The second exploration of the derivative products: Who is the king of the contract?

General Research Institute

Text: Song Shuangjie, CFA; Tian Zhiyuan; Sun Hanru; Zhou Yujing

Guide

- Blockchain games are breaking out, where is the future of investment? | Hangzhou Blockchain Game Forum

- Questioning the resurgence, XRP is wilting because Ripple accelerates sales?

- The world of encryption originated in Bitcoin, and the prosperity stems from some "small problems" in Bitcoin.

Digital citation derivatives have developed rapidly since their birth, but there is still much room for development compared to traditional financial markets. At present, the mainstream of the pass is a delivery futures contract. The competitions of the major exchanges are fierce. Who is the king of the delivery contract?

Summary

The delivery futures contract is the mainstream of the derivatives. According to the types of certificates and types of derivatives supported by mainstream exchanges, the delivery futures contract is the most mainstream derivative in the market. Coin contract analysis.

The fire currency contract started later than OKEx, but it developed rapidly and the product design is at the industry leading level. For example, the fire currency contract sets various price limits for different certificates and time contracts, and the price limit requirements are relatively stricter. On the limit measures, the fire currency contracts limit the maximum positions of users according to different varieties, and the online line has been zero-distributed so far; The basic transaction rate is lower than OKEx for the hot currency contract. OKEx has introduced the OKB for the ordinary users. When the position reaches 2000OKB, the OKEx pending order fee is lower than the fire currency contract, and the VIP user transaction rate is the fire currency contract. Below the OKEx; trading function, in order to enhance the user's trading experience, the Firecoin contract provides users with two functions of lightning closing and planning commissioning.

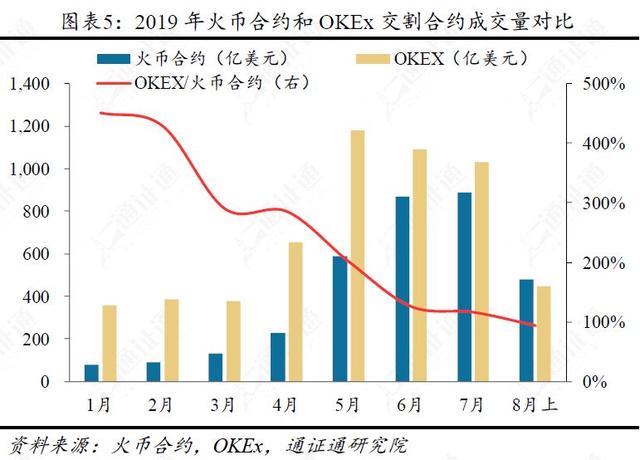

The trading volume of the Coin Delivery Contract exceeded OKEx in the first half of August 2019, and the position was less than OKEx. In terms of trading volume, the Coin Delivery Contract achieved a compound monthly growth rate of 49.6% since its launch, and exceeded the OKEx delivery contract for the first time in the first half of August 2019, but still lags behind OKEx in terms of open interest.

In terms of trading depth, the fire currency contract also appeared to be on the rise. On August 2, 2019, the depth of 0.1% of the seven currencies of the Coin Contract exceeded OKEx for the first time; from January to July 2019, the monthly compound growth rate of the 0.5% deep pending order of the BTC quarterly contract reached 38.14%.

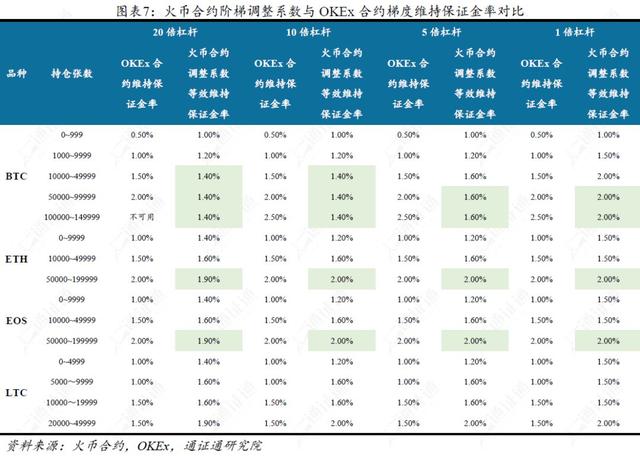

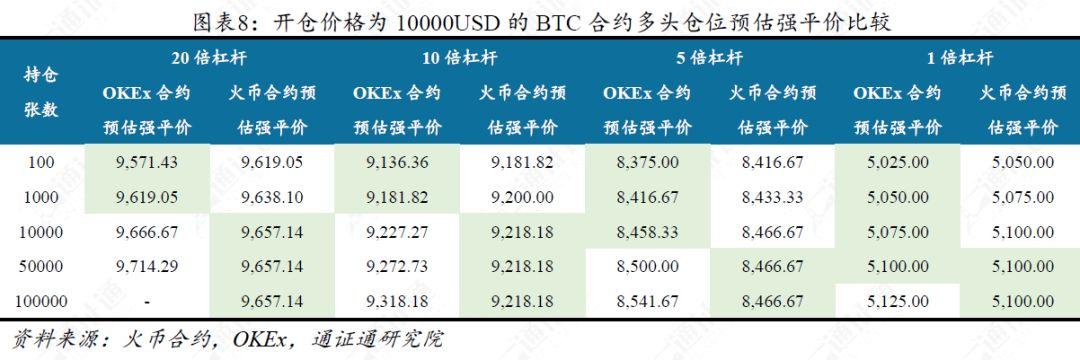

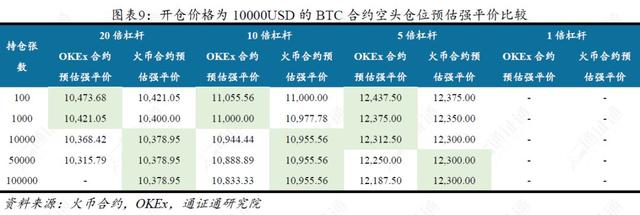

Both the Coin Contract Adjustment Coefficient and the OKEx Maintenance Margin Rate will cause the strong price of the user's position to be ahead of the actual price. When the other conditions are the same, the user holds a certain number of positions (for example, BTC contract 20 times leverage, positions exceed 10000), the maintenance margin rate required for the fire currency contract position will be lower than OKEx, and the level is later than OKEx, that is, The bullish price is lower, the bearish price is higher, and the OKEx is stronger than the fire coin contract. The ETH and EOS contracts of the Firecoin contract have an advantage over OKEx when the number of positions exceeds 50,000, and the OKEx contract has an advantage in LTC, BCH and other certificates.

Risk warning: leveraged trading risk, market volatility risk

table of Contents

1 Delivery contract is the mainstream of pass derivatives

2 Comparison and analysis of delivery contracts

2.1 Product design comparison

2.2 Comparison of trading volume

2.3 Comparison of positions

2.4 Transaction depth comparison

2.5 Risk Control Comparison

2.5.1 Loss of wear and tear is the main risk of digital pass insurance futures contract products

2.5.2 Comparison of Forced Closing Price: Advantages of Large Position Currency Contracts

2.5.3 Forced liquidation process

2.5.4 Comparison of historical contractual allocations of major contract platforms

3 Summary

text

1

Delivery contract is the mainstream of pass derivatives

With the enthusiasm of investors for the allocation of certificates, the general derivatives that cater to the diversified investment needs of the general market have emerged. The most common pass derivatives in the market currently include four categories: futures contracts, options contracts, perpetual contracts and leveraged transactions .

Since the birth of Digital Passage Derivatives, it has developed rapidly. Referring to the situation of Firecoin Global Station, OKEx and Japan Pass, the current digital trading volume of derivatives is about 3-4 times of the spot trading volume, compared with the traditional financial market. There is a lot of room for development.

The delivery futures contract is the mainstream, and the perpetual contract is gradually popularized. According to the types of VTC derivatives supported by mainstream exchanges and the trading volume of various derivatives, the delivery futures contract is the most mainstream certification derivative in the market; as the automatic delivery of daily delivery contract, the perpetual contract is investment. It simplifies the trading operation and reduces the negative impact of the loss of the position on the trading position. In the general market where individual investors are the mainstay, the number of exchanges supporting perpetual contracts is gradually increasing; the option contracts and spot leverage are relatively small. In view of this, this paper chooses OKEx and fire with the highest volume of delivery futures contracts. Coin contract analysis.

2

Comparative analysis of delivery contracts

2.1 Product design comparison

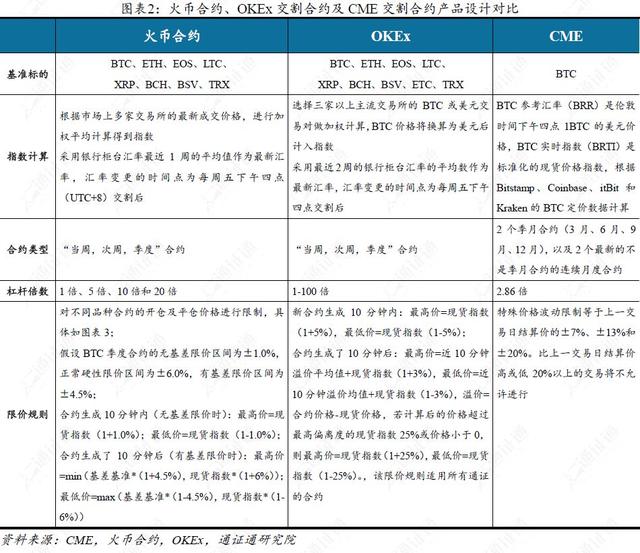

On the benchmark, CME currently only provides BTC futures contracts, and the fire currency contracts and OKEx futures contracts cover the main main circulation certificates;

In terms of index calculation, CME, Firecoin contract and OKEx are all weighted by the prices of many mainstream exchanges. The calculation method of CME is relatively complicated;

In terms of contract type, CME offers two quarterly contracts (March, June, September, December) and two new consecutive monthly contracts that are not quarterly contracts. The Firecoin contract and OKEx provide the week and week. And quarterly contracts;

On leverage, CME only offers 2.86 times leverage, and the Firecoin contract offers 1x, 5x, 10x and 20x leverage, and OKEx offers 1-100 leverage.

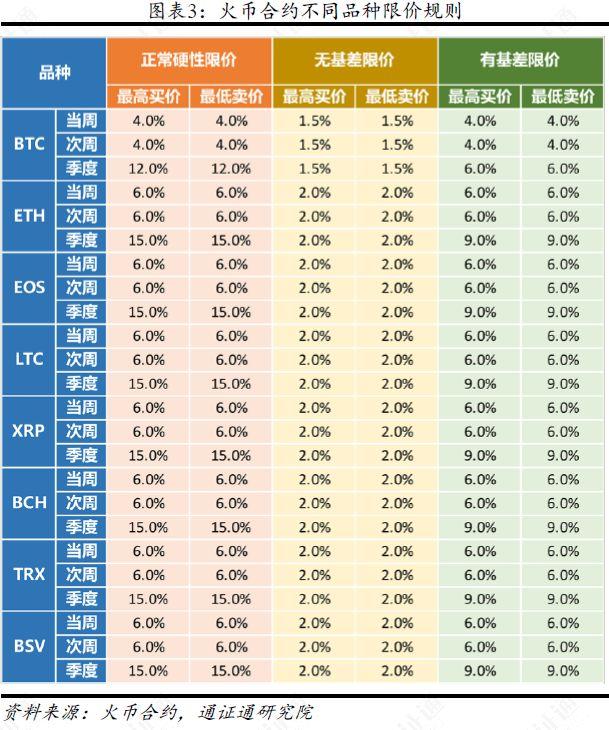

On the limit price rule, the CME special price fluctuation limit is equal to ±7%, ±13% and ±20% of the settlement price of the previous trading day. The limit price of the fire currency contract and OKEx is made ten minutes and ten minutes after the contract is generated. The difference is that the fire currency contract sets various price limits for different certificates and time contracts, and the price limit requirements are relatively stricter.

In the limit measures, the fire currency contract limits the user's maximum position according to the variety. The OKEx contract limits the maximum leverage of the high position users.

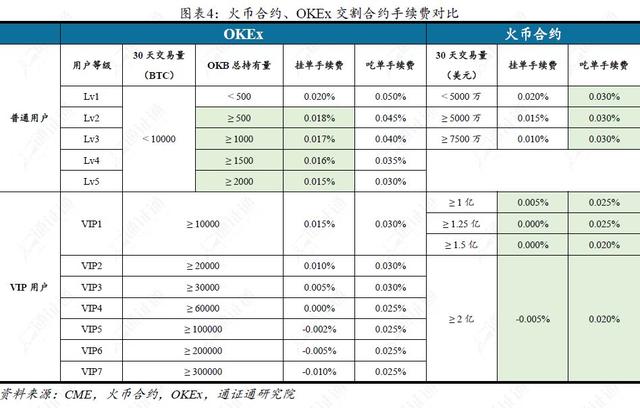

For the transaction rate, for ordinary users, the basic rate of OKEx contract is 0.02% for pending orders, 0.05% for pay orders, 0.02% for pending orders, 0.03% for orders, and the lower rate for OKEx. For the ordinary user OKEx, the OKB enjoys the handling fee discount. When the position reaches 2000OKB, the OKEx platform delivery contract pending order and the order rate are 0.015% and 0.03% respectively. In terms of VIP user classification, the OKEx platform VIP1 requires 30 days of trading volume to be greater than or equal to 10000 BTC, and is calculated to be equivalent to US$100 million at the current price of BTC of US$10,000. In terms of US dollar trading volume, the horizontal contract rate of the same level of the fire currency contract is low. Rates for OKEx VIP1~6.

In order to enhance the user's trading experience, the Firecoin contract provides two trading functions: Lightning Close and Plan Entrust. Lightning closeout can close the user's closing order with the opponent price within 30 slots in a short period of time, avoiding the situation that the order cannot be sold when the price changes greatly. The plan commission can set the trigger condition, commission price and commission quantity in advance according to the customer's wishes. When the transaction price reaches the preset trigger condition, the system automatically places an order at the predetermined order price and the entrusted quantity to help the investor realize the stop-loss and stop-loss.

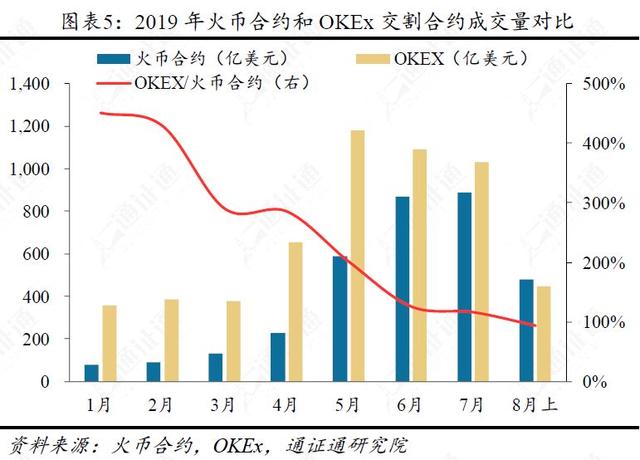

2.2 Comparison of trading volume

In the past eight months since the launch of the Coin contract, the monthly turnover has increased from US$7.9 billion in January to US$88.8 billion in July, with a monthly compound growth rate of approximately 49.6%. From May to July 2019, the trading volume of the fire currency contract increased by 50%, while the trading volume of the OKEx delivery contract decreased slightly during the same period. As of August 22, 2019, the trading volume of the fire currency contract in August was 70.72 billion US dollars, while the trading volume of the OKEx delivery contract in August was 66.38 billion US dollars. The trading volume of the fire currency contract has exceeded OKEx, and the gap between the two has continued to expand.

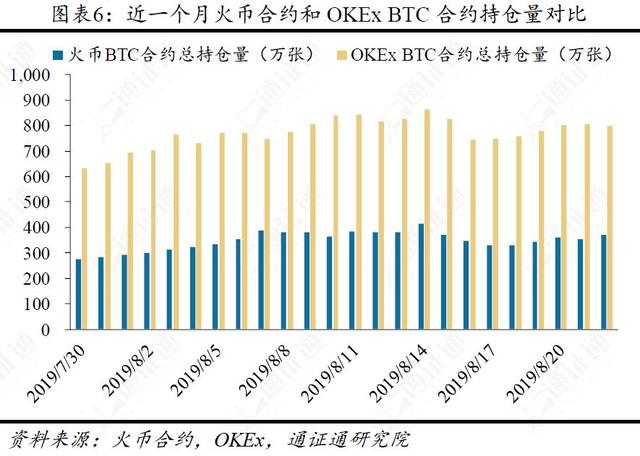

2.3 Comparison of positions

In terms of contract positions, the average daily position of the BTC contract for the last three weeks was 3.57.3 million, and the average daily position of the OKEx BTC contract (delivery + perpetual) was 7.865 million. Considering that OKEx's perpetual contract positions account for 15-20% of the total positions, the position of the BTC contract of the Coin Contract is about 50% to 55% of the OKEx BTC delivery contract. In other types of delivery contracts such as ETH, LTC, etc., the fire currency contract is also slightly behind OKEx.

2.4 Transaction depth comparison

In terms of transaction depth, the fire currency contract is on the rise. In July 2019, the average monthly pending amount in the 0.5% spread of the BTC quarterly contract of the Coin Contract reached US$1.915 million, and the monthly average pending amount in the 1% spread reached US$2.272 million. The monthly compound growth rate of 0.5% deep pending orders reached 38.14%, and the monthly compound growth rate of 1% deep pending orders reached 16.29%.

On August 2, 2019, the depth of 0.1% of the seven currencies of the Coin Contract exceeded OKEx for the first time, indicating that the indicators such as the depth of the contract and the spread of the market were at the leading level in the industry, and the friction cost of the trader's large position trading was relatively small. .

2.5 Risk Control Comparison

2.5.1 Loss of wear and tear is the main risk of digital pass insurance futures contract products

Generally speaking, the risks of futures contract products mainly exist in the three aspects of trading, margin control and delivery. At present, the mainstream digital certificate futures contract does not adopt the physical delivery method, so the delivery risk is easier to control; the transaction risk can be prevented by the measures of confirming the customer's identity through the exchange KYC and secondary verification.

In futures trading, the trader only pays a deposit to the exchange at a certain percentage of the value of its position as a guarantee for the ability to perform the futures contract. This ratio is called the initial margin rate . When the trader holds a position where the amount of the loss exceeds the margin paid, it will be forced to close the position.

In the actual business, if the benchmark price of the contract changes, causing the trader’s margin to be lower than a certain percentage of the value of the held position (usually lower than the initial margin rate), all the rights of the transaction will be held by the trader. To close the position, the ratio is called the maintenance margin rate .

When a trader issues a certain number of contracts, there must be another trader who issues the same type of contracts of equal and opposite direction. If the price of the contract is changed drastically, the margin of one of the parties after being forced to close the position is insufficient to pay the amount of the loss, which is called “wearing the position”. When a trader has a position, the margin is not enough to pay the counterparty's profit, resulting in a loss of the position. The loss of wearing a warehouse is the risk that the exchange bears. The probability of a contract product’s warehousing event, the size of the warehousing, and whether the loss after the warehousing is paid will test the risk control ability of the exchange.

Traditional futures exchanges control the risk of rushing by setting the method of maintaining the margin rate. Assuming the initial margin of the exchange is 5%, a trader holds 10 gold long contracts with a quantity of 1 ounce, and the base price of gold at the time of opening the position is 1,500 US dollars / ounce, then the value of the position held by the trader is For the $15,000, the initial margin required to be paid is $750, and the leverage multiplier is 1/0.05=20 times. If there is no maintenance margin rate, when the price of gold falls to $1,425 per ounce, the value of the position is reduced by $750, triggering a forced liquidation. If the final closing price of the 10 long contracts is less than $1,425, the position is broken. If the margin rate is maintained at 1%, when the price of gold falls to $1,440 per ounce, the position value is reduced by $600, and the margin remains at $150, which is the maintenance margin rate. At this time, the transaction ownership will close the position of the trader, if the actual transaction is completed. Prices above $1,425 per ounce will not result in a position. The trader's margin may be left based on the actual closing price and is generally returned to the trader by the exchange.

The root cause of wearing a position is that when the benchmark price of the contract is subject to drastic fluctuations, the depth of the transaction is not sufficient to cause all the open positions to be traded at the expected strong price. This results in the trader's margin not covering the loss amount. The solution to the loss of the position is that the loss is shared by all profitable traders (ie, the position is spread), and the position of the trader who may appear through the position is closed in advance (ie, the margin rate is maintained). ) two.

The way in which the digital clearing exchange controls the risk of wearing a position is gradually shifting from a method of shifting the position to a way of setting the margin rate. The latter avoids the unreasonable result of the risk of wearing a position by profitable users. It is a step toward a formality for the digital exchange to learn the relatively complete risk control measures of traditional finance.

The coin contract uses the "adjustment factor" to calculate the user's closing price, while the OKEx has a one-time forced-flat mode (old mode) and a new gradient-strength mode. The latest strong rules for the Coin Contract and the OKEx contract are as follows.

Coin contract adjustment factor

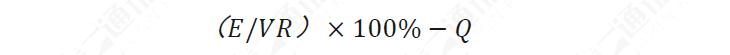

Margin rate = (account equity / occupancy margin) * 100% – adjustment factor

When the margin rate is ≤ 0, the position will be forced to close. Occupation margin = position margin + frozen margin

OKEx gradient strong flat mode (full warehouse)

Margin rate = (account balance + realized profit and loss + unrealized profit and loss) / (position value + pending order freeze margin * leverage multiple)

When the margin rate ≤ maintenance margin rate, the position will be forced to close. Among them, position value = face value * number of sheets / latest mark price

2.5.2 Comparison of Forced Closing Price: Advantages of Large Position Fire Contracts

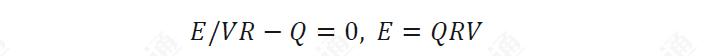

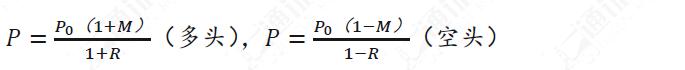

The Coin Contract Adjustment Factor can be converted to an (equivalent) maintenance margin rate compared to OKEx. L is used to represent the leverage multiplier, R is the initial margin rate, M is the maintenance margin rate, Q is the adjustment factor, E is the account equity, and V is the position value. Assume that all account equity is used as the initial margin to open the position, and there is no realized profit and loss and pending order freeze margin.

The formula for calculating the margin rate of a fire coin contract is

The forced closing condition is

The calculation formula for OKEx maintenance margin rate is

The forced closing condition is

Comparison of two formulas

which is:

Adjustment factor = corresponding equivalent maintenance margin rate * leverage multiple

If the opening price, the number of sheets, the direction, and the account equity are equal, the index of the fire currency contract is calculated using the adjustment factor equal to the estimated strong price calculated using the equivalent maintenance margin ratio of the OKEx contract.

According to the strong flat price formula

The estimated strong parity of the OKEx contract and the fire currency contract can be calculated separately for the same opening price, the same leverage multiple, the same margin, and no other positions.

From the perspective of strong price, when the number of BTC contract positions is less than 10,000, the OKEx contract is stronger than the fire currency contract. The fire currency contract begins to show advantages when the BTC contract position exceeds 10,000, and the required maintenance margin is required. The rate is lower. The ETH and EOS contracts of the Firecoin contract have an advantage over OKEx when the number of positions exceeds 50,000, and the OKEx contract has an advantage in the LTC, BCH and other cottage certificates.

2.5.3 Forced liquidation process

The forced closing process of the Coin Contract is as follows: When the latest transaction price reaches the forced closing price, it will trigger a forced liquidation, and the user's position will be taken over by the system at the takeover price (ie, the price at which the user account equity is zero). If the system is closed in the market without the matching system, the takeover price is not equal to the actual forced closing price.

The profit generated by the forced closing of the transaction (that is, the account equity of the remaining users after the transaction) will be injected into the risk reserve of the corresponding variety to compensate for the losses caused by the wearing of the position. If the risk reserve is insufficient to compensate for the short-selling losses, the users who earned this week will share the short-selling losses.

The OKEx contract is similar to the Firecoin contract. The matching system will entrust the position that triggers the forced liquidation to the market until the transaction, and the resulting surplus is also injected into the exchange's risk reserve.

At present, the delivery products of mainstream exchanges use the combination of gradient maintenance margin ratio and wear-through allocation to prevent the risk of warehousing, but there are still improvements. In this mode, the user's position will be flat and the margin may still have a surplus, but the surplus will be transferred to the exchange risk reserve instead of being returned to the user. The exchange should use the risk reserve reasonably and rethink the case when appropriate. The way the post-earnings margin is handled.

2.5.4 Comparison of historical contractual allocations of major contract platforms

The contracts for various types of the Coinage Contracts have remained on a zero basis.

In the history of OKEx BTC delivery contracts, there were 18 records of profit-loss users sharing their positions, mostly concentrated in 2018 and 2015. The latest apportionment occurred on August 10, 2018. The amount of wearables was 34.4 BTC, and the apportionment ratio was 0.4384%. The highest rate of apportionment occurred on August 3, 2018, with a total loss of 3,734 BTC, including risk reserve allocation. 2517.2BTC, the allocation ratio is 17.6818%.

Most of the OKEx delivery contracts have been worn out since 2018. In 2019, the LTC contract was shared by the warehouse for a total of 89 LTC; the ETH contract was spread 2 times in 2019, and the user's share amount was 6294.5 ETH; the XRP contract was spread once in 2019, and the user's share amount was 32,685 XRP. The highest rate of OKEx historical apportionment is the ETC delivery contract on November 23, 2018. The number of ETCs in the warehouse is 210,000, and the apportionment rate is as high as 50.6%.

3

to sum up

Digital pass derivatives have developed rapidly since their birth, and the current mainstream is still the delivery contract. The fire currency contract started later than OKEx, but it developed rapidly and the product design is at the industry leading level. In terms of trading volume, the Coin contract has achieved a compound monthly growth rate of 49.6% since its launch, and exceeded the OKEx delivery contract for the first time in the first half of August 2019. It also has a good trading depth, but its position is still behind OKEx. The Coin Contract has a good risk control system compared to other contract products. The step adjustment factor is used to reduce the losses that may occur due to the wearing of the warehouse. Since the launch, the zero-share record has been maintained.

Both the Coin Contract Adjustment Coefficient and the OKEx Maintenance Margin Rate will cause the strong price of the user's position to be ahead of the actual price. When the other conditions are the same, the user holds a certain number of positions (for example, BTC contract 20 times leverage, positions exceed 10000), the maintenance margin rate required for the fire currency contract position will be lower than OKEx, and the level is later than OKEx, that is, The bullish price is lower, the bearish price is higher, and the OKEx is stronger than the fire coin contract. The ETH and EOS contracts of the Firecoin contract have an advantage over OKEx when the number of positions exceeds 50,000, and the OKEx contract has an advantage in LTC, BCH and other certificates.

Note:

For some reasons, some of the nouns in this article are not very accurate, such as: pass, digital pass, digital currency, currency, token, Crowdsale, etc. If you have any questions, you can call us to discuss.

This article is original for the General Research Institute (ID: TokenRoll). Unauthorized reproduction is prohibited.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market analysis: BTC fluctuates slightly, weekends are still resting

- Vitalik: More pessimistic about capacity expansion through the second layer network, Zk-Snarks and sidechain solutions are more effective

- Blockchain and the future of the intelligent revolution

- Market Analysis: External factor disturbances tend to weaken the impact on the cryptocurrency market

- Winklevoss brothers talk about bitcoin: "Wall Street is absent-minded"

- China countered, the US stocks collapsed, and Bitcoin laughed.

- A bit of a bit of a bitcoin contract: Prosperous derivatives will pave the way for institutional investors