Crypto Race Weekly Report [10/9/2023] Decrease in ETH Staking Rewards, POW Track on the Rise

Crypto Race Weekly Report [10/9/2023] Decrease in ETH Staking Rewards, POW Track Rising.

【Summary】

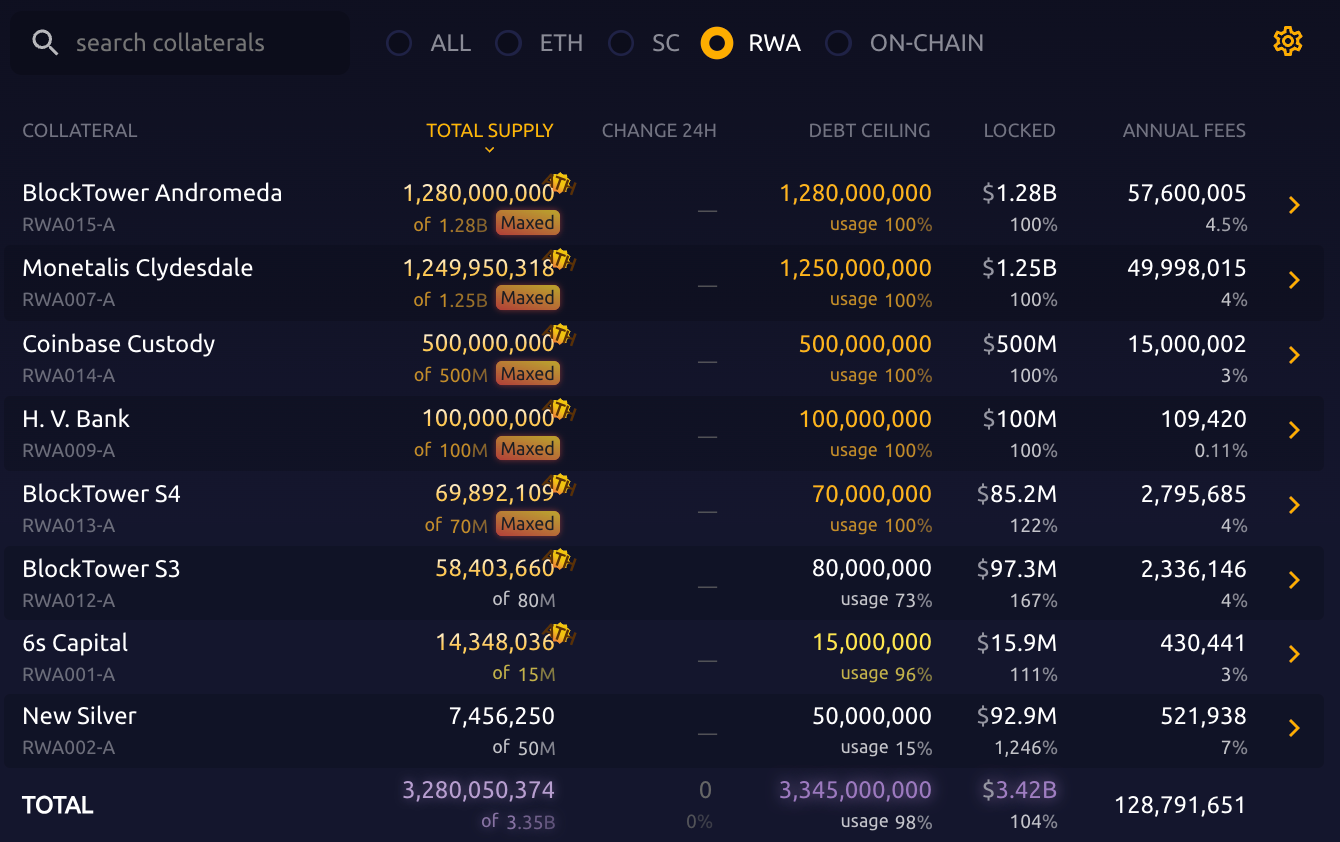

Loan: MakerDAO RWA business scale is about to reach the debt limit.

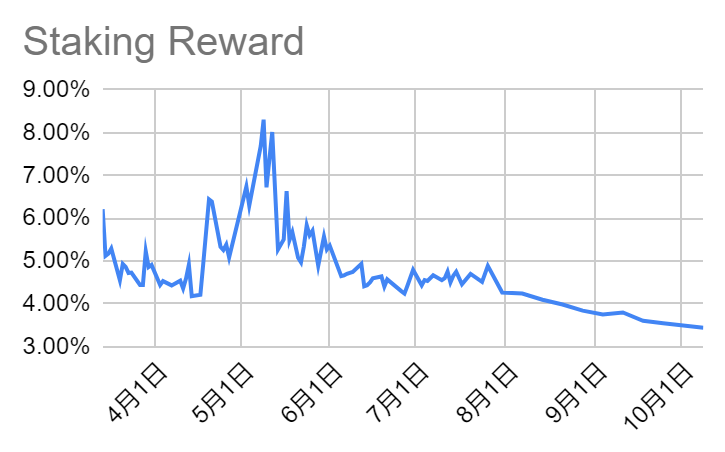

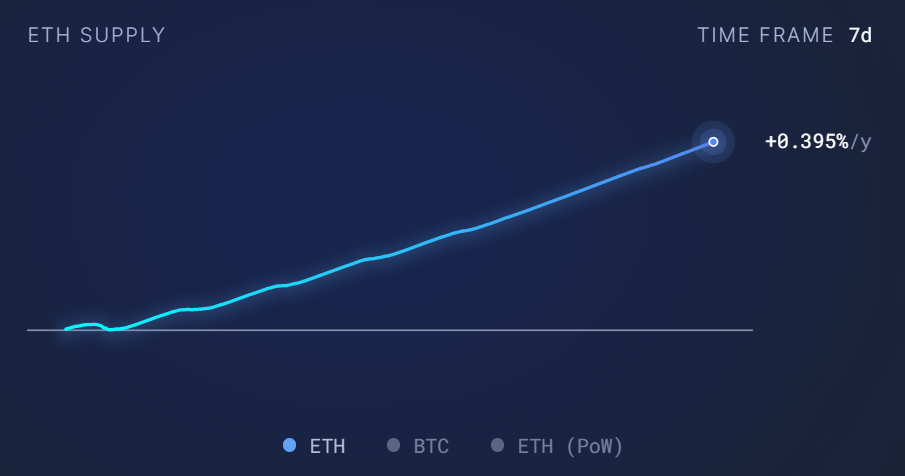

LSD: This week’s ETH staking yield continues to decline to 3.44%, and the annual inflation rate rises to 0.395%.

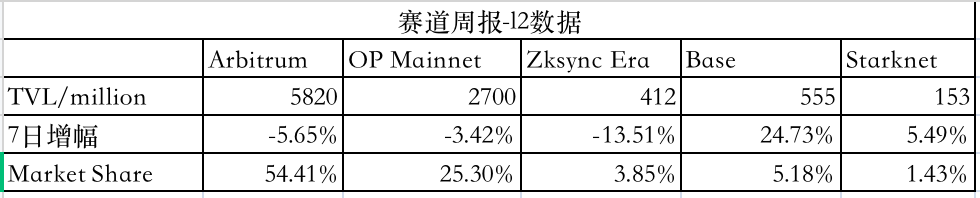

Ethereum L2: The total value locked (TVL) of Layer2 is $10.71 billion, with a 7-day decrease of 3.39%; in the 119th ACDC meeting, the timeline for the Cancun upgrade was gradually clarified, and it is currently scheduled to publicly launch the upgrade testnet in early November; OP Stack went live with a bug proof on the OP Goerli testnet on October 3.

- Polkadot Q3 Development Summary Native USDC will enter the ecosystem, staking and independent account data continue to grow.

- Financing Weekly Report | 14 public financing events; Web3 restaurant loyalty application Blackbird completes $24 million Series A financing, led by a16z Crypto.

- In the past month, about 270,000 RNDR tokens have been destroyed. How big is the future space for the distributed rendering network Render Network?

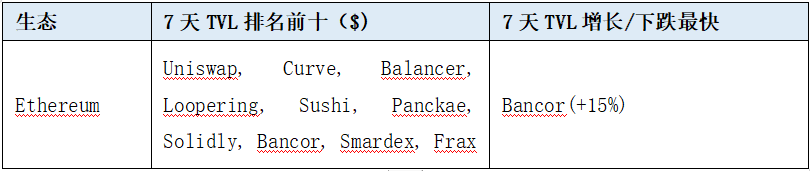

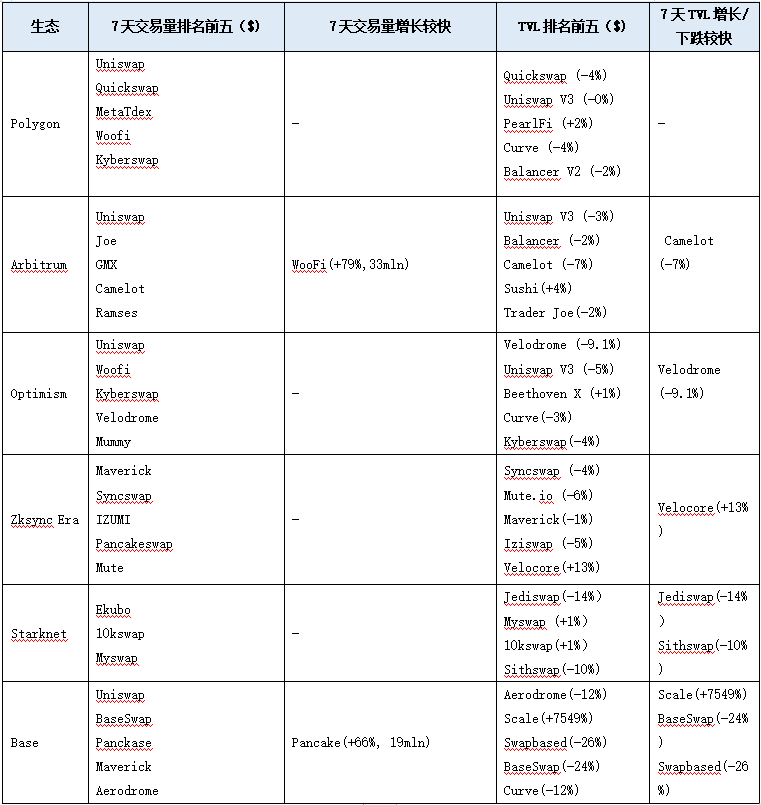

DEX: The combined TVL of DEX is $11.43 billion, which is basically the same as last week. The 24-hour trading volume of DEX is $2 billion, and the 7-day trading volume is $12.92 billion, an increase of $2.5 billion compared to last week.

POW: During the National Day holiday, the major tokens with high market capitalization in POW have all risen, but with the decline of BTC, the overall increase is not significant. The 7-day increase of LTC/BCH/KAS is between -6% and -10%. FLUX and DNX have achieved larger increases, with a 7-day increase of 3% and 25.2% respectively.

【Loan】

MakerDAO

The current total RWA assets of MakerDAO have reached $3.28 billion and are about to reach the upper limit of $3.34 billion. The community completed a survey on September 28 to raise the debt ceiling of RWA015 and RWA007 to $3 billion, and received support from 95,859 MKR votes. The DSR inside Dai has a scale of $1.68 billion and has not grown much since October.

Aave

1) Aave initiated a temperature check vote to add FXS to the Ethereum V3 liquidity pool, hoping to promote diversification of GHO collateral. The current vote has reached 99.99% agreement and has reached the required number of votes.

2) Aave integration lead Marc Zeller stated in a post on X platform that Aave DAO has purchased 390,000 GHO tokens to support the anchoring plan. Marc Zeller also stated that more anchoring plans will be initiated, including modifying interest rates, repurchases, and establishing a GHO liquidity committee, etc.

The current total supply of GHO is about 24 million, and there has been no significant increase since August.

【LSD】

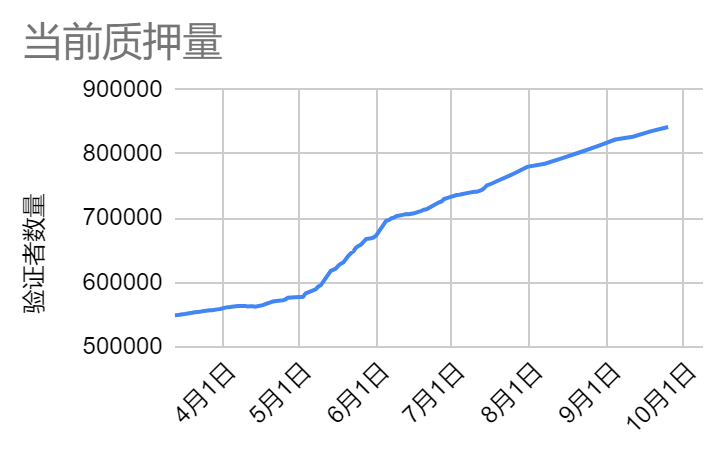

Last week, the ETH staking rate rose to 22.81%, an increase of 1.37% compared to the previous week. Last week, there were 27.44 million ETH locked in the beacon chain, corresponding to a staking rate of 22.81%, an increase of 1.37% compared to the previous week. Among them, there are 849,900 active validator nodes, an increase of 3.69% compared to the previous week. There are only 2,651 validator nodes left in the queue for activation, basically clearing out. This week’s ETH staking yield continues to decline to 3.44%, and the annual inflation rate rises to 0.395%.

This week’s ETH staking rate increased by 1.37% compared to the previous week

Source: LD Capital

This week, the staking yield of ETH continues to decline to 3.44%.

Source: LD Capital

The annualized inflation rate of ETH this week is 0.395%.

Source: Ultrasound, LD Capital

Among the three major LSD protocols, in terms of price performance, LDO fell by 3.7% in the past week, RPL fell by 11.6%, and FXS fell by 7.1%. In terms of ETH staking volume, Lido rose by 0.84% in the past week, Rocket Pool rose by 0.9%, and Frax rose by 1.43%. The current balance of Rocket Pool’s deposit pool is 17,859 ETH, with an RPL staking rate of 50.35% and an effective staking ratio of 85.74%. More nodes need to add collateral. SSV’s TVL growth is stagnant at the moment, and there are no new nodes operated by partners. However, as it is an Israeli project, it may receive attention in the short term.

[Ethereum L2]

TVL

The total TVL of Layer2 is 10.71 billion USD. The TVL has decreased by 3.39% in the past 7 days.

Source: L2beat, LD Capital

Cancun Upgrade

On October 5, 2023, Ethereum developers held the 119th ACDC meeting to gradually clarify the upgrade timeline.

1. Devnet-9 was launched on Friday, September 29. The network participation rate was about 90%. However, since the launch of Devnet-9, some errors have been found in client software, especially in the execution layer (EL) clients Reth, Besu, and Nethermind.

2. Developers discussed the launch time of the next (possibly final) development network Devnet-10. The main purpose of Devnet-10 is to test the new maximum epoch loss limit defined in EIP 7514. Engineer LianGuairithosh Jayanthi stated that if all client teams fix the outstanding errors and issues, developers can try to launch Devnet-10 as early as next week.

3. Regarding the discussion on the launch time of Devnet-10, ACDE Chairman Tim Beiko reiterated the decision made in the ACD conference call last Thursday, aiming to publicly launch the Dencun upgrade testnet before the Ethereum Developer Conference Devconnect. Devconnect is scheduled to be held in Istanbul, Turkey in mid-November this year. During ACDE #171, developers agreed to launch Dencun on the Goerli test network (public Ethereum test network) before Devconnect.

OP

OP Stack was launched on the OP Goerli test network alpha on October 3, which lays the foundation for modular design including ZK proofs and other multiple proofs in the future, and is currently in testing.

ARB

On October 7, Arbitrumdao voted on 95 STIP applications from eligible protocols on Snapshot. This proposal outlines a community-created consensus framework to allocate up to 50 million ARB tokens for DAO funding incentives. The plan aims to meet short-term community needs, and the allocation is expected to be distributed by January 31, 2024.

In the past 20 days, the trend correlation between OP and ARB with ETH has been high.

Source: tradingview

Starknet

According to community news, the “Starknet token unlocking contract” (0xBE19……BAB3) was updated last week. The update information shows that the token unlocking date has been postponed from November 30th of this year to April 15th of next year.

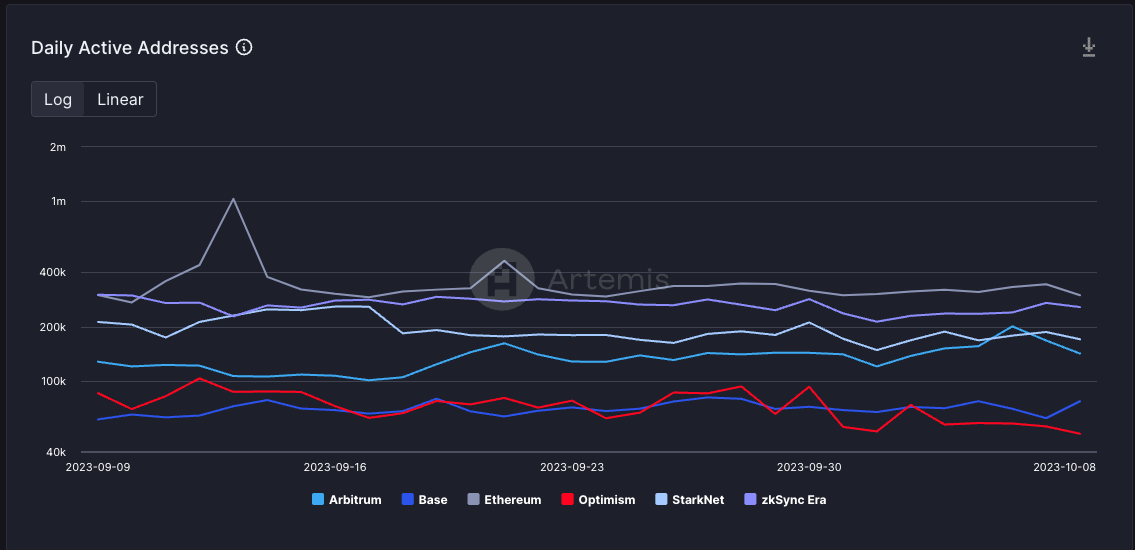

On-chain activity

Source: Artemis

[DEX]

The Dex combined TVL is 11.43 billion, which is basically unchanged from last week. The Dex 24-hour trading volume is 2 billion, and the 7-day trading volume is 12.92 billion, an increase of 2.5 billion compared to last week.

Ethereum

BNT, as a concept coin affected by the Israeli-Palestinian conflict, has a significant increase today.

ETH L2/sidechain

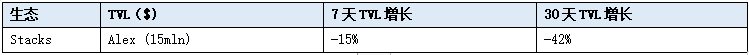

BTC L2/Sidechain

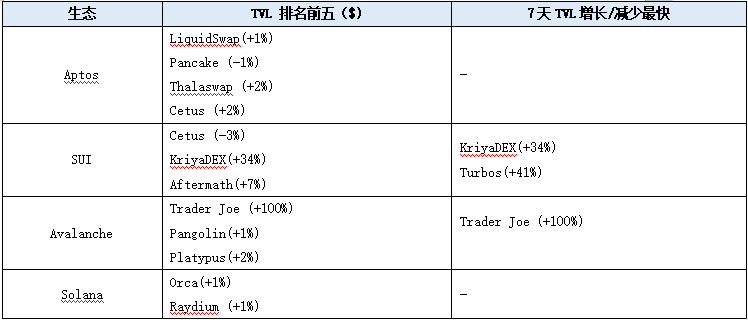

Alt L1

[POW]

Market trends

During the National Day holiday, after a high and then a decline, BTC maintained a small oscillation, making several attempts to break through 28,300-28,500, but failed to do so. The trend of BTC has an impact on the trend of POW tokens. During the National Day holiday, the major tokens with high market value in the POW sector have all increased, but the overall increase is not significant as BTC experienced a high and then a decline. The 7-day increase of LTC/BCH/KAS is between -6% and -10%. FLUX and DNX have achieved significant increases, with 7-day increases of 3% and 25.2% respectively.

24-hour mining output and computing power

According to the information disclosed by F2Pool, in terms of output ranking, KAS ranks third, after BTC and DOGE; LTC ranks fourth; BCH ranks sixth; DNX ranks seventh. DNX has shown a significant increase in ranking. In mid-September, DNX ranked ninth.

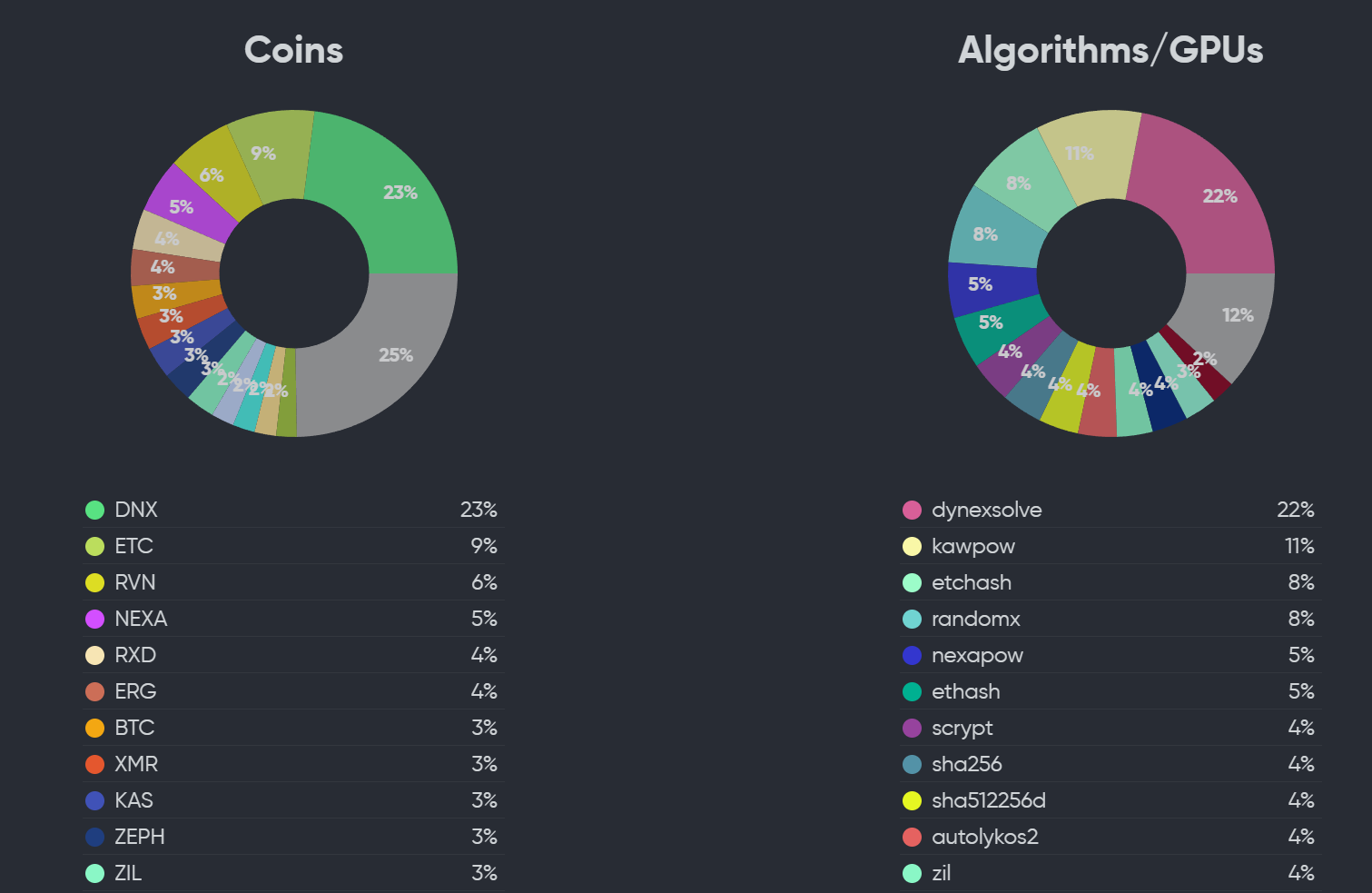

In GPU mining, DNX currently has the largest computing power and has gained 5% growth since mid-September, with a market share of 23%. This is a relatively high proportion of computing power. After ETH, DNX is the project that has gained more than 20% of the computing power.

From the perspective of computing power growth, DNX is worth paying attention to. There are two key concerns regarding this project. Firstly, what is the actual situation of the team and whether they have the corresponding professional abilities. Secondly, whether the mentioned neural computing and AI computing power platform technologies can be realized.

To address these two concerns, the project team and the community have taken the following measures: Firstly, they have invited community members to visit and exchange at the company’s headquarters. The project is located in Austria, and the investors are local entrepreneurs from Austria. The project originates from their corporate laboratory, with a team of approximately 30 employees. Secondly, they have provided testing applications, allowing community members to apply for participation in the testing process and understand the relevant operations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Q3 Crypto Dapp Report Daily active wallet count increased by 15% compared to the previous quarter, NFT transaction volume hits a new low in the past year.

- LayerZero’s Full-Chain Narrative Security Prospects and Ecological Opportunities

- What happened during the first week of the SBF case in a comprehensive article?

- Layoffs, restructuring, strategic adjustments, Yuga Labs, the Web3 Disney wakes up from its dream

- Not getting rich by speculating on coins, this user received a multimillion-dollar reward from the tax authorities for paying taxes on a trading platform.

- Port3 Network Research Report From Web2 to Web3, Building a New Social Data Layer

- Opinion Change in Speaker of the U.S. House of Representatives may be detrimental to the crypto world.