From the SAR to the digital currency: Shenzhen 38 years of currency transactions

It is also Shenzhen, a currency, and foreign trade. However, the 38-year time-space transition, the fate of the Shenzhen SAR currency in the past will not come to the digital currency to be issued in Shenzhen.

On August 18th, the "Opinions of the CPC Central Committee and the State Council on Supporting Shenzhen's Pioneering Demonstration Zone with Chinese Characteristics" was officially released. The "Opinions" mentioned "supporting innovative applications such as digital currency research and mobile payment in Shenzhen." — Black and white, the strategic decision of the Central Committee of China and the State Council, after five years of deliberation.

This news has been quickly discussed in the financial, blockchain, foreign trade and other industries. From the 38 years ago, Shenzhen proposed the issuance of the "Shenzhen Yuan" SAR, and the current digital currency pilot, Shenzhen's financial status in China has changed.

Shenzhen Yuan

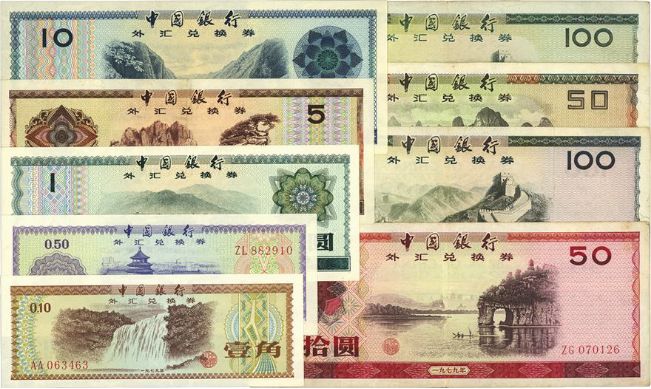

In August 1980, Shenzhen officially established a special economic zone. However, when it was first established, the currency system in Shenzhen was disordered: in mainland China, in April 1980, foreign exchange vouchers equivalent to the renminbi were issued. Foreign exchange vouchers are only available to foreigners and can be used in designated stores to sell goods that are generally difficult to obtain in mainland China. At the same time, Hong Kong goods continue to flow into Shenzhen. Hong Kong people spend more on Hong Kong dollars in Shenzhen and purchases of real estate. Hong Kong companies investing in Shenzhen also pay more in Hong Kong dollars. The Hong Kong dollar circulating in Shenzhen continues to increase, forming Shenzhen with both RMB and foreign exchange. The circulation of vouchers and Hong Kong dollars.

- Research Report | Central Bank Digital Currency Research Report (2)

- The second exploration of the derivative products: Who is the king of the contract?

- Blockchain games are breaking out, where is the future of investment? | Hangzhou Blockchain Game Forum

(Forex coupon legend)

Since the use of Hong Kong dollars can buy a lot of goods that can't be bought in RMB, and can buy various valuable goods at the border of Sha Tau Kok in Hong Kong, the Hong Kong dollar is favored in Shenzhen, and the RMB and foreign exchange certificates are excluded. For example, the black market exchange market at that time could be exchanged for a maximum of HK$100 for 55 yuan, which is 19.6 yuan higher than the exchange rate.

Between 1979 and 1982, Shenzhen people mostly stored Hong Kong dollars. According to the State Council’s "Summary of Some Problems in the Trial Implementation of Special Economic Zones" in 1982, it is estimated that Shenzhen residents hold more than 100 million Hong Kong dollars.

In the spring of 1981, Wu Nansheng, then the deputy governor of Guangdong Province and the first secretary of the Shenzhen Municipal Committee of the Communist Party of China, first formally proposed the issuance of SAR currency. In May of the same year, the CPC Guangdong Provincial Committee made the proposal to the CPC Central Committee and the State Council. In mid-July, the Central Committee of the Communist Party of China and the State Council issued a plan for the People's Bank of China to study the issue of the SAR currency in Shenzhen. By the end of November of that year, Shenzhen’s “Report on the Study of Issuing the Special Zone Currency as Quickly as Possible and Approving the Establishment of Branches of Foreign-funded Banks to Shenzhen Special Economic Zones” stated that there were about 8 million Hong Kong dollars in circulation in the same year, accounting for about a large amount of currency circulation. First, if the Shenzhen currency is not researched and issued as early as possible, the circulation of the Hong Kong dollar may continue to expand.

At the beginning of 1982, the group led by Shang Ming, deputy governor of the People's Bank of China, went to Shenzhen to investigate. In April, the group submitted a report to the State Council, arguing that the currency issue is of great importance. It also involves the positioning of the Shenzhen Special Economic Zone and the relationship with the central government. Therefore, it is not appropriate. Hurry to act. The report also stated that not issuing SAR currency will not create obstacles to attracting foreign investment. At the end of the year, the State Council held two related meetings, at which most people agreed to issue the SAR currency.

In January 1983, the State Council Economic Research Center and other departments formed an investigation team to study currency issues in Shenzhen and Zhuhai. Among them, Guangdong Province, Shenzhen City, and China Merchants Group advocated the issuance. The requirements of Zhuhai City are not urgent. The Hong Kong and Macao Working Committee does not advocate the issuance. In the same month, the investigation team expressed its support to the leaders of the Guangdong Provincial Party Committee in issuing the SAR currency to facilitate the development of the capitalist economy. In April of the same year, Vice Premier Tian Jiyun announced the establishment of the “Ministry of Economic Affairs Research Group of the State Council”. The group basically affirmed the direction of issuing the SAR currency. The main task was to study how to issue it.

In 1984, the Hong Kong dollar circulated to the peak in Shenzhen. The black market exchange price rose to HK$100 to RMB 63, which was more than 30 yuan higher than the official price. At the same time, the Hong Kong dollar and foreign exchange vouchers accounted for 70.5% of the retail sales of social goods. The renminbi fell sharply, making the central and Guangdong The provincial government is worried that the yuan will be affected. In January of that year, the Shenzhen Municipal Party Committee and the Municipal Government again requested the province and the central government to issue the SAR currency. In February, Deng Xiaoping proposed that the SAR currency could be issued in Shenzhen and Xiamen. Soon after the research group made comments, it proposed a currency plan to Shenzhen, including the exchange rate, the relationship with the renminbi, and the amount of foreign exchange support provided by the central government. In August of that year, the State Council meeting agreed to issue the Shenzhen Special Economic Zone currency and cut off the circulation of RMB in the Shenzhen Special Economic Zone. In October, Shenzhen submitted a “report report on how to issue a good SAR currency” to Guangdong and the central government, proposed a specific plan, and clarified the relationship between the SAR currency and the renminbi. In the same month, the money group reported three plans to the Political Bureau of the CPC Central Committee, namely, letting Hong Kong currency circulate, letting foreign exchange vouchers circulate, issuing SAR currency, and circulating three options in Hong Kong after Hong Kong's return. The Politburo of the Central Committee supported the plan to issue SAR currency.

In 1985, the currency group submitted a report to the State Council, proposing that the SAR currency be issued by the People's Bank of China, using an independent exchange rate, and a basket of currencies including the US dollar, Japanese yen, Hong Kong dollar, and British pound as a floating exchange rate, based on the renminbi, without any The international currency is directly linked. The report was also issued on October 1, 1985.

The issuance of the Shenzhen SAR currency has been on the line.

When the issue of the Shenzhen Special Economic Zone was most heated from 1984 to 1985, the currency group headed by the People's Bank of China was ready to issue currency. In June 1984, the head office of the People's Bank of China bought two buildings in the Shenzhen Light Industry Zone as the “Shenzhen Guanghua Banknote Printing and Minting Co., Ltd.” and began to acquire land for paper mills. In January 1985, the report submitted by the currency group proposed that the Shenzhen SAR currency banknotes should be imaged by Huang Di (Xuanyuan), and the coins used a bird map. In August of the same year, the People's Bank of China sent the sample ticket design to the central government for approval. The denomination of banknotes is divided into 5 kinds, 5 yuan, 50 yuan, 100 yuan, 500 yuan, 5 kinds of pictures, the picture is selected by the Yellow Emperor; the coin denomination is divided into 1 point, 2 points, 5 points, 1 angle, 5 angles, 1 yuan, 6 kinds. The picture shows the bird picture. In 1984, when the State Council Vice Premier Gu Mu was inspecting work in Shenzhen, he said: "The ticket of the 'Special Zone Currency' uses the Yellow Emperor's head, which is conducive to uniting the Hong Kong, Macao, Taiwan, and overseas Chinese compatriots, and is also conducive to the development of the foreign economy. ”

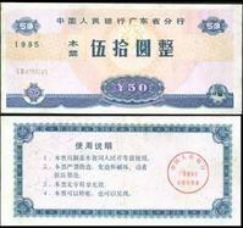

(Shenzhen Special Zone Currency Legend)

But at this moment, in July and August 1985, Deng Xiaoping once again gave instructions to the SAR. He said: Shenzhen is developing very fast, but after all, it is an experiment, and there are still some unresolved issues, such as currency issues, the introduction of technology. And earning foreign exchange through exports is not ideal. However, it took only three years to build the SAR. After three more years, these problems will be solved.

As a result, the Shenzhen SAR currency was not issued.

Digital money board nail

Although the SAR currency was eventually “dead in the belly”, in November 1985, the Shenzhen Special Economic Zone Foreign Exchange Adjustment Center was established. On December 12, 1985, the center handled the first foreign exchange transaction with a turnover of 1 million US dollars. The Foreign Exchange Adjustment Center is the most primitive foreign exchange market for enterprises and institutions to conduct trading and lending between them. The establishment of the foreign exchange adjustment center of the SAR in Shenzhen has played a certain role in stabilizing the RMB exchange rate.

In 1996, foreign exchange trading of foreign-invested enterprises could be carried out through the bank settlement and sales system. Most foreign exchange transactions of domestic institutions were handled through the bank settlement and sales system. The operation of the bank's foreign exchange settlement and sales system has been basically mature, which can meet the business needs of market entities and foreign exchange settlement and sales enterprises. Therefore, from December 1, 1998, the Central Bank and the SAFE jointly canceled the foreign exchange adjustment centers in various places.

After another 18 years, on January 20, 2016, the People’s Bank of China Digital Currency Seminar was held in Beijing. The digital currency research experts from the People's Bank of China, Citibank and Deloitte have discussed and exchanged the overall framework of digital currency issuance, the national digital currency in the currency evolution, and the cryptocurrency issued by the state. Zhou Xiaochuan, then Governor of the People's Bank of China, attended the meeting, and Fan Yifei, deputy governor of the People's Bank of China, presided over the meeting.

The meeting identified a keynote:

"Under the current new economic normal of our country, exploring the central bank's issuance of digital currency has positive practical significance and far-reaching historical significance. The issuance of digital currency can reduce the high cost of traditional banknote issuance and circulation, improve the convenience and transparency of economic transaction activities, and reduce Money laundering, tax evasion and other illegal and criminal activities, enhance the central bank's control over money supply and currency circulation, better support economic and social development, and help the comprehensive realization of inclusive finance. In the future, the establishment of digital currency issuance and circulation system Help China build a new financial infrastructure, further improve China's payment system, improve the efficiency of payment and liquidation, and promote economic upgrading and efficiency upgrading."

The next development is concerned with this field. The central bank has actively invested in the research and development of digital currencies, and the pace of research and development has accelerated significantly in the past two months.

Recently, Mu Changchun, deputy director of the Payment and Settlement Department of the People's Bank of China, disclosed the progress of the current research and development: "At present, we belong to a horse racing state. Several designated operators have adopted different technical routes to do DC/EP research and development. Whose route is good? Who will eventually be accepted by the people and accepted by the market, who will eventually win the game. So this is the process of market competition."

(tabulation: interchain pulse)

From the perspective of time and space, the digital currency being developed is no longer dead like the SAR.

The era of the SAR currency appeals to the strength of the Hong Kong dollar, while the demand for digital currency is to promote industrial upgrading and internationalization of the renminbi. The former is defensive, the latter is offensive; the former is a last resort, the latter is the need of the times; the former is not conducive to the international reputation of the renminbi, the latter is conducive to the internationalization of the renminbi; the former does not do, can be resolved through the strong renminbi, If the latter does not do it, it will accumulate problems because of the rise of sovereign digital currencies in other countries; the former is an expedient measure, and the latter is a strategic plan…

In short, the demand for digital currency in Shenzhen is much better than that of the SAR in that year.

If the SAR currency is issued in the same year, it will completely change the status quo of Shenzhen and other SARs. If the SAR currency is successful and become a bridge for the internationalization of the renminbi, the SAR currency will even become a hard currency in the region. However, if the failure is successful, the development of the Shenzhen Special Economic Zone may be seriously blocked. The outside world did not go out and became an obstacle to the connection between Shenzhen and the mainland.

If history is not there, standing in 2019, the central bank’s pilot of digital currency in Shenzhen will also become a turning point in history.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Questioning the resurgence, XRP is wilting because Ripple accelerates sales?

- The world of encryption originated in Bitcoin, and the prosperity stems from some "small problems" in Bitcoin.

- Market analysis: BTC fluctuates slightly, weekends are still resting

- Vitalik: More pessimistic about capacity expansion through the second layer network, Zk-Snarks and sidechain solutions are more effective

- Blockchain and the future of the intelligent revolution

- Market Analysis: External factor disturbances tend to weaken the impact on the cryptocurrency market

- Winklevoss brothers talk about bitcoin: "Wall Street is absent-minded"