Weekly Financing Report | 16 public financing events; Oracle Supra completes over $24 million financing, with participation from Animoca Brands, Coinbase Ventures, and others.

Weekly Financing Report 16 public financing events including Oracle Supra's $24 million financing round with participation from Animoca Brands, Coinbase Ventures, and others.Highlights of this issue

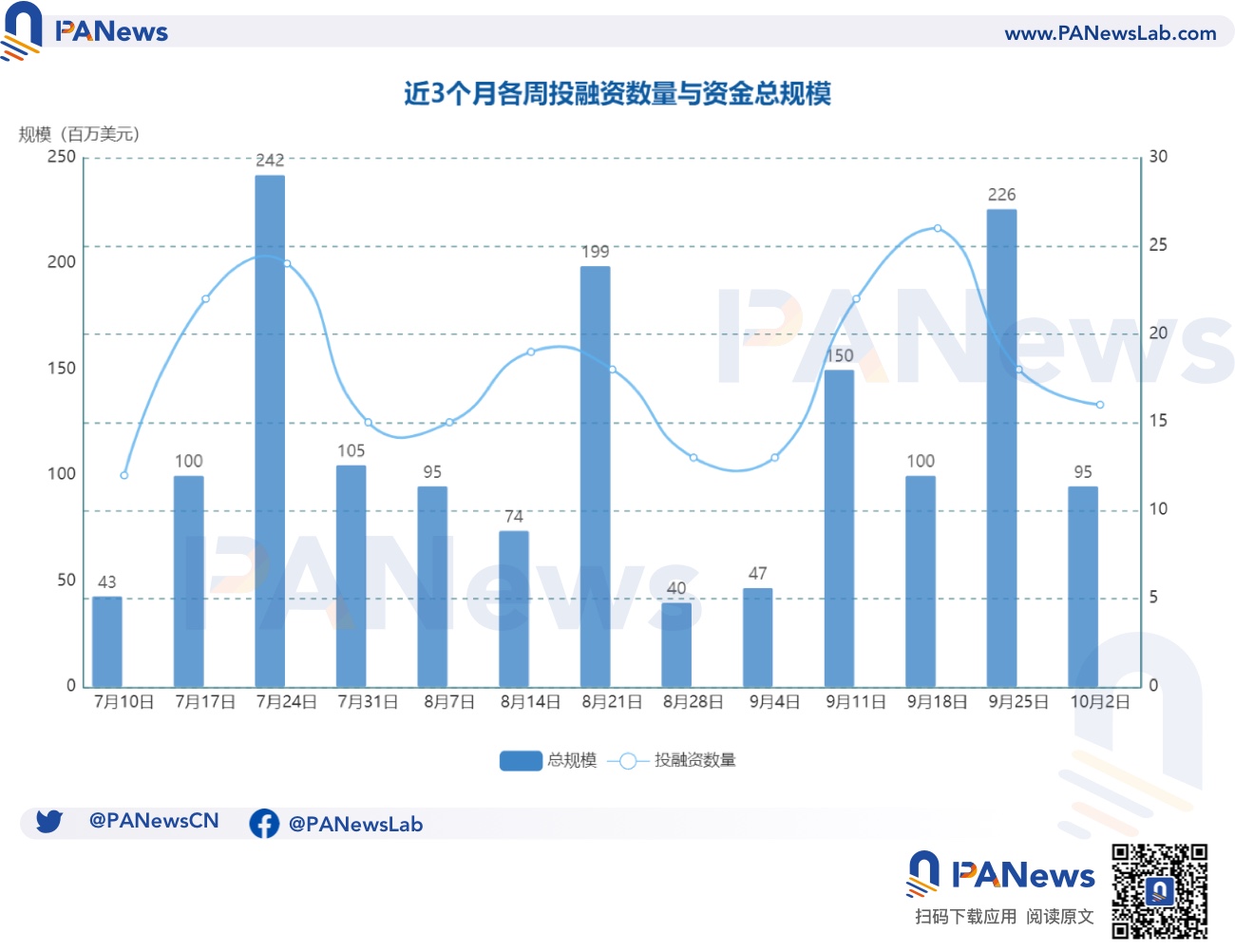

According to incomplete statistics from LianGuaiNews, there were 16 blockchain investment and financing events worldwide last week (9.25-10.1), with a total funding amount exceeding $95 million. The overview is as follows:

- In the DeFi sector, there were 5 investment and financing events. Among them, the oracle and VRF service provider Supra announced that it has raised over $24 million in financing, with investors including Animoca Brands, BCW, Coinbase Ventures, etc.;

- No investment and financing events were announced in the NFT and metaverse field;

- In the blockchain gaming track, there was 1 investment and financing event: the blockchain game Fableborne developed by Web3 game studio Pixion Games has raised $7.8 million this year, with investors including Mechanism Capital, etc.;

- In the infrastructure and tools track, there were 5 financing events. Among them, the Ethereum network browser Rated announced the completion of a $12.89 million Series A financing round, with Archetype leading the investment;

- In the other Web3/crypto-related projects sector, there were 4 financing events. Among them, Web3 startup IYK has completed a $16.8 million seed round of financing, with a16z Crypto leading the investment;

- In the field of centralized finance, there was 1 financing event: AnchorWatch, a Bitcoin custody and insurance platform, announced the completion of a $3 million financing round, with Ten31 leading the investment.

DeFi

On-chain leverage trading platform Avantis Labs raises $4 million in financing, led by LianGuaintera Capital

- Su Zhu being sentenced to prison, will the four-month imprisonment time be extended?

- Amazon’s participation and the skyrocketing value of AI company Anthropic become FTX’s biggest hope of repaying the debt?

- LianGuai Daily | Li Xiaolai responds to the Mixin incident; Hong Kong Securities and Futures Commission releases multiple lists of virtual asset trading platforms.

On-chain leverage trading platform Avantis Labs has completed a $4 million seed round of financing, with LianGuaintera Capital leading the investment. Founders Fund, Base Ecosystem Fund under Coinbase, and Modular Capital also participated. The new funds will be used to develop its flagship product Avantis, which is a perpetual contract trading and market-making protocol. Avantis aims to provide leveraged trading of cryptocurrencies and RWA assets for institutional and retail investors. Its underlying trading engine is supported by Pyth and Chainlink oracles. The platform is being developed on Optimism Superchain and has already launched a private testnet phase on Base blockchain. It plans to launch on the mainnet of Base in the first quarter of 2024. After the mainnet launch, Avantis will support Bitcoin and Ethereum as well as three forex currency pairs: GBP, JPY, and EUR, and will later add more cryptocurrencies, forex, and commodities such as gold, silver, and crude oil. Avantis also plans to start developing an options engine in mid-2023.

DeFi startup Bril Finance completes $3 million seed round of financing

DeFi portfolio management startup Bril Finance has completed a $3 million seed round of financing, with participation from FalconX, Kosmos Ventures, and the Algorand Foundation. Bril Finance is a decentralized portfolio management platform that uses algorithms and automatic token deployment to adjust user positions. Bril Finance stated that it is being deployed on Sei and aims to collaborate with leading blockchains including Ethereum, Base, Avalanche, Polygon, Arbitrum, etc.

LeverFi, an on-chain leverage trading platform, receives a $2 million investment from DWF Labs

LeverFi, an on-chain leverage trading platform, announced that it has received a $2 million investment from DWF Labs on the X platform. This investment has a lock-up period and a staged release period that lasts for two years. In addition, LeverFi has also received an additional $2 million over-the-counter trading commitment, which can be executed at any time within the next two years if needed. These new funds will be used for protocol innovation, marketing activities, and user acquisition. Furthermore, DWF Labs and LeverFi have reached a market-making arrangement, with DWF Labs providing liquidity for the LEVER trading pair on relevant exchanges. DWF Labs will also assist LeverFi in its growth and strategic business development activities. LeverFi is an Ethereum-based permissionless on-chain leverage trading platform that offers leverage of up to 10x.

Restake, a liquidity re-staking platform, completes a $500,000 seed round of financing with participation from DCD and others

Restake Finance, a liquidity re-staking platform, announced the completion of a $500,000 seed round of financing with participation from AlfaDAO, DCD, Yields and More, Moni, and others.

Zunami Protocol, a stablecoin yield protocol, completes an angel round of financing with participation from the founder of Curve

Decentralized stablecoin yield protocol Zunami Protocol has completed an angel round of financing. Participants include Cream Finance, individual investors such as Michael Egorov, the founder of Curve, Mr. Block, C2tP and Winthorpe from Convex, Hubirb from Twitter, and other Stake DAO contributors, as well as core contributors from AladdinDAO, LianGuaiuls. This round of financing will be used to develop Zunami V2 and conduct audits. Zunami V2 is scheduled to be launched in November.

Blockchain Games

Fableborne, a blockchain game, announces a total of $7.8 million in financing to date

Fableborne, a blockchain game developed by Pixion Games, announced on the X platform that it has raised a total of $7.8 million in funding with the injection of new funds this year. Investors include Mechanism Capital, VGC, Merit Circle, Eldridge, GSR, Zee Prime Capital, Big Brain Holdings, Builder Capital, Blizzard Fund from Avalanche Foundation, Shima Capital, and ReadyPlayerDAO, among others. Fableborne is an isometric free-to-play multiplayer game that combines action RPG and base-building mechanics with unique elements. The game enhances the experience of players and creators using blockchain technology and redefines competition with a fast-paced rhythm. Fableborne is currently in closed ALPHA testing and plans to be publicly released next year. In June of this year, Pixion Games announced the completion of a $5.5 million seed round of financing.

Infrastructure & Tools

Oracle provider Supra completes over $24 million in financing with participation from Animoca Brands and Coinbase Ventures

Supra, an oracle and VRF service provider, announced that it has completed over $24 million in financing to date. Investors include Animoca Brands, BCW, Coinbase Ventures, FiveT Fintech (formerly Avaloq Ventures), Galaxy Interactive, Hashed, HashKey, Huobi Ventures, No Limit Holdings, Prosus Ventures, Razer.com, Republic Crypto, Shima Capital, and others. Supra is developing an innovative cross-chain oracle and “bridgeless” communication network aiming to achieve sub-2-second finality with security guarantees expected to be more than 10 times higher than existing bridges that use its custom consensus algorithm, “Moonshot Consensus.” In addition, Supra recently announced a Learn-to-Earn airdrop opportunity for community members to further distribute SUPRA to a wide range of stakeholders.

Ethereum browser Rated completes $12.89 million in Series A financing, led by Archetype

Ethereum browser Rated has announced the completion of $12.89 million in Series A financing, led by Archetype. Seed investors Placeholder, 1confirmation, Cherry and Semantic, as well as new supporters Robot Ventures, Chorus One, Factor and Maelstrom, also participated. Ash Egan, founder and general partner of Archetype, has joined the Rated board of directors. Elias Simos, co-founder and CEO of Rated, stated that the Series A financing began in February of this year and ended in May. It is a “pure equity” financing round. It is reported that Rated Labs currently provides Ethereum browsers, data APIs, and oracles, and plans to expand its products to multiple Layer 1 blockchain networks next year, including Polygon, Solana, Cosmos, and Polkadot.

Blockchain project Fhenix completes $7 million in seed funding, led by Multicoin Capital

Blockchain project Fhenix has announced the completion of $7 million in seed funding, led by Multicoin Capital and Collider Ventures. Node Capital, Bankless, HackVC, TaneLabs, and Metaplanet also participated, along with individual investors Tarun Chitra and Robert Leshner of Robot Ventures. Fhenix is the first blockchain supported by fully homomorphic encryption. By using fhEVM, Fhenix enables Ethereum developers to seamlessly build encrypted smart contracts and perform data encryption calculations, while using Solidity and other familiar and easy-to-use tools. FHE provides developers with a way to protect private data and perform encrypted calculations. Fhenix’s modular design facilitates the seamless integration of FHE/encryption calculations in all blockchain data layers, as well as the easy deployment of confidential smart contracts on public blockchains.

Blockchain project Pimlico completes $1.6 million in pre-seed funding, led by 1confirmation

Blockchain project Pimlico has completed $1.6 million in pre-seed funding, led by 1confirmation, with participation from institutions such as Safe and ConsenSys, as well as a dozen angel investors. Pimlico is dedicated to providing infrastructure layers to drive the transition of Ethereum to ERC-4337 smart accounts. It offers features including ERC-20 token gas payment, multi-signature schemes, social recovery, and spending limits. These smart accounts provide customizable logic and introduce features such as gas sponsorship, ERC-20 token gas payment, multi-signature schemes, social recovery, and spending limits.

LianGuairaX completes strategic financing round with participation from digital asset management company Metalpha

Web3 “super app” LianGuairaX has announced the completion of a strategic financing round with participation from Hong Kong digital asset wealth management company Metalpha. The specific amount has not been disclosed. The LianGuairaX ecosystem is built on top of existing LianGuairaSLianGuaice and LianGuairallel products, covering account abstraction, meta-user interfaces, zkVM, and cross-domain intent-based LLM. LianGuairaX aims to simplify the interaction between users and Web3 applications by introducing an automated smart execution layer.

Others

Web3 startup IYK completes $16.8 million seed round financing, led by a16z Crypto

Web3 startup IYK has completed a $16.8 million seed round financing, led by a16z Crypto, with participation from 1kx, Collab Currency, Lattice Capital, and gmoney. IYK helps brands, musicians, and creators create digital physical experiences, reward customers and fans, and stay connected with their communities. Since its establishment in 2021, IYK has recruited over 100 creators from industries such as fashion, music, and art.

AIOPs platform Senser completes $9.5 million seed round financing, led by Eclipse

Senser, an artificial intelligence operations (AIOPs) platform that provides data analysis support for Web3 infrastructure, has announced the completion of a $9.5 million seed round financing, led by Eclipse, with participation from Amdocs. Senser provides real-time intelligent and instrument-free analysis services based on eBPF technology to enterprise production environments, supporting cross-distributed systems. The product is currently deployed in blockchain company ConsenSys.

SaaS platform Cygnetise raises £2.5 million to deploy blockchain for authorization signature sharing

London-based cloud-based SaaS platform Cygnetise has raised £2.5 million in a pre-Series A funding round. The project was led by UK investment group Adjuvo (backers of Zen Educate and Q-BOT), with participation from US VC Massive and existing venture capital and angel investors. The oversubscribed round will be used to further expand the company’s sales and technical teams, accelerating the growth of its collaborative digital signature management solution. Cygnetise, founded by Steve Pomfret in London in 2016, applies blockchain technology to transform the process of authorization signature management (ASM).

Tokenize.it, a token-based corporate financing platform, completes €2 million seed round financing with participation from w3fund

Tokenize.it, a token-based corporate financing and employee participation platform, has announced the completion of a €2 million seed round financing, with participation from High-Tech Gründerfonds (HTGF), w3fund, Seed+Speed, and a group of angel investors. Tokenize.it provides compliant and standardized financing procedures for corporate investment transactions through profit participation rights mapped on tokens. It ensures automated execution of financing transactions based on blockchain smart contract technology, bringing greater trust and transparency.

Centralized Finance

Bitcoin custody and insurance platform AnchorWatch raises $3 million

Bitcoin custody and insurance platform AnchorWatch has announced a $3 million financing round, led by Ten31, with participation from Axiom BTC, Timechain, Bitcoin Opportunity Fund, UTXO Management, and others. AnchorWatch’s Trident Vault software provides protocol-native custody solutions for Bitcoin holders, supported by regulated insurance. With this latest investment, AnchorWatch will be able to meet all regulatory and capital requirements necessary to offer Trident Vault to customers and begin selling policies.

Venture Capital Institutions

Mercury Fund’s Fifth Fund Completes $160 Million Fundraising

Venture capital firm Mercury Fund announced that its fifth fund, Mercury Fund V, has completed a $160 million fundraising, making it the largest round of financing the company has ever completed. Mercury Fund stated that the fund will continue its existing investment strategy and has already invested in emerging Web3 innovation institutions such as Brassica Technologies, which provides transfer services. Mercury Fund was launched in January 2022 and its limited partners include institutional investors such as Galaxy Digital and Digital Currency Group, as well as individual investors such as Marc Andreessen, co-founder of a16z, and Chris Dixon, a partner at a16z.

European Cryptocurrency Fund Eureka LianGuairtners Completes $40 Million Financing

European-based local cryptocurrency fund Eureka LianGuairtners has completed a $40 million financing, invested by Nordic Venture Innovations AB, a Nordic family office. This round of financing will accelerate its development in the blockchain and cryptocurrency field.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interview with Former President of Polygon Labs Games will be a key factor in driving the mainstream adoption of cryptocurrencies

- Interpreting Namada A Modular Privacy Solution Serving the Multi-Chain Ecosystem

- RWA Potential Exploration The Next Large-Scale Application Track after Stablecoins?

- UBI Development History The Combination of Utopia and Fantasy

- Wall Street Journal Binance Empire on the Verge of Collapse

- A Shenzhen University alumnus who graduated just a year ago donated 50 million yuan to his alma mater, and his first bucket of gold may have come from cryptocurrency.

- Binance He Yi’s Open Letter Perseverance and a Light Boat Will Cross Ten Thousand Mountains