Four narrative shifts in the Ethereum ecosystem’s cycles

Ethereum's ecosystem has undergone four narrative shifts.It is well known that the flexibility of the Ethereum application layer is a boon to innovation, narrative generation, and software development. They can both trigger hype and creativity, as well as lead to the emergence of some malicious activities that affect end-user experience. But overall, most innovations promote long-term adoption and bring new capital and talent to the ecosystem.

4 Main Narratives of the Ethereum Ecosystem

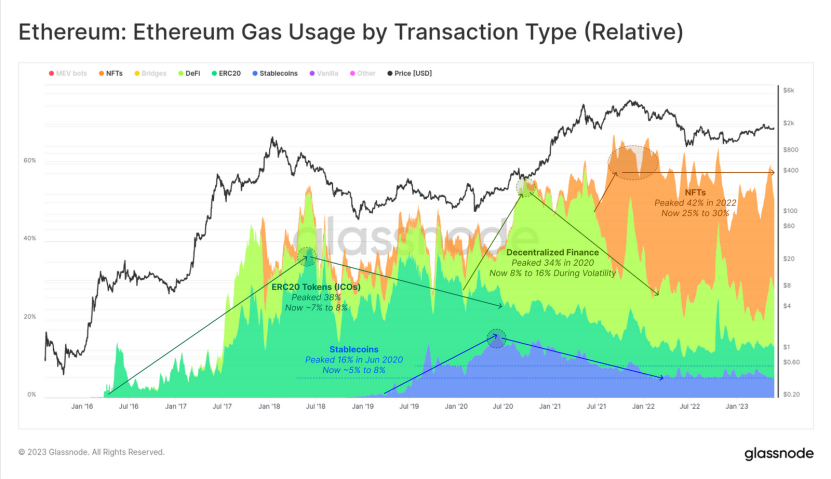

By comparing the gas usage of various major activity types on the Ethereum chain, one can roughly understand the market user demand in different periods. According to Glassnode statistics, in recent years, the Ethereum ecosystem has mainly had four narratives, and the peak of each innovative narrative usually drives up the price of ETH.

ICO: The ICO craze witnessed the peak of the cryptocurrency market in 2017 and 2018. During this period, 40% of gas consumption came from ERC-20 token transfers. Although the demand for ERC-20 token transfers has been decreasing, it still contributes a certain share of gas consumption (7%-8%) today, driven by the popularity of Memecoins and new token distribution methods (such as Yield Farming and airdrops).

Stablecoins: Since mid-2020, there has been a surge in user demand for stablecoins, with gas consumption accounting for as much as 16%, currently falling to 5%-8%. However, the decrease in gas consumption of stablecoins reflects more changes in their utility than a real decrease in demand. Currently, stablecoins are used more for hedging and value storage than for payment methods.

- Understanding Binance’s Decentralized Global Operating Model from SEC Lawsuit Documents

- 5 Misconceptions About the Metaverse

- Attacker’s liquidation price for BNB bridged to Venus Protocol is around $220. Venus governance proposal: Frozen, cannot be liquidated.

NFT: NFT introduces unique digital representations in the real world. Although NFT has existed for many years, it only found its way into mainstream society in mid-2021. After the peak in 2022, when gas consumption accounted for 42%, the market demand for NFTs decreased to 25%-30%.

DeFi: DeFi emerged in 2020 with the aim of creating the use of on-chain raw finance and tools without traditional intermediaries. DeFi’s gas usage accounted for as much as 30% from June 2020 to 2021, currently ranging from 8% to 16%, with a slight recent rebound.

Gas Consumption of DeFi Activities

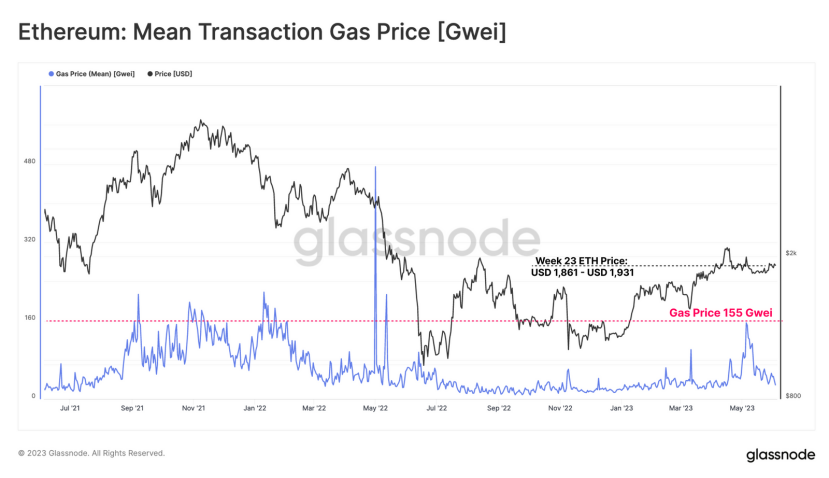

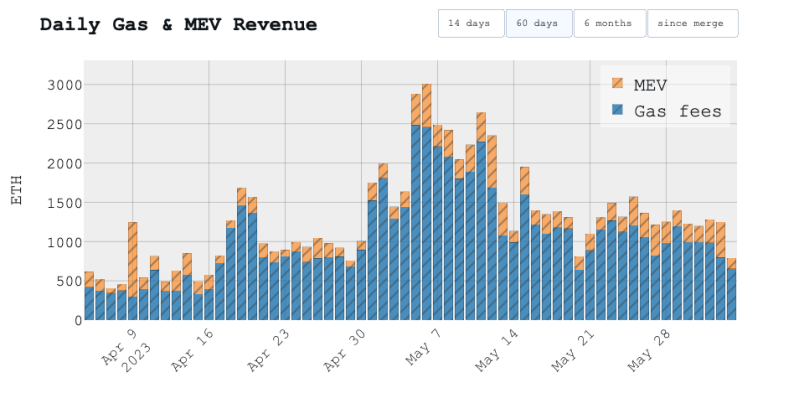

Since March of this year, the price of ETH has been oscillating within a relatively stable range, with an average gas fee of 76 GWE during this period. However, gas prices experienced a more pronounced increase in May, with average gas fees reaching 155 GWEI at the beginning of May, almost reaching levels seen during the 2021-2022 bull market cycle.

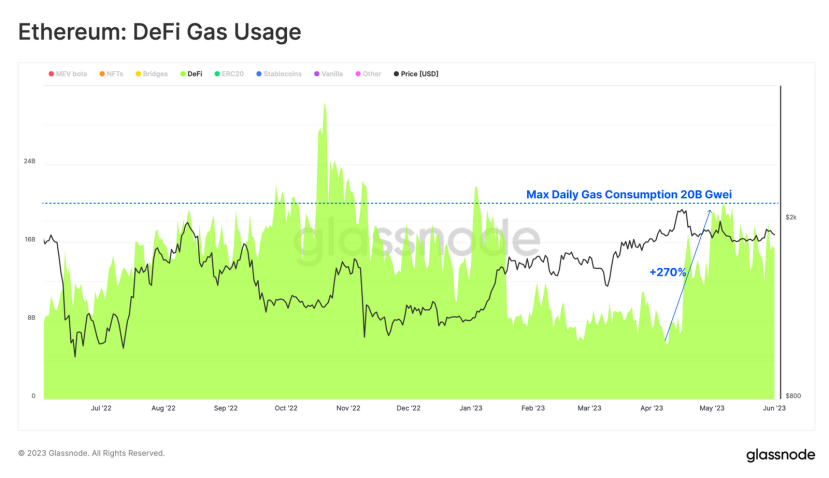

Smart contract interactions are becoming more frequent, with the gas consumed by contract interactions being several times that of token transfers. Gas consumption related to DeFi protocols surged by 270% in late April.

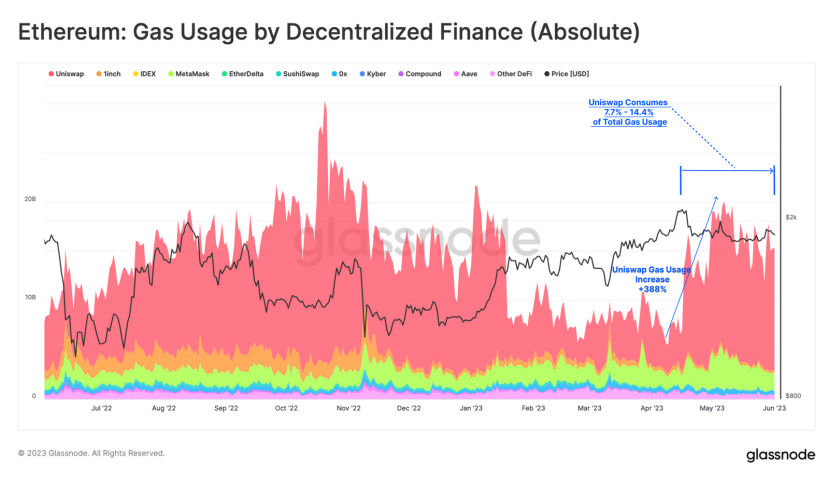

If we analyze DeFi gas consumption by protocol, it quickly becomes apparent that the main driver of the increase in gas consumption is the trading activity on decentralized exchanges. Uniswap is still the main contributor, with gas usage increasing by 388% since April, now accounting for 7.7% to 14.4% of the total Ethereum gas demand.

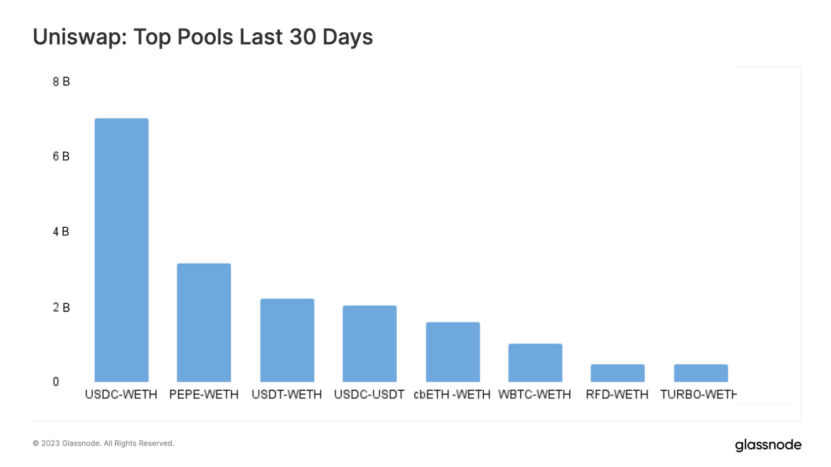

Many people’s first reaction upon seeing this data may be that recent hype around Memecoins like Pepe and Hex is the main reason for the increase in gas usage. However, a detailed analysis of Uniswap’s trading volume reveals that the highest volumes in the past 30 days are still mainly related to higher-market-cap assets such as ETH, stablecoins, WBTC, and Coinbase’s staked derivative cbETH.

Are Arbitrage Bots Taking Over DEXs?

After comparing the addresses of the top 10 traders, it was found that only one trader’s address was not related to MEV bots. Over the past month, the trading volume of well-known MEV bot Jaredfromsubway.eth has reached $3 billion.

Although it requires further research to determine the number of bots among global traders, the data on the top 10 trading volumes also indicates that there is a relatively high proportion of automated arbitrage traders on Uniswap.

One way to rationalize automated arbitrage traders is to consider the exponential range of arbitrage opportunities available on Ethereum DEXs:

1) As the price of each token (+ slippage) changes, the final gas fee will prove that arbitrage trades are rational.

2) Each DEX liquidity pool that provides token trading provides a platform for arbitrage trading.

3) The number of potential arbitrage trading opportunities is directly related to the number of liquidity pools and the number of tokens available for trading on DEX. If we take into account the many robots involved in arbitrage trading or “sandwich attacks,” the proportion of normal trading volume on UNISWAP may account for about two-thirds of all DEX activity.

With the sideways movement of the crypto market and the recent overall low trading volume in the cryptocurrency market, the use of DeFi has become increasingly automated, with a large amount of arbitrage, MEV, and algorithmic trading in DEX trading behavior.

Although the activities of these trading robots may be harmful to Ethereum end users, they do benefit Ethereum validators. In the past month, validators have not only received higher rewards due to the increase in priority fees, but also benefited from MEV-Boost payments, which come from traders and robots who complete transactions in the most profitable way.

To some extent, this highlights the trend of staked ETH as the main asset in the Ethereum ecosystem, while also establishing a local threshold that tokens must compete to attract capital inflows. According to the Ebunker index, the current APR for ETH Staking is about 6%, with MEV contributing more than 1/6.

New Products in the Ethereum Ecosystem

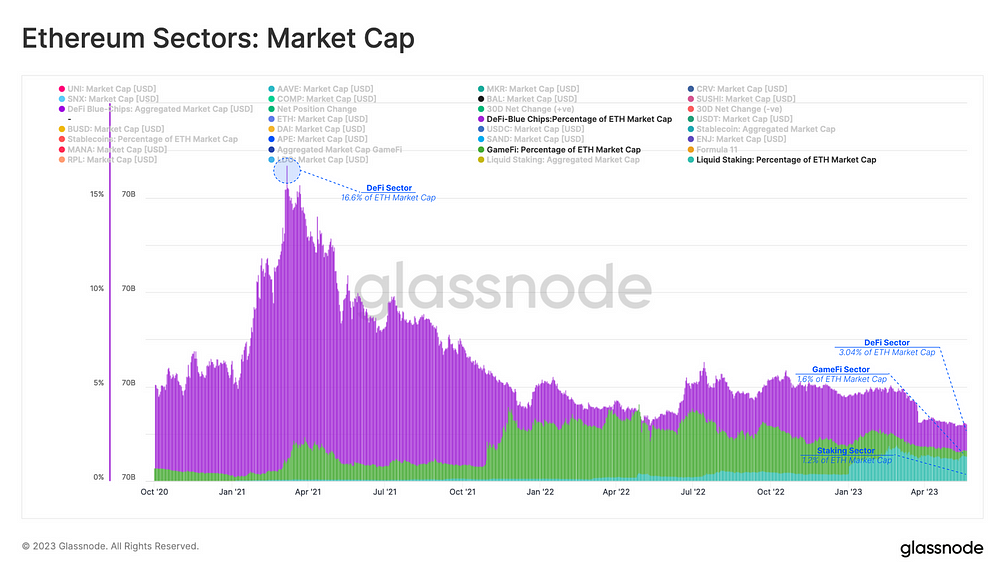

In the past two years, two new products and services have emerged in the Ethereum ecosystem: GameFi and Staking. Both have attracted varying degrees of investor interest, with GameFi outperforming DeFi in mid-2022, but declining rapidly. Since early 2023, Staking has been on the rise, with a total market value rising from $505 million in January 2023 to $3.2 billion in April 2023.

If these products and services are viewed as part of the broader Ethereum economy and in the context of the EIP1559 burning mechanism, it can be expected that, similar to DeFi, some of the value generated in these areas will also be reflected in the valuation of ETH. Therefore, the performance of these areas can be evaluated by the ratio of their market value to the market value of ETH. In 2021, the market value of DeFi peaked at 16.6% of the market value of Ethereum, compared to only 3.04% currently. The current values of emerging GameFi and LSD tokens are 1.2% and 1.6%, respectively, and their growth potential and subsequent performance are still to be observed.

Thanks to the burning mechanism of EIP-1559, no matter how narratives switch on Ethereum, they will burn a large amount of ETH for Ethereum. The collective promotion of these narratives actually completes Ethereum’s own grand narrative. And when Ethereum becomes a more mainstream platform because of the narratives, these small narratives will also eventually benefit, which is Ethereum’s “super positive cycle”.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exchange sued by SEC: Future regulation in the US will be more transparent

- Explanation of Six LSD Stablecoin Protocols: Could It Trigger a New Round of LSDFi Conflict?

- Comparison of Stablecoins on New Decentralized Algorithms: Dai, GHO, crvUSD, and sUSD

- How can cryptocurrency exchanges move towards compliance after heavy regulation?

- How to establish a compliant cryptocurrency exchange following the consecutive lawsuits against Binance and Coinbase?

- After the heavy regulation, how can cryptocurrency exchanges move towards compliance?

- Stability AI founder Mostaque hits back at media’s allegations of plagiarism and salary arrears