Facebook Libra in-depth analysis report

Summary of key points

Facebook officially released the Libra project white paper on June 18, 2019, along with technical documentation, governance documentation, and Reserve documentation. There are many analyses on Libra in the market. The extreme view regards the emergence of Libra as a “super-sovereign national currency” and a “currency war weapon” between different sovereign countries in the future digital society. At the same time, there are many opinions that Libra first The threshold for supervision is too late, and even if it has passed, it will not be a "revolution . " According to TokenInsight, there are four reasons for Facebook to issue Libra projects:

1. A “self-salvation” about the crisis of self-confidence;

2. An essential act of profit-seeking as a capital market company;

3. Quickly seize the “first mover advantage” in the future digital certification society;

- The world is financial, but ultimately it is technology – blockchain or the ultimate weapon of technology to defeat finance

- PricewaterhouseCoopers announces 8 cryptocurrency audit services, both BTC and ETH

- Institution Fomoing, whales enter, collect licenses, summon dragons

4. Zuckerberg’s own vision of the future.

But in terms of its meaning, it is absolutely not only the case. The launch of the Libra project is only the first step in the modern financial society to open digital certification . The use of blockchain technology to develop fast, secure, convenient and low-cost financial services is an inevitable trend. In addition, the trend of pass is also very obvious . Facebook is just the first company that the giants are trying to start. After that, more and more companies will issue certificates that match their business model and business characteristics . This also makes it necessary for the regulation of laws and regulations on these certificates to be introduced as soon as possible. More importantly, due to the nature of the blockchain, the legal regulatory framework can no longer be limited to individual countries or regions. A more comprehensive, regulatory framework with a broader coverage is still necessary now.

As a product of Inclusive Finance, Libra itself can provide convenient and simple financial services for those who cannot access banking services from the bottom up. But Libra's passive and dual-structure management is very likely to cause Libra's "two" prices . In addition, how the financial data generated by users after using Libra can be solved is also a problem that Facebook needs to face. Compared to the promise of “doing it but not doing it”, “inability to gain user privacy” seems to really help Facebook solve the crisis of trust .

The rights represented by the LIT Pass can govern the Alliance at a lower cost. For Libra, Libra and LIT's dual-pass design makes the Libra ecosystem more complete and easy to manage. In fact, the process of transforming the Libra ecosystem from centralization to decentralization is the process of “alternating power” between LIT and Libra . The design of the LIT “different shares” distracts the rights of early investment institutions while at the same time ensuring their rights.

1. Introduction to Libra

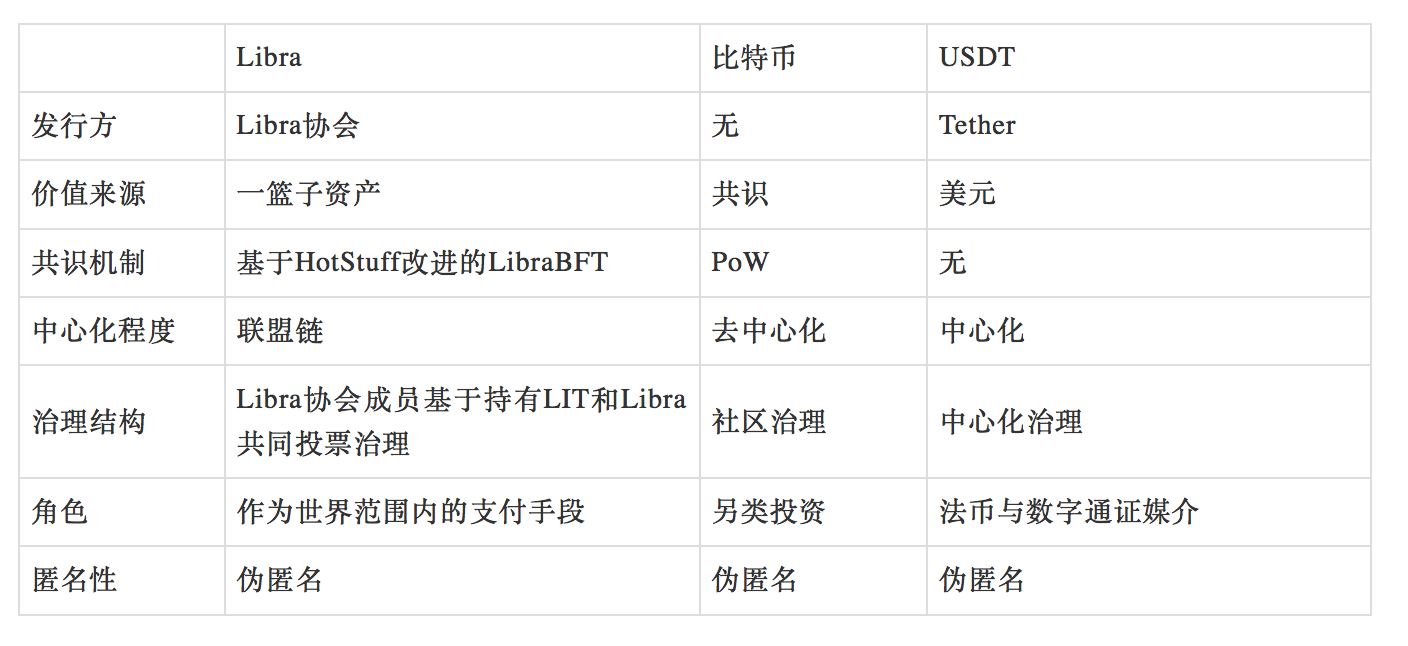

Libra is very similar to the current digital pass market stabilization currency USDT, USDC, which is a “special stable currency”. Unlike these stable currencies, Libra uses a basket of low-risk, high-liquid assets as value collateral. In fact, Libra is more similar to the IMF's “Special Drawing Rights SDR”. The value of SDR is also supported by a basket of currencies: US dollar, Chinese yuan, Euro, British pound, Japanese yen.

Because Libra is based on blockchain technology, it also has the function of cross-regional settlement, low commission, convenient and real-time settlement. Libra's main mission is to provide users with convenient payment methods around the world, especially for the 1.7 billion people who do not have access to banking services. Cross-border payment is one of its important goals.

In terms of structural design, Libra is distributed on a separate blockchain and is maintained by the Libra Association. The nodes on the blockchain are responsible for recording transactions and realizing the transfer. Libra uses an improved BFT model with the organization participating in the network as a verification node. At present, in theory (initiating members can choose not to act as nodes), 28 nodes participate, and the future plans to develop into 100. In the longer term, Libra also plans to completely open up the network and transform the current "chain of alliances" model into a complete public chain model.

Figure 1-1 Libra vs. Bitcoin, USDT

Source: TokenInsight

The dilemma of privacy and trust brought about by anonymity

In terms of anonymity, Libra uses the same method as Bitcoin, which is pseudo-anonymous. This means that the transaction record recorded on the Libra chain has only one user's address and no real identity of the user. And Libra also guarantees in its blockchain that it will not link the transaction records on the chain to the true identity of the user. But a little bit of a paradox is that users who use Calibra (Libra wallet from Facebook) need to pass KYC. This is necessarily the same for other future compliance wallets. That is to say, although Libra does not record the user's true identity on the chain, it still (possibly) collects the user's true identity information, and at the same time can link the user's real identity to the chain transaction. This is one of the many users who question Libra. Facebook has social and preferences information for all its users. Libra can also get user financial information. Once connected, it is equivalent to letting users "streaking" completely in front of Facebook. Although Facebook promises not to do so, it is actually guaranteed by Facebook before the incident of revealing personal information of users.

On the other hand, although the compliance wallet must require users to pass KYC, there must be some wallet vendors to launch services that do not require KYC in order to increase the number of users. And because of the demand rigidity of this point, this service will inevitably be repeatedly prohibited. In addition, even for wallets that do not require KYC certification, the user's own preservation of the private key is another pain point that needs to be resolved. This is also the problem faced by many decentralized wallet vendors. For the security of the account, the private key of the user account must be a string of long and difficult to remember meaningless characters. In the digital pass market, even users who know more or less about this mechanism often have this situation. For Facebook, most ordinary users don't have the awareness of keeping private keys. As a result, Facebook has entered a dilemma:

1. Help users keep private keys – require user personal information (mailbox, real identity, etc.) – users do not trust;

2. The user saves the private key himself – the cost of educating the user is too high – the user's assets are permanently lost.

2. Facebook's motivation, problems and the future of Citation

Profit-seeking Facebook seeks new profit growth points

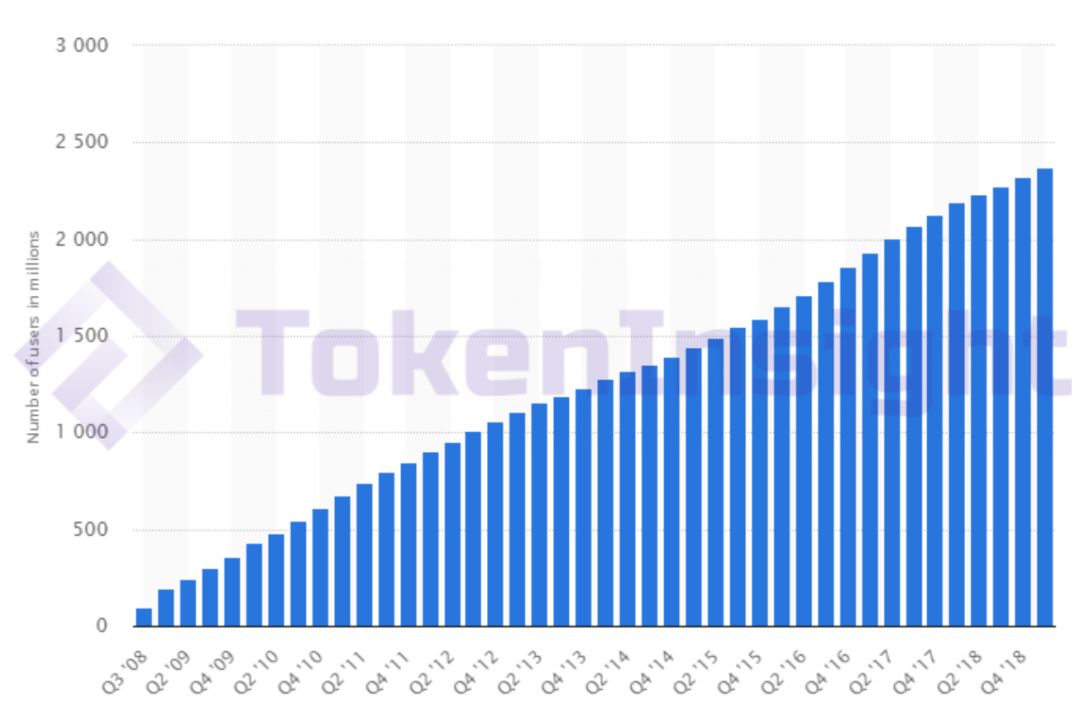

An important reason for Facebook to launch Libra is that Facebook can do this. In Facebook's social product system, there are more than 2 billion monthly users and more than 1.5 billion daily users. Making payments from the social starting point, WeChat has proved the feasibility of this road. In the face of such a big piece of cake, Facebook is not tempted.

Almost all of Facebook's profits come from advertising. The revenue of the advertising business is determined by the number of users and the conversion rate. By the end of 2018, Facebook’s users reached nearly 2.4 billion. Although the number of users is rising steadily, it will eventually reach the upper limit, and the growth rate of this user will inevitably slow down. On the other hand, from the perspective of conversion rate, Facebook improves the conversion rate by accurately advertising the user data. However, the resulting privacy of user data has also caused Facebook's share price to be hit hard. The crisis of trust facing Facebook is still serious.

Chart 2-1 Number of Facebook users

Source: Statista

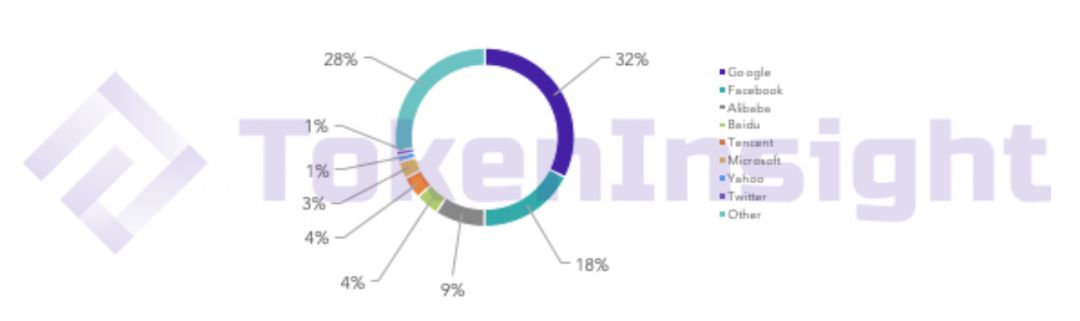

Facebook and Google currently have a 50% market share in the digital advertising market. Although Facebook's advertising business can still bring considerable profits, other advertising platforms are constantly making efforts to compete for the market.

Figure 2-2 Digital advertising market share distribution

Source: eMarketer

Through the Libra project, Facebook is able to find new breakthroughs based on existing business. On the day of the Libra white paper, the market reaction has proved this.

Chart 2-3 Facebook and Western Union remittance share changes after Libra white paper is released

Source: Yahoo Finance

On the day of the Libra white paper, Facebook's stock price rose more than 3%, while Western Union remittances, which are international remittance giants, fell 2.8%. The market seems to be very optimistic about the Libra project. According to McKinsey's report, the total revenue of the global payment industry in 2017 has reached $1.9 trillion. Cross-border remittances account for 2%-8% (regional gaps). Even if Libra charges a very small fee for user transfers or withdrawals (Libra converts to French currency), it is still a huge income in the face of such a large volume.

Facebook itself is a product of capital, and regardless of how it promises to serve users, it is always the interests of shareholders. The company's profit-seeking nature is the core factor that Facebook does when making almost every decision.

"The crisis of trust has forced Facebook to seize Blockchain's "life-saving straw", but not optimistic

In the past year, Facebook has been questioned by too many people in terms of user data privacy. Ignore, steal, sell user privacy, and even manipulate the US election. Facebook's share price has also fallen from a peak of $217 to a minimum of $124, close to the "waist." The blockchain protects user privacy from a technical perspective. Although all data on the chain is open, no one can accurately determine the true user identity of the line, based solely on the information on the chain. Compared to "can't do it," "can't do it" seems to be able to fundamentally solve Facebook's trust crisis.

But "regret" is that the Calibra wallet requires users to perform KYC certification. In addition, if users use Libra to transfer money and remit money in Facebook products, they must be on top of their Facebook accounts. This means that Facebook actually controls the user's real information and the relationship with Libra. Even if Facebook has already guaranteed and established a subsidiary to participate in the operation independently, it will not touch the financial information of the user. But compared to the guarantee that "can do it but not do it", it seems that only "technically impossible to do" can truly gain the trust of users .

So from this point of view, because the issue of trust has not been fundamentally resolved, Facebook's "history" makes users do not easily believe its guarantee. Rebuilding trust is a long way to go for Facebook.

Regulatory risks are still large, and there are possibilities for prohibitions by different countries.

Undoubtedly, Facebook will inevitably carry out a large number of arguments within the company before the Libra project. The professional opinions of the financial and legal circles must also be sufficient for consulting work. In addition, Facebook has also approached the regulatory authorities in advance to prepare Libra for operation in a legal compliance framework. This is one of the reasons why most people think Libra can pass.

In terms of trends, projects like Libra will definitely reappear. Even if Libra does not pass, the future will certainly be legally compliant by other projects. However, it is worth noting that for digital currencies, regulators in different countries often adopt different attitudes due to the different levels of financial infrastructure. Generally speaking, countries with more developed economies have stronger ability to control financial risks, so they are more tolerant of financial innovation. However, emerging economies have relatively weak ability to control financial risks, and generally adopt measures that are relatively tough.

As one of the largest users of Facebook products, India is not friendly towards digital currency. In addition, according to Coindesk's report, Facebook did not seek advice from the Central Bank of India on the Libra project in advance, and did not make any application. In India, Facebook has 400 million WhatsApp users. At the same time, India is also one of the countries with huge cross-border payments. Another country with a huge amount of Facebook users – Brazil – is also less friendly towards digital currencies.

In addition, the French Finance Minister also made it clear that “it is not possible to let Libra happen, it is impossible to turn Libra into a 'sovereign currency'”, and it also calls on the G7 central bank to re-examine Facebook's Libra project. Members of the US Congress have also called for a halt to the Libra project. Relative to these opinions, the UK and the US SEC are relatively friendly, and the Bank of England Governor said that it can open a overnight deposit account to the central bank for technology innovation companies. This means that the status of the company has been raised to the same level of the bank, and the company officially touched the central bank's balance sheet. The SEC chairman said that he had contact with the Libra project in advance, and that Libra can bring certain positive effects, but also need to pay attention to potential risks.

Digital currency regulation itself is a problem. Libra's application in the world is actually pushing the regulators in various regions to express their opinions. If so, what kind of legal framework should be implemented; if they are opposed, they also need relevant laws and regulations as guidance. The field, what can be done, what can not be done. From this perspective, Facebook's Libra project is actually driving the entire industry of digital currency, and this step is crucial.

It is more likely that some countries (capital controls, unfriendly to digital currency) will restrict Libra's local use; others will allow it. But in the long run, if the trend is fixed, countries with negative attitudes will certainly be forced by the internal pressure (the demand for efficient payment methods) and external (the demand for cross-border payment) to gradually liberalize and adopt Libra ( Or other similar projects). But this time period may be longer.

In the end, this is actually a game of interest between giant companies represented by Facebook and government agencies. What regulators really care about is whether such projects have unauthorised arbitrage. In countries with developed financial facilities, such regulators ignore the arbitrage space and make it easier to make up for it; however, countries with weaker financial infrastructure development have huge arbitrage. If left unchecked, companies and corporate consortia driven by profit maximization may tear up this vulnerability and cause more serious consequences.

Instead of caring about who is in the Libra Association, it’s better to see who is not in the Libra Association.

In a society like the United States, a large number of laws and regulations, especially in the financial field, can be understood in the context of the game of different interest groups. There is only eternal interest between the state and the state, as is the internal interest group.

There are three main purposes for Facebook to unite with many companies. One is to gain more users' trust, and let more companies endorse Libra; the second is to unite more large enterprises, form alliances, and get more Bargaining Power; the third is to cover as many countries and regions as possible within the geographical scope. As much as possible in terms of products and services to cover the full range of user needs. In this way, when sanctions may be imposed on individual companies in the future, the alliance may provide a stronger counterattack or a response.

Facebook announced the first batch of 28 founding members, most of whom are focused on which companies are in the league. But the comparison found that there are many important companies that are not in the league. Not being in the league does not mean that Facebook has not communicated with it. On the contrary, when creating the alliance, Facebook must communicate as many influential companies as possible to try to convince them to join the alliance. Therefore, there is no company in the alliance, the big probability is because it is not accepted.

Apple, Google, Microsoft, Amazon, and all banks are not among the Libra alliances. Apple has its own Apple Pay, although it has not robbed the market under the temptation of cashback of up to 10%; Google has a number of users who do not lose to Facebook, and also outperforms Facebook in the digital advertising industry share; Microsoft has already In cooperation with JPMorgan, it is responsible for running and maintaining its blockchain platform Quorum; Amazon's layout in the blockchain field also started early. In addition, JPMorgan also released its own stable currency JPM Coin for internal circulation of the system a few months ago. The exploration of blockchains by many giant companies and the exploration of pass-through have undoubtedly verified the signal of digital pass-through trends.

There are many precedents for companies to issue internal integral forms, but the liquidity of points is weak, and the application scenarios are relatively simple and controlled by enterprises at will. Users are more of a “preferential” rather than a medium of circulation. However, the use of the pass issued by the blockchain is far superior to the form of integration in terms of liquidity, settlement, and decentralization. There are currently two forms of corporate issuance of certificates. One is the issuance of separate companies and the circulation within the user network. The advantage of this form is that it is relatively less difficult and requires only a separate enterprise decision. However, the shortcomings are also very obvious. The number of users in a single enterprise is insufficient, and the application scenario of the certificate is single, which leads to insufficient liquidity of the certificate. The second form is that the enterprise jointly forms an alliance and issues a certificate within the alliance. This kind of pass is determined according to the strength of the alliance. If the service users of the alliance cover a large number of countries, the circulation of the pass is not restricted by the state within the geographical scope. This kind of pass has the meaning of “beyond the national sovereign currency”, and thus it may be subject to greater supervision and implementation.

There are two problems that come with it:

1. Will these passes be circulated?

2. What is the ratio between the certificates issued by different companies or alliances?

It is inevitable that the certificates issued by different enterprises or alliances can be exchanged for each other. In fact, the United States blockchain company Circle and Coinbase jointly established Centre is working to do such a thing. From the business logic, users will use different goods and services provided by different companies, and users have the need to exchange certificates from different companies. Technically, the provision of liquidity of different certificates relies on cross-chain technology. In addition, the exchange will also be one of the places to provide a exchange of exchanges; of course, the wallet will be similar. A better way for the user experience is that the user does not need to be too cumbersome to use the front end. In summary, providing liquidity for the certificates issued by these companies in the future will be a potential business opportunity.

Secondly, the certificate issued by the enterprise or the alliance can provide real commodity service or some degree of value support compared to the current market certificate. The purpose of the certificate issued by the enterprise or the alliance is generally to use the pass as the medium for purchasing its goods on the basis of its existing business, to provide users with a more convenient, safe and efficient use experience. In addition, the distributed characteristics of the electronic pass enable the enterprise service scope to be expanded at a low cost, greatly reducing the business development cost of the enterprise. In the early US banking industry, Hayek’s different banks described in “Non-Currency of Currency” issued their own credit currency scenes. I just didn't expect that after decades, not only banks, commercial companies have begun such an attempt. However, it is worth noting that the certificate issued by the company will not appear to rely on the issuance of the certificate by its own credit. The "coin of coins" can still be controlled by the central bank only by the central bank for the time being. The essence of these competitions is that companies or alliances can provide users with the value of goods and services. In addition to being a medium of circulation, the nature of the certificate can also be used as proof of rights. The programmability of a blockchain pass can give its equity, bonds, or other properties that existed before.

3. Libra Reserve and currency issues

3.1 Libra Reserve

Libra is a “stabilized currency” and its value support depends on a basket of low-risk assets behind it. Libra established the Libra Association to manage the Reserve assets. The core goal of the association is to ensure Libra's preservation and stability so that it can be applied to trading media.

Sources of funds

Libra Reserve's funding comes mainly from two aspects:

1. Investors invest in legal currency invested by Libra Investment Token (LIT);

2. The legal currency funds invested by Libra purchased by the user (through the institution).

It is worth noting that users holding Libra will not receive any interest . The Libra Association will use the funds received for asset allocation, mainly for low-risk, low-volatility and highly liquid assets. The range of assets that satisfy these characteristics is actually small, mainly the national currency with a high sovereign credit rating and some short-term bonds. Compared to the bank's high interest margin, the Libra Association earns a zero interest "loan" to the user's interest differential managed by Libra and Reserve .

In addition to the above interest income, another income of the Libra Association is the user fee transfer or Libra and the legal currency exchange process. Compared to traditional international remittances, Libra's payment method must be extremely low. But under the premise of huge user volume and transaction volume, this is also a very substantial income. All revenues of the Libra Association will be paid to the initial investors based on the LIT holdings after the cost of coverage (including operating costs and incentives for users and merchants to use Libra) .

Libra's "two prices"

The Libra Association is similar to the binary structure of the central bank to commercial banks in managing Libra. Users are not allowed to redeem Libra or redeem the currency directly to the Libra Association, but must pass Libra-certified institutions . The Libra Association is completely passive in its management of funds. In other words, Libra does not actively adjust the number of Libra in the market (the so-called “monetary policy”), but based on feedback from users through the certification body. But there is a gap in this way.

Libra's price is weighted by a basket of assets behind it. Libra's “price” will not change when there is no change in the assets behind it. And in a short time, Libra's price is fixed in the eyes of the Libra Association. However, Libra's actual market “price” will fluctuate according to market prices. That is to say, when the demand for Libra changes in the market (such as a region suddenly forbids or allows the use of Libra, a company or institution accepts or rejects Libra as a means of payment), Libra will appear two times in a short time. Price": Libra's "official price" and "market price". Because Libra adopts passive management, it can only be adjusted to the certification body through the user's needs. This allows the certification body to have a profit margin in the process, that is, when the "market price" is high, the low price is exchanged to the Libra Association for Libra and then sold to the user at a high price; otherwise, the opposite operation is performed .

Currency attribute

From a basket of currencies, Libra is very similar to the IMF's SDR. However, Libra's main purpose is to serve as a means of payment settlement for users' daily use. Compared with the national sovereign currency, Libra's application range is not limited by geographical location, and it has certain "super-sovereign national currency" nature. But for now, the so-called "Facebook empire" is somewhat nonsense, and Libra is unlikely to get or dare to give himself "the coinage." Regulators in any country or region cannot allow such things to happen. Most of the assets in the Libra Reserve will be US dollar or US dollar bonds, as there are not many assets that satisfy the Libra Association's support for the value behind Libra. The dollar is now actually the world currency, and the emergence of Libra will not pose any challenge to the status of the dollar. Because it seems that Libra is only an additional demand for the increase of the US dollar, in principle, it has no effect on the US dollar or other monetary policies behind the French currency.

More likely, the value of Libra is ultimately measured in dollars. As a means of payment, Libra's intention is to become a unit of pricing for other goods and services and even for legal currency. But as the SDR results, trying to become the dollar and other currency pricing units, but actually use the dollar to measure its value. That is to say, users will not use Libra to measure the dollar, but still use the dollar (or other legal currency) to measure how much Libra is worth.

In fact, it is worth noting that the Bank of England’s statement will really open up the right to withdraw funds for such financial technology innovation companies. Libra is also able to gain the approval of the central bank, and the central bank opens an account to enter the central bank's balance sheet, thus gaining the same status as the bank. Once this happens, Libra's future will be very different.

Inclusive finance, and the impact on other countries' currencies

Libra claims to be committed to serving 1.7 billion people without a bank account. These people without bank accounts can use Libra through their smartphones, which is in line with the concept of inclusive finance. But will the financial system of the countries where these people live receive the impact of the monetary system?

Consider the simplest amount of money:

MV=PQ

Once the people began to choose Libra instead of their own currency, that is, they changed the circulation speed of their own currency, V, the total quantity of commodities was constant, and at the same time they needed to stabilize prices, that is, when P remained unchanged, it was necessary to change the money supply. The amount M. Once the amount of money is changed, it also affects the local monetary policy. In the case of out of control, it is more difficult for the local government to adjust. Once this happens, the most likely solution is for the local government to begin capital controls. Libra's inclusive financial vision is also difficult to achieve.

However, considering the market economy, if there are other options, the final use of money in a country as a means of payment is entirely the result of market competition. In some high-inflation countries, Libra may be a good solution to the problem. In addition, Libra may be one of the ways to improve the efficiency of payment and settlement in countries that are currently dollarized.

4. Libra Investment Token and Association Governance

The process of Libra's development towards decentralization actually relies on the “power alternation” process of LIT and Libra; the two together build a complete Libra ecosystem.

In Libra's ecology, in addition to Libra, there is another pass: Libra Investment Token, LIT. LIT currently only has an institution that meets the requirements of the Libra Association in exchange for investment. The main interest of LIT is the voting rights in the Libra Association, which is the governance of the Libra Ecology; in addition, another interest in LIT is Libra's operating dividends.

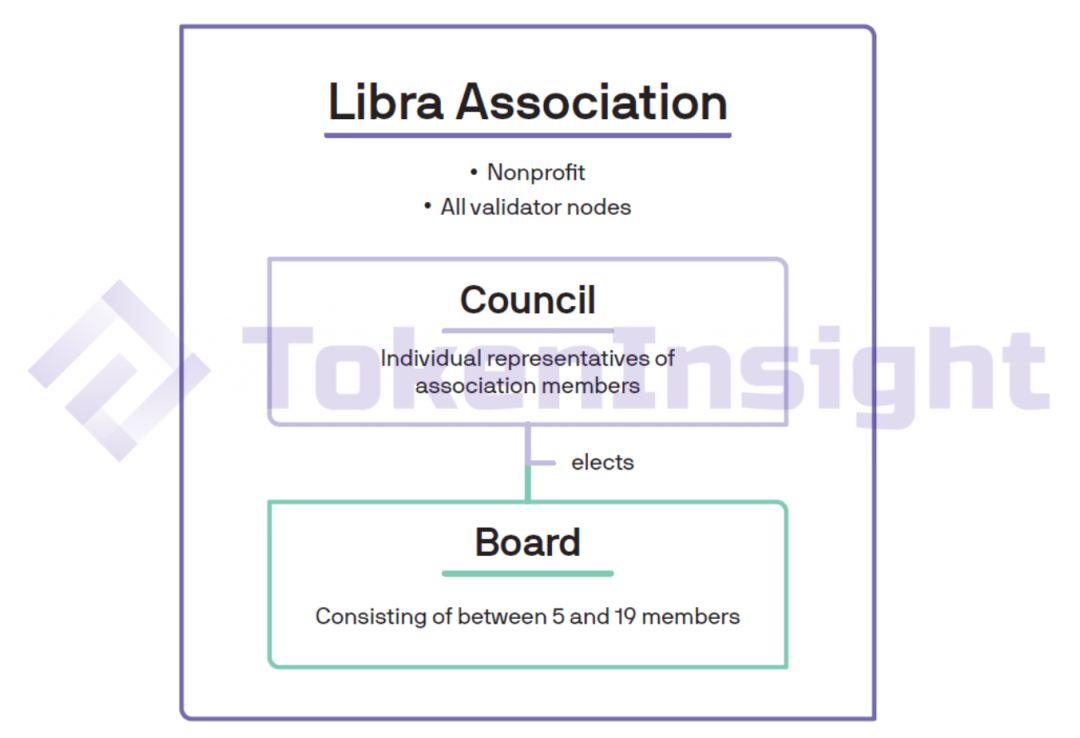

Figure 4-1 Libra Association's governance model

Source: Libra Association

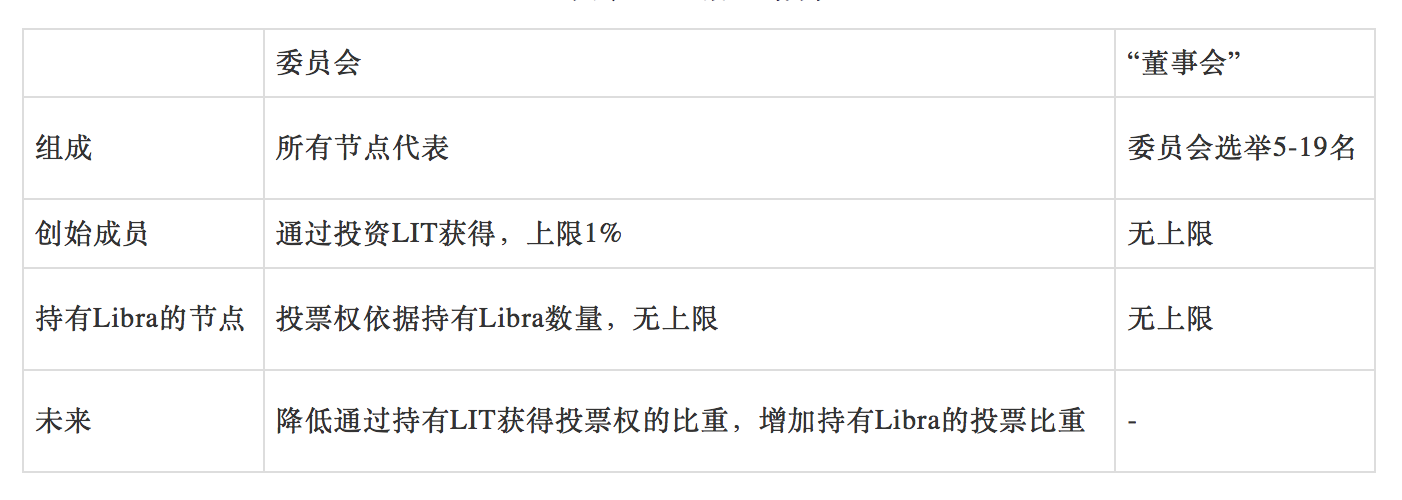

Organizations that invest in LIT can be used as Libra network nodes, while later organizations can become network nodes by holding Libra. All network nodes can assign a representative to participate in the Libra committee, and representatives in the Libra committee elect 5-19 representatives as members of the “Board of Directors” to take charge of day-to-day affairs.

In terms of governance, Libra's voting governance is divided into two layers. The first level is governance at the committee level. Nodes holding LIT or Libra have voting rights, but in order to avoid the influence of the founding members, the organization that initially purchased the LIT as a node can only have no more than 1% of voting rights . However, the nodes that hold Libra later are not subject to this limitation . The rationale for this approach is to first limit the rights of the founding members to the committee; the second is to hand over power to the nodes that are tightly bound to the Libra network (holding a large amount of Libra).

Figure 4-2 Governance structure

Source: TokenInsight

Libra's positioning of the two types of certifications, as well as the use of the number of changes in the number of passes to achieve a change in the overall ecological governance structure has its own unique innovations. LIT is positioned in early-stage qualified investment institutions and early decentralized governance; Libra is positioned to be a broader community governance after decentralization of the late network .

The early Libra ecology was in the form of a coalition chain, and the governance approach was more central, but Libra's node reputation was relatively higher and easier to gain trust than other projects. The transition to the decentralization process in the later period is actually a change in the status of the two certificates of LIT and Libra. When the committee runs Libra for the fifth year, it will give 20% of the voting rights to the Libra-sponsored node, not just the investors who hold the LIT. All important decisions about the Libra ecology need to be voted on in the committee.

Libra's design for the committee is similar to “the same rights”, but at the same time it guarantees that the dividends are proportional to the “shares”. While not damaging the enthusiasm of early institutional investors, we strive to ensure that the decentralization of the ecology can be achieved.

5. The impact of industry development

The emergence of Libra has actually created many investment opportunities and new business opportunities.

The first is that many organizations are currently trying to apply to become one of the founding members of Libra, but this is a higher requirement. To put it simply, companies need to pay $10 million to purchase LITs; in addition, financial requirements for businesses and service users are higher. Secondly, it became a Libra-certified institution in various regions. As a “intermediary”, it is responsible for the communication medium between Libra Association and users. The main task is to adjust Libra's liquidity according to changes in market demand. The third big demand is the demand for Libra wallets.

Facebook's launch of the Libra project proves that digital pass is a future trend. Regardless of the short-term or long-term perspective, it is a positive factor for the digital pass market. Especially for some main circulation certificates. Libra is likely to open legally accessible legal and digital pass-through channels around the world, adding side-by-side liquidity such as Bitcoin to make Bitcoin more accessible. From a positioning point of view, Bitcoin as an alternative investment target does not conflict with Libra's role as a medium of exchange.

Bitcoin and other certificates have officially opened the era of digital certification. A series of stable currencies such as USDT have built a bridge between digital certificates and French currency, while Libra has taken the foundation of stable currency and expanded this range. Not limited by location.

Finally, follow-up companies or alliances follow the pace of Facebook and Libra. What kind of sparks will be wiped out between different passes, and what kind of pass will survive after free competition, and who will be eliminated. A massive digital pass-through process officially opened.

Source: TokenInsight

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- G20 Summit Meeting V20 Preview: Digital Asset Service Proposal Extends Effective Date of FATF Standard

- Jinan, Shandong: When the blockchain meets government service, it takes only one hour for the company to start.

- Institutions are also suffering from "missing phobias". Who buys Bitcoin in large quantities?

- Dfuse received $3.5 million in seed round financing, led by Multicoin Capital and Intel Capital

- Talking about the governance of encryption protocol: making good use of the power of evolution to achieve network effect

- SWAP: Asset allocation is not a privilege for the rich, blockchain + traditional finance gives you the Pareto optimal solution

- Wanchain released the PoS Galaxy Consensus Beta in the first quarter of the year, doubling the speed of the block, the official light wallet debut