Research Report | Central Bank Digital Currency Research Report (2)

Recap

The Jinqiu Blockchain Research Institute has launched a series of research reports using a combination of blockchain & digital currency and banking and financial systems to explore more about the central bank digital currency (CBDC) and the central bank's digital currency (DC/). EP) policy interpretation and a series of predictions and application ideas for the financial institutions' business after the introduction of the central bank's digital currency.

In the last article, we discussed the definition and basic information of the central bank's digital currency; the difference between the central bank's digital currency and cash, demand deposits, electronic cash, and stable currency; whether the central bank's digital currency is a pseudo-demand. (Last Review: Central Bank Digital Currency Research Report (1) )

- The second exploration of the derivative products: Who is the king of the contract?

- Blockchain games are breaking out, where is the future of investment? | Hangzhou Blockchain Game Forum

- Questioning the resurgence, XRP is wilting because Ripple accelerates sales?

The main problem we will solve in this paper is:

1. Construct a currency assessment model from a demand perspective;

2. Use the currency assessment model to quantify the mainstream currency form;

3. Quantitative comparison of central bank digital currency (CBDC) and bank deposits (M1), cash (M0), Libra;

4. From the perspective of supply, explore the impact of the central bank's digital currency.

First, construct a currency assessment model from the perspective of demand

As mentioned above, "Whether a specific form of money has value, we must judge from two dimensions of supply and demand." In this paper, we will first build a currency assessment model.

From an economic perspective, money has three main functions: the unit of valuation, the instrument of payment, and the storage of value.

1. unit of valuation (a unit ofaccount) : Money acts as a yardstick function for pricing, and the same unit of money can theoretically be exchanged for the same amount of goods.

2. A means of payment : Act as a medium for payment and facilitate transactions.

3. Value store (a store of value): A secure form of value storage that prevents multiple value risks from occurring in a secure value store.

Scalability scalability: supports the size of any amount;

Acceptance: People and people, people and businesses, businesses and businesses, equipment requirements, network requirements;

Eatra Service Additional services: Whether you can get other financial services, such as loans, consultancy services, etc.

Transaction transaction: whether it is easy to use, transaction fee is high or low;

Anonymity Anonymity: the level of anonymity;

Settlement anti-settlement risk: the delay between agreeing to the transaction and receiving the funds;

Returns: the usual interest payments;

Theft & Loss is stolen and lost: the ability to roll back fraudulent transactions, fraud and cyber security, and recover losses;

Default Risk: The default risk of a currency issuer.

Second, use the currency assessment model to quantify the mainstream currency form

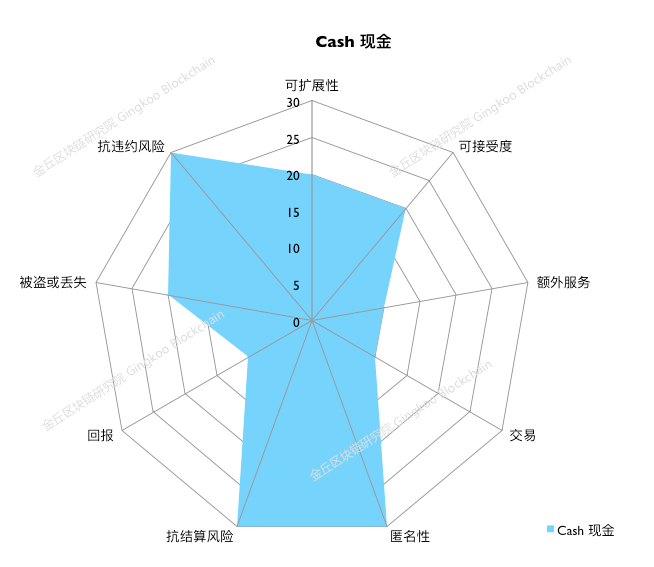

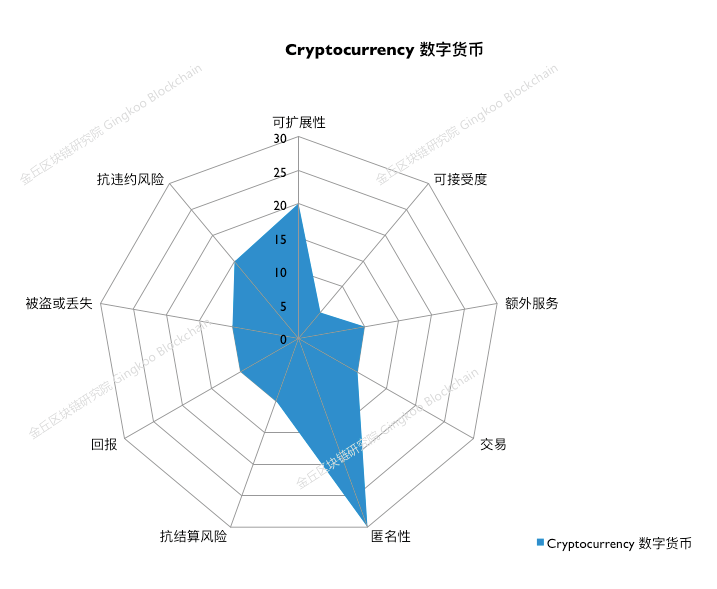

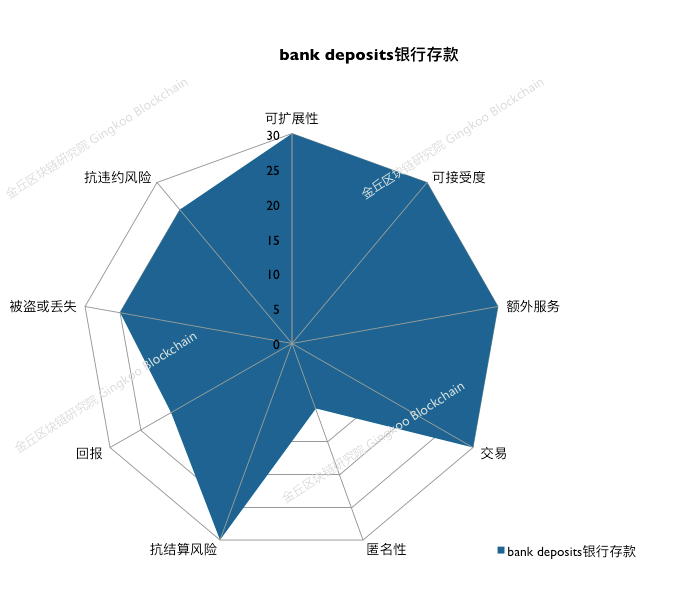

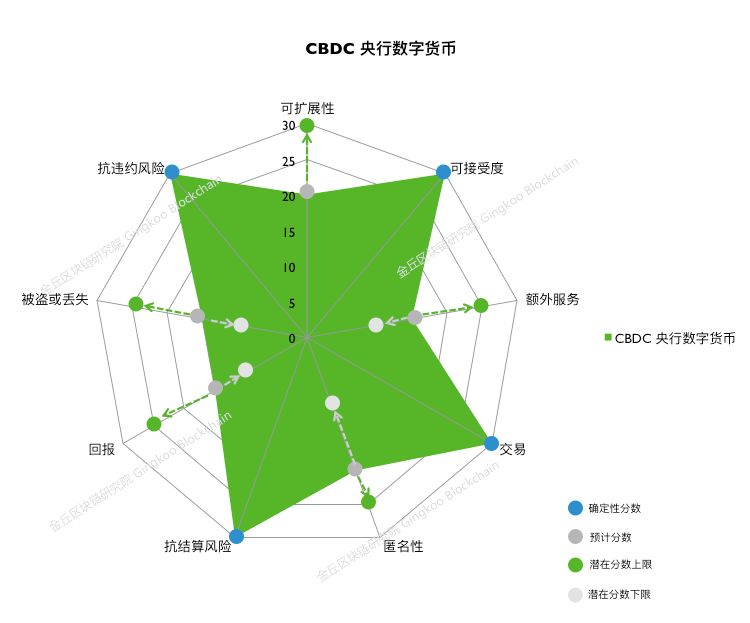

Based on the above currency assessment model, we quantify the mainstream currency patterns in the market, including cash, cryptocurrency, electronic cash, bank deposits, and central bank digital currency (CBDC). The Jinqiu Block Chain Research Institute has made a radar chart for currency assessment based on different currency characteristics. The larger the coverage area, the greater the advantage of the currency. On each indicator, 5 is the lowest and 30 is the highest.

cash

Cash is not a popular payment method in general. The main problem is the high transaction cost (there is a lot of restrictions on the physical payment of the two parties, withdrawals, etc.), easy to be stolen (especially large), no return (lack of interest) ). But the advantages of cash are also very prominent, such as timely settlement, no information system risk, and completely anonymous.

Cryptographic currency

The most unattractive payment method, which is dragged down by the settlement speed, has a low score against the settlement risk. At the same time, there are obvious defects in theft and loss, transaction costs, additional services, and acceptability. The only advantage is in the anonymity dimension.

Electronic cash e-money

The e-cash advantage is obvious and has a wide acceptance because of its extremely low transaction costs (usually a good customer experience, payment scenarios designed by Internet companies) and an abundance of additional service scenarios. Due to regulatory and regulatory restrictions, e-cash scalability has the opportunity to cover large payments, but its acceptability is limited in B2B scenarios compared to bank deposits, and is as anonymous as bank deposits. The degree of sexuality is not high.

Commercial bank deposit

A variety of additional services can be superimposed, and the developed online banking support also brings high acceptance (2C and 2B are widely accepted), and the payment is highly scalable (supporting large and small payments). The payment fee is very low and there is no settlement risk. The above five dimensions are full marks. The risk of loss and theft and the default risk (with account insurance coverage) are relatively controllable, the only shortcoming is that it is not anonymous.

CBDC's quantitative data prediction

CBDC is a new form of currency. Since there is no CBDC used on a large scale in the market, we can only dynamically predict its quantitative indicators.

Of course, there are some common advantages between CBDC and bank deposits and electronic cash, such as low settlement risk and transaction cost, and high acceptance.

But there are also several deterministic disadvantages, or uncertainty: in the interest-reward dimension, CBDC can provide a complete interest plan, but there are more uncertainties than deposits; in the prevention of theft and loss dimensions, If the CBDC is highly anonymous, it will not be able to recover and freeze fraudulent transactions. If the anonymity is low, the theft and loss may be higher; in the scalability dimension, the potential CBDC can support large payments, or it may be like Like electronic cash, it is within the scope of small and medium-sized supervision.

Third, quantitative comparison of central bank digital currency (CBDC) and bank deposits (M1), cash (M0), Libra

In order to understand the central bank digital currency (CBDC) more intuitively, we focus on comparing it with three representative forms of currency: bank deposit (M2), cash (M0) and Libra.

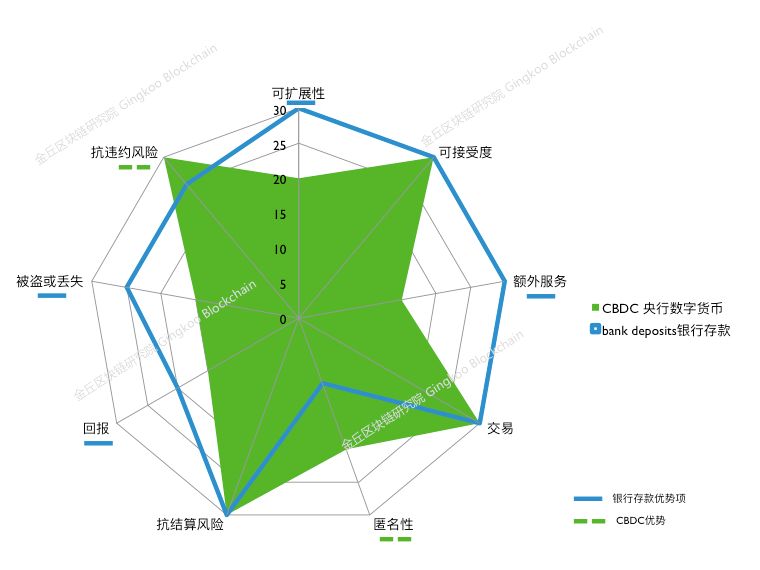

CBDC vs Bank Deposit

The CBDC is significantly inferior to bank deposits. In the quantitative radar chart, bank deposits have obvious advantages in the four core indicators of “scalability”, “extra service”, “return”, “stolen or lost”, but “anonymity” and “anti-default risk” "The performance is not good enough to CBDC. In fact, China's financial system is very developed, and the function of bank deposits as a form of payment has been quite perfect. At present, China's M1 and M2 have been electronically and digitized.

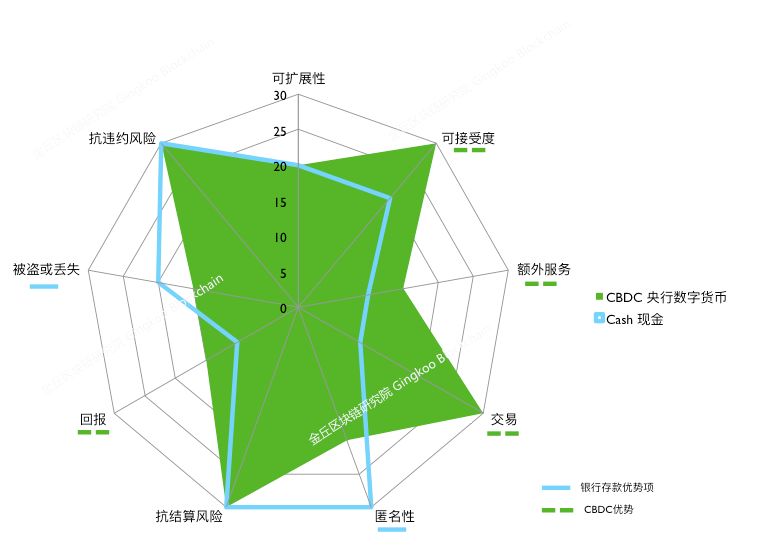

CBDC vs cash

Compared with cash (M0), CBDC has potential advantages in the “acceptability”, “extra service”, “transaction” and “return” dimensions. Cash is easy to be forged anonymously, and there are risks such as money laundering and terrorist financing. In areas where account services and communication networks are poorly covered, the dependence on cash is still high. With the development of the digital economy, banknotes have become increasingly out of date in many scenarios, and replacing CBDC with cash is a worthwhile pilot option.

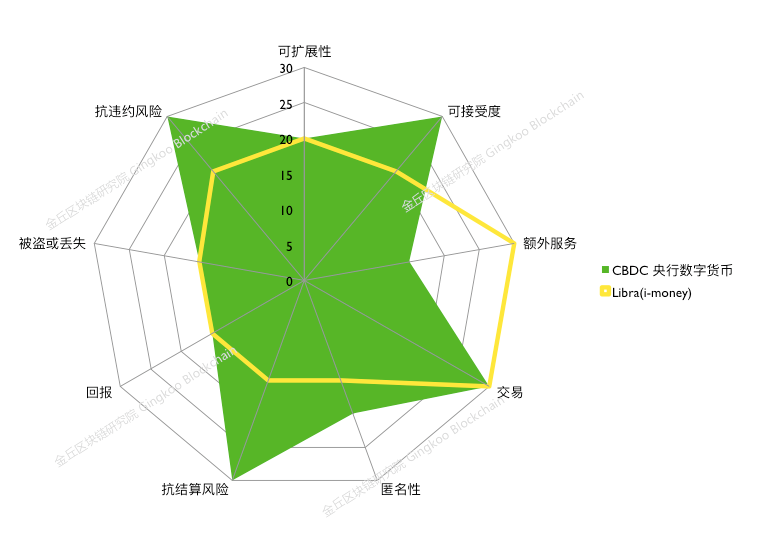

CBDC vs Libra

As an i-money, Libra also predicted the parameters based on the public information provided by Facebook and compared it with the central bank's digital currency (predictive parameters).

Of course, with the clear regulation and Libra's own development, like e-money, Libra will gradually improve the scores in all dimensions, but this is not within the scope of our research report.

Under such a scoring system, Libra is lower than CBDC in multiple dimensions as a payment method. At the same time, there are obvious weaknesses compared with e-money and b-money. However, in addition to regulatory considerations, another reason Libra has placed a strategic starting point in the unbanked crowd in emerging markets is that Libra has more advantages than the currency forms of third world countries, which is a good entry point. .

Fourth, from the perspective of supply, explore the impact of central bank digital currency

From a supply perspective, that is, from the perspective of the central bank's regulatory perspective, the impact of central bank digital currency (CBDC) is a very complex topic. Due to the relationship between the length and the main research direction, we only briefly discuss the framework.

The financial system's soundness Financial Integrity

Depending on the design, CBDC can enhance or weaken the financial integrity of the national financial system (Financial Integrity).

In the design of the currency form, regulators often face a game in terms of the soundness of the financial system and the privacy of legitimate users. For example, cash transactions can be completely anonymous, without the need for an account system and no transaction records, so that cash transactions protect the privacy of users. But it also brings a series of problems such as money laundering, tax evasion, and terrorist financing.

Using CBDC instead of cash (M0) also involves this game. We can assume that if CBDC limits the amount of each transfer and sets transaction identity authentication and transaction records, the transaction identity and information are encrypted and kept confidential to any third party, including the government, unless there is a criminal suspect. The court order can decrypt the transaction details.

This model will fully evade the risk of financial soundness, but how to establish a set of effective privacy protection mechanisms that users can trust needs to be explored in practice. Another possibility is to not limit the limit of the transfer limit, and not to record the transaction identity and information in a completely anonymous form. The problem with this method is to undermine the existing financial soundness. It should be emphasized that in the design of CBDC rules, there are some flexible rules in the field of KYC (customer identity authentication), but strict and effective control will be carried out in AML (anti-money laundering) and CFT (anti-terrorism financing) .

Financial stability and bank disintermediation Financial stability Banking intermediation

If CBDC and bank deposits form a competitive relationship, CBDC will affect financial stability and financial disintermediation. This is why the Chinese central bank's digital currency (DC/EP) adopts a two-tier architecture and is only a deep consideration for replacing M0.

In the speech, Director Mu also explained this part in detail: “If we use a single-tier operation structure, it will lead to 'financial disintermediation'. Under the single-tiered delivery framework, the central bank directly faces the public to put digital currency, the central bank digital currency. Compared with the deposit money of commercial banks, the former is better than the commercial bank deposit currency in the case of central bank credit endorsement, which will have a crowding effect on commercial bank deposits, affect the ability of commercial banks to lend, and increase the dependence of commercial banks on the interbank market. In this case, the price of funds will be raised, the cost of social financing will be increased, and the real economy will be damaged. The central bank’s digital currency is an alternative to M0, so no interest will be paid on cash, and financial disintermediation will not be triggered. Nor will it have a big impact on the existing real economy."

Effective Monetary Policy

The introduction of the CBDC will not significantly change the effectiveness of the central bank's monetary policy. There are four main channels for monetary policy transmission, including basic interest rates, bank lending channels, credit channels, and currency exchange channels. The IMF study shows that CBDC has a weaker impact on monetary policy in the four main transmission channels mentioned above.

From the dimension of demand and supply, this paper quantifies the mainstream currency form in the market with the model of IMF. In the world, the Jinqiu Blockchain Research Institute is also the first to give clear CBDC quantitative prediction and Libar quantitative prediction.

Since the information is the latest and the amount of information is limited, the indicator needs to be completed under a number of assumptions. In the third part of the next report, we will focus on the central bank's digital currency (DC/EP), which will be launched by the People's Bank of China. We will make quantitative predictions and policy interpretations on DC/EP.

From an economic point of view, it is necessary to inherit the rational connotation of the long-term evolution of traditional currency. Therefore, there should be no change in the intrinsic value of the legal digital currency. The change is in the digitization of the currency. – Yao Qian, former director of the Central Bank Digital Currency Institute

Reference

Adrian, Tobias. 2019. "Stablecoins, Central Bank Digital Currencies, and Cross-Border Payments: A New Look at the International Monetary System," speech given at the IMF-Swiss National Bank Conference, Zurich, May 2019.

https://www.imf.org/en/News/Articles/2019/05/13/sp051419 -stablecoins-central-bank-digital-currencies-and-cross -border-payments

Duffie, Darrell. 2019. “Digital Currencies and Fast Payment Systems,” mimeo, Stanford University.

"International Monetary Fund Policy Paper"- June 2019

“The Rise of Digital Money” Tobias Adrian, Tommaso Mancini-Griffoli, July 2019

Yao Qian, Tang Yingxi. Some Thoughts on the Legal Digital Currency of the Central Bank[J]. Journal of Finance Research, 2017, 445(7): 78-85.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The world of encryption originated in Bitcoin, and the prosperity stems from some "small problems" in Bitcoin.

- Market analysis: BTC fluctuates slightly, weekends are still resting

- Vitalik: More pessimistic about capacity expansion through the second layer network, Zk-Snarks and sidechain solutions are more effective

- Blockchain and the future of the intelligent revolution

- Market Analysis: External factor disturbances tend to weaken the impact on the cryptocurrency market

- Winklevoss brothers talk about bitcoin: "Wall Street is absent-minded"

- China countered, the US stocks collapsed, and Bitcoin laughed.