RWA Potential Exploration The Next Large-Scale Application Track after Stablecoins?

RWA Potential Exploration Next Big Application after Stablecoins?TLDR

-

The characteristics of RWA assets, such as high transparency and strong liquidity, make them the next track for achieving scale in DeFi after stablecoins pegged to the US dollar.

-

RWA roughly has three development directions: public chains with a similar experience to non-custodial DeFi, public chains with regulatory whitelist transaction characteristics, and limited transactions on private or consortium chains. The first direction has the highest composability and is the development direction we most want to see.

-

Currently, DeFi does not have a good way to retain existing assets or introduce new assets. Tradfi faces the urgent need to solve liquidity, transparency, and transaction cost issues. Introducing RWA can to some extent solve the current problems of both sides and promote the integration of DeFi and Tradfi.

-

Referring to the concept of RWA, we can extend to CWA (Crypto-World Asset), such as BTC ETF and other financial instruments in the traditional financial market that participate in the cryptocurrency market. The deep needs of both can be attributed to the urgent need for investors to launch risk-matched segmented products to improve financial efficiency.

-

In terms of comprehensive user transaction costs, holding asset costs, and resistance to meeting compliance requirements, US Treasury bond ETF assets are the best choice for early-scale application of RWA. For the current development of RWA, compliance risks, counterparty risks, and US Treasury default risks are the main sources of uncertainty.

-

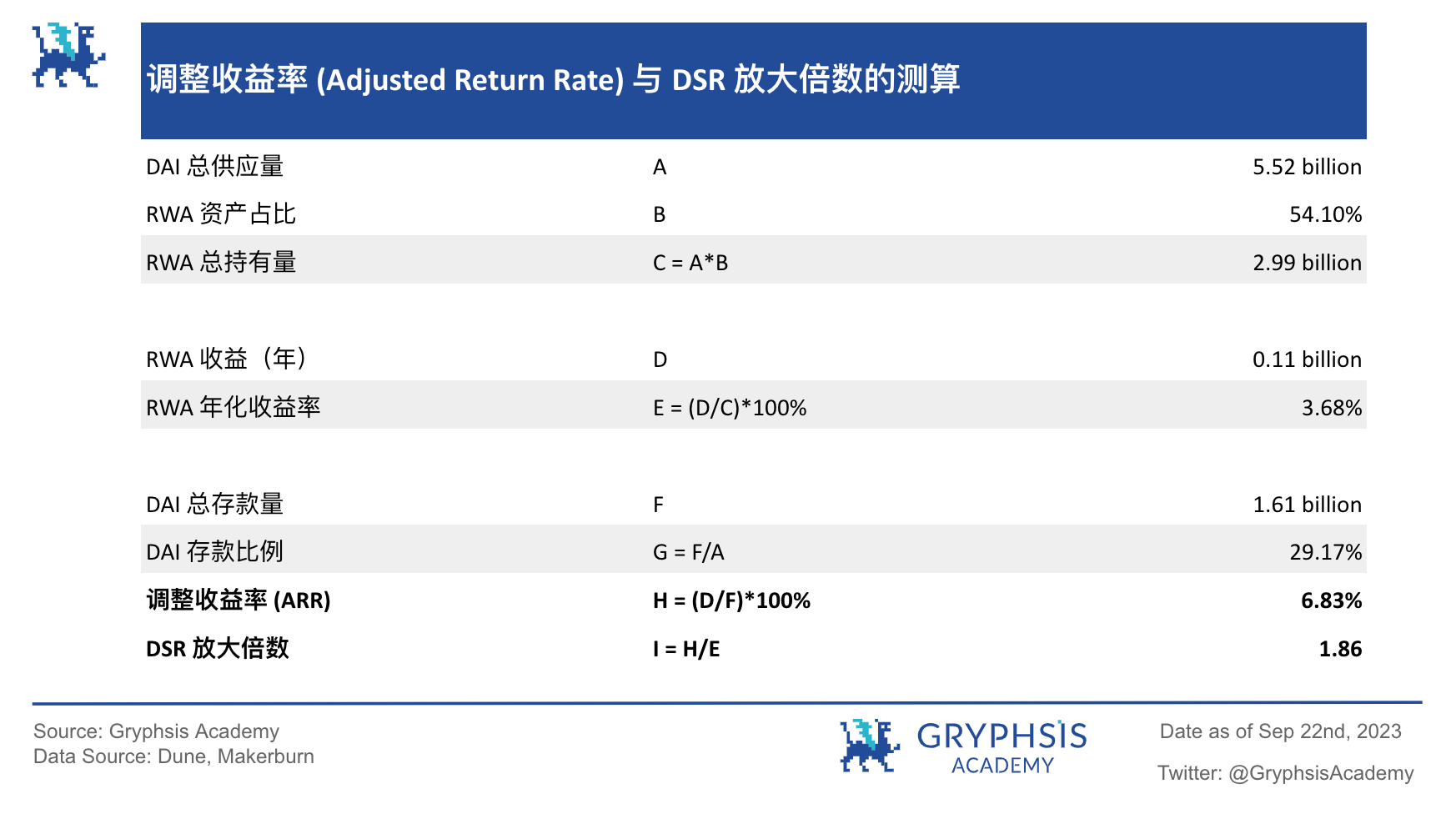

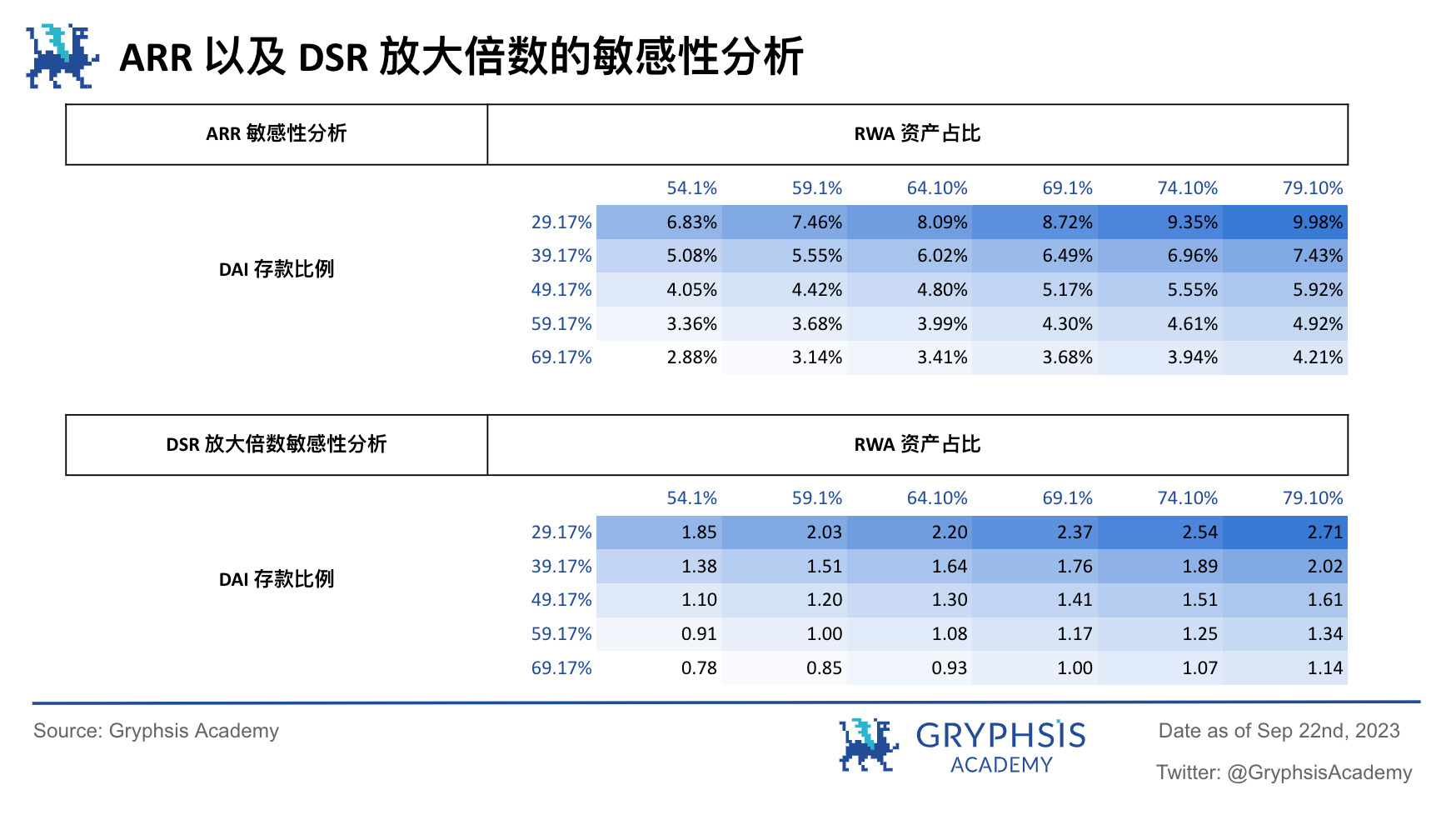

By introducing RWA assets, MakerDAO has currently achieved an adjusted yield of approximately 6.83%. Since the DAI deposit ratio is not high, Maker can amplify the DSR to 1.86 times the RWA yield. Currently, MakerDAO offers a 5% yield to DAI depositors, slightly higher than the yield of US Treasury bond ETF. It not only achieves considerable income through RWA yield but also brings this income to the chain and gives it to DAI depositors.

-

As CDP stablecoin projects gradually follow in the footsteps of MakerDAO and gradually use RWA as their underlying assets, RWA will have exponential growth space in the CDP stablecoin market as the share of the CDP stablecoin market and the proportion of RWA assets increase, ranging from $15.96 billion to $21.50 billion.

-

With the improvement of regulatory compliance, RWA will start from standardized assets and gradually expand to non-standard assets, combining with CWA. This will achieve the transformation of blockchain technology from the backend to the frontend. RWA will also become a key track for the integration of DeFi and Tradfi and achieve scale application.

RWA Overview

Real World Assets (RWA) refers to traditional assets that are tokenized using blockchain technology, giving these assets a digital form and programmable characteristics. In this framework, various types of assets – from real estate and infrastructure to artwork and private equity – can be converted into digital tokens. These tokens are not just numerical symbols of asset value; they also contain multidimensional information about the corresponding physical assets, including but not limited to the nature of the assets, current status, historical transaction records, and ownership structure. Broadly speaking, widely used stablecoins pegged to the US dollar are also a form of RWA, namely the tokenization of the US dollar. This article will step by step introduce how RWA can become the next track for achieving scale after stablecoins pegged to the US dollar.

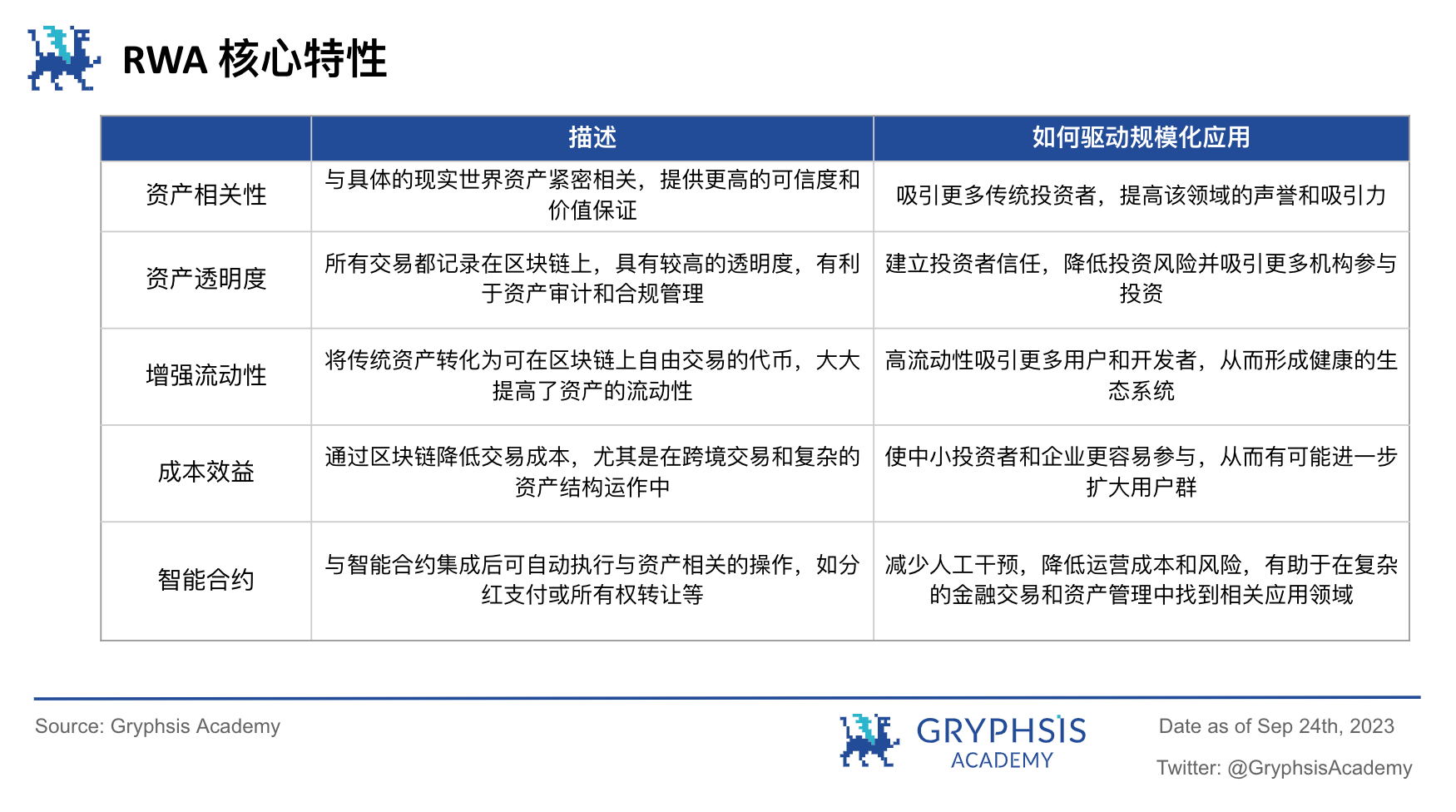

RWA assets have the potential to achieve large-scale applications in the blockchain ecosystem due to their unique multidimensional advantages. The high asset correlation and transaction transparency establish investor trust, while the enhanced liquidity and cost efficiency effectively promote market activity and diversity. The introduction of smart contracts further improves operational efficiency and simplifies compliance and audit processes. These core features pave the way for RWA to become the next scalable application track after stablecoins, indicating its broad prospects in the blockchain and even the entire financial field. Of course, RWA assets are diverse, so which assets will be scaled on-chain first? And what are the risks or challenges of putting different assets on-chain?

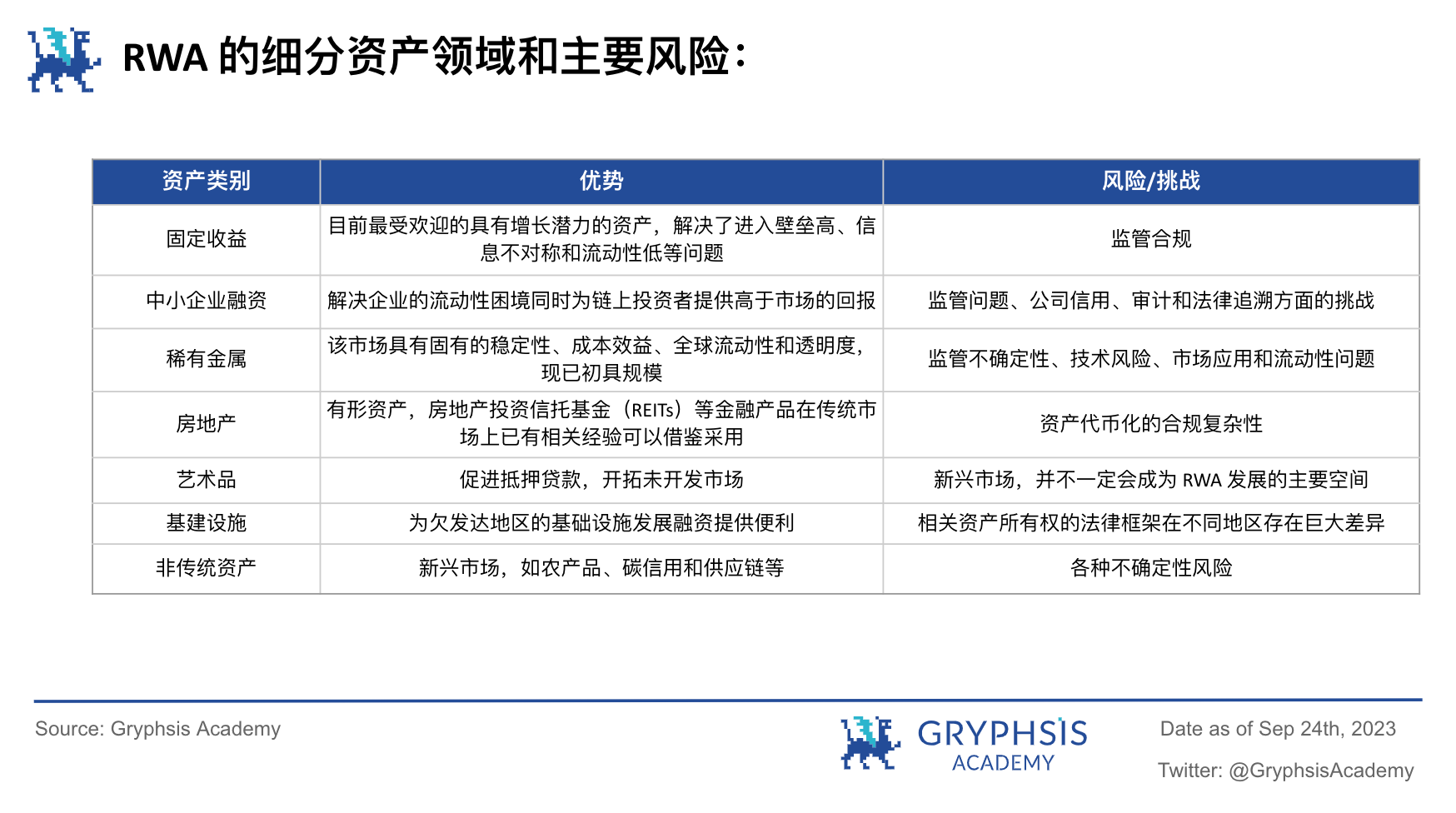

Overall, the relatively easier-to-implement and already-scaled tokenized markets are fixed-income assets and rare metal assets. Although the market value of gold tokenization has exceeded 1 billion (mainly represented by projects $LianGuaiXG and $XAUT), starting with fixed-income assets such as US bonds/US bond ETFs is currently a relatively easier and more efficient way from the perspective of addressing the pain points and demands of the DeFi itself, seeking standardized assets that can bring real yields on-chain.

From the perspective of the blockchain and the strictness of KYC, RWA has three main development directions:

1. Public chains and permissionless experience

The first direction emphasizes achieving permissionless transactions of assets on public chains to provide a user experience close to DeFi. In this mode, real-world assets are tokenized and freely traded on public chains without centralized approval or permission, and asset transfers are not subject to any restrictions. This approach maximizes asset liquidity and market participation while reducing transaction costs. However, this DeFi-like experience also brings a series of regulatory and compliance challenges, including but not limited to anti-money laundering (AML) and KYC issues. Therefore, although this direction has obvious advantages, it also needs to address corresponding risks and compliance issues.

2. Public chains and regulatory whitelists

The second direction is a compromise solution, where assets may be traded on public chains but may be subject to some form of regulation or have certain thresholds, such as restricting participants through address whitelisting mechanisms. In this case, only addresses that have been verified and added to the whitelist can participate in RWA transactions. This approach provides a certain level of liquidity and transparency while allowing regulatory agencies to conduct more effective supervision and compliance checks. In this way, it strikes a balance between permissionless and fully regulated models.

3. Private Chain/Consortium Chain and Complex KYC Process

The third direction is to conduct RWA transactions on private chains or consortium chains, which typically involve complex KYC processes and stricter regulatory control, and currently there is no asset composability. In this mode, the validating nodes are usually government-validated and have certain thresholds, which ensures that the entire system operates in a highly compliant and controlled environment. Although this approach may limit the liquidity of assets and market participation, it provides the highest level of regulatory compliance and data security. This is the mode that many governments and traditional financial institutions are more inclined to adopt.

Why do we need RWA?

Defi Perspective:

From the above Defi TVL data, it can be seen that since the market panic and a large number of sell-offs triggered by the decoupling of UST in May 2022, the TVL of the Defi sector has been on a downward trend. It is currently difficult for projects and narratives to attract off-chain funds, so it is necessary to introduce new narrative structures and participants. Based on the characteristics of RWA mentioned above, bringing real-world assets onto the chain to provide real asset value may be the best solution at present.

At the same time, in order to retain on-chain funds or attract off-chain funds, the high yield that Defi can provide is the key data that funds pursue. However, the quasi-parallel yield of $UST leads to distrust of high yields by fund providers. RWA can increase the real yield of the protocol with real-world asset endorsement and solve this problem well.

Tradfi Perspective:

1. Strong regulatory control and limitations of liquidity tools

Although the traditional financial system has made significant progress in asset securitization and liquidity, such as through real estate investment trusts (REITs) and exchange-traded funds (ETFs), these tools are still subject to strict regulations and structural limitations. For example, REITs and ETFs usually need to meet a series of complex compliance requirements, which not only increases operating costs but also limits product innovation and market participation. Therefore, although these tools improve asset liquidity to a certain extent, there is still much room for improvement.

2. Limitations in the private credit sector

In the private market, especially in the private credit sector, there are various restrictions and unmet needs. These markets are usually manual, slow, opaque, and have high operating costs. The capital matching process involves multiple steps from finding and qualifying investors and investment opportunities to initial capital allocation, secondary trading and management of assets. These factors result in irrational capital allocation and suboptimal customer experience.

3. “Black Box” problem of complex financial products

When creating complex financial products, the traditional financial system often faces the “black box” problem, which is the lack of transparency and traceability, making it difficult to penetrate underlying assets. This opacity not only increases risks but also limits the trust and participation of market participants. By mapping underlying assets onto the chain and packaging them into products through the composability of smart contracts on the chain, regulatory authorities only need to regulate the custody of the underlying assets, making the process of creating complex financial products based on simple financial products transparent. The convenience in terms of regulation may enhance the diversity and liquidity of on-chain financial products compared to traditional financial means.

In general, TradFi faces the needs and challenges of improving liquidity, increasing transparency, and reducing costs. RWA provides effective solutions to these problems through tokenization and blockchain technology. Especially in the private market and complex financial product fields, RWA is expected to bring unprecedented transparency and efficiency, thereby addressing the core bottlenecks of the traditional financial system. By introducing RWA, the traditional financial system is expected to achieve higher capital efficiency, broader market participation, and lower transaction costs, thereby promoting the health and sustainable development of the entire financial ecosystem.

At the same time, it is easy to observe that both traditional institutions and official institutions in TradFi, as well as project parties in DeFi, have been deeply cultivating the RWA field for many years, seeking opportunities for synergy and integration between the two. This also brings us to a recently popular concept – Bitcoin ETF, and from this, we can extend a new concept based on the RWA concept – CWA (Crypto-World Assets).

RWA and CWA

As Bitcoin gradually becomes a mainstream investment category, major financial institutions are actively applying for the approval of Bitcoin ETFs. This trend not only signifies the gradual integration of crypto assets into the traditional financial system but also provides us with a new perspective to consider these assets: the concept of CWA (Crypto-World Assets). CWA has many similarities with RWA, mainly in terms of asset standardization and liquidity enhancement. However, unlike RWA, which mainly focuses on tokenizing real-world assets, CWA is the standardization of crypto assets and the related financial products in the real world. We can see the prototypes of both, respectively, the on-chain issuance of US Treasury bonds/US Treasury bond ETFs and the approval and issuance of Bitcoin ETFs in the real world.

Like RWA, CWA also faces a series of regulatory and compliance issues. However, due to the decentralized and cross-border nature of crypto assets, these issues are more complex in the context of CWA. For example, the approval of Bitcoin ETFs requires solving multiple regulatory challenges, including but not limited to asset custody, price manipulation, and market supervision. But the introduction of CWA is expected to further improve the liquidity and market participation of crypto assets. By combining crypto assets with traditional financial products, CWA can not only attract more traditional investors to enter the crypto market but also provide more investment and risk management tools for existing crypto investors.

Whether it is RWA or CWA, their deep-seated needs and reasons for appearing can be traced back to the launch of risk-matched differentiated products, which improves financial efficiency. Efficient financial markets promote increased speculative behavior, which further drives the demand for more assets and investment opportunities. In this context, both traditional financial institutions and DeFi platforms need RWA and CWA to bridge the flow of funds, thereby attracting more users and capital. RWA and CWA, as new forms of financial innovation, can not only meet the market’s demand for diversified assets and stable returns but also promote the flow of funds to more efficient areas. By breaking down the barriers between TradFi and DeFi, RWA and CWA are expected to drive the entire financial ecosystem towards greater efficiency, transparency, and sustainability. This can not only improve the overall efficiency of the financial market but also provide investors with more investment choices and better risk management tools. This is also an important basis behind the large-scale application of RWA.

Why U.S. Treasury ETF Assets?

Educational Cost

Let’s think about why stablecoins pegged to the U.S. dollar have become the application area for mass adoption of cryptocurrencies. Why not Bitcoin or other native cryptocurrencies, or why not stablecoins pegged to other fiat currencies?

Firstly, the educational cost for users is an important but often overlooked factor to consider. For most users, understanding and accepting new financial products and technologies takes time and effort. Secondly, compared to other fiat-backed stablecoins, stablecoins pegged to the U.S. dollar are more easily accepted by users worldwide. The U.S. dollar itself is the most significant reserve currency and trading currency globally, with a wide range of cross-border use cases, which greatly reduces the educational cost for users. Therefore, stablecoins pegged to the U.S. dollar, leveraging users’ understanding and trust in the U.S. dollar, can gain market trust more quickly. Additionally, due to the global dominance of the U.S. dollar, related educational materials and resources are more easily standardized and globalized, further reducing education difficulties in multilingual and multicultural environments. Lower user educational costs are often an important factor in achieving scalable applications.

Similarly, this is why we adopt U.S. Treasury-related assets instead of bonds issued by other sovereign countries. U.S. Treasury bonds are widely regarded as one of the safest assets globally. Their high reputation and liquidity in the global financial market reduce the resistance for users to accept new financial products or investment channels. High market transparency and audit standards provide users with strong information support, thereby reducing the costs of ongoing education and market promotion. In addition, the stability and global liquidity of U.S. Treasury bonds also help shorten users’ learning curve and make it easier to accelerate the adaptation and acceptance of new users through community interaction and social endorsement. Of course, transparency and audit issues should not be ignored. The U.S. financial market has a high degree of transparency and strict audit standards, which also provide reliability and credibility for U.S. Treasury assets.

Real Yield

Tether ($USDT), as the most widely used stablecoin in the field of digital assets, has always faced transparency and compliance issues with reserve assets. The lack of transparency allows Tether to have room to issue excessive $USDT without sufficient reserves, and then use the overissued funds for other financial activities to generate profits. These profits are not returned to $USDT holders, but belong to the Tether company. This is particularly concerning in the current DeFi environment, as it raises the question of how to fairly distribute such potential profits to members of the DeFi ecosystem. In this context, U.S. Treasury bonds, with their relatively stable, standardized, and lower-risk characteristics, have become a worthy consideration as the underlying asset for stablecoin issuers. On this basis, U.S. Treasury ETFs not only reduce regulatory risks compared to U.S. Treasury assets, but also make it easier for issuers to access and benefit from this portion of assets (see the comparison of eligibility for purchasing U.S. Treasury bonds and U.S. Treasury ETFs in the table below).

In general, US Treasury ETFs become a powerful option that can solve the transparency and counterparty risks brought by USDT and other centralized stablecoins as underlying assets for stablecoin issuers like MakerDAO. They also have the potential to promote the acceptance of cryptocurrencies by the masses. Using US Treasury ETFs as underlying assets not only provides a more transparent and regulated investment channel but also allows for a fairer distribution of investment returns to all participants. This has a positive impact on the DeFi ecosystem while meeting the requirements of public acceptance and regulation. Therefore, we now see many stablecoin projects, like MakerDAO, starting to link their collateralized stablecoins to US Treasury yields. In the future, this is believed to become a necessary element for CDP stablecoins (Collateralized Debt Position is a protocol that generates stablecoins by locking collateral in a smart contract) and even the stablecoin market, bringing real-world asset-backed real returns to DeFi. Compared to stablecoins like USDT, stablecoins that map RWA asset yields on the chain are more transparent in terms of underlying assets and returns and have fairer distribution of returns for investors. They have higher credibility and acceptance for regulatory agencies and provide stablecoin issuers with a larger market and stability, although they give up some black-box benefits. The mass adoption of RWA assets is a win-win situation for the stablecoin field.

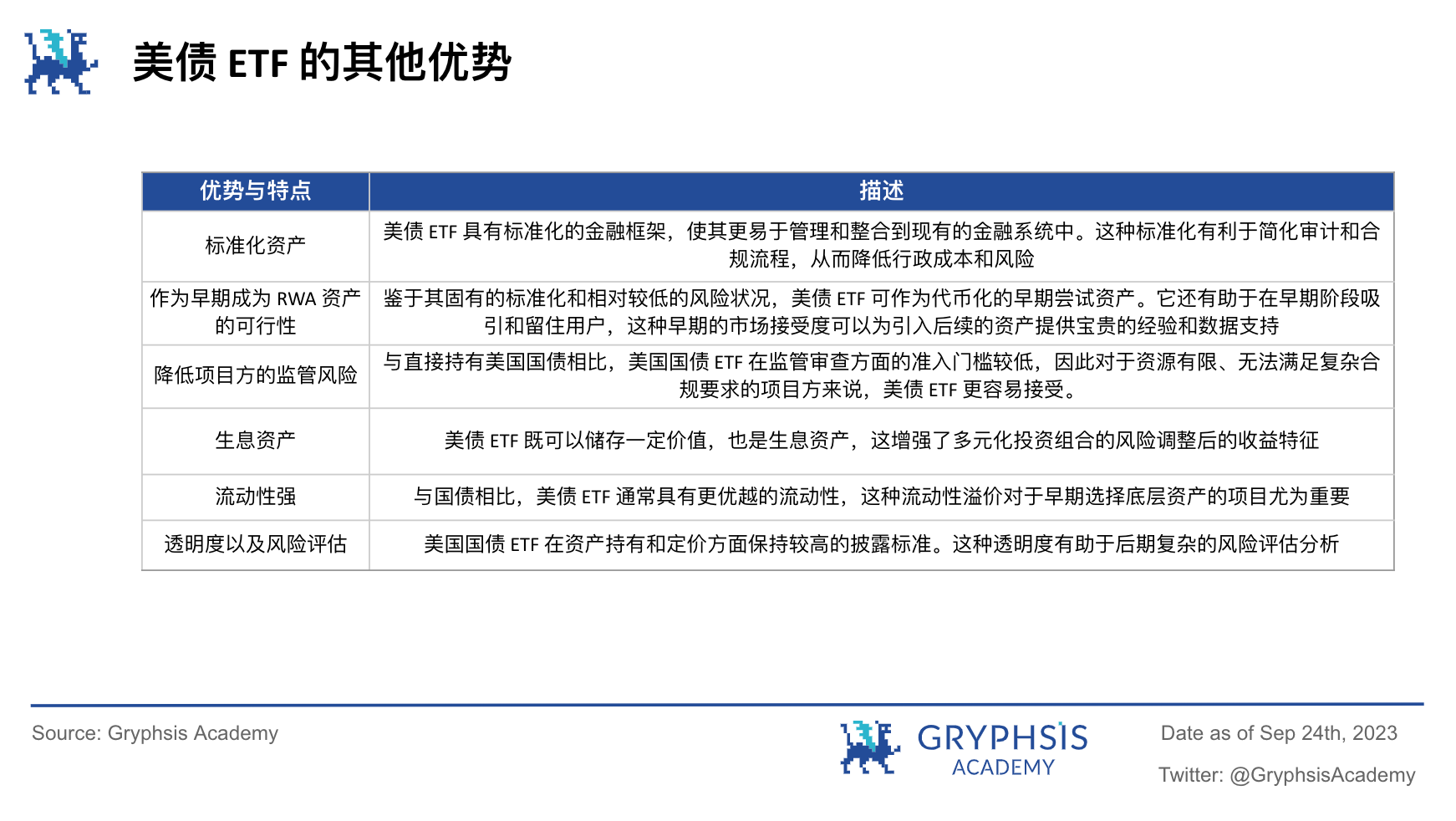

Advantages of US Treasury ETFs

Combining the above table comparing US Treasuries and US Treasury ETFs, directly purchasing US Treasuries requires higher requirements for investors in all aspects, especially for decentralized stablecoin issuers who already have compliance risks or other DeFi projects that want to obtain real-world asset returns. Therefore, if there is a reliable ETF issuance institution as a partner, directly purchasing US Treasury ETF assets is a lower-cost and more liquid way than directly holding US Treasury assets. At the same time, referring to the table below, DeFi project holders of US Treasury ETF assets have multiple advantages compared to other real-world assets.

According to Colin, a researcher at Mint Ventures (reference: ‘The Only Solution for Medium-Term RWA: A Discussion on Web3 National Debt Business’), the main advantage of using US Treasury ETFs as underlying assets is that it greatly simplifies the asset management process. In this arrangement, all management responsibilities related to the underlying assets, including liquidity management and bond rolling, are handled by the ETF issuer and manager. This approach actually reduces the operational burden and risks of the project in asset management. Furthermore, US Treasury ETFs have not yet experienced any significant risk issues, so project teams do not need to worry about this aspect of risk. Currently, they only need to select the largest, most liquid, and standardized assets on the market to include in their investment portfolio. Compared to holding US Treasury assets themselves, US Treasury ETFs allow project teams to focus on their core business and delegate complex asset management tasks to professional ETF issuers and managers, thereby reducing operational risks and improving efficiency.

In general, US Treasury ETFs have multiple advantages as on-chain targets, including their standardized characteristics, the potential as early targets for exploring RWA, relatively low compliance requirements, and the ability to serve as interest-bearing assets. These advantages make them a worthy option, especially for projects that want to explore and experiment with on-chain assets in the real world. Of course, these advantages are based on the current limited size of the tokenized asset market. According to the asset tokenization document published by the Federal Reserve Board in August, as the scale gradually expands, the high liquidity and composability of tokenized assets may cause the fragility of the prices of ETF assets in traditional financial markets or transmit price fluctuations in the cryptocurrency market to traditional asset markets. This is also a concern for investors and regulatory agencies, and effective solutions still need to be waited for. In addition, as US bond yields decline, finding similar US bond products will also be a major issue for the DeFi sector.

How to achieve on-chain RWA assets?

Although the RWA market has already taken shape, it is still in the exploratory stage. Different project parties and financial institutions in the DeFi and TradFi sectors are also trying different solutions for on-chain assetization. Combining the three development directions of RWA mentioned above, we can see that the closest experience to DeFi and the one that penetrates the income of RWA assets through DAI savings rate (DSR) is MakerDAO. Or various ways of tokenizing real-world assets, such as whitelist trading models like Ondo Finance and green bonds issued on private chains through Goldman Sachs’ tokenization platform GS DAP by the Hong Kong government.

Approach of MakerDAO’s on-chain RWA assets:

Although MakerDAO began planning the development of RWA as early as 2020, according to the development of regulatory compliance, it has only obtained income from RWA assets mainly in US Treasuries through different institutions, and has brought this part of the penetrated US Treasury income to the chain through DSR (DAI Savings Rate) for distribution to some DAI holders. In other words, it can be considered as tokenizing the economic rights of RWA assets rather than ownership, but given that it is currently the closest way to obtain real-world asset income in DeFi, it is expected that one day MakerDAO and its cooperative institutions can further tokenize RWA assets and have higher composability with the improvement of regulatory compliance. Next, let’s take a look at the paths through which projects that have already tokenized US Treasury ETFs have taken, using the two main Vault Types currently holding US Treasury assets in MakerDAO: RWA007-A (Monetails Clydesdale) and RWA015 (BlockTower Andromeda & Centriduge) as examples.

I Monetails Glydesdale

Referring to the MIP65 proposal, we can have a general understanding of the architecture of how the third-party institution Monetalis helps MakerDAO hold US Treasury ETF assets. First, MakerDAO proposes solutions to the three main problems caused by more than 50% of stablecoins in the asset-liability table, especially $USDC and $USDP assets, namely the inability to generate interest, asset concentration risk, and negative public relations impact. They believe that they can create some positive income while reducing the risk exposure to existing stablecoin issuers by holding short-term government bonds themselves.

The initial idea behind MakerDAO is to manage the assets of each fiat-backed stablecoin ($USDC/$USDP, etc.) by setting a target debt ceiling and a minimum/maximum range. When the debt ceiling of a stablecoin’s PSM pool exceeds the maximum limit, the excess funds are converted into cash and invested in short-term investment-grade bond ETFs, reducing the risk exposure to that stablecoin while potentially increasing returns. Conversely, if the debt ceiling is below the minimum limit, the system allows for manual intervention, usually executed by MKR holders. The overall mechanism aims to more efficiently manage the supply and demand of DAI while balancing risk diversification and increased returns. The choice of bond ETFs as an investment instrument is mainly based on considerations of liquidity, simplicity, cost-effectiveness, and risk management. ETFs not only provide high liquidity and asset diversification to reduce overall risk but also offer simplicity and cost-effectiveness compared to managed accounts, while still having some potential for returns, although not high at the time. Additionally, as ETFs are managed and supervised by professional asset management companies and regulatory agencies, they provide a certain level of transparency and security. From the perspective of risk management and income generation in MIP65, it is difficult to see MakerDAO’s intention to develop RWAs. However, through its collaboration with Monetails and the collaborative projects in MIP68, we can see MakerDAO’s long-term plans for developing RWAs.

According to Monetails’ description in MIP68, MakerDAO’s vision for RWAs is to integrate diverse and high-quality RWA assets through institutions like Monetails to achieve the integration of Maker and Tradfi. This allows for more flexible, innovative, and market-responsive credit assessments and other business operations, ultimately realizing Maker’s vision of Clean Money. The most ambitious goal is for Maker to create and operate integrated services that combine high-quality Tradfi and Defi, becoming an integrated service operator for tokenizing RWAs and other aspects of integrating Tradfi and Defi both on-chain and off-chain. Such a massive market is indeed attractive, and we can see how Monetails specifically implements this.

First, find a stable integration point without significantly changing the day-to-day operations of Defi and Tradfi to rapidly increase trading volume. After establishing a foundation of large-scale capital flow, gradually achieve more comprehensive on-chain integration. Ultimately, bring DeFi and traditional financial markets closer together, transitioning from experimentation to mainstream adoption. In other words, this is a basic plan for Monetails’ development of RWA business, serving as a complement to various other RWA businesses in fields like Centrifuge, Maple, and TrueFi.

So how is this specifically achieved? According to MIP68, there are roughly three main entities involved:

-

ARENA is dedicated to solving the complex interaction problems between traditional finance and DeFi, finding a suitable integration point to serve as a breakthrough for growth. This includes but is not limited to compliance, operations, and technology, ultimately achieving the organic integration and long-term development of both parties, acting as a bridge between them.

-

On the TradFi side, Glydesdale is primarily responsible for managing and initiating relationships with financial institutions, building trust, analyzing and matching suitable products and demands, and implementing these relationships. It also addresses the conflicts and challenges between DeFi and TradFi at the practical level. Currently, both parties have their own inherent needs and expectations, but there is limited tolerance for compromise. Clydesdale exists to bridge the gap between DeFi and TradFi as an intermediary solution, particularly for DeFi protocols like MakerDAO, providing a pathway to gradually attract and integrate large financial institutions.

-

Meanwhile, Lusitano is an asset management platform that specifically attracts and integrates teams with specific asset category experience and proven performance. By creating a flexible platform, it not only facilitates deep integration between DeFi and TradFi but also serves as an empirical tool to demonstrate the feasibility and innovation capabilities of DeFi. The platform particularly focuses on driving teams towards ESG and the green economy, thereby establishing broader and more diverse cooperation between DeFi and TradFi.

In other words, through the above solutions, MakerDAO and Monetails have cooperated to explicitly introduce RWA assets as collateral, providing real-world asset guarantees for DAO revenue. At the same time, it can be seen that both parties are aiming to participate in and expand a broader market. Next, let’s take a look at how BlockTower Andromeda and Centrifuge, which have also reached cooperation with Maker, operate.

II. The Path of BlockTower Andromeda and Centrifuge

If the cooperation between MakerDAO and Monetails is the two parties’ joint and in-depth advancement of the RWA vision, then the three-party cooperation between MakerDAO, BlockTower Andromeda, and Centrifuge provides almost a complete set of solutions for other project parties to introduce RWA assets. In particular, the latter two consider their main mission to be creating a repeatable, scalable, and reliable framework for RWA investment, which is a crucial part of the process of scaling RWA applications. At the same time, we can also see that at this stage, MakerDAO has a greater ambition for the integration of Tradfi and Defi, that is, an ambitious plan aiming to push MakerDAO and DAI into a wider social and commercial field, especially in emerging markets and real-world applications.

Through cooperation with the Centrifuge platform, MakerDAO indirectly holds real-world assets such as US government bonds. This process is highly innovative, combining the advantages of traditional finance and blockchain technology. First, the asset management company BlockTower Andromeda creates SPVs, which are associated with the funding pools established on the Centrifuge platform. This setup ensures the independence of each funding pool and also gives each pool a certain legal identity, helping to reduce compliance and operational risks.

Borrowers issue NFTs corresponding to the real-world assets they hold (such as US government bonds) through the SPVs. These NFTs are considered as the on-chain representation of these assets and are locked in the relevant funding pools on Centrifuge to extract corresponding loans. This step is particularly crucial because it provides additional transparency and traceability through blockchain, making external audits and risk assessments easier and more reliable. These NFTs are aggregated into asset pools, which are further divided into two types of tokens: $DROP and $TIN. The $DROP token represents the senior portion of the asset pool with lower risk, while the $TIN token represents the junior portion with higher risk.

As the main debt buyer of Centrifuge, MakerDAO directly integrates with Centrifuge’s funding pools, allowing it to directly withdraw the corresponding DAI stablecoins from its Vault through the $DROP tokens. This direct integration greatly simplifies the process of debt purchase and management, improving the efficiency and usability of the entire system. Due to this integration, MakerDAO not only gains robust returns associated with real-world assets such as US government bonds but also manages and optimizes its balance sheet more effectively. To ensure investment security, Centrifuge introduces a series of complex risk layering and protection mechanisms. The two most important concepts among them are the “Minimum Subordination Percentage” and the “Epoch Mechanism.” The former is used to ensure that priority assets ($DROP) have sufficient risk buffers to prevent unexpected losses. The latter is a redemption mechanism that allows token holders to redeem based on the cash flow of underlying assets, with priority given to $DROP holders. These mechanisms collectively provide MakerDAO with additional risk protection.

However, this mechanism is not without risks. Firstly, the system involves multiple parties and complex contractual relationships, which increases compliance risks, counterparty risks, and legal risks. Secondly, although the use of SPVs and funding pools to some extent reduces centralized risks, interacting with real-world assets can still bring other forms of risk, such as liquidity risk and market risk. Furthermore, as this model is relatively new, further exploration and resolution are needed to address potential security issues such as governance attacks.

Undoubtedly, not every project can gradually connect with real-world assets through cooperation with institutions similar to Monetails, as MakerDAO did. Indirectly holding real-world assets through infrastructure institutions like BlockTower Andromeda and Centrifuge that specifically put RWA assets on the chain not only simplifies the process and reduces costs but, more importantly, currently does not require the project to bear legal compliance costs and allows access to a wider variety of assets. This infrastructure construction is crucial for the realization of the vision of scaling RWA applications. Of course, what MakerDAO has achieved so far is only the “tokenization” of the economic rights of RWA assets. If we follow our original concept of asset tokenization, the method of putting assets on the chain by Ondo Finance is more in line with the RWA concept.

Ondo Finance’s whitelist trading mode for US Treasury bond tokens:

$OUSG tokens are cryptographic tokens that represent investors’ shares in the Ondo I LP fund. Ondo I LP is a limited partnership registered in Delaware that attracts on-chain investors to invest in and hold fund assets such as ETF assets. $OUSG tokens are different from regular cryptocurrencies or assets; they are tokens related to specific fund assets.

Technically, $OUSG tokens are based on Ethereum smart contracts. They can track investors’ fund shares on-chain and can be used in the subscription and redemption processes of the fund. When investors want to subscribe to the fund, they need to go through the KYC/AML process of Ondo I LP. This usually involves providing personal identification, financial information, etc. Once completed, the investor’s Ethereum wallet address is whitelisted so that they can send USDC to the fund’s smart contract for subscription. This process is completed by the smart contract, including the receipt of funds and the allocation of shares.

After investors send USDC to the fund’s smart contract, the contract will automatically transfer the funds to the fund account hosted by Coinbase. Then, Ondo Investment Management (Ondo IM) will convert the USDC into USD and transfer it to the cash account of Clear Street (a securities broker and qualified custodian) through a cooperating bank. There, Ondo IM uses these funds to purchase ETF shares. After the subscription is completed, investors will receive an equivalent amount of $OUSG tokens as proof of their share in the fund. These $OUSG tokens can be stored in an Ethereum wallet or used on other platforms (interoperability) and can also be used for future redemption operations.

When investors are ready to redeem their shares, they can send $OUSG tokens to the fund’s smart contract to submit a redemption request. The smart contract will automatically record this operation. Then, Ondo IM will sell enough ETF shares on Clear Street to fulfill the redemption request. The resulting USD will be converted to USDC and sent to the investor’s Ethereum wallet via Coinbase.

It can be said that Ondo Finance has currently found a compromise and showed us the next step after the tokenization of RWA assets, which is the composability of RWA tokens. However, due to compliance development, we still cannot be very optimistic about this whitelist approach.

Evergreen project of the Hong Kong government:

In the Evergreen project, the tokenization of bonds is divided into multiple stages during issuance and subscription, some of which are conducted on the Goldman Sachs GS DAP platform. Initially, the platform is only open to platform participants such as the Hong Kong SAR government, Hong Kong Securities Depository (CMU), distributors, custodian banks, and secondary market traders, and these participants are assigned corresponding roles and responsibilities, with high entry barriers. Non-direct platform participants will hold their interests through custodian banks (similar to customers who have undergone super-strong KYC by banks).

For tokenized bonds, some steps are carried out off-chain, such as bookkeeping and pricing. At the same time, on the day of bookkeeping and pricing, CMU will create smart contracts representing the actual rights of tokenized bonds on the chain, as well as smart contract instructions representing Hong Kong dollar cash tokens. At this time, authenticated participants on the platform, such as distributors, need to transfer the corresponding funds to the real-time gross settlement system (RTGS) account managed by CMU to participate in the subscription process on the platform through smart contracts.

In this project, the digital platform consists of the Canton blockchain that is responsible for interpreting and executing smart contracts and the Hyperledger Besy for inter-node communication and consensus ledger running on Ethereum. Both are private chains, providing higher security and privacy. It is worth noting that the visibility of different participants in certain smart contracts in this project depends on whether they are signatories and observers of the relevant smart contracts.

Finally, various payment and settlement activities throughout the bond’s lifecycle, such as interest payments and principal repayments, are conducted using Hong Kong dollar cash tokens minted by the HKMA on the digital platform. The smart contract automatically handles these payment and settlement operations. Compared to other digital securities transactions that use tokens not minted by the HKMA or any central bank, which may be tokens specifically designed for a single transaction and are flexible but highly unstable in terms of counterparty risk, operational risk, and liquidity, using a unified Hong Kong dollar cash token for transactions ensures the smooth operation of the entire process of the Evergreen project.

In conclusion, the tokenization model of securities by the Hong Kong government can be said to be highly compliant and controllable, but this may only be an attempt by traditional institutions to use blockchain technology to improve the efficiency and reduce the cost of financial asset transactions, and may not necessarily be strong evidence of the scale and growth of RWA applications.

Data Analysis

With the continuous interest rate hike initiated by the Federal Reserve at the beginning of 2022, the yield of US Treasuries has also increased significantly. The yield of two-year US Treasuries has soared from an average of only 0.15% at the end of 2021 to an average of 4.5% at the end of 2022. It can be seen that the decision of MakerDAO to introduce US Treasury assets is almost synchronized with the interest rate hike decision of the Federal Reserve. It is undeniable that MakerDAO has currently earned a considerable income through RWA and has also distributed a portion of the income to DAI holders. We use data to roughly estimate the Adjusted Return Rate (ARR) brought to DAI depositors by RWA assets and the amplification factor of DSR penetrating into the income process of RWA assets.

In the table above, the Adjusted Return Rate (ARR) is calculated by dividing the annual income of RWA (D, 0.11 billion) by the total deposits of DAI (F, 1.61 billion). This adjusted return rate can be regarded as the theoretical return rate that DAI depositors can obtain through the MakerDAO platform based on the current deposit ratio and the annual income of RWA, although it is indirectly achieved through RWA assets. In addition, the amplification factor of DSR (Dai Savings Rate) is calculated by dividing the Adjusted Return Rate (ARR) by the annualized yield of RWA (E, 3.68%). This ratio reflects the increase in the return rate that DAI depositors can obtain through the DSR mechanism relative to directly holding RWA assets. A DSR amplification factor of 1.86 indicates that DAI depositors can achieve an annualized return rate close to twice that of directly holding RWA assets through the DSR mechanism. This amplification factor shows the potential value and income advantage provided by the DSR mechanism for DAI depositors. In this case, the DSR mechanism seems to provide DAI depositors with a higher return rate, enabling them to achieve better investment returns in one year.

So why is ARR almost twice as high as the annualized yield of RWA? This is because the current DAI deposit rate is not high, and MakerDAO can distribute the income obtained through RWA to DAI depositors with a relatively smaller scale. This is also why we see Maker can offer a DSR as high as 8%. But how do we determine if this is a Ponzi scheme? We believe that as long as Maker guarantees the transparency of underlying assets and profit & cost, if the historical average data of DSR is lower than the real income of RWA assets, it means that the on-chain return rate has real-world asset income as a guarantee. Higher return rates will attract more DAI deposits, that is, an increase in the total deposits of DAI, an increase in the deposit ratio of DAI, leading to a decrease in ARR and DSR amplification factor, which means the same RWA income is distributed among more people.

In conclusion, it is already quite effective for MakerDAO to penetrate the stable income of RWA assets and distribute the income to DAI depositors. A transparent rate of return with real-world assets as a guarantee is currently a major gap in DeFi, and it will become the most fundamental layer for the future scale application of RWA. Of course, US Treasuries may not always maintain such high interest rates, but assuming that MakerDAO can obtain a stable annualized return of 3.68% through RWA, we can conduct sensitivity analysis on the proportion of RWA as underlying assets and the deposit ratio of DAI towards ARR and DSR amplification factor.

As shown in the above table, the left column lists different DAI deposit ratios, and the top column lists different RWA asset ratios. As the DAI deposit ratio increases, the annualized yield for DAI depositors gradually decreases, and the DSR amplification factor also decreases. This means that the deposit yield of DAI gradually approaches or falls below the real income MakerDAO obtains from RWA assets. As MakerDAO uses more and more RWA assets as collateral, its real income also increases, and we can see that the DAI deposit rate and DSR multiplier also increase accordingly.

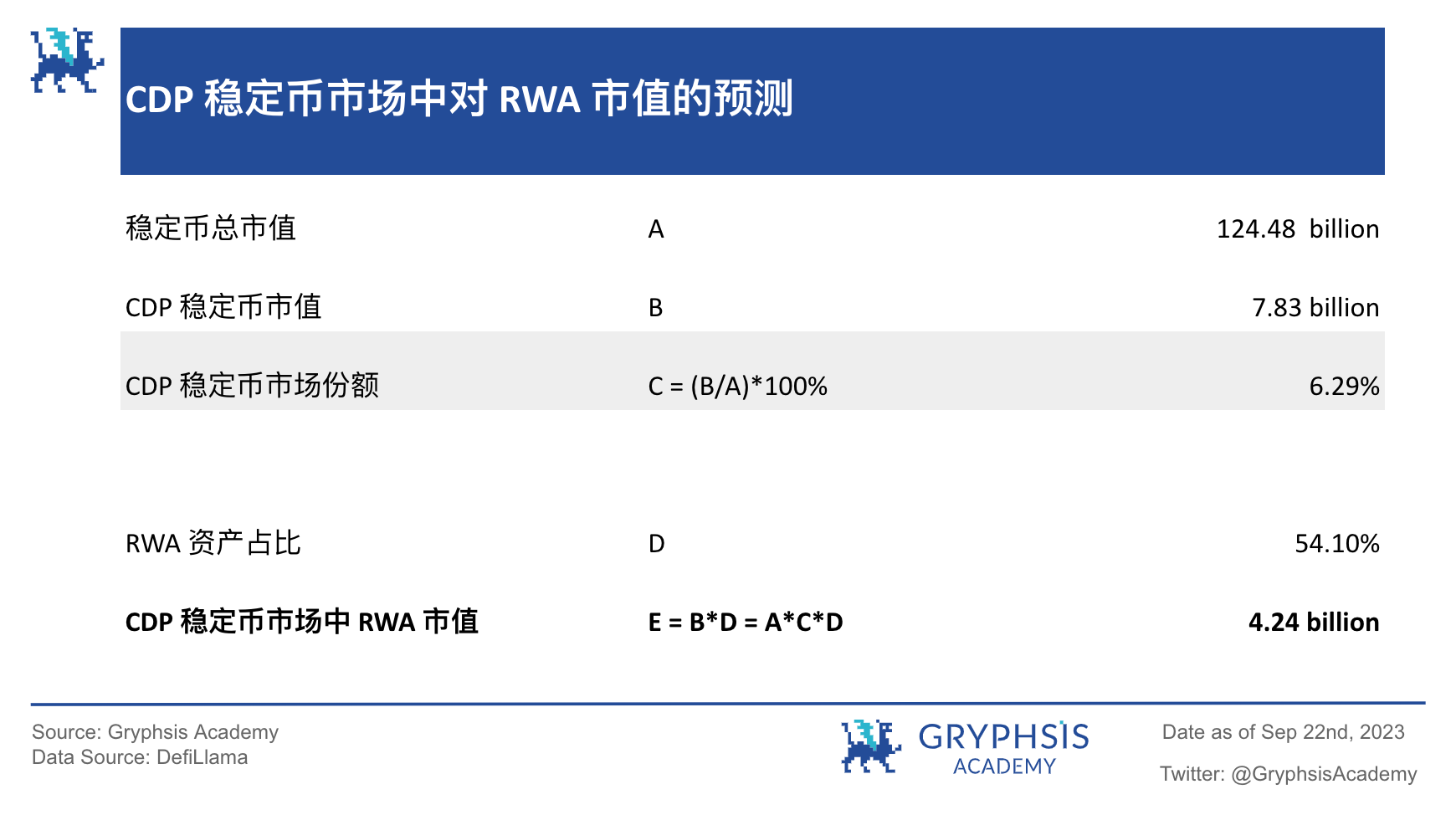

Currently, holding DAI deposits to obtain a nearly risk-free deposit interest rate is a good development direction that MakerDAO has explored for this type of CDP stablecoin, especially in the current environment where relatively high risk-free rates can be obtained from US bonds. Based on this, let’s roughly predict the market value of the RWA sector in the CDP market.

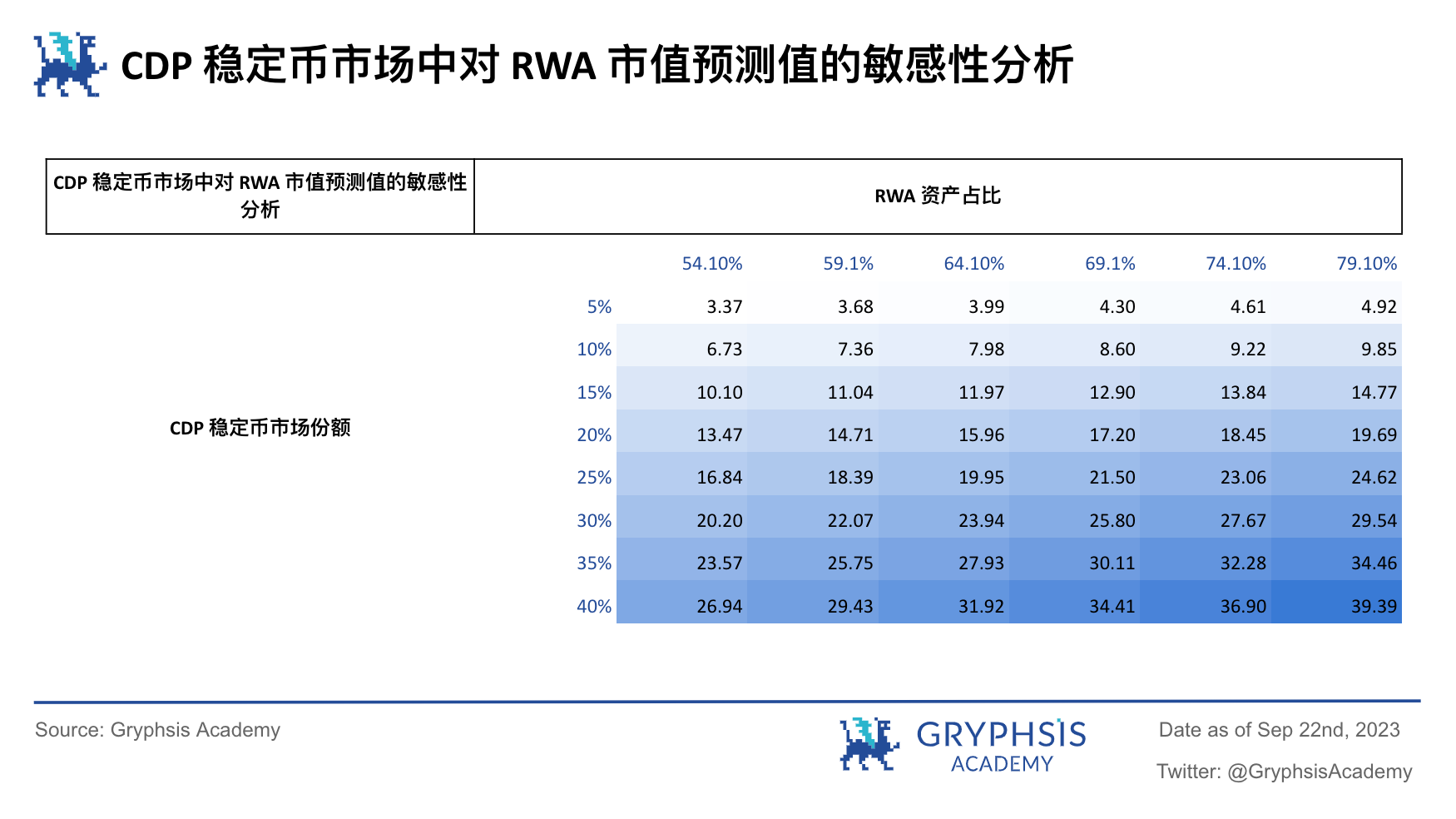

Based on the current 54.1% share of RWA assets in MakerDAO, the market value of RWA in the CDP stablecoin market is approximately $4.24 billion. As mentioned above, as RWA is widely applied, the market share of CDP stablecoins will also increase because they can distribute stable and transparent returns from RWA assets to stablecoin depositors. Therefore, let’s do a simple sensitivity analysis on the market value of RWA in the CDP stablecoin market. (Unit: billion)

In the table above, the left column lists the market share of CDP stablecoins, and the top column lists the percentage of RWA as underlying assets. It can be seen that as both increase, the market value of RWA experiences significant growth. Compared to the current mainstream stablecoin USDC, this CDP stablecoin, which is equivalent to having a built-in deposit interest rate, is more transparent and has a more reasonable distribution of returns to holders. It is reasonable to speculate that more project teams will follow MakerDAO’s lead and gradually replace their underlying assets with RWA assets, although this may only be a small part of the RWA’s scale-up application landscape.

Summary and Outlook

After in-depth analysis and data evidence, we believe that RWA demonstrates tremendous market potential and long-term growth space. With the promotion of the scale-up application of RWA, both the DeFi and TradFi fields will usher in numerous new opportunities, and even achieve partial integration and fusion. However, the unclear attitude of regulations and compliance currently remains the main obstacle to the scale-up application of RWA. Although we expect RWA to achieve a similar experience as DeFi on public chains and without permission after the regulatory framework is clarified, excessive optimism in the short term still needs to be cautious.

By observing the practices of MakerDAO, Ondo Finance, and the Hong Kong government, we have preliminarily seen various solutions and potential applications of RWA. We look forward to further leveraging its characteristics and addressing the various issues faced by DeFi and TradFi as the scale of RWA gradually expands.

Looking ahead, the development of RWA lays the foundation for innovative changes in the financial field. In terms of asset selection, the initial phase of RWA will focus on standardized assets such as US Treasury bonds, US bond ETFs, gold, REITs, and high-rated corporate bonds. These assets have mature trading mechanisms and high liquidity, providing a solid foundation for RWA. As technology advances and the market matures, we expect RWA to gradually expand to non-standardized assets such as artwork, real estate, and private equity, which will require more innovative ideas and solutions, including complex evaluation mechanisms and risk management strategies, as well as the gradual improvement of regulatory and compliance frameworks.

In terms of user acceptance, the strategy of RWA should focus on meeting investors’ demand for standardized assets first, and then gradually guide them to understand and accept non-standardized assets. This process requires not only carefully designed market education and promotion strategies but also in-depth analysis of investor needs to ensure that RWA can provide investment opportunities with substantial value.

In addition, the combination of RWA and CWA is expected to drive the application of blockchain technology from the back end to the front end. This transformation is similar to the development and evolution of the Internet from back-end servers and databases to front-end user interfaces and applications, greatly enhancing the usability and popularity of the technology. At the same time, the combination of RWA and CWA will not only break the limitations of traditional financial markets but also provide investors with more and higher-quality investment choices. To achieve this goal, various efforts and collaborations are needed, including asset standardization, infrastructure construction, market education, and regulatory compliance support.

Overall, RWA is highly likely to become an important track for achieving scalable applications and promoting the integration of DeFi and TradFi, following the stablecoin in USD. We will continue to monitor the development of RWA and related regulatory policies in order to provide accurate and timely market analysis for investors.

References:

https://vote.makerdao.com/executive/template-executive-vote-monetalis-clydesdale-rwa007-a-onboarding-funding-ambassador-program-spf-core-unit-mkr-streams-and-transfers-october-5-2022

https://forum.makerdao.com/t/monetalis-evolution/14811

https://docs.centrifuge.io/getting-started/off-chain/

https://www.federalreserve.gov/econres/feds/tokenization-overview-and-financial-stability-implications.htm

https://drive.google.com/file/d/1x89OjKjaqPLJI-W2-U7pXiS9H_zBOyUb/view

https://drive.google.com/file/d/1kDMvQ2drS0jfbv4uB5UAUbfcObmA-I0H/view

https://www.hkma.gov.hk/media/gb_chi/doc/key-information/press-release/2023/20230824c3a1.pdf

https://docs.ondo.finance/qualified-access-products/ousg/how-it-works

Translated:

https://drive.google.com/file/d/1kDMvQ2drS0jfbv4uB5UAUbfcObmA-I0H/view

https://www.hkma.gov.hk/media/gb_chi/doc/key-information/press-release/2023/20230824c3a1.pdf

https://docs.ondo.finance/qualified-access-products/ousg/how-it-works

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Binance He Yi’s Open Letter Perseverance and a Light Boat Will Cross Ten Thousand Mountains

- Andre Cronje The Lone Ranger’s Network Odyssey

- Popular Token Simple Rating CRV Achieves the Best Performance, OP Only Has Speculative Value

- Mixin’s aftermath of being stolen about 200 million US dollars Compensation plan includes bonds, Li Xiaolai’s Weibo questioned Where is the users’ money?

- Market value doubled within a year, will Azuki be knocked down How much longer can Pudgy Pengunis remain popular?

- Hot discussions among peers, uncovering the little-known stories of market maker DWF Labs and Lianchuang.

- Weekly Financing Report | 18 public financing events; Cryptocurrency gaming company Proof of Play completes $33 million seed round financing, led by Greenoaks and a16z.