In the past month, about 270,000 RNDR tokens have been destroyed. How big is the future space for the distributed rendering network Render Network?

Over the past month, approximately 270,000 RNDR tokens have been burned. What is the potential for growth in the Render Network's distributed rendering network?Author: hitesh.eth, Crypto KOL

Compiled by: Felix, LianGuaiNews

Render Network, a distributed rendering network, has burned over 269,000 RNDR tokens in the past 30 days. This article provides an overview of the operation mechanism and development potential of Render Network.

LianGuaiNews Note: The views expressed in this article are solely those of the author and should not be considered as investment advice. DYOR.

- Q3 Crypto Dapp Report Daily active wallet count increased by 15% compared to the previous quarter, NFT transaction volume hits a new low in the past year.

- LayerZero’s Full-Chain Narrative Security Prospects and Ecological Opportunities

- What happened during the first week of the SBF case in a comprehensive article?

What is Render Network?

Render Network’s parent company OTOY is a US cloud graphics company with a history of 15 years. OTOY’s rendered films have won Oscars and have been guided by the founders of Google and Mozilla. Render Network, which OTOY is developing, is a crypto-supported p2p network for distributed GPU computing in the 3D rendering and AI industries.

What is 3D rendering?

The high-end 3D graphics in animated movies and computer games are created by GPU computing devices. The graphics processing that provides more details to the 3D models is called rendering.

Competitive Advantage

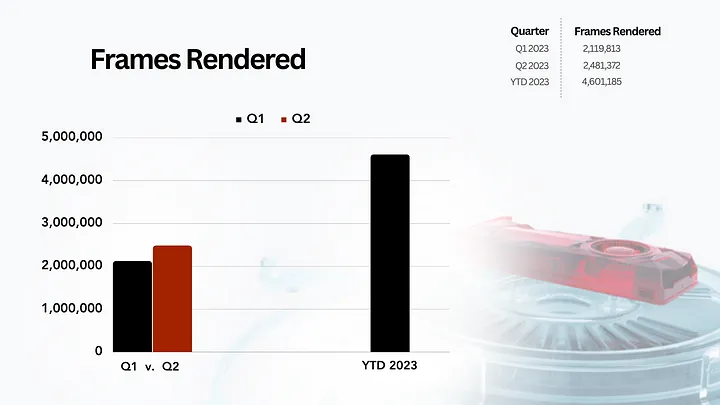

In the first half of 2023, Render Network rendered over 4.6 million frames at an average cost of $20, which is cheaper than other rendering platforms.

RNDR Token

Render Network allows users to contribute their idle GPU resources to their network and receive RNDR tokens as compensation after successfully completing rendering jobs. RNDR is a multi-purpose token with functions such as governance, payment, and incentives.

New Token Economics

In February 2023, Render Network made changes to the token economics of RNDR.

- Maximum supply: 644.2 million tokens

- Circulating supply: 372 million tokens

- Percentage allocated to future incentives: 16.67%

By February 2024, the annual issuance of RNDR will be 9%, decreasing to 4% by 2028. Render Network has introduced the “Burn-Mint-Emission” model, which allows creators to pay their work fees to node operators by burning RNDR and minting Credits. Instead of directly receiving income from creators purchasing rendering services, node operators receive newly minted tokens as rewards. (Note: Previously, creators initiated rendering tasks and used fiat or RNDR for payment, where 1 credit = 1 euro).

Demand-Driven Factors

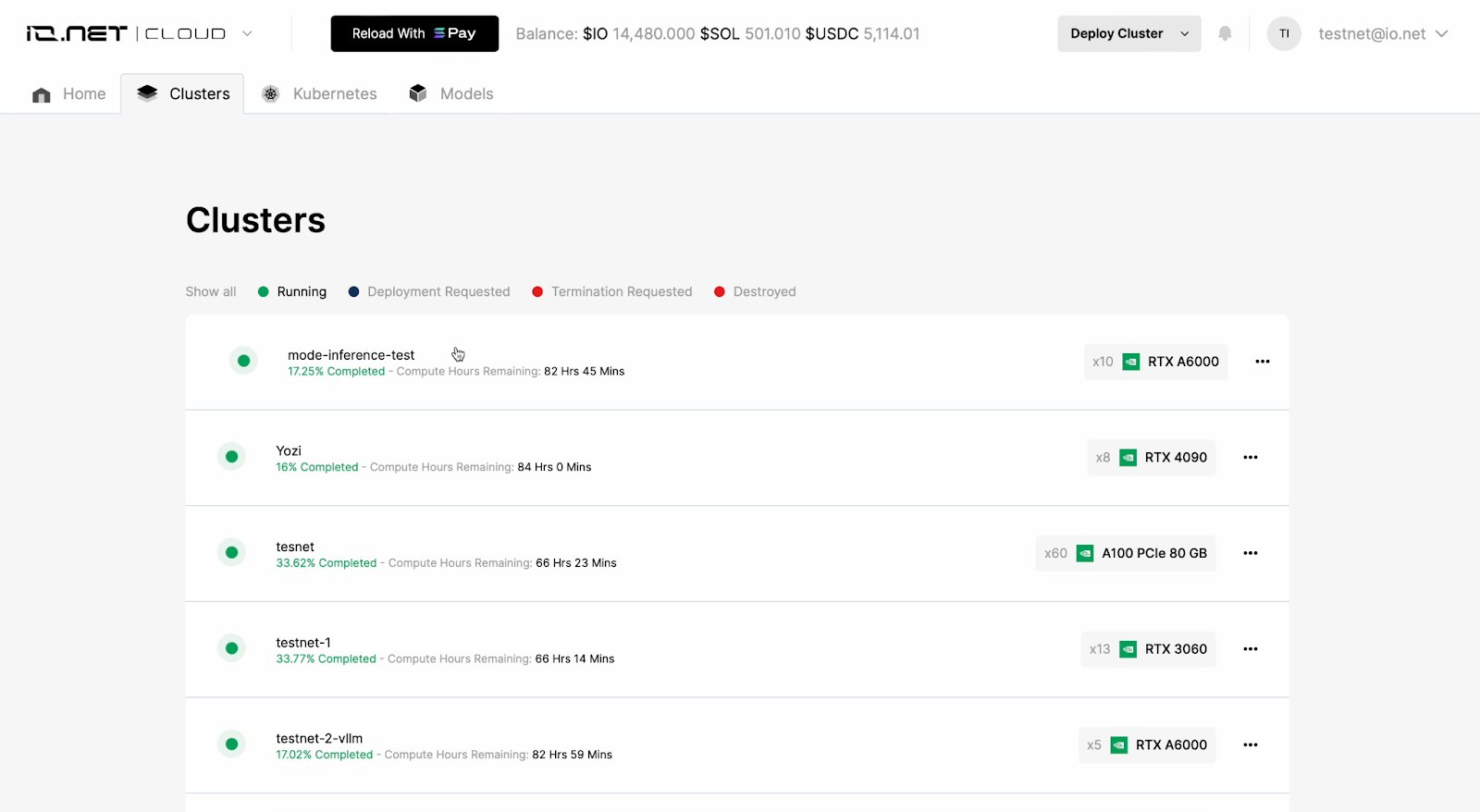

- Render Network collaborates with io.net to utilize GPU infrastructure for AI/ML-related work.

- Launch of Octane X in the Apple Store.

- Integration with Cinema4D/Redshift.

Rendering Flywheel

Creators purchase RNDR, destroy it, and mint Render Credits –> Node operators complete work –> Node operators earn RNDR rewards from the reserve supply –> Creators and liquidity providers also receive token incentives –> More rendering work leads to more RNDR destruction.

Insights on-chain

- Node operators: 597

- Total rendering workload: 943,385

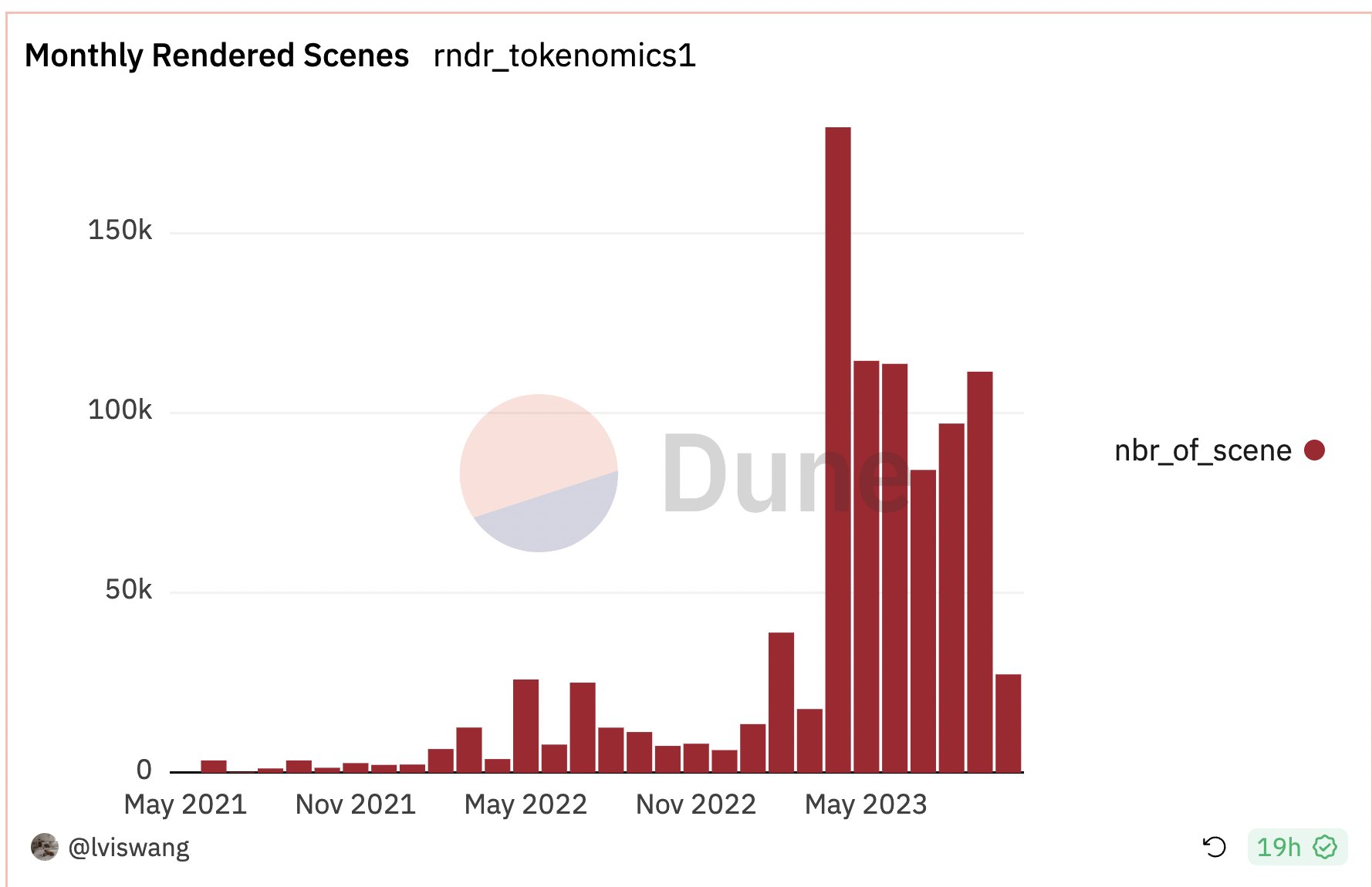

In the past 3 months, the rendering workload of Render Network has grown by 32%. In the last 30 days, the network has destroyed 269,043 tokens while issuing 760,567 new tokens.

The current monthly net burn rate of RNDR is approximately 269,000 tokens, while the current monthly issuance rate is around 760,000 tokens. However, starting from March 2023 to 2024, the monthly issuance rate will decrease to 492,000 tokens.

Within the next 6 months, if the demand for rendering work doubles, there is a possibility of deflation in RNDR. Considering the rapid development of Render Network and its foray into the metaverse and AI markets, the number of rendering users is expected to grow 10-20 times in the next 2-3 years.

With the right incentives and deflationary mechanisms, the author expects RNDR to attract more market demand and ultimately reflect in the price of RNDR tokens.

Disclaimer: The information shared by the author does not constitute any investment advice.

Related reading: Apple Vision Pro’s One-Month Anniversary: Rethinking the Future of XR, RNDR, and Spatial Computing

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Layoffs, restructuring, strategic adjustments, Yuga Labs, the Web3 Disney wakes up from its dream

- Not getting rich by speculating on coins, this user received a multimillion-dollar reward from the tax authorities for paying taxes on a trading platform.

- Port3 Network Research Report From Web2 to Web3, Building a New Social Data Layer

- Opinion Change in Speaker of the U.S. House of Representatives may be detrimental to the crypto world.

- Former close friend to testify against SBF, list of other witnesses revealed.

- Weekly Financing Report | 16 public financing events; Oracle Supra completes over $24 million financing, with participation from Animoca Brands, Coinbase Ventures, and others.

- Su Zhu being sentenced to prison, will the four-month imprisonment time be extended?