the Encrypted Quantification Fund Management Team is generally 10 to 20 people. Most fund company practitioners have traditional fund management experience. Fund managers are mainly from the traditional finance and Internet industries. About 70% of the market's quantitative funds are funded by individual investors, and most of them are funded by the heads of the quantitative funds.

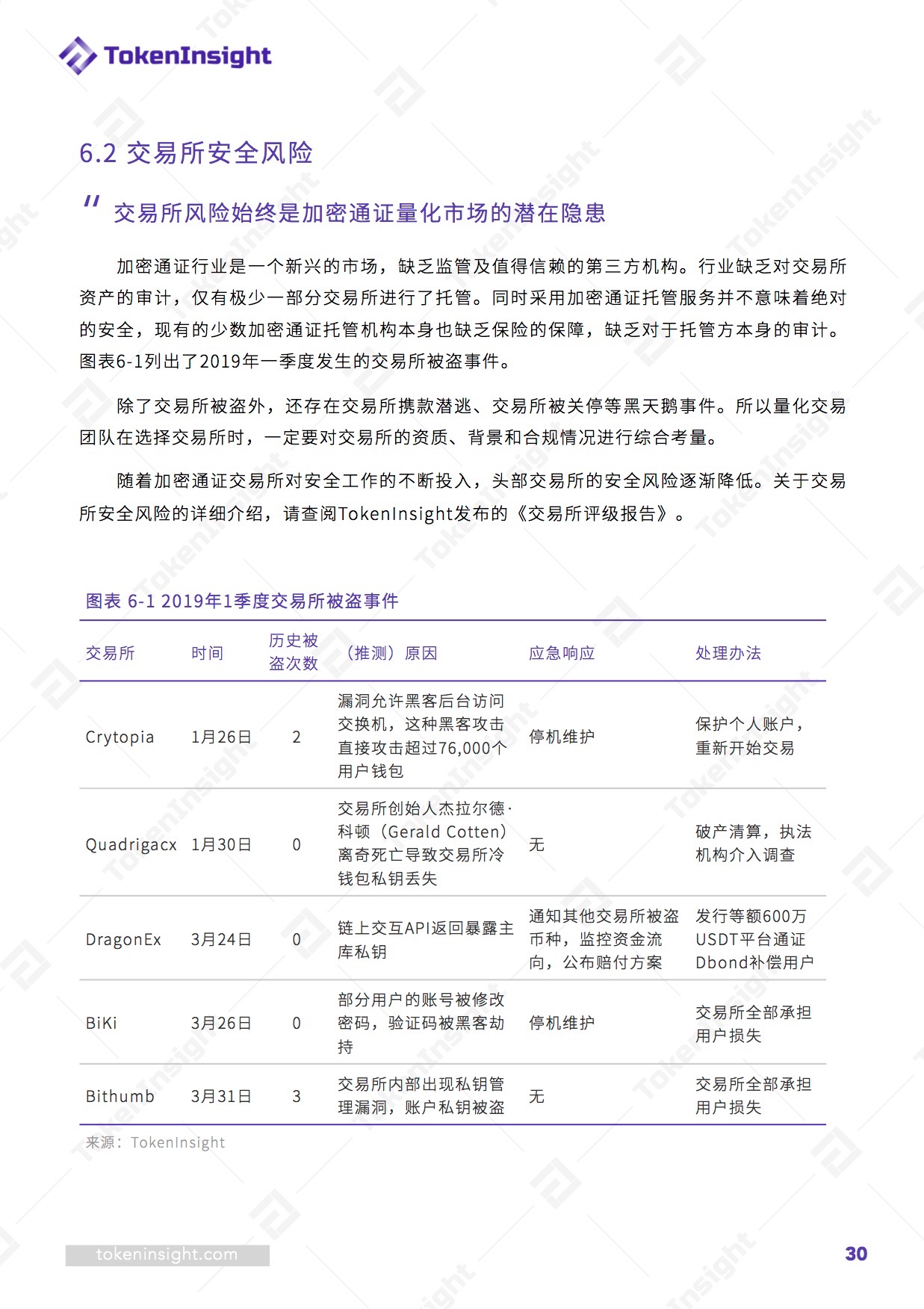

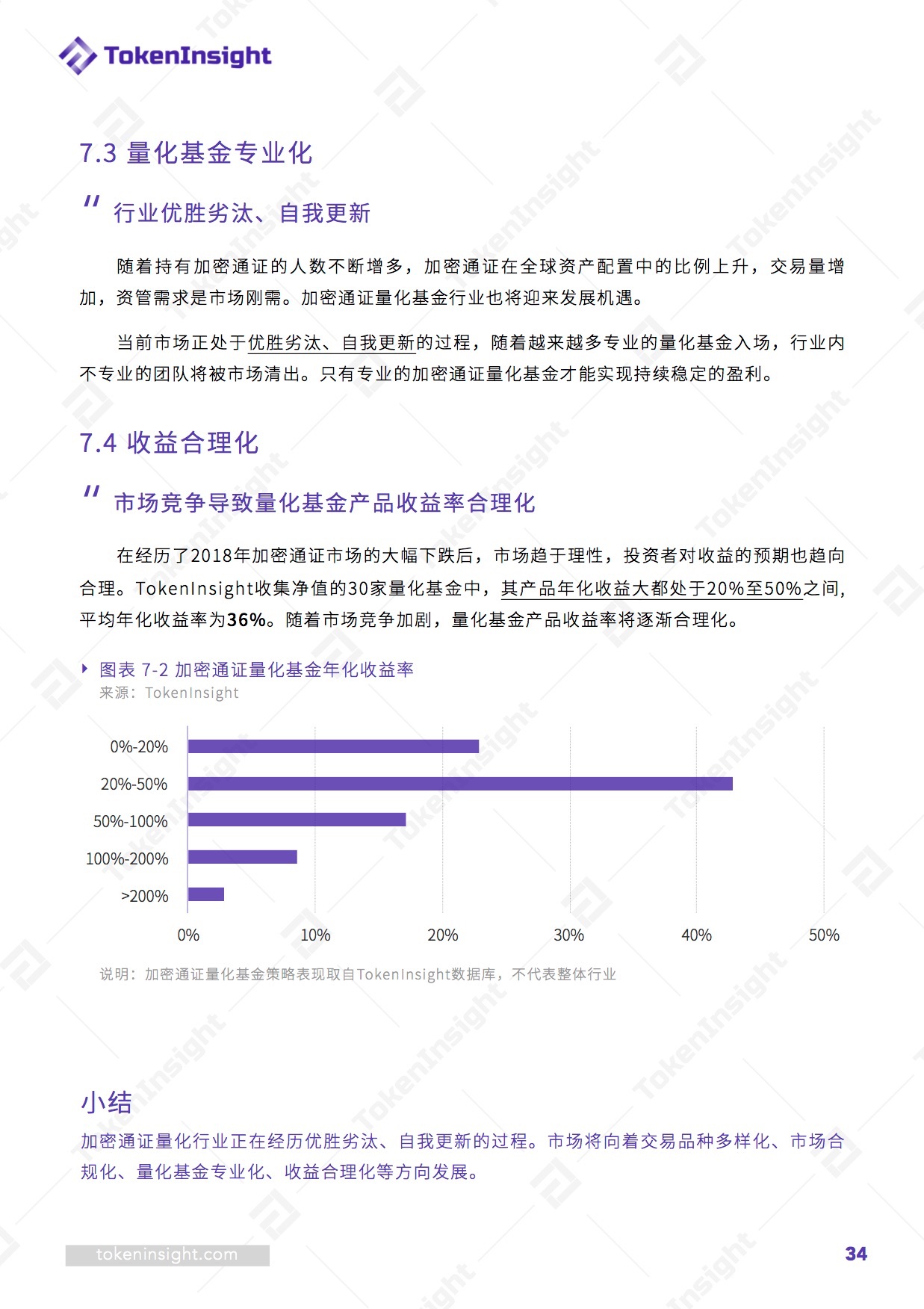

11. Encrypted Certified Quantitative Fund In addition to the risks brought by market volatility itself, there are some market risks, such as: trading risk, exchange security risk, regulatory risk, and quantitative fund moral hazard. TokenInsight will focus on improving the transparency of the crypto-acceptance quantification market and establishing a net value auditing system and rating system for the cryptographic vouchers to promote the healthy development of the industry.

12. The encryption and certification industry is undergoing a process of survival of the fittest and self-renewal. The market will develop in the direction of diversification of trading varieties, market compliance, quantification of fund specialization, and rationalization of revenue.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The US House of Representatives new working group will review blockchain and cryptocurrency

- Market Analysis: Insufficient market capital, BTC bloodstaking breakthrough of $6,200

- Then talk about the fork, who is the real power of the Bitcoin world?

- The trap of the blockchain talents: After the "pseudo-blue sea", what are the reasons for the supply and demand sides?

- 40 times the size of the MLM in 2 months? Demystifying VDS "resonance" mode

- Facebook's "blockchain revolution": Entering the field of cryptocurrency payment, is it really ready?

- China rushes to the highlands and publishes the world's first telecommunication industry blockchain application white paper