History repeats itself? Three consecutive hackers stunned three times "blood wash" coin market

After a lapse of ten months, the security breach of the currency security was looted by hackers. The market was shocked, and mainstream currencies such as BTC and BNB vomited blood.

According to the official announcement of the currency security, on the morning of May 8, the Currency Exchange discovered a large-scale security breach. In this attack, the hacker stole 7,000 bitcoins from the coin security wallet at a height of 575,012, worth about 300 million yuan.

There are 350,000 bitcoins in the currency, which is more than 120 billion yuan. The stolen 7,000 BTCs account for about 2% of the total BTC holdings.

There are 350,000 bitcoins in the currency, which is more than 120 billion yuan. The stolen 7,000 BTCs account for about 2% of the total BTC holdings.

It is reported that hackers can obtain a large number of user API keys, Google verifies 2FA codes and other related information. In this attack, the hacker community used a combination of attack techniques, including phishing, viruses and other attacks to steal encrypted assets.

- BTC has reached new heights. Can Ethereum futures save the encryption market?

- Bank of Thailand builds blockchain solution to make real-time settlement between banks possible

- Market Analysis: The main force borrows the profit, but everything is a routine

The announcement stated that

“The hacker waited patiently to complete the long-planned attack through multiple seemingly independent accounts at the most appropriate time. The deal bypassed our existing security checks.”

The security company Beijing Chainan said that the money security was stolen.

"It is very likely that the intranet has been hacked by hackers for a long time, and not by single or batch users being hacked by phishing viruses. The stolen 7,000 bitcoins are scattered among more than 40 hacker-controlled wallets. There has been no transfer."

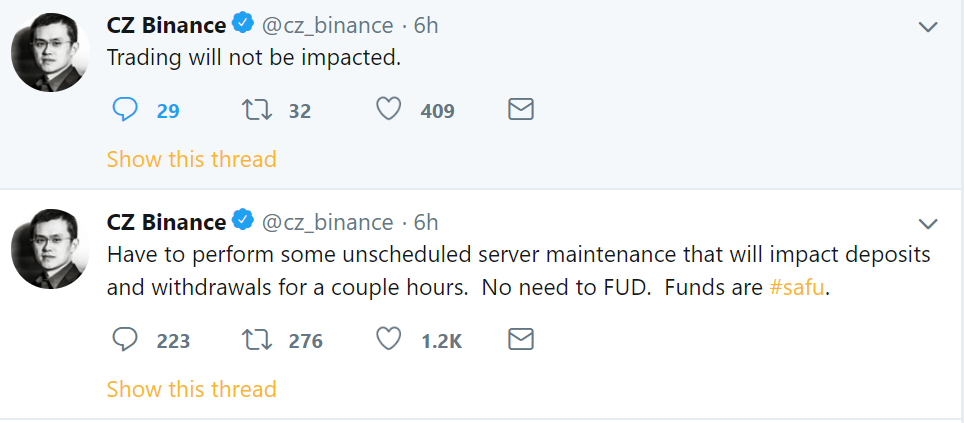

After the theft incident, Chan Chan CEO Zhao Changpeng issued a statement that the transaction was the only affected transaction, and the currency will use the SAFU fund to pay the stolen losses in full, and no user funds will be affected. In addition, the currency security is expected to undergo a thorough security review within a week, during which time the deposit and withdrawal business will be suspended.

Cryptography fell across the board

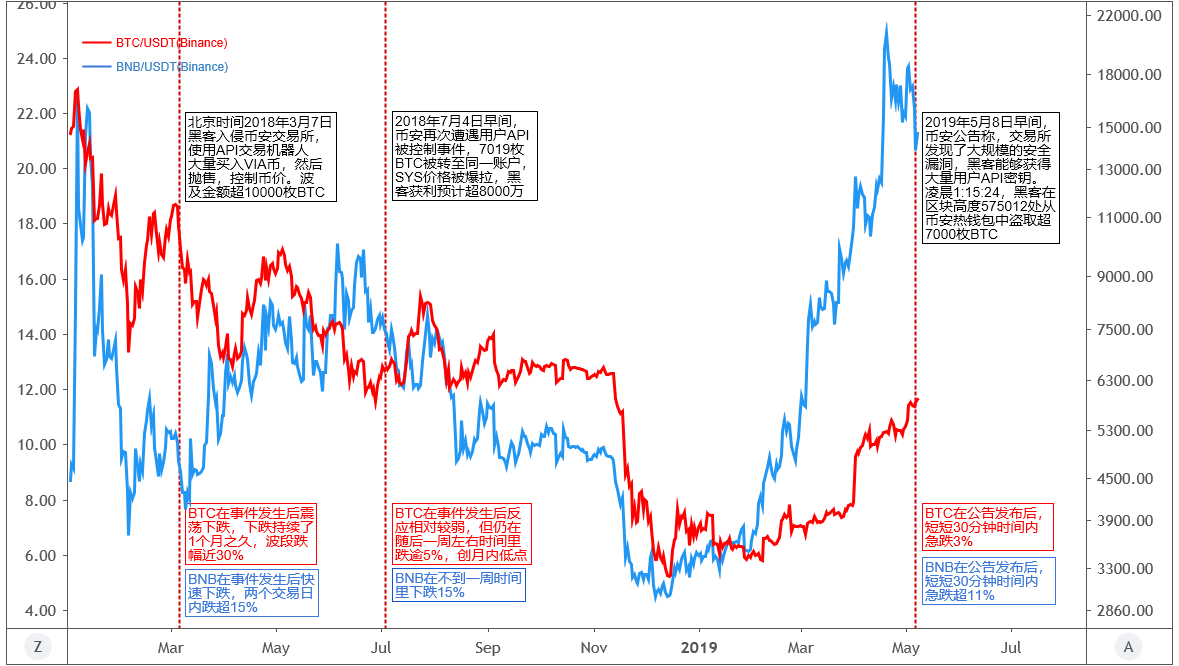

At about 7 o'clock today, the official website of the company announced the theft. After the news broke out, BTC quickly fell. According to CoinMarketCap data, at 7:29, BTC began to fall from an intraday high of 5,951.27 US dollars, and fell to an intraday low of 5,806.38 US dollars in an hour, a drop of nearly 3%.  BNB fell nearly 5% in half an hour and is now reporting at 20.61USDT, which has fallen to 7.37% in the past 24 hours.

BNB fell nearly 5% in half an hour and is now reporting at 20.61USDT, which has fallen to 7.37% in the past 24 hours.

Other cryptocurrencies have fallen, with over 70% of the top 100 mainstream currencies currently falling.

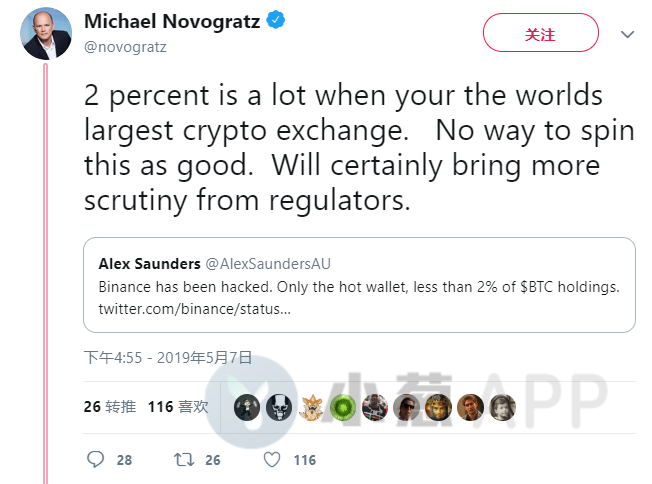

In response to the 7,000 BTC incidents in which Coin’s was stolen, NuggetsNewsAU CEO Alex Saunders advertised that only 2% of the total BTC holdings were stolen. In this regard, Galaxy Digital founder Michael Novogratz replied:

“When there is a theft in the world’s largest exchange, 2% will have a big impact. This is an unavoidable result and will definitely lead to more scrutiny by regulators.”

The security problems are endless, and the currency is safe for three times.

At 5 o'clock in the morning of July 4, 2018, the Coin Exchange Exchange had a large amount of cash withdrawals. It is reported that within 2 hours, more than 7,000 BTCs were transferred to the same address, and the news that the currency was suspected of being stolen quickly spread.

On the same day, there was a suspicious transaction in the currency security, and a SYS purchased at the $0.29 in the currency security purchase of 96 BTCs (worth about $6.23 million). In the early morning of the same day, SYS said that its network may have loopholes, and one billion SYS was taken from a block. The abnormal transaction of the currency security is suspected to be related to the network vulnerability of SYS.

On the morning of July 4th, the company announced the suspension of the transaction, and resumed the transaction until 16:00 pm, and announced the announcement at around 17:00 to characterize the incident as a phishing incident. During the event fermentation, the currency An Zhao Changpeng and He Yi both sent Weibo to appease the users, saying that everything is under control. Everyone is safe. I suggest that you don’t believe it, don’t pass it, but it still can’t hold the market. Rumors and guesses.

An abnormal transaction occurred on the currency, SYS had a network vulnerability, and the price of SYS skyrocketed, which was soaring nearly 90% in 24 hours. As the price of SYS is blown up, hackers will be able to make a profit of at least 80 million through other exchanges.

After the news of the stolen stolen goods on July 4, the BTC quickly fell, falling from $6,638 to around $6,447 in one hour, a drop of nearly 3%.

BNB fell 15% in less than a week

Subsequently, the company announced the establishment of the Binance Investor Protection Fund (SAFU) to guarantee investor rights, saying that from July 14, 2018, 10% of the transaction fee will be used as an investor protection fund, and the relevant assets will be deposited in Independent address, special purpose. Binance users are paid first when all platforms are in a sudden risk, and special funds are used to deal with possible extreme security incidents; Binance will withdraw funds from investor protection funds for any loss of user assets caused by users' own reasons. The user implements full advance payment.

The stolen money can be traced back to March 2018.

Around 23 o'clock on March 7th, the hacker manipulated several coin security user accounts, and exchanged all the currency transactions of the cryptocurrency into BTC, which amounted to more than 10,000 BTCs. Hackers use API trading robots to buy VIA coins in large quantities with these BTCs. The price of VIA is directly increased by more than 100 times, and then sold to control the price of coins.

At that time, the market was affected by the news, and the whole market collapsed, and the price plummeted by 10% in one hour. The BTC fell below the $10,000 mark and hit a 10-day low of $9,400, a drop of more than 10%. The BTC's decline lasted for a month, and the band dropped nearly 30%. Affected by this incident, BNB quickly fell, falling more than 15% in two trading days.

The scallions sorted out the time points of the three safety accidents and their impact on the currency price. From the historical data, the three shocks of the coin were accompanied by the rapid decline of BTC and BNB, causing collective blood loss in the currency market.

Source: Shallot APP Author | Gu Mengting, reproduced please indicate the source

Source: Shallot APP Author | Gu Mengting, reproduced please indicate the source

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Let some Fidelity advanced field cryptocurrency

- Bitcoin trading volume is close to the peak of December 2017, transaction fees soared by 250%

- Iron Man Elon Musk 膺 膺 “ “ 最 最 最 最 最 最 最 最

- The coin was stolen for the first time, and the 7000BTC was missing.

- Blockchain Deducing the Value of Financial Innovation

- Mysterious people donate 50 BTC to Grin, or early Bitcoin participants

- Unwilling to lag behind, Microsoft released the Ethereum Application Development Kit