a16z Partner 4 Theories Driving the Creator Economy

a16z Partner on 4 Theories Driving the Creator EconomyAuthor: Andrew Chen, General Partner at a16z, Manager of Games Fund One

Translation: Luffy, Foresight News

In the past few years, with the rise of social media platforms, content creators have become the focus of consumer engagement, and there has been a wave of startups in the creator economy. These startups promise creators that they can help them monetize their audience on social media as long as they promote their products. So we often see creators promoting new products of startups through links in their profiles, videos, etc., and then attracting their fans to a login page that allows them to use new interactions or features. Initially, these products mostly started with a “tip” model, but over the years, many creative products have emerged, from e-commerce to newsletters to Q&A, and so on. These products all promise a win-win situation with creators, so when their fans consume, the company only takes a certain percentage of the revenue (usually around 10%), and the rest belongs to the creator.

Some creator economy companies have achieved tremendous success, paying creators billions of dollars in revenue, while others have struggled. Successful startups have strong barriers to entry, making it difficult for newcomers to stand out. After a few years, what new insights do we have about this industry? Why have some creator economy startups succeeded while others have failed?

- Taking speculation to the extreme? While everyone is obsessed with ‘personal stocks,’ friend.tech options contracts quietly go live.

- Enhancing user experience, reducing interaction steps, how can ‘intent-based transactions’ support the next wave of Web3 narrative?

- Wreck League Research Report Bored Apes Teams Up with Animoca to Create a 3A-Level PVP Fighting Blockchain Game

Here are some of my theoretical conclusions:

- Power law of creators: A small number of creators have the majority of the audience, leading to the potential vulnerability and dependency of creator economy startups.

- Bio link battle: Creator economy companies acquire audiences from larger social media platforms, which usually have only one spot (profile link) to promote a company. This is a zero-sum game where the winner takes all.

- Graduation problem: Startups typically charge a certain percentage of fees, and if creators acquire their own customers, they will pressure you to lower costs. The biggest creators usually “graduate” from a platform and then build their own platforms.

- Algorithm feast: Creator traffic is driven by social feedback algorithms, which can cause traffic to peak and then disappear – this goes against the stable and sustained growth that startups seek.

The above concepts are what I have learned from communicating with dozens of creator economy companies over the past few years. As the next generation of creator economy startups emerge, they must figure out how to deal with these dynamics. Let’s continue to delve deeper.

Power law of creators

Do you want to start a creator economy company? The biggest motivation you must have is the power law of the audience and income of the creator class itself.

The chart below shows the percentage of income that the top-ranked creators on platforms like LianGuaitron have, while the income of the second, third, and fourth-ranked creators continues to decline (source: Power Law in Culture).

Imagine if you plotted all the millions of creators on this axis, you would see that it eventually flattens out and approaches 0%. There are many reasons for this phenomenon, first of all, these creator platforms are built on top of social media, which itself follows a power law distribution of fans and content participants. In turn, due to algorithmic discovery, social media platforms exhibit power law curves, with a few social butterflies knowing even more people than the range of the power law curve.

Therefore, any creator economy product built on a social platform inherits these power law curves. OnlyFans creators offer free content on many social platforms and then drive traffic to their login pages. The chart below shows creator income, displaying a similar curve distribution. While some creators earn up to $100,000 per month, the median is only $180 per month.

Although power laws naturally occur in social media platforms, they also appear in other creative works, including TV, movies, music, and so on. The image below is an example in television (source: Power Law in Culture).

A small number of popular shows attract all the viewers. The same phenomenon occurs in video games, movies, novels, directors, writers, and so on.

Power laws are universal, so a core question is that the distribution of creative skills in the world is not uniform. Top writers or film directors are indeed much better than the 100th.

So, what does this mean for creator economy companies?

– When creator economy companies are just launched, the long-tail creators they initially attract have little impact.

– To scale up, platforms need to attract top-tier creators.

– Even if there are a large number of creators on your platform, income tends to be concentrated in a small number of people – so if top-tier creators are lost, there may be significant negative financial impact.

These dynamics mean that the initial stages of a startup company launching can be challenging. The best companies can gather a large number of small creators so that quantity starts to matter, or they can organically attract large/medium-sized creators. If a startup company acquires/controls many creators itself, it indicates that the product may not be addressing a large enough problem and cannot solve it on its own.

The Battle of Bio Links

Social media platforms like Instagram and TikTok have commercial models with advertisers, so they don’t want to give people “too much” organic traffic. Instead, they prefer you to pay for sponsored posts, creators, and ads. One way they achieve this is by providing a single link to drive organic traffic, known as the infamous “link in bio.”

For creator economy startups, bio links are of great significance. If you can convince creators to include your startup in this link, organic traffic will follow. By combining some monetization mechanisms, startups can benefit from this. In the early stages of the creator economy cycle, startups were competing with non-commercial links – either links to other social media profiles or personal websites. But over time, people started filling their bios with high-profit links like LianGuaitreon, Substack, Twitch, etc., intensifying the competition.

Now, replacing another startup’s bio link has become a zero-sum game. The only way to obtain organic traffic from creator profiles is to commercialize better than older, more established competitors. Simply matching what incumbents may bring you is not enough. You have to find something different, whether it’s within the creator content itself, be it videos, texts, or other forms. However, new entrants will encounter a major barrier: although they might initially want to use investor funds to subsidize revenue for growth, this may not be enough to achieve meaningful scale.

The Graduation Problem

The graduation problem refers to what happens when your best creators scale up and eventually “graduate” – both they and their fans leave your platform. Why does this happen? Creators provide obvious value to startups, driving traffic, creating content, and profiting through users. But as their influence grows, they often start to think they are “too” attractive. They begin to question why they should share profits with you when they have done all the work. This problem is especially severe due to the power-law effect, where a few whales often dominate revenue. If these whales start to wonder if they can replicate your product by hiring agencies to build their own platforms, they will eventually want to “graduate” from your platform and establish their own.

The creator economy is often compared to marketplace startups. In this field, companies like Airbnb or Uber independently aggregate both sides of the network. These marketplaces achieve the best results when both sides are highly dispersed, which is why the biggest successes are C2C or consumer-to-small-business markets, rather than B2B. In the initial formation process, creator economy startups looked more like B2B networks, and they might even be SaaS platforms – their customer base (creators) was highly concentrated, and the creators brought in consumers.

In order to solve the graduation problem, creator economy startups must provide much higher value than payment and other commercialization technologies. They need to have a moat, not only for external companies but also for creators who want to graduate over time. The best way is to create network effects themselves and bring it to every creator, forming a bidirectional network with all the usual advantages. The additional features created by startups should ideally be proprietary. If a creator economy company supporting artificial intelligence develops a very good basic model that allows creators to commercialize themselves 10 times more than before, creators are unlikely to leave.

Algorithm Feast

Creator economy startups often find themselves highly dependent on the explosive content of social media platforms. If a video goes viral on TikTok, the user acquisition of the creator economy platform may increase significantly. However, startups are always trying to achieve stable growth, which is different from SEO, recommendation plans, or paid marketing, and it is difficult to sustain 20% MoM growth. In contrast, marketplace startups increase value by aggregating market participants – often spending billions of dollars to build buyer and seller systems. During Uber’s high-growth years, the annual marketing budget for acquiring passengers was $1 billion, and for drivers, it was close to $2 billion. In addition, diversification was achieved in areas such as SEO, brand marketing, paid, recommendation plans, and partnerships. This added a lot of value to connect buyers and sellers.

What sets creator economy startups apart is that they use creators to find consumers, but in doing so, they rely heavily on a single channel. Relying on a single marketing channel is always dangerous, as we have seen in recent years when changes in SEO algorithms have wiped out many SEO-dependent content websites. The reliance on social media is even more fragile because the content is naturally more transient and subtle. I think this is also one of the reasons why subscriptions have become the dominant business model for successful creator economy companies – it allows creators to generate long-term and sustainable income from each fan.

Algorithmic recommendations are also a competitive factor. In recent years, we have also seen YouTube, Twitch, Twitter, and other underlying platforms try to pay creators directly and play a more vertically integrated role in the creator economy.

Of course, the best solution is to establish additional marketing channels to improve predictability. Combining social media channels with traffic from recommendations, search engine optimization, mobile installations, etc., will make the growth curve more sustainable. However, in the early stages of creator economy startups, they often focus entirely on the social domain, and only after success can they choose to invest in other channels.

The advantages and future of creator economy companies

The creator economy has evolved into its second and third generations. The barriers to entry have become higher, and startups no longer offer flashy tipping features, but instead build mature products that support multiple platforms, new interaction forms, and provide creators with new functions for interacting with their fans. Startups are no longer launching products endorsed by celebrities and hoping for success; instead, they are building real technology and combining it with extensive market strategies.

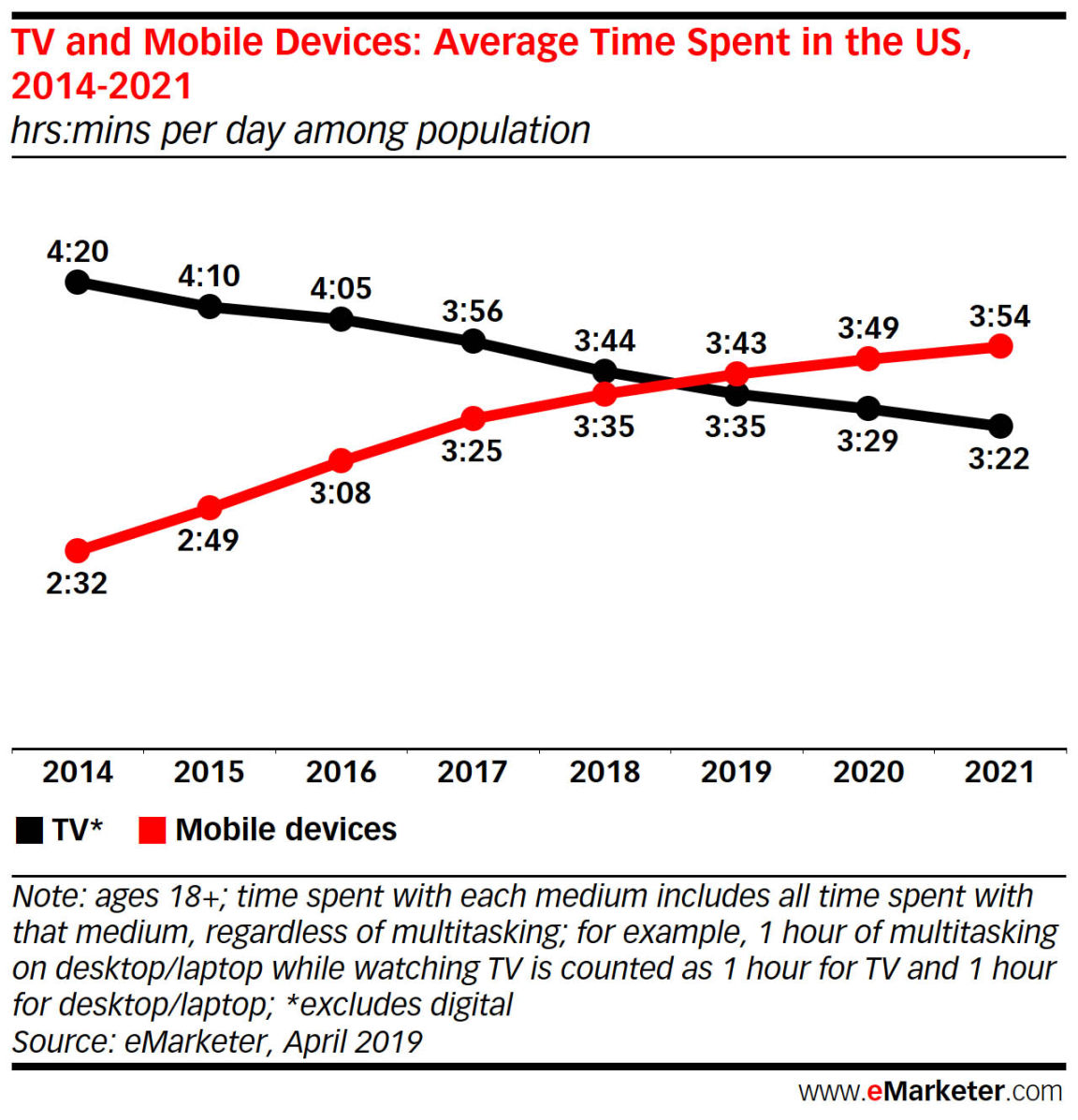

The advantage of the creator economy lies in the use of mobile devices and the continued rapid growth of social media platforms, which have reduced the time people spend watching TV:

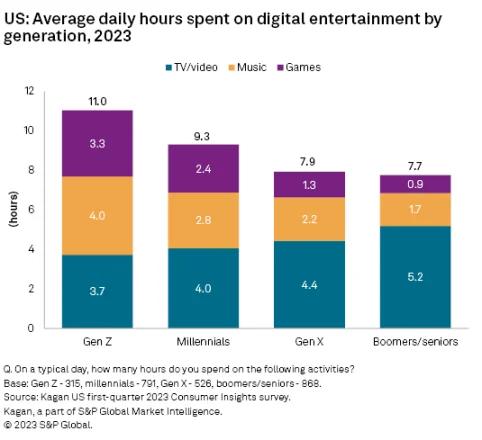

Of course, this movement is largely driven by the younger generation:

By the way, can you believe that most people over 18 still watch 4-5 hours of TV every day?

The key is that social media continues to play a huge role, and creators ultimately become new participants in the economy, gaining power in both cultural and economic aspects. The products and tools they use to achieve their goals will continue to be attractive. Because ultimately, creators themselves do not want to rely on a single social platform. If they are strong in videos, they will want to create podcasts and have a large Instagram following. Startups will always be more friendly to creators compared to large social platforms.

Therefore, I believe the future of the creator economy is still full of hope, but the path has clearly changed and the standards have been raised. Startups need to provide new features, create new forms of monetization, and adopt new technologies to better withstand competition. Personally, I am more interested in AI or video-first creator economy startups, as their behavior is more market-like, providing highly managed solutions for both parties. I have more confidence in startups that can charge $1000 from a smaller user base rather than companies that rely on $2 tips from everyone. In the coming years, we will see more viable changes, and considering potential consumer trends, I believe the creator economy will continue to be the cradle of high-value startups.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyzing Friend.Tech from First Principles

- Attracting 100,000 users in a month and ranking third in terms of protocol income, how much longer can the decentralized social application Friend.tech stay popular?

- OPNX Development History Tokens soar by a hundredfold, becoming a leading bankruptcy concept?

- Weekly Announcement | OKX platform upgrades KYC process and recommends users to complete advanced authentication; Avalanche (AVAX) will unlock tokens worth approximately $100 million.

- LianGuai Daily | The SEC files a motion for intermediate appeal regarding the Ripple case; friend.tech completes seed round investment, with LianGuairadigm participating.

- Content Marketing Methodology A Required Course for Web3 Startups

- Regulatory crackdown, slowed growth, Binance suffers two major setbacks.