The world is financial, but ultimately it is technology – blockchain or the ultimate weapon of technology to defeat finance

History repeats, but not simply repeats.

In 2013, Yu'e Bao was born, when traditional financial institutions shouted "Wolf is coming." Based on Alibaba's technology and user blessings of Yu'ebao, Yu'ebao reached 1.99 trillion yuan and 480 million investors at the end of the first quarter of 2018. This growth rate has moved the traditional financial cheese, and its development, Yu'ebao will become a large savings bank.

Subsequently, the regulator adjusted the holding or trading limit for five consecutive times, from 1 million yuan to 100,000 yuan. Affected by this, at the end of the first quarter of this year, the balance of the balance of the treasures has shrunk to 10,400 yuan. However, its user base has climbed to 588 million, an increase of 100 million users from the end of the first quarter of 2018.

If it is not regulation, technology has already gained the upper hand in competition with finance. However, traditional finance still has its own unique skills – credit, which is unmatched by technology companies. The credit of traditional finance comes from many aspects: brand credit, license credit, business professional credit, and credit granted by the state. The reason why Yu'ebao is restricted is that the supervision department cannot predict whether it will affect financial stability after it is allowed to expand. After all, it is a financial credit issue. So financial institutions found that the "wolf" did not come, and they committed themselves to the wave of improvement in financial technology.

- PricewaterhouseCoopers announces 8 cryptocurrency audit services, both BTC and ETH

- Institution Fomoing, whales enter, collect licenses, summon dragons

- G20 Summit Meeting V20 Preview: Digital Asset Service Proposal Extends Effective Date of FATF Standard

However, the emergence of the blockchain has given credit a solution to technology, and the jigsaw for technology entry into financial technology has been basically complete.

In 2019, Facebook launched the Libra project, and traditional finance shouted "Wolf is coming". This time it may be true.

Technology (computing power) empowering finance

The first collision between technology and the "wolf" and finance began in the 1970s.

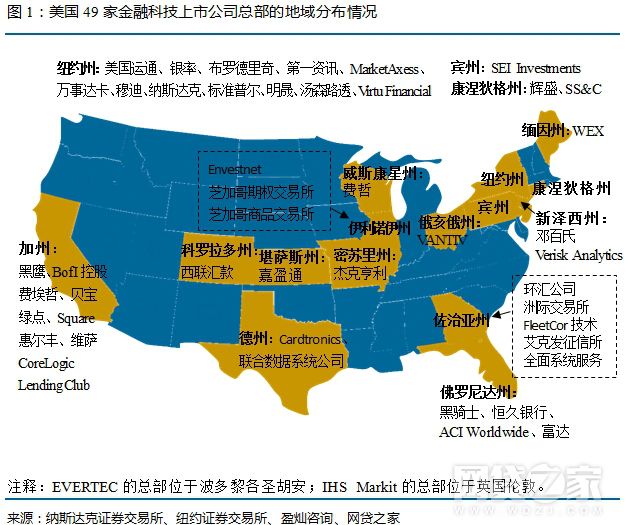

In July 2016, the KBW NASDAQ Financial Technology Index was officially released in the United States. The index is used to track the performance of companies that use high-tech financial products and have strong influence in financial services.

The index has 49 constituent stocks. Visa is considered to be the first native financial technology company if it excludes financial companies that later armed themselves with technology. The emergence of Visa is inextricably linked to the development of information technology.

In 1970, Visa founder Dee Hock founded National Bank Americas Inc. (NBI) in Delaware. In 1976 BankAmericard was renamed Visa.

Visa is defined as a payment technology company dedicated to helping consumers, businesses, banks and governments use digital currency. The technology it used was the computer and Internet technology that was thriving at the time. In the 1970s, the emergence of very large-scale integrated circuits, computers were gradually used in commercial organizations; the Internet also produced the main standards in the 1970s, and efficient communication across regions became possible.

As can be seen from the figure below, the Visa office in the 1970s was a large computer room.

Every step of Visa has its own opposition from traditional financial institutions, such as the security of the network. When Visa launched Visa payWave in 2007, it was questioned that the user's information was leaked in the air.

But the efficiency gains brought about by information technology have actually brought benefits to financial companies. Today, no financial institution is open to information technology. Even in the most uncertain areas of investment, technology is gaining the upper hand.

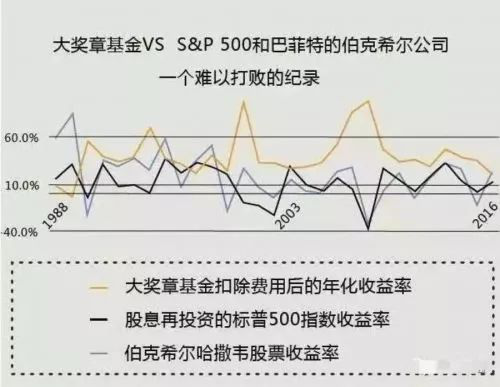

It is well known that Buffett is a "share god", but in the face of the "great medal" fund of technology blessing, Buffett's performance is a lot worse.

In 1988, Simons, the founder of the "Grand Medal" fund, recruited a large number of mathematicians, cryptographers and senior computer engineers to create a quantitative fund company – Renaissance Technology.

Simmons' head product medallion, its annual compound yield has reached 35.6% since 1989, significantly ahead of the "S&P 500" 20 points in the same period, and more ahead of Buffett's Berkshire Hathaway.

But in general, in the early days of the combination of information technology and finance, although the financial industry is worried about information technology, but the overall benefits of technology, the new generation of information technology represented by computers and the Internet provides a large number of calculations. Force to become a financial company's tool for handling complex data.

At this stage, financial technology is mainly driven by financial companies or practitioners. 49 financial technology stocks are mainly distributed in New York, Pennsylvania, New Jersey, and Illinois, where traditional financial industries are concentrated.

Traffic (data) empowerment

After entering the era of mobile Internet, the blessing of computing power to the financial industry has gradually come to an end. On the one hand, Moore's Law is exhausted, but personal computing power is already very strong. Technology companies can provide financial computing products directly to individuals. Users do not need to go to traditional financial institutions. On the other hand, financial institutions find that they are calculating their own data. After the market data, more data has gradually flowed to technology companies.

Therefore, the competition between finance and technology enters the second stage: technology companies use financial or user data to empower finance. In 2013, Tianhong Fund and Alibaba cooperated to launch the model of Yubao Detonation. At that time, the author was in this industry, the traditional fund company faced the Internet "barbarians" almost unable to resist, watching the Tianhong fund scale from the countdown to the first. Then, the fund company began to join various Internet companies such as Tencent, Jingdong, Baidu, etc., trying to achieve the import of traffic and data.

So domestic financial + technology accelerated integration. Because it occupies the traffic entrance and the data entry, the Internet company is now Party A, so this stage puts forward the concept of "Internet finance".

Around 2013, the main entities of Internet finance were born, and pleasant loans were born in 2012; Zhongan Insurance and Crowdfunding Network were born in 2013; WeChat Payment and Weizhong Bank were born in 2014.

It is worth noting that in the Internet finance stage, Chinese Internet companies are almost invincible through the network effect. The loan balance of online loans in the early 2018 is 1.2 trillion yuan. Compared with traditional financial institutions, Internet finance has no store cost, product iteration is fast, and insight into human greed.

However, a large number of risks are also accumulating. Subsequently, equity crowdfunding, online lending, and Internet insurance all exposed risk exposure. Since 2015, violent torrents have continued until now.

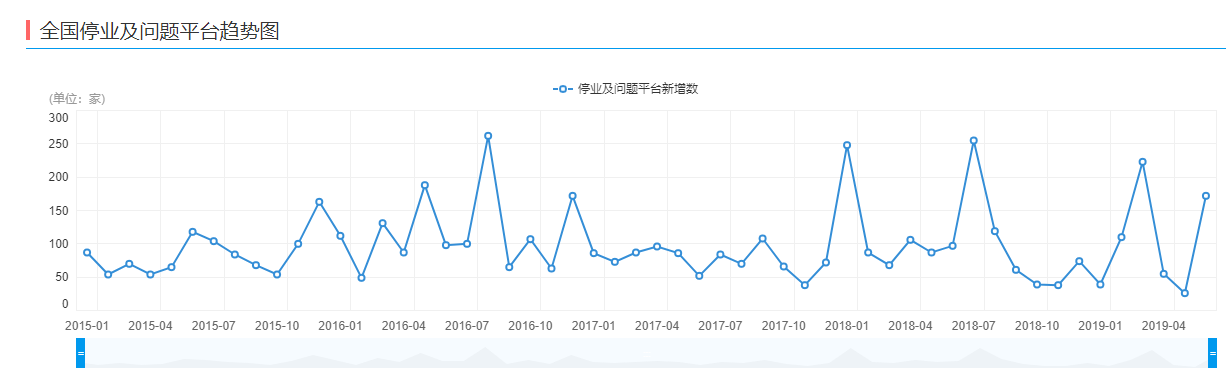

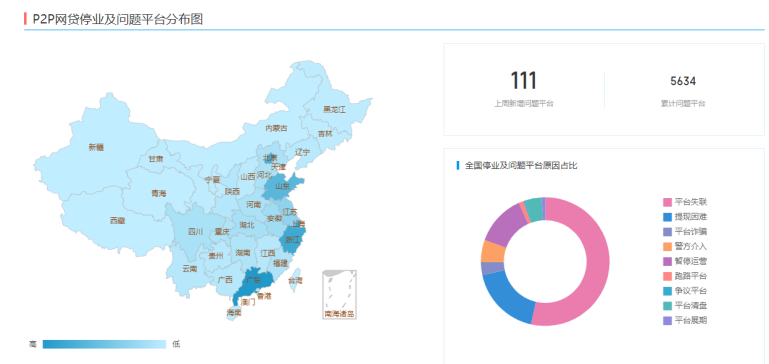

According to the data of the network loan, from the beginning of 2015 to June 25, 2019, there are 5,634 online loan platforms.

Figure: Statistics on the number of thunderstorm platforms on the Internet

Loss of association, running, exhibition, suspected fraud, etc., has greatly reduced the trust of investors in online loans.

Figure: Statistics on the causes of online loans

Today, the Internet financial platform is still fading at the rate of hundreds of corporate thunderstorms per week. Credit is especially important at this time. Therefore, Internet finance has gradually concentrated on large enterprises that have established huge credits in the Internet industry. For example, Tencent & WeChat platform, Alibaba & Alipay platform, and their establishment of Weizhong Bank, Zhongan Insurance.

Ordinary users have slowed down the gods: Although the fast-rising Internet finance has high-yield products, it also has high risk exposure. Behind high risk is the lack of ability to build credit. With the high yields, users are instantly disintegrated.

Traditional finance also understands its own advantages, that is, credit and the path to establish credit. They began to use technology again as their own tool, so Fintech (financial technology) came into being.

Financial technology company established by traditional banks

Mutual chain pulse statistics, in line with the trend of Fintech, domestic traditional financial institutions have basically established financial technology subsidiaries or financial technology business units.

Fintech, financial front, technology behind, subtext is financially dominant. Because the soul of the financial industry – "credit" is still in the hands of traditional financial institutions. The credit construction of traditional financial institutions has gone through thousands of years, forming various legal systems, financial systems, state systems, corporate rules and regulations, etc., to protect the credit of financial enterprises. For example, the international Barthal agreement, the FATF organization; the "Commercial Banking Law", the "Trust Law", the "Fund Law", the "Insurance Law" and the "Securities Law" formulated by China; the deposit reserve system of the central bank and commercial banks, and The degree of wind control set by various financial institutions.

Credit is also the biggest threshold for technology companies to access the financial road. Alipay and WeChat payment are often instructed, punished, and required to be rectified by the regulatory authorities from 2014 to 2018. The essence of these technology companies is that they are heavy-duty users, and the risk of credit construction costs.

Credit empowerment

In the mutual love of finance and technology, these two industries have become the world's leading players.

In 2018, among the top 100 global market capitalizations, for the second consecutive year, technology became the industry's largest market capitalization among the top 100 companies, reaching a market value of 4.8 trillion US dollars. The second-ranked industry is finance, with a market capitalization of $4.4 trillion. However, the number of companies listed in the financial sector is the largest, with 23 companies. Ranked third is the consumer industry, with a market capitalization of $2.8 trillion and a large distance from the first and second places.

What is more noteworthy is that the market value of technology companies is growing very fast. From 2009 to 2018, the total market capitalization of the top 100 technology companies increased by 433%, and the financial growth during the same period was 222%.

2009-2018 market capitalization of the top 100 industry growth

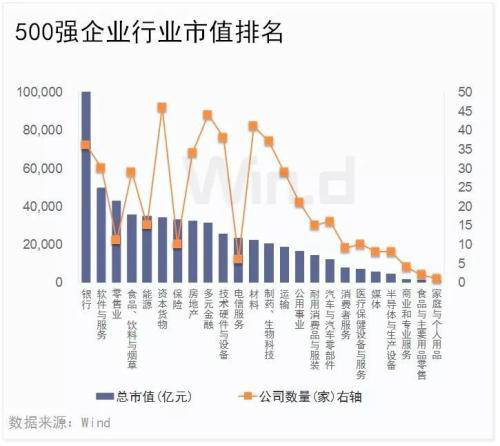

The domestic situation is also the gimmick of finance and technology. As of the end of the first quarter of 2019, among the top 500 Chinese companies, the market value of the banking industry accounted for the highest proportion, reaching 18%; followed by software and services (technology) accounting for 9%.

Both Chinese and foreign, the world has been dominated by the two major industries of finance and technology. The world is financial and technological.

However, from the experience of the United States, the technology industry has surpassed finance, and Fintech is moving toward Techfin.

Science and technology enter the financial gap to solve the credit step – what can the financial products of technology companies allow users, supervision, and long-term trust in the country? The blockchain has emerged and the credit threshold for financial companies is collapsing.

Currency is a concentrated expression of financial credit. For example, a country's financial loss of credit and currency depreciation are encountered by countries with financial crises. In 2008, Nakamoto published the Bitcoin white paper, and people are increasingly discovering that the underlying blockchain technology is a trusted machine. Bitcoin's credit through distributed computing, consensus mechanisms, encryption algorithms and other technologies is almost no less than the "ultimate fantasy" of human currency credit in the past few thousand years – gold.

But the blockchain trust machine can't be built in a few years. From 2016 to 2019, ICO, IEO, IMO and other chaos, not only did not use the blockchain to establish credit, but the blockchain technology. Brought to the ditch that approximates "fraud." The reason is that on the one hand, the blockchain technology and supporting facilities are not perfect. During this period, the trust of the blockchain is not efficient, and the trust of information under the chain cannot be established. On the other hand, many projects under the name of the blockchain do not want to establish credit, but to defraud, or even root. The blockchain is not used. Finally, the supporting regulatory system for the blockchain is not perfect. Even if the code can establish credit, the code for the regulatory blockchain has not yet been generated.

Even the stable currency linked to the US dollar, such as the USDT, publicly acknowledges that only about 74% of the USDT is supported by cash and equivalents.

But Facebook's blockchain project, Libra, has been launched to shake the financial industry: it really uses the blockchain as a trusted machine, and it is pragmatic to adopt reliable technology, such as the initial use of the alliance chain, using the BFT consensus Wait. Some people say that Libra is Q coins + Alipay. This may be the case from the use of feelings, but this is only the appearance.

Because Libra uses the blockchain, its transactions do not need to be settled by traditional financial institutions such as banks. People trust the books. The value of traditional financial institutions such as banks has completely disappeared.

In addition, it also superimposes the credit of technology companies such as Facebook, Uber, and booking; the credit of Visa, mastercard, PayPal financial technology companies, and the credit of a basket of French currency. The probability of success has increased dramatically.

However, Libra is not the end, it is just the beginning. Imagine, when we buy insurance money, why do we need insurance companies to withdraw large sums of money to maintain a large marketing team; why should our loans pay such high interest rates for financial institutions to conduct credit investigations for us; why should companies pay for them? High investment bank fees, legal fees, accountant fees…

Techfin has just started, the wolf is really coming.

Author: Mutual chain pulse commentator Yuan yet

This article is [inter-chain pulse] original, reproduced please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Jinan, Shandong: When the blockchain meets government service, it takes only one hour for the company to start.

- Institutions are also suffering from "missing phobias". Who buys Bitcoin in large quantities?

- Dfuse received $3.5 million in seed round financing, led by Multicoin Capital and Intel Capital

- Talking about the governance of encryption protocol: making good use of the power of evolution to achieve network effect

- SWAP: Asset allocation is not a privilege for the rich, blockchain + traditional finance gives you the Pareto optimal solution

- Wanchain released the PoS Galaxy Consensus Beta in the first quarter of the year, doubling the speed of the block, the official light wallet debut

- Bitcoin is 15 minutes deep and $1,700. Coinbase and other platforms once 瘫痪