Holding money or using DeFi to manage money, who is more profitable?

Written by: Evgeny Yurtaev, founder and CEO of Zerion, a decentralized financial platform

Source: Chain News

Let's take a look at the wealth management through DeFi protocols such as Compound, Uniswap Pools, TokenSets, and different investment returns for holding ETH and Bitcoin in the past year.

Also, pay attention to the beauty of DeFi protocols: they allow investors with different risk-return preferences to look for more promising investment opportunities.

- Babbitt site 丨 Li Lin: Upgrade Huobi Cloud to provide digital financial solutions based on blockchain digital currency issuance and payment

- Bitcoin Mining 60 Days Visit: Recording the Mysterious Nugget Paradise

- The funds were cheated under the name of the public chain. Where is the way out for the public chain?

Key takeaways

- The DeFi application has greatly improved the risk-return provided to investors in the past year;

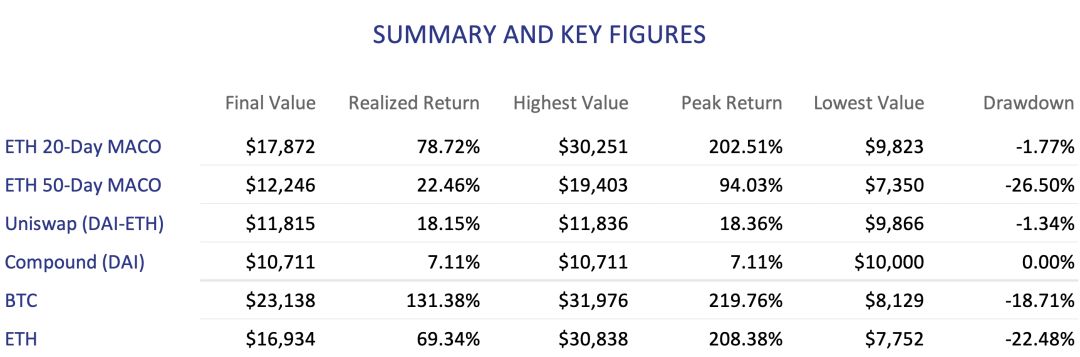

- TokenSets ’ ETH 20 Day Moving Average Crossover (MACO) is better than the strategy of buying ETH and holding it, and the maximum drawdowns (peak to trough) (Decline) has also been greatly reduced;

- Compound and Uniswap offer attractive income opportunities for investors holding stablecoins.

In the past year, the DeFi ( Decentralized Finance) ecosystem has become one of the most active applications on Ethereum . Compound , Uniswap and Tokenset have become the most popular investment choices today. The native token ETH on the Ethereum blockchain is the main mortgage asset in these financial applications.

I hope that through this article, I will compare the performance of Compound cDAI, Uniswap ’s DAI-ETH pool, and Token MACs ’ETH MACO strategies over the past eleven months.

I set the analysis period from December 3, 2018 to October 31, 2019. During this time, I compared the DAI loan return on Compound, the supply liquidity of Uniswap's DAI-ETH pool, and the ETH 20 of TokenSets. Day and 50 Day MACO (Moving Average Crossing) Strategy. We will also present the returns of ETH and Bitcoin purchases and holding strategies over the same time period. However, our analysis did not take into account transaction costs, slippage, and price fluctuations of stablecoins.

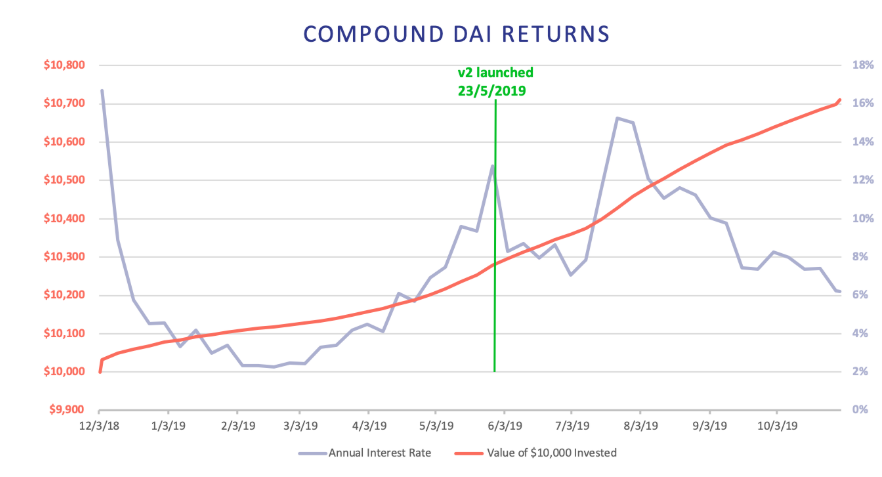

Compound returns

Compound is a money market agreement that allows users to pool a set of assets that others can borrow after providing collateral. Its lending rate is variable and depends on market supply and demand.

About Compound, we show the performance of a portfolio worth 10,000 DAI and its weekly annualized interest rate. In addition to Compound, DeFi projects like dYdX v2, Dharma, bZx, and Nuo can also provide similar returns for DAI, but since these projects were only launched in 2019, we were excluded from analysis.

From December 2018 to the end of October 2019, this investment received a 7.1% return on the Compound platform.

As can be clearly seen from the figure below, after MakerDAO's stabilization fee increased from March 2019, the compound interest rate also began to increase. Interest rates on other mortgage-type debt agreements are too low, allowing users to transfer their positions to Compound for a more attractive interest rate. We did not consider the price change of DAI, however, during this period the price of DAI / USD has been between 0.95-1.02, with little fluctuation. In December 2018, the Compound protocol was not fully operational for several hours, and the team applied a patch to fix a bug. This operation has no negative impact on any users.

Image source: https://loanlist.io

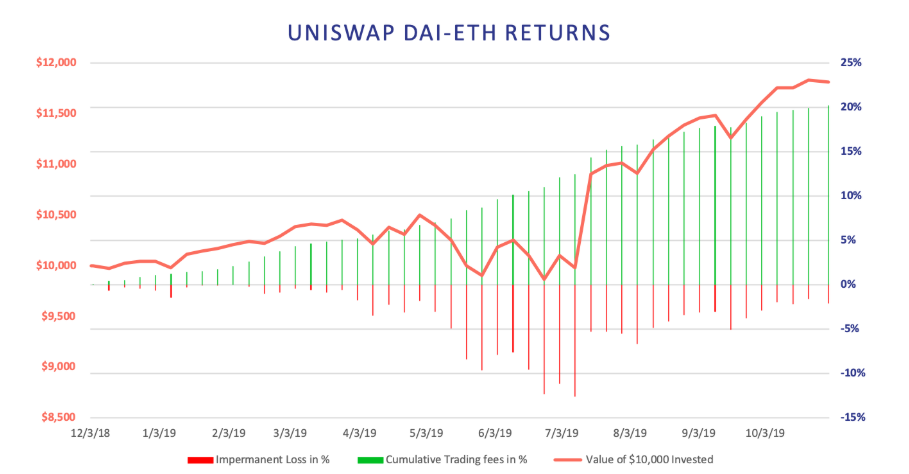

Uniswap pool returns

Uniswap is an on-chain exchange where users can trade tokens. Some liquidity providers will supply various asset reserves to match transactions, and these liquidity providers can earn transaction fees.

We show how the DAI-ETH pool that provided $ 10,000 to Uniswap would be rewarded. In practice this means that the investor provided the pool with $ 5,000 worth of ETH and $ 5,000 worth of DAI. These numbers mean that investors put these assets into the pool on December 4, 2018, until October 31, 2019.

During this period, Uniswap's DAI-ETH pool received a return of 18.15%. Due to the price fluctuations of ETH / DAI, investors who provide liquidity at different points in time will receive different returns.

- The price of the asset at the time of supply and retrieval;

- The size of the liquidity pool;

- Transaction value.

The high volatility of cryptocurrency prices translates into the high variability of Uniswap returns, so Uniswap's future returns are likely to differ significantly from the figures presented here.

In the chart below, the green bars show the weekly accumulated transaction fees, and the red bars show the weekly temporary losses due to price fluctuations. Interestingly, in the days when the price of ETH fluctuated greatly, the fees charged due to the increase in transaction behavior greatly reduced the temporary loss of the total value of the portfolio.

There is another reason for this result, which is that the size of the liquidity pool is small compared to the transaction amount, which allows liquidity providers to charge a larger proportion of transaction fees. If the size of the liquidity pool is large, and the transaction volume is low, or both, then when the price of Ethereum fluctuates greatly, as the proportion of transaction fee income becomes smaller, investors will have more Large (net) losses. As can be seen from the chart below, this investment strategy has only slightly decreased from its original value in five weeks.

Image source: https://zumzoom.github.io/analytics/uniswap/roi.html

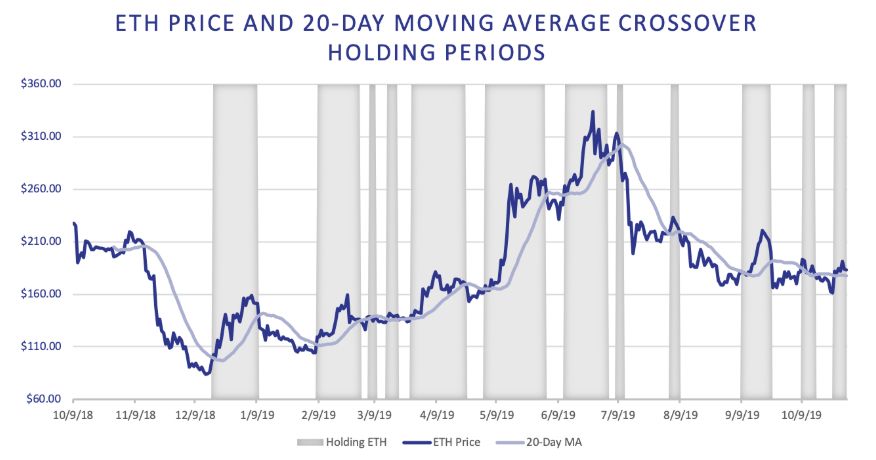

TokenSets: ETH 20-day and 50-day Moving Average Crossover Strategy (MACO)

TokenSets is a tokenized trading strategy. Its strategy is executed automatically without any user action.

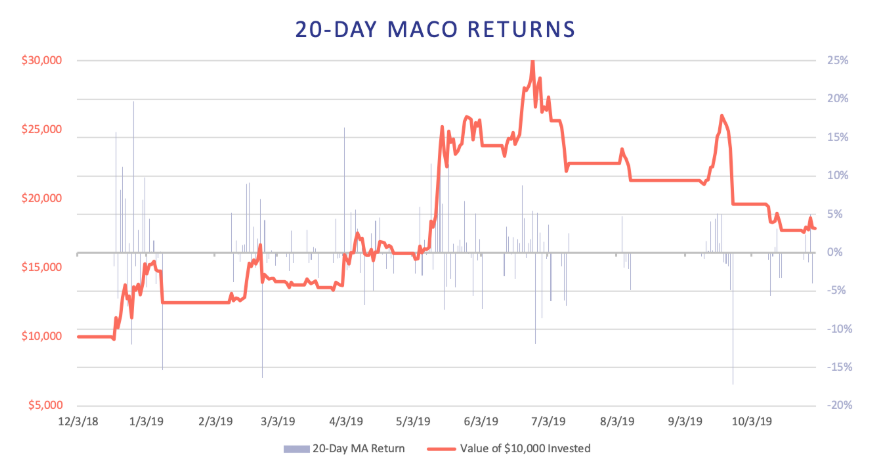

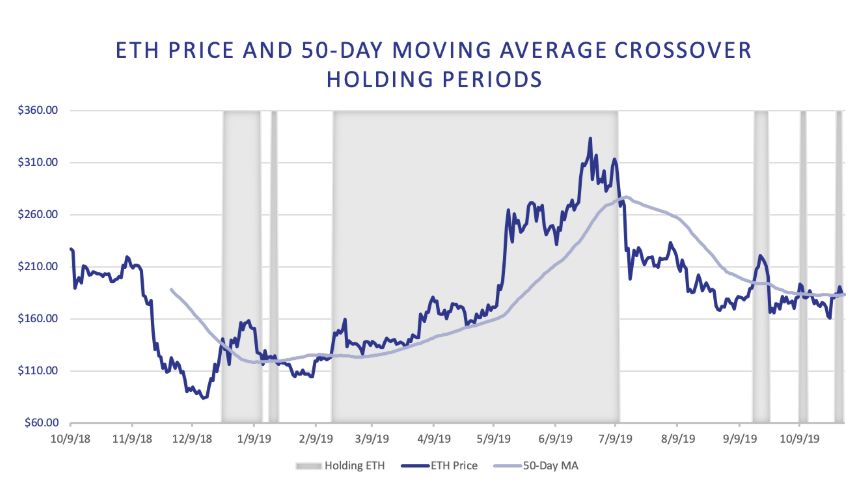

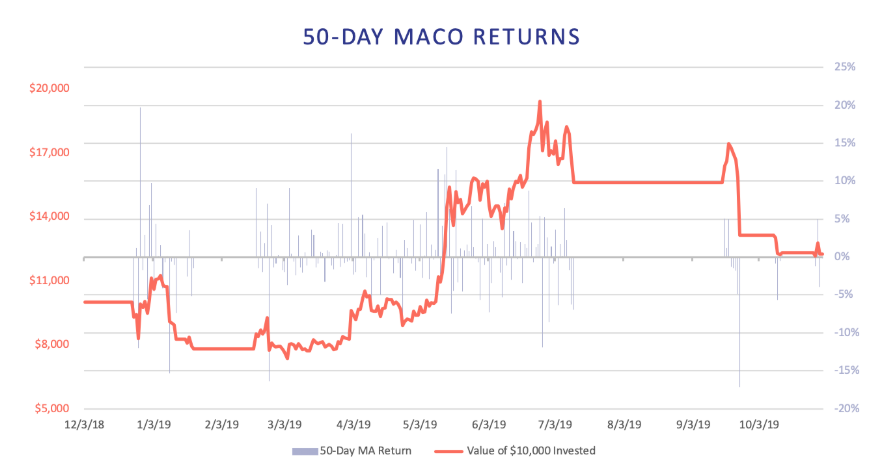

We will show the performance of two trend trading strategies: the 20-day moving average crossing strategy (MACO) and the 50-day moving average crossing strategy. Both are simple trend strategies, the goal of which is to obtain returns from the ongoing trend and rebalance to cash when the trend reverses.

TokenSets only released its trend trading strategy in July 2019. We use daily price data to estimate how much return we can get from October 2018 to this date. It should be noted that our analysis did not consider fees and slippage, and the recent rebalancing event of TokenSet caused a slippage of 0.5% or more. Therefore, if the frequency of rebalance is considered, these factors may affect the actual performance of the TokenSets strategy.

When the price of ETH is higher than the moving average, the moving average crossover strategy will buy and hold ETH, and when the price of ETH is lower than the moving average, the strategy will sell ETH and hold stablecoins. Rebalancing transactions generally occur on the day the price line crosses, and the execution condition is that four days have passed since the last rebalance.

The 20-day MACO strategy created a 78.7% return on investment, which outperformed the strategy of buying and holding ETH.

We found that when the ETH price plummeted in July 2019, both strategies (20-day and 50-day MACO) avoided significant impairment by timely rebalancing to stablecoins. However, the price of ETH in September dropped too steeply, and the rebalancing of the two strategies for stablecoins seemed too late. It can be seen from the results that the 20-day MACO strategy achieved a return on investment of 78.7%, which performed better than the investment strategy of buying and holding ETH, but the 50-day MACO strategy performed poorly with a return of only 22.5%. (The blue bar in the image below represents daily revenue)

Image source: https://etherscan.io/

Image source: https://etherscan.io/

Image source: https://etherscan.io/

Image source: https://etherscan.io/

Image source: https://etherscan.io/

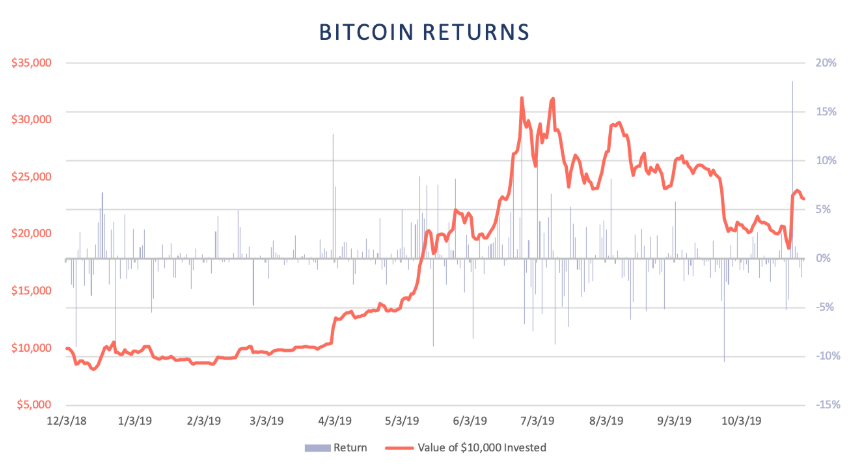

Return on holding ETH and Bitcoin

The prices of ETH and Bitcoin have always maintained a high correlation, and their performance is largely comparable. However, in July 2019, Ethereum continued to fall, while the price of Bitcoin recovered. However, when the time came to September 2019, the price of Bitcoin also followed a sharp dive. During our evaluation period, the peak prices of both assets increased by 200% from their respective starting prices. Compared to the peak price, ETH is now down about 50%, while Bitcoin is down about 34%. At the end of the evaluation period, the Ethereum buy and hold strategy achieved a 69.3% return, while the Bitcoin buy and hold strategy achieved a 131.4% return.

In the figure below, the orange curve shows the performance of an investment worth $ 10,000, and the blue bar indicates the daily return. The calculations are based on daily price data.

Image source: https://etherscan.io/

Image source: https: // ww w.blockchain.com/

to sum up

In absolute terms, the ETH 20-day strategy is superior to other DeFi strategies and ETH buying and holding investment strategies shown in this article. This result stems from the fact that the strategy avoided most of the downside of ETH, while generating gains during the rise in ETH prices. Similarly, the 50-day strategy captured the rise in the ETH price starting in March and rebalanced to a stablecoin in July, but suffered a sharp decline in September, thereby greatly reducing the final return of the strategy. If the rebalancing time of the two strategies is accelerated a little bit (for example, at the time of cross-price) , then the return of the 50-day strategy will exceed 50%, and the return of the 20-day strategy may exceed 130%.

We also noticed a difference between return volatility and maximum declines. The most obvious is that based on the starting value, the maximum decline of the 20-day strategy is -1.77%, while the maximum decline of the 50-day strategy is -26.5%, and the maximum decline of the ETH buy and hold is -22.48%. The biggest drop in BTC's buy and hold is -18.71%. However, compared to lending a stablecoin on Compound, holding ETH, BTC or TokenSet will bring higher risks due to price fluctuations. Similarly, the liquidity providers of Uniswap's DAI-ETH pool can also reduce the volatility of their investment portfolio by placing half of their investment in stablecoins.

Another interesting development of DeFi is the ability to tokenize investment positions. For example, Compound's cToken represents a deposit and its accrued interest, but it also exists independently as a token. This means that investors can transfer Compound deposits and deposit them into other smart contracts, such as Uniswap (existing as a cDAI-ETH pool) . The cDAI-ETH liquidity provider can thus earn both Compound DAI interest and transaction fees from the cDAI-ETH pool. Similarly, TokenSets can be rebalanced into cToken stablecoins, such as cDAI or cUSDC, so that investors can get an interest on their cash position.

As our analysis shows, DeFi allows investors with different risk-return preferences to look for more promising investment opportunities. Due to the open and decentralized nature of DeFi, this area may continue to introduce more exciting and innovative financial products. The emergence of tokenized positions has made us find this area very worth exploring for further development.

You can also use our product Zerion to track and manage your DeFi investment.

risk warning

DeFi is still in the early stages of development, and all smart contract systems should be considered experimental and high-risk, and may even cause investors to lose all their funds.

All in all, investors are better off decentralizing their DeFi and other investment activities into more smart contracts, rather than just optimizing for the highest interest rates today.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Securities Daily: Multi-regional efforts to promote blockchain technology innovation industry layout have their own focuses

- How long do analysts look at the market outlook?

- AFP: French central bank plans to test digital currency in first quarter of 2020

- The market exploded in the early morning, the main force repeatedly washed up

- Istanbul hard fork is coming, but Ethereum 2.0 is still 10,000 miles away

- Research Report | Blockchain Enabling Commodity Traceability and Anti-Counterfeiting

- Introduction to Blockchain 丨 How to prevent SIM card fraud attacks?