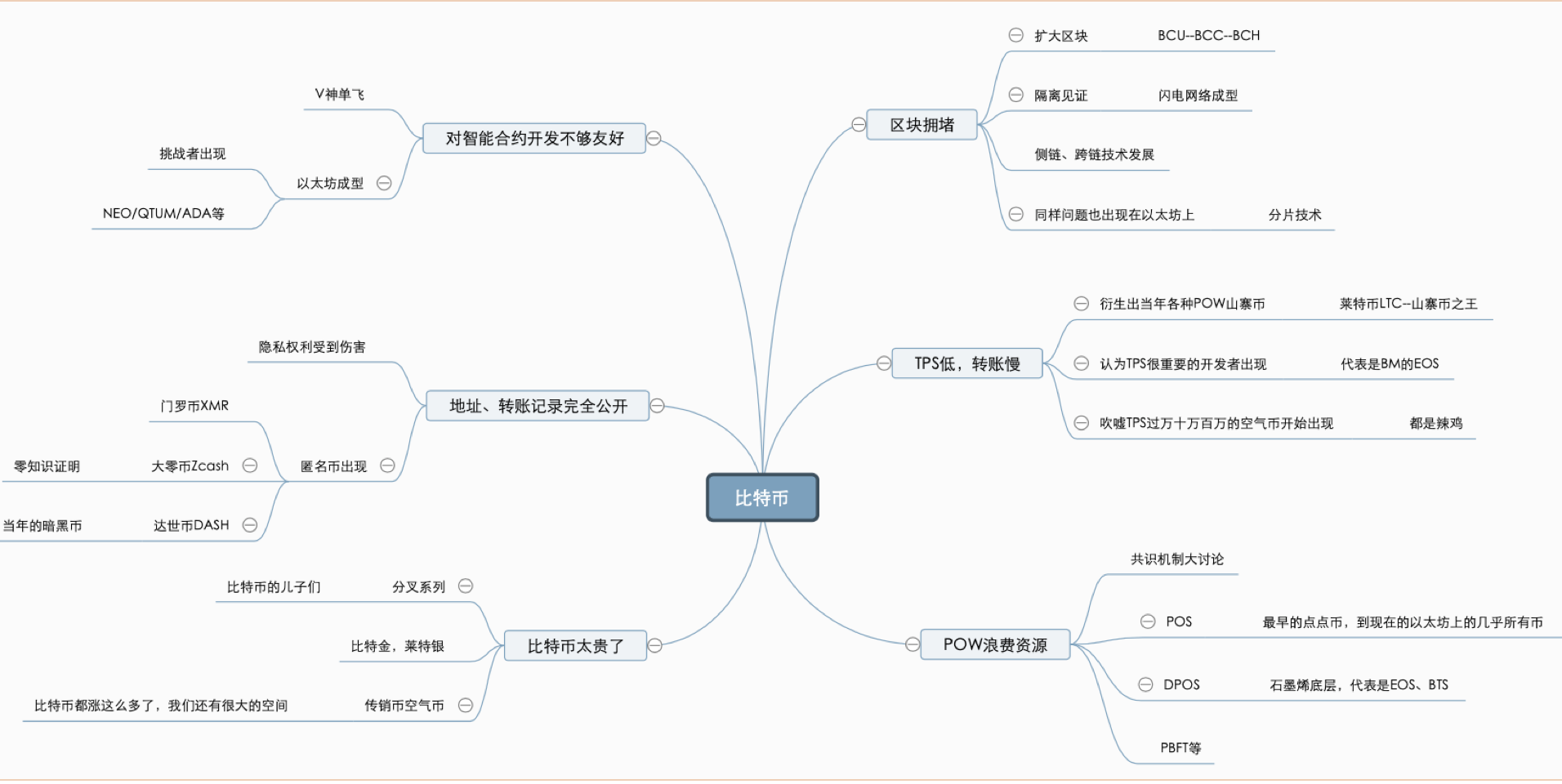

The world of encryption originated in Bitcoin, and the prosperity stems from some "small problems" in Bitcoin.

The current world of cryptocurrencies originates from Bitcoin. The birth of each "pure" cryptocurrency is often related to a certain shortcoming of Bitcoin. Perhaps it is a consensus mechanism, perhaps the speed of the transaction, perhaps the transfer fee, perhaps not enough. anonymous. In short, the prosperity of the encryption world stems from some "small problems" in Bitcoin.

After all, if a new cryptocurrency can't do better than bitcoin in some way, then there is no meaning of birth.

Of course, I personally don't think that the following problems are the shortcomings of Bitcoin, but the world of blockchain is free and open. If someone thinks it is good, then someone must be dissatisfied. If there is a certain ability in the unsatisfied person. Whether it is appeal, openness, or even financial strength, he will dissipate his dissatisfaction and even lead to a brand new cryptocurrency branch, which has been recognized by many people.

In fact, what everyone sees now, which can be among the best in the market value rankings, is a "successful fork". They learn the advantages of Bitcoin and optimize what they think are not satisfactory, thus forming a brand new currency, even Formed a new branch, such as "public chain", "anonymous currency", "forked coin" and so on.

- Market analysis: BTC fluctuates slightly, weekends are still resting

- Vitalik: More pessimistic about capacity expansion through the second layer network, Zk-Snarks and sidechain solutions are more effective

- Blockchain and the future of the intelligent revolution

1. POW wastes resources

This discussion, from the birth of Bitcoin, is still being discussed today. The mainstream financial media and Bitcoin hater have always liked to use this point to attack Bitcoin. After all, Bitcoin now consumes more electricity than a small country. energy used.

All the discussion about the waste of resources in Bitcoin comes from the core consensus mechanism of Bitcoin – POW (Power of Work), the workload proof mechanism.

This led to a discussion of the consensus mechanism, resulting in POS (Ethernet is transforming from POW+POS hybrid mechanism to pure POS mechanism), DPOS (graphene bottom layer, representing BM products such as EOS), and PBFT related mechanisms (representative Small ants NEO, etc.).

They believe that decentralization on the blockchain can also be achieved by other means. At present, pos and dpos have already had a place in the top five of the market value, indicating that the market has already been recognized, and they do not waste resources.

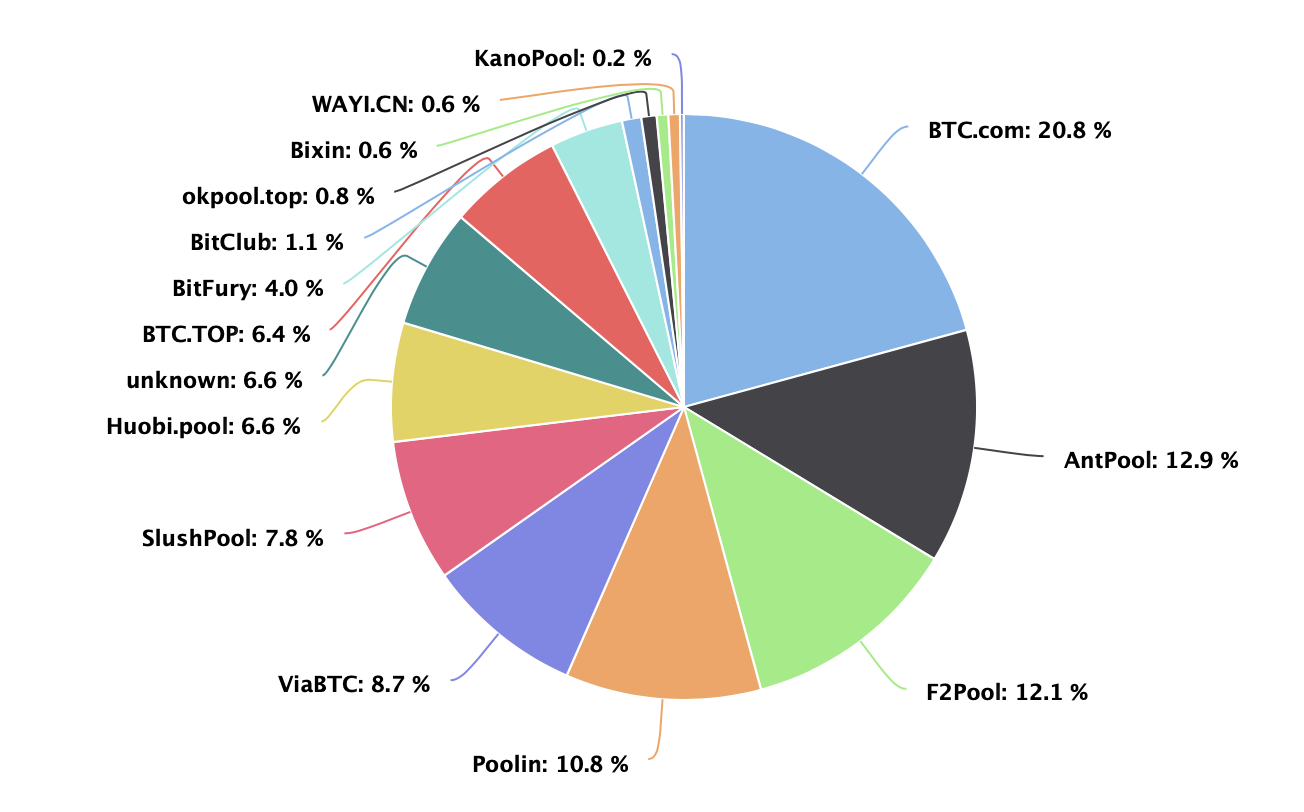

However, POW supporters always believe that only the actual amount of computing power can ensure fairness, security, and decentralization. Although the distribution of the mine has made many people criticize for a long time:

Especially for foreign bitcoin enthusiasts, they feel that China’s mining pool is a devil, and Wu Jihan has been approved as a “killer”, thinking that as the real head of China’s seemingly scattered major mining pools It is the only person in the entire Bitcoin world who can play a "speaking finger" to make the market value of Bitcoin fall by half. Of course, the fool will do this, and, too, can't do it.

But this did give them the point of attack.

We can often see the picture because of the concentration of power (in fact, the calculation of the mining pool), and then to argue that bitcoin is centralized, and that "their coins" are decentralized, so that there is no such thing.

2, Bitcoin is too open and transparent

As we all know, the bitcoin block can be used to check the transfer address and transfer amount, transfer time. Of course, the address is indeed not a real name, but in the case where the address is known, it is easy to locate the individual that matches the address by various means. In fact, at present, Bitcoin has a lot of addresses that have become "tag addresses" and has been archived in departments like the FBI.

This is of course not a problem for ordinary people, but in the group of “privacy greater than days” and “not free to die”, this is an important reason why they do not recognize Bitcoin. They are determined to be a cryptocurrency that can be truly anonymous and untrackable.

Thus, the anonymous coin was born.

Anonymous currency is a special blockchain token that hides the transaction amount during the transaction and hides the sender and receiver.

The coin (bitcoin, etc.) can query the amount of each transaction (transaction), transaction time, sender and receiver through the blockchain browser, and the anonymous currency cannot be found.

(Although that is said, it is embarrassing that in 2016, the FBI directly intercepted 12,000 Monero; in 2017 law enforcement officers seized 3,700 Zcash from Alexandre Cases, leader of AlphaBay, a drug market provider in the dark market.)

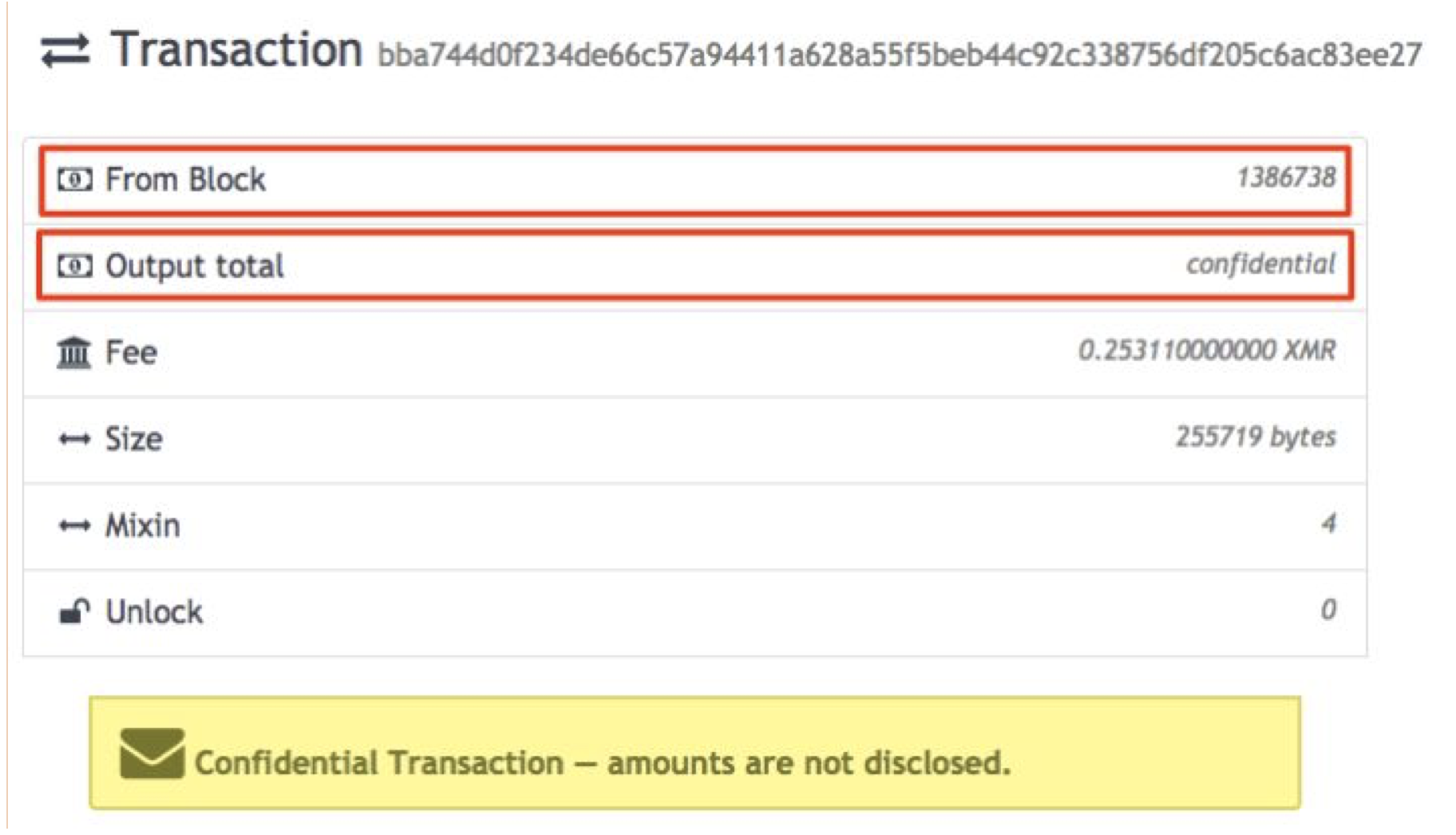

Here is what is displayed in the block trade of Monroe:

Note that in the red box above, only the From Block is provided, and the Output total shows "confidential", not to mention the addresses of both parties to the transaction.

On the Monroe blockchain chain, the only transaction that can see the transaction amount is the transaction from Coinbase, which is the Monroe coin obtained from mining. Don't think that the blockchain browser of Monroe does not intentionally display the transaction amount and the two parties to the transaction. Because of the principle and structure of the Monroe blockchain, it is impossible to obtain such information accurately.

Anonymous coins, in addition to Monroe, there is a large coin (Zcash, the reason is called large coin instead of zero coin, because there is a coin called small coin), and the previous dark coin, Dash (DASH) .

Anonymous coins have also become a very strong classification and community, and are deeply loved by developers and hacker communities.

I predict that whether Bitcoin is to be anonymous or not, "no difference" will be the main topic of discussion for some time to come.

3. Bitcoin is not friendly to smart contracts and DApp development.

Bitcoin brings a blockchain, but in fact, the word "blockchain application" really fires up, but also Vie's Ethereum. Because of the limitations of BTC, the lack of openness and other factors, it is not realistic to develop applications on Bitcoin on a large scale. It is said that Ethereum founder V God had planned to do Ethereum on the bitcoin chain. The earliest Ethereum version was a macro coin similar to Counterparty on the PrimeCoin chain. But at the time some bitcoin core developers might have more concerns, so the matter did not go smoothly. When V God wanted BTC to be more open and more support for the development of smart contracts, it was rejected by the Bitcoin core. Of course, we don't judge the right or wrong here, but for this reason, Vitalik is determined to take another path and create a unique one.

After Ethereum opened its doors, many public chains dedicated to creating a better development environment and a more friendly developer environment began to emerge, including but not limited to EOS, QTUM, ADA, AE, and so on.

What the sects say in detail can actually be said to be "blockchain sects." If it is not the "disadvantage" of Bitcoin, perhaps there will be no classification of blockchain, but it is still creating "bitcoin application", "bitcoin technology" and "bitcoin industry".

4, transfer is too slow

This problem can be said to be a point that people who don't understand Bitcoin like to bitcoin. After all, "only 7 transactions per second, an average transfer of 10 minutes to get the account." This sounds too far and far from VISA, Alipay, and bank transfer. It sounds like Bitcoin is not something that can be used as a payment tool.

So people want to do better in a variety of ways, so they created the EOS to transfer the second, created a larger block of BCH, created LTC with shorter block time and so on. – An understatement of a sentence filled with rivers and lakes.

The problem of slow transfer of Bitcoin has always existed. It is easy to directly optimize the code of Bitcoin. Other copies are completely easy. It is easy to produce a brand new coin, but Bitcoin is Bitcoin. If you optimize it, you are still a altcoin. And many people, only believe in bitcoin, such people are actually a majority, then they hope that they can be directly modified on Bitcoin. (In fact, the bitcoin rules that everyone is familiar with are not unchangeable).

So where did they come up with a solution?

——The block is too small, the expansion of the block is not finished, and a block is more decorated, isn’t it? Because the block of Bitcoin was originally set to a maximum of 32m, and because it was too big, there were not so many transactions, so he set a limit on Bitcoin afterwards, limiting the block to 1M. At this time, some people suggested expanding the block (the completion group), but the other party felt that the block did not need to be expanded (code farmer). Everyone knows about the later things. The two sides are incompatible with each other. After the quarrel is really intolerable, Bitcoin has forked and forked out the BCH of the big block.

It even brought a bunch of garbage forks that have nothing to do with the wind.

– Segregation Witness, the purpose is to allow each block to accommodate more transactions. Later, the main solution for Bitcoin was now developed: Lightning Network.

——Accelerate the block production speed, that is, the original ten minutes out of a block, changed to five minutes, one minute or even ten seconds. Of course, this method was crushed to death as soon as it was proposed.

In fact, I am telling the truth, it is not technology, but a bear market that can really solve the congestion of Bitcoin block.

The bear market is gone, and the block is still blocked. No matter how much TPS you have, as long as you have a lot of people to use it, you still have to block it. This is the early dilemma of decentralized solutions.

5, Bitcoin's biggest drawback: too expensive

This is what almost all the altcoin air coins like to say when propaganda, because bitcoin is too expensive, so there is not much room for the appreciation of bitcoin. This trick is especially useful for new arrivals of leeks. Why do you say that? Because the oysters that entered the big bull market in 2017, I really bought bitcoin, and I haven’t done any research, but the proportion of buying bitcoin is definitely not comparable to the ratio of buying Ethereum, and the new arrival in 2017. In the leek.

If you still think that Bitcoin is just like any other digital currency, just a kind of digital currency, then you are really wrong, and you are undoubtedly fresh and fresh new leeks.

Bitcoin has nurtured the entire cryptocurrency industry, the entire blockchain industry, and has become the decentralized currency that is currently the most likely to challenge the status of the legal currency in the world. It is about to spend its first decade, and the wheel of history is rolling. Forward, before it was born, and after birth, the world is different.

Pay tribute to Bitcoin.

(all content, in the picture)

Author: William Chen

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis: External factor disturbances tend to weaken the impact on the cryptocurrency market

- Winklevoss brothers talk about bitcoin: "Wall Street is absent-minded"

- China countered, the US stocks collapsed, and Bitcoin laughed.

- A bit of a bit of a bitcoin contract: Prosperous derivatives will pave the way for institutional investors

- The central bank issued the "FinTech Development Plan": Strengthening the development and application of distributed databases

- He donated $100,000 in bitcoin to the Amazon Rainforest but was dismissed by BitPay.

- Bitcoin volatility is too high, but I still continue to hold bitcoin